Question: Peace Computer Corporation acquired 90 percent of

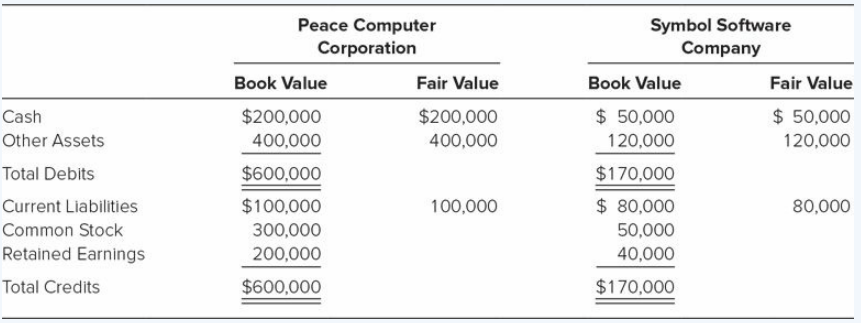

Peace Computer Corporation acquired 90 percent of Symbol Software Company’s common stock on January 2, 20X3, by issuing preferred stock with a par value of $6 per share and a market value of $8.10 per share. A total of 10,000 shares of preferred stock was issued. Balance sheet data for the two companies immediately before the business combination are presented in E3-8.

Required:

Prepare a consolidated balance sheet for the companies immediately after Peace obtains ownership of Symbol by issuing the preferred stock.

Data from E3-8:

Peace Computer Corporation acquired 75 percent of Symbol Software Company’s stock on January 2, 20X3, by issuing bonds with a par value of $50,000 and a fair value of $67,500 in exchange for the shares. Summarized balance sheet data presented for the companies just before the acquisition follow:

Required:

Prepare a consolidated balance sheet immediately following the acquisition.

Transcribed Image Text:

Peace Computer Corporation Symbol Software Company Book Value Fair Value Book Value Fair Value Cash $200,000 $200,000 $ 50,000 $ 50,000 Other Assets 400,000 400,000 120,000 120,000 Total Debits $600,000 $170,000 Current Liabilities $100,000 100,000 $ 80,000 80,000 Common Stock 300,000 50,000 Retained Earnings 200,000 40,000 Total Credits $600,000 $170,000

> Roy Gross is considering an investment that pays 7.6 percent, compounded annually. How much will he have to invest today so that the investment will be worth $25,000 in six years?

> Joe Mauer, a catcher for the Minnesota Twins, is expected to hit 15 home runs in 2018. If his home-run-hitting ability is expected to grow by 12 percent every year for the following five years, how many home runs is he expected to hit in 2023?

> Find the future value of a five-year $100,000 investment that pays 8.75 percent and that has the following compounding periods: a. Quarterly. b. Monthly. c. Daily. d. Continuous.

> Your birthday is coming up and instead of other presents, your parents promised to give you $1,000 in cash. Since you have a part time job and thus don’t need the cash immediately, you decide to invest the money in a bank CD that pays 5.2 percent, compou

> Your bank pays 5 percent interest semiannually on your savings account. You don’t expect to add to the current balance of $2,700 over the next four years. How much money can you expect to have at the end of this period?

> Kate Eden received a graduation present of $2,000 that she is planning on investing in a mutual fund that earns 8.5 percent each year. How much money will she have in three years?

> Kelly Martin has $10,000 that she can deposit into a savings account for five years. Bank A pays compounds interest annually, Bank B twice a year, and Bank C quarterly. Each bank has a stated interest rate of 4 percent. What amount would Kelly have at th

> You will be graduating in two years and are thinking about your future. You know that you will want to buy a house five years after you graduate and that you will want to put down $60,000. As of right now, you have $8,000 in your savings account. You are

> Surmec, Inc., reported sales of $2.1 million last year. The company’s primary business is the manufacture of nuts and bolts. Since this is a mature industry, analysts are confident that sales will grow at a steady rate of 7 percent per year. The company’

> Jared Goff, the number 1 draft pick of the NFL Los Angeles Rams in 2016, and his agent are evaluating three contract options. Each option offers a signing bonus and a series of payments over the life of the contract. Goff uses a 10.25 percent rate of ret

> When you were born your parents set up a bank account in your name with an initial investment of $5,000. You are turning 21 in a few days and will have access to all your funds. The account was earning 7.3 percent for the first seven years, but then the

> You have $12,000 in cash. You can deposit it today in a mutual fund earning 8.2 percent compounded semiannually, or you can wait, enjoy some of it, and invest $11,000 in your brother’s business in two years. Your brother is promising you a return of at l

> Patrick Seeley has $2,400 to invest. His brother approached him with an investment opportunity that could double his money in four years. What interest rate would the investment have to yield in order for Patrick’s brother to deliver on his promise?

> You have $2,500 that you want to invest in your classmate’s start-up business. You believe the business idea to be great and hope to get $3,700 back at the end of three years. If all goes according to the plan, what will be the return on your investment?

> Congress and the President have decided to increase the federal tax rate in an effort to reduce the budget deficit. Suppose that Caroline Weslin, from problem 5.29, will pay 35 percent of her bonus to the federal government for taxes if she accepts the b

> Your aunt is planning to invest in a bank CD that will pay 7.5 percent interest compounded semiannually. If she has $5,000 to invest, how much will she have at the end of four years?

> Caroline Weslin needs to decide whether to accept a bonus of $1,820 today or wait two years and receive $2,100 then. She can invest at 6 percent. What should she do?

> Emily Smith deposits $1,200 in her bank today. a. If the bank pays 4 percent simple interest, how much money will she have at the end of five years? b. What if the bank pays compound interest? c. How much of the earnings will be interest on interest?

> The Abercrombie Supply Company reported the following information for 2017. Prepare a common-size income statement for the year ended June 30, 2017? Abercrombie Supply Company Income Statement for the Fiscal Year Ended June 30, 2017 ($ thousands) Net sal

> Purchase Corporation purchased 60 percent of Steal Company ownership on January 1, 20X7, for $277,500. Steal reported the following net income and dividend payments: On January 1, 20X7, Steal had $250,000 of $5 par value common stock outstanding and re

> Punk Corporation purchased 80 percent of Soul Corporation’s stock on January 1, 20X2. At that date, Soul reported retained earnings of $80,000 and had $120,000 of stock outstanding. The fair value of its buildings was $32,000 more than the book value. Pu

> Public Corporation acquired 90 percent of Station Company’s voting common stock on January 1, 20X1, for $486,000. At the time of the combination, Station reported common stock outstanding of $120,000 and retained earnings of $380,000, and the fair value

> Select the most appropriate answer for each of the following questions. 1. If A Company acquires 80 percent of the stock of B Company on January 1, 20X2, immediately after the acquisition, which of the following is correct? a. Consolidated retained earni

> Softball Corporation reported the following balances at January 1, 20X9: On January 1, 20X9, Pitcher Corporation purchased 100 percent of Softball’s stock. All tangible assets had a remaining economic life of 10 years at January 1, 20

> Pitch Corporation purchased 100 percent ownership of Southpaw Corporation on January 1, 20X4, for $65,000, which was $10,000 above the underlying book value. Half the additional amount was attributable to an increase in the value of land held by Southpaw

> Pistol Corporation purchased 100 percent ownership of Scope Products on January 1, 20X6, for $56,000, at which time Scope Products reported retained earnings of $10,000 and capital stock outstanding of $30,000. The differential was attributable to patent

> Player Corporation purchased 100 percent of Scout Company’s common stock on January 1, 20X5, and paid $28,000 above book value. The full amount of the additional payment was attributed to amortizable assets with a life of eight years remaining at January

> Plastic Company purchased 100 percent of Spoon Company’s voting common stock for $648,000 on January 1, 20X4. At that date, Spoon reported assets of $690,000 and liabilities of $230,000. The book values and fair values of Spoon’s assets were equal except

> Planner Corporation purchased 100 percent of Schedule Company’s stock on January 1, 20X4, for $340,000. On that date, Schedule reported net assets with a historical cost of $300,000 and a fair value of $340,000. The difference was due to the increased va

> Select the correct answer for each of the following questions. 1. On December 31, 20X3, Saxe Corporation was merged into Poe Corporation. In the business combination, Poe issued 200,000 shares of its $10 par common stock, with a market price of $18 a sha

> Planet Corporation acquired 100 percent of the voting common stock of Saturn Company on January 1, 20X7, by issuing bonds with a par value and fair value of $670,000 and making a cash payment of $24,000. At the date of acquisition, Saturn reported assets

> Pop Company acquired all of Soda Corporation’s common shares on January 2, 20X3, for $789,000. At the date of combination, Soda’s balance sheet appeared as follows: The fair values of all of Soda’s

> Polka Corporation acquired 100 percent of Song Company’s voting stock on January 1, 20X4, at underlying book value. Polka uses the equity method in accounting for its ownership of Song. On December 31, 20X4, the trial balances of the tw

> Pony Corporation acquired all of Stallion Company’s common shares on January 1, 20X5, for $180,000. On that date, the book value of the net assets reported by Stallion was $150,000. The entire differential was assigned to depreciable as

> Police Corporation acquired 100 percent of Station Corporation’s voting shares on January 1, 20X3, at underlying book value. At that date, the book values and fair values of Station’s assets and liabilities were equal.

> Police Corporation acquired 100 percent of Station Corporation’s voting shares on January 1, 20X3, at underlying book value. At that date, the book values and fair values of Station’s assets and liabilities were equal.

> Pizza Corporation purchased 100 percent of the common stock of Slice Corporation on January 1, 20X2, by issuing 45,000 shares of its $6 par value common stock. The market price of Pizza’s shares at the date of issue was $24. Slice reported net assets wit

> Stick Corporation is a wholly owned subsidiary of Point Corporation. Point acquired ownership of Stick on January 1, 20X3, for $28,000 above Stick’s reported net assets. At that date, Stick reported common stock outstanding of $60,000 and retained earnin

> Pocket Corporation acquired 100 percent of Strap Corporation’s common stock on December 31, 20X2. Balance sheet data for the two companies immediately following the acquisition follow: At the date of the business combination, the book

> Single Corporation’s balance sheet at January 1, 20X7, reflected the following balances: Plural Corporation, which had just entered into an active acquisition program, acquired 100 percent of Single’s common stock on

> Assume the same facts as in E8-3 but prepare entries using straight-line amortization of bond discount or premium. “A” indicates that the item relates to Appendix 8A. Data from E8-3: Purse Corporation owns 70 percent of Scarf Company’s voting shares. O

> Pint Enterprises acquired 100 percent of Saloon Builders’ stock on December 31, 20X4. Balance sheet data for Pint and Saloon on January 1, 20X5, are as follows: At the date of the business combination, Saloon’s cash

> Plump Corporation acquired 100 percent of Slim Corporation’s common stock on December 31, 20X2, for $189,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: At the date

> Plumber Corporation acquired all of Socket Corporation’s voting shares on January 1, 20X2, for $470,000. At that time, Socket reported common stock outstanding of $80,000 and retained earnings of $130,000. The book values of Socket’s assets and liabiliti

> Plaza Corporation acquired 100 percent of Square Corporation’s voting common stock on December 31, 20X4, for $395,000. At the date of combination, Square reported the following: At December 31, 20X4, the book values of Squareâ&#

> On June 10, 20X8, Playoff Corporation acquired 100 percent of Series Company’s common stock. Summarized balance sheet data for the two companies immediately after the stock acquisition are as follows: Required: a. Give the consolidati

> Select the correct answer for each of the following questions. 1. On January 1, 20X1, Prim Inc. acquired all of Scrap Inc.’s outstanding common shares for cash equal to the stock’s book value. The carrying amounts of S

> Select the most appropriate answer for each of the following questions: 1. Goodwill is a. Seldom reported because it is too difficult to measure. b. Reported when more than book value is paid in purchasing another company. c. Reported when the fair value

> Pirate Corporation purchased 100 percent ownership of Ship Company on January 1, 20X5, for $270,000. On that date, the book value of Ship’s reported net assets was $200,000. The excess over book value paid is attributable to depreciable

> Peace Computer Corporation acquired 75 percent of Symbol Software Company’s stock on January 2, 20X3, by issuing bonds with a par value of $50,000 and a fair value of $67,500 in exchange for the shares. Summarized balance sheet data pre

> Select the correct answer for each of the following questions. 1. Goodwill represents the excess of the sum of the fair value of the (1) consideration given, (2) shares already owned, and (3) the non controlling interest over the a. Sum of the fair value

> Pencil Company acquired 80 percent of Stylus Corporation’s stock on January 2, 20X3, for $72,000 cash. Summarized balance sheet data for the companies on December 31, 20X2, follow: Required: Prepare a consolidated balance sheet immedi

> Pawn Company acquired 90 percent of the voting common shares of Shop Corporation by issuing bonds with a par value and fair value of $121,500 to Shop’s existing shareholders. Immediately prior to the acquisition, Pawn reported total assets of $510,000, l

> On January 1, 20X3, Parade Corporation reported total assets of $470,000, liabilities of $270,000, and stockholders’ equity of $200,000. At that date, Summer Corporation reported total assets of $190,000, liabilities of $135,000, and stockholders’ equity

> Select the correct answer for each of the following questions. 1. Consolidated financial statements are typically prepared when one company has a. Accounted for its investment in another company by the equity method. b. Accounted for its investment in an

> Select the correct answer for each of the following questions. Items 1 and 2 are based on the following: On January 2, 20X8, Paint Company acquired 75 percent of Stain Company’s outstanding common stock at an amount equal to its underly

> Select the correct answer for each of the following questions. 1. Special-purpose entities generally a. Have a much larger portion of assets financed by equity shareholders than do companies such as General Motors. b. Have relatively large amounts of pre

> On December 31, 20X8, Paragraph Corporation acquired 80 percent of Sentence Company’s common stock for $136,000. At the acquisition date, the book values and fair values of all of Sentence’s assets and liabilities were

> Photo Corporation acquired 75 percent of Shutter Corporation’s voting common stock on January 1, 20X2, at underlying book value. At the acquisition date, the book values and fair values of Shutter’s assets and liabilities were equal, and the fair value o

> Phone Corporation owns 75 percent of Smart Company’s common stock, acquired at underlying book value on January 1, 20X4. At the acquisition date, the book values and fair values of Smart’s assets and liabilities were e

> Pesto Corporation acquired 70 percent of Sauce Corporation’s common stock on January 1, 20X7, for $294,000 in cash. At the acquisition date, the book values and fair values of Sauce’s assets and liabilities were equal,

> Stallion Corporation sold $100,000 par value, 10-year first mortgage bonds to Pony Corporation on January 1, 20X5. The bonds, which bear a nominal interest rate of 12 percent, pay interest semiannually on January 1 and July 1. The entry to record interes

> Plug Motors’ accountant was called away after completing only half of the consolidated statements at the end of 20X4. The data left behind included the following: Required: a. Plug Motors acquired shares of Spark Body Shop at underlyi

> The trial balance data presented in P8-24 can be converted to reflect use of the cost method by inserting the following amounts in place of those presented for Patio Corporation: Investment in Stone Container Stock ………..$ 75,000 Retained Earnings ………………

> Gamble Company convinced Conservative Corporation that the two companies should establish Simpletown Corporation to build a new gambling casino in Simpletown Corner. Although chances for the casino’s success were relatively low, a local bank loaned $140

> Private Manufacturing Company acquired 90 percent of Secret Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Secret reported commo

> Select the correct answer for each of the following questions. 1. When a parent-subsidiary relationship exists, consolidated financial statements are prepared in recognition of the accounting concept of a. Reliability. b. Materiality. c. Legal entity. d.

> Private Manufacturing Company acquired 90 percent of Secret Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the non controlling interest was $128,000, and Secret reported comm

> Ravine Corporation purchased 30 percent ownership of Valley Industries for $90,000 on January 1, 20X6, when Valley had capital stock of $240,000 and retained earnings of $60,000. During the period of January 1, 20X6, through December 31, 20X9, the market

> Panther Enterprises owns 80 percent of Strike Corporation’s voting stock. Panther acquired the shares on January 1, 20X4, for $234,500. On that date, the fair value of the noncontrolling interest was $58,625, and Strike reported common

> Phillips Company bought 40 percent ownership in Jones Bag Company on January 1, 20X1, at underlying book value. During the period of January 1, 20X1, through December 31, 20X3, the market value of Phillips’ investment in Jonesâ

> Winston Corporation purchased 40 percent of the stock of Fullbright Company on January 1, 20X2, at underlying book value. During the period of January 1, 20X2, through December 31, 20X4, the market value of Winston’s investment in Fullb

> Select the correct answer for each of the following questions. 1. Growth in the complexity of the U.S. business environment a. Has led to increased use of partnerships to avoid legal liability. b. Has led to increasingly complex organizational structures

> Puzzle Corporation purchased 75 percent of Sunday Company’s common stock at underlying book value on January 1, 20X3. At that date, the fair value of the non controlling interest was equal to 25 percent of Sunday’s boo

> Select the correct answer for each of the following questions. 1. On January 2, 20X3, Kean Company purchased a 30 percent interest in Pod Company for $250,000. Pod reported net income of $100,000 for 20X3 and declared and paid a dividend of $10,000. Kean

> Patio Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the non controlling interest was equal to 40 percent of Stone’s book value. On December

> On July 1, 20X2, Alan Enterprises merged with Terry Corporation through an exchange of stock and the subsequent liquidation of Terry. Alan issued 200,000 shares of its stock to effect the combination. The book values of Terry’s assets a

> Purple Manufacturing purchased 60 percent of the ownership of Socks Corporation stock on January 1, 20X1, at underlying book value. At that date, the fair value of the non controlling interest was equal to 40 percent of the book value of Socks Corporatio

> The following financial statement information was prepared for Plue Corporation and Sparse Company at December 31, 20X2: Plue and Sparse agreed to combine as of January 1, 20X3. To effect the merger, Plue paid finder’s fees of $30,000

> Smart Company issued $100,000 of 10 percent bonds on January 1, 20X1, at 120. The bonds mature in 10 years and pay 10 percent interest annually on December 31. Phone Corporation holds 80 percent of Smart’s voting shares, acquired on Jan

> Phone Corporation holds 80 percent of Smart Company’s voting shares, acquired on January 1, 20X1, at underlying book value. On January 1, 20X4, Phone purchased Smart bonds with a par value of $40,000. The bonds pay 10 percent interest a

> The following balance sheets were prepared for Pam Corporation and Slest Company on January 1, 20X2, just before they entered into a business combination: Pam acquired all of Slest Company’s assets and liabilities on January 1, 20X2,

> School Perfume Company issued $300,000 of 10 percent bonds on January 1, 20X2, at 110. The bonds mature 10 years from issue and have semiannual interest payments on January 1 and July 1. Parsons Corporation owns 80 percent of School Perfume stock. On Apr

> Assume the same facts as in E8-1 and prepare entries using straight-line amortization of bond discount or premium. Data from E8-1: Pretzel Corporation owns 60 percent of Stick Corporation’s voting shares. On January 1, 20X2, Pretzel Corporation sold $1

> Punyain Company acquired Sallsap Corporation on January 1, 20X1, through an exchange of common shares. All of Sallsap’s assets and liabilities were immediately transferred to Punyain, which reported total par value of shares outstanding of $218,400 and $

> Pea Corporation acquired 80 percent of Split Company’s stock on January 1, 20X1, at underlying book value. At that date, the fair value of the non controlling interest was equal to 20 percent of Split’s book value. On

> Prant Company acquired all of Sedford Corporation’s assets and liabilities on January 1, 20X2, in a business combination. At that date, Sedford reported assets with a book value of $624,000 and liabilities of $356,000. Prant noted that Sedford had $40,00

> Police Corporation purchased 70 percent of Station Company’s voting shares on January 1, 20X4, at underlying book value. On that date it also purchased $100,000 par value 12 percent Station bonds, which had been issued on January 1, 20X1, with a 10-year

> Plasher Company has a reporting unit resulting from an earlier business combination. The reporting unit’s current assets and liabilities are Required: Determine the amount of goodwill to be reported and the amount of goodwill impairme

> Plug Corporation purchased $100,000 par value bonds of its subsidiary, Spark Company, on December 31, 20X5, from Lemon Corporation. The 10-year bonds bear a 9 percent coupon rate, and Spark originally sold them on January 1, 20X3, to Lemon. Interest is p

> On January 1, 20X7, Proft Company purchased Strobe Company’s net assets and assigned them to four separate reporting units. Total goodwill of $176,000 is assigned to the reporting units as indicated: Required: Determine the amount of

> Series Corporation issued $500,000 par value 10-year bonds at 104 on January 1, 20X1, which Independent Corporation purchased. On July 1, 20X5, Playoff Corporation purchased $200,000 of Series bonds from Independent. The bonds pay 9 percent interest annu

> Practical Corporation acquired all of the common stock of Simple Company for $450,000 on January 1, 20X4. On that date, Simple’s identifiable net assets had a fair value of $390,000. The assets acquired in the purchase of Simple are considered to be a se

> On January 1, 20X1, Prize Corporation paid Morton Advertising $116,200 to acquire 70 percent of Statue Company’s stock. Prize also paid $45,000 to acquire $50,000 par value 8 percent, 10-year bonds directly from Statue on that date. Int

> Series Corporation issued $500,000 par value, 10-year bonds at 104 on January 1, 20X1, which Independent Corporation purchased. On January 1, 20X5, Playoff Corporation purchased $200,000 of Series bonds from Independent for $196,700. The bonds pay 9 perc

> On January 1, 20X1, Porta Corporation purchased Swick Company’s net assets and assigned goodwill of $80,000 to Reporting Division K. The following assets and liabilities are assigned to Reporting Division K on the acquisition date: Re

> Assume the same facts as in E8-15 except for the changes in the trial balances, but prepare entries using straight-line amortization of bond discount or premium. Required: a. Record the journal entry or entries for 20X4 on Punk’s book

> Using the data presented in E1-13, determine the amount Planter Corporation would record as a gain on bargain purchase and prepare the journal entry Planter would record at the time of the exchange if Planter issued bonds with a par value of $580,000 and

> Planter Corporation used debentures with a par value of $625,000 to acquire 100 percent of Sorden Company’s net assets on January 1, 20X2. On that date, the fair value of the bonds issued by Planter was $608,000. The following balance s

> How is the receipt of a dividend recorded under the equity method? When investments are carried at fair value?