Question: Prepare the operating activities section of the

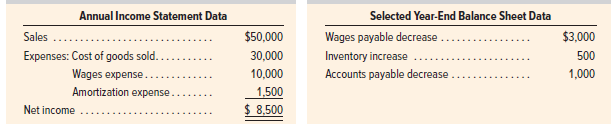

Prepare the operating activities section of the statement of cash flows for Green Garden using the indirect method.

> On December 31, Mars Co. had the following portfolio of stock investments with insignificant influence. Mars had no stock investments in prior periods. Prepare the December 31 adjusting entry to report these investments at fair value.

> On December 31, Westworld Inc. has the following equity accounts and balances: Retained Earnings, $45,000; Common Stock, $1,000; Treasury Stock, $2,000; Paid-In Capital in Excess of Par Value, Com- mon Stock, $39,000; Preferred Stock, $7,000; and Paid-In

> Epic Inc. has 10,000 shares of $2 par value common stock outstanding. Epic declares a 5% stock dividend on July 1 when the stock’s market value is $8 per share. The stock dividend is distributed on July 20. Prepare journal entries for (a) declaration and

> Refer to the data in QS 12-7. Furniture costing $55,000 is sold at its book value in 2020. Acquisitions of furniture total $45,000 cash, on which no depreciation is necessary because it is acquired at year-end. What is the cash inflow from the sale of fu

> Refer to the balance sheet data in QS 12-10 from Anders Company. During 2020, a building with a book value of $70,000 and an original cost of $300,000 was sold at a gain of $60,000. 1. How much cash did Anders receive from the sale of the building? 2. Ho

> The plant assets section of the comparative balance sheets of Anders Company is reported below. Refer to the balance sheet data above from Anders Company. During 2020, equipment with a book value of $40,000 and an original cost of $210,000 was sold at a

> Indicate the effect each separate transaction has on investing cash flows. a. Sold a truck costing $40,000, with $22,000 of accumulated depreciation, for $8,000 cash. The sale results in a $10,000 loss. b. Sold a machine costing $10,000, with $8,000 of a

> Review the chapter’s opener involving Vera Bradley and its founder, Barbara Bradley. Required 1. In a business such as Vera Bradley, monitoring cash flow is always a priority. Explain how cash flow can lag behind net income. 2. What are potential sources

> Team members are to coordinate and independently answer one question within each of the following three sections. Team members should then report to the team and confirm or correct teammates’ answers. 1. Answer one of the following questions about the st

> Access the April 14, 2016, filing of the 10-K report (for year ending December 31, 2015) of Mendocino Brewing Company, Inc. (ticker: MENB) at SEC.gov. Required 1. Does Mendocino Brewing use the direct or indirect method to construct its consolidated stat

> Refer to Samsung’s 2018 statement of cash flows in Appendix A. List its cash flows from operating activities, investing activities, and financing activities.

> Analyze transactions (a through c) from Exercise C-8 by showing each transaction’s effect on the accounting equation—specifically, identify the accounts and amounts (including + or −) for each transaction.

> Refer to Google’s statement of cash flows in Appendix A. What are its cash flows from financing activities for the year ended December 31, 2018? List the items and amounts

> Refer to Apple’s statement of cash flows in Appendix A. (a) which method is used to compute its net cash provided by operating activities? (b) Its balance sheet shows an increase in accounts receivable from September 30, 2017, to September 29, 2018; wh

> Key comparative information for Samsung, Apple, and Google follows. Required 1. Compute the recent two years’ cash flow on total assets ratio for Samsung. 2. Is the change in Samsung’s cash flow on total assets ratio f

> Key figures for Apple and Google follow. Required 1. Compute the recent two years’ cash flow on total assets ratios for Apple and Google. 2. For the current year, which company has the better cash flow on total assets ratio? 3. For the

> Use Apple’s financial statements in Appendix A to answer the following. 1. Is Apple’s statement of cash flows prepared under the direct method or the indirect method? 2. For each fiscal year 2018, 2017, and 2016, identify the amount of cash provided by o

> Santana Rey, owner of Business Solutions, decides to prepare a statement of cash flows for her business. (Although the serial problem allowed for various ownership changes in earlier chapters, we will prepare the statement of cash flows using the followi

> Use the indirect method to prepare the operating activities section of Cruz’s statement of cash flows.

> Refer to Satu Company’s financial statements and related information in Problem 12-6B. Required Prepare a complete statement of cash flows using the direct method for the current year.

> Satu Company’s current-year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3)

> Refer to Gazelle Corporation’s financial statements and related information in Problem 12-3B. Required Prepare a complete statement of cash flows using the direct method. Disclose any noncash investing and financing activities in a note.

> Prepare journal entries to record the following transactions involving the short-term stock investments of Duke Co., all of which occurred during the current year. a. On March 22, purchased 1,000 shares of RPI Company stock at $10 per share. Duke’s stock

> Refer to the information reported about Gazelle Corporation in Problem 12-3B. Required Prepare a complete statement of cash flows using a spreadsheet as in Exhibit 12A.1 using the indirect method. Identify the debits and credits in the Analysis of Change

> Gazelle Corporation’s current-year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customer

> Refer to the information in Problem 12-1B. Required Prepare the operating activities section of the statement of cash flows using the direct method for the current year.

> Refer to Golden Corporation’s financial statements and related information in Problem 12-6A. Required Prepare a complete statement of cash flows using the direct method for the current year.

> Golden Corp.’s current-year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3)

> Refer to Forten Company’s financial statements and related information in Problem 12-3A. Required Prepare a complete statement of cash flows using the direct method. Disclose any noncash investing and financing activities in a note.

> Refer to the information reported about Forten Company in Problem 12-3A. Required Prepare a complete statement of cash flows using a spreadsheet as in Exhibit 12A.1 using the indirect method. Identify the debits and credits in the Analysis of Changes col

> Use the following information to determine cash flows from operating activities using the indirect method.

> Forten Company’s current-year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3

> Refer to the information in Problem 12-1A. Required Prepare the operating activities section of the statement of cash flows using the direct method for the current year.

> For each of the following situations, identify (1) the case as either (a) a present or a future value and (b) a single amount or an annuity, (2) the table you would use in your computations (but do not solve the problem), and (3) the interest rate and ti

> The following Cash T-account shows the total debits and total credits to the Cash account of Thomas Corporation for the current year. 1. Prepare a complete statement of cash flows for the current year using the direct method. 2. Refer to the statement of

> Use the following information about Ferron Company to prepare a complete statement of cash flows (direct method) for the current year ended December 31. Use a note disclosure for any noncash investing and financing activities.

> Refer to information in Exercise 12-4. Use the direct method to prepare the operating activities section of Sonad’s statement of cash flows.

> Refer to the information in Exercise 12-12. Using the direct method, prepare the statement of cash flows for the year ended June 30, 2020. Hint: Prepaid Expenses and Wages Payable relate to Operating Expenses on the income statement.

> For each of the following separate cases, compute the required cash flow information

> Indicate where each item would appear on a statement of cash flows using the direct method by placing an x in the appropriate column.

> Complete the following spreadsheet in preparation of the statement of cash flows. (The statement of cash flows is not required.) Prepare the spreadsheet as in Exhibit 12A.1 under the indirect method. Identify the debits and credits in the Analysis of Cha

> A company reported average total assets of $1,240,000 in Year 1 and $1,510,000 in Year 2. Its net operating cash flow was $102,920 in Year 1 and $138,920 in Year 2. (1) Calculate its cash flow on total assets ratio for both years. (2) Did its cash flow o

> For each separate company, compute cash flows from operations using the indirect method.

> Use the following Cash account to determine (a) cash flows used by investing activities and (b) cash flows provided by financing activities.

> Accenture purchases 55% of the voting common stock of JBL. After the purchase, Accenture has a con- trolling influence over JBL. (1) Which method does Accenture use to account for its investment in JBL? (2) What type of financial statements does Accentu

> Use the following information to prepare a statement of cash flows for the current year using the indirect method.

> The following financial statements and additional information are reported. (1) Prepare a statement of cash flows using the indirect method for the year ended June 30, 2020. (2) Compute the company’s cash flow on total assets ratio for

> For each of the following separate transactions, (a) prepare the reconstructed journal entry and (b) identify the effect it has, if any, on the investing section or financing section of the statement of cash flows. 1. Sold a building costing $30,000, wit

> Cain Co. reports net cash provided by operating activities of $30,000. It also reports the following information under “Adjustments to reconcile net income to net cash provided by operating activities” on its statement

> Using the following income statement and additional year-end information, prepare the operating activities section of the statement of cash flows using the indirect method.

> Indicate where each item would appear on a statement of cash flows using the indirect method by placing an x in the appropriate column.

> Refer to the data in QS 12-7. Use the direct method to prepare the operating activities section of Cruz’s statement of cash flows.

> Refer to the data in QS 12-7. 1. How much cash is paid to acquire inventory during year 2020? 2. How much cash is paid for operating expenses (excluding depreciation) during year 2020? Hint: Examine prepaid expenses and wages payable.

> Cain Inc. reports net income of $15,000. Its comparative balance sheet shows the following changes: accounts receivable increased $6,000; inventory decreased $8,000; prepaid insurance decreased $1,000; accounts payable increased $3,000; and taxes payable

> Prepare Krum Co.’s journal entries to record the following transactions involving its short-term investments in available-for-sale debt securities, all of which occurred during the current year. a. On August 1, paid $50,000 cash to purchase Houtte’s 9%,

> Refer to the data in QS 12-7. 1. How much cash is received from sales to customers for year 2020? 2. What is the net increase or decrease in the Cash account for year 2020?

> For each separate case, compute the required cash flow information for BioClean.

> BTN Inc. reports operating expenses of $27,000. Its comparative balance sheet shows that accrued liabilities decreased $6,000 and prepaid expenses increased $2,000. Compute cash used in operating activities using the direct method.

> Bioware Co. reports cost of goods sold of $42,000. Its comparative balance sheet shows that inventory decreased $7,000 and accounts payable increased $5,000. Compute cash payments to suppliers using the direct method.

> Russell Co. reports sales revenue of $30,000 and interest revenue of $5,000. Its comparative balance sheet shows that accounts receivable decreased $4,000 and interest receivable increased $1,000. Compute cash provided by operating activities using the d

> A company uses a spreadsheet to prepare its statement of cash flows. Indicate whether each of the following items would be recorded in the Debit column or Credit column of the spreadsheet’s statement of cash flows section. a. Decrease in accounts payable

> Revo Co. reports average total assets of $200,000, revenue of $90,000, net income of $30,000, and cash flow from operations of $38,000. 1. Compute its cash flow on total assets. 2. Is Revo’s cash flow on total assets better than the 8% for its competitor

> Use the following information for VPI Co. to prepare a statement of cash flows for the year ended December 31 using the indirect method.

> Refer to the data in QS 12-7. 1. Assume that all common stock is issued for cash. What amount of cash dividends is paid during 2020? 2. Assume that no additional notes payable are issued in 2020. What cash amount is paid to reduce the notes payable balan

> Indicate the effect, if any, that each separate transaction has on financing cash flows. a. Notes payable with a carrying value of $15,000 are retired for $16,000 cash, resulting in a $1,000 loss. b. Paid cash dividends of $11,000 to common stockholders.

> Prepare Natura Co.’s journal entries to record the following transactions involving its short-term investments in held-to-maturity debt securities, all of which occurred during the current year. a. On June 15, paid $1,000 cash to purchase Remed’s 90-day

> Bryant Co. reports net income of $20,000. For the year, depreciation expense is $7,000 and the company reports a gain of $3,000 from sale of machinery. It also had a $2,000 loss from retirement of notes. Compute cash flows from operations using the indir

> Mifflin Co. reported the following for the current year: net sales of $60,000; cost of goods sold of $38,000; beginning balance in accounts receivable of $14,000; and ending balance in accounts receivable of $6,000. Compute (a) accounts receivable turnov

> At its prior year-end, VPN Co. reported current assets of $60,000 and current liabilities of $55,000. Deter- mine how each of the following transactions would increase, decrease, or have no effect on total current assets, total current liabilities, and t

> Pritchett Co. reported the following year-end data: cash of $15,000; short-term investments of $5,000; accounts receivable (current) of $8,000; inventory of $20,000; prepaid (current) assets of $6,000; and total current liabilities of $20,000. Compute th

> You are to devise an investment strategy to enable you to accumulate $1,000,000 by age 65. Start by making some assumptions about your salary. Next, compute the percent of your salary that you will be able to save each year. If you will receive any lump-

> Express the items from QS 13-5 in common-size percent’s.

> Assume that Carla Harris of Morgan Stanley (MorganStanley.com) has impressed you with the company’s success and its commitment to ethical behavior. You learn of a staff opening at Morgan Stanley and decide to apply for it. Your resume i

> A team approach to learning financial statement analysis is often useful. Required 1. Each team should write a description of horizontal and vertical analysis that all team members agree with and understand. Illustrate each description with an example. 2

> Access the February 22, 2019, filing of the December 31, 2018, 10-K report of The Hershey Company (ticker: HSY) at SEC.gov and complete the following requirements. Required Compute or identify the following profitability ratios of Hershey for its years e

> Each team is to select a different industry, and each team member is to select a different company in that industry and acquire its financial statements. Use those statements to analyze the company, including at least one ratio from each of the four buil

> Analyze transactions (1 through 3) from Exercise C-2 by showing each transaction’s effect on the accounting equation—specifically, identify the accounts and amounts (including + or −) for each.

> Use Samsung’s financial statements in Appendix A to compute its return on total assets for fiscal year ended December 31, 2018.

> Refer to Samsung’s financial statements in Appendix A. Compute its debt ratio as of December 31, 2018, and December 31, 2017.

> Refer to Google’s financial statements in Appendix A to compute its equity ratio as of December 31, 2018, and December 31, 2017.

> Refer to Apple’s financial statements in Appendix A. Compute its profit margin for the years ended September 29, 2018, and September 30, 2017.

> Key figures for Samsung follow (in ₩ millions). Required 1. Compute common-size percents for Samsung using the data given. Round percents to one decimal. 2. What is Samsung’s gross margin ratio on sales? 3. Does Samsun

> Key figures for Apple and Google follow. Required 1. Compute common-size percents for each company using the data given. Round percents to one decimal. 2. If Google paid a dividend, would retained earnings as a percent of total assets increase or decreas

> Refer to the information in QS 13-6. Determine the prior-year and current-year common-size percent’s for cost of goods sold using net sales as the base.

> Use Apple’s financial statements in Appendix A to answer the following. 1. Using fiscal 2016 as the base year, compute trend percents for fiscal years 2016, 2017, and 2018 for net sales, cost of sales, operating income, other income (expense) net, provis

> Use the following selected data from Business Solutions’s income statement for the three months ended March 31, 2021, and from its March 31, 2021, balance sheet to complete the requirements. Required 1. Compute the gross margin ratio (b

> Selected account balances from the adjusted trial balance for Harbor Corp. as of its calendar year-end December 31 follow. Required 1. Assume that the company’s income tax rate is 25% for all items. Identify the tax effects and after-ta

> Brooks Co. purchases debt investments as trading securities at a cost of $66,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $72,000. 1. Prepare the December 27 entry for th

> Summary information from the financial statements of two companies competing in the same industry follows. Required 1. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turn- over, (d) inventory turnover, (e)

> Selected current year-end financial statements of Overton Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $17,400; total assets, $94,900; common stock, $35,500; and retained e

> Selected comparative financial statement information of Bluegrass Corporation follows. Required 1. Compute each year’s current ratio. Round ratios to one decimal. 2. Express the income statement data in common-size percents. Round perce

> Selected comparative financial statements of Tripoly Company follow. Required 1. Compute trend percents for all components of both statements using 2014 as the base year. Round percents to one decimal. Analysis Component 2. Analyze and comment on the fin

> Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year- end December 31 follow. Required 1. Assume that the company’s income tax rate is 30% for all items. Identify the tax effects and a

> Summary information from the financial statements of two companies competing in the same industry follows. Required 1. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) Inventory turnover, (e) da

> Selected current year-end financial statements of Cabot Corporation follow. All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $48,900; total assets, $189,400; common stock, $90,000; and retained ea

> Compute the annual dollar changes and percent changes for each of the following items.

> Plum Corporation began the month of May with $700,000 of current assets, a current ratio of 2.50:1, and an acid-test ratio of 1.10:1. During the month, it completed the following transactions (the company uses a perpetual inventory system). May 2 Purchas

> Selected comparative financial statements of Korbin Company follow. Required 1. Compute each year’s current ratio. Round ratios to one decimal. 2. Express the income statement data in common-size percents. Round percents to two decimals

> Compute the amount that can be borrowed under each of the following circumstances: 1. A promise to repay $90,000 seven years from now at an interest rate of 6%. 2. An agreement made on February 1, 2021, to make three separate payments of $20,000 on Febru

> Identify investments as an investment in either debt securities or equity securities. a. U.S. Treasury bonds b. Google stock c. Certificate of deposit d. Apple bonds e. IBM corporate notes f. German government bonds g. Amazon stock h. Costco co