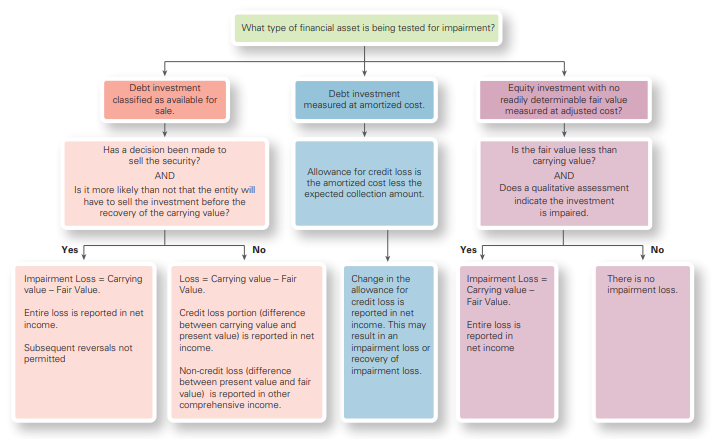

Question: Refer to Exhibit 16A.1, which presents

Refer to Exhibit 16A.1, which presents a decision tree for impairments of investments in financial assets under U.S. GAAP. Detail the decisions and judgments that you must make when determining whether an investing asset has been impaired and, if so, the amount of impairment. Provide explanations as necessary. Is the area of investing asset impairments more of an objective or subjective area of financial reporting?

EXHIBIT 16A.1:

> Supergreen Grocers, Inc. offered its customers a free baking pan in exchange for 100 green stickers. Customers earn 1 green sticker for each $10 of groceries purchased at Supergreen during 2018. During 2018, Supergreen purchased with cash 1,100 baking pa

> Landau Manufacturing Company manufactures and distributes small power tools. Landau offers an assurance-type warranty that covers all repair costs, including parts and labor, for 2 years after the date of sale. During the current year, the company sold $

> Genius Computers sells computers and offers an assurance type warranty that covers all repair costs, including parts and labor, for 1 year after the date of purchase. Genius also sells a service-type warranty contract that covers all parts and labor for

> Cole Electronics, Inc. manufactures and distributes LCD televisions. Every television manufactured by Cole carries an assurance-type warranty covering all parts and labor to protect against defects for a 2-year period. During the current year, Cole’s sal

> On November 1, Barcelona Sales, Inc. purchased inventory costing $589,000 using a 5-month trade note payable. The note carries an annual interest rate of 10%. Barcelona has a December 31 year-end. The company uses a perpetual inventory system. Required

> Elyctric Company reports a $2,850,000 monthly payroll. Payroll income taxes average 20% for federal and 4% for state and local taxes. The company is also responsible for federal and state unemployment taxes. The federal unemployment tax rate is 1.6%. The

> Neumann Consulting Group reports a $1,200,000 biweekly payroll. Payroll income taxes average 20% for federal and 4% for state and local taxes. The company is also responsible for federal and state unemployment taxes. The federal unemployment tax rate is

> Lousa Company revalues its equipment with a carrying value of €1,100,000 to its fair value of €950,000. The original cost of the equipment is €1,500,000 and accumulated depreciation is €400,000. Required: a. What is the revaluation surplus or unrealiz

> Sousa Company revalues equipment with a carrying value of €1,100,000 to its fair value of €1,400,000. The original cost of the equipment is €1,600,000 and accumulated depreciation is €500,000. Required: a. What is the revaluation surplus or unrealized

> Hattie Corporation recently decided to dispose of a significant portion of its plant assets. The assets to be held for disposal are summarized here: * Machinery is depreciated by the straight-line method, assuming a 6-year life with no scrap value. The

> Use the same information from E12-5 but now assume that Brigatti Company is an IFRS reporter and that Cornish Division is a cash-generating unit. Assume that costs to sell the unit are zero. Required: a. Determine whether goodwill is impaired assuming

> Use the same information from E12-4 but now treat SMC Research Associates as an IFRS reporter. Required: a. Compute the impairment loss (if any) for each intangible asset. b. Prepare the journal entry necessary to record the impairment loss. c. Assu

> IFRS. Use the information from BE13-14 and now assume that TU Bank is an IFRS reporter. What is the journal entry under IFRS? Data from BE13-14: In August 2018, a customer at TU Bank slipped on a wet floor and broke an arm. The customer sued the bank in

> Use the same information from E12-3 but now assume that Derrick’s Domino Manufacturing Company is an IFRS reporter. Required: a. Prepare the journal entry required to record the impairment loss. b. Assuming that Derrickâ€

> Use the same information from E12-1 but now assume that Henne Optical Corporation is an IFRS reporter. Henne Optical’s discount rate is 5% and costs to sell any equipment are zero. Required: a. Determine the asset group for purposes o

> Brigatti Company pays $1,560,000 to acquire 100% of the common stock of Cornish Incorporated. It assumes that Cornish’s plant assets (such as the factory building and land) are undervalued by $40,000. The historical cost of the net asse

> Environmental remediation costs have become increasingly prevalent in the last few decades. Read paragraphs 4 through 7, paragraph 15, and paragraph 25 of ASC 410-30-05. Also read paragraphs 1 through 13 of ASC 410-30-25. 1. Briefly explain the followin

> Kraker, Inc. is a calendar-year private company that is not required to register with the SEC. It operates five different restaurant chains, two of which are fast-food chains and three of which provide higher-end dining experiences. On January 2, 2017, K

> A&N, Inc. is a manufacturer and retailer of specialized office equipment. It currently operates in two countries, both of which follow IFRS for their financial reporting. For the sake of simplicity, assume that both countries have the same currency,

> Refer to FASB ASC 230-10 and the Basis for Conclusions in FASB’s Statement of Financial Accounting Standards No. 95 to answer the following questions: 1. Are companies permitted to report cash flow per share on their financial statements? 2. What was F

> Refer to the Codification to determine the correct classification in the statement of cash flows (operating, investing, or financing) for the following transactions: 1. Cash contributions to charities 2. Proceeds from insurance on a building that was d

> 1. Read FASB ASC 250-10-S99 to respond to the following question. ASCO Recordings has decided to change its inventory system from the LIFO method to the FIFO method for the 2015 fiscal year. Because it does not carry much inventory, the change in princip

> On March 1 of the current year, Johanne Stores acquired 100% of the voting shares of Ferry Furniture Com pany. Johanne reports only annually on a calendar basis. As part of the merger agreement, Johanne agreed to distribute 0.2 additional shares for each

> In August 2018, a customer at TU Bank slipped on a wet floor and broke an arm. The customer sued the bank in September 2018. As of TU Bank’s December 31 year-end, the company’s attorneys believe that it is 80% likely that TU will lose this case. The atto

> ASC 825-10 Financial Instruments – Overall permits (but does not require) the option to report most financial assets at fair value. Read paragraphs A12 – A19 of the Basis for Conclusions in Statement of Financial Accounting Standards No. 159. 1. When mus

> On January 1, 2018, Western Wear, Inc. granted 100,000 stock options to its employees. Of these options, 30% will vest on December 31, 2018, 30% will vest on December 31, 2019, and the remaining 40% will vest on December 31, 2020. The fair value of the o

> On January 1, 2018, Western Wear, Inc. granted 100,000 stock options to its employees. Of these options, 30% will vest on December 31, 2018, 30% will vest on December 31, 2019, and the remaining 40% will vest on December 31, 2020. The fair value of the o

> In the text, we discussed the practical, step-by-step approach for the subsequent measurement of an operating lease for the lessee. However, that exact approach is not specified by the Codification. Consider the following lease scenario. Baldwin Brokerag

> On January 1, 2019 (lease inception date), Tofootles Company leases a piece of equipment from ABC Leasing Company. The lease term is for 4 years with the first payment of $1,000 due on January 1, 2019. The remaining three payments of $1,000 each are due

> Consider each of the following scenarios and determine whether a lease contract exists for each scenario. Support your conclusions with Topic 842 in the Codification and provide appropriate citations to the Codification. 1. Guitar World Company (GWC) se

> GTI Corporation acquired a 15% interest in DDA Partnership on February 15 of the current year. GTI is preparing its financial statements for the first quarter and needs to determine how to report the investment. GTI realizes that it will either report at

> Toofles Company, a publicly traded entity, issued nonredeemable preferred stock on January 1, 2018, Toofles issued 1,000 shares of $100 par value shares for $82,425. On January 1, 2015, the market rate of interest for preferred stock with the same charac

> Companies sometimes issue bonds with detachable warrants entitling the bondholder to buy the stock of the company at a fixed price. The U.S. GAAP rules related to the issue of these bonds are included in ASC 470-20, Debt with Conversion and Other Options

> Under U.S. GAAP, firms may choose to report most financial assets and financial liabilities at fair value, using the fair value option. The rules related to the fair value option are included in ASC 825-10 Financial Instruments—Overall. When an entity ch

> The managers of Axbo Company, a private company whose bank requires it to follow U.S. GAAP, have decided to close one of its factories. The managers made this decision on July 16 of the current year and communicated this plan to their workers on August 1

> Buckner Chemical Products reported the following information on its latest balance sheet dated December 31 of the current year. The relevant t-accounts follow. On January 1 of the following year, Buckner sold the plant asset for $9,000 and incurred $6,2

> Use the information in Judgment Case 1 and assume that Generics, Inc. reports under IFRS. 1. Do you think Generics should accrue the contingency, only disclose the contingency, or not report the contingency at all in its December 31, 2018, financial sta

> Generics, Inc. is a U.S. GAAP reporter that manufactures and sells generic drugs and has a December 31 year-end. On March 1, 2018, it began selling a drug, Anocyn, which is a generic of Dicital. Dicital was patented by the pharmaceutical company Pharma,

> Background AKS Company’s common shares are publicly traded and it files with the SEC. AKS has a single reporting unit, which sells high-end consumer electronics. AKS has a March 31 fiscal year-end. Fiscal 2021 data On April 1, 2020, AKS acquired a compet

> Background Toyda, Inc. (Toyda) is one of the world’s leading car manufacturers. It sells cars exclusively in the United States. In recent years, Toyda has begun producing electric cars as well as specialized equipment that is used to ch

> Refer to the information in Surfing the Standards Case 1 later in the chapter to answer the following questions. a. Prepare the calculation of the impairment loss. b. What items included in the case itself involved issues of judgment? (Include only those

> Consider KaseyKraft Company from Example 22.15 in the text. As discussed, its operating cash flow (OCF) for the year is $248,610. Because this is much lower than operating income of $733,077, KaseyKraft would like to report a higher OCF figure. What deci

> SAB Topic 1.M., Assessing Materiality, found in FASB ASC 250-10-S99-1, presents the SEC’s views on the issue of materiality in the financial statements. Based on this document, indicate whether each of the following errors is material and thus should be

> The CFO of Last Things Computing, Inc. (LTC) prepared the following balance sheet and statement of net income for the year ended December 31, 2018. LTC had 15,000 common shares outstanding for the entire year. It had no preferred stock or dilutive secur

> Jones Automotives granted employee stock options on January 2, 2018, to acquire 100,000 shares of common stock. The exercise price was $25 per share and the vesting period is 4 years. The estimated fair value of the options is $20 per share. In 2018, Jon

> On January 1, 2019, Lessee Company leased a piece of machinery from Lessor Bank. The machinery could also be used by other parties. The 14-year lease requires payments of $250,000 due at the beginning of each year. The lease agreement does not transfer o

> Using the information provided in BE13-11, prepare the journal entries to record the first year’s depreciation and accretion accrual. Data From BE13-11: On January 1, Pollison Energy Group, Inc. acquired an oil processing plant at a total cost of $13,56

> The lease rules discussed in this chapter have an effective date for fiscal years beginning after December 15, 2018. Under U.S. GAAP, the classification rules that were effective before that date are a bit different. Specifically, the Group I rules were

> Refer to Exhibit 16A.2, which presents a decision tree for impairments of investments in financial assets under IFRS. Please detail the decisions and judgments that you must make when determining whether an investing asset has been impaired and, if so, t

> On June 6, 2012, Universal Bioenergy, Inc. declared a 20% stock dividend. Because it is a 20% dividend, it had the flexibility to account for this as a small or large stock dividend. Its common stock was trading at $0.01 per share at that time. Excerpts

> TUFA, Inc. is a calendar-year, nonpublic company that follows U.S. GAAP. TUFA uses the cost method to account for repurchases of treasury stock. Recently, TUFA repurchased 10,000 shares of its common stock from a key shareholder at $55 per share. This pa

> Jillian Limited (JL) issued a financial instrument with the following terms: • A face value of $100. • Not secured by any assets of the entity (unsecured). • Redeemable in cash at the option of the issuer. • Pays 5% of face value annually. • The 5%

> Jillian Limited (JL) issued a financial instrument with the following terms: • A face value of $100. • Not secured by any assets of the entity (unsecured). • Redeemable in cash at the option of the issuer. • Pays 5% of face value annually. • The 5% d

> Companies normally obtain financing for operations from three sources: 1. Borrowing funds (debt) 2. Issuing shares (equity) 3. Using internally generated capital (from retained profits) Sometimes, deciding how to present and classify these sources of

> PDC Coal, Inc. received a mining permit to strip mine 1,000 acres of land in West Virginia on January 5 of the current year. Prior to receiving the permit, PDC submitted a legally-binding plan that included a timetable for the full reclamation process. P

> Cisco Systems, Inc., the leading Internet protocol-based networking equipment company, has significant holdings of investment securities. Use the financial statement information provided to analyze Cisco’s holdings and answer the follow

> On January 1, Pollison Energy Group, Inc. acquired an oil processing plant at a total cost of $13,560,000 and paid cash. The estimated cost to dismantle the plant and restore the property at the end of the plant’s 10-year life is $2,100,000. Pollison’s c

> With declining demand and sales, the last several years have been challenging in the global auto industry. You are interested in better understanding the performance and valuation of major global companies in the industry. The following table presents ne

> Grifols, S.A. is a Spanish pharmaceutical company focusing on the development, manufacturing, and sale of therapeutic products. At the end of 2016, Grifols was rated “BB” by Standard & Poor’s and

> You are interested in further analyzing and comparing the liquidity of Pfizer Inc., and Johnson & Johnson Company. In an earlier analysis in Appendix B of Chapter 6, you found the current ratios of both companies at the end of fiscal year 2016 were a

> BlackBerry Limited, the smartphone manufacturer, reported a $2,748 million impairment loss on its income statement during the year ended March 1, 2014. You are interested in further examining this and any other impairment losses at BlackBerry and have id

> Our assignment is to analyze Pfizer’s Inc. operating cash flows and compare it to that of Johnson & Johnson. Use Pfizer’s statement of cash flows and the following information to address these questions: a. What i

> The 2013 financial statements of Lexmark International, Inc., a leading developer, manufacturer, and supplier of printing, imaging, and device management, indicated that it reported an accounting policy change. Use the following information and excerpts

> You are asked to analyze NCR Corporation’s EPS. NCR is a business solution company manufacturing automated teller machines (ATMs), point of sale (POS) terminals and devices, and self-service kiosks. Use the footnote disclosure to answer

> Pfizer Inc., a global pharmaceutical company, offers several different types of stock-based compensation to its employees. Pfizer reports under U.S. GAAP. Use the disclosures provided in Exhibit 19.3 to answer the following questions. Required: a. What

> Eli Lilly and Company, a global pharmaceutical company, offers defined-benefit plans to its employees. The following table presents select data about Eli Lilly’s defined-benefits pension plan. Eli Lilly reports under U.S. GAAP. Use this

> You are reviewing the financial statements of Trident Incorporated and observed that Trident entered into a significant operating lease for office equipment at the end of the current year. Because of the nature of items leased and the length of the lease

> The employees of Wilson Lumber are allowed to take 5 sick days per year. The sick days vest and are paid at the current rate of $150 per day. Wilson employs 70 employees. Employees took 80% of the sick days in the current year and carried over the remain

> Under certain circumstances, IFRS allows some intangible assets to be revalued, whereas U.S. GAAP does not allow revaluation. Read the Basis for Conclusions in IAS 38, Intangible Assets, particularly paragraphs BC76 and BC77. Does the IASB provide any in

> Consider the Basis for Conclusions in IAS 16, Property, Plant and Equipment (particularly paragraph BC25) as well as the legacy U.K. standard on tangible fixed assets Financial Reporting Standard (FRS) 15 (particularly Appendix IV, paragraphs 17 and 29 t

> Currently, U.S. GAAP allows entities to present their operating cash flows either under the direct or the indirect method. 1. Briefly describe each method’s approach. 2. What is the primary advantage of each method? 3. Discuss which participants in th

> U.S. GAAP and IFRS differ in the classifications of dividends and interest on the statement of cash flows. U.S. GAAP requires firms to classify cash receipts from interest and dividends and cash payments for interest as operating cash flows. However, IFR

> Read the Basis for Conclusions (paragraphs B1 through B38) in FASB’s Statement of Financial Accounting Standards No. 154 to respond to the following questions. 1. When debating the issues of FASB’s “Accounting Changes and Error Corrections,” Statement o

> Read paragraphs 105 through 107 in Appendix B: Background information and basis for conclusions in FASB’s Statement of Financial Accounting Standards No. 128. Required: a. Why did the Board decide to continue to use the treasury stock method? b. What

> Read paragraphs 95 through 99 in Appendix B: Background information and basis for conclusions in FASB’s Statement of Financial Accounting Standards No. 128. Required: a. Why did the Board decide to require an antidilution sequence that considers secur

> Prior to 2005, firms did not have to recognize an expense for all employee stock options but could disclose the effect of the options in the footnotes. The concept of recognition versus disclosure in the context of employee stock options is discussed in

> U.S. GAAP did not require companies to expense employee stock options through the income statement prior to 2005. Paragraphs B2 through B11 in the Statement of Financial Accounting Standards No. 123(R) basis for conclusions indicate that reaching an agre

> In deliberating on ASU 2016-02, Leases, the Board debated several methods for lease classification. What did the Board decide and why? What other methods did they consider and why did they not choose those methods? Provide citations to the Basis for Conc

> On February 1, Seville Sales, Inc. purchased inventory costing $450,000 using a 6-month trade note payable. The note carries an annual interest rate of 9%. Seville has a December 31 yearend. Prepare the journal entries required. The company uses the perp

> IFRS accounts for all leases in the same way (for the lessee), but U.S. GAAP measures lease-related expenses and the right-of-use asset for operating leases (lessee) differently than for finance leases. Required: a. Explain the subsequent measurement d

> The lease rules discussed in this chapter have an effective date for fiscal years beginning after December 15, 2018. Under U.S. GAAP, the accounting treatment of operating leases for the lessee were quite different than these new rules. Under the old rul

> ASC 825-10 Financial Instruments – Overall permits (but does not require) the option to report most financial assets at fair value. Read paragraph A3 of the Basis for Conclusions in Statement of Financial Accounting Standards No. 159. Briefly explain the

> In January 1996, FASB issued an exposure draft of a standard that would address both the computation of earnings per share and the disclosure of information about a firm’s capital structure. However, the board divided these topics into two standards. Sta

> Many financial instruments include characteristics of both a liability and equity. Read ASC 480-10-15, paragraphs 3 and 4, and ASC 480-10-25, paragraph 1. Also read International Accounting Standard 32, paragraphs 28 through 32. In addition, read the rel

> In the following exercise, you are required to review the Basis for Conclusions (BCs) for the standard(s) that provide the accounting guidance for this topic. As the BCs are generally not included in the codification and thus are not authoritative, it wi

> In the following exercise, you are required to review the Basis for Conclusions (BCs) for the standard(s) that provide the accounting guidance for this topic. Because the BCs is generally not included in the codification and thus is not authoritative, it

> FASB issued ASU 2014-02 in January 2014 to allow private companies an alternative to testing goodwill for impairment. 1. Please provide a discussion of why FASB issued the standard. 2. What are the primary differences in this standard for private compa

> Using the information provided in BE22-5, prepare the financing activities section of Larry’s Luggage Company’s cash flow statement assuming that Larry’s Luggage reports under IFRS. Larryâ€

> Repeat the requirements of BE22-5 under the indirect method assuming that Larry’s Luggage Company reports under IFRS and it begins the reconciliation to operating cash flows with operating income. Larry’s Luggage classifies interest paid as a financing a

> Verde Corporation sold a piece of land for $720,000. The land originally cost $810,000, but 2 years ago Verde had revalued it to $700,000. What is the gain or loss on the sale? What is the journal entry to record the sale?

> Repeat the requirements of BE22-5 under the indirect method assuming that Larry’s Luggage Company reports under IFRS and begins the reconciliation to operating cash flows with operating income. Larry’s Luggage classifies interest paid, interest received,

> Repeat the requirements of BE22-5 under the indirect method. Data from BE22-5: Prepare the operating activities section of the cash flow statement using the direct method. Assume that accrued expenses relate to selling, general, and administrative expen

> Larry’s Luggage Company provided the following balance sheet and income statement for the current year. Prepare the operating activities section of the cash flow statement using the direct method. Assume that accrued expenses relate to

> State whether a firm would add or subtract the following items from income to compute cash flows from operations under the indirect method.

> State whether a firm would add or subtract the following items from income to compute cash flows from operations under the indirect method.

> Mirat, Inc. has net income of $49,400 in the current year. Additional information for the year follows: • It experienced net unrealized losses on investment securities of $4,900 reported in net income and net unrealized losses of $2,200 reported in othe

> Salat, Inc. has net income of $78,800 in the current year. Pertinent company information follows. • Salat experiences net unrealized gains on investment securities of $6,200 reported in net income and net unrealized losses of $2,200 reported in other com

> Donegal Industries reported net income of $67,000 for the current year. The balances and activity in its accounts receivable accounts follow. In addition, the company recorded $3,300 of bad debt expense and wrote off $2,800 of uncollectible accounts. Re

> During the year, Zurry Coach Service reported an increase in income taxes payable of $1,400 during the year and a decrease in deferred-tax asset of $2,000. Its income tax expense was $5,700. Required: a. What is cash paid for income taxes? b. What wo

> Roadster Car Service reported a decrease in income taxes payable of $4,500 during the year and an increase in deferred-tax liability of $3,000. Its income tax expense was $2,300. Required: a. What is cash paid for income taxes? b. What would Roadster