Question: The Calloway Book Company’s accounting records

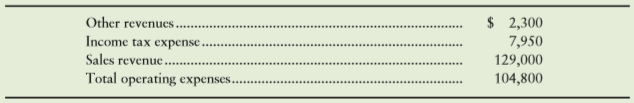

The Calloway Book Company’s accounting records include the following for 2016 (in thousands):

Requirements

1. Prepare Calloway Book’s single-step income statement for the year ended December 31, 2016, including EPS. Calloway Book had 1,000,000 shares of common stock and no preferred stock outstanding during the year.

2. Assume Calloway Book Company’s income from operations reflects that its core business been steadily increasing by about 10% per year over the past three years and that none of its operations have been discontinued. What does this say about the quality of its earnings?

3. Assume investors capitalize Calloway Book earnings from continuing operations at 8%. Estimate the price of one share of the company’s stock.

Transcribed Image Text:

$ 2,300 7,950 129,000 Other revenues. Income tax expense Sales revenue Total operating expenses.. 104,800

> Net sales, net income, and total assets for Abacus Shipping, Inc., for a five-year period follow: Requirements 1. Compute trend percentages for each item for 2013 through 2016. Use 2012 as the base year and round to the nearest percent.

> You are evaluating two companies as possible investments. The two companies, which are similar in size, are commuter airlines that fly passengers up and down the East Coast. All other available information has been analyzed, and your inves

> Prepare a horizontal analysis of the comparative income statements of Mitchell Music Co. Round percentage changes to the nearest one-tenth percent (three decimal places). A1 Mitchell Music Co. Comparative Income Statements Years Ended December 31, 2

> What were the dollar amount of change and the percentage of each change in Blueberry Lane Lodge’s net working capital during 2016 and 2015? Is this trend favorable or unfavorable? 2016 2015 2014 Total current assets. $424,950 $259,

> Two companies with different economic-value-added (EVA®) profiles are Emerson Company, Inc., and Farmers Bank Limited. Adapted versions of the two companies’ financial statements are presented he

> Evaluate the common stock of Monroe Falls Distributing Company as an investment. Specifically, use the three common stock ratios to determine whether the common stock increased or decreased in attractiveness during the past year. (The numb

> For 2016 and 2015, compute return on sales (ROS), asset turnover (AT), return on assets (ROA), leverage (L), return on common stockholders’ equity (ROE), gross profit percentage (GP), operating income percentage (OI), and

> DuBois Furniture Company has requested that you determine whether the company’s ability to pay its current liabilities and long-term debts improved or deteriorated during 2016. To answer this question, compute the following ratios for 2

> The financial statements of Adventure News, Inc., include the following items: Requirements 1. Using Exhibit 13-8 as a model, compute the following ratios for 2016 and 2015: a. Current ratio b. Quick (acid-test) ratio c. Inventory tu

> Identify any weaknesses revealed by the statement of cash flows of Beckwith Orchards, Inc. A1 Beckwith Orchards, Inc. Statement of Cash Flows For the Current Year 1 2 Operating activities: Net income Add (subtract) adjustments to reco

> Prepare a comparative common-size income statement for Connor Music Co., using the 2016 and 2015 data of E13-16A and rounding to four decimal places. From E13-16A A1 Connor Music Co. Comparative Income Statements Years Ended December 31, 2016 and 2

> The stockholders’ equity of Akron Uniforms as of December 31, 2016 and 2015, follows: Requirements 1. What is the par value of the common stock? 2. How many shares of common stock were outstanding at the end of 2016? 3. As of Decem

> Suppose you manage Outward Bound, Inc., a Vermont sporting goods store that lost money during the past year. To turn the business around, you must analyze the company and industry data for the current year to learn what is wrong. The companyâ€

> Fandom, Inc., ended 2016 with 9 million shares of $1 par common stock issued and outstanding. Beginning additional paid-in capital was $9 million, and retained earnings totaled $36 million. In April 2017, Fandom issued 4 million shares of common stock a

> Atlantic Corporation reported the following stockholders’ equity data (all dollars in millions except par value per share): Atlantic earned net income of $2,940 during 2016. For each account except Retained Earnings, one transaction e

> Use the Dolson Networking Solutions data in E10-86 to show how the company reported cash flows from financing activities during 2016. From E10-86 Dolson Networking Solutions began operations on January 1, 2016, and immediately issued its stock, receiving

> Dolson Networking Solutions began operations on January 1, 2016, and immediately issued its stock, receiving cash. Dolson’s balance sheet at December 31, 2016, reported the following stockholders’ equity: Common stock,

> The income statement and additional data of One Stop, Inc., follow: Additional data: a. Collections from customers are $15,000 more than sales. b. Payments to suppliers are $2,300 more than the sum of cost of goods sold plus advertising expense. c.

> Selected accounts of Rosemont Golf Company show the following: Requirement 1. For each account, identify the item or items that should appear on a statement of cash flows prepared by the direct method. State where to report the item Salary Payable

> The accounting records of Stanley Pharmaceuticals, Inc., reveal the following: Requirement 1. Prepare cash flows from operating activities using the direct method. Also evaluate Stanley’s operating cash flow. Give the reason for your

> Compute the following items for the statement of cash flows: a. Beginning and ending Plant Assets, Net, are $120,000 and $112,000, respectively. Depreciation for the period was $16,000, and purchases of new plant assets were $26,000. Plant assets were so

> Consider three independent cases for the cash flows of Loader Company. For each case, identify from the statement of cash flows how Loader Company generated the cash to acquire new plant assets. Rank the three cases from the

> The income statement and additional data of Norman Travel Products, Inc., follow: Additional data: a. Acquisition of plant assets was $150,000. Of this amount, $99,000 was paid in cash and $51,000 by signing a note payable. b. Proceeds from sale of l

> Assume that you are a financial analyst. You are trying to compare the financial statements of Caterpillar, Inc., with those of CNH Global, an international company that uses international financial reporting standards (IFRS). Caterpillar, Inc., uses the

> The accounting records of The Dakota Trading Post Company include these accounts: Requirement 1. Prepare the company’s net cash provided by (used for) operating activities section of the statement of cash flows for the month of Octob

> The December 31, 2015, balance sheet and the 2016 statement of cash flows for Northtown, Inc., follow: Requirement 1. Prepare the December 31, 2016, balance sheet for Northtown, Inc. A1 Northtown, Inc. Balance Sheet December 31, 20

> Crown Specialties reported the following at December 31, 2016 (in thousands): Requirement 1. Determine the following items for Crown Specialties during 2016: a. Gain or loss on the sale of property and equipment b. Amount of long-term debt issued fo

> Top Notch, Inc., reported the following in its financial statements for the year ended May 31, 2016 (in thousands): Requirement 1. Determine the following cash receipts and payments for Top Notch, Inc., during 2016 (enter all amounts in

> Compute the following items for the statement of cash flows: a. Beginning and ending Accounts Receivable are $47,000 and $53,000, respectively. Credit sales for the period total $141,000. How much are cash collections from customers? b. Cost of Goods So

> The income statement and additional data of Value World, Inc., follow: Additional data: a. Collections from customers are $12,000 less than sales. b. Payments to suppliers are $2,300 less than the sum of cost of goods sold plus advertising expense. c

> Selected accounts of Downtown Galleries show the following: Requirement 1. For each account, identify the item or items that should appear on a statement of cash flows prepared by the direct method. State where to report the item. Salary Payable B

> The accounting records of Pelham Pharmaceuticals, Inc., reveal the following: Requirement 1. Prepare cash flows from operating activities using the direct method. Also evaluate Pelham’s operating cash flow. Give the reason for your e

> Compute the following items for the statement of cash flows: a. Beginning and ending Plant Assets, Net, are $120,000 and $115,000, respectively. Depreciation for the period was $13,000, and purchases of new plant assets were $15,000. Plant assets were so

> Consider three independent cases for the cash flows of Sharma Merchandising Corp. For each case, identify from the statement of cash flows how Sharma Merchandising Corp. generated the cash to acquire new plant assets. Rank t

> Suppose American Cable and Entertainment, Inc., is having a bad year in 2016, as the company has incurred a $4.9 billion net loss. The loss has pushed most of the return measures into the negative column, and the current ratio dropped below 1.0. The comp

> The income statement and additional data of Nyman Travel Products, Inc., follow: Additional data: a. Acquisition of plant assets was $134,000. Of this amount, $90,000 was paid in cash and $44,000 by signing a note payable. b. Proceeds from sale of la

> The accounting records of the Wisconsin Trading Post Company include these accounts: Requirement 1. Prepare the company’s net cash provided by (used for) operating activities section of the statement of cash flows for the month of Ju

> The accounting records of Midwest Distributors, Inc., reveal the following: Requirement 1. Prepare the cash flows from operating activities by section of the statement of cash flows using the indirect method. Use the format of the operating

> A company uses the indirect method to prepare the statement of cash flows. Indicate whether each of the following transactions affects an operating activity, an investing activity, a financing activity, or a noncash investin

> Bloomfield Investments specializes in low-risk government bonds. Identify each of Bloomfield’s transactions as operating (O), investing (I), financing (F), noncash investing and ï¬&#

> The following data (dollar amounts in millions) are from the financial statements of Valley Corporation: Requirement 1. Complete the following condensed income statement. Report amounts to the nearest million dollars. Average stock

> An incomplete comparative income statement and balance sheet for Emore Corporation follow: Requirement 1. Using the ratios, common-size percentages, and trend percentages given, complete the income statement and balance sheet for Emore for 2016. Addi

> Windy City Fashions, Inc., operates as a retailer of casual apparel. A recent, condensed income statement for Windy City Fashions follows: Requirements Assume that the following transactions were inadvertently omitted at the end of the year. Using the

> The following data (dollar amounts in millions) are taken from the financial statements of Burbick Industries, Inc.: Requirement 1. Complete the following condensed balance sheet. Report amounts to the nearest million dollars. Tota

> Prestige Loan Company’s balance sheet at December 31, 2016, reports the following: During 2016, Prestige Loan earned net income of $6,300,000. Compute Prestige Loan’s earnings per common share (EPS) for 2016. (Round

> Applied Technology, Inc., and Four-Star Catering are asking you to recommend their stock to your clients. Because Applied and Four-Star earn about the same net income and have similar financial positions, your decision depends on their sta

> During 2016, Botto Heights Corp.’s income statement reported income of $420,000 before tax. The company’s income tax return filed with the IRS showed taxable income of $390,000. During 2016, Botto Heights was subject to an income tax rate of 40%. Requir

> Assume that Newman Stores completed the following foreign-currency transactions: Requirements 1. Journalize these transactions for Newman. Focus on the gains and losses caused by changes in foreign-currency rates; round your answers to the nearest who

> During 2016, Rondell, Inc., had sales of $6.96 billion, operating profit of $2.0 billion, and net income of $3.0 billion. EPS was $4.30. On January 3, 2017, one share of Rondell common stock was priced at $54.10 on the New York Stock Exchange. What inves

> Suppose Victor Cycles, Inc., reported a number of special items on its income statement. The following data, listed in no particular order, came from Victor’s financial statements (amounts in thousands): Requirements 1

> The following information appears in a footnote to the 2014 financial statements of The Procter & Gamble Company (the information has been adapted for this exercise): Requirements 1. What are The Procter & Gamble Companyâ

> During the year ended December 31, 2016, Bacarella International Corporation earned $3,600,000 in net income after taxes. The company reported $120,000 of net unrealized gains on available-for sale securities, net of taxes, and $160,000 in foreign-curren

> EcoClean, Inc., a household products chain, reported a prior-period adjustment in 2016. An accounting error caused net income of 2015 to be understated by $13 million. Retained earnings at December 31, 2015, as previously reported, was $344 million. Net

> Rickett Water Company reported the following items on its statement of shareholders’ equity for the year ended December 31, 2016 (amounts in thousands of dollars): Requirements 1. Determine the December 31, 2016, balances in Rickett

> Use the Easton data in E10-49B to show how the company reported cash flows from financing activities during 2016 (the current year). From E10-49B Payment of long-term debt . $ 17,055 Procceds from issuance Dividends pa

> The 2016 income statement and the 2016 comparative balance sheet of T-Bar-M Camp, Inc., have just been distributed at a meeting of the camp’s board of directors. The directors raise a fundamental question: Why is the cash balance so low

> Easton Company included the following items in its financial statements for 2016, the current year (amounts in millions): Requirements 1. Use DuPont Analysis to compute Easton’s return on assets and return on common eq

> The balance sheet of Walton Wallcoverings Company reported the following: Redeemable preferred stock, 6%, $90 par value, redemption value $25,000; outstanding 200 shares................ $18,000 Common stockholders’ equity: 4,000 shares issued and outstan

> Identify the effects—both the direction and the dollar amount—of these assumed transactions on the total stockholders’ equity of Newberry Corporation. Each transaction is independent. a. Declaration of cash dividends of $82 million. b. Payment of the c

> The stockholders’ equity for Little Wonders Company on August 13, 2017, follows: On August 13, 2017, the market price of Little Wonders common stock was $20 per share. Assume Little Wonders declared and distributed a 25% stock dividen

> Ontario Manufacturing, Inc., reported the following at December 31, 2016, and December 31, 2017: Ontario Manufacturing has paid all preferred dividends through 2013. Requirement 1. Compute the total amounts of dividends to both preferred and common f

> Crogan Products Company reported the following stockholders’ equity on its balance sheet: Requirements 1. What caused Crogan’s preferred stock to decrease during 2017? Cite all possible causes. 2. What caused Croga

> Use the Pioneer Corporation data in E10-42B to prepare the stockholders’ equity section of the company’s balance sheet at December 31, 2017. From E10-42B Common stock $3.00 par value per share, 22 million shares issued...................... $ 66 Paid-

> At December 31, 2016, Pioneer Corporation reported the stockholders’ equity accounts shown here (with dollar amounts in millions, except per-share amounts). Common stock $3.00 par value per share, 22 million shares issued...................... $ 66 Paid

> Raintree Marketing Corporation reported the following stockholders’ equity at December 31 (adapted and in millions): Common stock.................................. $ 365 Additional paid-in capital...................... 286 Retained earnings...........

> Patterson Software had the following selected account balances at December 31, 2016 (all numbers and amounts are in thousands, except par value per share): Requirements 1. Prepare the stockholders’ equity section of Patterson Softwar

> Mike Magid Toyota is an automobile dealership. Magid’s annual report includes Note 1—Summary of Significant Accounting Policies as follows: Bay Area Nissan, a competitor of Mike Magid Toyota, includes

> The financial statements of Royal Employment Services, Inc., reported the following accounts (adapted, with dollar amounts in thousands except for par value): Prepare the stockholders’ equity section of Royalâ

> Nationwide Publishing was recently organized. The company issued common stock to an attorney who provided legal services worth $27,000 to help organize the corporation. Nationwide Publishing also issued common stock to an inventor in exchange for her pat

> Tropical Goods is authorized to issue 10,000 shares of common stock. During a two-month period, Tropical completed these stock-issuance transactions: Requirements 1. Journalize the transactions. 2. Prepare the stockholders’ equity s

> Seaside Water Company reported the following items on its statement of shareholders’ equity for the year ended December 31, 2016 (amounts in thousands of dollars): Requirements 1. Determine the December 31, 2016, balances in Seaside

> Use the York Company data in E10-34A to show how the company reported cash flows from financing activities during 2016 (the current year). From E10-34A Payment of long-term debt . $17,075 Dividends paid.. ... $ 205 Pro

> York Company included the following items in its financial statements for 2016, the current year (amounts in millions): Requirements 1. Use DuPont Analysis to compute York’s return on assets and return on common equity

> The balance sheet of Eclectic Rug Company reported the following: Redeemable preferred stock, 8%, $100 par value, redemption value $25,000; outstanding 200 shares................ $ 20,000 Common stockholders’ equity: 4,000 shares issued and outstanding..

> Identify the effects—both the direction and the dollar amount—of these assumed transactions on the total stockholders’ equity of Ashby Corporation. Each transaction is independent. a. Declaration of cash dividends of $78 million. b. Payment of the cash

> On January 14, Roland Corporation issued 100,000 shares of its $0.01 par-value common stock for the market price of $13.50 per share. Attorney Christie Mann invoiced Roland Corporation for $28,000 and has agreed to accept 2,000 shares of its $0.01 par-va

> At fiscal year-end 2016, Martin Legal Services and Kramer Doughnuts reported these adapted amounts on their balance sheets (all amounts in millions except for par value per share): Assume each company issued its stock in a single transac

> Mitchell Corporation received $11,500,000 for the issuance of its stock on May 14. The par value of the Mitchell Corporation stock was only $11,500. Was the excess amount of $11,488,500 a profit to Mitchell Corporation? If not, what was it? Suppose the p

> Answer the following questions about the characteristics of a corporation’s stock: 1. Who are the real owners of a corporation? 2. What privileges do preferred stockholders have over common stockholders? 3. Which class of stockholders reaps greater be

> What are two main advantages that a corporation has over a proprietorship and a partnership? What are two main disadvantages of a corporation? Describe the authority structure of a corporation. Who holds ultimate power?

> Use the financial statements of Gagnon, Inc., in S13-6 and S13-7 to compute these profitability measures for 2016. Show each computation. a. Rate of return on sales b. Asset turnover ratio c. Rate of return on total asset

> Use the financial statements of Gagnon, Inc., in S13-6 and S13-7. 1. Compute the company’s debt ratio at December 31, 2016. 2. Compute the company’s times-interest-earned ratio for 2016. For operating

> Use the Gagnon 2016 income statement that follows and the balance sheet from S13-6 to compute the following: a. Gagnon, Inc.’s, rate of inventory turnover and days’ inventory outstanding for 2016. b. Daysâ

> Use the Gagnon, Inc., balance-sheet data to answer the following questions. 1. Compute Gagnon, Inc.’s, quick (acid-test) ratio at December 31, 2016, and 2015. 2. Use the comparative information from the table given for Horner, Inc., I

> Examine the financial data of Peterson Corporation. Show how to compute Peterson’s current ratio for each year 2014 through 2016. Is the company’s ability to pay its current liabilities improving or de

> The stockholders’ equity for Rightwell Corporation on June 16, 2017, follows: On June 16, 2017, the market price of Rightwell common stock was $18 per share. Assume Rightwell declared and distributed a 12% stock dividend on this date.

> Carlton, Inc., and Lofton Corporation are competitors. Compare the two companies by converting their condensed income statements to common size. Which company earned more net income? Which company’s net income was a higher percentage

> Crafton Software reported the following amounts on its balance sheets at December 31, 2016, 2015, and 2014: Sales and profits are high. Nevertheless, Crafton is experiencing a cash shortage. Perform a vertical analysis of Cra

> Breen, Inc., reported the following sales and net income amounts: Show Breen’s trend percentages for sales and net income. Use 2013 as the base year. (In thousands) 2016 2015 2014 2013 Sales. $10,962 $10,266 $9,570 392 $8,700 350

> Compute economic value added (EVA®) for Beecher Software. The company’s cost of capital is 12%. Net income before taxes was $730 thousand, interest expense $403 thousand, beginning long-term debt $750 thousand, and beginning stockholders’ equity was $3,2

> Take the role of an investment analyst at Cole Binder. It is your job to recommend investments for your client. The only information you have is the following ratio values for two companies in the graphics software industry: Write a report to the Cole

> A skeleton of Pine Florals’ balance sheet appears as follows (amounts in thousands): Use the following ratio data to complete Pine Florals’ balance sheet: a. Debt ratio is 0.58. b. Current ratio is 1.10. c. Quick

> A skeleton of Pine Florals’ income statement appears as follows (amounts in thousands): Use the following ratio data to complete Pine Florals’ income statement: a. Inventory turnover was 4 (beginning inventory was $

> The annual report of Ferguson Cars, Inc., for the year ended December 31, 2016, included the following items (in millions): 1. Compute earnings per share (EPS) and the price-earnings ratio for Ferguson Cars’ stock. Round to the neares

> Verifine Corporation reported the following amounts on its 2016 comparative income Statements: Perform a horizontal analysis of revenues and net income—both in dollar amounts and in percentages—for 20

> Pratt Computer Sales, Inc., reported the following financial statements for 2016: Compute the following investing cash flows; enter all amounts in thousands. a. Acquisitions of plant assets (all were for cash). Pratt Com

> Supreme Manufacturing, Inc., reported the following at December 31, 2016, and December 31, 2017: Supreme Manufacturing has paid all preferred dividends through 2013. Requirement 1. Compute the total amounts of dividends to both preferred and common

> Prudhoe Bay Oil Co. is having its initial public offering (IPO) of company stock. To create public interest in its stock, Prudhoe Bay’s chief financial officer has blitzed the media with press releases. One in particular caught your eye. On November 19, P

> Use the data in SE12-7 to prepare Williams Corporation’s statement of cash flows for the year ended June 30, 2016. Williams uses the indirect method for operating activities. From SE12-7 Williams Corporation accountants

> Williams Corporation accountants have assembled the following data for the year ended June 30, 2016: Prepare the operating activities section of Williams’ statement of cash flows for the year ended June 30, 2016. Willia