Question: Kiwi Painting Company engages in a number

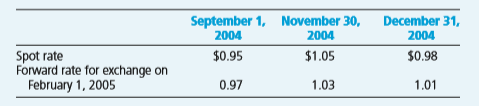

Kiwi Painting Company engages in a number of foreign currency transactions in euros (€). For each of the following independent transactions, determine the dollar amount to be reported in the December 31, 2004, financial statements for the items presented in the following requirements. The relevant direct exchange rates for the euro follow:

These are the independent transactions:

Kiwi entered into a forward exchange contract on September 1, 2004, to be settled on February 1, 2005, to hedge a firm foreign currency commitment to purchase inventory on November 30, 2004, with payment due on February 1, 2005. The forward contract was for €20,000, the agreed-upon cost of the inventory. The derivative is designated as a fair value hedge of the firm commitment.

Kiwi entered into a forward exchange contract on September 1, 2004, to be settled on February 1, 2005, to hedge a forecasted purchase of inventory on November 30, 2004. The inventory was purchased on November 30 with payment due on February 1, 2005. The forward contract was for €20,000, the expected cost of the inventory. The derivative is designated as a cash flow hedge to be continued through to payment of the euro-denominated account payable.

Kiwi entered into a forward contract on November 30, 2004, to be settled on February 1, 2005, to manage the financial currency exposure of a euro-denominated accounts payable in the amount of €20,000 from the purchase of inventory on that date. The payable is due on February 1, 2005. The forward contract is not designated as a hedge. Kiwi entered into a forward contract on September 1, 2004, to speculate on the possible changes in exchange rates between the euro and the U.S. dollar between September 1, 2004, and February 1, 2005. The forward contract is for speculation purposes and is not a hedge.

Required:

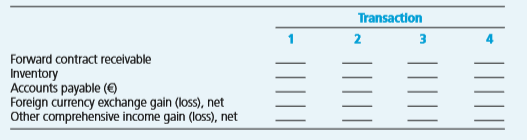

Enter the dollar amount that would be shown for each of the following items as of December 31, 2004. Compute the statement amounts net. For example, if the transaction generated both a foreign currency exchange gains and a loss, specify just the net amount that would be reported in the financial statements. If no amount would be reported for an item, enter NA for Not Applicable in the space.

Transcribed Image Text:

September 1, November 30, 2004 December 31, 2004 2004 $0.95 $1.05 $0.98 Spot rate Forward rate for exchange on February 1, 2005 0.97 1.03 1.01 Transaction 2 3 Forward contract recelvable Inventory Accounts payable (O Foreign currency exchange gain (loss), net Other comprehensive income gain (loss), net

> Select the correct answer for each of the following questions. Form 10-K is filed with the SEC to update the information a company supplied when filing a registration statement under the Securities and Exchange Act of 1934. Form 10-K is a report t

> Select the correct answer for each of the following questions. In the registration and sales of new securities issues, the SEC Endorses a security’s investment merit by allowing its registration to “go effective.” Provides a rating

> On January 1, 20X1, Eddy decides to retire from the partnership of Cobb, Davis, and Eddy. The partners share profits and losses in the ratio of 3:2:1, respectively. The following condensed balance sheets present the account balances immediately before an

> In the LMK partnership, Luis’s capital is $40,000, Marty’s is $50,000, and Karl’s is $30,000. They share income in a 4:1:1 ratio, respectively. Karl is retiring from the partnership. Required: Prepare journal entries to record Karl’s withdrawal

> Select the correct answer for each of the following questions. (Note: The following balance sheet is for the partnership of Alex, Betty, and Claire in questions 1 and 2.) (Note: Figures shown parenthetically reflect agreed-upon profit and loss&acir

> Pam and John are partners in PJ’s partnership, having capital balances of $120,000 and $40,000, respectively, and share income in a ratio of 3:1. Gerry is to be admitted into the partnership with a 20 percent interest in the business. Required: F

> On the GMP partnership (to which Elan seeks admittance), the capital balances of Mary, Gene, and Pat, who share income in the ratio of 6:3:1, are Required: If no goodwill or bonus is recorded, how much must Elan invest for a one-third interest? P

> Various Enterprises Corporation is a medium-size conglomerate listed on the American Stock Exchange. It is constantly in the process of acquiring small corporations and invariably needs additional money. Among its diversified holdings is a citrus grove t

> The income statement for the Apple-Jack Partnership for the year ended December 31, 20X5, follows: Additional Information for 20X5: Apple began the year with a capital balance of $40,800. Jack began the year with a capital balance of $112,000.

> Left and Right are partners. Their capital accounts during 20X1 were as follows: Partnership net income is $50,000 for the year. The partnership agreement provides for the division of income as follows: Each partner is to be credited 8 percent inte

> The partnership agreement of Angela and Dawn has the following provisions: The partners are to earn 10 percent on the average capital. Angela and Dawn are to earn salaries of $25,000 and $15,000, respectively. Any remaining income or

> Select the correct answer for each of the following questions. Two interesting and important topics concerning the SEC are the role it plays in the development of accounting principles and the impact it has had and will continue to have on the

> Many larger U.S. companies have significant investments in foreign operations. For example, McDonald’s Corporation, the food service company, obtains 47 percent of its consolidated revenues and 44 percent of its operating income from, and has 45 percent

> The following footnote was abstracted from a recent annual report of Johnson & Johnson Company: Footnote 7: Foreign Currency Translation For translation of its international currencies, the Company has determined that the local cu

> Dundee Company owns 100 percent of a subsidiary located in Ireland. The parent company uses the Euro as the subsidiary’s functional currency. At the beginning of the year, the debit balance in the Accumulated Other Comprehensive Income&

> Wahl Company’s 20X5 consolidated financial statements include two wholly owned subsidiaries, Wahl Company of Australia (Wahl A) and Wahl Company of France (Wahl F). Functional currencies are the U.S. dollar for Wahl A and the European euro for Wahl F.

> Petie Products Company was incorporated in Wisconsin in 20X0 as a manufacturer of dairy supplies and equipment. Since incorporating, Petie has doubled in size about every three years and is now considered one of the leading dairy supply companies in th

> Following are descriptions of several independent situations. Rockford Company has a subsidiary in Argentina. The subsidiary does not have much debt because of the high interest costs resulting from the average annual inflation rate exceeding

> The IASB website can be found at www.ifrs.org. At the top of the page, click on the link “About Us.” Briefly describe the structure of the IASB.

> Sonoma Company has owned 100 percent of the outstanding common stock of Valencia Corporation, a Spanish subsidiary, for the past 15 years. The Spanish company’s functional currency is the euro, and its financial statements are translated into U.S. dollar

> Maxima Corporation, a U.S. company, manufactures lighting fixtures and ceiling fans. Eight years ago, it set up a subsidiary in Mexico to manufacture three of its most popular ceiling fan models. When the subsidiary, Luz Maxima, was set up, it did busine

> Prepare a brief answer to each of the following questions about interim reporting, assuming the company is preparing its Form 10-Q for the third quarter of its fiscal year. How many different income statements would the company present? Describe the

> Andrea Meyers, a supervisor in the controller’s department at Vanderbilt Company, is reviewing the calculation of the income tax provision to be included in the financial statements for the first quarter of 20X5. She is questioning the estimate of the ef

> Randy Rivera, CFO of Stanford Corporation, a manufacturer of packaged retail food products, has reviewed the company’s segment disclosures for the current year. In the first draft of the disclosures, the company reports information about four segments: c

> The company you work for is considering going public. Your current position is in the external financial reporting group. The manager you work for wants you to review some public company quarterly reports, Form 10-Qs, to see what type of information is d

> The manager you work for has asked you to perform some research to determine what types of information public companies are providing on their Internet home pages. The public company you work for is considering establishing its own home page. In particul

> A major producer of cereal breakfast foods had been reporting in its annual reports just one dominant product line (cereals) in only the U.S. domestic geographic area. The company had no other separately reportable segments. For several years, the U.S. c

> Bennett Inc. is a publicly held corporation whose diversified operations have been separated into five industry segments. Bennett is in the process of preparing its annual financial statements for the year ended December 31, 20X5. The following informati

> Periodic reporting adds complexity to accounting by requiring estimates, accruals, deferrals, and allocations. Interim reporting creates even greater difficulties in matching revenue and expenses. Required: Explain how revenue, product co

> Chemax Inc. manufactures a wide variety of pharmaceuticals, medical instruments, and other medical supplies. Eighteen months ago the company developed and began to market a new product line of antihistamine drugs under various trade names. Sales and prof

> The company that employs you is a U.S. publicly traded corporation that manufactures chemicals. You are in the external financial reporting department, and your position requires that you keep current on all the new accounting requirements. Although you

> An early event leading to the establishment of audit committees as a regular subcommittee of boards of directors occurred in 1940 as part of the consent decree relative to the Mc Kesson Robbins scandal. (A consent decree is the formal statement issued in

> The purpose of the Securities Act of 1933 is to regulate the initial offering of a firm’s securities by ensuring that investors are given full and fair disclosure of all pertinent information about the firm. The Securities Exchange Act of 1934 was passed

> Jerford Company is a well-known manufacturing company with several wholly owned subsidiaries. The company’s stock is traded on the New York Stock Exchange, and the company files all appropriate reports with the SEC. Jerford’s financial statements are aud

> Bandex Inc. has been in business for 15 years and has compiled a record of steady but not spectacular growth. Bandex’s engineers have recently perfected a product that has an application in the small computer market. Initial orders have exceeded the comp

> Form 10-K is the annual filing required of publicly traded entities. The form contains the financial information for the year as well as a number of other disclosures the SEC requires. Required: Using EDGAR or another source, obtain the most

> The proxy contains an abundance of information the SEC believed to be necessary for stockholders to make an informed vote on the items the company presents for their voting consideration. This case provides opportunities to analyze the proxy of a publicl

> The development of accounting theory and practice has been influenced directly and indirectly by many organizations and institutions. Two of the most important institutions have been the Financial Accounting Standards Board (FASB) and the Securities and

> During the late 1920s, approximately 55 percent of all personal savings in the United States was used to purchase securities. Public confidence in the business community was extremely high as stock values doubled and tripled in short periods of time. The

> This case provides learning opportunities using available databases and/or the Internet to obtain contemporary information about the topics in advanced financial accounting. Note that the Internet is dynamic and any specific website listed may change its

> You are providing accounting services for the JR Company partnership. The two partners, Jason and Richard, are thinking of adding a third partner to their business, and they have several questions regarding the use of GAAP for their partnership. Re

> Adam, Bob, and Cathy are planning to form a partnership to create a business that will retail cell phones in a new shopping center just completed in their city. They have been able to reach agreement on many issues, but Cathy is still concerned that Adam

> You are in a group that is considering forming a partnership to purchase a coffee shop located near your campus. The coffee shop offers freshly brewed coffee and rolls in the morning and soup and sandwiches the remainder of the day. During your prelimina

> Bill, George, and Anne are partners in the BGA Partnership. A difference of opinion exists among the partners as to how to account for Newt’s admission as a new partner. The three present partners have the following positions: Bill wants

> Nitty and Gritty are considering the formation of a partnership to operate a crafts and hobbies store. They have come to you to obtain information about the basic elements of a partnership agreement. These agreements usually specify an income and loss–sh

> The Mattfield v. Kramer Brothers court case presents a number of the interesting legal issues that often arise from the dissolution of a partnership. The case was heard in the Supreme Court of the State of Montana in 2005 and decided on May 31, 2005, as

> Hiller, Luna, and Welsh are attempting to form a partnership to operate a travel agency. They have agreed to share profits in a ratio of 4:3:2 but cannot settle on the terms of the partnership agreement relating to possible liquidation. Hiller believes t

> After successfully operating a partnership for several years, the partners have proposed to incorporate the business and admit another investor. The original partners will purchase at par an amount of preferred stock equal to the book values of their cap

> Adam and Bard agreed to liquidate their partnership. Having been asked to assist them in this process, you prepare the following balance sheet for the date of the beginning of the liquidation. The loss-sharing percentages are in parentheses next to the c

> On November 3, 20X2, PRD Corporation acquired 100 shares of JRS Company at a cost of $12 per share. PRD classifies them as available-for-sale securities. On this same date, PRD decides to hedge against a possible decline in the value of the securities by

> Mega Company believes the price of oil will increase in the coming months. Therefore, it decides to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On Novem

> Select the correct answer for each of the following questions. According to ASC 815, which of the following is not an underlying? A security price. A monthly average temperature. The price of a barrel of oil. The number of foreign curren

> Dexter Inc. had the following items in its unadjusted and adjusted trial balances at December 31, 20X5: Additional Information: On December 1, 20X5, Dexter sold goods to a company in Australia for A$70,000. Payment in Australian dollars is du

> Part I Maple Company had the following export and import transactions during 20X5: On March 1, Maple sold goods to a Canadian company for C$30,000, receivable on May 30. The spot rates for Canadian dollars were C$1 = $0.65 on March 1 and C$1 = $0.68

> On December 1, 20X1, Micro World Inc. entered into a 120-day forward contract to purchase 100,000 Australian dollars (A$). Micro World’s fiscal year ends on December 31. The direct exchange rates follow: Required: Prepare all journal

> Globe Shipping, a U.S. company, is an importer and exporter. The following are some transactions with foreign companies. Globe sold blue jeans to a South Korean importer on January 15 for $7,400, when the exchange rate was South Korean won (KRW)1 = $0

> Tex Hardware sells many of its products overseas. The following are some selected transactions. Tex sold electronic subassemblies to a firm in Denmark for 120,000 Danish kroner (Dkr) on June 6, when the exchange rate was Dkr 1 = $0.1750. Collection was m

> Jon-Jan Restaurants purchased green rice, a special variety of rice, from China for 100,000 renminbi on November 1, 20X8. Payment is due on January 30, 20X9. On November 1, 20X8, the company also entered into a 90-day forward contract to purchase 100,000

> Refer to the information given in Problems P12-23 and P12-26 for Alamo and its subsidiary, Western Ranching. Assume that the U.S. dollar is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its investment i

> Refer to the information in Problem P12-23. Assume the U.S. dollar is the functional currency. Required: Prepare a schedule remeasuring the December 31, 20X3, trial balance of Western Ranching from Australian dollars to U.S. dollars. Prepare a

> Refer to the information given in Problems P12-23 and P12-24 for Alamo and its subsidiary, Western Ranching. Assume that the Australian dollar (A$) is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its inv

> Refer to the information given in Problem P12-23 for Alamo and its subsidiary, Western Ranching. Assume that the Australian dollar (A$) is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its investment in W

> Alamo Inc. purchased 80 percent of the outstanding stock of Western Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (A$) was A$200,000, and A$40,000 of the differential was allocated to plant and equip

> Refer to the information in Problem P12-21. Assume that the dollar is the functional currency. Required: Prepare a schedule remeasuring DaSilva Company’s December 31, 20X4, trial balance from reals to dollars. Prepare a

> On January 1, 20X4, Alum Corporation acquired DaSilva Company, a Brazilian subsidiary, by purchasing all its common stock at book value. DaSilva’s trial balances on January 1, 20X4, and December 31, 20X4, expressed in Brazilian reals (B

> Refer to the information given in Problem P12-17 and your answer to part a of Problem P12-18. Required: Prepare a schedule providing a proof of the remeasurement gain or loss. For this part of the problem, assume that the Norwegian subsidiary had the f

> Refer to the information presented in Problem P12-17 and your answer to part a of Problem P12-17. Required: Prepare a schedule providing a proof of the translation adjustment. Data from Problem P12-17: On January 1, 20X5, Taft Company acquired all

> Refer to the information in Problem P12-17. Assume the U.S. dollar is the functional currency, not the krone. Required: Prepare a schedule remeasuring the trial balance from Norwegian kroner into U.S. dollars. Assume that Taft uses the fully adju

> On January 1, 20X5, Taft Company acquired all of the outstanding stock of Vikix Inc., a Norwegian company, at a cost of $151,200. Vikix’s net assets on the date of acquisition were 700,000 kroner (NKr). On January 1, 20X5, the book and

> MaMi Co. Ltd. located in Mexico City is a wholly owned subsidiary of Special Foods, a U.S. company. At the beginning of the year, MaMi’s condensed balance sheet was reported in Mexican pesos (MXP) as follows: During the year, the comp

> The U.S. parent company is preparing its consolidated financial statements for December 31, 20X4. The foreign company’s local currency (LCU) is the functional currency. Information is presented in Data Set A and Data Set B. Data Set A:

> On January 1, 20X1, Par Company purchased all the outstanding stock of North Bay Company, located in Canada, for $120,000. On January 1, 20X1, the direct exchange rate for the Canadian dollar (C$) was C$1 = $0.80. North Bay’s book value on January 1, 20X

> Refer to the information in Problem P12-29 for Kiner Company and its foreign subsidiary. Required: Prepare a schedule translating the selected accounts into U.S. dollars as of December 31, 20X1, and December 31, 20X2, respectively, assuming that the

> On January 1, 20X1, Kiner Company formed a foreign subsidiary that issued all of its currently outstanding common stock on that date. Selected accounts from the balance sheets, all of which are shown in local currency units, are as follows: Additional

> Refer to the information given in Problems P12-23 and P12-27 for Alamo and its subsidiary, Western Ranching. Assume that the U.S. dollar is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its investment in

> Multiplex Inc., a public company whose stock is traded on a national stock exchange, reported the following information on its consolidated financial statements for 20X5: Multiplex management determined that it had the following operating seg

> During the third quarter of its 20X7 fiscal year, Press Company is considering the different methods of reporting accounting changes on its interim segments. Preliminary data are available for the third quarter of 20X7, ending on September 30, 20X7, prio

> For many years, Clark Company operated exclusively in the United States but recently expanded its operations to the Pacific Rim countries of New Zealand, Singapore, and Australia. After a modest beginning in these countries, recent successes have resulte

> At the end of the second quarter of 20X1, Malta Corporation assembled the following information: The first quarter resulted in a $90,000 loss before taxes. During the second quarter, sales were $1,200,000; purchases were $650,000; and operating expens

> Chris Inc. has accumulated the following information for its second-quarter income statement for 20X2: Additional Information: First-quarter income before taxes was $100,000, and the estimated effective annual tax rate was 40 percent. At the end o

> Calvin Inc. has operating segments in five different industries: apparel, building, chemical, furniture, and machinery. Data for the five segments for 20X1 are as follows: Additional Information: The corporate headquarters had general corporate expe

> West Corporation reported the following consolidated data for 20X2: Data reported for West’s four operating divisions are as follows: Intersegment sales are priced at cost, and all goods have been subsequently sold to non-

> Watson Inc., a multinational company, has operating divisions in France, Mexico, and Japan as well as in the United States. The company reported the following information on its consolidated financial statements for 20X5: The following additional

> Haskins and Sells formed a partnership on January 2, 20X3. Each had been a sole proprietor before forming their partnership. Part I: Each partner’s contributions follow. The amounts under the cost column represent the amounts report

> The DELS partnership was formed by combining individual accounting practices on May 10, 20X1. The initial investments were as follows: Required: Prepare the journal entry to record the initial investments using GAAP accounting. Calculate the tax

> The partnership of Jordan and O’Neal began business on January 1, 20X7. Each partner contributed the following assets (the noncash assets are stated at their fair values on January 1, 20X7): The land was subject to a $50,000 mortgage,

> Select the correct answer for each of the following questions. When property other than cash is invested in a partnership, at what amount should the noncash property be credited to the contributing partner’s capital account?

> The partnership of Ace, Jack, and Spade has been in business for 25 years. On December 31, 20X5, Spade decided to retire. The partnership balance sheet reported the following capital balances for each partner at December 31, 20X5: The partners allocate

> Champion Play Company is a partnership that sells sporting goods. The partnership agreement provides for 10 percent interest on invested capital, salaries of $24,000 to Luc and $28,000 to Dennis, and a bonus for Luc. The 20X3 capital accounts were as fol

> The following condensed balance sheet is presented for the partnership of Der, Egan, and Oprins, who share profits and losses in the ratio of 4:3:3, respectively. Assume that the partnership decides to admit Snider as a new partner with a 25 percent i

> Eastwood, A. North, and M. West are manufacturers’ representatives in the architecture business. Their capital accounts in the ENW partnership for 20X1 were as follows: Required: For each of the following independent income-sharing a

> Debra and Merina sell electronic equipment and supplies through their partnership. They wish to expand their computer lines and decide to admit Wayne to the partnership. Debra’s capital is $200,000, Merina’s capital is $160,000, and they share income in

> Some accountants are seeking to harmonize international accounting standards. What is meant by the term harmonize? How might harmonization result in better financial reporting for a U.S. parent company with many foreign investments?

> What factors are used to determine a reporting entity’s functional currency? Provide at least one example for which a company’s local currency may not be its functional currency?

> Define the following terms: local currency unit recording currency reporting currency

> What potential benefits might be achieved if U.S. firms are allowed to use IFRS?

> How widely used are IFRS? Can IFRS be used for listings on U.S. stock exchanges?

> Describe the basic problem of eliminating intercompany transactions with a foreign affiliate.

> Briefly discuss the International Accounting Standards Board (IASB). What is its mission? What is the composition of its membership and how long do members serve? Where is the IASB located?

> Describe the accounting for a foreign investment that is not consolidated with the U.S. company.