Question: Portland Electronics Company’s (PEC) president,

Portland Electronics Company’s (PEC) president, Marsha Kunselman, is concerned about the prospects of one of the firm’s major products. The president has been reviewing a marketing report with Jeff Keller, marketing product manager, for their top-of-the-line stereo amplifier. The report indicates another price reduction is needed to meet anticipated competitors’ reductions in sales prices. The current selling price for PEC’s amplifier is $700 per unit. It is expected that within three months PEC’s two major competitors will be selling their comparable amplifiers for $600 per unit. This concerns

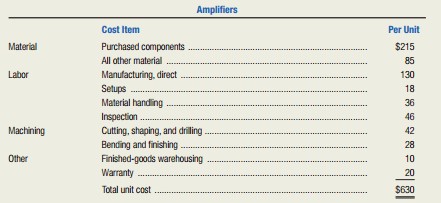

Kunselman because PEC’s current cost of producing the amplifiers is $630, which yields a $70 profit on each unit sold.

The situation is especially disturbing because PEC had implemented an activity-based costing (ABC) system about two years ago. The ABC system helped them better identify costs, cost pools, cost drivers, and cost reduction opportunities. Changes made when adopting ABC reduced costs on this product by approximately 15 percent during the last two years. Now it appears that costs will need to be reduced considerably more to remain competitive and to earn a profit on the amplifier. Total costs to produce, sell, and service the amplifiers are as follows:

Kunselman has decided to hire Donald Collins, a consultant, to help decide how to proceed. After a value-engineering analysis, Collins suggested that PEC adopt a just-in-time (JIT) cell manufacturing process to help reduce costs. He also suggested that using target costing would help in meeting the new target price. By changing to a JIT cell manufacturing system, PEC expects that manufacturing direct labor will increase by $30 per finished unit. However, setup, material handling, inspection, and finished goods warehousing will all be eliminated. Machine costs will be reduced from $70 to $60 per unit, and warranty costs are expected to be reduced by 40 percent.

Required:

1. Define target costing.

2. Define value engineering.

3. Determine Portland Electronics Company’s unit target cost at the $600 competitive sales price while maintaining the same percentage of profit on sales as is earned on the current $700 sales price.

4. If the just-in-time cell manufacturing process is implemented with the changes in costs noted, will PEC meet the unit target cost you determined in requirement (3)? Prepare a schedule detailing cost reductions and the unit cost under the proposed JIT cell manufacturing process.

Transcribed Image Text:

Amplifiers Cost Item Per Unit Material Purchased components $215 All other material 85 Labor Manufacturing, direct 130 Setups 18 Material handling. 36 46 Inspection Cutting, shaping, and drilling Machining 42 Bending and finishing 28 Other Finished-goods warehousing 10 Warranty 20 Total unit cost $630

> “All this marginal revenue and marginal cost stuff is just theory. Prices are determined by production costs.” Evaluate this assertion.

> Briefly explain the potential negative consequences in pricing decisions from using a traditional, volume based product-costing system.

> Refer to the data f or Riverside Clinic given in Exhibits 17–2 and 17–5. Exhibit 17-2: Exhibit 17-5: Required: Use the reciprocal-services method in combination with the dual-allocation approach to allocate Rive

> What is meant by a post audit of an investment project?

> Chemco, Inc., manufactures two products out of a joint process: Compod and U ltrasene. The joint costs incurred are $750,000 for a standard production run that generates 120,000 gallons of Compod and 80,000 gallons of Ultrasene. Compod sells for $6.00 pe

> Wyalusing Chemicals uses a joint process to produce MJ-4, a chemical used in the manufacture of paints and varnishes; HD-10, a chemical used in household cleaning products; and FT-5, a by-product that is sold to fertilizer manufacturers. Joint production

> Allegheny River Sawmill manufactures two lumber products from a joint milling process. The two products developed are mine support braces (MSB) and unseasoned commercial building lumber (CBL). A standard production run incurs joint costs of $750,000 and

> Gleed Company manufactures products Alpha, Beta, and Gamma from a joint process. Production, sales, and cost data for July follow. Required: 1. Assuming that joint costs are allocated using the relative-sales-value method, what were the joint costs allo

> Le Monde Company is a manufacturer of chemicals for various purposes. One of the processes used by Le Monde produces HTP–3, a chemical used in hot tubs and swimming pools; PST–4, a chemical used in pesticides; and RJ&a

> Travelcraft, Inc., manufactures a complete line of fiberglass suitcases and attaché cases. The firm has three manufacturing departments: Molding, Component, and Assembly. There are also two service departments: Power and Maintenance. The sid

> Refer to the data given in the preceding problem. When Jacksonville Instrument Company established its service departments, the following long-run needs were anticipated. Data given in preceding problem: Jacksonville Instrument Company manufactures gaug

> Jacksonville Instrument Company manufactures gauges for construction machinery. The company has two production departments: Machining and Finishing. There are three service departments: Human Resources (HR), Maintenance, and Design. The budgeted costs in

> Vallejo Cablevision Company provides television cable service to two counties in Southern California. The firm’s management is considering the construction of a new satellite dish in December of 20x0. The new antenna would improve reception and the servi

> The Golden Triangle Theater is a nonprofit enterprise in downtown Pittsburgh. The board of directors is considering an expansion of the theater’s seating capacity, which will entail significant renovations to the existing facilities. The board has

> For what purpose should the managerial accountant be careful to not use joint cost allocations?

> Refer to the data given in the preceding problem. The owner of Zivanov’s Pancake House will consider capital projects only if they have a payback period of six years or less. The owner also favors projects that exhibit an accounting rat

> The owner of Zivanov’s Pancake House is considering an expansion of the business. He has identified two alternatives, as follows: • Build a new restaurant near the mall. • Buy and renovate an old buil

> Weisinger Corporation’s management is considering the replacement of an old machine. It is fully depreciated but it can be used by the corporation through 20x5. If management decides to replace the old machine, James Company has offered to purchase it fo

> LifeLine Corporation manufactures fire extinguishers. One part used in all types of fire extinguishers is a unique pressure fitting that requires specialized machine tools that need to be replaced. LifeLine’s production manager has concluded that the onl

> MicroTest Technology, Inc., is a high-technology company that manufactures sophisticated testing instruments for evaluating microcircuits. These instruments sell for $3,500 each and cost $2,450 each to manufacture. An essential component of the company’s

> Flotilla Beam, the owner of the Bay City Boatyard, recently had a brilliant idea. There is a shortage of boat slips in the harbor during the summer. Beam’s idea is to develop a system of “dry slips.” A dry slip is a large storage rack in a warehouse on w

> Refer to the data given in Problem 6. The County Board of Representatives believes that if the county conducts a promotional effort costing $20,000 per year, the proposed long runway will result in substantially greater economic development than was proj

> Refer to the data given in the preceding problem. Data given in preceding: Adams County’s Board of Representatives is considering the construction of a longer runway at the county airport. Currently, the airport can handle only private aircraft and smal

> Adams County’s Board of Representatives is considering the construction of a longer runway at the county airport. Currently, the airport can handle only private aircraft and small commuter jets. A new, long runway would enable the airport to handle the m

> Special People Industries (SPI) is a nonprofit organization which employs only people with physical or mental disabilities. One of the organization’s activities is to make cookies for its snack food store. Several years ago, Special Peo

> Are joint cost allocations useful? If they are, for what purpose?

> Refer to the data in the preceding problem regarding Medical Arts Hospital. Data from preceding problem: Medical Arts Hospital’s board of trustees is considering the addition of a comprehensive medical testing laboratory. In the past, the hospital has s

> Medical Arts Hospital’s board of trustees is considering the addition of a comprehensive medical testing laboratory. In the past, the hospital has sent all blood and tissue specimens to Diagnostic Testing Services, an independent testing service. The hos

> Community Challenges, a nonprofit organization for physically and mentally challenged people, manufactures a variety of products in four plants located in California. The company is currently purchasing an electronic igniter from an outside supplier for

> Refer to the data given in the preceding problem for Vallejo Cablevision Company. Data from preceding problem: Vallejo Cablevision Company provides television cable service to two counties in Southern California. The firm’s management is considering the

> Portsmouth Printing Corporation recently purchased a truck for $36,000. Under MACRS, the first year’s depreciation was $7,200. The truck driver’s salary in the first year of operation was $38,400. Required: Show how each of the amounts mentioned above

> For each of the following assets, indicate the MACRS property class and depreciation method. 1. A pharmaceutical company bought a new microscope to use in its Research and Development Division. 2. A mid western farmer constructed a new barn to house bee

> The state’s secretary of education is considering the purchase of a new computer for $150,000. A cost study indicates that the new computer should save the Department of Education $45,000, measured in real dollars, during each of the next eight years. Th

> Yankay Specialty Metals Corporation is reviewing an investment proposal. The initial cost as well as the estimate of the book value of the investment at the end of each year, the net after-tax cash flows for each year, and the net income for each year ar

> The management of Iroquois National Bank is considering an investment in automatic teller machines. The machines would cost $124,200 and have a useful life of seven years. The bank’s controller has estimated that the automatic teller machines will save t

> The owner of Cape Cod Confectionary is considering the purchase of a new semi-automatic candy machine. The machine will cost $30,000 and last 10 years. The machine is expected to have no salvage value at the end of its useful life. The owner projects tha

> Describe the relative-sales-value method of joint cost allocation.

> Trenton Fabrication Company purchased industrial tools costing $110,000, which fall in the 3-year property class under MACRS. Required: 1. Prepare a schedule of depreciation deductions assuming: a. The firm uses the accelerated depreciation schedule spe

> Refer to the data given in the preceding exercise. Suppose the Toronto Shakespearean Theater’s board is uncertain about the cost savings with the new lighting system. Data from preceding exercise: Toronto Shakespearean Theater’s board of directors is co

> Toronto Shakespearean Theater’s board of directors is considering the replacement of the theater’s lighting system. The old system requires two people to operate it, but the new system would require only a single opera

> The trustees of the Danube School of Art and Music, located in Tuttlingen, Germany, are considering a major overhaul of the school’s audio system. With or without the overhaul, the system will be replaced in two years. If an overhaul is done now, the tru

> Refer to the data given in Exercise 1. Data from preceding Exercise 1: Jefferson County’s Board of Representatives is considering the purchase of a site for a new sanitary landfill. The purchase price for the site is $234,000 and prepa

> Refer to the data given in the preceding exercise. Data given in preceding exercise: Jefferson County’s Board of Representatives is considering the purchase of a site for a new sanitary landfill. The purchase price for the site is $234,000 and preparato

> Jefferson County’s Board of Representatives is considering the purchase of a site for a new sanitary landfill. The purchase price for the site is $234,000 and preparatory work will cost $88,080. The landfill would be usable for 10 years. The board hired

> Refer to the data in the preceding exercise. Data in preceding exercise: The state’s secretary of education is considering the purchase of a new computer for $150,000. A cost study indicates that the new computer should save the Department of Education

> Heartland Corporation manufactures flour milling machinery according to customer specifications. The company operated at 75 percent of practical capacity during the year just ended, with the following results (in thousands): Sales revenue ...............

> Danish Interiors, Ltd., manufactures easy-to-assemble wooden furniture for home and office. Management is considering modification of a table to make it more attractive to individuals and businesses that buy products through outlets such as Office Max, O

> Briefly explain how to use the physical-units method of joint cost allocation.

> Super Sounds, Inc. manufactures two models of stereo speaker sets. The company uses an absorption (or full) product-costing system, which means that both variable and fixed overhead are included in the product cost. Cost estimates for the two models for

> Maritime Services Corporation (MSC) will soon enter a very competitive marketplace in which it will have limited influence over the prices that are charged. Management and consultants are currently working to fine-tune the company’s sole service, which t

> Detroit Synthetic Fibers, Inc., specializes in the manufacture of synthetic fibers used in many products such as blankets, coats, and uniforms. The company applies overhead on the basis of direct-labor hours. Management has recently received a request to

> For many years, Lehigh Corporation has used a straightforward cost-plus pricing system, marking its goods up approximately 25 percent of total cost. The company has been profitable; however, it has recently lost considerable business to foreign competito

> The marginal cost, marginal revenue, and demand curves for Houston Home and Garden’s deluxe wheelbarrow are shown in the graph at the top of the next page. Required: Before completing any of the following requirements, read over the e

> Refer to Exhibit 15–7 . Suppose the Repair Department of Sydney Sailing Supplies adds a markup of 5 percent on the material charges of a job (including the cost of material handling and storage). Exhibit 15-7: Required: 1. Rewrite the

> Bair Company is a manufacturer of standard and c ustom-designed bottling equipment. Early in December 20x0 Lyan Company asked Bair to quote a price for a custom-designed bottling machine to be delivered in April. Lyan intends to make a decision on the pu

> Handy Household Products, Inc., is a multiproduct company with several manufacturing plants. The Shreveport Plant manufactures and distributes two household cleaning and polishing compounds, standard and commercial, under the Clean & Bright label. Th

> Why can unitized fixed costs cause errors in decision making?

> What potential behavioral problem can result when the dual approach is used?

> List four potential pitfalls in decision making, which represent common errors.

> What is meant by the term contribution margin per unit of scarce resource?

> Are allocated joint processing costs relevant when making a decision to sell a joint product at the split-off point or process it further? Why?

> What is meant by the term differential cost analysis?

> How does the existence of excess production capacity affect the decision to accept or reject a special order?

> Give an example of an irrelevant future cost. Why is it irrelevant?

> Explain why the book value of equipment is not a relevant cost.

> Explain what is meant by the term decision model.

> Distinguish between qualitative and quantitative decision analyses.

> Describe the managerial accountant’s role in the decision-making process.

> Why does the dual-allocation approach improve the resulting cost allocation?

> Refer to the data given in Exercise 1 for Aurora National Bank. Data given in Exercise 1: Aurora National Bank has two service departments, the Human Resources (HR) Department and the Computing Department. The bank has two other departments that directl

> "In the long run, a profit-maximizing firm would never knowingly market unsafe products. However, in the short run, unsafe products can do a lot of damage." Discuss this statement.

> Why is the concept of enlightened self-interest important in economics?

> Some argue that prescription drug manufacturers, like Pfizer, gouge consumers with high prices and make excessive profits. Others contend that high profits are necessary to give leading pharmaceutical companies the incentive to conduct risky research and

> Which concept--the business profit concept or the economic profit concept--provides the more appropriate basis for evaluating business operations? Why?

> How is the popular notion of business profit different from the economic profit concept? What role does the idea of normal profits play in this difference?

> In the wake of corporate scandals at Enron, Tyco, and WorldCom, some argue that managers of large, publicly owned firms sometimes make decisions to maximize their own welfare as opposed to that of stockholders. Does such behavior create problems in using

> What does a perfect business look like? For Warren Buffett and his partner Charlie Munger, vice- chairman of Berkshire Hathaway, Inc., it looks a lot like Coca-Cola. To see why, imagine going back in time to 1885, to Atlanta, Georgia, and trying to inven

> A spreadsheet is a table of data organized in a logical framework similar to an accounting income statement or balance sheet. At first, this marriage of computers and accounting information might seem like a minor innovation. However, it is not. For exam

> Amos Jones and Andrew Brown own and operate Amos & Andy, Inc., a Minneapolis-based installer of conversion packages for vans manufactured by the major auto companies. Amos & Andy has fixed capital and labour expenses of $1.2 million per year, and variabl

> Presto Products, Inc., recently introduced an innovative new frozen dessert maker with the following revenue and cost relations: P = $60 - $0.005Q TC = $88,000 + $5Q + $0.0005Q2 MR = ∂TR/∂Q = $60 - $0.01Q MC = ∂TC/∂Q = $5 + $0.001Q a. Set up a spreadshee

> Pharmed Caplets is an antibiotic product with monthly revenues and costs of: TR = $900Q - $0.1Q2 TC = $36,000 + $200Q + $0.4Q2 MR = ∂TR/∂Q = $900 - $0.2Q MC = ∂TC/∂Q = $200 + $0.8Q a. Set up a spreadsheet for output (Q), price (P), total revenue (TR), ma

> For those 50 or older, membership in AARP, formerly known as the American Association of Retired Persons, brings numerous discounts for health insurance, hotels, auto rentals, shopping, travel planning, etc. Use the marginal profit concept to explain why

> Describe the effects of each of the following managerial decisions or economic influences on the value of the firm: a. The firm is required to install new equipment to reduce air pollution. b. Through heavy expenditures on advertising, the firm's marketi

> “The personal computer is a calculating device and a communicating device. Spreadsheets incorporate the best of both characteristics by allowing managers to determine and communicate the optimal course of action.” Discuss this statement and explain why c

> In 2007, Chrysler Group said it would cut 13,000 jobs, close a major assembly plant and reduce production at other plants as part of a restructuring effort designed to restore profitability at the auto maker by 2008. Its German parent, DaimlerChrysler sa

> In estimating regulatory benefits, the Environmental Protection Agency (EPA) and other government agencies typically assign a value of approximately $6 million to each life saved. What factors might the EPA consider in arriving at such a valuation? How w

> "It is often impossible to obtain precise information about the pattern of future revenues, costs, and interest rates. Therefore, the process of economic optimization is futile.” Discuss this statement.

> Economists have long argued that if you want to tax away excess profits without affecting allocative efficiency, you should use a lump-sum tax instead of an excise or sales tax. Use the concepts developed in the chapter to support this position.

> McDonald’s restaurants do the bulk of their business at lunchtime but have found that promotionally-priced meals at breakfast and dinner make a significant profit contribution. Does the success of McDonald’s restaurants in this regard reflect an effectiv

> Intel Corp. designs, develops, manufactures and sells integrated circuit solutions for wireless data and personal computer (PC) applications. The company is expanding rapidly to achieve hoped-for reductions in average costs as output expands. Does the po

> Southwest Airlines is known for offering cut-rate promotional fares to build customer awareness, grow market share, and boost revenues in new markets. Would you expect total revenue to be maximized at an output level that is typically greater than or les

> If a baseball player hits .285 during a given season, the player’s lifetime batting average of .278 will rise. Use this observation to explain why the marginal cost curve always intersects the related average cost curve at either a maximum or a minimum p

> Meredith Grey is a regional sales representative for Dental Laboratories, Inc., a company that sells alloys created from gold, silver, platinum, and other precious metals to several dental laboratories in Washington, Oregon, and Idaho. Grey's goal is to

> Explain how the valuation model given in Equation 1.2 could be used to describe the integrated nature of managerial decision making across the functional areas of business

> Founded in 1985, Starbucks Corporation offers brewed coffees, espresso beverages, cold blended beverages, various complementary food items, and related products at over 12,000 retail outlets in the United States Canada, the United Kingdom, Thailand, Aust

> Climate Control Devices, Inc., estimates that sales of defective thermostats cost the firm $50 each for replacement or repair. Boone Carlyle, an independent engineering consultant, has recommended hiring quality control inspectors so that defective therm

> Giant Screen TV, Inc., is a Miami-based importer and distributor of 60-inch screen HDTVs for residential and commercial customers. Revenue and cost relations are as follows: TR = $1,800Q - $0.006Q2 MR = ∂TR/∂Q = $1,800 - $0.012Q TC = $12,100,000 + $8

> The Portland Sea Dogs, the AA affiliate of the Boston Red Sox major league baseball team, have enjoyed a surge in popularity. During a recent home stand, suppose the club offered $5 off the $12 regular price of reserved seats, and sales spurted from 3,2

> Fill in the missing data for price (P), total revenue (TR), marginal revenue (MR), total cost (TC), marginal cost (MC), profit (Ï€), and marginal profit (MÏ€) in the following table: B. At what output level is profit maximized? C. At

> 21st Century Insurance offers mail-order automobile insurance to preferred-risk drivers in the Los Angeles area. The company is the low-cost provider of insurance in this market but doesn't believe its annual premium of $1,500 can be raised for c