Question: On January 1, 2018, Parker Company issued

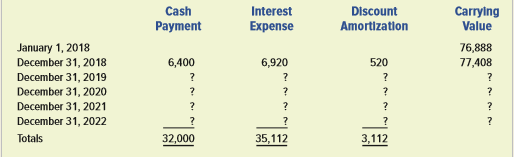

On January 1, 2018, Parker Company issued bonds with a face value of $80,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at the time the bonds were issued. The bonds sold for $76,888. Parker used the effective interest rate method to amortize the bond discount.

Required:

a. Prepare an amortization table like the one that follows. Round answers to nearest whole dollar.

b. What item(s) in the table would appear on the 2021 balance sheet?

c. What item(s) in the table would appear on the 2021 income statement?

d. What item(s) in the table would appear on the 2021 statement of cash flows?

Transcribed Image Text:

Cash Interest Discount Amortization Carrylng Value Рayment Еxpense January 1, 2018 December 31, 2018 December 31, 2019 December 31, 2020 76,888 6,400 6,920 520 77,408 ? ? December 31, 2021 ? ? December 31, 2022 ? Totals 32,000 35,112 3,112

> Identify each of the items shown in the left column of the following table as being an upstream, a midstream, or a downstream cost by placing an X in the one of the columns to the right of the items column. The first item is shown as an example. Ite

> Mustafa Manufacturing Company began operations on January 1. During the year, it started and completed 3,000 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purch

> Weib Manufacturing experienced the following events during its first accounting period:Â 1. Recognized revenue from cash sale of products. 2. Recognized cost of goods sold from sale referenced in Event 1. 3. Acquired cash by issuing common st

> A review of the accounting records of Baird Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company’s financial statements are prepared in accordance with GAAP. 1. Salary of the company

> Driscoll Industries recognized the annual cost of depreciation on its December 31, 2018, financial statements. Using the following horizontal financial statements model, indicate how this event affected the company’s financial statement

> Finch Corporation recognized accrued compensation cost. Use the following model to show how this event would affect the company’s financial statements under the following two assumptions: (1) the compensation is for office personnel and

> Use the following table to classify each cost as a product cost or an SG&A cost. Also indicate whether the cost would be recorded as an asset or an expense. Assume product cost is defined by generally accepted accounting principles. The first item is

> Indicate whether each of the following costs should be classified as a product cost or as an SG&A cost in accordance with GAAP: a. Direct materials used in a manufacturing company. b. Indirect materials used in a manufacturing company. c. Salaries of emp

> John Riley, a certified public accountant, has worked for the past eight years as a payroll clerk for Southeast Industries, a small furniture manufacturing firm in the Northeast. John recently experienced unfortunate circumstances. His teenage son requir

> In February 2006, former senator Warren Rudman of New Hampshire completed a 17-month investigation of an $11 billion accounting scandal at Fannie Mae (a major enterprise involved in home mortgage financing). The Rudman investigation concluded that Fannie

> The CFO of the Jordan Microscope Corporation intentionally misclassified a downstream transportation expense in the amount of $575,000 as a product cost in an accounting period when the company made 5,000 microscopes and sold 4,000 microscopes. Jordan re

> Gwen Pet Supplies purchases its inventory from a variety of suppliers, some of which require a sixweek lead time before delivering the goods. To ensure that she has a sufficient supply of goods on hand, Ms. Leblanc, the owner, must maintain a large suppl

> Becky Shelton, a teacher at Kemp Middle School, is in charge of ordering the T-shirts to be sold for the school’s annual fund-raising project. The T-shirts are printed with a special Kemp School logo. In some years, the supply of T-shirts has been insuff

> The following information pertains to Flaxman Manufacturing Company for March 2018. Assume actual overhead equaled applied overhead. March 1 Inventory balances Raw m

> Supply the missing information on the following schedule of cost of goods manufactured: FISCHER CORPORATION Schedule of Cost of Goods Manufactured For the Year Ended December 31, 2018 Raw materials Beginning inventory $ 120,000 ? Plus: Purchases Raw

> The following financial statements model shows the effects of recognizing depreciation in two different circumstances. One circumstance represents recognizing depreciation on a machine used in a factory. The other circumstance recognizes depreciation on

> Anne Wood was talking to another accounting student, Don Kirby. Upon discovering that the accounting department offered an upper-level course in cost measurement, Anne remarked to Don, “How difficult can it be? My parents own a toy store. All you have

> During 2017, Rooney Manufacturing Company incurred $8,000,000 of research and development (R&D) costs to create a long-life battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense in 2017. Manufact

> Indicate whether each of the following items is representative of managerial or of financial accounting: a. Information is factual and is characterized by objectivity, reliability, consistency, and accuracy. b. Information is reported continuously and h

> Sarah Johnson was a trusted employee of Evergreen Trust Bank. She was involved in everything. She worked as a teller, she accounted for the cash at the other teller windows, and she recorded many of the transactions in the accounting records. She was so

> Weaver Corporation had the following stock issued and outstanding at January 1, 2018: 1. 150,000 shares of $1 par common stock. 2. 15,000 shares of $100 par, 6 percent, noncumulative preferred stock. On June 10, Weaver Corporation declared the annual cas

> When Crossett Corporation was organized in January 2018, it immediately issued 4,000 shares of $50 par, 6 percent, cumulative preferred stock and 50,000 shares of $20 par common stock. Its earnings history is as follows: 2018, net loss of $35,000; 2019,

> Eastport Inc. was organized on June 5, 2018. It was authorized to issue 300,000 shares of $10 par common stock and 50,000 shares of 5 percent cumulative class A preferred stock. The class A stock had a stated value of $50 per share. The following stock t

> Newly formed S&J Iron Corporation has 50,000 shares of $10 par common stock authorized. On March 1, 2018, S&J Iron issued 6,000 shares of the stock for $16 per share. On May 2, the company issued an additional 10,000 shares for $18 per share. S&a

> The stockholders’ equity section of Creighton Company’s balance sheet is shown as follows. Required: a. Assuming the preferred stock was originally issued for cash, determine the amount of cash that was collected whe

> Astro Corporation was started with the issue of 2,000 shares of $5 par stock for cash on January 1, 2018. The stock was issued at a market price of $12 per share. During 2018, the company earned $31,000 in cash revenues and paid $17,100 for cash expenses

> Faith Busby and Jeremy Beatty started the B&B partnership on January 1, 2018. The business acquired $44,000 cash from Busby and $66,000 from Beatty. During 2018, the partnership earned $42,000 in cash revenues and paid $18,400 for cash expenses. Busby wi

> A sole proprietorship was started on January 1, 2018, when it received $60,000 cash from Marlin Jones, the owner. During 2018, the company earned $35,300 in cash revenues and paid $16,200 in cash expenses. Jones withdrew $1,000 cash from the business dur

> Discount Drugs (one of the three largest drug makers) just reported that its 2018 third quarter profits are essentially the same as the 2017 third quarter profits. In addition to this announcement, the same day, Discount Drugs also announced that the Foo

> On December 30, Billy’s Boat Yard (BBY) had $90,000 of cash, $20,000 of liabilities, $30,000 of common stock, and $40,000 of unrestricted retained earnings. On December 31, BBY appropriated retained earnings in the amount of $18,000 for

> Using the most current Form 10-K available on EDGAR, or the company’s website, answer the following questions about the J. M. Smucker Company. Instructions for using EDGAR are in Appendix A. Note: In some years the financial statements, footnotes, etc.,

> The market value of Yeates Corporation’s common stock had become excessively high. The stock was currently selling for $240 per share. To reduce the market price of the common stock, Yeates declared a 3-for-1 stock split for the 100,000 outstanding share

> Beacon Corporation issued a 5 percent stock dividend on 30,000 shares of its $10 par common stock. At the time of the dividend, the market value of the stock was $15 per share. Required: a. Compute the amount of the stock dividend. b. Show the effects o

> On May 1, 2018, Love Corporation declared a $50,000 cash dividend to be paid on May 31 to shareholders of record on May 15. Required: Record the events occurring on May 1 and May 31 in a horizontal statements model like the following one. In the Cash Fl

> The following information pertains to JAE Corp. at January 1, 2018: Common stock, $10 par, 20,000 shares authorized, 2,000 shares issued and outstanding…………………………………….$20,000 Paidin capital in excess of par, common stock………………………….

> Elroy Corporation repurchased 4,000 shares of its own stock for $30 per share. The stock has a par of $10 per share. A month later Elroy resold 900 shares of the treasury stock for $32 per share. Required: What is the balance of the Treasury Stock accou

> Tom Yuppy, a wealthy investor, paid $20,000 for 1,000 shares of $10 par common stock issued to him by Leuig Corp. A month later, Leuig Corp. issued an additional 2,000 shares of stock to Yuppy for $25 per share. Required: Show the effect of the two stoc

> Mercury Corporation issued 6,000 shares of no-par common stock for $45 per share. Mercury also issued 3,000 shares of $50 par, 5 percent noncumulative preferred stock at $52 per share. Required: Record these events in a horizontal statements model like

> The three primary types of business organization are proprietorship, partnership, and corporation. Each type has characteristics that distinguish it from the other types. In the left column of the following table write the name of the type of business or

> Dan Dayle started a business by issuing an $80,000 face value note to First State Bank on January 1, 2018. The note had an 8 percent annual rate of interest and a five-year term. Payments of $20,037 are to be made each December 31 for five years. Round a

> Sanders Co. is planning to finance an expansion of its operations by borrowing $150,000. City Bank has agreed to loan Sanders the funds. Sanders has two repayment options: (1) to issue a note with the principal due in 10 years and with interest payable a

> The following cash and bank information is available for three companies on June 30, 2018: Required: a. Organize the class into three sections and divide each section into groups of three to five students. Assign Peach Co. to section 1, Apple Co. to se

> The Chair Company provides a 120-day parts-and-labor warranty on all merchandise it sells. The Chair Company estimates the warranty expense for the current period to be $2,650. During the period a customer returned a product that cost $1,830 to repair.

> To support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations, Deloch purchased the stereo systems for $140,000 and sold them for $250,000 cash. She provided her customers with a one-yea

> The following three independent sets of facts relate to contingent liabilities: 1. In November of the current year an automobile manufacturing company recalled all pickup trucks manufactured during the past two years. A flaw in the battery cable was disc

> The following selected transactions apply to Topeca Supply for November and December 2018. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1

> Vail Book Mart sells books and other supplies to students in a state where the sales tax rate is 8 percent. Vail engaged in the following transactions for 2018. Sales tax of 8 percent is collected on all sales. 1. Book sales, not including sales tax, for

> On January 1, 2018, the Christie Companies issued bonds with a face value of $500,000, a stated rate of interest of 10 percent, and a 20-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 8

> On January 1, 2018, Hart Company issued bonds with a face value of $60,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at

> Required Use the following information to prepare a classified balance sheet for Alpha Co. at the end of 2018. Accounts receivable………………………………………$26,500 Accounts payable……………………………………………..12,200 Cash……………………………………………………………….20,500 Common stock…………………………

> The following transactions apply to Ozark Sales for 2018: 1. The business was started when the company received $50,000 from the issue of common stock. 2. Purchased equipment inventory of $380,000 on account. 3. Sold equipment for $510,000 cash (not incl

> Use the Target Corporation’s Form 10-K to answer the following questions related to Target’s 2015 fiscal year (year ended January 30, 2016). Target’s Form 10-K is available on the company’s website or through the SEC’s EDGAR database. Appendix A provides

> The Square Foot Grill, Inc. issued $200,000 of 10-year, 6 percent bonds on January 1, 2018, at 102. Interest is payable in cash annually on December 31. The straight-line method is used for amortization. Required: a. Use a financial statements model lik

> Bill Darby started Darby Company on January 1, 2018. The company experienced the following events during its first year of operation: 1. Earned $16,200 of cash revenue. 2. Borrowed $12,000 cash from the bank. 3. Adjusted the accounting records to recogni

> In each of the following situations, state whether the bonds will sell at a premium or discount. a. Valley issued $300,000 of bonds with a stated interest rate of 7 percent. At the time of issue, the market rate of interest for similar investments was 6

> Compute the cash proceeds from bond issues under the following terms. For each case, indicate whether the bonds sold at a premium or discount. a. Pear, Inc. issued $400,000 of 10-year, 8 percent bonds at 103. b. Apple, Inc. issued $200,000 of five-year,

> Diaz Company issued $180,000 face value of bonds on January 1, 2018. The bonds had a 7 percent stated rate of interest and a five-year term. Interest is paid in cash annually, beginning December 31, 2018. The bonds were issued at 98. The straight-line me

> Milan Company issued bonds with a face value of $200,000 on January 1, 2018. The bonds had a 7 percent stated rate of interest and a six-year term. The bonds were issued at face value. Interest is payable on an annual basis. Required: a. What total amou

> Doyle Company issued $500,000 of 10-year, 7 percent bonds on January 1, 2018. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land was

> Boyd Company has a line of credit with State Bank. Boyd can borrow up to $400,000 at any time over the course of the 2018 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid

> Colson Company has a line of credit with Federal Bank. Colson can borrow up to $800,000 at any time over the course of the 2018 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and

> A partial amortization schedule for a 10-year note payable that Mabry Company issued on January 1, 2018, is shown as follows. Required a. What rate of interest is Mabry Company paying on the note? b. Using a financial statements model like the one show

> Bell Farm and Garden Equipment reported the following information for 2018: Net Sales of Equipment……………………………………………….$2,450,567 Other Income………………………………………………………………………6,786 Cost of Goods Sold…………………………………………………………1,425,990 Selling, General, and Administ

> Abardeen Corporation borrowed $90,000 from the bank on October 1, 2018. The note had an 8 percent annual rate of interest and matured on March 31, 2019. Interest and principal were paid in cash on the maturity date. Required: a. What amount of cash did

> At the beginning of 2018, Copeland Drugstore purchased a new computer system for $52,000. It is expected to have a five-year life and a $7,000 salvage value. Required: a. Compute the depreciation for each of the five years, assuming that the company use

> Golden Manufacturing Company started operations by acquiring $150,000 cash from the issue of common stock. On January 1, 2018, the company purchased equipment that cost $120,000 cash, had an expected useful life of six years, and had an estimated salvage

> The following events apply to Gulf Seafood for the 2018 fiscal year: 1. The company started when it acquired $60,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $40,000 cash. 3. Earned $72,000 in cash revenue. 4. Paid $25,000 cash

> Pitney Co. purchased an office building, land, and furniture for $500,000 cash. The appraised value of the assets was as follows: Land……………………………..$180,000 Building………………………….300,000 Furniture………………………..120,000 Total…………………………….$600,000 Required: a. Co

> Carver Inc. purchased a building and the land on which the building is situated for a total cost of $700,000 cash. The land was appraised at $320,000 and the building at $480,000. Required: a. What is the accounting term for this type of acquisition? b.

> Southwest Milling Co. purchased a front-end loader to move stacks of lumber. The loader had a list price of $140,000. The seller agreed to allow a 4 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Freight cos

> Identify each of the following long-term operational assets as either tangible (T) or intangible (I): a. Pizza oven b. Land c. Franchise d. Filing cabinet e. Copyright f. Silver mine g. Office building h. Drill press i. Patent j. Oil well k. Desk l. Good

> American Greetings Corporation manufactures and sells greeting cards and related items such as gift wrapping paper. CSX Corporation is one of the largest railway networks in the nation. The following data were taken from one of the companiesâ€

> Arizona Corp. acquired the business Data Systems for $320,000 cash and assumed all liabilities at the date of purchase. Data’s books showed tangible assets of $260,000, liabilities of $40,000, and stockholders’ equity

> Complete the following requirements using the most recent financial statements available [20xx] on Amazon.com’s corporate website. Obtain the statements on the Internet by following the steps given. (Be aware that the formatting of the company’s website

> Which of the following items should be classified as long-term operational assets? a. Prepaid insurance b. Coal mine c. Office equipment d. Accounts receivable e. Supplies f. Copyright g. Delivery van h. Land used in the business i. Goodwill j. Cash k. F

> Dynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets acquired were the following items: Patent with 4 remaining years of legal life………â€&brvb

> Colorado Mining paid $600,000 to acquire a mine with 40,000 tons of coal reserves. The following statements model reflects Colorado Mining’s financial condition just prior to purchasing the coal reserves. The company extracted 15,000 to

> On January 1, 2018, Webb Construction Company overhauled four cranes resulting in a slight increase in the life of the cranes. Such overhauls occur regularly at two-year intervals and have been treated as maintenance expense in the past. Management is co

> Sellers Construction Company purchased a compressor for $28,000 cash. It had an estimated useful life of four years and a $4,000 salvage value. At the beginning of the third year of use, the company spent an additional $6,000 related to the equipment. Th

> Bill’s Wrecker Service has just completed a minor repair on a tow truck. The repair cost was $1,550, and the book value prior to the repair was $6,500. In addition, the company spent $12,000 to replace the roof on a building. The new roof extended the li

> On January 1, 2018, Poultry Processing Company purchased a freezer and related installation equipment for $42,000. The equipment had a three-year estimated life with a $3,000 salvage value. Straight line depreciation was used. At the beginning of 2020, P

> On January 1, 2018, Prairie Enterprises purchased a parcel of land for $28,000 cash. At the time of purchase, the company planned to use the land for a warehouse site. In 2020, Prairie Enterprises changed its plans and sold the land. Required: a. Assume

> Un Company sold office equipment with a cost of $23,000 and accumulated depreciation of $12,000 for $14,000. Required: a. What is the book value of the asset at the time of sale? b. What is the amount of gain or loss on the disposal? c. How would the sa

> City Taxi Service purchased a new auto to use as a taxi on January 1, 2018, for $36,000. In addition, City paid sales tax and title fees of $1,200 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $4,000. Required: a.

> The following quarterly information is given for Raybon for the year ended 2018 (amounts shown are in millions): Required: a. Divide the class into groups and organize the groups into four sections. Assign each section financial information for one of

> Use the Target Corporation’s Form 10-K to answer the following questions related to Target’s 2015 fiscal year (year ended January 30, 2016). Target’s Form 10-K is available on the company’s website or through the SEC’s EDGAR database. Appendix A provides

> Using the information below for Dean Corporation, calculate the amount of dividends Dean most likely paid to common stockholders in 2013, 2014, and 2015. Retained Earnings Balances Year Net Income $ 700 January 1, 2013 December 31, 2013 890 2008 $25

> The Lazy O ranch just purchased equipment costing $60,000. the equipment is expected to last five years and have no salvage value. (a) Calculate the depreciation expense using the straight-line method for the first two years the equipment is owned. (b) C

> The King Corporation has total annual revenue of $800,000; expenses other than depreciation of $350,000; depreciation expense of $200,000 for tax purposes; and depreciation expense of $130,000 for reporting purposes. the tax rate is 34%. Calculate net in

> Alpha Company purchased 30% of the voting common stock of Beta Company on January 1 and paid $500,000 for the investment. Beta Company reported $100,000 of earnings for the year and paid $40,000 in cash dividends. Calculate investment income and the bala

> The hydrogenics case is the first in a series of four cases that illustrate a comprehensive analysis of an international corporation. In this case the balance sheet will be analyzed with the income statement and cash flow statement analyzed in cases for

> The following excerpts are from the 2013 Walgreen Co. Form 10-K: The accompanying Notes to Consolidated Financial Statements are integral parts of these statements. Notes to Consolidated Financial Statements 1. Summary of Major Accounting Policies Des

> Each chapter in the textbook contains a continuation of this problem. the objective is to learn how to do a comprehensive financial statement analysis in steps as the content of each chapter is learned. Using the 2013 Applied Materials Form 10-K that can

> The 2013 Intel Form 10-K can be found at the following Web site: www.pearsonhighered .com/fraser. Using the Form 10-K, answer the following questions: (a) Prepare a common-size balance sheet for Intel for all years presented. (b) Describe the types of as

> Excerpts from the Management Discussion and analysis of Financial condition and results of Operations (MD&a) of the Biolase, Inc., 2013 Form 10-K are found on pages 39–46. Required: (a) Why is the MD&a section of the annual report useful to the financi

> Locate the Form 10-K for Mattel Inc. using the EDGar database at the SEc Web site: www.sec.gov. answer the following questions using Mattel’s 2013 Form 10-K. 1. Briefly state the line of business within which Mattel Inc. operates. 2. Find the following i

> Each chapter in the textbook contains a continuation of this problem. the objective is to learn how to do a comprehensive financial statement analysis in steps as you learn the content of each chapter. To complete this problem, access the applied Materia

> Look up the FASB home page on the Internet at the following address: www.fasb.org/. Find the list of technical projects that are currently on the board’s agenda. Choose one of the projects that will affect the income statement. Describe the potential cha

> Indicate whether each of the following items would result in net cash flow from operating activities being higher (h) or lower (L) than net income. (a) Decrease in accounts payable. (b) Depreciation expense. (c) Decrease in inventory. (d) Gain on sale of

> Indicate which of the following current assets and current liabilities are operating accounts (O) and thus included in the adjustment of net income to cash flow from operating activities and which are cash (C), investing (I), or financing (F) accounts. (