Question: Using the information provided in BE22-5,

Using the information provided in BE22-5, prepare the financing activities section of Larry’s Luggage Company’s cash flow statement assuming that Larry’s Luggage reports under IFRS. Larry’s Luggage classifies interest paid as a financing activity and interest received as an investing activity. Larry’s Luggage made payments of $2,000 on its notes payable.

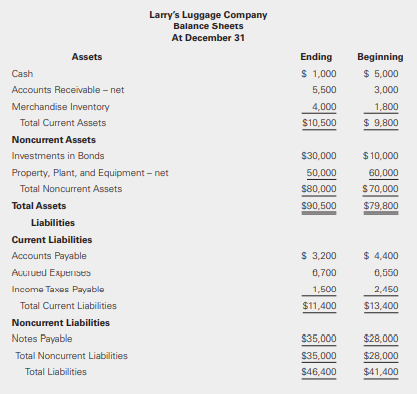

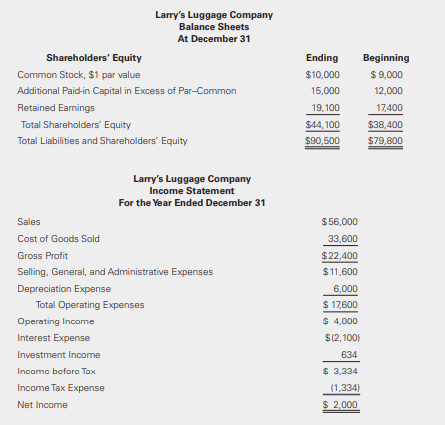

Data from BE22-5:

> Background Toyda, Inc. (Toyda) is one of the world’s leading car manufacturers. It sells cars exclusively in the United States. In recent years, Toyda has begun producing electric cars as well as specialized equipment that is used to ch

> Refer to the information in Surfing the Standards Case 1 later in the chapter to answer the following questions. a. Prepare the calculation of the impairment loss. b. What items included in the case itself involved issues of judgment? (Include only those

> Consider KaseyKraft Company from Example 22.15 in the text. As discussed, its operating cash flow (OCF) for the year is $248,610. Because this is much lower than operating income of $733,077, KaseyKraft would like to report a higher OCF figure. What deci

> SAB Topic 1.M., Assessing Materiality, found in FASB ASC 250-10-S99-1, presents the SEC’s views on the issue of materiality in the financial statements. Based on this document, indicate whether each of the following errors is material and thus should be

> The CFO of Last Things Computing, Inc. (LTC) prepared the following balance sheet and statement of net income for the year ended December 31, 2018. LTC had 15,000 common shares outstanding for the entire year. It had no preferred stock or dilutive secur

> Jones Automotives granted employee stock options on January 2, 2018, to acquire 100,000 shares of common stock. The exercise price was $25 per share and the vesting period is 4 years. The estimated fair value of the options is $20 per share. In 2018, Jon

> On January 1, 2019, Lessee Company leased a piece of machinery from Lessor Bank. The machinery could also be used by other parties. The 14-year lease requires payments of $250,000 due at the beginning of each year. The lease agreement does not transfer o

> Using the information provided in BE13-11, prepare the journal entries to record the first year’s depreciation and accretion accrual. Data From BE13-11: On January 1, Pollison Energy Group, Inc. acquired an oil processing plant at a total cost of $13,56

> The lease rules discussed in this chapter have an effective date for fiscal years beginning after December 15, 2018. Under U.S. GAAP, the classification rules that were effective before that date are a bit different. Specifically, the Group I rules were

> Refer to Exhibit 16A.2, which presents a decision tree for impairments of investments in financial assets under IFRS. Please detail the decisions and judgments that you must make when determining whether an investing asset has been impaired and, if so, t

> Refer to Exhibit 16A.1, which presents a decision tree for impairments of investments in financial assets under U.S. GAAP. Detail the decisions and judgments that you must make when determining whether an investing asset has been impaired and, if so, the

> On June 6, 2012, Universal Bioenergy, Inc. declared a 20% stock dividend. Because it is a 20% dividend, it had the flexibility to account for this as a small or large stock dividend. Its common stock was trading at $0.01 per share at that time. Excerpts

> TUFA, Inc. is a calendar-year, nonpublic company that follows U.S. GAAP. TUFA uses the cost method to account for repurchases of treasury stock. Recently, TUFA repurchased 10,000 shares of its common stock from a key shareholder at $55 per share. This pa

> Jillian Limited (JL) issued a financial instrument with the following terms: • A face value of $100. • Not secured by any assets of the entity (unsecured). • Redeemable in cash at the option of the issuer. • Pays 5% of face value annually. • The 5%

> Jillian Limited (JL) issued a financial instrument with the following terms: • A face value of $100. • Not secured by any assets of the entity (unsecured). • Redeemable in cash at the option of the issuer. • Pays 5% of face value annually. • The 5% d

> Companies normally obtain financing for operations from three sources: 1. Borrowing funds (debt) 2. Issuing shares (equity) 3. Using internally generated capital (from retained profits) Sometimes, deciding how to present and classify these sources of

> PDC Coal, Inc. received a mining permit to strip mine 1,000 acres of land in West Virginia on January 5 of the current year. Prior to receiving the permit, PDC submitted a legally-binding plan that included a timetable for the full reclamation process. P

> Cisco Systems, Inc., the leading Internet protocol-based networking equipment company, has significant holdings of investment securities. Use the financial statement information provided to analyze Cisco’s holdings and answer the follow

> On January 1, Pollison Energy Group, Inc. acquired an oil processing plant at a total cost of $13,560,000 and paid cash. The estimated cost to dismantle the plant and restore the property at the end of the plant’s 10-year life is $2,100,000. Pollison’s c

> With declining demand and sales, the last several years have been challenging in the global auto industry. You are interested in better understanding the performance and valuation of major global companies in the industry. The following table presents ne

> Grifols, S.A. is a Spanish pharmaceutical company focusing on the development, manufacturing, and sale of therapeutic products. At the end of 2016, Grifols was rated “BB” by Standard & Poor’s and

> You are interested in further analyzing and comparing the liquidity of Pfizer Inc., and Johnson & Johnson Company. In an earlier analysis in Appendix B of Chapter 6, you found the current ratios of both companies at the end of fiscal year 2016 were a

> BlackBerry Limited, the smartphone manufacturer, reported a $2,748 million impairment loss on its income statement during the year ended March 1, 2014. You are interested in further examining this and any other impairment losses at BlackBerry and have id

> Our assignment is to analyze Pfizer’s Inc. operating cash flows and compare it to that of Johnson & Johnson. Use Pfizer’s statement of cash flows and the following information to address these questions: a. What i

> The 2013 financial statements of Lexmark International, Inc., a leading developer, manufacturer, and supplier of printing, imaging, and device management, indicated that it reported an accounting policy change. Use the following information and excerpts

> You are asked to analyze NCR Corporation’s EPS. NCR is a business solution company manufacturing automated teller machines (ATMs), point of sale (POS) terminals and devices, and self-service kiosks. Use the footnote disclosure to answer

> Pfizer Inc., a global pharmaceutical company, offers several different types of stock-based compensation to its employees. Pfizer reports under U.S. GAAP. Use the disclosures provided in Exhibit 19.3 to answer the following questions. Required: a. What

> Eli Lilly and Company, a global pharmaceutical company, offers defined-benefit plans to its employees. The following table presents select data about Eli Lilly’s defined-benefits pension plan. Eli Lilly reports under U.S. GAAP. Use this

> You are reviewing the financial statements of Trident Incorporated and observed that Trident entered into a significant operating lease for office equipment at the end of the current year. Because of the nature of items leased and the length of the lease

> The employees of Wilson Lumber are allowed to take 5 sick days per year. The sick days vest and are paid at the current rate of $150 per day. Wilson employs 70 employees. Employees took 80% of the sick days in the current year and carried over the remain

> Under certain circumstances, IFRS allows some intangible assets to be revalued, whereas U.S. GAAP does not allow revaluation. Read the Basis for Conclusions in IAS 38, Intangible Assets, particularly paragraphs BC76 and BC77. Does the IASB provide any in

> Consider the Basis for Conclusions in IAS 16, Property, Plant and Equipment (particularly paragraph BC25) as well as the legacy U.K. standard on tangible fixed assets Financial Reporting Standard (FRS) 15 (particularly Appendix IV, paragraphs 17 and 29 t

> Currently, U.S. GAAP allows entities to present their operating cash flows either under the direct or the indirect method. 1. Briefly describe each method’s approach. 2. What is the primary advantage of each method? 3. Discuss which participants in th

> U.S. GAAP and IFRS differ in the classifications of dividends and interest on the statement of cash flows. U.S. GAAP requires firms to classify cash receipts from interest and dividends and cash payments for interest as operating cash flows. However, IFR

> Read the Basis for Conclusions (paragraphs B1 through B38) in FASB’s Statement of Financial Accounting Standards No. 154 to respond to the following questions. 1. When debating the issues of FASB’s “Accounting Changes and Error Corrections,” Statement o

> Read paragraphs 105 through 107 in Appendix B: Background information and basis for conclusions in FASB’s Statement of Financial Accounting Standards No. 128. Required: a. Why did the Board decide to continue to use the treasury stock method? b. What

> Read paragraphs 95 through 99 in Appendix B: Background information and basis for conclusions in FASB’s Statement of Financial Accounting Standards No. 128. Required: a. Why did the Board decide to require an antidilution sequence that considers secur

> Prior to 2005, firms did not have to recognize an expense for all employee stock options but could disclose the effect of the options in the footnotes. The concept of recognition versus disclosure in the context of employee stock options is discussed in

> U.S. GAAP did not require companies to expense employee stock options through the income statement prior to 2005. Paragraphs B2 through B11 in the Statement of Financial Accounting Standards No. 123(R) basis for conclusions indicate that reaching an agre

> In deliberating on ASU 2016-02, Leases, the Board debated several methods for lease classification. What did the Board decide and why? What other methods did they consider and why did they not choose those methods? Provide citations to the Basis for Conc

> On February 1, Seville Sales, Inc. purchased inventory costing $450,000 using a 6-month trade note payable. The note carries an annual interest rate of 9%. Seville has a December 31 yearend. Prepare the journal entries required. The company uses the perp

> IFRS accounts for all leases in the same way (for the lessee), but U.S. GAAP measures lease-related expenses and the right-of-use asset for operating leases (lessee) differently than for finance leases. Required: a. Explain the subsequent measurement d

> The lease rules discussed in this chapter have an effective date for fiscal years beginning after December 15, 2018. Under U.S. GAAP, the accounting treatment of operating leases for the lessee were quite different than these new rules. Under the old rul

> ASC 825-10 Financial Instruments – Overall permits (but does not require) the option to report most financial assets at fair value. Read paragraph A3 of the Basis for Conclusions in Statement of Financial Accounting Standards No. 159. Briefly explain the

> In January 1996, FASB issued an exposure draft of a standard that would address both the computation of earnings per share and the disclosure of information about a firm’s capital structure. However, the board divided these topics into two standards. Sta

> Many financial instruments include characteristics of both a liability and equity. Read ASC 480-10-15, paragraphs 3 and 4, and ASC 480-10-25, paragraph 1. Also read International Accounting Standard 32, paragraphs 28 through 32. In addition, read the rel

> In the following exercise, you are required to review the Basis for Conclusions (BCs) for the standard(s) that provide the accounting guidance for this topic. As the BCs are generally not included in the codification and thus are not authoritative, it wi

> In the following exercise, you are required to review the Basis for Conclusions (BCs) for the standard(s) that provide the accounting guidance for this topic. Because the BCs is generally not included in the codification and thus is not authoritative, it

> FASB issued ASU 2014-02 in January 2014 to allow private companies an alternative to testing goodwill for impairment. 1. Please provide a discussion of why FASB issued the standard. 2. What are the primary differences in this standard for private compa

> Repeat the requirements of BE22-5 under the indirect method assuming that Larry’s Luggage Company reports under IFRS and it begins the reconciliation to operating cash flows with operating income. Larry’s Luggage classifies interest paid as a financing a

> Verde Corporation sold a piece of land for $720,000. The land originally cost $810,000, but 2 years ago Verde had revalued it to $700,000. What is the gain or loss on the sale? What is the journal entry to record the sale?

> Repeat the requirements of BE22-5 under the indirect method assuming that Larry’s Luggage Company reports under IFRS and begins the reconciliation to operating cash flows with operating income. Larry’s Luggage classifies interest paid, interest received,

> Repeat the requirements of BE22-5 under the indirect method. Data from BE22-5: Prepare the operating activities section of the cash flow statement using the direct method. Assume that accrued expenses relate to selling, general, and administrative expen

> Larry’s Luggage Company provided the following balance sheet and income statement for the current year. Prepare the operating activities section of the cash flow statement using the direct method. Assume that accrued expenses relate to

> State whether a firm would add or subtract the following items from income to compute cash flows from operations under the indirect method.

> State whether a firm would add or subtract the following items from income to compute cash flows from operations under the indirect method.

> Mirat, Inc. has net income of $49,400 in the current year. Additional information for the year follows: • It experienced net unrealized losses on investment securities of $4,900 reported in net income and net unrealized losses of $2,200 reported in othe

> Salat, Inc. has net income of $78,800 in the current year. Pertinent company information follows. • Salat experiences net unrealized gains on investment securities of $6,200 reported in net income and net unrealized losses of $2,200 reported in other com

> Donegal Industries reported net income of $67,000 for the current year. The balances and activity in its accounts receivable accounts follow. In addition, the company recorded $3,300 of bad debt expense and wrote off $2,800 of uncollectible accounts. Re

> During the year, Zurry Coach Service reported an increase in income taxes payable of $1,400 during the year and a decrease in deferred-tax asset of $2,000. Its income tax expense was $5,700. Required: a. What is cash paid for income taxes? b. What wo

> Roadster Car Service reported a decrease in income taxes payable of $4,500 during the year and an increase in deferred-tax liability of $3,000. Its income tax expense was $2,300. Required: a. What is cash paid for income taxes? b. What would Roadster

> IFRS. Blanc Corporation sold a piece of land for $620,000. The land originally cost $450,000, but Blanc revalued it to $600,000 last year. a. What is the gain or loss on the sale? b. What are the journal entries to record the sale?

> During the year, Big Ben Corporation sold equipment for $2,000. The equipment’s cost was $25,000 and accumulated depreciation was $18,000. There were no other transactions conducted during the period. Big Ben also purchased a new building for $44,000 and

> During the year, Solar Corporation sold equipment with a net book value of $6,000 for $9,000. It also purchased equity securities for $8,000. Net income for the year is $22,000. There were no other transactions conducted during the period. Required: a.

> Using the information provided in BE22-15, prepare the financing activities section of Simons Products’ cash flow statement. Data from BE22-15:

> Using the information provided in BE22-15, prepare the investing activities section of Simons Products’ cash flow statement. Data from BE22-15:

> Classify each item in the following list of cash receipts and cash payments as operating, investing, or financing under IFRS

> Soccer Emporium provides the following information for the current year. Compute cash flows from operating activities for Soccer Emporium under the direct reporting format.

> Use the information from BE22-17 assuming that Soccer Emporium is an IFRS reporter that reconciles operating income to operating cash flows. Compute cash flows from operating activities for Soccer Emporium under the indirect reporting format. Data from

> Soccer Emporium provided the following information for the current year. Compute cash flows from operating activities for Soccer Emporium under the indirect reporting format.

> Using the information provided in BE22-15, prepare the operating activities section of the statement of cash flows using the direct method. Data from BE22-15:

> Simons Products, Inc. reports the following comparative balance sheets and income statement for the current year.

> IFRS. Esta Company, an IFRS reporter, has opted to revalue land. The land originally cost €2,000,000 on January 1. At the end of the year, the land is appraised at €1,800,000. Determine the amount of gain or loss on the asset revaluation and indicate whe

> Prepare the operating activities section of the statement of cash flows for Polly’s Imported Goods in BE22-12 using the indirect method assuming that Polly reports under IFRS. Polly begins the operating activities section with operating income. It report

> Prepare the operating activities section of the statement of cash flows for Polly’s Imported Goods in BE22-12 using the indirect method.

> Polly’s Imported Goods, Ltd. recently issued its annual report for the current year. Its comparative balance sheets for the current year follow. Prepare the operating activities section of the statement of cash flows using the direct me

> Repeat the requirements in BE22-10 using the indirect method Data from BE22-10:

> Rodent World Exotic Pet Shops, Incorporated reported the following comparative balance sheets and income statement for the current year. Prepare the operating activities section of the statement of cash flows using the direct method. Assume that accrued

> Classify each item in the following list of cash receipts and cash payments as operating, investing, or financing.

> Natalie Charles Designs elected to change its method of depreciation from the double-declining balance method to the straight-line method. Cumulative depreciation up to—but not including—the year of the change would have been $345,000 lower had the compa

> Using the information in BE21-7, prepare the footnote to disclose the change in accounting estimate for Enko Incorporated. Data from BE21-7: Enko Incorporated has one plant asset. The asset’s original cost was $750,000. There is a $50,000 expected resid

> Enko Incorporated has one plant asset. The asset’s original cost was $750,000. There is a $50,000 expected residual value and the estimated useful life is 20 years. On January 1 of the current year, following 10 full years of depreciation, the company de

> Assume now that Cole Construction Company from BE21-5 compensates its management team by offering a base salary and a 2% bonus based on reported earnings before tax. The bonus plan requires adjustment for changes in accounting methods that includes prior

> IFRS. Esta Company, an IFRS reporter, has opted to revalue land. The land originally cost €2,000,000 on January 1. At the end of the year, the land is appraised at €2,200,000. Determine the amount of gain or loss on the asset revaluation and indicate whe

> Cole Construction Company elected to change its method of accounting from the completed-contract method to the percentage-ofcompletion method. Prior-years income (cumulative) would have been $550,000 higher if Cole had always used the percentage-of-compl

> Serat Construction Company elected to change its method of accounting from the percentage-of-completion method to the completedcontract method. Prior-years income (cumulative) would have been $300,000 lower if Serat had always used the completed contract

> Draft a footnote to disclose the accounting change implemented by the Mills Abrams Manufacturing Company using the information provided in BE21-2. Assume that pre-tax income for the current year is $230,000 under the LIFO method but would have been $455,

> Mills Abrams Manufacturing Company changed its method of accounting for inventory from the average-cost method to the LIFO basis as of January 1 of the current year. It still uses the average-cost method for tax purposes. The company is subject to a 40%

> Tyrion Retailers, Inc. incorrectly recorded inventory in 2016. Rather than recording ending inventory as $570,000, Tyrion’s accounting manager entered $750,000. Tyrion’s controller discovered the error in 2017. Prepare the journal entry necessary to corr

> Using the information from BE21-12, prepare the journal entry necessary to correct the inventory error, assuming that Barin’s controller discovered the error in 2017 after the books had been closed for 2016. Ignore any income tax effects. Data from BE21

> Barin Retail Outlets incorrectly recorded inventory in 2016. Rather than recording ending inventory as $960,000, Barin’s accounting manager entered $690,000, understating ending inventory by $270,000. Barin’s controller discovered the error in 2018. Prep

> Using the data from BE21-10 for Wilson Incorporated, assume now that the general accountant discovered the error in 2019 when the books had already been closed for 2018. Prepare the correcting entry for this transaction. Data from BE21-10: Wilson Incorp

> Wilson Incorporated acquired a leather-cutting machine for $200,000 on December 31, 2018. The general accountant incorrectly coded the invoice as Miscellaneous Expense. The general accountant discovered the error in 2018 before the books were closed. The

> For each of the following events, indicate the type of change and the proper accounting treatment (retrospective or prospective).

> IFRS. Perlu Products, an IFRS reporter, reported a write-down loss of $65,000 for one of its plant assets on December 31, 2018. The asset is currently held for disposal. At December 31, 2019, the fair value of the asset increased by $90,000. Can Perlu re

> Fillepeel Manufacturing, Inc. has only one plant asset used in production. The asset had a cost of $500,000 and has been depreciated for 2 full years since the date of acquisition. This accounting resulted in a total accumulated depreciation of $200,000.

> Ardmore Pet Food Suppliers reported $7,000,000 net income for the current year. The company indicated that it has $6,000,000, 5% convertible debt issued at par and $450,000 par value, 6% nonconvertible, cumulative preferred shares outstanding. The firm d

> Fill in the following chart to indicate the capital structure type— simple or complex—for a company holding only this type of security.

> Bee-Boy Honey Products began the current year with 5,000 common shares outstanding. The firm issued additional shares of 1,500 and 1,800 on February 1 and June 1, respectively. In addition, the firm purchased 600 shares of treasury stock on September 1.

> Using the information provided in BE20-5, compute the weighted-average number of common shares outstanding for Elmwood Excavation Consultants assuming that the company implemented a 10% stock dividend on December Data From BE20-5: Elmwood Excavation Co