Question: Palisade Creek Co. is a merchandising business

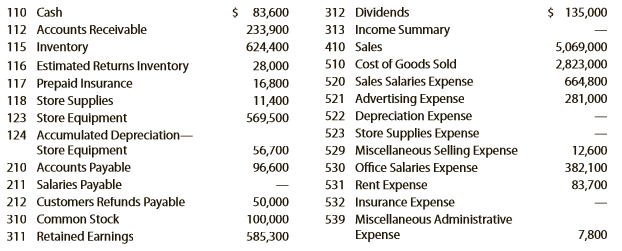

Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 2018 (unless otherwise indicated), are as follows:

During May, the last month of the fiscal year, the following transactions were completed:

May 1. Paid rent for May, $5,000.

3. Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, $36,000.

May 4. Paid freight on purchase of May 3, $600.

6. Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, $68,500. The cost of the goods sold was $41,000.

7. Received $22,300 cash from Halstad Co. on account.

10. Sold merchandise for cash, $54,000. The cost of the goods sold was $32,000.

13. Paid for merchandise purchased on May 3.

15. Paid advertising expense for last half of May, $11,000.

16. Received cash from sale of May 6.

19. Purchased merchandise for cash, $18,700.

19. Paid $33,450 to Buttons Co. on account.

20. Paid Korman Co. a cash refund of $13,230 for returned merchandise from sale of May 6. The invoice amount of the returned merchandise was $13,500 and the cost of the returned merchandise was $8,000.

Record the following transactions on Page 21 of the journal:

May 20. Sold merchandise on account to Crescent Co., terms 1/10, n/30, FOB shipping point, $110,000. The cost of the goods sold was $70,000.

21. For the convenience of Crescent Co., paid freight on sale of May 20, $2,300. 21. Received $42,900 cash from Gee Co. on account.

21. Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination, $88,000.

24. Returned of damaged merchandise purchased on May 21, receiving a credit memo from the seller for $5,000.

26. Refunded cash on sales made for cash, $7,500. The cost of the merchandise returned was $4,800. 28. Paid sales salaries of $56,000 and office salaries of $29,000.

29. Purchased store supplies for cash, $2,400.

30. Sold merchandise on account to Turner Co., terms 2/10, n/30, FOB shipping point, $78,750. The cost of the goods sold was $47,000.

30. Received cash from sale of May 20 plus freight paid on May 21.

31. Paid for purchase of May 21, less return of May 24.

Instructions:

1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark ( Balance in the item section, and place a check mark ( Balance ) in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal.

2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers.

3. Prepare an unadjusted trial balance.

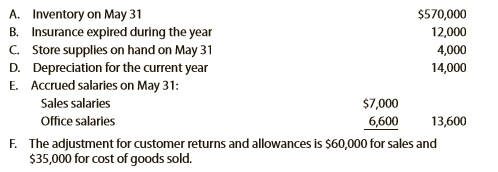

4. At the end of May, the following adjustment data were assembled. Analyze and use these At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6).

5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet.

6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal.

7. Prepare an adjusted trial balance.

8. Prepare an income statement, a retained earnings statement, and a balance sheet.

9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account.

10. Prepare a post-closing trial balance.

Transcribed Image Text:

$ 83,600 233,900 624,400 110 Cash 312 Dividends $ 135,000 112 Accounts Recelvable 313 Income Summary 115 Inventory 410 Sales 5,069,000 510 Cost of Goods Sold 2,823,000 116 Estimated Returns Inventory 117 Prepaid Insurance 118 Store Supplies 123 Store Equipment 124 Accumulated Depreciation- Store Equipment 210 Accounts Payable 211 Salaries Payable 212 Customers Refunds Payable 310 Common Stock 28,000 520 Sales Salaries Expense 521 Advertising Expense 522 Depreciation Expense 523 Store Supplies Expense 529 Miscellaneous Selling Expense 530 Office Salaries Expense 531 Rent Expense 532 Insurance Expense 16,800 664,800 11,400 281,000 569,500 56,700 12,600 96,600 382,100 83,700 50,000 100,000 539 Miscellaneous Administrative 311 Retained Earnings 585,300 Expense 7,800 A. Inventory on May 31 B. Insurance expired during the year C. Store supplies on hand on May 31 D. Depreciation for the current year E. Accrued salaries on May 31: $570,000 12,000 4,000 14,000 Sales salaries $7,000 Office salaries 6,600 13,600 F. The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of goods sold.

> Identify the following costs as a prime cost (P), conversion cost (C), or both (B) for a magazine publisher: A. Paper used for the magazine B. Wages of printing machine employees C. Glue used to bind magazine D. Maintenance on printing machines

> During May, Bergan Company accumulated 2,500 hours of direct labor costs on Job 200 and 3,000 hours on Job 305. The total direct labor was incurred at a rate of $28 per direct labor hour for Job 200 and $24 per direct labor hour for Job 305. Journalize t

> Identify whether each of the following would be reported as an operating, investing, or financing activity on the statement of cash flows: A. Purchase of investments B. Disposal of equipment C. Payment for selling expenses D. Collection of accounts recei

> Jones Industries received $800,000 from issuing shares of its common stock and $700,000 from issuing bonds. During the year, Jones Industries also paid dividends of $90,000. How are the effects of these transactions reported on the statement of cash flow

> Ripley Corporation’s accumulated depreciation—equipment account increased by $11,575 while $2,500 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In

> The payroll register of Heritage Co. indicates $3,900 of social security withheld and $975 of Medicare tax withheld on total salaries of $65,000 for the period. Federal withholding for the period totaled $14,250. Retirement savings withheld from employee

> The cost of goods sold reported on the income statement was $240,000. The accounts payable balance increased $12,000, and the inventory balance increased by $19,200 over the year. Determine the amount of cash paid for merchandise.

> A summary of cash flows for Paradise Travel Service for the year ended May 31, 2018, follows: Cash receipts: Cash received from customers…………………………………$880,000 Cash received from issuing common stock……………………40,000 Cash payments: Cash paid for operating e

> Shrute Inc. manufactures office copiers, which are sold to retailers. The price and cost of goods sold for each copier are as follows: Price……………â&

> Using the bond from Basic Exercise 11-4, journalize the first interest payment and the amortization of the related bond premium. Data from Exercise 11-4: On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays

> Alpine Energy Corporation has 1,500,000 shares of $40 par common stock outstanding. On August 2, Alpine Energy declared a 4% stock dividend to be issued October 8 to stockholders of record on September 15. The market price of the stock was $70 per share

> Using the income statement for Paradise Travel Service shown in Basic Exercise 1-4, prepare a retained earnings statement for the year ended May 31, 2018. Everett McCauley invested an additional $40,000 in the business in exchange for common stock, and $

> The revenues and expenses of Paradise Travel Service for the year ended May 31, 2018, follow: Fees earned………………………………………………$900,000 Office expense……………………………………………..300,000 Miscellaneous expense……………………………………15,000 Wages expense…………………………………………….450,000

> Using the following data for Paradise Travel Service as well as the retained earnings statement shown in Basic Exercise 1-5, prepare a balance sheet as of May 31, 2018: Accounts payable………………………………….$ 18,000 Accounts receivable…………………………………38,000 Cash……

> A $500,000 bond issue on which there is an unamortized premium of $67,000 is redeemed for $490,000. Journalize the redemption of the bonds.

> Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, Classify or (4) accrued expense: A. Cash received for use of l

> Identify each of the following as relating to (A) the control environment, (B) control procedures, or (C) monitoring: 1. Hiring of external auditors to review the adequacy of controls 2. Personnel policies 3. Safeguarding inventory in a locked warehouse

> On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays semiannual interest of $300,000 ($7,500,000 × 8% × ½), receiving cash of $7,740,000. Journalize the bond issuance.

> On the first day of the fiscal year, a company issues $45,000, 8%, six-year installment notes that have annual payments of $9,734. The first note payment consists of $3,600 of interest and $6,134 of principal repayment. A. Journalize the entry to record the

> Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount

> Regling Company provides its employees vacation benefits and a defined benefit pension plan. Employees earned vacation pay of $35,000 for the period. The pension formula calculated a pension cost of $201,250. Only $175,000 was contributed to the pension pla

> The payroll register of Heritage Co. indicates $3,900 of social security withheld and $975 of Medicare tax withheld on total salaries of $65,000 for the period. Earnings of $10,000 are subject to state and federal unemployment compensation taxes at the f

> For each of the following errors, considered individually, indicate whether the error would cause the trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal, indicate whether the debit or credit total is highe

> From the following list of steps in the accounting cycle, identify what two steps are missing: A. Transactions are analyzed and recorded in the journal. B. Transactions are posted to the ledger. C. An unadjusted trial balance is prepared. D. An optional

> At the end of the current year, Accounts Receivable has a balance of $2,150,000; Allowance for Doubtful Accounts has a debit balance of $10,500; and sales for the year total $51,850,000. Using the aging method, the balance of Allowance for Doubtful Accou

> At the end of the current year, Accounts Receivable has a balance of $2,150,000; Allowance for Doubtful Accounts has a debit balance of $10,500; and sales for the year total $51,850,000. Bad debt expense is estimated at ¼ of 1% of sales. Determine (A) th

> Prepare journal entries for each of the following: A. Issued a check to establish a petty cash fund of $600. B. The amount of cash in the petty cash fund is $130. Issued a check to replenish the fund, based on the following summary of petty cash receipts

> The following data were gathered to use in reconciling the bank account of Reddan Company: Balance per bank……………………………………………..$18,250 Balance per company records……………………………..12,045 Bank service charges………………………………………………..30 Deposit in transit…………………………

> Prospect Realty Co. pays weekly salaries of $27,600 on Monday for a six-day workweek ending the preceding Saturday. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Friday.

> Journalize the following merchandise transactions: A. Sold merchandise on account, $92,500 with terms 1/10, n/30. The cost of the goods sold was $55,500. B. Received payment less the discount. C. Refunded $750 to customer for defective merchandise that w

> Big Sound Inc. manufactures two products: receivers and loudspeakers. The factory overhead incurred is as follows: Indirect labor……………â€&brvba

> The balances for the accounts that follow appear in the Adjusted Trial Balance columns of the end-of-period spreadsheet. Indicate whether each account would flow into the income statement, retained earnings statement, or balance sheet. 1. Accumulated Dep

> The following accounts appear in an adjusted trial balance of Kangaroo Consulting. Indicate whether each account would be reported in the (A) current asset; (B) property, plant, and equipment; (C) current liability; (D) long-term liability; or (E) stockh

> On June 1, 2018, Herbal Co. received $18,900 for the rent of land for 12 months. Journalize the adjusting entry required for unearned rent on December 31, 2018.

> Be-The-One is a motivational consulting business. At the end of its accounting period, December 31, 2017, Be-The-One has assets of $395,000 and liabilities of $97,000. Using the accounting equation, determine the following amounts: A. Stockholders’ equit

> Indicate with a Yes or No whether or not each of the following accounts normally requires an adjusting entry: A. Building B. Cash C. Wages Expense D. Miscellaneous Expense E. Common Stock F. Prepaid Insurance

> A company reports the following: Net income………………………………………………..$410,000 Preferred dividends……………………………………..$60,000 Shares of common stock outstanding………………50,000 Market price per share of common stock……………….$84 A. Determine the company’s earnings per s

> A company reports the following: Net income……………………………………………………..$1,000,000 Preferred dividends……………………………………………….50,000 Average stockholders’ equity………………………………6,250,000 Average common stockholders’ equity………………..3,800,000 Determine (A) the return on

> Prepare a journal entry for the purchase of office supplies on March 9 for $1,775, paying $275 cash and the remainder on account.

> The costs of materials consumed in producing good units in the Forming Department of Thomas Company were $76,000 and $77,350 for September and October, respectively. The number of equivalent units produced in September and October was 800 tons and 850 to

> Liu Company has sales of $48,500,000, and the break-even point in sales dollars is $31,040,000. Determine the company’s margin of safety as a percent of current sales.

> Howard Industries Inc., operating at full capacity, sold 64,000 units at a price of $45 per unit during the current year. Its income statement is as follows: The division of costs between variable and fixed is as follows: Management is considering a

> You are the Cookie division controller for Auntie M’s Baked Goods Company. Auntie M recently introduced a new chocolate chip cookie brand called Full of Chips, which has more than twice as many chips as any other brand on the market. The brand has quickl

> Pasadena Candle Inc. pays 40% of its purchases on account in the month of the purchase and 60% in the month following the purchase. If purchases are budgeted to be $40,000 for August and $36,000 for September, what are the budgeted cash payments for purc

> Roen Company incurred an activity cost of $105,600 for inspecting 40,000 units of production. Management determined that the inspecting objectives could be met without inspecting every unit. Therefore, rather than inspecting 40,000 units of production, t

> A quality control activity analysis indicated the following four activity costs of a hotel: Inspecting cleanliness of rooms……………………………………$175,000 Processing lost customer reservations……………………………..40,000 Rework incorrectly prepared room service meal……………

> The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: The data needed to determine adjustments are as follows: • During July, PS Music provided guest disc jockeys for KXMD for a

> The transactions completed by PS Music during June 2018 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business’s operations: July 1. Peyton Smith made an additiona

> The unadjusted trial balance of PS Music as of July 31, 2018, along with the adjustment data for the two months ended July 31, 2018, are shown in Chapter 3. Based upon the adjustment data, the following adjusted trial balance was prepared: Instructions

> Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2018. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following

> Selected transactions completed by Kornett Company during its first fiscal year ended December 31, 20Y5, were as follows: Jan. 3. Issued a check to establish a petty cash fund of $4,500. Feb. 26. Replenished the petty cash f

> The annual budgeted conversion costs for a lean cell are $180,000 for 2,000 production hours. Each unit produced by the cell requires 18 minutes of cell process time. During the month, 550 units are manufactured in the cell. The estimated materials costs

> Spotted Cow Dairy Company manufactures three products—whole milk, skim milk, and cream— in two production departments, Blending and Packing. The factory overhead for Spotted Cow Dairy is $299,700. The three products co

> Which of the following are features of a lean manufacturing system? A. Centralized maintenance areas B. Smaller batch sizes C. Employee involvement D. Less wasted movement of material and people

> Rough Riders Inc. manufactures jeans in the cutting and sewing process. Jeans are manufactured in 50-jean batch sizes. The cutting time is 6 minutes per jean. The sewing time is 15 minutes per jean. It takes 5 minutes to move a batch of jeans from cuttin

> VMH Group is a French domiciled company known for Dior, Givenchy, Louis Vuitton, and many other fashion brands. LVMH’s operating segment revenues, operating income, and depreciation and amortization expenses for a recent year are as fol

> Marcus Simmons caught the flu and needed to see the doctor. Simmons called to set up an appointment and was told to come in at 1:00 p. m. Simmons arrived at the doctor’s office promptly at 1:00 p. m. The waiting room had five other people in it. Patients

> Turn around time (TAT) is a measure of the length of time from the end of one surgery in an operating room to the beginning of the next surgery. Improving TAT improves the operating room efficiency by allowing more surgeries to be performed per day. TAT

> Shield Insurance Company takes 10 days to make payments on insurance claims. Claims are processed through three departments: Data Input, Claims Audit, and Claims Adjustment. The three departments are located in different buildings, approximately one hour

> Auto Source, Inc. designs and manufactures tires for automobiles. The company’s strategy is to design products that incorporate the full environmental impact of the product over its life cycle. This includes designing tires for ease of

> The Victor Paper Company manufactures paper products from pulp. The process creates paper scrap from paper trim, off-grade, and machine errors. Presently, the scrap paper is discarded in a landfill. Management is considering a proposal for a scrap paper

> Central Plains Power Company is considering an investment in wind farm technology to reduce its use of natural gas. Initial installation costs are expected to be $1,200 per kilowatt-hour of capacity. The wind turbine has a capacity of generating 2 megawa

> Atlantis Cruise Lines offers luxury, one-week cruise packages in the Greek Aegean Sea. The ship has a capacity for 1,200 people. Atlantis averages 1,000 passengers per cruise. The price per passenger is $6,000. Costs associated with a cruise are as follo

> The management of Spotted Cow Dairy Company, described in Problem 1B, now plans to use the multiple production department factory overhead rate method. The total factory overhead associated with each department is as follows: Blending Department……………………

> Valley Power Company uses natural gas to create steam to spin turbines to generate electricity. The costs of the power plant, including depreciation, taxes, and insurance, are fixed to generating electricity. The costs of operating personnel, maintenance

> Cityscape Hotels has 200 rooms available in a major metropolitan city. The hotel is able to attract business customers during the weekdays and leisure customers during the weekend. However, the leisure customers on weekends occupy fewer rooms than do bus

> H &R Block Inc. provides tax preparation services throughout the United States and other parts of the world. These services are provided through company-owned and franchised operations. The total number of U.S. offices that are company-owned and fran

> Domino’s Pizza, Inc. is the second-largest pizza chain in the world. In the United States, Domino’s has 377 company-owned restaurants and 4,690 franchised restaurants. In addition, Domino’s has a supp

> GNC Holdings Inc. is a leading retailer of health and nutrition products, which are sold through both company-operated (3,500 outlets) and franchised retail (3,200 outlets) stores. In addition, GNC manufactures many of the products that it sells through

> Maywood City Police uses variance analysis to monitor police staffing. The following table identifies three common police activities, the standard time to perform each activity, and their actual frequency to establish the expected cost to serve these act

> One of the operations in the United States Postal Service is a mechanical mail sorting operation. In this operation, handwritten letter mail is sorted at a rate of 1.5 letters per second. An operator sitting at a keyboard mechanically sorts the letter fr

> Valley Hospital began using standards to evaluate its Admissions Department. The standard was broken into two types of admissions as follows: The unscheduled admission took longer because name, address, and insurance information needed to be determined

> Ambassador Suites Inc. operates a downtown hotel property that has 300 rooms. On average, 80% of Ambassador Suites’ rooms are occupied on weekdays, and 40% are occupied during the weekend. The manager has asked you to develop a budget for the housekeepin

> Adventure Park is a large theme park. Staffing for the theme park involves many different labor classifications, one of which is the parking lot staff. The parking lot staff collects parking fees, provides directions, and operates trams. The staff size i

> Data on the physical inventory of Katus Products Co. as of December 31 follows: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions: Determine the inven

> Mercy Hospital staffs its medical/surgical floors with nurses depending on the number of patients assigned to the floor and the severity of their condition. The index used to capture nurse effort is termed a relative value unit, or RVU. For example, taki

> Segment disclosure by Segment disclosure by Apple Inc. provides sales information for its major product lines for three recent years as follows (in millions): A. Which product had the greatest percentage of Year 3 sales? Which product had the least per

> The Walt Disney Company is a leading worldwide entertainment company. Disney operates five business segments. These segments and some of their larger businesses are: • Media Networks: ABC Network, ESPN, Disney Channel, and A&E &acir

> Yum! Brands, Inc. is a worldwide operator and franchisor of fast food restaurants, under the familiar brands of KFC, Pizza Hut, and Taco Bell. Segment revenues, operating income, and depreciation and amortization expense for Yum! ’s ope

> Lancaster County Hospital uses activity-based costing to determine the cost of serving patients. The hospital identified common treatments and developed the activity-based cost per patient by treatment. The activities and activity rates for a patient rec

> Music Land Theme Park has an average daily admission price of $60 per guest. The following financial data are available for analysis: Daily operating fixed costs…………………………………………………$750,000 Variable daily operating cost per guest………………………………………….24 Averag

> Star Stream is a subscription-based video streaming service. Subscribers pay $120 per year for the service. Star Stream licenses and develops content for its subscribers. In addition, Star Stream leases servers to hold this content. These costs are not v

> Ocean Escape Cruise Lines has a boat with a capacity of 1,200 passengers. An eight-day ocean cruise involves the following costs: Crew…………………………………………..$240,000 Fuel ………………………………………………60,000 Fixed operating costs…………………….800,000 The variable costs per

> Littlejohn, Inc. manufactures machined parts for the automotive industry. The activity cost associated with Part XX-10 is as follows: Each unit requires 30 minutes of fabrication direct labor. Moreover, Part XX-10 is manufactured in production run size

> Skidmore Electronics manufactures consumer electronic products. The company has three assembly labor classifications, S-1, S-2, and S-3. The three classifications are paid $15, $18, and $22 per hour, respectively. The assembly activity for a new smartpho

> Blue Ribbon Flour Company manufactures flour by a series of three processes, beginning in the Milling Department. From the Milling Department, the materials pass through the Sifting and Packaging departments, emerging as packaged refined flour. The balan

> Gourmet Master, Inc. uses activity-based costing to determine the cost of its stainless steel ovens. Activity-based product cost information is as follows: These activities only include the labor portion of the cost. Fabrication is the cutting and shap

> Eastern Skies Airlines has three flights that depart from New York City and arrive in Chicago every day. The three flights are as follows: Each flight uses a jet with a capacity of 180 seats. The airline measures the utilization of the aircraft by pass

> Midstate Containers Inc. manufactures cans for the canned food industry. The operations manager of a can manufacturing operation wants to conduct a cost study investigating the relationship of tin content in the material (can stock) to the energy cost fo

> Pix Paper Inc. produces photographic paper for printing digital images. One of the processes for this operation is a coating (solvent spreading) operation, where chemicals are coated onto paper stock. There has been some concern about the cost performanc

> Mystic Bottling Company bottles popular beverages in the Bottling Department. The beverages are produced by blending concentrate with water and sugar. The concentrate is purchased from a concentrate producer. The concentrate producer sets higher prices f

> Brady Furniture Company manufactures wooden oak furniture. The company employs a job cost system to trace manufacturing costs to jobs. Each job represents a batch of furniture of the same type. Information regarding direct materials on selected jobs thro

> Raneri Trophies Inc. uses a job order cost system for determining the cost to manufacture award products (plaques and trophies). Among the company’s products is an engraved plaque that is awarded to participants who complete a training

> Alvarez Manufacturing Inc. is a job shop. The management of Alvarez Manufacturing Inc. uses the cost information from the job sheets to assess cost performance. Information on the total cost, product type, and quantity of items produced is as follows:

> The Valley Hospital measures the in-patient occupancy of the hospital by determining the number of patient days divided by the number of available bed days in the hospital for a time period. The following in-patient data are available for the months of A

> Sunrise Suites and Nationwide Inns operate competing hotel chains across the region. Hotel capacity information for both hotels is as follows: Information on the number of guests for each hotel and the average length of visit for June were as follows:

> Pittsburgh Aluminum Company uses a process cost system to record the costs of manufacturing rolled aluminum, which consists of the smelting and rolling processes. Materials are entered from smelting at the beginning of the rolling process. The inventory

> A recent annual report of Hilton Hotels and Marriott International provided the following occupancy data for two recent years: A. Is the occupancy trend favorable or unfavorable for Hilton Hotels? B. Is the occupancy trend favorable or unfavorable for

> Priceline Group , Inc. is a leading provider of online travel reservation services, including brand names Priceline, KAYAK, and Open Table. Selected cash flow information from the statement of cash flows for three recent years is as follows (in millions)

> Marriott International, Inc. , and Hyatt Hotels C or p or at ion are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in mi