Question: Shrute Inc. manufactures office copiers, which are

Shrute Inc. manufactures office copiers, which are sold to retailers. The price and cost of goods sold for each copier are as follows:

Price………………………………………..$1,110 per unit

Cost of goods sold…………………………………….682

Gross proï¬t………………………………. $ 428 per unit

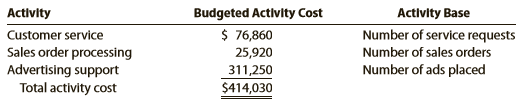

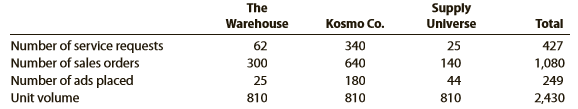

In addition, the company incurs selling and administrative expenses of $414,030. The company wishes to assign these costs to its three major retail customers, The Warehouse, Kosmo Co., and Supply Universe. These expenses are related to its three major nonmanufacturing activities: customer service, sales order processing, and advertising support. The advertising support is in the form of advertisements that are placed by Shrute Inc. to support the retailer’s sale of Shrute copiers to consumers. The budgeted activity costs and activity bases associated with these activities are:

Activity-base usage and unit volume information for the three customers is as follows:

Instructions:

1. Determine the activity rates for each of the three nonmanufacturing activities.

2. Determine the activity costs allocated to the three customers, using the activity rates in (1).

3. Construct customer profitability reports for the three customers, dated for the year ended December 31, using the activity costs in (2). The reports should disclose the gross profit and income from operations associated with each customer.

4. Provide recommendations to management, based on the profitability reports in (3).

Transcribed Image Text:

Activity Budgeted Activity Cost Activity Base $ 76,860 25,920 Customer service Number of service requests Sales order processing Advertising support Total activity cost Number of sales orders Number of ads placed 311,250 $414,030 The Supply Universe Warehouse Kosmo Co. Total Number of service requests 62 340 25 427 Number of sales orders 300 640 140 1,080 Number of ads placed 25 180 44 249 Unit volume 810 810 810 2,430

> The following is an excerpt from an article discussing supplier relationships with the Big Three North American automakers. “The Big Three select suppliers on the basis of lowest price and annual price reductions,” said Neil De Koker, president of the Or

> Williams Optical Inc. is considering a new lean product cell. The present manufacturing approach produces a product in four separate steps. The production batch sizes are 45 units. The process time for each step is as follows: Process Step 1……………………………5

> Flint Fabricators Inc. machines metal parts for the automotive industry. Under the traditional manufacturing approach, the parts are machined through two processes: milling and finishing. Parts are produced in batch sizes of 30 parts. A part requires 5 m

> Hammond Inc. has analyzed the setup time on its computer-controlled lathe. The setup requires changing the type of fixture that holds a part. The average setup time has been 135 minutes, consisting of the following steps: Turn off machine and remove fix

> Palm Pals Inc. manufactures toy stuffed animals. The direct labor time required to cut, sew, and stuff a toy is 12 minutes per unit. The company makes two types of stuffed toys—a lion and a bear. The lion is assembled in lot sizes of 40 units per batch,

> During the first month of operations ended July 31, YoSan Inc. manufactured 2,400 flat panel televisions, of which 2,000 were sold. Operating data for the month are summarized as follows: Instructions: 1. Prepare an income statement based on the absorp

> Active Apparel Company manufactures various styles of men’s casual wear. Shirts are cut and assembled by a workforce that is paid by piece rate. This means that they are paid according to the amount of work completed during a period of time. To illustrat

> Sloan Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $125,500. The freight and installation costs for the equipment are $1,600. If purchased, annual repairs and maintenance are estimated to be $2,50

> The financial statements for Nike, Inc. , are presented in Appendix E at the end of the text. The following additional information is available (in thousands): Accounts receivable at May 31, 2013……………………….$ 3,117 Inventories at May 31, 2013…………………………………

> The chief executive officer (CEO) of Platnum Inc. has just returned from a management seminar describing the benefits of the lean philosophy. The CEO issued the following statement after returning from the conference: This company will become a lean manu

> The actual variable cost of goods sold for a product was $140 per unit, while the planned variable cost of goods sold was $136 per unit. The volume increased by 2,400 units to 14,000 actual total units. Determine (A) the variable cost quantity factor and

> The following information is for LaPlanche Industries Inc.: Determine the contribution margin for (A) Product YY and (B) West Region. East West Sales volume (units): Product XX 38,000 50,000 45,000 Product YY 60,000 Sales price: $660 $720 Product X

> Variable manufacturing costs are $126 per unit, and fixed manufacturing costs are $157,500. Sales are estimated to be 10,000 units. A. How much would absorption costing income from operations differ between a plan to produce 10,000 units and a plan to pr

> The beginning inventory is 52,800 units. All of the units that were manufactured during the period and 52,800 units of the beginning inventory were sold. The beginning inventory fixed manufacturing costs are $14.70 per unit, and variable manufacturing co

> Fixed manufacturing costs are $44 per unit, and variable manufacturing costs are $100 per unit. Production was 67,200 units, while sales were 50,400 units. Determine (A) whether variable costing income from operations is less than or greater than absorpt

> Marley Company has the following information for March: Sales………………………………………………………………………$912,000 Variable cost of goods sold………………………………………..474,000 Fixed manufacturing costs………………………………………….82,000 Variable selling and administrative expenses……………..238,

> Kimbrell Inc. manufactures three sizes of utility tables—small (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Size M

> Taft Co. reports the following data: Sales……………………………………………………..$875,000 Variable costs…………………………………………..425,000 Contribution margin……………………………….$450,000 Fixed costs……………………………………………….150,000 Income from operations…………………………$300,000 Determine Taft Co.’

> Hughes Company has fixed costs of $3,565,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company’s two products follow: The sales mix for products Model 94 and Model 81 is 25% and 75%, res

> Ramirez Company sells a product for $80 per unit. The variable cost is $60 per unit, and fixed costs are $4,850,000. Determine (A) the break-even point in sales units and (B) the sales units required for the company to achieve a target profit of $500,000

> Bigelow Inc. sells a product for $1,200 per unit. The variable cost is $816 per unit, while fixed costs are $3,120,000. Determine (A) the break-even point in sales units and (B) the break-even point if the selling price were increased to $1,232 per unit.

> Lanning Company sells 160,000 units at $45 per unit. Variable costs are $27 per unit, and fixed costs are $975,000. Determine (A) the contribution margin ratio, (B) the unit contribution margin, and (C) income from operations.

> The total factory overhead for Bardot Marine Company is budgeted for the year at $600,000. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboat and bass boat each require 12 direct labor hours for manufacture. Each prod

> In July, the cost of materials transferred into the Rolling Department from the Casting Department of Oak Ridge Steel Company is $432,000. The conversion cost for the period in the Rolling Department is $144,150 ($54,700 factory overhead applied and $89,

> The costs per equivalent unit of direct materials and conversion in the Rolling Department of Oak Ridge Steel Company are $180 and $62, respectively. The equivalent units to be assigned costs are as follows: The beginning work in process inventory on J

> Sterling Hotel uses activity-based costing to determine the cost of servicing customers. There are three activity pools: guest check-in, room cleaning, and meal service. The activity rates associated with each activity pool are $8 per guest check-in, $25

> Jungle Junior Company manufactures and sells outdoor play equipment. Jungle Junior uses activity-based costing to determine the cost of the sales order processing and the customer return activity. The sales order processing activity has an activity rate

> Pachec Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended June 30 are as follows: Instructions: 1. Prepare a table indicating contributio

> The total factory overhead for Bardot Marine Company is budgeted for the year at $600,000, divided into four activities: fabrication, $204,000; assembly, $105,000; setup, $156,000; and inspection, $135,000. Bardot Marine manufactures two types of boats:

> The total factory overhead for Bardot Marine Company is budgeted for the year at $600,000 divided into two departments: Fabrication, $420,000, and Assembly, $180,000. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboat

> The cost of direct materials transferred into the Rolling Department of Oak Ridge Steel Company is $432,000. The conversion cost for the period in the Rolling Department is $144,150. The total equivalent units for direct materials and conversion are 2,40

> The Rolling Department of Oak Ridge Steel Company had 300 tons in beginning work in process inventory (25% complete) on July 1. During July, 2,200 tons were completed. The ending work in process inventory on July 31 was 500 tons (40% complete). What are

> The Rolling Department of Oak Ridge Steel Company had 300 tons in beginning work in process inventory (25% complete) on July 1. During July, 2,200 tons were completed. The ending work in process inventory on July 31 was 500 tons (40% complete). What are

> Oak Ridge Steel Company has two departments, Casting and Rolling. In the Rolling Department, ingots from the Casting Department are rolled into steel sheet. The Rolling Department received 2,400 tons from the Casting Department. During July, the Rolling

> Which of the following industries would typically use job order costing, and which would typically use process costing? Steel manufacturing…………………….Computer chip manufacturing Business consulting………………………………………………Candy making Web designer…………………………….Des

> A company reports the following: Sales……………………………………………………………………………………….$4,400,000 Average total assets (excluding long-term investments)………………2,000,000 Determine the asset turnover ratio. (Round percentages to one decimal place.)

> A company reports the following: Income before income tax………………………….$8,000,000 Interest expense……………………………………………..500,000 Determine the number of times interest charges are earned. (Round to one decimal place.)

> Pine Creek Company completed 200,000 units during the year at a cost of $3,000,000. The beginning finished goods inventory was 25,000 units at $310,000. Determine the cost of goods sold for 210,000 units, assuming a FIFO cost flow.

> Blue Star Airline provides passenger airline service, using small jets. The airline connects four major cities: Charlotte, Pittsburgh, Detroit, and San Francisco. The company expects to fly major cities: Charlotte, Pittsburgh, Detroit, and San Francisco.

> A company reports the following: Cost of goods sold…………………………………$435,000 Average inventory……………………………………..72,500 Determine (A) the inventory turnover and (B) the number of days’ sales in inventory. (Round to one decimal place.)

> A company reports the following: Sales………………………………………………………..$3,150,000 Average accounts receivable (net)…………………..210,000 Determine (A) the accounts receivable turnover and (B) the number of days’ sales in receivables. (Round to one decimal place.)

> Identify the following costs as a prime cost (P), conversion cost (C), or both (B) for a magazine publisher: A. Paper used for the magazine B. Wages of printing machine employees C. Glue used to bind magazine D. Maintenance on printing machines

> During May, Bergan Company accumulated 2,500 hours of direct labor costs on Job 200 and 3,000 hours on Job 305. The total direct labor was incurred at a rate of $28 per direct labor hour for Job 200 and $24 per direct labor hour for Job 305. Journalize t

> Identify whether each of the following would be reported as an operating, investing, or financing activity on the statement of cash flows: A. Purchase of investments B. Disposal of equipment C. Payment for selling expenses D. Collection of accounts recei

> Jones Industries received $800,000 from issuing shares of its common stock and $700,000 from issuing bonds. During the year, Jones Industries also paid dividends of $90,000. How are the effects of these transactions reported on the statement of cash flow

> Ripley Corporation’s accumulated depreciation—equipment account increased by $11,575 while $2,500 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In

> The payroll register of Heritage Co. indicates $3,900 of social security withheld and $975 of Medicare tax withheld on total salaries of $65,000 for the period. Federal withholding for the period totaled $14,250. Retirement savings withheld from employee

> The cost of goods sold reported on the income statement was $240,000. The accounts payable balance increased $12,000, and the inventory balance increased by $19,200 over the year. Determine the amount of cash paid for merchandise.

> A summary of cash flows for Paradise Travel Service for the year ended May 31, 2018, follows: Cash receipts: Cash received from customers…………………………………$880,000 Cash received from issuing common stock……………………40,000 Cash payments: Cash paid for operating e

> Using the bond from Basic Exercise 11-4, journalize the first interest payment and the amortization of the related bond premium. Data from Exercise 11-4: On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays

> Alpine Energy Corporation has 1,500,000 shares of $40 par common stock outstanding. On August 2, Alpine Energy declared a 4% stock dividend to be issued October 8 to stockholders of record on September 15. The market price of the stock was $70 per share

> Using the income statement for Paradise Travel Service shown in Basic Exercise 1-4, prepare a retained earnings statement for the year ended May 31, 2018. Everett McCauley invested an additional $40,000 in the business in exchange for common stock, and $

> The revenues and expenses of Paradise Travel Service for the year ended May 31, 2018, follow: Fees earned………………………………………………$900,000 Office expense……………………………………………..300,000 Miscellaneous expense……………………………………15,000 Wages expense…………………………………………….450,000

> Using the following data for Paradise Travel Service as well as the retained earnings statement shown in Basic Exercise 1-5, prepare a balance sheet as of May 31, 2018: Accounts payable………………………………….$ 18,000 Accounts receivable…………………………………38,000 Cash……

> A $500,000 bond issue on which there is an unamortized premium of $67,000 is redeemed for $490,000. Journalize the redemption of the bonds.

> Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, Classify or (4) accrued expense: A. Cash received for use of l

> Identify each of the following as relating to (A) the control environment, (B) control procedures, or (C) monitoring: 1. Hiring of external auditors to review the adequacy of controls 2. Personnel policies 3. Safeguarding inventory in a locked warehouse

> On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays semiannual interest of $300,000 ($7,500,000 × 8% × ½), receiving cash of $7,740,000. Journalize the bond issuance.

> On the first day of the fiscal year, a company issues $45,000, 8%, six-year installment notes that have annual payments of $9,734. The first note payment consists of $3,600 of interest and $6,134 of principal repayment. A. Journalize the entry to record the

> Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount

> Regling Company provides its employees vacation benefits and a defined benefit pension plan. Employees earned vacation pay of $35,000 for the period. The pension formula calculated a pension cost of $201,250. Only $175,000 was contributed to the pension pla

> The payroll register of Heritage Co. indicates $3,900 of social security withheld and $975 of Medicare tax withheld on total salaries of $65,000 for the period. Earnings of $10,000 are subject to state and federal unemployment compensation taxes at the f

> For each of the following errors, considered individually, indicate whether the error would cause the trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal, indicate whether the debit or credit total is highe

> From the following list of steps in the accounting cycle, identify what two steps are missing: A. Transactions are analyzed and recorded in the journal. B. Transactions are posted to the ledger. C. An unadjusted trial balance is prepared. D. An optional

> At the end of the current year, Accounts Receivable has a balance of $2,150,000; Allowance for Doubtful Accounts has a debit balance of $10,500; and sales for the year total $51,850,000. Using the aging method, the balance of Allowance for Doubtful Accou

> At the end of the current year, Accounts Receivable has a balance of $2,150,000; Allowance for Doubtful Accounts has a debit balance of $10,500; and sales for the year total $51,850,000. Bad debt expense is estimated at ¼ of 1% of sales. Determine (A) th

> Prepare journal entries for each of the following: A. Issued a check to establish a petty cash fund of $600. B. The amount of cash in the petty cash fund is $130. Issued a check to replenish the fund, based on the following summary of petty cash receipts

> The following data were gathered to use in reconciling the bank account of Reddan Company: Balance per bank……………………………………………..$18,250 Balance per company records……………………………..12,045 Bank service charges………………………………………………..30 Deposit in transit…………………………

> Prospect Realty Co. pays weekly salaries of $27,600 on Monday for a six-day workweek ending the preceding Saturday. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Friday.

> Journalize the following merchandise transactions: A. Sold merchandise on account, $92,500 with terms 1/10, n/30. The cost of the goods sold was $55,500. B. Received payment less the discount. C. Refunded $750 to customer for defective merchandise that w

> Big Sound Inc. manufactures two products: receivers and loudspeakers. The factory overhead incurred is as follows: Indirect labor……………â€&brvba

> The balances for the accounts that follow appear in the Adjusted Trial Balance columns of the end-of-period spreadsheet. Indicate whether each account would flow into the income statement, retained earnings statement, or balance sheet. 1. Accumulated Dep

> The following accounts appear in an adjusted trial balance of Kangaroo Consulting. Indicate whether each account would be reported in the (A) current asset; (B) property, plant, and equipment; (C) current liability; (D) long-term liability; or (E) stockh

> On June 1, 2018, Herbal Co. received $18,900 for the rent of land for 12 months. Journalize the adjusting entry required for unearned rent on December 31, 2018.

> Be-The-One is a motivational consulting business. At the end of its accounting period, December 31, 2017, Be-The-One has assets of $395,000 and liabilities of $97,000. Using the accounting equation, determine the following amounts: A. Stockholders’ equit

> Indicate with a Yes or No whether or not each of the following accounts normally requires an adjusting entry: A. Building B. Cash C. Wages Expense D. Miscellaneous Expense E. Common Stock F. Prepaid Insurance

> A company reports the following: Net income………………………………………………..$410,000 Preferred dividends……………………………………..$60,000 Shares of common stock outstanding………………50,000 Market price per share of common stock……………….$84 A. Determine the company’s earnings per s

> A company reports the following: Net income……………………………………………………..$1,000,000 Preferred dividends……………………………………………….50,000 Average stockholders’ equity………………………………6,250,000 Average common stockholders’ equity………………..3,800,000 Determine (A) the return on

> Prepare a journal entry for the purchase of office supplies on March 9 for $1,775, paying $275 cash and the remainder on account.

> The costs of materials consumed in producing good units in the Forming Department of Thomas Company were $76,000 and $77,350 for September and October, respectively. The number of equivalent units produced in September and October was 800 tons and 850 to

> Liu Company has sales of $48,500,000, and the break-even point in sales dollars is $31,040,000. Determine the company’s margin of safety as a percent of current sales.

> Howard Industries Inc., operating at full capacity, sold 64,000 units at a price of $45 per unit during the current year. Its income statement is as follows: The division of costs between variable and fixed is as follows: Management is considering a

> You are the Cookie division controller for Auntie M’s Baked Goods Company. Auntie M recently introduced a new chocolate chip cookie brand called Full of Chips, which has more than twice as many chips as any other brand on the market. The brand has quickl

> Pasadena Candle Inc. pays 40% of its purchases on account in the month of the purchase and 60% in the month following the purchase. If purchases are budgeted to be $40,000 for August and $36,000 for September, what are the budgeted cash payments for purc

> Roen Company incurred an activity cost of $105,600 for inspecting 40,000 units of production. Management determined that the inspecting objectives could be met without inspecting every unit. Therefore, rather than inspecting 40,000 units of production, t

> A quality control activity analysis indicated the following four activity costs of a hotel: Inspecting cleanliness of rooms……………………………………$175,000 Processing lost customer reservations……………………………..40,000 Rework incorrectly prepared room service meal……………

> The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: The data needed to determine adjustments are as follows: • During July, PS Music provided guest disc jockeys for KXMD for a

> The transactions completed by PS Music during June 2018 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business’s operations: July 1. Peyton Smith made an additiona

> The unadjusted trial balance of PS Music as of July 31, 2018, along with the adjustment data for the two months ended July 31, 2018, are shown in Chapter 3. Based upon the adjustment data, the following adjusted trial balance was prepared: Instructions

> Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 2018 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the followin

> Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2018. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following

> Selected transactions completed by Kornett Company during its first fiscal year ended December 31, 20Y5, were as follows: Jan. 3. Issued a check to establish a petty cash fund of $4,500. Feb. 26. Replenished the petty cash f

> The annual budgeted conversion costs for a lean cell are $180,000 for 2,000 production hours. Each unit produced by the cell requires 18 minutes of cell process time. During the month, 550 units are manufactured in the cell. The estimated materials costs

> Spotted Cow Dairy Company manufactures three products—whole milk, skim milk, and cream— in two production departments, Blending and Packing. The factory overhead for Spotted Cow Dairy is $299,700. The three products co

> Which of the following are features of a lean manufacturing system? A. Centralized maintenance areas B. Smaller batch sizes C. Employee involvement D. Less wasted movement of material and people

> Rough Riders Inc. manufactures jeans in the cutting and sewing process. Jeans are manufactured in 50-jean batch sizes. The cutting time is 6 minutes per jean. The sewing time is 15 minutes per jean. It takes 5 minutes to move a batch of jeans from cuttin

> VMH Group is a French domiciled company known for Dior, Givenchy, Louis Vuitton, and many other fashion brands. LVMH’s operating segment revenues, operating income, and depreciation and amortization expenses for a recent year are as fol

> Marcus Simmons caught the flu and needed to see the doctor. Simmons called to set up an appointment and was told to come in at 1:00 p. m. Simmons arrived at the doctor’s office promptly at 1:00 p. m. The waiting room had five other people in it. Patients

> Turn around time (TAT) is a measure of the length of time from the end of one surgery in an operating room to the beginning of the next surgery. Improving TAT improves the operating room efficiency by allowing more surgeries to be performed per day. TAT

> Shield Insurance Company takes 10 days to make payments on insurance claims. Claims are processed through three departments: Data Input, Claims Audit, and Claims Adjustment. The three departments are located in different buildings, approximately one hour