Question: On January 1, 20X1, Kiner Company formed

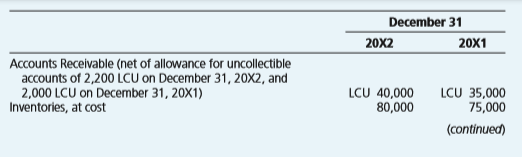

On January 1, 20X1, Kiner Company formed a foreign subsidiary that issued all of its currently outstanding common stock on that date. Selected accounts from the balance sheets, all of which are shown in local currency units, are as follows:

Additional Information:

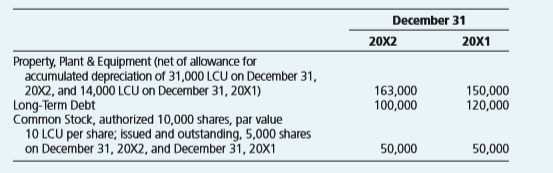

Exchange rates are as follows:

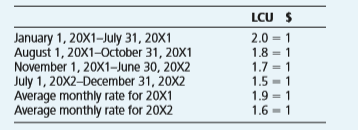

An analysis of the accounts receivable balance is as follows:

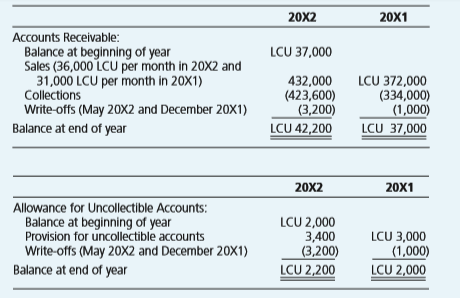

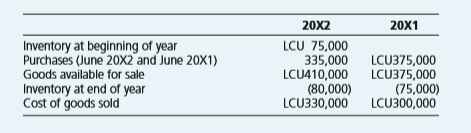

An analysis of inventories, for which the first-in, first-out inventory method is used, follows:

On January 1, 20X1, Kiner’s foreign subsidiary purchased land for 24,000 LCU and plant and equipment for 140,000 LCU. On July 4, 20X2, additional equipment was purchased for 30,000 LCU. Plant and equipment is being depreciated on a straight-line basis over a 10-year period with no residual value. A full year’s depreciation is taken in the year of purchase.

On January 15, 20X1, 7 percent bonds with a face value of 120,000 LCU were issued. These bonds mature on January 15, 20X7, and the interest is paid semiannually on July 15 and January 15. The first interest payment was made on July 15, 20X1.

Required:

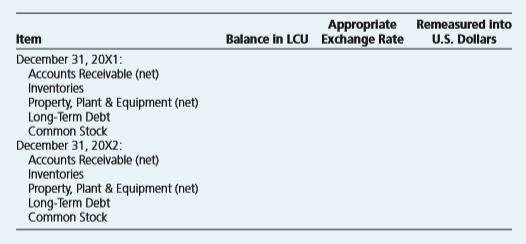

Prepare a schedule remeasuring the selected accounts into U.S. dollars for December 31, 20X1, and December 31, 20X2, respectively, assuming the U.S. dollar is the functional currency for the foreign subsidiary. The schedule should be prepared using the following form:

Transcribed Image Text:

December 31 20X2 20X1 Accounts Receivable (net of allowance for uncollectible accounts of 2,200 LCU on December 31, 20X2, and 2,000 LCU on December 31, 20X1) Inventories, at cost LCU 40,000 80,000 LCU 35,000 75,000 (continued) December 31 20X2 20X1 Property, Plant & Equipment (net of allowance for accumulated depreciation of 31,000 LCU on December 31, 20X2, and 14,000 LCU on December 31, 20X1) Long-Term Debt Common Stock, authorized 10,000 shares, par value 10 LCU per share; issued and outstanding, 5,000 shares on December 31, 20X2, and December 31, 20X1 163,000 100,000 150,000 120,000 50,000 50,000 LCU $ January 1, 20X1-July 31, 20X1 August 1, 20X1-0ctober 31, 20X1 November 1, 20X1-June 30, 20X2 July 1, 20X2–December 31, 20X2 Average monthly rate for 20X1 Average monthly rate for 20X2 2.0 = 1 1.8 = 1 1.7 = 1 1.5 - 1 %3D 1.9 = 1 1.6 - 1 20X2 20X1 Accounts Receivable: LCU 37,000 Balance at beginning of year Sales (36,000 LCU per month in 20X2 and 31,000 LCU per month in 20X1) Collections Write-offs (May 20X2 and December 20X1) Balance at end of year 432,000 (423,600) (3,200) LCU 42,200 LCU 372,000 (334,000) (1,000) LCU 37,000 20X2 20X1 Allowance for Uncollectible Accounts: Balance at beginning of year LCU 2,000 З400 (3,200) LCU 2,200 LCU 3,000 (1,000) LCU 2,000 Provision for uncollectible accounts Write-offs (May 20X2 and December 20X1) Balance at end of year 20X2 20X1 LCU 75,000 335,000 LCU410,000 (80,000) LCU330,000 Inventory at beginning of year Purchases (June 20x2 and June 20X1) LCU375,000 LCU375,000 (75,000) LCU300,000 Goods available for sale Inventory at end of year Cost of goods sold Appropriate Balance in LCU Exchange Rate Remeasured into Item U.S. Dollars December 31, 20X1: Accounts Receivable (net) Inventories Property, Plant & Equipment (net) Long-Term Debt Common Stock December 31, 20X2: Accounts Receivable (net) Inventories Property, Plant & Equipment (net) Long-Term Debt Common Stock

> The manager you work for has asked you to perform some research to determine what types of information public companies are providing on their Internet home pages. The public company you work for is considering establishing its own home page. In particul

> A major producer of cereal breakfast foods had been reporting in its annual reports just one dominant product line (cereals) in only the U.S. domestic geographic area. The company had no other separately reportable segments. For several years, the U.S. c

> Bennett Inc. is a publicly held corporation whose diversified operations have been separated into five industry segments. Bennett is in the process of preparing its annual financial statements for the year ended December 31, 20X5. The following informati

> Periodic reporting adds complexity to accounting by requiring estimates, accruals, deferrals, and allocations. Interim reporting creates even greater difficulties in matching revenue and expenses. Required: Explain how revenue, product co

> Chemax Inc. manufactures a wide variety of pharmaceuticals, medical instruments, and other medical supplies. Eighteen months ago the company developed and began to market a new product line of antihistamine drugs under various trade names. Sales and prof

> The company that employs you is a U.S. publicly traded corporation that manufactures chemicals. You are in the external financial reporting department, and your position requires that you keep current on all the new accounting requirements. Although you

> An early event leading to the establishment of audit committees as a regular subcommittee of boards of directors occurred in 1940 as part of the consent decree relative to the Mc Kesson Robbins scandal. (A consent decree is the formal statement issued in

> The purpose of the Securities Act of 1933 is to regulate the initial offering of a firm’s securities by ensuring that investors are given full and fair disclosure of all pertinent information about the firm. The Securities Exchange Act of 1934 was passed

> Jerford Company is a well-known manufacturing company with several wholly owned subsidiaries. The company’s stock is traded on the New York Stock Exchange, and the company files all appropriate reports with the SEC. Jerford’s financial statements are aud

> Bandex Inc. has been in business for 15 years and has compiled a record of steady but not spectacular growth. Bandex’s engineers have recently perfected a product that has an application in the small computer market. Initial orders have exceeded the comp

> Form 10-K is the annual filing required of publicly traded entities. The form contains the financial information for the year as well as a number of other disclosures the SEC requires. Required: Using EDGAR or another source, obtain the most

> The proxy contains an abundance of information the SEC believed to be necessary for stockholders to make an informed vote on the items the company presents for their voting consideration. This case provides opportunities to analyze the proxy of a publicl

> The development of accounting theory and practice has been influenced directly and indirectly by many organizations and institutions. Two of the most important institutions have been the Financial Accounting Standards Board (FASB) and the Securities and

> During the late 1920s, approximately 55 percent of all personal savings in the United States was used to purchase securities. Public confidence in the business community was extremely high as stock values doubled and tripled in short periods of time. The

> This case provides learning opportunities using available databases and/or the Internet to obtain contemporary information about the topics in advanced financial accounting. Note that the Internet is dynamic and any specific website listed may change its

> You are providing accounting services for the JR Company partnership. The two partners, Jason and Richard, are thinking of adding a third partner to their business, and they have several questions regarding the use of GAAP for their partnership. Re

> Adam, Bob, and Cathy are planning to form a partnership to create a business that will retail cell phones in a new shopping center just completed in their city. They have been able to reach agreement on many issues, but Cathy is still concerned that Adam

> You are in a group that is considering forming a partnership to purchase a coffee shop located near your campus. The coffee shop offers freshly brewed coffee and rolls in the morning and soup and sandwiches the remainder of the day. During your prelimina

> Bill, George, and Anne are partners in the BGA Partnership. A difference of opinion exists among the partners as to how to account for Newt’s admission as a new partner. The three present partners have the following positions: Bill wants

> Nitty and Gritty are considering the formation of a partnership to operate a crafts and hobbies store. They have come to you to obtain information about the basic elements of a partnership agreement. These agreements usually specify an income and loss–sh

> The Mattfield v. Kramer Brothers court case presents a number of the interesting legal issues that often arise from the dissolution of a partnership. The case was heard in the Supreme Court of the State of Montana in 2005 and decided on May 31, 2005, as

> Hiller, Luna, and Welsh are attempting to form a partnership to operate a travel agency. They have agreed to share profits in a ratio of 4:3:2 but cannot settle on the terms of the partnership agreement relating to possible liquidation. Hiller believes t

> After successfully operating a partnership for several years, the partners have proposed to incorporate the business and admit another investor. The original partners will purchase at par an amount of preferred stock equal to the book values of their cap

> Adam and Bard agreed to liquidate their partnership. Having been asked to assist them in this process, you prepare the following balance sheet for the date of the beginning of the liquidation. The loss-sharing percentages are in parentheses next to the c

> Kiwi Painting Company engages in a number of foreign currency transactions in euros (€). For each of the following independent transactions, determine the dollar amount to be reported in the December 31, 2004, financial statements for th

> On November 3, 20X2, PRD Corporation acquired 100 shares of JRS Company at a cost of $12 per share. PRD classifies them as available-for-sale securities. On this same date, PRD decides to hedge against a possible decline in the value of the securities by

> Mega Company believes the price of oil will increase in the coming months. Therefore, it decides to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On Novem

> Select the correct answer for each of the following questions. According to ASC 815, which of the following is not an underlying? A security price. A monthly average temperature. The price of a barrel of oil. The number of foreign curren

> Dexter Inc. had the following items in its unadjusted and adjusted trial balances at December 31, 20X5: Additional Information: On December 1, 20X5, Dexter sold goods to a company in Australia for A$70,000. Payment in Australian dollars is du

> Part I Maple Company had the following export and import transactions during 20X5: On March 1, Maple sold goods to a Canadian company for C$30,000, receivable on May 30. The spot rates for Canadian dollars were C$1 = $0.65 on March 1 and C$1 = $0.68

> On December 1, 20X1, Micro World Inc. entered into a 120-day forward contract to purchase 100,000 Australian dollars (A$). Micro World’s fiscal year ends on December 31. The direct exchange rates follow: Required: Prepare all journal

> Globe Shipping, a U.S. company, is an importer and exporter. The following are some transactions with foreign companies. Globe sold blue jeans to a South Korean importer on January 15 for $7,400, when the exchange rate was South Korean won (KRW)1 = $0

> Tex Hardware sells many of its products overseas. The following are some selected transactions. Tex sold electronic subassemblies to a firm in Denmark for 120,000 Danish kroner (Dkr) on June 6, when the exchange rate was Dkr 1 = $0.1750. Collection was m

> Jon-Jan Restaurants purchased green rice, a special variety of rice, from China for 100,000 renminbi on November 1, 20X8. Payment is due on January 30, 20X9. On November 1, 20X8, the company also entered into a 90-day forward contract to purchase 100,000

> Refer to the information given in Problems P12-23 and P12-26 for Alamo and its subsidiary, Western Ranching. Assume that the U.S. dollar is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its investment i

> Refer to the information in Problem P12-23. Assume the U.S. dollar is the functional currency. Required: Prepare a schedule remeasuring the December 31, 20X3, trial balance of Western Ranching from Australian dollars to U.S. dollars. Prepare a

> Refer to the information given in Problems P12-23 and P12-24 for Alamo and its subsidiary, Western Ranching. Assume that the Australian dollar (A$) is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its inv

> Refer to the information given in Problem P12-23 for Alamo and its subsidiary, Western Ranching. Assume that the Australian dollar (A$) is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its investment in W

> Alamo Inc. purchased 80 percent of the outstanding stock of Western Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (A$) was A$200,000, and A$40,000 of the differential was allocated to plant and equip

> Refer to the information in Problem P12-21. Assume that the dollar is the functional currency. Required: Prepare a schedule remeasuring DaSilva Company’s December 31, 20X4, trial balance from reals to dollars. Prepare a

> On January 1, 20X4, Alum Corporation acquired DaSilva Company, a Brazilian subsidiary, by purchasing all its common stock at book value. DaSilva’s trial balances on January 1, 20X4, and December 31, 20X4, expressed in Brazilian reals (B

> Refer to the information given in Problem P12-17 and your answer to part a of Problem P12-18. Required: Prepare a schedule providing a proof of the remeasurement gain or loss. For this part of the problem, assume that the Norwegian subsidiary had the f

> Refer to the information presented in Problem P12-17 and your answer to part a of Problem P12-17. Required: Prepare a schedule providing a proof of the translation adjustment. Data from Problem P12-17: On January 1, 20X5, Taft Company acquired all

> Refer to the information in Problem P12-17. Assume the U.S. dollar is the functional currency, not the krone. Required: Prepare a schedule remeasuring the trial balance from Norwegian kroner into U.S. dollars. Assume that Taft uses the fully adju

> On January 1, 20X5, Taft Company acquired all of the outstanding stock of Vikix Inc., a Norwegian company, at a cost of $151,200. Vikix’s net assets on the date of acquisition were 700,000 kroner (NKr). On January 1, 20X5, the book and

> MaMi Co. Ltd. located in Mexico City is a wholly owned subsidiary of Special Foods, a U.S. company. At the beginning of the year, MaMi’s condensed balance sheet was reported in Mexican pesos (MXP) as follows: During the year, the comp

> The U.S. parent company is preparing its consolidated financial statements for December 31, 20X4. The foreign company’s local currency (LCU) is the functional currency. Information is presented in Data Set A and Data Set B. Data Set A:

> On January 1, 20X1, Par Company purchased all the outstanding stock of North Bay Company, located in Canada, for $120,000. On January 1, 20X1, the direct exchange rate for the Canadian dollar (C$) was C$1 = $0.80. North Bay’s book value on January 1, 20X

> Refer to the information in Problem P12-29 for Kiner Company and its foreign subsidiary. Required: Prepare a schedule translating the selected accounts into U.S. dollars as of December 31, 20X1, and December 31, 20X2, respectively, assuming that the

> Refer to the information given in Problems P12-23 and P12-27 for Alamo and its subsidiary, Western Ranching. Assume that the U.S. dollar is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its investment in

> Multiplex Inc., a public company whose stock is traded on a national stock exchange, reported the following information on its consolidated financial statements for 20X5: Multiplex management determined that it had the following operating seg

> During the third quarter of its 20X7 fiscal year, Press Company is considering the different methods of reporting accounting changes on its interim segments. Preliminary data are available for the third quarter of 20X7, ending on September 30, 20X7, prio

> For many years, Clark Company operated exclusively in the United States but recently expanded its operations to the Pacific Rim countries of New Zealand, Singapore, and Australia. After a modest beginning in these countries, recent successes have resulte

> At the end of the second quarter of 20X1, Malta Corporation assembled the following information: The first quarter resulted in a $90,000 loss before taxes. During the second quarter, sales were $1,200,000; purchases were $650,000; and operating expens

> Chris Inc. has accumulated the following information for its second-quarter income statement for 20X2: Additional Information: First-quarter income before taxes was $100,000, and the estimated effective annual tax rate was 40 percent. At the end o

> Calvin Inc. has operating segments in five different industries: apparel, building, chemical, furniture, and machinery. Data for the five segments for 20X1 are as follows: Additional Information: The corporate headquarters had general corporate expe

> West Corporation reported the following consolidated data for 20X2: Data reported for West’s four operating divisions are as follows: Intersegment sales are priced at cost, and all goods have been subsequently sold to non-

> Watson Inc., a multinational company, has operating divisions in France, Mexico, and Japan as well as in the United States. The company reported the following information on its consolidated financial statements for 20X5: The following additional

> Haskins and Sells formed a partnership on January 2, 20X3. Each had been a sole proprietor before forming their partnership. Part I: Each partner’s contributions follow. The amounts under the cost column represent the amounts report

> The DELS partnership was formed by combining individual accounting practices on May 10, 20X1. The initial investments were as follows: Required: Prepare the journal entry to record the initial investments using GAAP accounting. Calculate the tax

> The partnership of Jordan and O’Neal began business on January 1, 20X7. Each partner contributed the following assets (the noncash assets are stated at their fair values on January 1, 20X7): The land was subject to a $50,000 mortgage,

> Select the correct answer for each of the following questions. When property other than cash is invested in a partnership, at what amount should the noncash property be credited to the contributing partner’s capital account?

> The partnership of Ace, Jack, and Spade has been in business for 25 years. On December 31, 20X5, Spade decided to retire. The partnership balance sheet reported the following capital balances for each partner at December 31, 20X5: The partners allocate

> Champion Play Company is a partnership that sells sporting goods. The partnership agreement provides for 10 percent interest on invested capital, salaries of $24,000 to Luc and $28,000 to Dennis, and a bonus for Luc. The 20X3 capital accounts were as fol

> The following condensed balance sheet is presented for the partnership of Der, Egan, and Oprins, who share profits and losses in the ratio of 4:3:3, respectively. Assume that the partnership decides to admit Snider as a new partner with a 25 percent i

> Eastwood, A. North, and M. West are manufacturers’ representatives in the architecture business. Their capital accounts in the ENW partnership for 20X1 were as follows: Required: For each of the following independent income-sharing a

> Debra and Merina sell electronic equipment and supplies through their partnership. They wish to expand their computer lines and decide to admit Wayne to the partnership. Debra’s capital is $200,000, Merina’s capital is $160,000, and they share income in

> Some accountants are seeking to harmonize international accounting standards. What is meant by the term harmonize? How might harmonization result in better financial reporting for a U.S. parent company with many foreign investments?

> What factors are used to determine a reporting entity’s functional currency? Provide at least one example for which a company’s local currency may not be its functional currency?

> Define the following terms: local currency unit recording currency reporting currency

> What potential benefits might be achieved if U.S. firms are allowed to use IFRS?

> How widely used are IFRS? Can IFRS be used for listings on U.S. stock exchanges?

> Describe the basic problem of eliminating intercompany transactions with a foreign affiliate.

> Briefly discuss the International Accounting Standards Board (IASB). What is its mission? What is the composition of its membership and how long do members serve? Where is the IASB located?

> Describe the accounting for a foreign investment that is not consolidated with the U.S. company.

> Are all foreign subsidiaries consolidated? Why or why not?

> What is the logic behind the parent company’s recognizing on its books its share of the translation adjustment arising from the translation of its foreign subsidiary?

> A U.S. company paid more than book value in acquiring a foreign affiliate. How is this excess reported in the consolidated balance sheet and income statement in subsequent periods when the functional currency is the local currency unit of the foreign aff

> Comment on the following statement: “The use of the current exchange rate method of translating a foreign affiliate’s financial statements allows for an assessment of foreign management by the same ratio criteria used to manage the foreign affiliate.”

> When the functional currency is the foreign affiliate’s local currency, why are the stockholders’ equity accounts translated at historical exchange rates? How is retained earnings computed?

> Where is the remeasurement gain or loss shown in the consolidated financial statements?

> Discuss the accounting treatment and disclosure of translation adjustments. When does the translation adjustment account have a debit balance? When does it have a credit balance?

> A U.S. company has a foreign sales branch located in Spain. The Spanish branch has selected the U.S. dollar for its functional currency. Describe the methodology for remeasuring the branch’s financial statements into the U.S. Company’s reporting currency

> A Canadian-based subsidiary of a U.S. parent uses the Canadian dollar as its functional currency. Describe the methodology for translating the subsidiary’s financial statements into the parent’s reporting currency.

> Why is there increasing interest in the adoption of a single set of high-quality accounting standards?

> A company has 10 industry segments, of which the largest 5 account for 80 percent of the combined revenues of the company. What considerations are important in determining the number of segments that are separately reportable? How are the remaining segme

> What are the three 10 percent significance tests used to determine reportable segments under ASC 280? Give the numerator and denominator for each test.

> Maness Company made a change in accounting for its inventories during the third quarter of its fiscal year. The company switched from the LIFO method to the average cost method. Describe the reporting of this accounting change on prior interim financial

> Describe the process of updating the estimate of the effective annual tax rate in the second quarter of a company’s fiscal year.

> What is the difference in the application of the lower-of-cost-or-market valuation method for inventories for interim statements and annual statements?

> Describe the basic rules for computing cost of goods sold and inventory on an interim basis. In what circumstances are estimates permitted to determine costs?

> How might information on a company’s operations in different industries be helpful to investors?

> Define the following terms, which are part of the SEC terminology: Customary review Comment letter Red herring prospectus Shelf registration

> Describe the major requirements of the Sarbanes-Oxley Act of 2002.

> What types of information must be disclosed in the management discussion and analysis

> Describe Parts I and II of the Foreign Corrupt Practices Act. What is this act’s impact on companies and public accountants?

> Explain the process of incorporating a partnership.

> S. Horton contributes assets with a book value of $5,000 to a partnership. The assets have a market value of $10,000 and a remaining liability of $2,000 that the partnership assumes. If the liability is shared equally with the other three partners, what

> Partner A has a capital credit of $25,000. Partner B’s capital credit is also $25,000. Partners A and B share profits and losses in a 60:40 ratio. Which partner will receive the first payment of cash in an installment liquidation?

> Define loss absorption potential and explain its importance in determining cash distributions to partners.