Question: Tisdale Incorporated reports the following amount

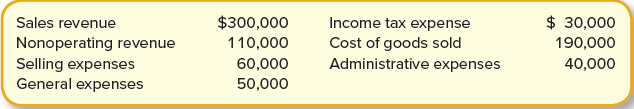

Tisdale Incorporated reports the following amount in its December 31, 2021, income statement.

Required:

1. Prepare a multiple-step income statement.

2. Explain how analyzing the multiple levels of profitability can help in understanding the future profit-generating potential of Tisdale Incorporated.

> Airline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for January, the first month of ATS’s fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,

> During January, Luxury Cruise Lines incurs employee salaries of $3 million. Withholdings in January are $229,500 for the employee portion of FICA, $450,000 for federal income tax, $187,500 for state income tax, and $30,000 for the employee portion of hea

> Aspen Ski Resorts has 100 employees, each working 40 hours per week and earning $20 an hour. Although the company does not pay any health or retirement benefits, one of the perks of working at Aspen is that employees are allowed free skiing on their days

> The following selected transactions relate to liabilities of Rocky Mountain Adventures. Rocky Mountain’s fiscal year ends on December 31. January 13 Negotiate a revolving credit agreement with First Bank that can be renewed annually upon bank approval. T

> OS Environmental provides cost-effective solutions for managing regulatory requirements and environmental needs specific to the airline industry. Assume that on July 1 the company issues a one-year note for the amount of $6 million. Interest is payable a

> On August 1, 2021, Trico Technologies, an aeronautic electronics company, borrows $21 million cash to expand operations. The loan is made by FirstBanc Corp. under a short-term line of credit arrangement. Trico signs a six-month, 9% promissory note. Inter

> On August 1, 2021, Trico Technologies, an aeronautic electronics company, borrows $21 million cash to expand operations. The loan is made by FirstBanc Corp. under a short-term line of credit arrangement. Trico signs a six-month, 9% promissory note. Inter

> On November 1, 2021, Aviation Training Corp. borrows $60,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 7% note payable. Interest is payable at maturity. Aviation’s year-end is December 31. Required: 1. Record the note p

> On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2 Sold gift cards totaling $8,000. The cards are redeemable for merchandise within one year

> Selected financial data regarding current assets and current liabilities for Queen’s Line, a competitor in the cruise line industry, is provided: Required: 1. Calculate the current ratio and the acid-test ratio for Queenâ€

> A very helpful site to learn about individual publicly traded companies is finance.yahoo.com. Go to this website and look up a well-known publicly traded company. Once you find the company page, perform the following tasks. Required: 1. Click on “Basic C

> Dow Chemical Company provides chemical, plastic, and agricultural products and services to various consumer markets. The following excerpt is taken from the disclosure notes of Dow’s annual report. Required: 1. Does the excerpt describe

> Lindy Appliance begins operations in 2021 and offers a one-year warranty on all products sold. Total appliance sales in 2021 are $1,600,000, and Lindy estimates future warranty costs in 2022 to be 2% of current sales. Actual warranty costs in 2022 are $2

> Computer Wholesalers restores and resells notebook computers. It originally acquires the notebook computers from corporations upgrading their computer systems, and it backs each notebook it sells with a 90-day warranty against defects. Based on previous

> Pacific Cruise Lines is a defendant in litigation involving a swimming accident on one of its three cruise ships. Required: For each of the following scenarios, determine the appropriate way to report the situation. Explain your reasoning and record any

> Top Sound International designs and sells high-end stereo equipment for auto and home use. Engineers notified management in December 2021 of a circuit flaw in an amplifier that poses a potential fire hazard. Further investigation indicates that a product

> Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2021, Vail sells gift cards (lift passes) for $100,000. The gift cards are redeemable for one day of skiing during the upcoming winter season. The gift cards expire o

> Apple Inc. is the number one online music retailer through its iTunes music store. Apple sells iTunes gift cards in $15, $25, and $50 increments. Assume Apple sells $21 million in iTunes gift cards in November, and customers redeem $14 million of the gif

> Match (by letter) the correct reporting method for each of the items listed below.

> Sub Sandwiches of America made the following expenditures related to its restaurant: 1. Replaced the heating equipment at a cost of $250,000. 2. Covered the patio area with a clear plastic dome and enclosed it with glass for use during the winter months.

> Listed below are several terms and phrases associated with operational assets. Pair each item from List A (by letter) with the item from List B that is most appropriately associated with it.

> Eugene Wright is CFO of Caribbean Cruise Lines. The company offers luxury cruises. It’s near year-end, and Eugene is feeling kind of queasy. The economy is in a recession, and demand for luxury cruises is way down. Eugene doesn’t want the company’s curre

> Satellite Systems modified its model Z2 satellite to incorporate a new communication device. The company made the following expenditures: During your year-end review of the accounts related to intangibles, you discover that the company has capitalized al

> Mainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce Corporation for $30,000,000 in cash. The book values and fair values of Iceberg’s assets and liabilities were as follows: Required: Calculate the

> Brick Oven Corporation made the following expenditures during the first month of operations: Required: Record the $131,500 in cash expenditures.

> The Donut Stop purchased land and a building for $2 million. To maximize the company’s tax deduction for depreciation, management allocated only 10% of the purchase price to land and 90% of the purchase price to the building. A more reasonable allocation

> Red Rock Bakery purchases land, building, and equipment for a single purchase price of $600,000. However, the estimated fair values of the land, building, and equipment are $175,000, $455,000, and $70,000, respectively, for a total estimated fair value o

> 21 On January 1, 2021, the general ledger of TNT Fireworks includes the following account balances: During January 2021, the following transactions occur: January 1 Purchase equipment for $19,500. The company estimates a residual value of $1,500 and a

> Midwest Services, Inc., operates several restaurant chains throughout the Midwest. One restaurant chain has experienced sharply declining profits. The company’s management has decided to test the operational assets of the restaurants fo

> Orion Flour Mills purchased a new machine and made the following expenditures: The machine, including sales tax, was purchased on account, with payment due in 30 days. The other expenditures listed above were paid in cash. Required: Record the above expe

> Brad’s BBQ reported sales of $735,000 and net income of $28,000. Brad’s also reported ending total assets of $496,000 and beginning total assets of $389,000. Required: Calculate the return on assets, the profit margin, and the asset turnover ratio for Br

> Salad Express exchanged land it had been holding for future plant expansion for a more suitable parcel of land along distribution routes. Salad Express reported the old land on the previously issued balance sheet at its original cost of $70,000. Accordin

> Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Calculate the current ratio for both companies for the year e

> Abbott Landscaping purchased a tractor at a cost of $42,000 and sold it three years later for $21,600. Abbott recorded depreciation using the straight-line method, a five-year service life, and a $3,000 residual value. Tractors are included in the Equipm

> On January 1, 2021, Weaver Corporation purchased a patent for $237,000. The remaining legal life is 20 years, but the company estimates the patent will be useful for only six more years. In January 2023, the company incurred legal fees of $57,000 in succ

> Tasty Subs acquired a delivery truck on October 1, 2021, for $21,500. The company estimates a residual value of $2,500 and a six-year service life. It expects to drive the truck 100,000 miles. Actual mileage was 5,000 miles in 2021 and 19,000 miles in 20

> The Donut Stop acquired equipment for $19,000. The company uses straight-line depreciation and estimates a residual value of $3,000 and a four-year service life. At the end of the second year, the company estimates that the equipment will be useful for f

> Tasty Subs acquired a delivery truck on October 1, 2021, for $21,600. The company estimates a residual value of $1,200 and a six-year service life. Required: Calculate depreciation expense using the straight-line method for 2021 and 2022, assuming a Dece

> Togo’s Sandwiches acquired equipment on April 1, 2021, for $18,000. The company estimates a residual value of $2,000 and a five-year service life. Required: Calculate depreciation expense using the straight-line method for 2021 and 2022, assuming a Decem

> Speedy Delivery Company purchases a delivery van for $36,000. Speedy estimates that at the end of its four-year service life, the van will be worth $6,400. During the four-year period, the company expects to drive the van 148,000 miles. Required: Calcula

> Super Saver Groceries purchased store equipment for $29,500. Super Saver estimates that at the end of its 10-year service life, the equipment will be worth $3,500. During the 10-year period, the company expects to use the equipment for a total of 13,000

> McCoy’s Fish House purchases a tract of land and an existing building for $1,000,000. The company plans to remove the old building and construct a new restaurant on the site. In addition to the purchase price, McCoy pays closing costs, including title in

> Littleton Books has the following transactions during May. May 2 Purchases books on account from Readers Wholesale for $3,300, terms 1/10, n/30. May 3 Pays cash for freight costs of $200 on books purchased from Readers. May 5 Returns books with a cost o

> Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Calculate the current ratio for the past two years. Did the current ratio improve or weaken in the more recent year? 2. Calculate the acid-test (quick) ratio

> On June 5, Staley Electronics purchases 200 units of inventory on account for $19 each, with terms 2/10, n/30. Staley pays for the inventory on June 12. Required: 1. Record transactions for the purchase of inventory and payment on account using a perpetu

> On June 5, Staley Electronics purchases 200 units of inventory on account for $20 each. After closer examination, Staley determines 40 units are defective and returns them to its supplier for full credit on June 9. All remaining inventory is sold on acco

> Bingerton Industries began the year with inventory of $85,000. Purchases of inventory on account during the year totaled $310,000. Inventory costing $335,000 was sold on account for $520,000. Required: Record transactions for the purchase and sale of in

> During the year, Trombley Incorporated has the following inventory transactions. For the entire year, the company sells 81 units of inventory for $30 each. Required: 1. Using FIFO, calculate (a) ending inventory, (b) cost of goods sold, (c) sales revenue

> During the year, TRC Corporation has the following inventory transactions. For the entire year, the company sells 450 units of inventory for $70 each. Required: 1. Using FIFO, calculate (a) ending inventory, (b) cost of goods sold, (c) sales revenue, and

> On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances: The $30,000 beginning balance of inventory consists of 300 units, each costing $100. During January 2021, Big Blast Fireworks had the following invento

> Mulligan Corporation purchases inventory on account with terms FOB shipping point. The goods are shipped on December 30, 2021, but do not reach Mulligan until January 5, 2022. Mulligan correctly records accounts payable associated with the purchase but d

> Wayman Corporation reports the following amounts in its December 31, 2021, income statement. Required: Prepare a multiple-step income statement.

> Refer to the transactions in E6–11. Required: 1. Record the transactions of DS Unlimited, assuming the company uses a periodic inventory system. 2. Record the period-end adjustment to cost of goods sold on August 31, assuming the company has no beginning

> Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1. Calculate the current ratio for the past two years. Did the current ratio improve or weaken in the more recent year? 2. Calculate the acid-test (quic

> Refer to the transactions in E6–10. Required: 1. Record the transactions of Sundance Systems, assuming the company uses a periodic inventory system. 2. Record the period-end adjustment to cost of goods sold on July 31, assuming the company has no beginni

> Refer to the transactions in E6–9. Required: 1. Record the transactions of Littleton Books, assuming the company uses a periodic inventory system. 2. Record the period-end adjustment to cost of goods sold on May 31, assuming the company has no beginning

> Below are amounts found in the income statements of three companies. Required: 1. For each company, calculate (a) gross profit, (b) operating income, (c) income before income taxes, and (d) net income. 2. For each company, calculate the gross profit rati

> Lewis Incorporated and Clark Enterprises report the following amounts for the year. Required: 1. Calculate cost of goods sold for each company. 2. Calculate the inventory turnover ratio for each company. 3. Calculate the average days in inventory for eac

> A company like Golf USA that sells golf-related inventory typically will have inventory items such as golf clothing and golf equipment. As technology advances the design and performance of the next generation of drivers, the older models become less mark

> Home Furnishings reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Required: 1. Calculate the total recorded cost of ending inventory before any adjustments. 2. Calculate end

> Refer to the transactions in E6–11. Required: Prepare the transactions for GameGirl, Inc., assuming the company uses a perpetual inventory system. Assume the 70 game devices sold on August 6 to DS Unlimited had a cost to GameGirl of $180 each. The items

> DS Unlimited has the following transactions during August. August 6 Purchases 70 handheld game devices on account from GameGirl, Inc., for $200 each, terms 1/10, n/60. August 7 Pays $400 to Sure Shipping for freight charges associated with the August 6

> Sundance Systems has the following transactions during July. July 5 Purchases 40 LCD televisions on account from Red River Supplies for $2,500 each, terms 3/10, n/30. July 8 Returns to Red River two televisions that had defective sound. July 13 Pays the

> Russell Retail Group begins the year with inventory of $55,000 and ends the year with inventory of $45,000. During the year, the company has four purchases for the following amounts. Required: Calculate cost of goods sold for the year.

> At the end of 2022, the following information is available for Great Adventures. • Additional interest for five months needs to be accrued on the $30,000, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. • Assume that

> Southwest Pediatrics has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $130,000; Allowance for Uncollectible Accounts = $2,100 (debit). On December 31, 2021, Southwest estimates uncollectible accounts to be 20%

> Physicians’ Hospital has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $60,000; Allowance for Uncollectible Accounts = $1,100 (credit). On December 31, 2021, Physicians’ estimates uncollectible accounts to be 1

> During 2021, its first year of operations, Pave Construction provides services on account of $160,000. By the end of 2021, cash collections on these accounts total $110,000. Pave estimates that 25% of the uncollected accounts will be uncollectible. In 20

> On April 25, Foreman Electric installs wiring in a new home for $3,500 on account. However, on April 27, Foreman’s electrical work does not pass inspection, and Foreman grants the customer an allowance of $600 because of the problem. The customer makes f

> Refer to the information in E5–4. Required: For Grace Hospital, record the purchase of services on account on March 12 and the payment of cash on March 31.

> Refer to the information in E5–3, but now assume that Grace does not pay for services until March 31, missing the 2% sales discount. Required: For Medical Waste Services, record the service on account on March 12 and the collection of cash on March 31.

> On March 12, Medical Waste Services provides services on account to Grace Hospital for $11,000, terms 2/10, n/30. Grace pays for those services on March 20. Required: For Medical Waste Services, record the service on account on March 12 and the collectio

> The general ledger of Pop’s Fireworks includes the following account balances in 2021: In addition, the following transactions occurred during 2021 and are not yet reflected in the account balances above: 1. Provide additional services

> On January 1, 2021, the general ledger of 3D Family Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2 Provide services to customers for cash, $35,100. January 6 Provide services to custom

> Refer to the information in E5–19, but now assume that the balance of the Allowance for Uncollectible Accounts on December 31, 2021, is $1,100 (debit) (before adjustment). Required: 1. Record the adjustment for uncollectible accounts using the percentage

> Edward L. Vincent is CFO of Energy Resources, Inc. The company specializes in the exploration and development of natural gas. It’s near year-end, and Edward is feeling terrific. Natural gas prices have risen throughout the year, and Energy Resources is s

> Merry Maidens Cleaning generally charges $300 for a detailed cleaning of a normal-size home. However, to generate additional business, Merry Maidens is offering a new-customer discount of 10%. On May 1, Ms. E. Pearson has Merry Maidens clean her house an

> Suzuki Supply reports the following amounts at the end of 2021 (before adjustment). Required: 1. Record the adjustment for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 12% of receivables will not be collected. 2. Re

> Below are amounts (in millions) from three companies’ annual reports. Required: For each company, calculate the receivables turnover ratio and the average collection period (rounded to one decimal place). Which company appears most effi

> On April 1, 2021, Shoemaker Corporation realizes that one of its main suppliers is having difficulty meeting delivery schedules, which is hurting Shoemaker’s business. The supplier explains that it has a temporary lack of funds that is slowing its produc

> Refer to the information in E5–15. Required: For Whole Grain Bakery, record the issuance of the note payable on March 1 and the cash payment on September 1.

> On March 1, Terrell & Associates provides legal services to Whole Grain Bakery regarding some recent food poisoning complaints. Legal services total $11,000. In payment for the services, Whole Grain Bakery signs a 9% note requiring the payment of the fac

> During 2021, LeBron Corporation accepts the following notes receivable. 1. On April 1, LeBron provides services to a customer on account. The customer signs a four- month, 9% note for $7,000. 2. On June 1, LeBron lends cash to one of the company’s vendor

> At the beginning of 2021, Brad’s Heating & Air (BHA) has a balance of $26,000 in accounts receivable. Because BHA is a privately owned company, the company has used only the direct write-off method to account for uncollectible accounts. However, at the e

> Consider the following transactions associated with accounts receivable and the allowance for uncollectible accounts. Required: For each transaction, indicate whether it would increase (I), decrease (D), or have no effect (NE) on the account totals. (Hin

> The Physical Therapy Center specializes in helping patients regain motor skills after serious accidents. The center has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $110,000; Allowance for Uncollectible Accoun

> At a recent luncheon, you were seated next to Mr. Fogle, the president of a local company that manufactures food processors. He heard that you were in a financial accounting class and asked: “Why is it that I’m forced to record depreciation expense on my

> Mercy Hospital has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $70,000; Allowance for Uncollectible Accounts = $1,400 (credit). Mercy estimates uncollectible accounts based on an aging of accounts receivable

> On May 7, Juanita Construction provides services on account to Michael Wolfe for $4,000. Michael pays for those services on May 13. Required: For Juanita Construction, record the service on account on May 7 and the collection of cash on May 13.

> Spielberg Company’s general ledger shows a checking account balance of $22,970 on July 31, 2021. The July cash receipts of $1,885, included in the general ledger balance, are placed in the night depository at the bank on July 31 and processed by the bank

> Janice Dodds opens the mail for Ajax Plumbing Company. She lists all customer checks on a spreadsheet that includes the name of the customer and the check amount. The checks, along with the spreadsheet, are then sent to Jim Seymour in the accounting depa

> Goldie and Kate operate a small clothing store that has annual revenues of about $100,000. The company has established the following procedures related to cash disbursements: The petty cash fund consists of $10,000. Employees place a receipt in the fund

> Douglas and Son, Inc., uses the following process for its cash receipts: The company typically receives cash and check sales each day and places them in a single drawer. Each Friday, the cash clerk records the amount of cash received and deposits the mon

> Below are several amounts reported at the end of the year. Required: Calculate the amount of cash to report in the balance sheet.

> Below are several scenarios related to control activities of a company. 1. A manufacturing company compares total sales in the current year to those in the previous year but does not compare the cost of production. 2. So that employees can have easy acce

> Below are several statements about internal controls. 1. The components of internal control are built on the foundation of the ethical tone set by top management. 2. Once every three months, managers need to review operations to ensure that control proce

> Below are amounts (in millions) for Glasco Company and Sullivan Company. Both companies have total revenues of $2,500, $3,000, and $3,500 in each year. Required: Make a prediction as to which firm will have the higher ratio of cash to noncash assets at t

> Companies are increasingly making their accounting information, especially their annual reports, available through their websites. Select a well-known publicly traded company and go to its website. Look for the investment section, and then click on annua

> Below are several statements about the Sarbanes-Oxley Act (SOX). 1. SOX represents legislation passed in response to several accounting scandals in the early 2000s. 2. The requirements outlined in SOX apply only to those companies expected to have weak i

> 1. Service Revenue for the year = $80,000. Of this amount, $70,000 is collected during the year and $10,000 is expected to be collected next year. 2. Salaries Expense for the year = $40,000. Of this amount, $35,000 is paid during the year and $5,000 is e