Question: Phoebe Company ended its fiscal year on

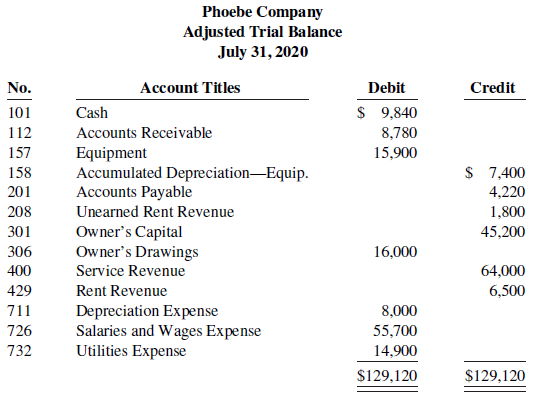

Phoebe Company ended its fiscal year on July 31, 2020. The company’s adjusted trial balance as of the end of its fiscal year is as follows.

Instructions

a. Prepare the closing entries using page J15.

b. Post to Owner’s Capital and No. 350 Income Summary accounts. (Use the three-column form.)

c. Prepare a post-closing trial balance at July 31.

Transcribed Image Text:

Phoebe Company Adjusted Trial Balance July 31, 2020 No. Account Titles Debit Credit 101 Cash $ 9,840 112 Accounts Receivable 8,780 Equipment Accumulated Depreciation-Equip. Accounts Payable Unearned Rent Revenue 157 15,900 158 $ 7,400 201 4,220 208 1,800 45,200 Owner's Capital Owner's Drawings 301 306 16,000 400 Service Revenue 64,000 429 Rent Revenue 6,500 Depreciation Expense Salaries and Wages Expense Utilities Expense 711 8,000 726 55,700 732 14,900 $129,120 $129,120

> In reviewing the accounts of Terri Kahn Co. at the end of the year, you discover that adjusting entries have not been made. Instructions Write a memo to Terri Kahn, the owner of Terri Kahn Co., that explains the following: the nature and purpose of adju

> Happy Camper Park was organized on April 1, 2019, by Erica Hatt. Erica is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Erica prepared the following income statement for the quarter that ended March 31,

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo, Inc.’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial stat

> The following situation is in chronological order. 1. Parker decides to buy a surfboard. 2. He calls Surfing USA Co. to inquire about its surfboards. 3. Two days later, he requests Surfing USA Co. to make a surfboard. 4. Three days later, Surfing USA Co.

> Russell Company is a pesticide manufacturer. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Russell’s chemical pesticides. In the coming year, Russell will have environmentally safe and competitive

> If your school has a subscription to the FASB Codifi cation, log in and prepare responses to the following. Instructions a. Access the glossary (“Master Glossary”) at the FASB Codification website to answer the following. 1. What is the definition of cu

> Companies prepare balance sheets in order to know their financial position at a specific point in time. This enables them to make a comparison to their position at previous points in time, and gives them a basis for planning for the future. In order to e

> Matilda Company reported the following amounts (in euros) in 2020: Net income, €150,000; Unrealized gain related to revaluation of buildings, €10,000; and Unrealized loss on non-trading securities, €(35,000). Determine Matilda’s total comprehensive incom

> Explain the differences between depreciation expense and accumulated depreciation.

> Explain the difference between the “nature-of-expense” and “function-of-expense” classifications.

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Identify five differences in the fo

> The following information is available for Sutter Bowling Alley at December 31, 2020. Buildings $128,800 Owner’s Capital $115,000 Accounts Receivable 14,520 Accumulated Depreciation—Buildings 42,600 Prepaid Insurance 4,680 Account

> The statement of financial position for Wallby Company includes the following accounts (in British pounds): Accounts Receivable £12,500, Prepaid Insurance £3,600, Cash £15,400, Supplies £5,200, and Debt Investments (short-term) £6,700. Prepare the curren

> In what ways does the format of a statement of financial of position under IFRS often diff er from a balance sheet presented under GAAP?

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Visit Louis Vuittonâ€&#

> At June 30, 2020, the end of its most recent fiscal year, Green River Computer Consultants’ post-closing trial balance was as follows: The company underwent a major expansion in July. New staff was hired and more fi nancing was obtain

> On August 1, 2020, the following were the account balances of B&B Repair Services. During August, the following summary transactions were completed. Aug. 1 Paid $400 cash for advertising in local newspapers. Advertising fl yers will be included w

> Lars Linken opened Lars Cleaners on March 1, 2020. During March, the following transactions were completed. Mar. 1 Owner invested $15,000 cash in the company. 1 Borrowed $6,000 cash by signing a 6-month, 6%, $6,000 note payable. Interest will be paid

> Mike Greenberg opened Kleene Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $12,000 cash in the company. 1 Purchased used truck for $8,000, paying $2,000 cash and the balance on accoun

> Celina Harris believes revenues from credit sales may be recorded before they are collected in cash. Do you agree? Explain.

> What standard classifications are used in preparing a classified balance sheet?

> How do correcting entries differ from adjusting entries?

> Which of the following accounts would not appear in the post-closing trial balance? Interest Payable, Equipment, Depreciation Expense, Owner’s Drawings, Unearned Service Revenue, Accumulated Depreciation—Equipment, and Service Revenue.

> What are the content and purpose of a post-closing trial balance?

> It is the end of November and Natalie has been in touch with her grandmother. Her grandmother asked Natalie how well things went in her fi rst month of business. Natalie, too, would like to know if she has been profitable or not during November. Natalie

> Natalie had a very busy December. At the end of the month, after journalizing and posting the December transactions and adjusting entries, Natalie prepared the following adjusted trial balance. Instructions Using the information in the adjusted trial b

> The adjusted trial balance of Sang Company shows the following data pertaining to sales at the end of its fiscal year October 31, 2020: Sales Revenue $820,000, Freight-Out $16,000, Sales Returns and Allowances $25,000, and Sales Discounts $13,000. Instr

> Presented below are transactions related to R. Humphrey Company. 1. On December 3, R. Humphrey Company sold $570,000 of merchandise on account to Frazier Co., terms 1/10, n/30, FOB destination. R. Humphrey paid $400 for freight charges. The cost of the m

> On June 10, Diaz Company purchased $8,000 of merchandise on account from Taylor Company, FOB shipping point, terms 2/10, n/30. Diaz pays the freight costs of $400 on June 11. Damaged goods totaling $300 are returned to Taylor for credit on June 12. The f

> On September 1, Nixa Office Supply had an inventory of 30 calculators at a cost of $18 each. The company uses a perpetual inventory system. During September, the following transactions occurred. Sept. 6 Purchased 90 calculators at $22 each from York. 9

> What is the debit/credit eff ect of a prepaid expense adjusting entry?

> Presented below are selected accounts for T. Swift Company as reported in the worksheet at the end of May 2020. Ending inventory is $75,000. Instructions Complete the worksheet by extending amounts reported in the adjustment trial balance to the appro

> Presented below is information related to Chung Co. 1. On April 5, purchased merchandise on account from Jose Company for $21,000, terms 2/10, net/30, FOB shipping point. 2. On April 6, paid freight costs of $800 on merchandise purchased from Jose. 3. On

> This information relates to Nandi Co. 1. On April 5, purchased merchandise on account from Dion Company for $25,000, terms 2/10, net/30, FOB shipping point. 2. On April 6, paid freight costs of $900 on merchandise purchased from Dion Company. 3. On April

> Information related to Kerber Co. is presented below. 1. On April 5, purchased merchandise on account from Wilkes Company for $23,000, terms 2/10, net/30, FOB shipping point. 2. On April 6, paid freight costs of $900 on merchandise purchased from Wilkes.

> Below is a series of cost of goods sold sections for companies B, F, L, and R. Instruction Fill in the lettered blanks to complete the cost of goods sold sections. B F R $ 180 1,620 40 $ 70 $1,000 (g) $ Beginning inventory Purchases (j) 43,590 (k)

> On January 1, 2020, Brooke Hanson Corporation had inventory of $50,000. At December 31, 2020, Brooke Hanson had the following account balances. At December 31, 2020, Brooke Hanson determines that its ending inventory is $60,000. Instructions a. Comput

> The trial balance of A. Wiencek Company at the end of its fiscal year, August 31, 2020, includes these accounts: Inventory $19,500; Purchases $149,000; Sales Revenue $190,000; Freight-In $5,000; Sales Returns and Allowances $3,000; Freight-Out $1,000; an

> The trial balance columns of the worksheet using a perpetual inventory system for Balistreri Company at June 30, 2020, are as follows. Other data: Operating expenses incurred on account, but not yet recorded, total $1,500. Instructions Enter the trial

> The following are selected accounts for McPhan Company as reported in the worksheet using a perpetual inventory system at the end of May 2020. Instructions Complete the worksheet by extending amounts reported in the adjusted trial balance to the approp

> Financial information is presented below for three different companies. Instructions Determine the missing amounts. Hardy Wang Wholesalers Yee Cosmetics Grocery Sales revenue $90,000 $ (e) $122,000 Sales returns and allowances (a) 86,000 56,000 5,0

> The trial balance of Beowulf Company includes the following balance sheet accounts, which may require adjustment. For each account that requires adjustment, indicate (a) the type of adjusting entry (prepaid expense, unearned revenue, accrued revenue, or

> Presented below is financial information for two different companies. Instructions a. Determine the missing amounts. b. Determine the gross profit rates. (Round to one decimal place.) Summer Company Winter Company Sales revenue $92,000 (d) $ 5,000

> Financial Statement In 2020, Laquen Company had net sales of $900,000 and cost of goods sold of $522,000. Operating expenses were $225,000, and interest expense was $11,000. Laquen prepares a multiple-step income statement. Instructions a. Compute Laque

> An inexperienced accountant for Stahr Company made the following errors in recording merchandising transactions. 1. A $210 refund to a customer for faulty merchandise was debited to Sales Revenue $210 and credited to Cash $210. 2. A $180 credit purchase

> Financial Statement In its income statement for the year ended December 31, 2020, Anhad Company reported the following condensed data. Operating expenses $ 725,000 Interest revenue $ 28,000 Cost of goods sold 1,289,000 Loss on disposa

> Mr. McKenzie has prepared the following list of statements about service companies and merchandisers. 1. Measuring net income for a merchandiser is conceptually the same as for a service company. 2. For a merchandiser, sales less operating expenses is ca

> The adjusted trial balance for Phoebe Company is presented in E4.8. Instructions a. Prepare an income statement and an owner’s equity statement for the year. Phoebe did not make any capital investments during the year. b. Prepare a cla

> Victoria Lee Company had the following adjusted trial balance. Instructions a. Prepare closing entries at June 30, 2020. b. Prepare a post-closing trial balance. Victoria Lee Company Adjusted Trial Balance For the Month Ended June 30, 2020 Adjusted

> Selected worksheet data for Bonita Company are presented below. Instructions a. Fill in the missing amounts. b. Prepare the adjusting entries that were made. Adjusted Account Titles Trial Balance Trial Balance Dr. Cr. Dr. Cr. Accounts Receivable 34

> The adjustments columns of the worksheet for Becker Company are shown below. Instructions a. Prepare the adjusting entries. b. Assuming the adjusted trial balance amount for each account is normal, indicate the financial statement column to which each

> The bookkeeper for Abduli Company asks you to prepare the following accrued adjusting entries at December 31. 1. Interest on notes payable of $400 is accrued. 2. Services performed but not recorded total $2,300. 3. Salaries earned by employees of $900 ha

> Worksheet data for Auburn Company are presented in E4.2. Instructions a. Journalize the closing entries at April 30. b. Post the closing entries to Income Summary and Owner’s Capital. Use T-accounts. c. Prepare a post-closing trial bal

> Worksheet data for Auburn Company are presented in E4.2. The owner did not make any additional investments in the business in April. Instructions Prepare an income statement, an owner’s equity statement, and a classified balance sheet.

> On December 31, the adjusted trial balance of Shihata Employment Agency shows the following selected data. Accounts Receivable $24,500 Service Revenue $92,500 Interest Expense 7,700 Interest Payable 2,200 Analysis shows that adjusting entries were m

> Krantz Company pays salaries of $15,000 every Monday for the preceding 5-day week (Monday through Friday). Assume December 31 falls on a Tuesday, so Krantz’s employees have worked 2 days without being paid at the end of the fiscal year. Instructions a.

> These financial statement items are for Basten Company at yearend, July 31, 2020. Salaries and wages payable $ 2,080 Notes payable (long-term) $ 1,800 Salaries and wages expense 48,700 Cash 14,200 Utilities expense 22,600 Accounts receivable 9,780

> The following items were taken from the financial statements of P. Jimenez Company. (All amounts are in thousands.) Long-term debt $ 1,000 Accumulated depreciation—equipment $ 5,655 Prepaid insurance 650 Accounts payable 1,214 Equipment 11,500

> The following are the major balance sheet classifications. Instructions Classify each of the following accounts taken from Faust Company’s balance sheet. ________ Accounts payable ________ Accumulated depreciation—eq

> The adjusted trial balance for Carter Bowling Alley at December 31, 2020, contains the following accounts. Instructions a. Prepare a classified balance sheet; assume that $30,000 of the note payable will be paid in 2021. b. Comment on the liquidity of

> Patel Company has an inexperienced accountant. During the first 2 weeks on the job, the accountant made the following errors in journalizing transactions. All entries were posted as made. 1. A payment on account of $750 to a creditor was debited to Accou

> Blair Natt Company discovered the following errors made in January 2020. 1. A payment of Salaries and Wages Expense of $700 was debited to Equipment and credited to Cash, both for $700. 2. A collection of $1,500 from a client on account was debited to Ca

> What components of revenues and expenses are different between merchandising and service companies?

> Selected accounts for Tamora’s Salon are presented below. All June 30 postings are from closing entries. Instructions a. Prepare the closing entries that were made. b. Post the closing entries to Income Summary. Salaries and Wages

> Ray Louis has prepared the following list of statements about the accounting cycle. 1. “Journalize the transactions” is the first step in the accounting cycle. 2. Reversing entries are a required step in the accounting cycle. 3. Correcting entries do not

> A friend of yours, Mindy Gare, recently completed an undergraduate degree in science and has just started working with a biotechnology company. Mindy tells you that the owners of the business are trying to secure new sources of financing which are needed

> Speyeware International Inc., headquartered in Vancouver, Canada, specializes in Internet safety and computer security products for both the home and commercial markets. In a recent balance sheet, it reported a defi cit of US$5,678,288. It has reported o

> The following characteristics, assumptions, principles, or constraint guide the FASB when it creates accounting standards. Match each item above with a description below. 1. ________ Ability to easily evaluate one company’s results re

> Weber Co. had three major business transactions during 2020. a. Reported at its fair value of $260,000 merchandise inventory with a cost of $208,000. b. The president of Weber Co., Austin Weber, purchased a truck for personal use and charged it to his ex

> The trial balance columns of the worksheet for Dixon Company at June 30, 2020, are as follows. Other data: 1. A physical count reveals $500 of supplies on hand. 2. $100 of the unearned revenue is still unearned at month-end. 3. Accrued salaries are $21

> At Sekon Company, prepayments are debited to expense when paid, and unearned revenues are credited to revenue when cash is received. During January of the current year, the following transactions occurred. Jan. 2 Paid $1,920 for fi re insurance protecti

> Bob Zeller Company has the following balances in selected accounts on December 31, 2020. Service Revenue …………………………… $40,000 Insurance Expense ………………………... $ 2,400 Supplies Expense …………………………... $ 2,450 All the accounts have normal balances. Bob Zeller

> The following data are taken from the comparative balance sheets of Bundies Billiards Club, which prepares its financial statements using the accrual basis of accounting. Members are billed based upon their use of the club’s facilitie

> Anya Clark opened Anya’s Cleaning Service on July 1, 2020. During July, the following transactions were completed. July 1 Anya invested $20,000 cash in the business. 1 Purchased used truck for $12,000, paying $4,000 cash and the balance on account. 3

> The adjusted trial balance for Renfro Company is given in E3.17. Instructions Prepare the income and owner’s equity statements for the year and the balance sheet at August 31. Data from E3.17: Renfro Company Trial Balance August

> At the beginning of the current season on April 1, the ledger of Gage Pro Shop showed Cash $3,000, Inventory $4,000, and Owner’s Capital $7,000. These transactions occurred during April 2020. Apr. 5 Purchased golf bags, clubs, and balls on account from

> Kayla Inc. operates a retail operation that purchases and sells home entertainment products. The company purchases all merchandise inventory on credit and uses a periodic inventory system. The Accounts Payable account is used for recording inventory purc

> At the end of Donaldson Department Store’s fiscal year on November 30, 2020, these accounts appeared in its adjusted trial balance. Additional facts: 1. Merchandise inventory on November 30, 2020, is $52,600. 2. Donaldson Department S

> The trial balance of Gaolee Fashion Center contained the following accounts at November 30, the end of the company’s fiscal year. Adjustment data: 1. Supplies on hand totaled $2,600. 2. Depreciation is $11,500 on the equipment. 3. Int

> Yolanda Hagen, a former disc golf star, operates Yolanda’s Discorama. At the beginning of the current season on April 1, the ledger of Yolanda’s Discorama showed Cash $1,800, Inventory $2,500, and Owner’s Capital $4,300. The following transactions were c

> Big Box Store is located in midtown Madison. During the past several years, net income has been declining because of suburban shopping centers. At the end of the company’s fiscal year on November 30, 2020, the following accounts appeare

> Renner Hardware Store completed the following merchandising transactions in the month of May. At the beginning of May, the ledger of Renner showed Cash of $5,000 and Owner’s Capital of $5,000. May 1 Purchased merchandise on account from Braun’s Wholesal

> Kern’s Book Warehouse distributes hardcover books to retail stores and extends credit terms of 2/10, n/30 to all of its customers. At the end of May, Kern’s inventory consisted of books purchased for $1,800. During June, the following merchandising trans

> Horace Culpepper, CPA, was retained by Pulsar Cable to prepare financial statements for April 2020. Horace accumulated all the ledger balances per Pulsar’s records and found the following. Horace Culpepper then reviewed the records an

> In completing the engagement in Question 3, Hardy pays no costs in March, $2,000 in April, and $2,500 in May (incurred in April). How much expense should the fi rm deduct from revenues in the month when it recognizes the revenue? Why?

> Whitegloves Janitorial Service was started 2 years ago by Jenna Olson. Because business has been exceptionally good, Jenna decided on July 1, 2020, to expand operations by acquiring an additional truck and hiring two more assistants. To finance the expan

> Hasty plc’s financial year ended on 31 March 20X8. Inventory taken on 7 April 20X8 amounted to £100,000. The following information needs to be taken into account: (i) Sales invoices totaling £9,000 were raised during the seven days after the year-end. £1

> The accountant of Hanson Products Ltd has asked you how your answer to Question 7 above would be affected using the following two methods of calculating deferred taxation. Required: (a) For each of the years from 20X1 to 20X5, calculate the deferred tax

> Uptodate plc’s financial year ended on 31 March 20X8. Inventory taken on 7 April 20X8 amounted to £200,000. The following information needs to be taken into account: (i) Purchases made during the seven days to 7 April amounted to £40,000. Invoices had no

> Alpha Ltd makes one standard article. You have been given the following information: 1 The inventory sheets at the year-end show the following items: 2 Manufacturing overheads are 100% of labour cost. Selling and distribution expenses are £

> Delta Ltd has been developing a lightweight automated wheelchair. The research costs written off have been far greater than originally estimated and the equity and preference capital has been eroded as seen on the statement of financial position. The fol

> Speedster Ltd commenced trading in 1986 as a wholesaler of lightweight travel accessories. The company was efficient and traded successfully until 2000 when new competitors entered the market selling at lower prices which Speedster could not match. The c

> In the year to 31 December 20X9, Amy bought a new machine and made the following payments in relation to it: Required: (a) State and justify the cost figure which should be used as the basis for depreciation. (b) What does depreciation do, and why is i

> (a) On 1 October 2012, Paradigm acquired 75% of Strata’s equity shares by means of a share exchange of two new shares in Paradigm for every five acquired shares in Strata. In addition, Paradigm issued to the shareholders of Strata a $10

> Discuss the advantages to a company of: (a) purchasing and cancelling its own shares; (b) purchasing and holding its own shares in treasury.

> Applying the principles of control in IFRS 10 Consolidated Financial Statements, as described in Section 22.3.2 of this chapter, you are required to consider whether certain investments of Austin plc are subsidiaries. Austin plc has investments in a numb

> Base plc acquired 60% of the common shares of Ball plc on 1 January 20X0 and gained control. At that date the statements of financial position of the two companies were as follows: Note: The fair value of the property, plant and equipment in Ball at 1/

> Boldwin Construction has entered into a contract with Spears Retailers to construct a new department store on Spears land. The contract sum is £45 million. At 30 June 20X1 the situation is as follows: (a) the contract is 30% complete; (b) expenses to dat

> Norwik Construction plc is a large construction company involved in multiple large contracts around the world. One contract to build three stadiums is being undertaken by the Australasian division. Each stadium has an individual contract price. Jim Norwi