Question: On January 1, 20X7, Proft Company purchased

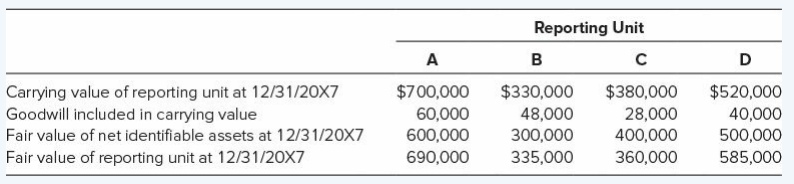

On January 1, 20X7, Proft Company purchased Strobe Company’s net assets and assigned them to four separate reporting units. Total goodwill of $176,000 is assigned to the reporting units as indicated:

Required:

Determine the amount of goodwill that Proft should report at December 31, 20X7. Show how you computed it.

Transcribed Image Text:

Reporting Unit A в D $700,000 60,000 600,000 690,000 $330,000 48,000 300,000 $380,000 28,000 400,000 360,000 Carrying value of reporting unit at 12/31/20X7 Goodwill included in carrying value $520,000 40,000 Fair value of net identifiable assets at 12/31/20X7 500,000 Fair value of reporting unit at 12/31/20X7 335,000 585,000

> Plump Corporation acquired 100 percent of Slim Corporation’s common stock on December 31, 20X2, for $189,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: At the date

> Plumber Corporation acquired all of Socket Corporation’s voting shares on January 1, 20X2, for $470,000. At that time, Socket reported common stock outstanding of $80,000 and retained earnings of $130,000. The book values of Socket’s assets and liabiliti

> Plaza Corporation acquired 100 percent of Square Corporation’s voting common stock on December 31, 20X4, for $395,000. At the date of combination, Square reported the following: At December 31, 20X4, the book values of Squareâ&#

> On June 10, 20X8, Playoff Corporation acquired 100 percent of Series Company’s common stock. Summarized balance sheet data for the two companies immediately after the stock acquisition are as follows: Required: a. Give the consolidati

> Select the correct answer for each of the following questions. 1. On January 1, 20X1, Prim Inc. acquired all of Scrap Inc.’s outstanding common shares for cash equal to the stock’s book value. The carrying amounts of S

> Select the most appropriate answer for each of the following questions: 1. Goodwill is a. Seldom reported because it is too difficult to measure. b. Reported when more than book value is paid in purchasing another company. c. Reported when the fair value

> Pirate Corporation purchased 100 percent ownership of Ship Company on January 1, 20X5, for $270,000. On that date, the book value of Ship’s reported net assets was $200,000. The excess over book value paid is attributable to depreciable

> Peace Computer Corporation acquired 90 percent of Symbol Software Company’s common stock on January 2, 20X3, by issuing preferred stock with a par value of $6 per share and a market value of $8.10 per share. A total of 10,000 shares of

> Peace Computer Corporation acquired 75 percent of Symbol Software Company’s stock on January 2, 20X3, by issuing bonds with a par value of $50,000 and a fair value of $67,500 in exchange for the shares. Summarized balance sheet data pre

> Select the correct answer for each of the following questions. 1. Goodwill represents the excess of the sum of the fair value of the (1) consideration given, (2) shares already owned, and (3) the non controlling interest over the a. Sum of the fair value

> Pencil Company acquired 80 percent of Stylus Corporation’s stock on January 2, 20X3, for $72,000 cash. Summarized balance sheet data for the companies on December 31, 20X2, follow: Required: Prepare a consolidated balance sheet immedi

> Pawn Company acquired 90 percent of the voting common shares of Shop Corporation by issuing bonds with a par value and fair value of $121,500 to Shop’s existing shareholders. Immediately prior to the acquisition, Pawn reported total assets of $510,000, l

> On January 1, 20X3, Parade Corporation reported total assets of $470,000, liabilities of $270,000, and stockholders’ equity of $200,000. At that date, Summer Corporation reported total assets of $190,000, liabilities of $135,000, and stockholders’ equity

> Select the correct answer for each of the following questions. 1. Consolidated financial statements are typically prepared when one company has a. Accounted for its investment in another company by the equity method. b. Accounted for its investment in an

> Select the correct answer for each of the following questions. Items 1 and 2 are based on the following: On January 2, 20X8, Paint Company acquired 75 percent of Stain Company’s outstanding common stock at an amount equal to its underly

> Select the correct answer for each of the following questions. 1. Special-purpose entities generally a. Have a much larger portion of assets financed by equity shareholders than do companies such as General Motors. b. Have relatively large amounts of pre

> On December 31, 20X8, Paragraph Corporation acquired 80 percent of Sentence Company’s common stock for $136,000. At the acquisition date, the book values and fair values of all of Sentence’s assets and liabilities were

> Photo Corporation acquired 75 percent of Shutter Corporation’s voting common stock on January 1, 20X2, at underlying book value. At the acquisition date, the book values and fair values of Shutter’s assets and liabilities were equal, and the fair value o

> Phone Corporation owns 75 percent of Smart Company’s common stock, acquired at underlying book value on January 1, 20X4. At the acquisition date, the book values and fair values of Smart’s assets and liabilities were e

> Pesto Corporation acquired 70 percent of Sauce Corporation’s common stock on January 1, 20X7, for $294,000 in cash. At the acquisition date, the book values and fair values of Sauce’s assets and liabilities were equal,

> Stallion Corporation sold $100,000 par value, 10-year first mortgage bonds to Pony Corporation on January 1, 20X5. The bonds, which bear a nominal interest rate of 12 percent, pay interest semiannually on January 1 and July 1. The entry to record interes

> Plug Motors’ accountant was called away after completing only half of the consolidated statements at the end of 20X4. The data left behind included the following: Required: a. Plug Motors acquired shares of Spark Body Shop at underlyi

> The trial balance data presented in P8-24 can be converted to reflect use of the cost method by inserting the following amounts in place of those presented for Patio Corporation: Investment in Stone Container Stock ………..$ 75,000 Retained Earnings ………………

> Gamble Company convinced Conservative Corporation that the two companies should establish Simpletown Corporation to build a new gambling casino in Simpletown Corner. Although chances for the casino’s success were relatively low, a local bank loaned $140

> Private Manufacturing Company acquired 90 percent of Secret Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Secret reported commo

> Select the correct answer for each of the following questions. 1. When a parent-subsidiary relationship exists, consolidated financial statements are prepared in recognition of the accounting concept of a. Reliability. b. Materiality. c. Legal entity. d.

> Private Manufacturing Company acquired 90 percent of Secret Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the non controlling interest was $128,000, and Secret reported comm

> Ravine Corporation purchased 30 percent ownership of Valley Industries for $90,000 on January 1, 20X6, when Valley had capital stock of $240,000 and retained earnings of $60,000. During the period of January 1, 20X6, through December 31, 20X9, the market

> Panther Enterprises owns 80 percent of Strike Corporation’s voting stock. Panther acquired the shares on January 1, 20X4, for $234,500. On that date, the fair value of the noncontrolling interest was $58,625, and Strike reported common

> Phillips Company bought 40 percent ownership in Jones Bag Company on January 1, 20X1, at underlying book value. During the period of January 1, 20X1, through December 31, 20X3, the market value of Phillips’ investment in Jonesâ

> Winston Corporation purchased 40 percent of the stock of Fullbright Company on January 1, 20X2, at underlying book value. During the period of January 1, 20X2, through December 31, 20X4, the market value of Winston’s investment in Fullb

> Select the correct answer for each of the following questions. 1. Growth in the complexity of the U.S. business environment a. Has led to increased use of partnerships to avoid legal liability. b. Has led to increasingly complex organizational structures

> Puzzle Corporation purchased 75 percent of Sunday Company’s common stock at underlying book value on January 1, 20X3. At that date, the fair value of the non controlling interest was equal to 25 percent of Sunday’s boo

> Select the correct answer for each of the following questions. 1. On January 2, 20X3, Kean Company purchased a 30 percent interest in Pod Company for $250,000. Pod reported net income of $100,000 for 20X3 and declared and paid a dividend of $10,000. Kean

> Patio Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the non controlling interest was equal to 40 percent of Stone’s book value. On December

> On July 1, 20X2, Alan Enterprises merged with Terry Corporation through an exchange of stock and the subsequent liquidation of Terry. Alan issued 200,000 shares of its stock to effect the combination. The book values of Terry’s assets a

> Purple Manufacturing purchased 60 percent of the ownership of Socks Corporation stock on January 1, 20X1, at underlying book value. At that date, the fair value of the non controlling interest was equal to 40 percent of the book value of Socks Corporatio

> The following financial statement information was prepared for Plue Corporation and Sparse Company at December 31, 20X2: Plue and Sparse agreed to combine as of January 1, 20X3. To effect the merger, Plue paid finder’s fees of $30,000

> Smart Company issued $100,000 of 10 percent bonds on January 1, 20X1, at 120. The bonds mature in 10 years and pay 10 percent interest annually on December 31. Phone Corporation holds 80 percent of Smart’s voting shares, acquired on Jan

> Phone Corporation holds 80 percent of Smart Company’s voting shares, acquired on January 1, 20X1, at underlying book value. On January 1, 20X4, Phone purchased Smart bonds with a par value of $40,000. The bonds pay 10 percent interest a

> The following balance sheets were prepared for Pam Corporation and Slest Company on January 1, 20X2, just before they entered into a business combination: Pam acquired all of Slest Company’s assets and liabilities on January 1, 20X2,

> School Perfume Company issued $300,000 of 10 percent bonds on January 1, 20X2, at 110. The bonds mature 10 years from issue and have semiannual interest payments on January 1 and July 1. Parsons Corporation owns 80 percent of School Perfume stock. On Apr

> Assume the same facts as in E8-1 and prepare entries using straight-line amortization of bond discount or premium. Data from E8-1: Pretzel Corporation owns 60 percent of Stick Corporation’s voting shares. On January 1, 20X2, Pretzel Corporation sold $1

> Punyain Company acquired Sallsap Corporation on January 1, 20X1, through an exchange of common shares. All of Sallsap’s assets and liabilities were immediately transferred to Punyain, which reported total par value of shares outstanding of $218,400 and $

> Pea Corporation acquired 80 percent of Split Company’s stock on January 1, 20X1, at underlying book value. At that date, the fair value of the non controlling interest was equal to 20 percent of Split’s book value. On

> Prant Company acquired all of Sedford Corporation’s assets and liabilities on January 1, 20X2, in a business combination. At that date, Sedford reported assets with a book value of $624,000 and liabilities of $356,000. Prant noted that Sedford had $40,00

> Police Corporation purchased 70 percent of Station Company’s voting shares on January 1, 20X4, at underlying book value. On that date it also purchased $100,000 par value 12 percent Station bonds, which had been issued on January 1, 20X1, with a 10-year

> Plasher Company has a reporting unit resulting from an earlier business combination. The reporting unit’s current assets and liabilities are Required: Determine the amount of goodwill to be reported and the amount of goodwill impairme

> Plug Corporation purchased $100,000 par value bonds of its subsidiary, Spark Company, on December 31, 20X5, from Lemon Corporation. The 10-year bonds bear a 9 percent coupon rate, and Spark originally sold them on January 1, 20X3, to Lemon. Interest is p

> Series Corporation issued $500,000 par value 10-year bonds at 104 on January 1, 20X1, which Independent Corporation purchased. On July 1, 20X5, Playoff Corporation purchased $200,000 of Series bonds from Independent. The bonds pay 9 percent interest annu

> Practical Corporation acquired all of the common stock of Simple Company for $450,000 on January 1, 20X4. On that date, Simple’s identifiable net assets had a fair value of $390,000. The assets acquired in the purchase of Simple are considered to be a se

> On January 1, 20X1, Prize Corporation paid Morton Advertising $116,200 to acquire 70 percent of Statue Company’s stock. Prize also paid $45,000 to acquire $50,000 par value 8 percent, 10-year bonds directly from Statue on that date. Int

> Series Corporation issued $500,000 par value, 10-year bonds at 104 on January 1, 20X1, which Independent Corporation purchased. On January 1, 20X5, Playoff Corporation purchased $200,000 of Series bonds from Independent for $196,700. The bonds pay 9 perc

> On January 1, 20X1, Porta Corporation purchased Swick Company’s net assets and assigned goodwill of $80,000 to Reporting Division K. The following assets and liabilities are assigned to Reporting Division K on the acquisition date: Re

> Assume the same facts as in E8-15 except for the changes in the trial balances, but prepare entries using straight-line amortization of bond discount or premium. Required: a. Record the journal entry or entries for 20X4 on Punk’s book

> Using the data presented in E1-13, determine the amount Planter Corporation would record as a gain on bargain purchase and prepare the journal entry Planter would record at the time of the exchange if Planter issued bonds with a par value of $580,000 and

> Planter Corporation used debentures with a par value of $625,000 to acquire 100 percent of Sorden Company’s net assets on January 1, 20X2. On that date, the fair value of the bonds issued by Planter was $608,000. The following balance s

> How is the receipt of a dividend recorded under the equity method? When investments are carried at fair value?

> Summer Company holds assets with a fair value of $120,000 and a book value of $90,000 and liabilities with a book value and fair value of $25,000. Required: Compute the following amounts if Parade Corporation acquires 60 percent ownership of Summer: a.

> Paint Corporation acquired 80 percent of the stock of Stain Company by issuing shares of its common stock with a fair value of $192,000. At that time, the fair value of the non controlling interest was estimated to be $48,000, and the fair values of Stai

> Stick Company reports net assets with a book value and fair value of $200,000. Paste Corporation acquires 75 percent ownership for $150,000. Paste reports net assets with a book value of $520,000 and a fair value of $640,000 at that time, excluding its i

> Pepper Corporation owns 70 percent of Salt Company’s stock. In the 20X9 consolidated income statement, the non controlling interest was assigned $18,000 of income. There was no differential in the acquisition. Required: What amount of net income did Sal

> Describe an investor’s treatment of an investment in common stock that was previously carried at fair value, if the investment becomes qualified for use of the equity method by an increase in the level of ownership.

> How does carrying securities at fair value differ from the equity method in reporting income from non subsidiary investments?

> Distinguish between an upstream sale of inventory and a downstream sale. Why is it important to know whether a sale is upstream or downstream?

> Porter Company purchased 60 percent ownership of Service Corporation on January 1, 20X1, at underlying book value. At that date, the fair value of the non controlling interest was equal to 40 percent of Service’s book value. On January

> Select the correct answer for each of the following questions. 1. Companies often acquire ownership in other companies using a variety of ownership arrangements. The investor should use equity-method reporting whenever a. The investor purchases voting co

> Private Manufacturing Company acquired 90 percent of Secret Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the non controlling interest was $128,000, and Secret reported comm

> Puzzle Corporation purchased 75 percent of Sunday Company’s common stock at underlying book value on January 1, 20X3. At that date, the fair value of the non controlling interest was equal to 25 percent of Sunday’s boo

> Patio Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the non controlling interest was equal to 40 percent of Stone’s book value. On December

> Purple Manufacturing purchased 60 percent of the ownership of Socks Corporation stock on January 1, 20X1, at underlying book value. At that date, the fair value of the non controlling interest was equal to 40 percent of the book value of Socks Corporatio

> School Perfume Company issued $300,000 of 10 percent bonds on January 1, 20X2, at 110. The bonds mature 10 years from issue and have semiannual interest payments on January 1 and July 1. Parsons Corporation owns 80 percent of School Perfume stock. On Jan

> Pea Corporation acquired 80 percent of Split Company’s stock on January 1, 20X1, at underlying book value. At that date, the fair value of the non controlling interest was equal to 20 percent of Split’s book value. On

> Plug Corporation purchased $100,000 par value bonds of its subsidiary, Spark Company, on December 31, 20X5, from Lemon Corporation for $102,800. The 10-year bonds bear a 9 percent coupon rate, and Spark originally sold them on January 1, 20X3, to Lemon a

> Using the data in P7-33, on December 31, 20X7, Prime Company recorded the following entry on its books to adjust its investment in Suspect Company from the fully adjusted equity method to the modified equity method: Required: a. Adjust the data reporte

> Pot Company acquired 65 percent of Seed Corporation’s voting common stock on June 20, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 35 percent of the book value of Seed Corporat

> Private Company acquired 80 percent of Secret Corporation’s common stock on January 1, 20X4, for $280,000. The fair value of the noncontrolling interest was $70,000 at the date of acquisition. Private’s corporate controller has lost the consolidation fil

> Assume the same facts as in E8-12 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-12: Sibling Company issued $500,000 par value, 10-year bonds at 104 on January 1, 20X3, which Mega Corporation purchased. T

> Prince Corporation holds 75 percent of the common stock of Sword Distributors Inc., purchased on December 31, 20X1, for $2,340,000. At the date of acquisition, Sword reported common stock with a par value of $1,000,000, additional paid-in capital of $1,3

> Partial trial balance data for Profile Corporation, Shadow Company, and the consolidated entity at December 31, 20X7, are as follows: Additional Information: 1. Profile Corporation acquired 60 percent ownership of Shadow Company on January 1, 20X4, for

> Putt Corporation acquired 70 percent of Slice Company’s voting common stock on January 1, 20X3, for $158,900. Slice reported common stock outstanding of $100,000 and retained earnings of $85,000. The fair value of the non controlling in

> Prime Company holds 80 percent of Suspect Company’s stock, acquired on January 1, 20X2, for $160,000. On the date of acquisition, Suspect reported retained earnings of $50,000 and $100,000 of common stock outstanding, and the fair value

> Prime Company holds 80 percent of Suspect Company’s stock, acquired on January 1, 20X2, for $160,000. On the acquisition date, the fair value of the non controlling interest was $40,000. Suspect reported retained earnings of $50,000 and

> Pork Company owns 60 percent of Swine Corporation’s voting shares, purchased on May 17, 20X1, at book value. At that date, the fair value of the non controlling interest was equal to 40 percent of the book value of Swine Corporation. Th

> In its 20X7 consolidated income statement, Plate Development Company reported consolidated net income of $961,000 and $39,000 of income assigned to the 30 percent non controlling interest in its only subsidiary, Subsidence Mining Inc. During the year, Su

> Select the correct answer for each of the following questions. 1. In the preparation of a consolidated income statement: a. Income assigned to non controlling shareholders always is computed as a pro rata portion of the reported net income of the consoli

> izza Corporation acquired 75 percent of Slice Corporation’s voting common stock on January 1, 20X4, for $348,000, when the fair value of its net identifiable assets was $464,000 and the fair value of the non controlling interest was $116,000. Slice repor

> Package Corporation acquired 90 percent ownership of Sack Grain Company on January 1, 20X4, for $108,000 when the fair value of Sack’s net assets was $10,000 higher than its $110,000 book value. The increase in value was attributed to amortizable assets

> Palm Corporation and Staple Company have announced terms of an exchange agreement under which Palm will issue 8,000 shares of its $10 par value common stock to acquire all of Staple Company’s assets. Palm shares currently are trading at

> The trial balance data presented in Problem P6-34 can be converted to reflect use of the cost method by inserting the following amounts in place of those presented for Prime Corporation: Investment in Steak Company ……………………………..$280,000 Retained Earning

> On December 31, 20X7, Prime Corporation recorded the following entry on its books to adjust from the fully adjusted equity method to the modified equity method for its investment in Steak Company stock: Investment in Steak Company Stock ……………11,000 Reta

> Prime Corporation acquired 80 percent of Steak Company’s voting shares on January 1, 20X4, for $280,000 in cash and marketable securities. At that date, the noncontrolling interest had a fair value of $70,000 and Steak reported net asse

> The December 31, 20X6, condensed balance sheets of Pine Corporation and its 90 percent-owned subsidiary, Slim Corporation, are presented in the accompanying worksheet. Additional Information: 1. Pine’s investment in Slim was acquired f

> Song Corporation was created on January 1, 20X0, to develop computer software. On January 1, 20X5, Polka Company purchased 90 percent of Song’s common stock at underlying book value. At that date, the fair value of the non controlling i

> Point Corporation acquired 60 percent of Stick Company’s stock on January 1, 20X3, for $24,000 in excess of book value. On that date, the book values and fair values of Stick’s assets and liabilities were equal and the

> Pop Corporation acquired 70 percent of Soda Company’s voting common shares on January 1, 20X2, for $108,500. At that date, the non controlling interest had a fair value of $46,500 and Soda reported $70,000 of common stock outstanding an

> Phone Corporation owns 80 percent of Smart Company’s stock. At the end of 20X8, Phone and Smart reported the following partial operating results and inventory balances: Phone regularly prices its products at cost plus a 40 percent mar

> Plaza Corporation purchased 70 percent of Square Company’s voting common stock on January 1, 20X5, for $291,200. On that date, the non controlling interest had a fair value of $124,800 and the book value of Square’s ne

> Pepper Enterprises owns 95 percent of Salt Corporation. On January 1, 20X1, Salt issued $200,000 of five-year bonds at 115. Annual interest of 12 percent is paid semiannually on January 1 and July 1. Pepper purchased $100,000 of the bonds on August 31, 2

> Pirate Company purchased 60 percent ownership of Ship Corporation on January 1, 20X1, for $82,800. On that date, the non controlling interest had a fair value of $55,200 and Ship reported common stock outstanding of $100,000 and retained earnings of $20,