Question: Selected comparative financial statement

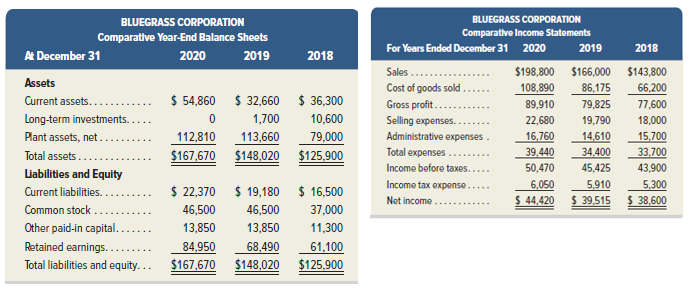

Selected comparative financial statement information of Bluegrass Corporation follows.

Required

1. Compute each year’s current ratio. Round ratios to one decimal.

2. Express the income statement data in common-size percents. Round percents to two decimals.

3. Express the balance sheet data in trend percents with 2018 as the base year. Round percents to two decimals.

Analysis Component

4. Comment on any significant relations revealed by the ratios and percents computed.

> For each separate company, compute cash flows from operations using the indirect method.

> Use the following Cash account to determine (a) cash flows used by investing activities and (b) cash flows provided by financing activities.

> Accenture purchases 55% of the voting common stock of JBL. After the purchase, Accenture has a con- trolling influence over JBL. (1) Which method does Accenture use to account for its investment in JBL? (2) What type of financial statements does Accentu

> Use the following information to prepare a statement of cash flows for the current year using the indirect method.

> The following financial statements and additional information are reported. (1) Prepare a statement of cash flows using the indirect method for the year ended June 30, 2020. (2) Compute the company’s cash flow on total assets ratio for

> For each of the following separate transactions, (a) prepare the reconstructed journal entry and (b) identify the effect it has, if any, on the investing section or financing section of the statement of cash flows. 1. Sold a building costing $30,000, wit

> Cain Co. reports net cash provided by operating activities of $30,000. It also reports the following information under “Adjustments to reconcile net income to net cash provided by operating activities” on its statement

> Prepare the operating activities section of the statement of cash flows for Green Garden using the indirect method.

> Using the following income statement and additional year-end information, prepare the operating activities section of the statement of cash flows using the indirect method.

> Indicate where each item would appear on a statement of cash flows using the indirect method by placing an x in the appropriate column.

> Refer to the data in QS 12-7. Use the direct method to prepare the operating activities section of Cruz’s statement of cash flows.

> Refer to the data in QS 12-7. 1. How much cash is paid to acquire inventory during year 2020? 2. How much cash is paid for operating expenses (excluding depreciation) during year 2020? Hint: Examine prepaid expenses and wages payable.

> Cain Inc. reports net income of $15,000. Its comparative balance sheet shows the following changes: accounts receivable increased $6,000; inventory decreased $8,000; prepaid insurance decreased $1,000; accounts payable increased $3,000; and taxes payable

> Prepare Krum Co.’s journal entries to record the following transactions involving its short-term investments in available-for-sale debt securities, all of which occurred during the current year. a. On August 1, paid $50,000 cash to purchase Houtte’s 9%,

> Refer to the data in QS 12-7. 1. How much cash is received from sales to customers for year 2020? 2. What is the net increase or decrease in the Cash account for year 2020?

> For each separate case, compute the required cash flow information for BioClean.

> BTN Inc. reports operating expenses of $27,000. Its comparative balance sheet shows that accrued liabilities decreased $6,000 and prepaid expenses increased $2,000. Compute cash used in operating activities using the direct method.

> Bioware Co. reports cost of goods sold of $42,000. Its comparative balance sheet shows that inventory decreased $7,000 and accounts payable increased $5,000. Compute cash payments to suppliers using the direct method.

> Russell Co. reports sales revenue of $30,000 and interest revenue of $5,000. Its comparative balance sheet shows that accounts receivable decreased $4,000 and interest receivable increased $1,000. Compute cash provided by operating activities using the d

> A company uses a spreadsheet to prepare its statement of cash flows. Indicate whether each of the following items would be recorded in the Debit column or Credit column of the spreadsheet’s statement of cash flows section. a. Decrease in accounts payable

> Revo Co. reports average total assets of $200,000, revenue of $90,000, net income of $30,000, and cash flow from operations of $38,000. 1. Compute its cash flow on total assets. 2. Is Revo’s cash flow on total assets better than the 8% for its competitor

> Use the following information for VPI Co. to prepare a statement of cash flows for the year ended December 31 using the indirect method.

> Refer to the data in QS 12-7. 1. Assume that all common stock is issued for cash. What amount of cash dividends is paid during 2020? 2. Assume that no additional notes payable are issued in 2020. What cash amount is paid to reduce the notes payable balan

> Indicate the effect, if any, that each separate transaction has on financing cash flows. a. Notes payable with a carrying value of $15,000 are retired for $16,000 cash, resulting in a $1,000 loss. b. Paid cash dividends of $11,000 to common stockholders.

> Prepare Natura Co.’s journal entries to record the following transactions involving its short-term investments in held-to-maturity debt securities, all of which occurred during the current year. a. On June 15, paid $1,000 cash to purchase Remed’s 90-day

> Bryant Co. reports net income of $20,000. For the year, depreciation expense is $7,000 and the company reports a gain of $3,000 from sale of machinery. It also had a $2,000 loss from retirement of notes. Compute cash flows from operations using the indir

> Mifflin Co. reported the following for the current year: net sales of $60,000; cost of goods sold of $38,000; beginning balance in accounts receivable of $14,000; and ending balance in accounts receivable of $6,000. Compute (a) accounts receivable turnov

> At its prior year-end, VPN Co. reported current assets of $60,000 and current liabilities of $55,000. Deter- mine how each of the following transactions would increase, decrease, or have no effect on total current assets, total current liabilities, and t

> Pritchett Co. reported the following year-end data: cash of $15,000; short-term investments of $5,000; accounts receivable (current) of $8,000; inventory of $20,000; prepaid (current) assets of $6,000; and total current liabilities of $20,000. Compute th

> You are to devise an investment strategy to enable you to accumulate $1,000,000 by age 65. Start by making some assumptions about your salary. Next, compute the percent of your salary that you will be able to save each year. If you will receive any lump-

> Express the items from QS 13-5 in common-size percent’s.

> Assume that Carla Harris of Morgan Stanley (MorganStanley.com) has impressed you with the company’s success and its commitment to ethical behavior. You learn of a staff opening at Morgan Stanley and decide to apply for it. Your resume i

> A team approach to learning financial statement analysis is often useful. Required 1. Each team should write a description of horizontal and vertical analysis that all team members agree with and understand. Illustrate each description with an example. 2

> Access the February 22, 2019, filing of the December 31, 2018, 10-K report of The Hershey Company (ticker: HSY) at SEC.gov and complete the following requirements. Required Compute or identify the following profitability ratios of Hershey for its years e

> Each team is to select a different industry, and each team member is to select a different company in that industry and acquire its financial statements. Use those statements to analyze the company, including at least one ratio from each of the four buil

> Analyze transactions (1 through 3) from Exercise C-2 by showing each transaction’s effect on the accounting equation—specifically, identify the accounts and amounts (including + or −) for each.

> Use Samsung’s financial statements in Appendix A to compute its return on total assets for fiscal year ended December 31, 2018.

> Refer to Samsung’s financial statements in Appendix A. Compute its debt ratio as of December 31, 2018, and December 31, 2017.

> Refer to Google’s financial statements in Appendix A to compute its equity ratio as of December 31, 2018, and December 31, 2017.

> Refer to Apple’s financial statements in Appendix A. Compute its profit margin for the years ended September 29, 2018, and September 30, 2017.

> Key figures for Samsung follow (in ₩ millions). Required 1. Compute common-size percents for Samsung using the data given. Round percents to one decimal. 2. What is Samsung’s gross margin ratio on sales? 3. Does Samsun

> Key figures for Apple and Google follow. Required 1. Compute common-size percents for each company using the data given. Round percents to one decimal. 2. If Google paid a dividend, would retained earnings as a percent of total assets increase or decreas

> Refer to the information in QS 13-6. Determine the prior-year and current-year common-size percent’s for cost of goods sold using net sales as the base.

> Use Apple’s financial statements in Appendix A to answer the following. 1. Using fiscal 2016 as the base year, compute trend percents for fiscal years 2016, 2017, and 2018 for net sales, cost of sales, operating income, other income (expense) net, provis

> Use the following selected data from Business Solutions’s income statement for the three months ended March 31, 2021, and from its March 31, 2021, balance sheet to complete the requirements. Required 1. Compute the gross margin ratio (b

> Selected account balances from the adjusted trial balance for Harbor Corp. as of its calendar year-end December 31 follow. Required 1. Assume that the company’s income tax rate is 25% for all items. Identify the tax effects and after-ta

> Brooks Co. purchases debt investments as trading securities at a cost of $66,000 on December 27. This is its first and only purchase of such securities. At December 31, these securities had a fair value of $72,000. 1. Prepare the December 27 entry for th

> Summary information from the financial statements of two companies competing in the same industry follows. Required 1. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turn- over, (d) inventory turnover, (e)

> Selected current year-end financial statements of Overton Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $17,400; total assets, $94,900; common stock, $35,500; and retained e

> Selected comparative financial statements of Tripoly Company follow. Required 1. Compute trend percents for all components of both statements using 2014 as the base year. Round percents to one decimal. Analysis Component 2. Analyze and comment on the fin

> Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year- end December 31 follow. Required 1. Assume that the company’s income tax rate is 30% for all items. Identify the tax effects and a

> Summary information from the financial statements of two companies competing in the same industry follows. Required 1. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) Inventory turnover, (e) da

> Selected current year-end financial statements of Cabot Corporation follow. All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $48,900; total assets, $189,400; common stock, $90,000; and retained ea

> Compute the annual dollar changes and percent changes for each of the following items.

> Plum Corporation began the month of May with $700,000 of current assets, a current ratio of 2.50:1, and an acid-test ratio of 1.10:1. During the month, it completed the following transactions (the company uses a perpetual inventory system). May 2 Purchas

> Selected comparative financial statements of Korbin Company follow. Required 1. Compute each year’s current ratio. Round ratios to one decimal. 2. Express the income statement data in common-size percents. Round percents to two decimals

> Compute the amount that can be borrowed under each of the following circumstances: 1. A promise to repay $90,000 seven years from now at an interest rate of 6%. 2. An agreement made on February 1, 2021, to make three separate payments of $20,000 on Febru

> Identify investments as an investment in either debt securities or equity securities. a. U.S. Treasury bonds b. Google stock c. Certificate of deposit d. Apple bonds e. IBM corporate notes f. German government bonds g. Amazon stock h. Costco co

> Selected comparative financial statements of Haroun Company follow. Required 1. Compute trend percents for all components of both statements using 2014 as the base year. Round percents to one decimal. Analysis Component 2. Refer to the results from part

> Use the financial data for Randa Merchandising, Inc., in Exercise 13-17A to prepare its December 31 year- end income statement. Ignore the earnings per share section.

> In the current year, Randa Merchandising, Inc., sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income

> Roak Company and Clay Company are similar firms that operate in the same industry. Clay began operations two years ago and Roak started five years ago. In the current year, both companies pay 6% interest on their debt to creditors. The following addition

> Following is an incomplete current-year income statement. Determine amounts a, b, and c. Additional information follows: Return on total assets is 16% (average total assets is $68,750). Inventory turnover is 5 (average inventory is $6,000). Accounts re

> Following are data for BioBeans and GreenKale, which sell organic produce and are of similar size. 1. Compute the profit margin and the return on total assets for both companies. 2. Based on analysis of these two measures, which company is the preferred

> Nintendo Company, Ltd., recently reported the following financial information (amounts in millions). Compute Nintendo’s current ratio and profit margin. Round to two decimals.

> Refer to Simon Company’s financial information in Exercises 13-6 and 13-9. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: (1) return on common stockholders&aci

> In the current year, Aveeno reported net income of $50,400, which was a 12% increase over prior year net income. Compute prior year net income.

> Refer to Simon Company’s financial information in Exercises 13-6 and 13-9. For both the current year and one year ago, compute the following ratios: (1) profit margin ratio—percent rounded to one decimal; did profit margin improve or worsen in the curren

> Spiller Corp. plans to issue 10%, 15-year, $500,000 par value bonds payable that pay interest semiannually on June 30 and December 31. The bonds are dated December 31, 2021, and are issued on that date. If the market rate of interest for the bonds is 8%

> Refer to the Simon Company information in Exercises 13-6 and 13-9. For both the current year and one year ago, compute the following ratios: (1) debt ratio and equity ratio—percent rounded to one decimal, (2) debt-to-equity ratio—rounded to two decimals;

> Refer to the Simon Company information in Exercise 13-6. The company’s income statements for the cur- rent year and one year ago follow. Assume that all sales are on credit and then compute (1) days’ sales uncollected,

> On January 1, 5G Co. reported current assets of $72,000 and current liabilities of $60,000. Compute total current assets, total current liabilities, and the current ratio at January 1 and after each of the following transactions. Jan. 5 Purchased equipme

> Refer to Simon Company’s balance sheets in Exercise 13-6. (1) Compute the current ratio for each of the three years. Did the current ratio improve or worsen over the three-year period? (2) Compute the acid-test ratio for each of the three years. Did the

> Simon Company’s year-end balance sheets follow. (1) Express the balance sheets in common-size per- cents. Round percents to one decimal. (2) Assuming annual sales have not changed in the last three years, is the change in accounts recei

> Common-size and trend percents for Roxi Company’s sales, cost of goods sold, and expenses follow. Determine whether net income increased, decreased, or remained unchanged in this three-year period.

> Compute common-size percents for the following comparative income statements (round percents to one decimal). Using the common-size percents, which item is most responsible for the decline in net income?

> Compute trend percents for the following accounts using 2016 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable.

> Identify which of the following six metrics a through f best completes questions 1 through 3. a. Days’ sales uncollected b. Accounts receivable turnover c. Working capital d. Return on total assets e. Total asset turnover f. Profit margin 1. Which two r

> Identify which standard of comparison, (a) intracompany, (b) competitor, (c) industry, or (d) guidelines, best describes each of the following examples. 1. Compare Ford’s return on assets to GM’s return on assets. 2. Compare a company’s acid-test ratio t

> Otto Co. borrows money on April 30, 2021, by promising to make four payments of $13,000 each on November 1, 2021; May 1, 2022; November 1, 2022; and May 1, 2023. 1. How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually

> Match the ratio to the building block of financial statement analysis to which it best relates. A. Liquidity and efficiency B. Solvency C. Profitability D. Market prospects 1. Equity ratio 2. Return on total assets 3. Dividend yield 4. Days’ sa

> Wipfli Co. provides auditing services and consulting services. Wipfli sells the consulting services segment for a gain of $75,000 (net of tax). Income from consulting services during the year is $20,000 (net of tax). Wipfli reports income from continuing

> Which of the following gains or losses would Organic Foods account for as unusual and/or infrequent? a. A hurricane destroys rainwater tanks that result in a loss for Organic Foods. b. The used vehicle market is weak and Organic Foods is forced to sell i

> Following is information for Morgan Company and Parker Company, which are similar firms operating in the same industry. 1. Based on current ratio and acid-test ratio, which company appears better positioned to pay current liabilities? 2. Based on account

> For each ratio listed, identify whether the change in ratio value from the prior year to the current year is usually regarded as favorable or unfavorable.

> Franklin Co. reported the following year-end data: net income of $220,000; annual cash dividends per share of $3; market price per (common) share of $150; and earnings per share of $10. Compute the a. Price-earnings ratio and b. dividend yield.

> Edison Co. reported the following for the current year: net sales of $80,000; cost of goods sold of $56,000; net income of $16,000; beginning balance of total assets of $60,000; and ending balance of total assets of $68,000. Compute (a) profit margin and

> Paddy’s Pub reported the following year-end data: income before interest expense and income tax expense of $30,000; cost of goods sold of $17,000; interest expense of $1,500; total assets of $70,000; total liabilities of $20,000; and total equity of $50,

> Dundee Co. reported the following for the current year: net sales of $80,000; cost of goods sold of $60,000; beginning balance of total assets of $115,000; and ending balance of total assets of $85,000. Compute total asset turnover. Round to one decimal.

> SCC Co. reported the following for the current year: net sales of $48,000; cost of goods sold of $40,000; beginning balance in inventory of $2,000; and ending balance in inventory of $8,000. Compute (a) inventory turnover and (b) days’ sales in inventory

> Analyze Rowan’s entries (1 through 3) from QS C-16 by showing each entry’s effect on the accounting equation—specifically, identify the accounts and amounts (including + or −) for each.

> Identify whether each of the following items are included as part of general-purpose financial statements. a. Income statement b. Balance sheet c. Shareholders’ meetings d. Financial statement notes e. Company news releases f. Statement of cash flows g.

> Use the following adjusted trial balance of Sierra Company to prepare its (1) income statement and (2) Statement of retained earnings for the year ended December 31. The Retained Earnings account balance was $5,500 on December 31 of the prior year.

> Common categories of a classified balance sheet include Current Assets, Long-Term Investments, Plant Assets, Intangible Assets, Current Liabilities, and Long-Term Liabilities. For each of the following items, identify the balance sheet category where the

> Following are unadjusted balances along with year-end adjustments for Quinlan Company. Complete the adjusted trial balance by entering the adjusted balance for each of the following accounts.

> For the entries below, identify the account to be debited and the account to be credited. Indicate which of the accounts the income statement account is and which the balance sheet account is. a. Entry to record services revenue earned that was previousl

> Molly Mocha employs one college student every summer in her coffee shop. The student works the five weekdays and is paid on the following Monday. (For example, a student who works Monday through Fri- day, June 1 through June 5, is paid for that work on M

> Select a company that you can visit in person or interview on the telephone. Call ahead to the company to arrange a time when you can interview an employee (preferably an accountant) who helps prepare the annual financial statements. Inquire about the fo

> Review this chapter’s opening feature involving Evan and Bobby and Snapchat. 1. Explain how a classified balance sheet can help Evan and Bobby know what bills are due when and whether they have the resources to pay those bills. 2. Why is it important for

> a. Tao Co. receives $10,000 cash in advance for four months of evenly planned legal services beginning on October 1. Tao records it by debiting Cash and crediting Unearned Revenue both for $10,000. It is now December 31, and Tao has provided legal servic