Question: On the basis of the following data,

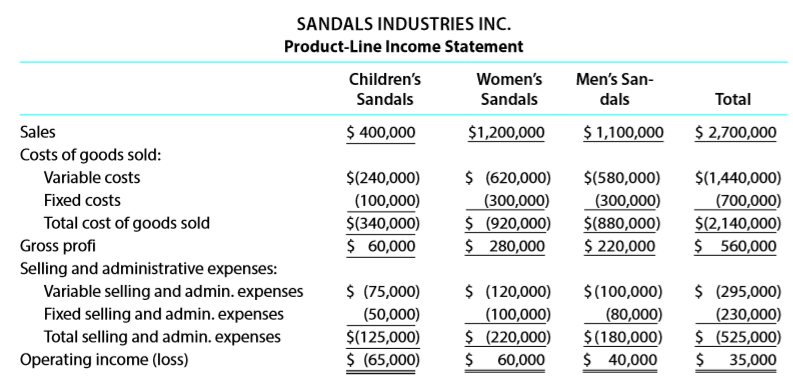

On the basis of the following data, the general manager of Sandals Industries Inc. decided to discontinue Children’s Sandals because it reduced operating income by $65,000. What is the flaw in this decision?

Transcribed Image Text:

SANDALS INDUSTRIES INC. Product-Line Income Statement Children's Women's Men's San- Sandals Sandals dals Total Sales $ 400,000 $1,200,000 $ 1,100,000 $ 2,700,000 Costs of goods sold: $ (620,000) (300,000) $ (920,000) $ 280,000 Variable costs $(240,000) $(580,000) $(1,440,000) Fixed costs (100,000) (300,000) $(880,000) $ 220,000 (700,000) $(2,140,000) $ 560,000 Total cost of goods sold Gross profi Selling and administrative expenses: Variable selling and admin. expenses Fixed selling and admin. expenses Total selling and admin. expenses $(340,000) $ 60,000 $ (75,000) $ (120,000) $ (295,000) (230,000) $ (525,000) $(100,000) (50,000) (100,000) $ (220,000) (80,000) $(180,000) $ 40,000 $(125,000) Operating income (loss) $ (65,000) $ 60,000 $ 35,000

> An agreement that is blatantly and substantially anticompetitive is deemed a per se violation of Section 1 of the Sherman Act. Under what rule is an agreement analyzed if it appears to be anticompetitive but is not a per se violation? In making this anal

> Wiring used by the Appliance Division of Kaufman Manufacturing is currently purchased from outside suppliers at a cost of $25 per unit. However, the same materials are available from the Electronic Division. The Electronic Division has unused capacity an

> Based on the data in Exercise 14-10, assume that management has established a 10% minimum acceptable rate of return for invested assets. a. Determine the residual income for each division. b. Which division has the most residual income? Data from Exerci

> A summary of the time tickets for January is as follows: a. Determine the amounts of factory labor costs transferred to Work in Process and Factory Overhead for January. b. Illustrate the effect on the accounts and financial statements of the factory l

> The operating income and the amount of invested assets in each division of Otte Industries are as follows: a. Compute the return on investment for each division. b. Which division is the most profitable per dollar invested? Operating Income Investe

> The production supervisor of the Machining Department for Lei Company agreed to the following monthly static budget for the upcoming year: The actual amount spent and the actual units produced in the first three months in the Machining Department were

> Fuller Enterprises uses flexible budgets that are based on the following data: Prepare a flexible selling and administrative expenses budget for July for sales volumes of $600,000, $800,000, and $1,000,000. (Use Exhibit 5

> Model 99 Hotels is considering the construction of a new hotel for $80 million. The expected life of the hotel is 20 years with no residual value. The hotel is expected to earn revenues of $15 million per year. Total expenses, including straight-line dep

> On Time Delivery Inc. is considering the purchase of an additional delivery truck for $85,000 on January 1, 20Y4. The truck is expected to have a five-year life with an expected residual value of $8,000 at the end of five years. The expected additional rev

> The following data are accumulated by Wocester Hat Company in evaluating the purchase of $250,000 of equipment, having a four-year useful life with no residual value. a. Assuming that the desired rate of return is 10%, determine the net present value f

> Bliss Beauty Products is considering an investment in one of two new product lines. The investment required for either product line is $2,800,000. The net cash flows associated with each product are shown below. a. Recommend a product of

> Wyoming Woodworks is evaluating two capital investment proposals for a retail outlet store, each requiring an investment of $1,000,000 and each with a five-year life and expected total net cash flows of $1,250,000. Location 1 is expected to provide equal a

> Daffodil Inc. is planning to invest in manufacturing equipment to make a new garden tool. The new garden tool is expected to generate additional annual sales of 120,000 units at $9 each. The new manufacturing equipment will cost $320,000, have a 10-year

> Arrowhead Inc. is considering an investment in new equipment that will be used to manufacture a mobile communications product. The product is expected to generate additional annual sales of 24,000 units at $400 per unit. The equipment has a cost of $27,0

> Buscho Industries is considering one of two investment options. Option 1 is a $45,000 investment in new blending equipment that is expected to produce equal annual cash flows of $18,000 for each of eight years. Option 2 is a $17,000 investment in a new co

> Aquarius Games Inc. has finished a new video game, Triathlon Challenge. Management is now considering its marketing strategies. The following information is available: Anticipated sales price per unit ……………………………………………… $75 Variable cost per unit* ………………

> Healey Development Company has two competing projects: an office building and a condominium complex. Both projects have an initial investment of $2,000,000. The net cash flows estimated for the two projects are as follows:

> Fire proofing Solutions Inc. is considering the purchase of automated machinery that is expected to have a useful life of eight years and no residual value. The average rate of return on the average investment has been computed to be 15%, and the cash pay

> Sager Industries is considering an investment in equipment that will replace direct labor. The equipment has a cost of $1,200,000 with a $300,000 residual value and a 10-year life. The equipment will replace three employees who has an average total wages

> Wisconsin Healthcare Corp. is proposing to spend $3,810,000 on a project that has estimated net cash flows of $620,000 for each of the 10 years. a. Compute the net present value, using a rate of return of 12%. Use the table of present values of an annuity

> Strahn Foods Inc. is considering two possible investments: a delivery truck or a bagging machine. The delivery truck would cost $65,970 and could be used to deliver an additional 90,000 bags of taquitos chips per year. Each bag of chips can be sold for a

> The Canyons Resort, a Utah ski resort, announced a $400 million expansion of lodging properties, lifts, and terrain. Assume that this investment is estimated to produce $79.7 million in equal annual cash flows for each of the ï¬&#

> The plant manager of Jurassic Industries is considering the purchase of new automated assembly equipment. The new equipment will cost $2,375,000. The manager believes that the new investment will result in direct labor savings of $500,000 per year for 10

> Southwest Transportation Inc. is considering a distribution facility at a cost of $10,000,000. The facility has an estimated life of 10 years and a $2,000,000 residual value. It is expected to provide yearly net cash flows of $2,500,000. The company’s min

> Ball Sports Inc. is considering an investment in one of two machines. The stitching machine will increase productivity from sewing 300 baseballs per hour to stitching 360 per hour. The contribution margin is $0.30 per baseball. Assume that any increased

> Montana Grill has computed the net present value for capital expenditures for the Billings and Great Falls locations using the net present value method. Relevant data related to the computation are as follows: a. Determine the present value index for

> “Every airline has what is called a break-even load factor. That is, the percentage of seats the airline (flies) that it must sell to cover its costs. Since revenue and costs vary from one airline to another, so does the break-even f actor. . . . Overall,

> Carnival Corporation has recently placed into service some of the largest cruise ships in the world. One of these ships can hold up to 3,600 passengers and cost $750 million to build. Assume the following additional information: • There will be 300 cruis

> Osborne Excavation Company is planning an investment of $315,000 for a bulldozer. The bulldozer is expected to operate for 1,850 hours per year for five years. Customers will be charged $140 per hour for bulldozer work. The bulldozer operator costs $37 pe

> The following data are accumulated by McDermott Motors Inc. evaluating two competing capital investment proposals: Determine the expected average rate of return for each proposal. Testing Equipment Diagnostic Software $150,000 5 years $5,000 Amount

> On-Demand Sports Co. operates two divisions—the Action Sports Division and the Team Sports Division. The following income and expense accounts were provided as of November 30, 20Y1, the end of the current fiscal year, after all adjustments, including thos

> Panda Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared: The service department charge rate for the service department cos

> Power Sports Company has two divisions, Wholesale and Retail, and two corporate service departments, Tech Support and Accounts Payable. The corporate expenses for the year ended December 31, 20Y7, are as follows: Tech Support Department â€&br

> Harris Corporation, a manufacturer of electronics and communications systems, uses a service department charge system to charge profit centers with Computing and Communications Services (CCS) service department costs. The following table i

> Millennium Printers Inc. manufactures color laser printers. Model L-1819 presently sells for $200 and has a total product cost of $160, as follows: Direct materials …………………………… $ 40 Direct labor …………………………………… 80 Factory overhead …………………………. 40 Total

> Toyota Motor Corporation (TM) uses target costing. Assume that Toyota marketing personnel estimate that the competitive, average selling price for the Rav4 in the upcoming model year will need to be $25,000. Assume further that the Rav4’s total unit cost

> Based on the data presented in Exercise 12-15, assume that Willis Products Inc. uses the variable cost concept of applying the cost-plus approach to product pricing. a. Determine the variable costs and the cost amount per unit for the production and sale

> Phil Fritz is a financial consultant to Magna Properties Inc., a real estate syndicate. Magna Properties Inc. finances and develops commercial real estate (office buildings). The completed projects are then sold as limited partnership interests to individu

> Based on the data presented in Exercise 12-15, assume that Willis Products Inc. uses the product cost concept of applying the cost-plus approach to product pricing. a. Determine the total manufacturing costs and the cost amount per unit for the productio

> Willis Products Inc. uses the total cost concept of applying the cost-plus approach to product pricing. The costs of producing and selling 200,000 units of medical tablets are as follows: Willis Products desires a profit equal to a 20% rate of return o

> Miramar Tire and Rubber Company has capacity to produce 250,000 tires. Miramar presently produces and sells 200,000 tires for the North American market at a price of $40 per tire. Miramar is evaluating a special order from a South American automobile com

> Palomar Battery Company expects to operate at 75% of full capacity during April. The total manufacturing costs for April for the production of 60,000 batteries are budgeted as follows: Direct materials ………………………………. $ 75,000 Direct labor ………………………………………

> Madison Industries Inc. has an annual plant capacity of 800,000 units, and current production is 650,000 units. Monthly fixed costs are $1,200,000 and variable costs are $36 per unit. The present selling price is $50 per unit. The company received an offe

> Bozeman Coffee Company produces Columbian coffee in batches of 10,000 pounds. The standard quantity of materials required in the process is 10,000 pounds, which cost $3.50 per pound. Columbian coffee can be sold without further processing for $8.00 per p

> Lone Wolf Technologies Inc. assembles circuit boards by using a manually operated machine to insert electronic components. The original cost of the machine is $75,000, the accumulated depreciation is $30,000, its remaining useful life is eight years, and

> Creekside Products Inc. is considering replacing an old piece of machinery, which cost $315,000 and has $130,000 of accumulated depreciation to date, with a new machine that costs $275,000. The old machine could be sold for $140,000. The annual variable

> Wisconsin Arts of Milwaukee employs five people in its Publication Department. These people lay out pages for pamphlets, brochures, and other publications for the productions. The pages are delivered to an outside company for printing. The company is cons

> Watts Technologies Company has been purchasing carrying cases for its portable tablets at a delivered cost of $6.50 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 60% of dire

> Warm Space Inc. manufactures electric space heaters. While the CEO, Gwen Willis, is visiting the production facility, the following conversation takes place with the plant manager, Tyra Chastain: Gwen: As I walk around the facility, I can’t help noticing

> The Charles Schwab Corporation (SCHW) is one of the more innovative brokerage and financial service companies in the United States. The company provided information about its major business segments as follows (in millions) for a recent ye

> The condensed product-line income statement for Dinner Ware Company is as follows: Fixed costs are 40% of the cost of goods sold and 18% of the selling and administrative expenses. Dinner Ware assumes that fixed costs would not be significantly affecte

> A condensed income statement by product line for Garcia Beverages Inc. indicated the following for Melon Cola for the past year: Sales ……………………………………. $ 3,750,000 Cost of goods sold …………………. (2,250,000) Gross profit …………………………. $ 1,500,000 Operating exp

> Orwell Industries is considering selling excess machinery with a book value of $300,000 (original cost of $950,000 less accumulated depreciation of $650,000) for $145,000 less a 5% brokerage commission. Alternatively, the machinery can be leased out for

> A new assistant controller recently said: “All the assembly workers in this plant are covered by union contracts, so there should be no labor variances.” Was the controller’s remark correct? Discuss.

> a. What are the two variances between the actual cost and the standard cost for direct materials? b. Discuss some possible causes of these variances.

> Monsanto Company, a large chemical and fibers company, invested $37 million in state-of-the-art systems to improve process control, laboratory automation, and local area network (LAN) communications. The investment was not justified merely on cost saving

> The reliability of cost-volume-profit (CVP) analysis depends on several key assumptions. What are those primary assumptions?

> Two projects have an identical net present value of $360,000. Are both projects equal in desirability?

> With a group of students, visit a local copy and graphics shop or a take-out pizza restaurant. As you observe the operation, consider the costs associated with running the business. As a group, identify as many costs as you can and classify them accordin

> Why might the use of the cash payback period for analyzing the financial performance of theatrical releases from a motion picture production studio be used over the net present value method?

> Why should the production requirements set forth in the production budget be carefully coordinated with the sales budget?

> How does the target cost concept differ from cost plus approaches?

> The returns on investment for Shear Co.’s three divisions, North, South, and Midwest are 38%, 30%, and 22%, respectively. In expanding operations, which of Shear Co.’s divisions should be given priority? Explain.

> What is the major shortcoming of using operating income as a performance measure for investment centers?

> Under what circumstances would a static budget be appropriate?

> Many fast-food restaurant chains, such as McDonald’s, occasionally discontinue restaurants in their system. What are some financial considerations in deciding to eliminate a store?

> A company fabricates a component at a cost of $7.75. A supplier offers to supply the same component for $6.15. Under what circumstances is it reasonable to purchase from the supplier?

> A company is offered incremental business at a special price that exceeds the variable cost. What other issues must the company consider in deciding whether to accept the business?

> Why would the average rate of return differ from the internal rate of return on the same project?

> Fabricator Inc., a specialized equipment manufacturer, uses a job order cost system. The overhead is allocated to jobs on the basis of direct labor hours. The overhead rate is now $3,000 per direct labor hour. The design engineer thinks that this is illo

> A company could sell a building for $650,000 or lease it out for $5,000 per month. What would need to be considered in determining if the lease option would be preferred?

> Explain the meaning of (a) differential revenue, (b) differential cost, and (c) differential income.

> a. What is the objective of just-in-time processing? b. How does just-in-time processing differ from traditional processing?

> a. Differentiate between the clock card and the time ticket. b. Why should the total time reported on an employee’s time tickets for a payroll period be compared with the time reported on the employee’s clock cards for the same period?

> a. Name two principal types of cost accounting systems. b. Which system provides for a separate record of each particular quantity of product that passes through the factory? c. Which system accumulates the costs for each department or process within the

> List three differences in how managerial accounting differs from financial accounting.

> In one group, find a local business, such as a copy shop, that charges for printing, faxing, copying, and scanning documents. In the other group, determine the price of a mid-range printer/copier/scanner/fax machine. Combine this information from the two

> Metro-Goldwyn-Mayer Studios Inc. (MGM) is a major producer and distributor of theatrical and television filmed entertainment. Regarding theatrical films, MGM states, “Our feature films are exploited through a series of sequential domestic and international

> World Electronics Inc. invested $16,000,000 to build a plant in a foreign country. The labor and materials used in production are purchased locally. The plant expansion was estimated to produce an internal rate of return of 20% in U.S. dollar terms. Due

> Use the data from E11-12 and assume that break-even sales are $2,798 million. Determine the following for Molson-Coors Brewing Company. Round to one decimal place. 1. Margin of safety expressed as dollar sales. 2. Margin of safety expressed as a percenta

> At a recent staff meeting, the management of Warp Time Technologies Inc. was considering discontinuing its Track Time line of electronic games. The chief financial analyst reported the following current monthly data for the Track Time F

> For a major university, match each cost in the following table with the appropriate activity base. An activity base may only be used more than once. Activity Base a. Number of enrollment applications b. Number of financial aid applications c. Number

> The following cost graphs illustrate various types of cost behavior: For each of the following costs, identify the cost graph that best illustrates its cost behavior as the number of units produced increases. a. Direct material cost per unit. b. Fees f

> Following is a list of various costs incurred in producing and selling college textbooks. With respect to the production and sale of textbooks, classify each cost as either variable, fixed, or mixed. 1. Art commission of $36,000 paid for use of art on tex

> Five selected transactions for the current month are indicated by letters in the following accounts in a job order cost accounting system: Describe each of the five transactions. Cost of Goods Sold Materials (e) increase (a) decrease Factory Overhe

> A Masters of Accountancy degree at Jalapeno University would cost $15,000 for an additional fifth year of education beyond the bachelor’s degree. Assume that all tuition is paid at the beginning of the year. A student considering this investment must eval

> Reboot Inc. provides computer repair services for the community. Ashley DaCosta’s computer was not working, and she called Reboot for a home repair visit. The Reboot Inc. technician arrived at 2:00 P.M. to begin work. By 4:00 P.M., the

> From the choices presented in the parentheses, choose the appropriate term for completing each of the following sentences: a. Advertising expenses are usually viewed as (period, product) costs. b. An example of factory overhead is (plant depreciation, sa

> From the following list of activity bases for an automobile dealership, select the base that would be most appropriate for each of these costs: (1) preparation costs (cleaning, oil, and gasoline costs) for each car received, (2) salespersons’ commission

> Which of the following items are properly classified as part of factory overhead for Caterpillar? a. Amortization of patents on new assembly process b. Consultant fees for a study of production line employee productivity c. Depreciation on Peoria, Illinoi

> Indicate whether the following costs of Colgate-Palmolive Company would be classified as direct materials cost, direct labor cost, or factory overhead cost: a. Bottles in which mouthwashes are sold b. Depreciation on production machinery c. Depreciation o

> Name the following graph and identify the items represented by the letters (a)Â through (f). Operating Profit (Loss) $300,000 $200,000 $100,000 b $(100,000) $(200,000) $(300,000) 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,00

> Name the following graph, and identify the items represented by the letters (a) through (f). Sales and Costs $100,000 $75,000 $50,000 a $25,000 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 Units of Sales

> The internal rate of return method is used by Leach Construction Co. in analyzing a capital expenditure proposal that involves an investment of $400,125 and annual net cash flows of $75,000 for each of the eight years of its useful life.

> Currently, the unit selling price of a product is $1,350, the unit variable cost is $900, and the total fixed costs are $810,000. A proposal is being evaluated to increase the unit selling price to $1,400. a. Compute the current break-even sales (units).

> One item is omitted from each of the following computations of the return on investment: Determine the missing items, identifying each by the appropriate letter. Return on Investment Profit Margin x Investment Turnover 12% 8% (a) (b) 16% 1.25 24% (

> For the current year ending December 31, McAdams Industries expects fixed costs of $1,860,000, a unit variable cost of $105, and a unit selling price of $125. a. Compute the anticipated break-even sales (units). b. Compute the sales (units) required to re

> Erin Haywood was recently hired as a cost analyst by Wind River Medical Supplies Inc. One of Erin’s first assignments was to perform a net present value analysis for a new warehouse. Erin performed the analysis and calculated a present value index of 0.8.

> For each of the following service departments, select the activity base listed that is most appropriate for charging service expenses to responsible units. Service Department Activity Base a. Accounts Receivable 1. Number of computers b. Central Pur

> Indicate whether each of the following costs of an airplane manufacturer would be classified as direct materials cost, direct labor cost, or factory overhead cost: a. Aircraft engines b. Controls for flight deck c. Depreciation of equipment d. Landing gea