Question: Kimbrell Inc. manufactures three sizes of utility

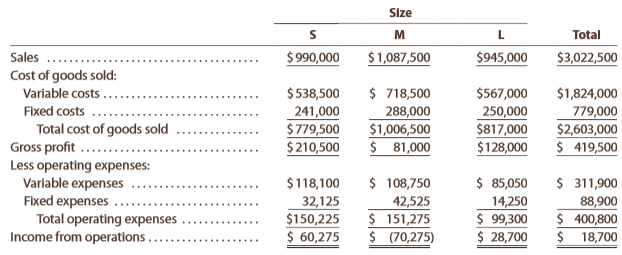

Kimbrell Inc. manufactures three sizes of utility tables—small (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals:

(1) continue Size M,

(2) discontinue Size M and reduce total output accordingly, or

(3) discontinue Size M and conduct an advertising campaign to expand the sales of Size S so that the entire plant capacity can continue to be used.

If Proposal 2 is selected and Size M is discontinued and production curtailed, the annual fixed production costs and fixed operating expenses could be reduced by $142,500 and $28,350, respectively. If Proposal 3 is selected, it is anticipated that an additional annual expenditure of $85,050 for the salary of an assistant brand manager (classified as a fixed operating expense) would yield an additional 130% in Size S sales volume. It is also assumed that the increased production of Size S would utilize the plant facilities released by the discontinuance of Size M.

The sales and costs have been relatively stable over the past few years, and they are expected to remain so for the foreseeable future. The income statement for the past year ended December 31, 20Y8, is as follows:

Instructions:

1. Prepare an income statement for the past year in the variable costing format. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the “Total†column, to determine income from operations.

2. Based on the income statement prepared in (1) and the other data presented above, determine the amount by which total annual income from operations would be reduced below its present level if Proposal 2 is accepted.

3. Prepare an income statement in the variable costing format, indicating the projected annual income from operations if Proposal 3 is accepted. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the “Total†column. For purposes of this problem, the additional expenditure of $85,050 for the assistant brand manager’s salary can be added to the fixed operating expenses.

4. By how much would total annual income increase above its present level if Proposal 3 is accepted? Explain.

Transcribed Image Text:

> Based on the following data, determine the cost of goods sold for November: Estimated returns of November sales……………$ 14,500 Inventory, November……………………………………1 28,000 Inventory, November…………………………………..30 31,500 Purchases………………………………………………………475,000 Purc

> The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2018: Estimated returns of current year sales……………………………….$ 11,600 Inventory, May 1, 2017………………………………………………………..380,000 Inventory, April 30, 20

> For (A) through (E), identify the items designated by X and Y. A. Purchases – (X + Y) = Net purchases B. Net purchases + X = Cost of inventory purchased C. Inventory (beginning) + Cost of inventory purchased = X D. Inventory available for sale – X = Cost

> Financial information related to Healthy Products Company for the month ended November 30, 2018, is as follows: Net income for November…………………………………….$ 93,500 Cash dividends paid during November……………………….7,000 Retained earnings, November 1, 2018………………….

> The controller of Mercury Shoes Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: The company expects to sell about 10% of its merchandise for cash. Of sales on accou

> The following categories represent typical process manufacturing industries: ▪ Beverages ▪ Chemicals ▪ Food ▪ Forest and paper products ▪ Metals ▪ Petroleum refining ▪ Pharmaceuticals ▪ Soap and cosmetics In groups of two or three, identify one company f

> Complete the following table by indicating for A through G whether the proper answer is debit or credit: Normal Account Increase Decrease Balance Purchases debit A B Purchases Discounts credit credit Purchases Returns and Allowances D. F Freight In

> On July 31, the close of the fiscal year, the balances of the accounts appearing in the ledger of Serbian Interiors Company, a furniture wholesaler, are as follows: Prepare the July 31 closing entries for Serbian Interiors Company. $ 115,000 Accumu

> Based on the data presented in Exercise 5-24, journalize the closing entries. Data from Exercise 5-24: On March 31, 2018, the balances of the accounts appearing in the ledger of Royal Furnishings Company, a furniture wholesaler, are as follows: A. Pr

> From the following list, identify the accounts that should be closed to Income Summary at the end of the fiscal year under a perpetual inventory system: (A) Accounts Payable, (B) Advertising Expense, (C) Cost of Goods Sold, (D) Dividends, (E) Inventory,

> On the basis of the following data, (A) journalize the adjusting entries at June 30, the end of the current fiscal year, and (B) journalize the reversing entries on July 1, the first day of the following year: 1. Wages are uniformly $66,000 for a five-day

> Prepare a cost of production report for the Cutting Department of Dalton Carpet Company for January. Use the average cost method with the following data: Work in process, January 1, 3,400 units, 75% completed…………………………………$ 23,000 Materials added during

> The increases to Work in Process—Roasting Department for Highlands Coffee Company for May as well as information concerning production are as follows: Work in process, May 1, 1,150 pounds, 40% completed……..…$ 1,700 Coffee beans added during May, 10,900 p

> The following information concerns production in the Forging Department for June. The Forging Department uses the average cost method. A. Determine the cost per equivalent unit. B. Determine cost of units transferred to Finished Goods. C. Determine the

> The charges to Work in Process—Baking Department for a period as well as information concerning production are as follows. The Baking Department uses the average cost method, and all direct materials are placed in process during product

> The following information concerns production in the Finishing Department for May. The Finishing Department uses the average cost method. A. Determine the number of units in work in process inventory at the end of the month. B. Determine the number of

> During the first month of operations ended July 31, Head Gear Inc. manufactured 6,400 hats, of which 5,200 were sold. Operating data for the month are summarized as follows: During August, Head Gear Inc. manufactured 4,000 hats and sold 5,200 hats. Ope

> Based on the data presented in Exercise 17, assume that Smart Stream Inc. uses the variable cost method of applying the cost-plus approach to product pricing. A. Determine the variable costs and the variable cost amount per unit for the production and sa

> Based on the data presented in Exercise 17, assume that Smart Stream Inc. uses the total cost method of applying the cost-plus approach to product pricing. A. Determine the total costs and the total cost amount per unit for the production and sale of 10,

> The procurement process for Omni Wholesale Company includes a series of activities that transforms a materials requisition into a vendor check. The process begins with a request for materials. The requesting department prepares and sends a materials requ

> Statewide Insurance Company has a process for making payments on insurance claims as follows: An activity analysis revealed that the cost of these activities was as follows: Receiving claim………

> The Brite Beverage Company bottles soft drinks into aluminum cans. The manufacturing process consists of three activities: 1. Mixing: water, sugar, and beverage concentrate are mixed. 2. Filling: mixed beverage is filled into 12-oz. cans. 3. Packaging: p

> A. Using the information in Exercise 17, identify the cost of quality classification for each activity and whether the activity is value-added or non-value-added. B. Prepare a cost of quality report. Assume that sales are $3,000,000. C. Prepare a value-a

> Three Rivers Inc. provides cable TV and Internet service to the local community. The activities and activity costs of Three Rivers are identified as follows: Activities……………………………………………………………………..Activity Cost Billing error correction…………………………………………………

> A. Using the information in Exercise 15, identify the cost of quality classification for each activity. B. Prepare of cost of quality report. Assume sales for the period were $4,000,000. C. Interpret the cost of quality report. Data from Exercise 15: M

> Meagher Solutions Inc. manufactures memory chips for personal computers. An activity analysis was conducted, and the following activity costs were identified with the manufacture and sale of memory chips: Activities……………………………….……………..Activity Cost Corr

> Vintage Audio Inc. manufactures audio speakers. Each speaker requires $48 per unit of direct materials. The speaker manufacturing assembly cell includes the following estimated costs for the period: Speaker assembly cell, estimated costs: Labor………………………

> The demand for aloe vera hand lotion, one of numerous products manufactured by Smooth Skin Care Products Inc., has dropped sharply because of recent competition from a similar product. The company’s chemists are currently completing tests of various new

> Modern Lighting Inc. manufactures lighting fixtures, using lean manufacturing methods. Style Omega has a materials cost per unit of $16. The budgeted conversion cost for the year is $308,000 for 2,200 production hours. A unit of Style Omega requires 18 m

> Westgate Inc. uses a lean manufacturing strategy to manufacture DVR (digital video recorder) players. The company manufactures DVR players through a single product cell. The budgeted conversion cost for the year is $600,000 for 2,000 production hours. Ea

> Pinnacle Technologies has recently implemented a lean manufacturing approach. A production manager has approached the controller with the following comments: I am very upset with our accounting system now that we have implemented our new lean manufacturi

> The management of Grill Rite Burger fast-food franchise wants to provide hamburgers quickly to customers. It has been using a process by which precooked hamburgers are prepared and placed under hot lamps. These hamburgers are then sold to customers. In t

> Quickie Designs Inc. uses teams in the manufacture of lightweight wheelchairs. Two features of its team approach are team hiring and peer reviews. Under team hiring, the team recruits, interviews, and hires new team members from within the organization.

> The following is an excerpt from an article discussing supplier relationships with the Big Three North American automakers. “The Big Three select suppliers on the basis of lowest price and annual price reductions,” said Neil De Koker, president of the Or

> Williams Optical Inc. is considering a new lean product cell. The present manufacturing approach produces a product in four separate steps. The production batch sizes are 45 units. The process time for each step is as follows: Process Step 1……………………………5

> Flint Fabricators Inc. machines metal parts for the automotive industry. Under the traditional manufacturing approach, the parts are machined through two processes: milling and finishing. Parts are produced in batch sizes of 30 parts. A part requires 5 m

> Hammond Inc. has analyzed the setup time on its computer-controlled lathe. The setup requires changing the type of fixture that holds a part. The average setup time has been 135 minutes, consisting of the following steps: Turn off machine and remove fix

> Palm Pals Inc. manufactures toy stuffed animals. The direct labor time required to cut, sew, and stuff a toy is 12 minutes per unit. The company makes two types of stuffed toys—a lion and a bear. The lion is assembled in lot sizes of 40 units per batch,

> During the first month of operations ended July 31, YoSan Inc. manufactured 2,400 flat panel televisions, of which 2,000 were sold. Operating data for the month are summarized as follows: Instructions: 1. Prepare an income statement based on the absorp

> Active Apparel Company manufactures various styles of men’s casual wear. Shirts are cut and assembled by a workforce that is paid by piece rate. This means that they are paid according to the amount of work completed during a period of time. To illustrat

> Sloan Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $125,500. The freight and installation costs for the equipment are $1,600. If purchased, annual repairs and maintenance are estimated to be $2,50

> The financial statements for Nike, Inc. , are presented in Appendix E at the end of the text. The following additional information is available (in thousands): Accounts receivable at May 31, 2013……………………….$ 3,117 Inventories at May 31, 2013…………………………………

> The chief executive officer (CEO) of Platnum Inc. has just returned from a management seminar describing the benefits of the lean philosophy. The CEO issued the following statement after returning from the conference: This company will become a lean manu

> The actual variable cost of goods sold for a product was $140 per unit, while the planned variable cost of goods sold was $136 per unit. The volume increased by 2,400 units to 14,000 actual total units. Determine (A) the variable cost quantity factor and

> The following information is for LaPlanche Industries Inc.: Determine the contribution margin for (A) Product YY and (B) West Region. East West Sales volume (units): Product XX 38,000 50,000 45,000 Product YY 60,000 Sales price: $660 $720 Product X

> Variable manufacturing costs are $126 per unit, and fixed manufacturing costs are $157,500. Sales are estimated to be 10,000 units. A. How much would absorption costing income from operations differ between a plan to produce 10,000 units and a plan to pr

> The beginning inventory is 52,800 units. All of the units that were manufactured during the period and 52,800 units of the beginning inventory were sold. The beginning inventory fixed manufacturing costs are $14.70 per unit, and variable manufacturing co

> Fixed manufacturing costs are $44 per unit, and variable manufacturing costs are $100 per unit. Production was 67,200 units, while sales were 50,400 units. Determine (A) whether variable costing income from operations is less than or greater than absorpt

> Marley Company has the following information for March: Sales………………………………………………………………………$912,000 Variable cost of goods sold………………………………………..474,000 Fixed manufacturing costs………………………………………….82,000 Variable selling and administrative expenses……………..238,

> Taft Co. reports the following data: Sales……………………………………………………..$875,000 Variable costs…………………………………………..425,000 Contribution margin……………………………….$450,000 Fixed costs……………………………………………….150,000 Income from operations…………………………$300,000 Determine Taft Co.’

> Hughes Company has fixed costs of $3,565,000. The unit selling price, variable cost per unit, and contribution margin per unit for the company’s two products follow: The sales mix for products Model 94 and Model 81 is 25% and 75%, res

> Ramirez Company sells a product for $80 per unit. The variable cost is $60 per unit, and fixed costs are $4,850,000. Determine (A) the break-even point in sales units and (B) the sales units required for the company to achieve a target profit of $500,000

> Bigelow Inc. sells a product for $1,200 per unit. The variable cost is $816 per unit, while fixed costs are $3,120,000. Determine (A) the break-even point in sales units and (B) the break-even point if the selling price were increased to $1,232 per unit.

> Lanning Company sells 160,000 units at $45 per unit. Variable costs are $27 per unit, and fixed costs are $975,000. Determine (A) the contribution margin ratio, (B) the unit contribution margin, and (C) income from operations.

> The total factory overhead for Bardot Marine Company is budgeted for the year at $600,000. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboat and bass boat each require 12 direct labor hours for manufacture. Each prod

> In July, the cost of materials transferred into the Rolling Department from the Casting Department of Oak Ridge Steel Company is $432,000. The conversion cost for the period in the Rolling Department is $144,150 ($54,700 factory overhead applied and $89,

> The costs per equivalent unit of direct materials and conversion in the Rolling Department of Oak Ridge Steel Company are $180 and $62, respectively. The equivalent units to be assigned costs are as follows: The beginning work in process inventory on J

> Sterling Hotel uses activity-based costing to determine the cost of servicing customers. There are three activity pools: guest check-in, room cleaning, and meal service. The activity rates associated with each activity pool are $8 per guest check-in, $25

> Jungle Junior Company manufactures and sells outdoor play equipment. Jungle Junior uses activity-based costing to determine the cost of the sales order processing and the customer return activity. The sales order processing activity has an activity rate

> Pachec Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended June 30 are as follows: Instructions: 1. Prepare a table indicating contributio

> The total factory overhead for Bardot Marine Company is budgeted for the year at $600,000, divided into four activities: fabrication, $204,000; assembly, $105,000; setup, $156,000; and inspection, $135,000. Bardot Marine manufactures two types of boats:

> The total factory overhead for Bardot Marine Company is budgeted for the year at $600,000 divided into two departments: Fabrication, $420,000, and Assembly, $180,000. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboat

> The cost of direct materials transferred into the Rolling Department of Oak Ridge Steel Company is $432,000. The conversion cost for the period in the Rolling Department is $144,150. The total equivalent units for direct materials and conversion are 2,40

> The Rolling Department of Oak Ridge Steel Company had 300 tons in beginning work in process inventory (25% complete) on July 1. During July, 2,200 tons were completed. The ending work in process inventory on July 31 was 500 tons (40% complete). What are

> The Rolling Department of Oak Ridge Steel Company had 300 tons in beginning work in process inventory (25% complete) on July 1. During July, 2,200 tons were completed. The ending work in process inventory on July 31 was 500 tons (40% complete). What are

> Oak Ridge Steel Company has two departments, Casting and Rolling. In the Rolling Department, ingots from the Casting Department are rolled into steel sheet. The Rolling Department received 2,400 tons from the Casting Department. During July, the Rolling

> Which of the following industries would typically use job order costing, and which would typically use process costing? Steel manufacturing…………………….Computer chip manufacturing Business consulting………………………………………………Candy making Web designer…………………………….Des

> A company reports the following: Sales……………………………………………………………………………………….$4,400,000 Average total assets (excluding long-term investments)………………2,000,000 Determine the asset turnover ratio. (Round percentages to one decimal place.)

> A company reports the following: Income before income tax………………………….$8,000,000 Interest expense……………………………………………..500,000 Determine the number of times interest charges are earned. (Round to one decimal place.)

> Pine Creek Company completed 200,000 units during the year at a cost of $3,000,000. The beginning finished goods inventory was 25,000 units at $310,000. Determine the cost of goods sold for 210,000 units, assuming a FIFO cost flow.

> Blue Star Airline provides passenger airline service, using small jets. The airline connects four major cities: Charlotte, Pittsburgh, Detroit, and San Francisco. The company expects to fly major cities: Charlotte, Pittsburgh, Detroit, and San Francisco.

> A company reports the following: Cost of goods sold…………………………………$435,000 Average inventory……………………………………..72,500 Determine (A) the inventory turnover and (B) the number of days’ sales in inventory. (Round to one decimal place.)

> A company reports the following: Sales………………………………………………………..$3,150,000 Average accounts receivable (net)…………………..210,000 Determine (A) the accounts receivable turnover and (B) the number of days’ sales in receivables. (Round to one decimal place.)

> Identify the following costs as a prime cost (P), conversion cost (C), or both (B) for a magazine publisher: A. Paper used for the magazine B. Wages of printing machine employees C. Glue used to bind magazine D. Maintenance on printing machines

> During May, Bergan Company accumulated 2,500 hours of direct labor costs on Job 200 and 3,000 hours on Job 305. The total direct labor was incurred at a rate of $28 per direct labor hour for Job 200 and $24 per direct labor hour for Job 305. Journalize t

> Identify whether each of the following would be reported as an operating, investing, or financing activity on the statement of cash flows: A. Purchase of investments B. Disposal of equipment C. Payment for selling expenses D. Collection of accounts recei

> Jones Industries received $800,000 from issuing shares of its common stock and $700,000 from issuing bonds. During the year, Jones Industries also paid dividends of $90,000. How are the effects of these transactions reported on the statement of cash flow

> Ripley Corporation’s accumulated depreciation—equipment account increased by $11,575 while $2,500 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In

> The payroll register of Heritage Co. indicates $3,900 of social security withheld and $975 of Medicare tax withheld on total salaries of $65,000 for the period. Federal withholding for the period totaled $14,250. Retirement savings withheld from employee

> The cost of goods sold reported on the income statement was $240,000. The accounts payable balance increased $12,000, and the inventory balance increased by $19,200 over the year. Determine the amount of cash paid for merchandise.

> A summary of cash flows for Paradise Travel Service for the year ended May 31, 2018, follows: Cash receipts: Cash received from customers…………………………………$880,000 Cash received from issuing common stock……………………40,000 Cash payments: Cash paid for operating e

> Shrute Inc. manufactures office copiers, which are sold to retailers. The price and cost of goods sold for each copier are as follows: Price……………â&

> Using the bond from Basic Exercise 11-4, journalize the first interest payment and the amortization of the related bond premium. Data from Exercise 11-4: On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays

> Alpine Energy Corporation has 1,500,000 shares of $40 par common stock outstanding. On August 2, Alpine Energy declared a 4% stock dividend to be issued October 8 to stockholders of record on September 15. The market price of the stock was $70 per share

> Using the income statement for Paradise Travel Service shown in Basic Exercise 1-4, prepare a retained earnings statement for the year ended May 31, 2018. Everett McCauley invested an additional $40,000 in the business in exchange for common stock, and $

> The revenues and expenses of Paradise Travel Service for the year ended May 31, 2018, follow: Fees earned………………………………………………$900,000 Office expense……………………………………………..300,000 Miscellaneous expense……………………………………15,000 Wages expense…………………………………………….450,000

> Using the following data for Paradise Travel Service as well as the retained earnings statement shown in Basic Exercise 1-5, prepare a balance sheet as of May 31, 2018: Accounts payable………………………………….$ 18,000 Accounts receivable…………………………………38,000 Cash……

> A $500,000 bond issue on which there is an unamortized premium of $67,000 is redeemed for $490,000. Journalize the redemption of the bonds.

> Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, Classify the following items as (1) prepaid expense, (2) unearned revenue, (3) accrued revenue, Classify or (4) accrued expense: A. Cash received for use of l

> Identify each of the following as relating to (A) the control environment, (B) control procedures, or (C) monitoring: 1. Hiring of external auditors to review the adequacy of controls 2. Personnel policies 3. Safeguarding inventory in a locked warehouse

> On the first day of the fiscal year, a company issues an $7,500,000, 8%, five-year bond that pays semiannual interest of $300,000 ($7,500,000 × 8% × ½), receiving cash of $7,740,000. Journalize the bond issuance.

> On the first day of the fiscal year, a company issues $45,000, 8%, six-year installment notes that have annual payments of $9,734. The first note payment consists of $3,600 of interest and $6,134 of principal repayment. A. Journalize the entry to record the

> Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount

> Regling Company provides its employees vacation benefits and a defined benefit pension plan. Employees earned vacation pay of $35,000 for the period. The pension formula calculated a pension cost of $201,250. Only $175,000 was contributed to the pension pla

> The payroll register of Heritage Co. indicates $3,900 of social security withheld and $975 of Medicare tax withheld on total salaries of $65,000 for the period. Earnings of $10,000 are subject to state and federal unemployment compensation taxes at the f

> For each of the following errors, considered individually, indicate whether the error would cause the trial balance totals to be unequal. If the error would cause the trial balance totals to be unequal, indicate whether the debit or credit total is highe

> From the following list of steps in the accounting cycle, identify what two steps are missing: A. Transactions are analyzed and recorded in the journal. B. Transactions are posted to the ledger. C. An unadjusted trial balance is prepared. D. An optional

> At the end of the current year, Accounts Receivable has a balance of $2,150,000; Allowance for Doubtful Accounts has a debit balance of $10,500; and sales for the year total $51,850,000. Using the aging method, the balance of Allowance for Doubtful Accou

> At the end of the current year, Accounts Receivable has a balance of $2,150,000; Allowance for Doubtful Accounts has a debit balance of $10,500; and sales for the year total $51,850,000. Bad debt expense is estimated at ¼ of 1% of sales. Determine (A) th

> Prepare journal entries for each of the following: A. Issued a check to establish a petty cash fund of $600. B. The amount of cash in the petty cash fund is $130. Issued a check to replenish the fund, based on the following summary of petty cash receipts