Question: Patterson Software had the following selected

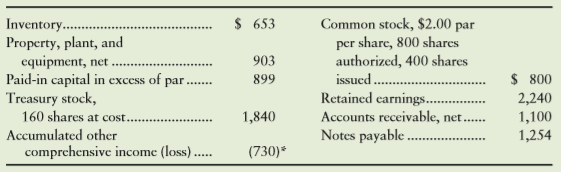

Patterson Software had the following selected account balances at December 31, 2016 (all numbers and amounts are in thousands, except par value per share):

Requirements

1. Prepare the stockholders’ equity section of Patterson Software’s balance sheet (in thousands).

2. How can Patterson have a larger balance of treasury stock than the sum of Common Stock and Paid-in Capital in Excess of Par?

Transcribed Image Text:

$ 653 Inventory.. Property, plant, and equipment, net. Paid-in capital in excess of par. Treasury stock, 160 shares at cost.. Common stock, $2.00 par per share, 800 shares authorized, 400 shares issued. 903 899 $ 800 Retained earnings.. Accounts receivable, net... 2,240 1,100 1,254 1,840 Accumulated other Notes payable . comprehensive income (loss). (730)* .....

> The income statement and additional data of One Stop, Inc., follow: Additional data: a. Collections from customers are $15,000 more than sales. b. Payments to suppliers are $2,300 more than the sum of cost of goods sold plus advertising expense. c.

> Selected accounts of Rosemont Golf Company show the following: Requirement 1. For each account, identify the item or items that should appear on a statement of cash flows prepared by the direct method. State where to report the item Salary Payable

> The accounting records of Stanley Pharmaceuticals, Inc., reveal the following: Requirement 1. Prepare cash flows from operating activities using the direct method. Also evaluate Stanley’s operating cash flow. Give the reason for your

> Compute the following items for the statement of cash flows: a. Beginning and ending Plant Assets, Net, are $120,000 and $112,000, respectively. Depreciation for the period was $16,000, and purchases of new plant assets were $26,000. Plant assets were so

> Consider three independent cases for the cash flows of Loader Company. For each case, identify from the statement of cash flows how Loader Company generated the cash to acquire new plant assets. Rank the three cases from the

> The income statement and additional data of Norman Travel Products, Inc., follow: Additional data: a. Acquisition of plant assets was $150,000. Of this amount, $99,000 was paid in cash and $51,000 by signing a note payable. b. Proceeds from sale of l

> Assume that you are a financial analyst. You are trying to compare the financial statements of Caterpillar, Inc., with those of CNH Global, an international company that uses international financial reporting standards (IFRS). Caterpillar, Inc., uses the

> The accounting records of The Dakota Trading Post Company include these accounts: Requirement 1. Prepare the company’s net cash provided by (used for) operating activities section of the statement of cash flows for the month of Octob

> The December 31, 2015, balance sheet and the 2016 statement of cash flows for Northtown, Inc., follow: Requirement 1. Prepare the December 31, 2016, balance sheet for Northtown, Inc. A1 Northtown, Inc. Balance Sheet December 31, 20

> Crown Specialties reported the following at December 31, 2016 (in thousands): Requirement 1. Determine the following items for Crown Specialties during 2016: a. Gain or loss on the sale of property and equipment b. Amount of long-term debt issued fo

> Top Notch, Inc., reported the following in its financial statements for the year ended May 31, 2016 (in thousands): Requirement 1. Determine the following cash receipts and payments for Top Notch, Inc., during 2016 (enter all amounts in

> Compute the following items for the statement of cash flows: a. Beginning and ending Accounts Receivable are $47,000 and $53,000, respectively. Credit sales for the period total $141,000. How much are cash collections from customers? b. Cost of Goods So

> The income statement and additional data of Value World, Inc., follow: Additional data: a. Collections from customers are $12,000 less than sales. b. Payments to suppliers are $2,300 less than the sum of cost of goods sold plus advertising expense. c

> Selected accounts of Downtown Galleries show the following: Requirement 1. For each account, identify the item or items that should appear on a statement of cash flows prepared by the direct method. State where to report the item. Salary Payable B

> The accounting records of Pelham Pharmaceuticals, Inc., reveal the following: Requirement 1. Prepare cash flows from operating activities using the direct method. Also evaluate Pelham’s operating cash flow. Give the reason for your e

> Compute the following items for the statement of cash flows: a. Beginning and ending Plant Assets, Net, are $120,000 and $115,000, respectively. Depreciation for the period was $13,000, and purchases of new plant assets were $15,000. Plant assets were so

> Consider three independent cases for the cash flows of Sharma Merchandising Corp. For each case, identify from the statement of cash flows how Sharma Merchandising Corp. generated the cash to acquire new plant assets. Rank t

> Suppose American Cable and Entertainment, Inc., is having a bad year in 2016, as the company has incurred a $4.9 billion net loss. The loss has pushed most of the return measures into the negative column, and the current ratio dropped below 1.0. The comp

> The income statement and additional data of Nyman Travel Products, Inc., follow: Additional data: a. Acquisition of plant assets was $134,000. Of this amount, $90,000 was paid in cash and $44,000 by signing a note payable. b. Proceeds from sale of la

> The accounting records of the Wisconsin Trading Post Company include these accounts: Requirement 1. Prepare the company’s net cash provided by (used for) operating activities section of the statement of cash flows for the month of Ju

> The accounting records of Midwest Distributors, Inc., reveal the following: Requirement 1. Prepare the cash flows from operating activities by section of the statement of cash flows using the indirect method. Use the format of the operating

> A company uses the indirect method to prepare the statement of cash flows. Indicate whether each of the following transactions affects an operating activity, an investing activity, a financing activity, or a noncash investin

> Bloomfield Investments specializes in low-risk government bonds. Identify each of Bloomfield’s transactions as operating (O), investing (I), financing (F), noncash investing and ï¬&#

> The following data (dollar amounts in millions) are from the financial statements of Valley Corporation: Requirement 1. Complete the following condensed income statement. Report amounts to the nearest million dollars. Average stock

> An incomplete comparative income statement and balance sheet for Emore Corporation follow: Requirement 1. Using the ratios, common-size percentages, and trend percentages given, complete the income statement and balance sheet for Emore for 2016. Addi

> Windy City Fashions, Inc., operates as a retailer of casual apparel. A recent, condensed income statement for Windy City Fashions follows: Requirements Assume that the following transactions were inadvertently omitted at the end of the year. Using the

> The following data (dollar amounts in millions) are taken from the financial statements of Burbick Industries, Inc.: Requirement 1. Complete the following condensed balance sheet. Report amounts to the nearest million dollars. Tota

> Prestige Loan Company’s balance sheet at December 31, 2016, reports the following: During 2016, Prestige Loan earned net income of $6,300,000. Compute Prestige Loan’s earnings per common share (EPS) for 2016. (Round

> Applied Technology, Inc., and Four-Star Catering are asking you to recommend their stock to your clients. Because Applied and Four-Star earn about the same net income and have similar financial positions, your decision depends on their sta

> During 2016, Botto Heights Corp.’s income statement reported income of $420,000 before tax. The company’s income tax return filed with the IRS showed taxable income of $390,000. During 2016, Botto Heights was subject to an income tax rate of 40%. Requir

> Assume that Newman Stores completed the following foreign-currency transactions: Requirements 1. Journalize these transactions for Newman. Focus on the gains and losses caused by changes in foreign-currency rates; round your answers to the nearest who

> During 2016, Rondell, Inc., had sales of $6.96 billion, operating profit of $2.0 billion, and net income of $3.0 billion. EPS was $4.30. On January 3, 2017, one share of Rondell common stock was priced at $54.10 on the New York Stock Exchange. What inves

> The Calloway Book Company’s accounting records include the following for 2016 (in thousands): Requirements 1. Prepare Calloway Book’s single-step income statement for the year ended December 31, 2016, including EPS.

> Suppose Victor Cycles, Inc., reported a number of special items on its income statement. The following data, listed in no particular order, came from Victor’s financial statements (amounts in thousands): Requirements 1

> The following information appears in a footnote to the 2014 financial statements of The Procter & Gamble Company (the information has been adapted for this exercise): Requirements 1. What are The Procter & Gamble Companyâ

> During the year ended December 31, 2016, Bacarella International Corporation earned $3,600,000 in net income after taxes. The company reported $120,000 of net unrealized gains on available-for sale securities, net of taxes, and $160,000 in foreign-curren

> EcoClean, Inc., a household products chain, reported a prior-period adjustment in 2016. An accounting error caused net income of 2015 to be understated by $13 million. Retained earnings at December 31, 2015, as previously reported, was $344 million. Net

> Rickett Water Company reported the following items on its statement of shareholders’ equity for the year ended December 31, 2016 (amounts in thousands of dollars): Requirements 1. Determine the December 31, 2016, balances in Rickett

> Use the Easton data in E10-49B to show how the company reported cash flows from financing activities during 2016 (the current year). From E10-49B Payment of long-term debt . $ 17,055 Procceds from issuance Dividends pa

> The 2016 income statement and the 2016 comparative balance sheet of T-Bar-M Camp, Inc., have just been distributed at a meeting of the camp’s board of directors. The directors raise a fundamental question: Why is the cash balance so low

> Easton Company included the following items in its financial statements for 2016, the current year (amounts in millions): Requirements 1. Use DuPont Analysis to compute Easton’s return on assets and return on common eq

> The balance sheet of Walton Wallcoverings Company reported the following: Redeemable preferred stock, 6%, $90 par value, redemption value $25,000; outstanding 200 shares................ $18,000 Common stockholders’ equity: 4,000 shares issued and outstan

> Identify the effects—both the direction and the dollar amount—of these assumed transactions on the total stockholders’ equity of Newberry Corporation. Each transaction is independent. a. Declaration of cash dividends of $82 million. b. Payment of the c

> The stockholders’ equity for Little Wonders Company on August 13, 2017, follows: On August 13, 2017, the market price of Little Wonders common stock was $20 per share. Assume Little Wonders declared and distributed a 25% stock dividen

> Ontario Manufacturing, Inc., reported the following at December 31, 2016, and December 31, 2017: Ontario Manufacturing has paid all preferred dividends through 2013. Requirement 1. Compute the total amounts of dividends to both preferred and common f

> Crogan Products Company reported the following stockholders’ equity on its balance sheet: Requirements 1. What caused Crogan’s preferred stock to decrease during 2017? Cite all possible causes. 2. What caused Croga

> Use the Pioneer Corporation data in E10-42B to prepare the stockholders’ equity section of the company’s balance sheet at December 31, 2017. From E10-42B Common stock $3.00 par value per share, 22 million shares issued...................... $ 66 Paid-

> At December 31, 2016, Pioneer Corporation reported the stockholders’ equity accounts shown here (with dollar amounts in millions, except per-share amounts). Common stock $3.00 par value per share, 22 million shares issued...................... $ 66 Paid

> Raintree Marketing Corporation reported the following stockholders’ equity at December 31 (adapted and in millions): Common stock.................................. $ 365 Additional paid-in capital...................... 286 Retained earnings...........

> Mike Magid Toyota is an automobile dealership. Magid’s annual report includes Note 1—Summary of Significant Accounting Policies as follows: Bay Area Nissan, a competitor of Mike Magid Toyota, includes

> The financial statements of Royal Employment Services, Inc., reported the following accounts (adapted, with dollar amounts in thousands except for par value): Prepare the stockholders’ equity section of Royalâ

> Nationwide Publishing was recently organized. The company issued common stock to an attorney who provided legal services worth $27,000 to help organize the corporation. Nationwide Publishing also issued common stock to an inventor in exchange for her pat

> Tropical Goods is authorized to issue 10,000 shares of common stock. During a two-month period, Tropical completed these stock-issuance transactions: Requirements 1. Journalize the transactions. 2. Prepare the stockholders’ equity s

> Seaside Water Company reported the following items on its statement of shareholders’ equity for the year ended December 31, 2016 (amounts in thousands of dollars): Requirements 1. Determine the December 31, 2016, balances in Seaside

> Use the York Company data in E10-34A to show how the company reported cash flows from financing activities during 2016 (the current year). From E10-34A Payment of long-term debt . $17,075 Dividends paid.. ... $ 205 Pro

> York Company included the following items in its financial statements for 2016, the current year (amounts in millions): Requirements 1. Use DuPont Analysis to compute York’s return on assets and return on common equity

> The balance sheet of Eclectic Rug Company reported the following: Redeemable preferred stock, 8%, $100 par value, redemption value $25,000; outstanding 200 shares................ $ 20,000 Common stockholders’ equity: 4,000 shares issued and outstanding..

> Identify the effects—both the direction and the dollar amount—of these assumed transactions on the total stockholders’ equity of Ashby Corporation. Each transaction is independent. a. Declaration of cash dividends of $78 million. b. Payment of the cash

> On January 14, Roland Corporation issued 100,000 shares of its $0.01 par-value common stock for the market price of $13.50 per share. Attorney Christie Mann invoiced Roland Corporation for $28,000 and has agreed to accept 2,000 shares of its $0.01 par-va

> At fiscal year-end 2016, Martin Legal Services and Kramer Doughnuts reported these adapted amounts on their balance sheets (all amounts in millions except for par value per share): Assume each company issued its stock in a single transac

> Mitchell Corporation received $11,500,000 for the issuance of its stock on May 14. The par value of the Mitchell Corporation stock was only $11,500. Was the excess amount of $11,488,500 a profit to Mitchell Corporation? If not, what was it? Suppose the p

> Answer the following questions about the characteristics of a corporation’s stock: 1. Who are the real owners of a corporation? 2. What privileges do preferred stockholders have over common stockholders? 3. Which class of stockholders reaps greater be

> What are two main advantages that a corporation has over a proprietorship and a partnership? What are two main disadvantages of a corporation? Describe the authority structure of a corporation. Who holds ultimate power?

> Use the financial statements of Gagnon, Inc., in S13-6 and S13-7 to compute these profitability measures for 2016. Show each computation. a. Rate of return on sales b. Asset turnover ratio c. Rate of return on total asset

> Use the financial statements of Gagnon, Inc., in S13-6 and S13-7. 1. Compute the company’s debt ratio at December 31, 2016. 2. Compute the company’s times-interest-earned ratio for 2016. For operating

> Use the Gagnon 2016 income statement that follows and the balance sheet from S13-6 to compute the following: a. Gagnon, Inc.’s, rate of inventory turnover and days’ inventory outstanding for 2016. b. Daysâ

> Use the Gagnon, Inc., balance-sheet data to answer the following questions. 1. Compute Gagnon, Inc.’s, quick (acid-test) ratio at December 31, 2016, and 2015. 2. Use the comparative information from the table given for Horner, Inc., I

> Examine the financial data of Peterson Corporation. Show how to compute Peterson’s current ratio for each year 2014 through 2016. Is the company’s ability to pay its current liabilities improving or de

> The stockholders’ equity for Rightwell Corporation on June 16, 2017, follows: On June 16, 2017, the market price of Rightwell common stock was $18 per share. Assume Rightwell declared and distributed a 12% stock dividend on this date.

> Carlton, Inc., and Lofton Corporation are competitors. Compare the two companies by converting their condensed income statements to common size. Which company earned more net income? Which company’s net income was a higher percentage

> Crafton Software reported the following amounts on its balance sheets at December 31, 2016, 2015, and 2014: Sales and profits are high. Nevertheless, Crafton is experiencing a cash shortage. Perform a vertical analysis of Cra

> Breen, Inc., reported the following sales and net income amounts: Show Breen’s trend percentages for sales and net income. Use 2013 as the base year. (In thousands) 2016 2015 2014 2013 Sales. $10,962 $10,266 $9,570 392 $8,700 350

> Compute economic value added (EVA®) for Beecher Software. The company’s cost of capital is 12%. Net income before taxes was $730 thousand, interest expense $403 thousand, beginning long-term debt $750 thousand, and beginning stockholders’ equity was $3,2

> Take the role of an investment analyst at Cole Binder. It is your job to recommend investments for your client. The only information you have is the following ratio values for two companies in the graphics software industry: Write a report to the Cole

> A skeleton of Pine Florals’ balance sheet appears as follows (amounts in thousands): Use the following ratio data to complete Pine Florals’ balance sheet: a. Debt ratio is 0.58. b. Current ratio is 1.10. c. Quick

> A skeleton of Pine Florals’ income statement appears as follows (amounts in thousands): Use the following ratio data to complete Pine Florals’ income statement: a. Inventory turnover was 4 (beginning inventory was $

> The annual report of Ferguson Cars, Inc., for the year ended December 31, 2016, included the following items (in millions): 1. Compute earnings per share (EPS) and the price-earnings ratio for Ferguson Cars’ stock. Round to the neares

> Verifine Corporation reported the following amounts on its 2016 comparative income Statements: Perform a horizontal analysis of revenues and net income—both in dollar amounts and in percentages—for 20

> Pratt Computer Sales, Inc., reported the following financial statements for 2016: Compute the following investing cash flows; enter all amounts in thousands. a. Acquisitions of plant assets (all were for cash). Pratt Com

> Supreme Manufacturing, Inc., reported the following at December 31, 2016, and December 31, 2017: Supreme Manufacturing has paid all preferred dividends through 2013. Requirement 1. Compute the total amounts of dividends to both preferred and common

> Prudhoe Bay Oil Co. is having its initial public offering (IPO) of company stock. To create public interest in its stock, Prudhoe Bay’s chief financial officer has blitzed the media with press releases. One in particular caught your eye. On November 19, P

> Use the data in SE12-7 to prepare Williams Corporation’s statement of cash flows for the year ended June 30, 2016. Williams uses the indirect method for operating activities. From SE12-7 Williams Corporation accountants

> Williams Corporation accountants have assembled the following data for the year ended June 30, 2016: Prepare the operating activities section of Williams’ statement of cash flows for the year ended June 30, 2016. Willia

> Peabody Cruiselines is preparing its statement of cash flows (indirect method) for the year ended March 31, 2016. Consider the following items in preparing the company’s statement of cash flows. Identify ea

> Smythe Transportation began 2016 with accounts receivable, inventory, and prepaid expenses totaling $60,000. At the end of the year, Smythe had a total of $62,000 for these current assets. At the beginning of 2016, Smythe owed current liabilities of $35

> The CEO and CFO from Jolson Hotels, Inc., are reviewing company performance for 2016. The income statement reports a 20% increase in net income over 2015. However, most of the increase resulted from a gain on insurance proceeds from fire d

> Examine the statement of cash flows of Chadwell Company. Suppose Chadwell’s operating activities provided, rather than used, cash. Identify three things under the indirect method that could cause operating cash flows to

> Sowell Enterprises, Inc., has experienced an unbroken string of nine years of growth in net income. Nevertheless, the company is facing bankruptcy. Creditors are calling all of Sowell’s loans for immediate payment, and the cash is simply not available. I

> Use the data in SE12-14 to prepare Mulberry Golf Club, Inc.’s, statement of cash flows for the year ended September 30, 2016. The company uses the direct method for operating cash flows. From SE12-14 Mulb

> Mulberry Golf Club, Inc., has assembled the following data for the year ended September 30, 2016: Prepare the operating activities section of Mulberry Golf Club, Inc.’s, statement of cash flows for the year

> Laughlin Horse Farms, Inc., began 2016 with cash of $190,000. During the year, Laughlin earned service revenue of $591,000 and collected $570,000 from customers. Expenses for the year totaled $425,000, with $410,000 paid in cash to suppliers and employee

> Quanto Products Company reported the following stockholders’ equity on its balance sheet: Requirements 1. What caused Quanto’s preferred stock to decrease during 2017? Cite all possible causes. 2. What caused Quant

> Use the Pratt Computer Sales data in SE12-9 to compute the following; enter all amounts in thousands. a. Payments to employees b. Payments of other expenses From SE12-9 Pratt Computer Sales, Inc., reported the following financial state

> Use the Pratt Computer Sales data in SE12-9 to compute the following; enter all amounts in thousands. a. Collections from customers b. Payments for inventory From SE12-9 Pratt Computer Sales, Inc., reported the following financial stat

> Use the Pratt Computer Sales data in SE12-9 to compute the following; enter all amounts in thousands. a. New borrowing or payment of long-term notes payable. Pratt Computer Sales had only one long-term note payable transaction during the year. b. Issua

> State how the statement of cash flows helps investors and creditors perform each of the following functions: a. Predict future cash flows b. Evaluate management decisions

> Weather Seal Windows Company has preferred stock outstanding and issued additional common stock during the year. 1. Give the basic equation to compute earnings per share of common stock for net income. 2. List the income items for which Weather Seal Wi

> Colossal Marine, Inc., had income before income tax of $171,000 and taxable income of $148,000 for 2016, the company’s first year of operations. The income tax rate is 40%. 1. Make the entry to record Colossal Marine’s income taxes for 2016. 2. Show wha

> Juneau Cruise Lines, Inc., reported the following income statement for the year ended December 31, 2016: Requirements 1. Were Juneau Cruise Line’s discontinued operations more like an expense or revenue? How can you tell? 2. Should

> Industrial Belting sells goods on account for 700,000 Mexican pesos. The foreign-exchange rate for a peso is $0.092 on the date of sale. Industrial Belting then collects cash on April 24 when the exchange rate for a peso is $0.096. Record Industrial Belt