Question: On January 1, 2021, the general ledger

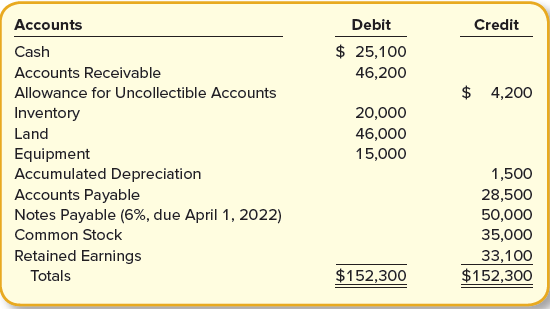

On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:

During January 2021, the following transactions occur:

January 2 Sold gift cards totaling $8,000. The cards are redeemable for merchandise within one year of the purchase date.

January 6 Purchase additional inventory on account, $147,000.

January 15 Firework sales for the first half of the month total $135,000. All of these sales are on account. The cost of the units sold is $73,800.

January 23 Receive $125,400 from customers on accounts receivable.

January 25 Pay $90,000 to inventory suppliers on accounts payable.

January 28 Write off accounts receivable as uncollectible, $4,800.

January 30 Firework sales for the second half of the month total $143,000. Sales include $11,000 for cash and $132,000 on account. The cost of the units sold is $79,500.

January 31 Pay cash for monthly salaries, $52,000.

Required:

1. Record each of the transactions listed above.

2. Record adjusting entries on January 31.

a. Depreciation on the equipment for the month of January is calculated using the straight- line method. At the time the equipment was purchased, the company estimated a residual value of $3,000 and a two-year service life.

b. At the end of January, $11,000 of accounts receivable are past due, and the company estimates that 30% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 5% will not be collected.

c. Accrued interest expense on notes payable for January.

d. Accrued income taxes at the end of January are $13,000.

e. By the end of January, $3,000 of the gift cards sold on January 2 have been redeemed (ignore cost of goods sold).

3. Prepare an adjusted trial balance as of January 31, 2021, after updating beginning balances (above) for transactions during January (requirement 1) and adjusting entries at the end of January (requirement 2).

4. Prepare a multiple-step income statement for the period ended January 31, 2021.

5. Prepare a classified balance sheet as of January 31, 2021.

6. Record closing entries.

7. Analyze the following for ACME Fireworks:

a. Calculate the current ratio at the end of January. If the average current ratio for the industry is 1.8, is ACME Fireworks more or less liquid than the industry average?

b. Calculate the acid-test ratio at the end of January. If the average acid-test ratio for the industry is 1.5, is ACME Fireworks more or less likely to have difficulty paying its currently maturing debts (compared to the industry average)?

c. Assume the notes payable were due on April 1, 2021, rather than April 1, 2022. Calculate the revised current ratio at the end of January, and indicate whether the revised ratio would increase, decrease, or remain unchanged compared to your answer in (a).

> Refer to the information in E10–6. In its first year of operations, Finishing Touches has net income of $160,000 and pays dividends at the end of the year of $94,500 ($1 per share) on all common shares outstanding and $2,400 on all preferred shares outst

> Finishing Touches has two classes of stock authorized: 8%, $10 par preferred, and $1 par value common. The following transactions affect stockholders’ equity during 2021, its first year of operations: January 2 Issues 100,000 shares of common stock for $

> Italian Stallion has the following transactions during the year related to stockholders’ equity. February 1 Issues 6,000 shares of no-par common stock for $16 per share. May 15 Issues 700 shares of $10 par value preferred stock for $13 per share. October

> Nathan’s Athletic Apparel has 2,000 shares of 5%, $100 par value preferred stock the company issued at the beginning of 2020. All remaining shares are common stock. The company was not able to pay dividends in 2020, but plans to pay dividends of $22,000

> Clothing Frontiers began operations on January 1 and engages in the following transactions during the year related to stockholders’ equity. January 1 Issues 700 shares of common stock for $50 per share. April 1 Issues 110 additional shares of common stoc

> Your friend, Jonathon Fain, is an engineering major with an entrepreneurial spirit. He wants to start his own corporation and needs your accounting expertise. He has no idea what the following terms mean: (1) authorized stock, (2) issued stock, (3) outst

> Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1. Calculate the debt to equity ratio for the past two years. Did the ratio increase or decrease the more recent year? 2. Calculate the return on assets

> On January 1, 2021, the general ledger of Grand Finale Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2 Issue an additional 2,000 shares of $1 par value common stock for $40,000. January

> Financial information for Forever 18 includes the following selected data: Required: 1. Calculate earnings per share in 2020 and 2021. Did earnings per share increase in 2021? 2. Calculate the price-earnings ratio in 2020 and 2021. In which year is the s

> The financial statements of Friendly Fashions include the following selected data (in millions): Required: 1. Calculate the return on equity in 2021. 2. Calculate the dividend yield in 2021. 3. Calculate earnings per share in 2021. 4. Calculate the price

> United Apparel has the following balances in its stockholders’ equity accounts on December 31, 2021: Treasury Stock, $850,000; Common Stock, $600,000; Preferred Stock, $3,600,000; Retained Earnings, $2,200,000; and Additional Paid-in Capital, $8,800,000.

> Indicate whether each of the following transactions increases (+), decreases (−), or has no effect (NE) on total assets, total liabilities, and total stockholders’ equity. The first transaction is completed as an examp

> Refer to the information in E10–9. Power Drive Corporation has the following beginning balances in its stockholders’ equity accounts on January 1, 2021: Common Stock, $100,000; Additional Paid-in Capital, $5,500,000; a

> Refer to the information in E10–9. Power Drive Corporation has the following beginning balances in its stockholders’ equity accounts on January 1, 2021: Common Stock, $100,000; Additional Paid-in Capital, $5,500,000; and Retained Earnings, $3,000,000. Ne

> On September 1, the board of directors of Colorado Outfitters, Inc., declares a stock dividend on its 10,000, $1 par, common shares. The market price of the common stock is $30 on this date. Required: 1. Record the stock dividend assuming a small (10%) s

> Match (by letter) the following terms with their definitions. Each letter is used only once. Definitions a. Shareholders can lose no more than the amount they invest in the company. b. Corporate earnings are taxed twice—at the corporate

> On January 1, 2021, Splash City issues $500,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Required: Assuming the market interest rate on the issue date is 8%, the bonds will issue at $549,482.

> Tony’s favorite memories of his childhood were the times he spent with his dad at camp. Tony was daydreaming of those days a bit as he and Suzie jogged along a nature trail and came across a wonderful piece of property for sale. He turned to Suzie and sa

> On January 1, 2021, Splash City issues $500,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Required: Assuming the market interest rate on the issue date is 10%, the bonds will issue at $457,102.

> On January 1, 2021, Splash City issues $500,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. Required: Assuming the market interest rate on the issue date is 9%, the bonds will issue at $500,000.

> On June 30, 2021, Exploration Inc. signs a lease requiring quarterly payments each year for the next five years. Each of the 20 quarterly payments is $29,122.87, with the first lease payment beginning September 30. The company’s normal borrowing rate is

> On June 1, 2021, Florida National leased a building. The lease agreement calls for Florida National to make lease payments of $3,618.18 each month for the next two years, with the first lease payment beginning June 30. The company’s normal borrowing rate

> Coney Island enters into a lease agreement for a new ride. The lease payments have a present value of $2 million. Prior to this agreement, the company’s total assets are $25 million and its total liabilities are $15 million. Required: 1. Calculate total

> On January 1, 2021, Jalen Company purchased land costing $800,000. Instead of paying cash at the time of purchase, Jalen plans to make four installment payments of $215,221.64 on June 30 and December 31 in 2021 and 2022. The payments include interest at

> On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: During January 2021, the following transactions occur: January 1 Borrow $100,000 from Captive Credit Corporation. The installment note bears interest at

> Two online travel companies, E-Travel and Pricecheck, provide the following selected financial data: Required: 1. Calculate the debt to equity ratio for E-Travel and Pricecheck. Which company has the higher ratio? 2. Calculate the times interest earned r

> On January 1, 2021, Tropical Paradise borrows $50,000 by agreeing to a 6%, six-year note with the bank. The funds will be used to purchase a new BMW convertible for use in promoting resort properties to potential customers. Loan payments of $828.64 are d

> On January 1, 2021, Water World issues $26 million of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Water World intends to use the funds to build the world’s largest water avalanche and the “tornado”—

> Quattro Technologies, a hydraulic manufacturer in the aeronautics industry, has reported steadily increasing net income over the past few years. The company reported net income of $120 million in 2019 and $140 million in 2020. The stock is receiving incr

> On January 1, 2021, Frontier World issues $41 million of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. The proceeds will be used to build a new ride that combines a roller coaster, a water ride, a dar

> On January 1, 2021, White Water issues $600,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. The market interest rate on the issue date is 6% and the bonds issued at $644,632. Required: 1. Using a

> On January 1, 2021, Splash City issues $500,000 of 9% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. The market interest rate on the issue date is 10% and the bonds issued at $457,102. Required: 1. Using

> On January 1, 2021, White Water issues $600,000 of 7% bonds, due in 10 years, with interest payable annually on December 31 each year. Required: Assuming the market interest rate on the issue date is 6%, the bonds will issue at $644,161. 1. Complete the

> On January 1, 2021, White Water issues $600,000 of 7% bonds, due in 10 years, with interest payable annually on December 31 each year. Required: Assuming the market interest rate on the issue date is 8%, the bonds will issue at $559,740. 1. Complete the

> On January 1, 2021, White Water issues $600,000 of 7% bonds, due in 10 years, with interest payable annually on December 31 each year. Required: Assuming the market interest rate on the issue date is 7%, the bonds will issue at $600,000. Record the bond

> On January 1, 2021, White Water issues $600,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Required: Assuming the market interest rate on the issue date is 6%, the bonds will issue at $644,632.

> On January 1, 2021, White Water issues $600,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Required: Assuming the market interest rate on the issue date is 8%, the bonds will issue at $559,229.

> On January 1, 2021, White Water issues $600,000 of 7% bonds, due in 10 years, with interest payable semiannually on June 30 and December 31 each year. Required: Assuming the market interest rate on the issue date is 7%, the bonds will issue at $600,000.

> Penny Arcades, Inc., is trying to decide between the following two alternatives to finance its new $35 million gaming center: a. Issue $35 million, 7% note. b. Issue 1 million shares of common stock for $35 per share. Required: 1. Assuming the note or sh

> Western Manufacturing is involved with several potential contingent liabilities. Your assignment is to draft the appropriate accounting treatment for each situation described below. Western’s fiscal year-end is December 31, 2021, and the financial statem

> Barth Interior provides decorating advice to its clients. Three recent transactions of the company include a. Providing decorating services of $500 on account to one of its clients. b. Paying $1,200 for an employee’s salary in the current period. c. Purc

> Airline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for January, the first month of ATS’s fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,

> During January, Luxury Cruise Lines incurs employee salaries of $3 million. Withholdings in January are $229,500 for the employee portion of FICA, $450,000 for federal income tax, $187,500 for state income tax, and $30,000 for the employee portion of hea

> Aspen Ski Resorts has 100 employees, each working 40 hours per week and earning $20 an hour. Although the company does not pay any health or retirement benefits, one of the perks of working at Aspen is that employees are allowed free skiing on their days

> The following selected transactions relate to liabilities of Rocky Mountain Adventures. Rocky Mountain’s fiscal year ends on December 31. January 13 Negotiate a revolving credit agreement with First Bank that can be renewed annually upon bank approval. T

> OS Environmental provides cost-effective solutions for managing regulatory requirements and environmental needs specific to the airline industry. Assume that on July 1 the company issues a one-year note for the amount of $6 million. Interest is payable a

> On August 1, 2021, Trico Technologies, an aeronautic electronics company, borrows $21 million cash to expand operations. The loan is made by FirstBanc Corp. under a short-term line of credit arrangement. Trico signs a six-month, 9% promissory note. Inter

> On August 1, 2021, Trico Technologies, an aeronautic electronics company, borrows $21 million cash to expand operations. The loan is made by FirstBanc Corp. under a short-term line of credit arrangement. Trico signs a six-month, 9% promissory note. Inter

> On November 1, 2021, Aviation Training Corp. borrows $60,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 7% note payable. Interest is payable at maturity. Aviation’s year-end is December 31. Required: 1. Record the note p

> Selected financial data regarding current assets and current liabilities for Queen’s Line, a competitor in the cruise line industry, is provided: Required: 1. Calculate the current ratio and the acid-test ratio for Queenâ€

> A very helpful site to learn about individual publicly traded companies is finance.yahoo.com. Go to this website and look up a well-known publicly traded company. Once you find the company page, perform the following tasks. Required: 1. Click on “Basic C

> Dow Chemical Company provides chemical, plastic, and agricultural products and services to various consumer markets. The following excerpt is taken from the disclosure notes of Dow’s annual report. Required: 1. Does the excerpt describe

> Lindy Appliance begins operations in 2021 and offers a one-year warranty on all products sold. Total appliance sales in 2021 are $1,600,000, and Lindy estimates future warranty costs in 2022 to be 2% of current sales. Actual warranty costs in 2022 are $2

> Computer Wholesalers restores and resells notebook computers. It originally acquires the notebook computers from corporations upgrading their computer systems, and it backs each notebook it sells with a 90-day warranty against defects. Based on previous

> Pacific Cruise Lines is a defendant in litigation involving a swimming accident on one of its three cruise ships. Required: For each of the following scenarios, determine the appropriate way to report the situation. Explain your reasoning and record any

> Top Sound International designs and sells high-end stereo equipment for auto and home use. Engineers notified management in December 2021 of a circuit flaw in an amplifier that poses a potential fire hazard. Further investigation indicates that a product

> Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2021, Vail sells gift cards (lift passes) for $100,000. The gift cards are redeemable for one day of skiing during the upcoming winter season. The gift cards expire o

> Apple Inc. is the number one online music retailer through its iTunes music store. Apple sells iTunes gift cards in $15, $25, and $50 increments. Assume Apple sells $21 million in iTunes gift cards in November, and customers redeem $14 million of the gif

> Match (by letter) the correct reporting method for each of the items listed below.

> Sub Sandwiches of America made the following expenditures related to its restaurant: 1. Replaced the heating equipment at a cost of $250,000. 2. Covered the patio area with a clear plastic dome and enclosed it with glass for use during the winter months.

> Listed below are several terms and phrases associated with operational assets. Pair each item from List A (by letter) with the item from List B that is most appropriately associated with it.

> Eugene Wright is CFO of Caribbean Cruise Lines. The company offers luxury cruises. It’s near year-end, and Eugene is feeling kind of queasy. The economy is in a recession, and demand for luxury cruises is way down. Eugene doesn’t want the company’s curre

> Satellite Systems modified its model Z2 satellite to incorporate a new communication device. The company made the following expenditures: During your year-end review of the accounts related to intangibles, you discover that the company has capitalized al

> Mainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $30,000,000 in cash. The book values and fair values of Iceberg’s assets and liabilities were as follows: Required: Calculate the

> Brick Oven Corporation made the following expenditures during the first month of operations: Required: Record the $131,500 in cash expenditures.

> The Donut Stop purchased land and a building for $2 million. To maximize the company’s tax deduction for depreciation, management allocated only 10% of the purchase price to land and 90% of the purchase price to the building. A more reasonable allocation

> Red Rock Bakery purchases land, building, and equipment for a single purchase price of $600,000. However, the estimated fair values of the land, building, and equipment are $175,000, $455,000, and $70,000, respectively, for a total estimated fair value o

> 21 On January 1, 2021, the general ledger of TNT Fireworks includes the following account balances: During January 2021, the following transactions occur: January 1 Purchase equipment for $19,500. The company estimates a residual value of $1,500 and a

> Midwest Services, Inc., operates several restaurant chains throughout the Midwest. One restaurant chain has experienced sharply declining profits. The company’s management has decided to test the operational assets of the restaurants fo

> Orion Flour Mills purchased a new machine and made the following expenditures: The machine, including sales tax, was purchased on account, with payment due in 30 days. The other expenditures listed above were paid in cash. Required: Record the above expe

> Brad’s BBQ reported sales of $735,000 and net income of $28,000. Brad’s also reported ending total assets of $496,000 and beginning total assets of $389,000. Required: Calculate the return on assets, the profit margin, and the asset turnover ratio for Br

> Salad Express exchanged land it had been holding for future plant expansion for a more suitable parcel of land along distribution routes. Salad Express reported the old land on the previously issued balance sheet at its original cost of $70,000. Accordin

> Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Calculate the current ratio for both companies for the year e

> Abbott Landscaping purchased a tractor at a cost of $42,000 and sold it three years later for $21,600. Abbott recorded depreciation using the straight-line method, a five-year service life, and a $3,000 residual value. Tractors are included in the Equipm

> On January 1, 2021, Weaver Corporation purchased a patent for $237,000. The remaining legal life is 20 years, but the company estimates the patent will be useful for only six more years. In January 2023, the company incurred legal fees of $57,000 in succ

> Tasty Subs acquired a delivery truck on October 1, 2021, for $21,500. The company estimates a residual value of $2,500 and a six-year service life. It expects to drive the truck 100,000 miles. Actual mileage was 5,000 miles in 2021 and 19,000 miles in 20

> The Donut Stop acquired equipment for $19,000. The company uses straight-line depreciation and estimates a residual value of $3,000 and a four-year service life. At the end of the second year, the company estimates that the equipment will be useful for f

> Tasty Subs acquired a delivery truck on October 1, 2021, for $21,600. The company estimates a residual value of $1,200 and a six-year service life. Required: Calculate depreciation expense using the straight-line method for 2021 and 2022, assuming a Dece

> Togo’s Sandwiches acquired equipment on April 1, 2021, for $18,000. The company estimates a residual value of $2,000 and a five-year service life. Required: Calculate depreciation expense using the straight-line method for 2021 and 2022, assuming a Decem

> Speedy Delivery Company purchases a delivery van for $36,000. Speedy estimates that at the end of its four-year service life, the van will be worth $6,400. During the four-year period, the company expects to drive the van 148,000 miles. Required: Calcula

> Super Saver Groceries purchased store equipment for $29,500. Super Saver estimates that at the end of its 10-year service life, the equipment will be worth $3,500. During the 10-year period, the company expects to use the equipment for a total of 13,000

> McCoy’s Fish House purchases a tract of land and an existing building for $1,000,000. The company plans to remove the old building and construct a new restaurant on the site. In addition to the purchase price, McCoy pays closing costs, including title in

> Littleton Books has the following transactions during May. May 2 Purchases books on account from Readers Wholesale for $3,300, terms 1/10, n/30. May 3 Pays cash for freight costs of $200 on books purchased from Readers. May 5 Returns books with a cost o

> Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Calculate the current ratio for the past two years. Did the current ratio improve or weaken in the more recent year? 2. Calculate the acid-test (quick) ratio

> On June 5, Staley Electronics purchases 200 units of inventory on account for $19 each, with terms 2/10, n/30. Staley pays for the inventory on June 12. Required: 1. Record transactions for the purchase of inventory and payment on account using a perpetu

> On June 5, Staley Electronics purchases 200 units of inventory on account for $20 each. After closer examination, Staley determines 40 units are defective and returns them to its supplier for full credit on June 9. All remaining inventory is sold on acco

> Bingerton Industries began the year with inventory of $85,000. Purchases of inventory on account during the year totaled $310,000. Inventory costing $335,000 was sold on account for $520,000. Required: Record transactions for the purchase and sale of in

> During the year, Trombley Incorporated has the following inventory transactions. For the entire year, the company sells 81 units of inventory for $30 each. Required: 1. Using FIFO, calculate (a) ending inventory, (b) cost of goods sold, (c) sales revenue

> During the year, TRC Corporation has the following inventory transactions. For the entire year, the company sells 450 units of inventory for $70 each. Required: 1. Using FIFO, calculate (a) ending inventory, (b) cost of goods sold, (c) sales revenue, and

> Tisdale Incorporated reports the following amount in its December 31, 2021, income statement. Required: 1. Prepare a multiple-step income statement. 2. Explain how analyzing the multiple levels of profitability can help in understanding the future profit

> On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances: The $30,000 beginning balance of inventory consists of 300 units, each costing $100. During January 2021, Big Blast Fireworks had the following invento

> Mulligan Corporation purchases inventory on account with terms FOB shipping point. The goods are shipped on December 30, 2021, but do not reach Mulligan until January 5, 2022. Mulligan correctly records accounts payable associated with the purchase but d

> Wayman Corporation reports the following amounts in its December 31, 2021, income statement. Required: Prepare a multiple-step income statement.

> Refer to the transactions in E6–11. Required: 1. Record the transactions of DS Unlimited, assuming the company uses a periodic inventory system. 2. Record the period-end adjustment to cost of goods sold on August 31, assuming the company has no beginning

> Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1. Calculate the current ratio for the past two years. Did the current ratio improve or weaken in the more recent year? 2. Calculate the acid-test (quic

> Refer to the transactions in E6–10. Required: 1. Record the transactions of Sundance Systems, assuming the company uses a periodic inventory system. 2. Record the period-end adjustment to cost of goods sold on July 31, assuming the company has no beginni

> Refer to the transactions in E6–9. Required: 1. Record the transactions of Littleton Books, assuming the company uses a periodic inventory system. 2. Record the period-end adjustment to cost of goods sold on May 31, assuming the company has no beginning

> Below are amounts found in the income statements of three companies. Required: 1. For each company, calculate (a) gross profit, (b) operating income, (c) income before income taxes, and (d) net income. 2. For each company, calculate the gross profit rati

> Lewis Incorporated and Clark Enterprises report the following amounts for the year. Required: 1. Calculate cost of goods sold for each company. 2. Calculate the inventory turnover ratio for each company. 3. Calculate the average days in inventory for eac

> A company like Golf USA that sells golf-related inventory typically will have inventory items such as golf clothing and golf equipment. As technology advances the design and performance of the next generation of drivers, the older models become less mark