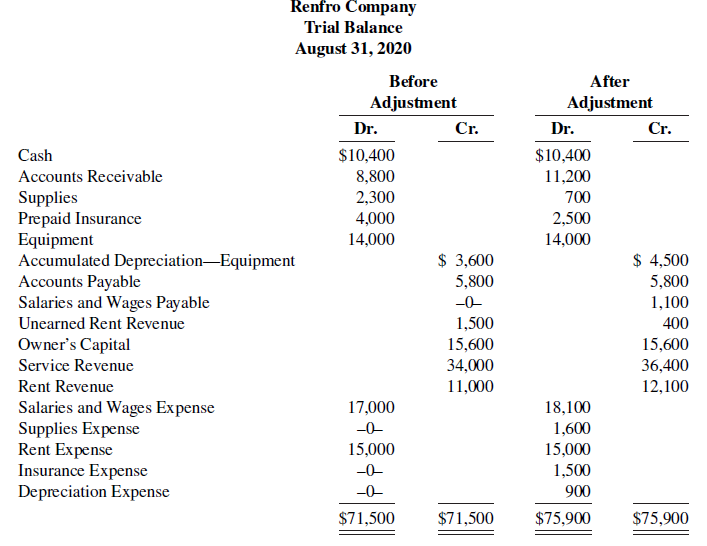

Question: The adjusted trial balance for Renfro Company

The adjusted trial balance for Renfro Company is given in E3.17.

Instructions

Prepare the income and owner’s equity statements for the year and the balance sheet at August 31.

Data from E3.17:

Transcribed Image Text:

Renfro Company Trial Balance August 31, 2020 Before After Adjustment Adjustment Dr. Cr. Dr. Cr. Cash $10,400 8,800 2,300 4,000 14,000 $10,400 Accounts Receivable 11,200 Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable 700 2,500 14,000 $ 3,600 5,800 $ 4,500 5,800 -0- 1,100 Unearned Rent Revenue 1,500 400 Owner's Capital 15,600 15,600 Service Revenue 34,000 36,400 Rent Revenue 11,000 12,100 Salaries and Wages Expense Supplies Expense Rent Expense Insurance Expense Depreciation Expense 17,000 18,100 1,600 15,000 1,500 -0- 15,000 -0- -0- 900 $71,500 $71,500 $75,900 $75,900

> The adjusted trial balance of Sang Company shows the following data pertaining to sales at the end of its fiscal year October 31, 2020: Sales Revenue $820,000, Freight-Out $16,000, Sales Returns and Allowances $25,000, and Sales Discounts $13,000. Instr

> Presented below are transactions related to R. Humphrey Company. 1. On December 3, R. Humphrey Company sold $570,000 of merchandise on account to Frazier Co., terms 1/10, n/30, FOB destination. R. Humphrey paid $400 for freight charges. The cost of the m

> On June 10, Diaz Company purchased $8,000 of merchandise on account from Taylor Company, FOB shipping point, terms 2/10, n/30. Diaz pays the freight costs of $400 on June 11. Damaged goods totaling $300 are returned to Taylor for credit on June 12. The f

> On September 1, Nixa Office Supply had an inventory of 30 calculators at a cost of $18 each. The company uses a perpetual inventory system. During September, the following transactions occurred. Sept. 6 Purchased 90 calculators at $22 each from York. 9

> What is the debit/credit eff ect of a prepaid expense adjusting entry?

> Presented below are selected accounts for T. Swift Company as reported in the worksheet at the end of May 2020. Ending inventory is $75,000. Instructions Complete the worksheet by extending amounts reported in the adjustment trial balance to the appro

> Presented below is information related to Chung Co. 1. On April 5, purchased merchandise on account from Jose Company for $21,000, terms 2/10, net/30, FOB shipping point. 2. On April 6, paid freight costs of $800 on merchandise purchased from Jose. 3. On

> This information relates to Nandi Co. 1. On April 5, purchased merchandise on account from Dion Company for $25,000, terms 2/10, net/30, FOB shipping point. 2. On April 6, paid freight costs of $900 on merchandise purchased from Dion Company. 3. On April

> Information related to Kerber Co. is presented below. 1. On April 5, purchased merchandise on account from Wilkes Company for $23,000, terms 2/10, net/30, FOB shipping point. 2. On April 6, paid freight costs of $900 on merchandise purchased from Wilkes.

> Below is a series of cost of goods sold sections for companies B, F, L, and R. Instruction Fill in the lettered blanks to complete the cost of goods sold sections. B F R $ 180 1,620 40 $ 70 $1,000 (g) $ Beginning inventory Purchases (j) 43,590 (k)

> On January 1, 2020, Brooke Hanson Corporation had inventory of $50,000. At December 31, 2020, Brooke Hanson had the following account balances. At December 31, 2020, Brooke Hanson determines that its ending inventory is $60,000. Instructions a. Comput

> The trial balance of A. Wiencek Company at the end of its fiscal year, August 31, 2020, includes these accounts: Inventory $19,500; Purchases $149,000; Sales Revenue $190,000; Freight-In $5,000; Sales Returns and Allowances $3,000; Freight-Out $1,000; an

> The trial balance columns of the worksheet using a perpetual inventory system for Balistreri Company at June 30, 2020, are as follows. Other data: Operating expenses incurred on account, but not yet recorded, total $1,500. Instructions Enter the trial

> The following are selected accounts for McPhan Company as reported in the worksheet using a perpetual inventory system at the end of May 2020. Instructions Complete the worksheet by extending amounts reported in the adjusted trial balance to the approp

> Financial information is presented below for three different companies. Instructions Determine the missing amounts. Hardy Wang Wholesalers Yee Cosmetics Grocery Sales revenue $90,000 $ (e) $122,000 Sales returns and allowances (a) 86,000 56,000 5,0

> The trial balance of Beowulf Company includes the following balance sheet accounts, which may require adjustment. For each account that requires adjustment, indicate (a) the type of adjusting entry (prepaid expense, unearned revenue, accrued revenue, or

> Presented below is financial information for two different companies. Instructions a. Determine the missing amounts. b. Determine the gross profit rates. (Round to one decimal place.) Summer Company Winter Company Sales revenue $92,000 (d) $ 5,000

> Financial Statement In 2020, Laquen Company had net sales of $900,000 and cost of goods sold of $522,000. Operating expenses were $225,000, and interest expense was $11,000. Laquen prepares a multiple-step income statement. Instructions a. Compute Laque

> An inexperienced accountant for Stahr Company made the following errors in recording merchandising transactions. 1. A $210 refund to a customer for faulty merchandise was debited to Sales Revenue $210 and credited to Cash $210. 2. A $180 credit purchase

> Financial Statement In its income statement for the year ended December 31, 2020, Anhad Company reported the following condensed data. Operating expenses $ 725,000 Interest revenue $ 28,000 Cost of goods sold 1,289,000 Loss on disposa

> Mr. McKenzie has prepared the following list of statements about service companies and merchandisers. 1. Measuring net income for a merchandiser is conceptually the same as for a service company. 2. For a merchandiser, sales less operating expenses is ca

> The adjusted trial balance for Phoebe Company is presented in E4.8. Instructions a. Prepare an income statement and an owner’s equity statement for the year. Phoebe did not make any capital investments during the year. b. Prepare a cla

> Phoebe Company ended its fiscal year on July 31, 2020. The company’s adjusted trial balance as of the end of its fiscal year is as follows. Instructions a. Prepare the closing entries using page J15. b. Post to Owner’

> Victoria Lee Company had the following adjusted trial balance. Instructions a. Prepare closing entries at June 30, 2020. b. Prepare a post-closing trial balance. Victoria Lee Company Adjusted Trial Balance For the Month Ended June 30, 2020 Adjusted

> Selected worksheet data for Bonita Company are presented below. Instructions a. Fill in the missing amounts. b. Prepare the adjusting entries that were made. Adjusted Account Titles Trial Balance Trial Balance Dr. Cr. Dr. Cr. Accounts Receivable 34

> The adjustments columns of the worksheet for Becker Company are shown below. Instructions a. Prepare the adjusting entries. b. Assuming the adjusted trial balance amount for each account is normal, indicate the financial statement column to which each

> The bookkeeper for Abduli Company asks you to prepare the following accrued adjusting entries at December 31. 1. Interest on notes payable of $400 is accrued. 2. Services performed but not recorded total $2,300. 3. Salaries earned by employees of $900 ha

> Worksheet data for Auburn Company are presented in E4.2. Instructions a. Journalize the closing entries at April 30. b. Post the closing entries to Income Summary and Owner’s Capital. Use T-accounts. c. Prepare a post-closing trial bal

> Worksheet data for Auburn Company are presented in E4.2. The owner did not make any additional investments in the business in April. Instructions Prepare an income statement, an owner’s equity statement, and a classified balance sheet.

> On December 31, the adjusted trial balance of Shihata Employment Agency shows the following selected data. Accounts Receivable $24,500 Service Revenue $92,500 Interest Expense 7,700 Interest Payable 2,200 Analysis shows that adjusting entries were m

> Krantz Company pays salaries of $15,000 every Monday for the preceding 5-day week (Monday through Friday). Assume December 31 falls on a Tuesday, so Krantz’s employees have worked 2 days without being paid at the end of the fiscal year. Instructions a.

> These financial statement items are for Basten Company at yearend, July 31, 2020. Salaries and wages payable $ 2,080 Notes payable (long-term) $ 1,800 Salaries and wages expense 48,700 Cash 14,200 Utilities expense 22,600 Accounts receivable 9,780

> The following items were taken from the financial statements of P. Jimenez Company. (All amounts are in thousands.) Long-term debt $ 1,000 Accumulated depreciation—equipment $ 5,655 Prepaid insurance 650 Accounts payable 1,214 Equipment 11,500

> The following are the major balance sheet classifications. Instructions Classify each of the following accounts taken from Faust Company’s balance sheet. ________ Accounts payable ________ Accumulated depreciation—eq

> The adjusted trial balance for Carter Bowling Alley at December 31, 2020, contains the following accounts. Instructions a. Prepare a classified balance sheet; assume that $30,000 of the note payable will be paid in 2021. b. Comment on the liquidity of

> Patel Company has an inexperienced accountant. During the first 2 weeks on the job, the accountant made the following errors in journalizing transactions. All entries were posted as made. 1. A payment on account of $750 to a creditor was debited to Accou

> Blair Natt Company discovered the following errors made in January 2020. 1. A payment of Salaries and Wages Expense of $700 was debited to Equipment and credited to Cash, both for $700. 2. A collection of $1,500 from a client on account was debited to Ca

> What components of revenues and expenses are different between merchandising and service companies?

> Selected accounts for Tamora’s Salon are presented below. All June 30 postings are from closing entries. Instructions a. Prepare the closing entries that were made. b. Post the closing entries to Income Summary. Salaries and Wages

> Ray Louis has prepared the following list of statements about the accounting cycle. 1. “Journalize the transactions” is the first step in the accounting cycle. 2. Reversing entries are a required step in the accounting cycle. 3. Correcting entries do not

> A friend of yours, Mindy Gare, recently completed an undergraduate degree in science and has just started working with a biotechnology company. Mindy tells you that the owners of the business are trying to secure new sources of financing which are needed

> Speyeware International Inc., headquartered in Vancouver, Canada, specializes in Internet safety and computer security products for both the home and commercial markets. In a recent balance sheet, it reported a defi cit of US$5,678,288. It has reported o

> The following characteristics, assumptions, principles, or constraint guide the FASB when it creates accounting standards. Match each item above with a description below. 1. ________ Ability to easily evaluate one company’s results re

> Weber Co. had three major business transactions during 2020. a. Reported at its fair value of $260,000 merchandise inventory with a cost of $208,000. b. The president of Weber Co., Austin Weber, purchased a truck for personal use and charged it to his ex

> The trial balance columns of the worksheet for Dixon Company at June 30, 2020, are as follows. Other data: 1. A physical count reveals $500 of supplies on hand. 2. $100 of the unearned revenue is still unearned at month-end. 3. Accrued salaries are $21

> At Sekon Company, prepayments are debited to expense when paid, and unearned revenues are credited to revenue when cash is received. During January of the current year, the following transactions occurred. Jan. 2 Paid $1,920 for fi re insurance protecti

> Bob Zeller Company has the following balances in selected accounts on December 31, 2020. Service Revenue …………………………… $40,000 Insurance Expense ………………………... $ 2,400 Supplies Expense …………………………... $ 2,450 All the accounts have normal balances. Bob Zeller

> The following data are taken from the comparative balance sheets of Bundies Billiards Club, which prepares its financial statements using the accrual basis of accounting. Members are billed based upon their use of the club’s facilitie

> Anya Clark opened Anya’s Cleaning Service on July 1, 2020. During July, the following transactions were completed. July 1 Anya invested $20,000 cash in the business. 1 Purchased used truck for $12,000, paying $4,000 cash and the balance on account. 3

> At the beginning of the current season on April 1, the ledger of Gage Pro Shop showed Cash $3,000, Inventory $4,000, and Owner’s Capital $7,000. These transactions occurred during April 2020. Apr. 5 Purchased golf bags, clubs, and balls on account from

> Kayla Inc. operates a retail operation that purchases and sells home entertainment products. The company purchases all merchandise inventory on credit and uses a periodic inventory system. The Accounts Payable account is used for recording inventory purc

> At the end of Donaldson Department Store’s fiscal year on November 30, 2020, these accounts appeared in its adjusted trial balance. Additional facts: 1. Merchandise inventory on November 30, 2020, is $52,600. 2. Donaldson Department S

> The trial balance of Gaolee Fashion Center contained the following accounts at November 30, the end of the company’s fiscal year. Adjustment data: 1. Supplies on hand totaled $2,600. 2. Depreciation is $11,500 on the equipment. 3. Int

> Yolanda Hagen, a former disc golf star, operates Yolanda’s Discorama. At the beginning of the current season on April 1, the ledger of Yolanda’s Discorama showed Cash $1,800, Inventory $2,500, and Owner’s Capital $4,300. The following transactions were c

> Big Box Store is located in midtown Madison. During the past several years, net income has been declining because of suburban shopping centers. At the end of the company’s fiscal year on November 30, 2020, the following accounts appeare

> Renner Hardware Store completed the following merchandising transactions in the month of May. At the beginning of May, the ledger of Renner showed Cash of $5,000 and Owner’s Capital of $5,000. May 1 Purchased merchandise on account from Braun’s Wholesal

> Kern’s Book Warehouse distributes hardcover books to retail stores and extends credit terms of 2/10, n/30 to all of its customers. At the end of May, Kern’s inventory consisted of books purchased for $1,800. During June, the following merchandising trans

> Horace Culpepper, CPA, was retained by Pulsar Cable to prepare financial statements for April 2020. Horace accumulated all the ledger balances per Pulsar’s records and found the following. Horace Culpepper then reviewed the records an

> In completing the engagement in Question 3, Hardy pays no costs in March, $2,000 in April, and $2,500 in May (incurred in April). How much expense should the fi rm deduct from revenues in the month when it recognizes the revenue? Why?

> Whitegloves Janitorial Service was started 2 years ago by Jenna Olson. Because business has been exceptionally good, Jenna decided on July 1, 2020, to expand operations by acquiring an additional truck and hiring two more assistants. To finance the expan

> Hasty plc’s financial year ended on 31 March 20X8. Inventory taken on 7 April 20X8 amounted to £100,000. The following information needs to be taken into account: (i) Sales invoices totaling £9,000 were raised during the seven days after the year-end. £1

> The accountant of Hanson Products Ltd has asked you how your answer to Question 7 above would be affected using the following two methods of calculating deferred taxation. Required: (a) For each of the years from 20X1 to 20X5, calculate the deferred tax

> Uptodate plc’s financial year ended on 31 March 20X8. Inventory taken on 7 April 20X8 amounted to £200,000. The following information needs to be taken into account: (i) Purchases made during the seven days to 7 April amounted to £40,000. Invoices had no

> Alpha Ltd makes one standard article. You have been given the following information: 1 The inventory sheets at the year-end show the following items: 2 Manufacturing overheads are 100% of labour cost. Selling and distribution expenses are £

> Delta Ltd has been developing a lightweight automated wheelchair. The research costs written off have been far greater than originally estimated and the equity and preference capital has been eroded as seen on the statement of financial position. The fol

> Speedster Ltd commenced trading in 1986 as a wholesaler of lightweight travel accessories. The company was efficient and traded successfully until 2000 when new competitors entered the market selling at lower prices which Speedster could not match. The c

> In the year to 31 December 20X9, Amy bought a new machine and made the following payments in relation to it: Required: (a) State and justify the cost figure which should be used as the basis for depreciation. (b) What does depreciation do, and why is i

> (a) On 1 October 2012, Paradigm acquired 75% of Strata’s equity shares by means of a share exchange of two new shares in Paradigm for every five acquired shares in Strata. In addition, Paradigm issued to the shareholders of Strata a $10

> Discuss the advantages to a company of: (a) purchasing and cancelling its own shares; (b) purchasing and holding its own shares in treasury.

> Applying the principles of control in IFRS 10 Consolidated Financial Statements, as described in Section 22.3.2 of this chapter, you are required to consider whether certain investments of Austin plc are subsidiaries. Austin plc has investments in a numb

> Base plc acquired 60% of the common shares of Ball plc on 1 January 20X0 and gained control. At that date the statements of financial position of the two companies were as follows: Note: The fair value of the property, plant and equipment in Ball at 1/

> Boldwin Construction has entered into a contract with Spears Retailers to construct a new department store on Spears land. The contract sum is £45 million. At 30 June 20X1 the situation is as follows: (a) the contract is 30% complete; (b) expenses to dat

> Norwik Construction plc is a large construction company involved in multiple large contracts around the world. One contract to build three stadiums is being undertaken by the Australasian division. Each stadium has an individual contract price. Jim Norwi

> IAS 10 deals with events after the reporting period. Required: (a) Define the period covered by IAS 10. (b) Explain when the financial statements should be adjusted. (c) Why should non-adjusting events be disclosed? (d) A customer made a claim for £50,

> During its financial year ended 30 June 20X7 Beavers, an engineering company, has worked on several contracts. Information relating to one for Dam Ltd which is being constructed to a specific customer design is given below: The plant and equipment is e

> The trial balance for LPO at 31 December 2013 was as follows: Notes: (i) Closing inventory at 31 December 2013 was $562,000. (ii) On 31 December 2013, LPO disposed of some obsolete plant and equipment for $3,000. The plant and equipment had originally

> MACTAR has a series of contracts to resurface sections of motorways. The scale of the contract means several years’ work and each motorway section is regarded as a separate contract. The M62 contract has had major difficulties due to

> Agriculture is a key business activity in many parts of the world, particularly in developing countries. Following extensive discussions with, and funding from, the World Bank, the International Accounting Standards Committee (IASC) developed an accounti

> The statement of income of Bottom, a manufacturing company, for the year ending 31 January 20X2 is as follows: Bottom has used the LIFO method of inventory valuation but the directors wish to assess the implications of using the FIFO method. Relevant d

> The following is the statement of financial position of Alpha Ltd as on 30 June 20X8: The following information is relevant: 1 There are contingent liabilities in respect of (i) a guarantee given to bankers to cover a loan of £30,000 made

> The following are the financial statements of the parent company Swish plc, a subsidiary company Broom and an associate company Handle. Swish acquired 90% of the shares in Broom on 1 January 20X1 when the balance on the retained earnings of Broom was

> The following are the statements of financial position of Garden plc, its subsidiary Rose Ltd and its associate Petal Ltd: On 1 January 20X3 Garden plc acquired 75% of Rose Ltd for £300,000 when Rose’s share capital and r

> The following are the financial statements of the parent company Alpha plc, a subsidiary company Beta and an associate company Gamma. On 1 January 20X5 Alpha plc acquired 80% of Beta plc for £216,000 when Beta plc’s share

> The statements of comprehensive income for Highway plc, Road Ltd and Lane Ltd for the year ended 31 December 20X9 were as follows: Highway plc acquired 80% of Road Ltd for $160,000 on 1.1.20X6 when Road Ltd’s share capital was $64,000

> The statements of income for Continent plc, Island Ltd and River Ltd for the year ended 31 December 20X9 were as follows: Continent plc acquired 80% of Island Ltd for €27,500 on 1 January 20X3, when Island Ltd’s retai

> Rumpus plc is a public listed manufacturing company. Its summarized consolidated financial statements for the year ended 31 March 2014 (and 2013 comparatives where relevant) are as follows: The following additional information is available: (i) The g

> H Ltd has one subsidiary, S Ltd. The company has held a controlling interest for several years. The latest financial statements for the two companies and the consolidated financial statements for the H Group are as shown below: Required: (a) Calculate

> The statements of financial position of Red Ltd and Pink Ltd at 31 December 20X2 are as follows: Statements of comprehensive income for the year ended 31 December 20x2 Red Ltd acquired 75% of the shares in Pink Ltd on 1 January 20X0 when Pink Ltd&aci

> The statements of financial position of Mars plc and Jupiter plc at 31 December 20X2 are as follows: Statements of comprehensive income for the year ended 31 December 20x2 Mars acquired 80% of the shares in Jupiter on 1 January 20X0 when Jupiter&acir

> Gamma is a company that manufactures power tools. Gamma was established by Mr Lee, who owns all of Gamma’s shares. Mrs Lee, Mr Lee’s wife, owns a controlling interest in Delta, a distributor of power tools. Delta is on

> Donna, Inc. operates a defined benefit pension scheme for staff. The pension scheme has been operating for a number of years but not following IAS 19. The finance director is unsure of which accounting policy to adopt under IAS 19 because he has heard ve

> River plc acquired 90% of the common shares and 10% of the 5% bonds in Pool Ltd on 31 March 20X1. All income and expenses are deemed to accrue evenly through the year. On 31 January 20X1 River sold Pool goods for £6,000 plus a markup of one-

> Morn Ltd acquired 90% of the shares in Eve Ltd on 1 January 20X1 for £90,000 when Eve Ltd’s accumulated profits were £50,000. On 10 January 20X1 Morn Ltd received a dividend of £10,800 from Eve Ltd

> Bill plc acquired 80% of the common shares and 10% of the preferred shares in Ben plc on 31 December three years ago when Ben’s retained profits were €45,000. During the year Bill sold Ben goods for €8,

> Forest plc acquired 80% of the ordinary shares of Bulwell plc some years ago. At acquisition, the fair values of the assets of Bulwell plc were the same as their carrying value. Bulwell plc manufacture plant and equipment. On 1 January 20X3, Bulwell sold

> The following are the summarized financial statements of two companies, Peel and Caval, for the financial year ended 31 October 2011. The following information is available: (i) Peel purchased 90% of the ordinary shares in Caval for £240m

> Hyson plc acquired 75% of the shares in Green plc on 1 January 20X0 for £6 million when Green plc’s accumulated profits were £4.5 million. At acquisition, the fair value of Green’s non-current

> The following accounts are the consolidated statement of financial position and parent company statement of financial position for Alpha Ltd as at 30 June 20X2: Notes: 1 There was only one subsidiary, called Beta Ltd. 2 There were no capital reserves i

> On 1 January 20X0 Hill plc purchased 70% of the ordinary shares of Valley plc for £1.3 million. The fair value of the non-controlling interest at that date was £0.5 million. At the date of acquisition, Valley’s

> Prop and Flap have produced the following statements of financial position as at 31 October 2008: The following information is relevant to the preparation of the financial statements of the Prop Group: 1 Prop acquired 80% of the issued ordinary share c