Question: The following footnote was abstracted from a

The following footnote was abstracted from a recent annual report of Johnson & Johnson Company:

Footnote 7: Foreign Currency Translation

For translation of its international currencies, the Company has determined that the local currencies of its international subsidiaries are the functional currencies except those in highly inflationary economies, which are defined as those which have had compound cumulative rates of inflation of 100 percent or more during the last three years.

In consolidating international subsidiaries, balance sheet currency effects are recorded as a separate component of stockholders’ equity. This equity account includes the results of translating all balance sheet assets and liabilities at current exchange rates, except those located in highly inflationary economies, principally Brazil, which are reflected in operating results. These translation adjustments do not exist in terms of functional cash flows; such adjustments are not reported as part of operating results since realization is remote unless the international businesses were sold or liquidated.

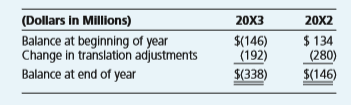

An analysis of the changes during 20X3 and 20X2 in the separate component of stockholders’ equity for foreign currency translation adjustments follows (with debit amounts in parentheses):

Required:

What is the main point of the footnote?

How is the footnote related to the concepts covered in the chapter?

List some possible reasons the company’s translation adjustment decreased from a $134 million credit balance at the end of 20X1 to a $338 million debit balance at the end of 20X3.

Assume that the translated stockholders’ equities of the foreign subsidiaries, other than the cumulative translation adjustment, remained constant from 20X1 through 20X3 at a balance of $500 million. What were the translated balances in the net assets (assets minus liabilities) of the foreign subsidiaries in each of the three years? What factors might cause the changes in the balances of the net assets over the three-year period?

How would changes in the local currency unit’s exchange rate in the countries in which the company has subsidiaries affect the cumulative translation adjustment?

How could you verify the actual causal factors for the changes in the cumulative translation adjustment of Johnson & Johnson Company for the years presented? Be specific!

Transcribed Image Text:

(Dollars in Millions) 20X3 20X2 Balance at beginning of year Change in translation adjustments Balance at end of year $(146) (192) $ 134 (280) $(146) $(338)

> Which securities act—1933 or 1934—regulates the initial registration of securities? Which regulates the periodic reporting of publicly traded companies?

> Under what circumstances would a partner’s capital account have a debit, or deficiency, balance? How is the deficiency usually eliminated?

> Which law requires that companies maintain accurate accounting records and an adequate system of internal control? What is meant by an “adequate system of internal control”?

> Which division of the SEC receives the registration statements of companies wishing to make public offerings of securities? Which division investigates individuals or firms that may be in violation of a security act?

> During a partnership liquidation, do a partnership’s liabilities to individual partners have a lower priority than the partnership’s obligations to other, third-party creditors? Explain.

> What is the Uniform Partnership Act of 1997 and what is its relevance to partnership accounting?

> Select the correct answer for each of the following questions. On May 1, 20X1, Cathy and Mort formed a partnership and agreed to share profits and losses in the ratio of 3:7, respectively. Cathy contributed a parcel of land that cost her $10,000. M

> Refer to the data in Exercise E12-5, but now assume that the exchange rates were as follows: The receivable from Popular Creek Corporation is denominated in Swiss francs. Popular Creek’s books show a $3,650 payable to RoadTime. Ass

> Refer to the data in Exercises E12-5 and E12-7. Required: Prepare a proof of the remeasurement gain or loss computed in Exercise E12-7. How should this remeasurement gain or loss be reported on Popular Creek’s consolidated financi

> Refer to the data in Exercise E12-5, but assume that the dollar is the functional currency for the foreign subsidiary. Required: Prepare a schedule remeasuring the December 31, 20X1, trial balance from Swiss francs to dollars. Data from E12-5:

> Refer to the data in Exercise E12-5. Required: Prepare a proof of the translation adjustment computed in Exercise E12-5. Where is the translation adjustment reported on Popular Creek’s consolidated financial statements and its for

> On January 1, 20X1, Popular Creek Corporation organized RoadTime Company as a subsidiary in Switzerland with an initial investment cost of Swiss francs (SFr) 60,000. RoadTime’s December 31, 20X1, trial balance in SFr is as follows: A

> Use the following information for questions 1, 2, and 3. Bartell Inc., a U.S. company, acquired 90 percent of the common stock of a Malaysian company on January 1, 20X5, for $160,000. The net assets of the Malaysian subsidiary amounted to 680,000 ringgi

> Match the items in the left-hand column with the descriptions/explanations in the right-hand column. Items Descriptions/Explanations A. The group that has attempted to harmonize the world's many different accounting methods. B. The currency of

> The following information should be used for questions 1, 2, and 3. Select the best answers under each of two alternative assumptions: (a) the LCU is the functional currency and the translation method is appropriate or (b) the U.S. dollar is the funct

> Hawk Company sold inventory to United Ltd., an English subsidiary. The goods cost Hawk $8,000 and were sold to United for $12,000 on November 27, payable in British pounds. The goods are still on hand at the end of the year on December 31. The British po

> On December 31, 20X2, your company’s Mexican subsidiary sold land at a selling price of 3,000,000 pesos. The land had been purchased for 2,000,000 pesos on January 1, 20X1, when the exchange rate was 10 pesos to 1 U.S. dollar. The exchange rate for 1 U.S

> Bentley Company owns a subsidiary in India whose balance sheets in rupees (R) for the last two years follow: Bentley formed the subsidiary on January 1, 20X6, when the exchange rate was 30 rupees for 1 U.S. dollar. The exchange rate for 1 U.S. dollar o

> Thames Company is located in London, England. The local currency is the British pound (£). On January 1, 20X8, Dek Company purchased an 80 percent interest in Thames for $400,000, which resulted in an excess of cost-over-book value of $48,00

> Duff Company is a subsidiary of Rand Corporation and is located in Madrid, Spain, where the currency is the euro (€). Data on Duff’s inventory and purchases are as follows: The beginning inventory was acquired duri

> Refer to the data in Exercise E12-5, but now assume that the exchange rates were as follows: The receivable from Popular Creek is denominated in Swiss francs. Its books show a $3,650 payable to RoadTime. Assume that the U.S. dollar is the function

> For each of the following seven cases, work the case twice and select the best answer. First assume that the foreign currency is the functional currency; then assume that the U.S. dollar is the functional currency. Certain balance sheet accounts in a

> Estimated Annual Tax Rate Supra Inc. estimates total federal and state tax rates to be 40 percent. Expected annual pretax earnings from continuing operations are $1,200,000. Differences between tax income and financial statement income are expected to be

> Sales by Knight Inc. to major customers are as follows: Required: If worldwide sales total $43,000,000 for the year, which of Knight’s customers should be disclosed as major customers? Customer Sales Reporting Segme

> Information about the domestic and foreign operations of Radon Inc. is as follows: Required: Prepare schedules showing appropriate tests to determine which countries are material using a 10 percent materiality threshold. Geographic Area United Sta

> Select the correct answer for each of the following questions. According to ASC 270 and 740, income tax expense in an income statement for the first interim period of an enterprise’s fiscal year should be computed by Applying

> Cub Company, a calendar-year entity, had 2,100 geothermal heating pumps in its beginning inventory for 20X1. On December 31, 20X0, the heating pumps had been adjusted down to $850 per unit from an actual cost of $920 per unit. It was the lower of cost or

> During July, Laesch Company, which uses a perpetual inventory system, sold 1,240 units from its LIFO-based inventory, which had originally cost $18 per unit. The replacement cost is expected to be $27 per unit. Required: Respond to the followi

> Select the correct answer for each of the following questions. Which of the following is an inherent difficulty in determining the results of operations on an interim basis? Cost of sales reflects only the amount of product expense allocable t

> Select the correct answer for each of the following questions. Barbee Corporation discloses supplementary operating segment information for its two reportable segments. Data for 20X5 are available as follows: Additional 20X5 expenses are as fo

> Following are seven independent cases on how accounting facts might be reported on an individual company’s interim financial reports. Bean Company was reasonably certain it would have an employee strike in the third quarter. As a result, the compan

> Symbiotic Chemical Company has four major industry segments and operates both in the U.S. domestic market and in several foreign markets. Information about its revenue from the specific industry segments and its foreign activities for the year 20X2 is as

> Tem Technology has a first-quarter operating loss of $100,000 and expects the following income for the other three quarters: Tem estimated the effective annual tax rate at 40 percent at the end of the first quarter and changed it to 45

> Data for the seven operating segments of Amalgamated Products follow: Included in the $105,000 revenue of the Bicycles segment are sales of $25,000 made to the Sporting Goods segment. Required: Which segments are separately reportable?

> Select the correct answer for each of the following questions. Which of the following statements concerning the prospectus required by the Securities Act of 1933 is correct? The prospectus is a part of the registration statement. The pro

> Select the correct answer for each of the following questions. A major impact of the Foreign Corrupt Practices Act of 1977 is that registrants subject to the Securities Exchange Act of 1934 are required to Keep records that reflect the transa

> Select the correct answer for each of the following questions. Form 10-K is filed with the SEC to update the information a company supplied when filing a registration statement under the Securities and Exchange Act of 1934. Form 10-K is a report t

> Select the correct answer for each of the following questions. In the registration and sales of new securities issues, the SEC Endorses a security’s investment merit by allowing its registration to “go effective.” Provides a rating

> On January 1, 20X1, Eddy decides to retire from the partnership of Cobb, Davis, and Eddy. The partners share profits and losses in the ratio of 3:2:1, respectively. The following condensed balance sheets present the account balances immediately before an

> In the LMK partnership, Luis’s capital is $40,000, Marty’s is $50,000, and Karl’s is $30,000. They share income in a 4:1:1 ratio, respectively. Karl is retiring from the partnership. Required: Prepare journal entries to record Karl’s withdrawal

> Select the correct answer for each of the following questions. (Note: The following balance sheet is for the partnership of Alex, Betty, and Claire in questions 1 and 2.) (Note: Figures shown parenthetically reflect agreed-upon profit and loss&acir

> Pam and John are partners in PJ’s partnership, having capital balances of $120,000 and $40,000, respectively, and share income in a ratio of 3:1. Gerry is to be admitted into the partnership with a 20 percent interest in the business. Required: F

> On the GMP partnership (to which Elan seeks admittance), the capital balances of Mary, Gene, and Pat, who share income in the ratio of 6:3:1, are Required: If no goodwill or bonus is recorded, how much must Elan invest for a one-third interest? P

> Various Enterprises Corporation is a medium-size conglomerate listed on the American Stock Exchange. It is constantly in the process of acquiring small corporations and invariably needs additional money. Among its diversified holdings is a citrus grove t

> The income statement for the Apple-Jack Partnership for the year ended December 31, 20X5, follows: Additional Information for 20X5: Apple began the year with a capital balance of $40,800. Jack began the year with a capital balance of $112,000.

> Left and Right are partners. Their capital accounts during 20X1 were as follows: Partnership net income is $50,000 for the year. The partnership agreement provides for the division of income as follows: Each partner is to be credited 8 percent inte

> The partnership agreement of Angela and Dawn has the following provisions: The partners are to earn 10 percent on the average capital. Angela and Dawn are to earn salaries of $25,000 and $15,000, respectively. Any remaining income or

> Select the correct answer for each of the following questions. Two interesting and important topics concerning the SEC are the role it plays in the development of accounting principles and the impact it has had and will continue to have on the

> Many larger U.S. companies have significant investments in foreign operations. For example, McDonald’s Corporation, the food service company, obtains 47 percent of its consolidated revenues and 44 percent of its operating income from, and has 45 percent

> Dundee Company owns 100 percent of a subsidiary located in Ireland. The parent company uses the Euro as the subsidiary’s functional currency. At the beginning of the year, the debit balance in the Accumulated Other Comprehensive Income&

> Wahl Company’s 20X5 consolidated financial statements include two wholly owned subsidiaries, Wahl Company of Australia (Wahl A) and Wahl Company of France (Wahl F). Functional currencies are the U.S. dollar for Wahl A and the European euro for Wahl F.

> Petie Products Company was incorporated in Wisconsin in 20X0 as a manufacturer of dairy supplies and equipment. Since incorporating, Petie has doubled in size about every three years and is now considered one of the leading dairy supply companies in th

> Following are descriptions of several independent situations. Rockford Company has a subsidiary in Argentina. The subsidiary does not have much debt because of the high interest costs resulting from the average annual inflation rate exceeding

> The IASB website can be found at www.ifrs.org. At the top of the page, click on the link “About Us.” Briefly describe the structure of the IASB.

> Sonoma Company has owned 100 percent of the outstanding common stock of Valencia Corporation, a Spanish subsidiary, for the past 15 years. The Spanish company’s functional currency is the euro, and its financial statements are translated into U.S. dollar

> Maxima Corporation, a U.S. company, manufactures lighting fixtures and ceiling fans. Eight years ago, it set up a subsidiary in Mexico to manufacture three of its most popular ceiling fan models. When the subsidiary, Luz Maxima, was set up, it did busine

> Prepare a brief answer to each of the following questions about interim reporting, assuming the company is preparing its Form 10-Q for the third quarter of its fiscal year. How many different income statements would the company present? Describe the

> Andrea Meyers, a supervisor in the controller’s department at Vanderbilt Company, is reviewing the calculation of the income tax provision to be included in the financial statements for the first quarter of 20X5. She is questioning the estimate of the ef

> Randy Rivera, CFO of Stanford Corporation, a manufacturer of packaged retail food products, has reviewed the company’s segment disclosures for the current year. In the first draft of the disclosures, the company reports information about four segments: c

> The company you work for is considering going public. Your current position is in the external financial reporting group. The manager you work for wants you to review some public company quarterly reports, Form 10-Qs, to see what type of information is d

> The manager you work for has asked you to perform some research to determine what types of information public companies are providing on their Internet home pages. The public company you work for is considering establishing its own home page. In particul

> A major producer of cereal breakfast foods had been reporting in its annual reports just one dominant product line (cereals) in only the U.S. domestic geographic area. The company had no other separately reportable segments. For several years, the U.S. c

> Bennett Inc. is a publicly held corporation whose diversified operations have been separated into five industry segments. Bennett is in the process of preparing its annual financial statements for the year ended December 31, 20X5. The following informati

> Periodic reporting adds complexity to accounting by requiring estimates, accruals, deferrals, and allocations. Interim reporting creates even greater difficulties in matching revenue and expenses. Required: Explain how revenue, product co

> Chemax Inc. manufactures a wide variety of pharmaceuticals, medical instruments, and other medical supplies. Eighteen months ago the company developed and began to market a new product line of antihistamine drugs under various trade names. Sales and prof

> The company that employs you is a U.S. publicly traded corporation that manufactures chemicals. You are in the external financial reporting department, and your position requires that you keep current on all the new accounting requirements. Although you

> An early event leading to the establishment of audit committees as a regular subcommittee of boards of directors occurred in 1940 as part of the consent decree relative to the Mc Kesson Robbins scandal. (A consent decree is the formal statement issued in

> The purpose of the Securities Act of 1933 is to regulate the initial offering of a firm’s securities by ensuring that investors are given full and fair disclosure of all pertinent information about the firm. The Securities Exchange Act of 1934 was passed

> Jerford Company is a well-known manufacturing company with several wholly owned subsidiaries. The company’s stock is traded on the New York Stock Exchange, and the company files all appropriate reports with the SEC. Jerford’s financial statements are aud

> Bandex Inc. has been in business for 15 years and has compiled a record of steady but not spectacular growth. Bandex’s engineers have recently perfected a product that has an application in the small computer market. Initial orders have exceeded the comp

> Form 10-K is the annual filing required of publicly traded entities. The form contains the financial information for the year as well as a number of other disclosures the SEC requires. Required: Using EDGAR or another source, obtain the most

> The proxy contains an abundance of information the SEC believed to be necessary for stockholders to make an informed vote on the items the company presents for their voting consideration. This case provides opportunities to analyze the proxy of a publicl

> The development of accounting theory and practice has been influenced directly and indirectly by many organizations and institutions. Two of the most important institutions have been the Financial Accounting Standards Board (FASB) and the Securities and

> During the late 1920s, approximately 55 percent of all personal savings in the United States was used to purchase securities. Public confidence in the business community was extremely high as stock values doubled and tripled in short periods of time. The

> This case provides learning opportunities using available databases and/or the Internet to obtain contemporary information about the topics in advanced financial accounting. Note that the Internet is dynamic and any specific website listed may change its

> You are providing accounting services for the JR Company partnership. The two partners, Jason and Richard, are thinking of adding a third partner to their business, and they have several questions regarding the use of GAAP for their partnership. Re

> Adam, Bob, and Cathy are planning to form a partnership to create a business that will retail cell phones in a new shopping center just completed in their city. They have been able to reach agreement on many issues, but Cathy is still concerned that Adam

> You are in a group that is considering forming a partnership to purchase a coffee shop located near your campus. The coffee shop offers freshly brewed coffee and rolls in the morning and soup and sandwiches the remainder of the day. During your prelimina

> Bill, George, and Anne are partners in the BGA Partnership. A difference of opinion exists among the partners as to how to account for Newt’s admission as a new partner. The three present partners have the following positions: Bill wants

> Nitty and Gritty are considering the formation of a partnership to operate a crafts and hobbies store. They have come to you to obtain information about the basic elements of a partnership agreement. These agreements usually specify an income and loss–sh

> The Mattfield v. Kramer Brothers court case presents a number of the interesting legal issues that often arise from the dissolution of a partnership. The case was heard in the Supreme Court of the State of Montana in 2005 and decided on May 31, 2005, as

> Hiller, Luna, and Welsh are attempting to form a partnership to operate a travel agency. They have agreed to share profits in a ratio of 4:3:2 but cannot settle on the terms of the partnership agreement relating to possible liquidation. Hiller believes t

> After successfully operating a partnership for several years, the partners have proposed to incorporate the business and admit another investor. The original partners will purchase at par an amount of preferred stock equal to the book values of their cap

> Adam and Bard agreed to liquidate their partnership. Having been asked to assist them in this process, you prepare the following balance sheet for the date of the beginning of the liquidation. The loss-sharing percentages are in parentheses next to the c

> Kiwi Painting Company engages in a number of foreign currency transactions in euros (€). For each of the following independent transactions, determine the dollar amount to be reported in the December 31, 2004, financial statements for th

> On November 3, 20X2, PRD Corporation acquired 100 shares of JRS Company at a cost of $12 per share. PRD classifies them as available-for-sale securities. On this same date, PRD decides to hedge against a possible decline in the value of the securities by

> Mega Company believes the price of oil will increase in the coming months. Therefore, it decides to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On Novem

> Select the correct answer for each of the following questions. According to ASC 815, which of the following is not an underlying? A security price. A monthly average temperature. The price of a barrel of oil. The number of foreign curren

> Dexter Inc. had the following items in its unadjusted and adjusted trial balances at December 31, 20X5: Additional Information: On December 1, 20X5, Dexter sold goods to a company in Australia for A$70,000. Payment in Australian dollars is du

> Part I Maple Company had the following export and import transactions during 20X5: On March 1, Maple sold goods to a Canadian company for C$30,000, receivable on May 30. The spot rates for Canadian dollars were C$1 = $0.65 on March 1 and C$1 = $0.68

> On December 1, 20X1, Micro World Inc. entered into a 120-day forward contract to purchase 100,000 Australian dollars (A$). Micro World’s fiscal year ends on December 31. The direct exchange rates follow: Required: Prepare all journal

> Globe Shipping, a U.S. company, is an importer and exporter. The following are some transactions with foreign companies. Globe sold blue jeans to a South Korean importer on January 15 for $7,400, when the exchange rate was South Korean won (KRW)1 = $0

> Tex Hardware sells many of its products overseas. The following are some selected transactions. Tex sold electronic subassemblies to a firm in Denmark for 120,000 Danish kroner (Dkr) on June 6, when the exchange rate was Dkr 1 = $0.1750. Collection was m

> Jon-Jan Restaurants purchased green rice, a special variety of rice, from China for 100,000 renminbi on November 1, 20X8. Payment is due on January 30, 20X9. On November 1, 20X8, the company also entered into a 90-day forward contract to purchase 100,000

> Refer to the information given in Problems P12-23 and P12-26 for Alamo and its subsidiary, Western Ranching. Assume that the U.S. dollar is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its investment i

> Refer to the information in Problem P12-23. Assume the U.S. dollar is the functional currency. Required: Prepare a schedule remeasuring the December 31, 20X3, trial balance of Western Ranching from Australian dollars to U.S. dollars. Prepare a

> Refer to the information given in Problems P12-23 and P12-24 for Alamo and its subsidiary, Western Ranching. Assume that the Australian dollar (A$) is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its inv

> Refer to the information given in Problem P12-23 for Alamo and its subsidiary, Western Ranching. Assume that the Australian dollar (A$) is the functional currency and that Alamo uses the fully adjusted equity method for accounting for its investment in W

> Alamo Inc. purchased 80 percent of the outstanding stock of Western Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (A$) was A$200,000, and A$40,000 of the differential was allocated to plant and equip

> Refer to the information in Problem P12-21. Assume that the dollar is the functional currency. Required: Prepare a schedule remeasuring DaSilva Company’s December 31, 20X4, trial balance from reals to dollars. Prepare a