Question: The following excerpts are from the 2013

The following excerpts are from the 2013 Walgreen Co. Form 10-K:

The accompanying Notes to Consolidated Financial Statements are integral parts of these statements.

Notes to Consolidated Financial Statements

1. Summary of Major Accounting Policies

Description of Business

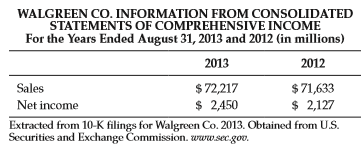

The Company is principally in the retail drugstore business and its operations are within one reportable segment. At August 31, 2013 there were 8,582 drugstore and other locations in 50 states, the District of Columbia, Guam, and Puerto rico. Prescription sales were 62.9% of total sales for fiscal 2013 compared to 63.2% in 2012 and 64.7% in 2011.

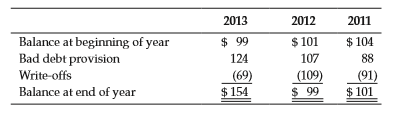

Allowance for Doubtful Accounts

The provision for bad debt is based on both historical write-off percentages and specifically identified receivables. Activity in the allowance for doubtful accounts was as follows (In millions):

Inventories

Inventories are valued on a lower of last-in, first-out (LIFO) cost or market basis. At August 31, 2013 and 2012, inventories would have been greater by $2.1 billion and $1.9 billion, respectively, if they had been valued on a lower of first-in, first-out (FIFO) cost or market basis. As a result of declining inventory levels, the fiscal 2013 and 2012 LIFO provisions were reduced by $194 million and $268 million of LIFO liquidation, respectively. Inventory includes product costs, inbound freight, warehousing costs, and vendor allowances not classified as a reduction of advertising expense.

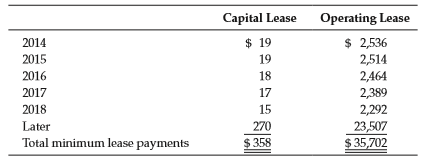

3. Leases the Company owns 20.2% of its operating locations; the remaining locations are leased premises. Initial terms are typically 20 to 25 years, followed by additional terms containing renewal options at five-year intervals, and may include rent escalation clauses. the commencement date of all lease terms is the earlier of the date the Company becomes legally obligated to make rent payments or the date the Company has the right to control the property. the Company recognizes rent expense on a straight-line basis over the term of the lease. In addition to minimum fixed rentals, some leases provide for contingent rentals based upon a portion of sales. Minimum rental commitments at August 31, 2013, under all leases having an initial or remaining non-cancelable term of more than one year are shown below (In millions):

The capital lease amount includes $155 million of imputed interest and executory costs. total minimum lease payments have not been reduced by minimum sublease rentals of approximately $140 million on leases due in the future under non-cancelable subleases.

The Company remains secondarily liable on 26 assigned leases. the maximum potential undiscounted future payments are $18 million at August 31, 2013. Lease option dates vary, with some extending to 2041.

Required:

(a) Using the Consolidated Balance Sheets for Walgreen Co. for August 31, 2013 and 2012, prepare a common-size Balance Sheet.

(b) Which current asset is the most significant? Which noncurrent asset is the most significant? Are the relative proportions of current and noncurrent assets what you would expect for a drug store?

(c) Analyze accounts receivable and allowance for doubtful accounts.

(d) What inventory method is used to value inventories? has Walgreen experienced inflation or deflation? Explain your answer. Explain the reference in the inventory note to the LIFO liquidation and what this means with regard to net income reported.

(e) Assess the level of debt and risk that Walgreen has by looking only at the balance sheet.

(f) Estimate the dollar amount of dividends Walgreen paid in 2013.

(g) Does Walgreen use off–balance sheet financing? Explain your answer.

(h) Evaluate the creditworthiness of Walgreen based on the balance sheet and the excerpts from the notes.

Transcribed Image Text:

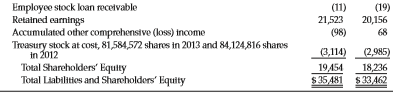

CONSOLIDATED BALANCE SHEETS Walgreen Co. and Subsidiaries at August 31, 2013 and 2012 Yin millions, except shares and per share amounts) 2013 2012 Assets Current Assets Cash and cash equivakents Accounts neceivable, net $ 2,106 $ 1,297 2,167 7,086 2,632 Inventories Other current assets Total Curront Assets 6,852 284 260 11,874 10,760 Noncurrent Assets Property and oquipment, at cost, less accumulatod doprociation and amortization 12,138 12,038 Equity investment in Alliance Boots Alliance Boots call option 2,410 2,161 6,261 6,140 Соodwill 839 866 Other noncurrent assets 1,959 23,617 $35481 1,497 Total Noncurrent Assets 22,702 $33462 Total Assets Liabilities and Shareholders' Equity Current Liabilites $ 570 $1,319 Short-term borrowings Trade accounts payable Accrued exponsos and other liabilities 4,635 4,384 3,577 3,019 Income taxes 101 Total Current Liabilities 8,883 8,722 NonCurrent Liabilites Long-term debt Deferred income taxes 4,477 4,073 600 545 Other noncurrent liabilities 2,067 1,886 Total Noncurrent Liabilities 7,144 6,50M Commitments and Contingencies (see Note) Shareholders' Equity Preferred stock, S.0625 par value; authortzed 32 million shares; noñe issued Common stock, S.078125 par valte; authorized 3.2 billion shares; issued 1,028,180,150 shares in 2013 and 2012 Paid-in captal 80 80 1,074 936 Employee stock loan receivable Retained earningN Accumulated other comprehensive (loss) tncome Treasury stock at cost, 81,584,572 shares in 2013 and 84,124,816 shares in 2012 Total Shareholders' Equity Total Liabilitios and Sharoholders' Equity (11) (19) 21,523 20,156 68 (98) (3,114) (2,985) 19,454 $35,481 $33A62 18,236 2013 2012 2011 Balance at beginning of year $ 9 $ 101 $ 104 Bad debt provision 124 107 88 Write-offs (69) $ 154 (109) $ 99 (91) $ 101 Balance at end of year Capital Lease Operating Lease 2014 $ 19 $ 2,536 2015 19 2,514 2016 18 2,464 2017 17 2,389 2,292 23,507 $ 35,702 2018 15 Later 270 Total minimum lease payments $ 358 WALGREEN CO. INFORMATION FROM CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the Years Ended August 31, 2013 and 2012 (in millions) 2013 2012 $ 72,217 $ 2,450 $ 71,633 $ 2,127 Sales Net income Extracted from 10-K filings for Walgreen Co. 2013. Obtained from U.S. Securities and Exchange Commission. www.sec.gov.

> To support herself while attending school, Daun Deloch sold stereo systems to other students. During the first year of operations, Deloch purchased the stereo systems for $140,000 and sold them for $250,000 cash. She provided her customers with a one-yea

> The following three independent sets of facts relate to contingent liabilities: 1. In November of the current year an automobile manufacturing company recalled all pickup trucks manufactured during the past two years. A flaw in the battery cable was disc

> The following selected transactions apply to Topeca Supply for November and December 2018. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month. 1

> Vail Book Mart sells books and other supplies to students in a state where the sales tax rate is 8 percent. Vail engaged in the following transactions for 2018. Sales tax of 8 percent is collected on all sales. 1. Book sales, not including sales tax, for

> On January 1, 2018, the Christie Companies issued bonds with a face value of $500,000, a stated rate of interest of 10 percent, and a 20-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 8

> On January 1, 2018, Hart Company issued bonds with a face value of $60,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent at

> On January 1, 2018, Parker Company issued bonds with a face value of $80,000, a stated rate of interest of 8 percent, and a five-year term to maturity. Interest is payable in cash on December 31 of each year. The effective rate of interest was 9 percent

> Required Use the following information to prepare a classified balance sheet for Alpha Co. at the end of 2018. Accounts receivable………………………………………$26,500 Accounts payable……………………………………………..12,200 Cash……………………………………………………………….20,500 Common stock…………………………

> The following transactions apply to Ozark Sales for 2018: 1. The business was started when the company received $50,000 from the issue of common stock. 2. Purchased equipment inventory of $380,000 on account. 3. Sold equipment for $510,000 cash (not incl

> Use the Target Corporation’s Form 10-K to answer the following questions related to Target’s 2015 fiscal year (year ended January 30, 2016). Target’s Form 10-K is available on the company’s website or through the SEC’s EDGAR database. Appendix A provides

> The Square Foot Grill, Inc. issued $200,000 of 10-year, 6 percent bonds on January 1, 2018, at 102. Interest is payable in cash annually on December 31. The straight-line method is used for amortization. Required: a. Use a financial statements model lik

> Bill Darby started Darby Company on January 1, 2018. The company experienced the following events during its first year of operation: 1. Earned $16,200 of cash revenue. 2. Borrowed $12,000 cash from the bank. 3. Adjusted the accounting records to recogni

> In each of the following situations, state whether the bonds will sell at a premium or discount. a. Valley issued $300,000 of bonds with a stated interest rate of 7 percent. At the time of issue, the market rate of interest for similar investments was 6

> Compute the cash proceeds from bond issues under the following terms. For each case, indicate whether the bonds sold at a premium or discount. a. Pear, Inc. issued $400,000 of 10-year, 8 percent bonds at 103. b. Apple, Inc. issued $200,000 of five-year,

> Diaz Company issued $180,000 face value of bonds on January 1, 2018. The bonds had a 7 percent stated rate of interest and a five-year term. Interest is paid in cash annually, beginning December 31, 2018. The bonds were issued at 98. The straight-line me

> Milan Company issued bonds with a face value of $200,000 on January 1, 2018. The bonds had a 7 percent stated rate of interest and a six-year term. The bonds were issued at face value. Interest is payable on an annual basis. Required: a. What total amou

> Doyle Company issued $500,000 of 10-year, 7 percent bonds on January 1, 2018. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land was

> Boyd Company has a line of credit with State Bank. Boyd can borrow up to $400,000 at any time over the course of the 2018 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid

> Colson Company has a line of credit with Federal Bank. Colson can borrow up to $800,000 at any time over the course of the 2018 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and

> A partial amortization schedule for a 10-year note payable that Mabry Company issued on January 1, 2018, is shown as follows. Required a. What rate of interest is Mabry Company paying on the note? b. Using a financial statements model like the one show

> Bell Farm and Garden Equipment reported the following information for 2018: Net Sales of Equipment……………………………………………….$2,450,567 Other Income………………………………………………………………………6,786 Cost of Goods Sold…………………………………………………………1,425,990 Selling, General, and Administ

> Abardeen Corporation borrowed $90,000 from the bank on October 1, 2018. The note had an 8 percent annual rate of interest and matured on March 31, 2019. Interest and principal were paid in cash on the maturity date. Required: a. What amount of cash did

> At the beginning of 2018, Copeland Drugstore purchased a new computer system for $52,000. It is expected to have a five-year life and a $7,000 salvage value. Required: a. Compute the depreciation for each of the five years, assuming that the company use

> Golden Manufacturing Company started operations by acquiring $150,000 cash from the issue of common stock. On January 1, 2018, the company purchased equipment that cost $120,000 cash, had an expected useful life of six years, and had an estimated salvage

> The following events apply to Gulf Seafood for the 2018 fiscal year: 1. The company started when it acquired $60,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $40,000 cash. 3. Earned $72,000 in cash revenue. 4. Paid $25,000 cash

> Pitney Co. purchased an office building, land, and furniture for $500,000 cash. The appraised value of the assets was as follows: Land……………………………..$180,000 Building………………………….300,000 Furniture………………………..120,000 Total…………………………….$600,000 Required: a. Co

> Carver Inc. purchased a building and the land on which the building is situated for a total cost of $700,000 cash. The land was appraised at $320,000 and the building at $480,000. Required: a. What is the accounting term for this type of acquisition? b.

> Southwest Milling Co. purchased a front-end loader to move stacks of lumber. The loader had a list price of $140,000. The seller agreed to allow a 4 percent discount because Southwest Milling paid cash. Delivery terms were FOB shipping point. Freight cos

> Identify each of the following long-term operational assets as either tangible (T) or intangible (I): a. Pizza oven b. Land c. Franchise d. Filing cabinet e. Copyright f. Silver mine g. Office building h. Drill press i. Patent j. Oil well k. Desk l. Good

> American Greetings Corporation manufactures and sells greeting cards and related items such as gift wrapping paper. CSX Corporation is one of the largest railway networks in the nation. The following data were taken from one of the companiesâ€

> Arizona Corp. acquired the business Data Systems for $320,000 cash and assumed all liabilities at the date of purchase. Data’s books showed tangible assets of $260,000, liabilities of $40,000, and stockholders’ equity

> Complete the following requirements using the most recent financial statements available [20xx] on Amazon.com’s corporate website. Obtain the statements on the Internet by following the steps given. (Be aware that the formatting of the company’s website

> Which of the following items should be classified as long-term operational assets? a. Prepaid insurance b. Coal mine c. Office equipment d. Accounts receivable e. Supplies f. Copyright g. Delivery van h. Land used in the business i. Goodwill j. Cash k. F

> Dynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets acquired were the following items: Patent with 4 remaining years of legal life………â€&brvb

> Colorado Mining paid $600,000 to acquire a mine with 40,000 tons of coal reserves. The following statements model reflects Colorado Mining’s financial condition just prior to purchasing the coal reserves. The company extracted 15,000 to

> On January 1, 2018, Webb Construction Company overhauled four cranes resulting in a slight increase in the life of the cranes. Such overhauls occur regularly at two-year intervals and have been treated as maintenance expense in the past. Management is co

> Sellers Construction Company purchased a compressor for $28,000 cash. It had an estimated useful life of four years and a $4,000 salvage value. At the beginning of the third year of use, the company spent an additional $6,000 related to the equipment. Th

> Bill’s Wrecker Service has just completed a minor repair on a tow truck. The repair cost was $1,550, and the book value prior to the repair was $6,500. In addition, the company spent $12,000 to replace the roof on a building. The new roof extended the li

> On January 1, 2018, Poultry Processing Company purchased a freezer and related installation equipment for $42,000. The equipment had a three-year estimated life with a $3,000 salvage value. Straight line depreciation was used. At the beginning of 2020, P

> On January 1, 2018, Prairie Enterprises purchased a parcel of land for $28,000 cash. At the time of purchase, the company planned to use the land for a warehouse site. In 2020, Prairie Enterprises changed its plans and sold the land. Required: a. Assume

> Un Company sold office equipment with a cost of $23,000 and accumulated depreciation of $12,000 for $14,000. Required: a. What is the book value of the asset at the time of sale? b. What is the amount of gain or loss on the disposal? c. How would the sa

> City Taxi Service purchased a new auto to use as a taxi on January 1, 2018, for $36,000. In addition, City paid sales tax and title fees of $1,200 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $4,000. Required: a.

> The following quarterly information is given for Raybon for the year ended 2018 (amounts shown are in millions): Required: a. Divide the class into groups and organize the groups into four sections. Assign each section financial information for one of

> Use the Target Corporation’s Form 10-K to answer the following questions related to Target’s 2015 fiscal year (year ended January 30, 2016). Target’s Form 10-K is available on the company’s website or through the SEC’s EDGAR database. Appendix A provides

> Using the information below for Dean Corporation, calculate the amount of dividends Dean most likely paid to common stockholders in 2013, 2014, and 2015. Retained Earnings Balances Year Net Income $ 700 January 1, 2013 December 31, 2013 890 2008 $25

> The Lazy O ranch just purchased equipment costing $60,000. the equipment is expected to last five years and have no salvage value. (a) Calculate the depreciation expense using the straight-line method for the first two years the equipment is owned. (b) C

> The King Corporation has total annual revenue of $800,000; expenses other than depreciation of $350,000; depreciation expense of $200,000 for tax purposes; and depreciation expense of $130,000 for reporting purposes. the tax rate is 34%. Calculate net in

> Alpha Company purchased 30% of the voting common stock of Beta Company on January 1 and paid $500,000 for the investment. Beta Company reported $100,000 of earnings for the year and paid $40,000 in cash dividends. Calculate investment income and the bala

> The hydrogenics case is the first in a series of four cases that illustrate a comprehensive analysis of an international corporation. In this case the balance sheet will be analyzed with the income statement and cash flow statement analyzed in cases for

> Each chapter in the textbook contains a continuation of this problem. the objective is to learn how to do a comprehensive financial statement analysis in steps as the content of each chapter is learned. Using the 2013 Applied Materials Form 10-K that can

> The 2013 Intel Form 10-K can be found at the following Web site: www.pearsonhighered .com/fraser. Using the Form 10-K, answer the following questions: (a) Prepare a common-size balance sheet for Intel for all years presented. (b) Describe the types of as

> Excerpts from the Management Discussion and analysis of Financial condition and results of Operations (MD&a) of the Biolase, Inc., 2013 Form 10-K are found on pages 39–46. Required: (a) Why is the MD&a section of the annual report useful to the financi

> Locate the Form 10-K for Mattel Inc. using the EDGar database at the SEc Web site: www.sec.gov. answer the following questions using Mattel’s 2013 Form 10-K. 1. Briefly state the line of business within which Mattel Inc. operates. 2. Find the following i

> Each chapter in the textbook contains a continuation of this problem. the objective is to learn how to do a comprehensive financial statement analysis in steps as you learn the content of each chapter. To complete this problem, access the applied Materia

> Look up the FASB home page on the Internet at the following address: www.fasb.org/. Find the list of technical projects that are currently on the board’s agenda. Choose one of the projects that will affect the income statement. Describe the potential cha

> Indicate whether each of the following items would result in net cash flow from operating activities being higher (h) or lower (L) than net income. (a) Decrease in accounts payable. (b) Depreciation expense. (c) Decrease in inventory. (d) Gain on sale of

> Indicate which of the following current assets and current liabilities are operating accounts (O) and thus included in the adjustment of net income to cash flow from operating activities and which are cash (C), investing (I), or financing (F) accounts. (

> Identify the following as financing activities (F) or investing activities (I): (a) Purchase of equipment. (b) Purchase of treasury stock. (c) reduction of long-term debt. (d) Sale of building. (e) resale of treasury stock. (f) Increase in short-term deb

> Why is the statement of cash flows a useful document?

> Research the joint FaSB/IaSB Financial Statement presentation project. Write a short essay outlining the current status of the project and the expected changes to the financial statements.

> How is it possible for a company with positive retained earnings to be unable to pay a cash dividend?

> What are the intangible factors that are important in evaluating a company’s financial position and performance but are not available in the annual report?

> Explain what can be found on a statement of stockholders’ equity.

> Indicate whether each of the following events would cause an inflow or an outflow of cash and whether it would affect the investing (I) or financing (F) activities on the statement of cash flows. (a) repayments of long-term debt. (b) Sales of marketable

> Which inventory valuation method, FIFO or LIFO, will generally produce an ending inventory value on the balance sheet that is closest to current cost?

> What is an example of an industry that would need to spend a minimum amount on advertising to be competitive? On research and development?

> How is a common-size income statement created?

> What organization has legal authority to set accounting policies in the United States? Does this organization write most of the accounting rules in the United States? Explain.

> What are the two causes of an increasing or decreasing sales number?

> How is a common-size balance sheet created?

> What is the difference between a multiple-step and a single-step format of the earnings statement? Which format is the most useful for analysis?

> Eleanor’s Computers is a retailer of computer products. Using the financial data provided, complete the financial ratio calculations for 2016. Advise management of any ratios that indicate potential problems and provide an explanation o

> Determine the effect on the current ratio, the quick ratio, net working capital (current assets less current liabilities), and the debt ratio (total liabilities to total assets) of each of the following transactions. Consider each transaction separately

> ABC Company and XYZ Company are competitors in the manufacturing industry. The following ratios and financial information have been compiled for these two companies for the most recent year: Required: (a) Compare and evaluate the strengths and weakness

> RareMetals Inc. sells a rare metal found only in underdeveloped countries overseas. As a result of unstable governments in these countries and the rarity of the metal, the price fluctuates significantly. Financial information is given assuming the use of

> Luna Lighting, a retail firm, has experienced modest sales growth over the past three years but has had difficulty translating the expansion of sales into improved profitability. Using three years’ financial statements, you have develop

> How is the Du Pont System helpful to the analyst?

> What do liquidity ratios measure? Activity ratios? Leverage ratios? Profitability ratios? Market ratios?

> What are the limitations of financial ratios?

> Sage Inc.’s staff of accountants finished preparing the financial statements for 2016 and will meet next week with the company’s CEO as well as the Director of Investor relations and representatives from the marketing and art departments to design the cu

> Using the ratios and information given for republic Airways holdings Inc. & Subsidiaries, an airline company, analyze the capital structure, long-term solvency, and profitability of republic Airways as of 2013. Financial ratios 2013 2012 Leverag

> Using the ratios and information given for Wal-Mart Stores, Inc., a retailer, analyze the short-term liquidity and operating efficiency of the firm as of January 31, 2014. Financial ratios for the years ended January 31, 2014 2013 Liquidity Current

> Laurel Street, president of Uvalde Manufacturing Inc., is preparing a proposal to present to her board of directors regarding a planned plant expansion that will cost $10 million. At issue is whether the expansion should be financed with debt (a long-ter

> Explain how the credit analyst’s focus will differ from the investment analyst’s focus.

> Condensed financial statements for Dragoon Enterprises follow. (a) Calculate the amount of dividends Dragoon paid using the information given. (b) Prepare a statement of cash flows using the indirect method. Dragoon Enterprises Comparative Balance

> What can creditors, investors, and other users learn from an analysis of the cash flow statement?

> How does the direct method differ from the indirect method?

> Define the following terms as they relate to the statement of cash flows: cash, operating activities, investing activities, and financing activities.

> Prior to the financial recession in the late 2000s, some companies had built up significant cash balances. Since that time some companies have continued to increase their cash balances and discussions began about whether “cash hoarding” by firms was an a

> Write a short article (250 words) for a local business publication in which you explain why cash flow from operations is important information for small business owners.

> The following cash flows were reported by Techno Inc. in 2015 and 2014. (a) Explain the difference between net income and cash flow from operating activities for Techno in 2015. (b) Analyze Techno Inc.’s cash flows for 2015 and 2014.

> The following comparative balance sheets and income statement are available for AddieMae Inc. Prepare a statement of cash flows for 2016 using the indirect method and analyze the statement. December 31, 2016 2015 $ 3,300 1,100 11,200 $15,600 Cash $

> The following income statement and balance sheet information are available for two firms, Firm A and Firm B. (a) Calculate the amount of dividends Firm A and Firm B paid using the information given. (b) Prepare a statement of cash flows for each firm usi

> Discuss the four items that are included in a company’s comprehensive income.

> Explain how a company could have a decreasing gross profit margin but an increasing operating profit margin.

> Discuss all reasons that could explain an increase or decrease in gross profit margin.

> Income statements are presented for the Elf Corporation for the years ending December 31, 2016, 2015, and 2014. Required: Write a one-paragraph analysis of Elf Corporation’s profit performance for the period. To the Student: The focus

> LA Theatres Inc. has two distinct revenue sources, ticket and concession revenues. The following information from LA Theatres Inc. income statements for the past three years is available: (a) Calculate gross profit margins for tickets and concessions f

> Income statements for Yarrick Company for the years ending December 31, 2016, 2015, and 2014 are shown below. Prepare a common-size income statement and analyze the profitability of the company. Yarrick Company Income Statements for the Years Ending

> Prepare a multiple-step income statement for Jackrabbit Inc. from the following single step statement. Net sales……………………………………………………..$1,840,000 Gain on sale of equipment……………………………………15,000 Interest income…………………………………………………..13,000