Question: Powder Ski Shop reports inventory using the

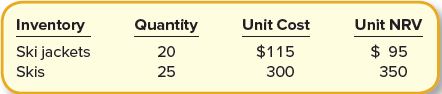

Powder Ski Shop reports inventory using the lower of cost and net realizable value (NRV). Information related to its year-end inventory appears below. Calculate the total amount to be reported for ending inventory.

> Provide an example of an aggressive accounting practice. Why is this practice aggressive?

> Provide an example of a conservative accounting practice. Why is this practice conservative?

> Explain the difference between conservative and aggressive accounting practices.

> Shifting Formations, Inc., reports earnings per share of $1.30. In the following year, it reports bottom-line earnings per share of $1.25 but earnings per share on income before discontinued operations of $1.50. Is this trend in earnings per share favora

> Define earnings persistence. How does earnings persistence relate to the reporting of discontinued operations?

> Refer to the information in BE6–11, but now assume that Shankar uses a periodic system to record inventory transactions. Record the purchase of inventory on February 2, including the freight charges.

> Hash Mark, Inc., reports a return on assets of 8% and a return on equity of 12%. Why do the two rates differ?

> Determine whether each of the following changes in profitability ratios normally is good news or bad news about a company. a. Increase in profit margin. b. Decrease in asset turnover. c. Decrease in return on equity. d. Increase in the price-earnings rat

> Which profitability ratios best answer each of the following financial questions? a. What is the income earned for each dollar invested in assets? b. What is the income earned for each dollar of sales? c. What is the amount of sales for each dollar inves

> Pro Leather, a supplier to sporting goods manufacturers, has a current ratio of 0.90, based on current assets of $450,000 and current liabilities of $500,000. How, if at all, will a $100,000 purchase of inventory on account affect the current ratio?

> Identify the three types of comparisons commonly used in financial statement analysis.

> The executives at Peach, Inc., are confused. The company reports a net loss of $200,000, and yet its net cash flow from operating activities increased $300,000 during the same period. Is this possible? Explain.

> Describe the most common adjustments we use to convert net income to net cash flows from operations under the indirect method.

> Distinguish between the indirect method and the direct method for reporting net cash flows from operating activities. Which method is more common in practice? Which method provides a more logical presentation of cash flows?

> Briefly describe the four steps outlined in the text for preparing a statement of cash flows.

> Describe the basic format used in preparing a statement of cash flows, including the heading, the three major categories, and what is included in the last three lines of the statement.

> Refer to the information in BE6–10, but now assume that Shankar uses a periodic system to record inventory transactions. Record transactions for the purchase and sale of inventory.

> Why is it necessary to use an income statement, balance sheet, and additional information to prepare a statement of cash flows?

> Explain what we mean by noncash activities and provide an example.

> Why do we exclude depreciation expense and the gain or loss on sale of an asset from the operating activities section of the statement of cash flows under the direct method?

> Changes in current assets and current liabilities are used in determining net cash flows from operating activities. Changes in which balance sheet accounts are used in determining net cash flows from investing activities?Changes in which balance sheet ac

> What are the primary cash inflows and cash outflows under the direct method for determining net cash flows from operating activities?

> Describe the two primary strategies firms use to increase cash return on assets.

> Explain the difference between the calculation of return on assets and cash return on assets. How can cash-based ratios supplement the analysis of ratios based on income statement and balance sheet information?

> Bell Corporation purchases land by issuing its own common stock to the seller. No cash is exchanged. How do we report this transaction in the statement of cash flows, if at all?

> Provide three examples of financing activities reported in the statement of cash flows.

> A $10,000 investment on the books of a company is sold for $9,000. Under the indirect method, how does this transaction affect operating, investing, and financing activities?

> Using the amounts below, calculate the inventory turnover ratio, average days in inventory, and gross profit ratio.

> How does an increase in accounts receivable affect net income in relation to operating cash flows? Why? How does a decrease in accounts receivable affect net income in relation to operating cash flows? Why?

> Indicate whether each of the following items would be added or subtracted from net income in preparing the statement of cash flows using the indirect method: (a) an increase in current assets, (b) a decrease in current assets, (c) an increase in curre

> Describe how we report a gain or loss on the sale of an asset in the statement of cash flows using the indirect method. Why do we report it this way?

> Explain how we report depreciation expense in the statement of cash flows using the indirect method. Why do we report it this way?

> Identify and briefly describe the three categories of cash flows reported in the statement of cash flows.

> What is par value? How is it related to market value? How is it used in recording the issuance of stock?

> The articles of incorporation allow for the issuance of 1 million shares of common stock. During its first year, California Clothing issued 100,000 shares and reacquired 10,000 shares it held as treasury stock. At the end of the first year, how many shar

> Explain the difference between authorized, issued, and outstanding shares.

> Explain how an LLC or an S corporation represents the “best of both worlds” in terms of business ownership.

> Describe the primary advantages and disadvantages of a corporation.

> Creative Technology reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Calculate the total amount to be reported for ending inventory.

> Which form of business organization is most common? Which form of business organization is larger in terms of total sales, total assets, earnings, and number of employees?

> What are the basic ownership rights of common stockholders?

> What does “PE” stand for in the PE ratio, and how do investors use this ratio?

> Explain why earnings per share is useful for comparing earnings performance for the same company over time, but is not useful for comparing earnings performance between two competing companies.

> Why doesn’t total stockholders’ equity equal the market value of the firm?

> How is the stockholders’ equity section of the balance sheet different from the statement of stockholders’ equity?

> What is the difference between a public and a private corporation? Provide an example of each.

> Indicate the correct order in which to report the following accounts in the stockholders’ equity section of the balance sheet: Additional Paid-in Capital, Common Stock, Preferred Stock, Treasury Stock, and Retained Earnings.

> What happens to the par value, the share’s trading price, and the number of shares outstanding in a 2-for-1 stock split?

> Contrast the effects of a cash dividend and a stock dividend on total assets, total liabilities, and total stockholders’ equity.

> How does a 100% stock dividend or a 2-for-1 stock split affect total assets, total liabilities, and total stockholders’ equity?

> Describe the declaration date, record date, and payment date for a cash dividend.

> Explain why some companies choose not to pay cash dividends. Why do investors purchase stock in companies that do not pay cash dividends?

> How is the accounting for a purchase of a company’s own stock (treasury stock) different from the purchase of stock in another corporation?

> What would motivate a company to buy back its own stock?

> Explain why preferred stock often is said to be a mixture of attributes somewhere between common stock and bonds.

> What are the three potential features of preferred stock? Indicate whether each feature makes the preferred stock appear more like stockholders’ equity or more like long-term liabilities.

> Corporations typically do not first raise capital by issuing stock to the general public. What are the common stages of equity financing leading to an initial public offering (IPO)?

> Explain the difference in each of these terms used for bonds: a. Face amount and carrying value. b. Stated interest rate and market interest rate.

> What are convertible bonds? How do they benefit both the investor and the issuer?

> Shankar Company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 2 for $40,000, with terms 3/10, n/30. On February 10, the company pays on account for the inventory. Record the inventory pur

> Contrast the following types of bonds: a. Secured and unsecured. b. Term and serial. c. Callable and convertible.

> Why do some companies issue bonds rather than borrow money directly from a bank?

> What are bond issue costs? What is an underwriter?

> What is a lease and how does a lease affect a company’s balance sheet?

> How do interest expense and the carrying value of the note change over time for an installment note with fixed monthly loan payments?

> What are the potential risks and rewards of carrying additional debt?

> Why would a company choose to borrow money rather than issue additional stock?

> Extreme Motion issues $500,000 of 6% bonds due in 20 years with interest payable semiannually on June 30 and December 31. Calculate the issue price of the bonds assuming a market interest rate of a. 5% b. 6% c. 7%

> Extreme Motion issues $500,000 of 6% bonds due in 20 years with interest payable semiannually on June 30 and December 31. What is the amount of the cash payment for interest every six months? How many interest payments will there be?

> How do we calculate the issue price of bonds? Is it equal to the present value of the principal? Explain.

> Shankar Company uses a perpetual system to record inventory transactions. The company purchases 1,500 units of inventory on account on February 2 for $60,000 ($40 per unit) but then returns 100 defective units on February 5. Record the inventory purchase

> If bonds with a face amount of $250,000 and a carrying value of $280,000 are retired early at a cost of $330,000, is a gain or loss recorded by the issuer retiring the bonds? How does the issuer record the retirement?

> Why would a company choose to buy back bonds before their maturity date?

> Explain how each of the columns in an amortization schedule is calculated, assuming the bonds are issued at a discount. How is the amortization schedule different if bonds are issued at a premium?

> If bonds issue at a premium, what happens to the carrying value of bonds payable and the amount recorded for interest expense over time?

> If bonds issue at a discount, what happens to the carrying value of bonds payable and the amount recorded for interest expense over time?

> If bonds issue at a premium, is the stated interest rate less than, equal to, or more than the market interest rate? Explain.

> If bonds issue at a discount, is the stated interest rate less than, equal to, or more than the market interest rate? Explain.

> What is capital structure? How do the capital structures of Ford and Microsoft differ?

> Name at least four employer costs in addition to the employee’s salary. Which costs are required by law and which are voluntary?

> Name at least four items withheld from employee payroll checks. Which deductions are required by law and which are voluntary?

> Shankar Company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 2 for $40,000. In addition to the cost of inventory, the company also pays $600 for freight charges associated with the purch

> How does commercial paper differ from a normal bank loan? Why is the interest rate often less for commercial paper?

> Bank loans often are arranged under existing lines of credit. What is a line of credit? How does a line of credit work?

> Explain why we record interest in the period in which we incur it rather than in the period in which we pay it.

> Provide examples of current liabilities in the airline industry.

> Why is it important to distinguish between current and long-term liabilities?

> How would the following transactions affect the current ratio and the acid-test ratio? (a) Purchase of inventory with cash; and (b) sale of inventory for more than its cost. Assume that prior to these transactions the current ratio and acid-test ratio a

> Explain the differences among working capital, the current ratio, and the acid-test ratio.

> Current liabilities affect a company’s liquidity. What is liquidity, and how do we evaluate it?

> Your company is the plaintiff in a lawsuit. Legal counsel advises you that your eventual victory is inevitable. “You will be awarded $2 million,” your attorney confidently asserts. Describe the appropriate accounting treatment.

> How do we define current liabilities? Long-term liabilities?

> Shankar Company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 2 for $40,000 and then sells this inventory on account on March 17 for $60,000. Record transactions for the purchase and sale

> You have recently been hired as the assistant controller for Stanton Temperton Corporation, which rents building space in major metropolitan areas. Customers are required to pay six months of rent in advance. At the end of 2021, the company’s president,

> Financial information for Buckle is presented in Appendix B at the end of the book. Required: 1. Calculate Buckle’s percentage change in total assets and percentage change in net sales for the most recent year. 2. Calculate Buckle’s percentage change in

> How do you think the work locus of control might influence your effectiveness as a manager?

> Do you think that your score accurately reflects your locus of control at work? Why or why not?

> What multicultural experiences can you seek out to enhance your global perspective?

> What did you do well and what could you have done better in these interactions?

> Do you think that you were equally able to think and act locally as you interacted with people from other cultures?