Question: Refer to Table 12.1 in the

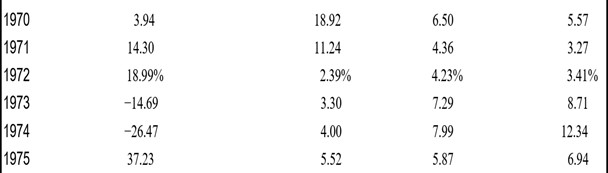

Refer to Table 12.1 in the text and look at the period from 1970 through 1975.

Data from Table 12.1:

a. Calculate the arithmetic average returns for large-company stocks and T-bills over this period.

b. Calculate the standard deviation of the returns for large-company stocks and T-bills over this period.

c. Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. What was the average risk premium over this period? What was the standard deviation of the risk premium over this period?

d. Is it possible for the risk premium to be negative before an investment is undertaken? Can the risk premium be negative after the fact? Explain.

> The Rhaegel Corporation’s common stock has a beta of 1.07. If the risk-free rate is 3.5 percent and the expected return on the market is 10 percent, what is the company’s cost of equity capital?

> Your company has been approached to bid on a contract to sell 4,800 voice recognition (VR) computer keyboards per year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment

> What would the lease payment have to be for both lessor and lessee to be indifferent about the lease?

> You are planning to save for retirement over the next 30 years. To do this, you will invest $750 per month in a stock account and $250 per month in a bond account. The return of the stock account is expected to be 10 percent, and the bond account will pa

> Given the following information for Watson Power Co., find the WACC. Assume the company’s tax rate is 21 percent.Debt: …………………….. 15,000 bonds with a 5.8 percent coupon outstanding, $1,000 par value, 25 years to maturity, selling for 108 percent of par;

> Starset, Inc., has a target debt-equity ratio of .85. Its WACC is 9.1 percent, and the tax rate is 23 percent.a. If the company’s cost of equity is 14 percent, what is its pretax cost of debt?b. If instead you know that the after tax cost of debt is 6.5

> In Problem 12, suppose the most recent dividend was $3.25 and the dividend growth rate is 5 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Both bonds make semiannual payments. The

> Dinklage Corp. has 7 million shares of common stock outstanding. The current share price is $68, and the book value per share is $8. The company also has two bond issues outstanding. The first bond issue has a face value of $70 million, a coupon rate of

> Fama’s Llamas has a weighted average cost of capital of 7.9 percent. The company’s cost of equity is 11 percent, and its pretax cost of debt is 5.8 percent. The tax rate is 25 percent. What is the company’s target debt-equity ratio?

> Lannister Manufacturing has a target debt-equity ratio of .55. Its cost of equity is 11 percent, and its cost of debt is 6 percent. If the tax rate is 21 percent, what is the company’s WACC?

> The Drogon Co. just issued a dividend of $2.80 per share on its common stock. The company is expected to maintain a constant 4.5 percent growth rate in its dividends indefinitely. If the stock sells for $58 a share, what is the company’s cost of equity?

> Consider the following information:

> A portfolio is invested 25 percent in Stock G, 55 percent in Stock J, and 20 percent in Stock K. The expected returns on these stocks are 11 percent, 9 percent, and 15 percent, respectively. What is the portfolio’s expected return? How do you interpret y

> Based on the following information, calculate the expected return:

> Suppose the firm in Problem 16 is considering two mutually exclusive investments. Project A has an NPV of $1,900, and Project B has an NPV of $2,800. As the result of taking Project A, the standard deviation of the return on the firm’s assets will increa

> To solve the bid price problem presented in the text, we set the project NPV equal to zero and found the required price using the definition of OCF. Thus the bid price represents a financial breakeven level for the project. This type of analysis can be e

> Based on the following information, calculate the expected return:,,,

> Based on the following information, calculate the expected return:,,,

> You have $10,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 12.1 percent and Stock Y with an expected return of 9.8 percent. If your goal is to create a portfolio with an expected return of 10.85 percent, how much

> Use the results of Problem 26 to find the degree of operating leverage for the company in Problem 27 at the base-case output level of 30,000 tons. How does this number compare to the sensitivity figure you found in Problem 28? Verify that either approach

> You own a portfolio that is invested 35 percent in Stock X, 20 percent in Stock Y, and 45 percent in Stock Z. The expected returns on these three stocks are 9 percent, 15 percent, and 12 percent, respectively. What is the expected return on the portfolio

> Use the results of Problem 25 to find the accounting, cash, and financial break-even quantities for the company in Problem 27.Data from Problem 27:Consider a project to supply Detroit with 30,000 tons of machine screws annually for automobile production.

> Suppose you observe the following situation:a. Calculate the expected return on each stock.b. Assuming the capital asset pricing model holds and Stock A’s beta is greater than Stock B’s beta by .35, what is the expecte

> Suppose you observe the following situation:

> Consider the following information about Stocks I and II:The market risk premium is 7 percent, and the risk-free rate is 3.5 percent. Which stock has the most systematic risk? Which one has the most unsystematic risk? Which stock is “ri

> You receive a credit card application from Shady Banks Savings and Loan offering an introductory rate of 1.25 percent per year, compounded monthly for the first six months, increasing thereafter to 17.8 percent compounded monthly. Assuming you transfer t

> You have $100,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to create a portfolio that has an expected return of 12.7 percent. If Stock X has an expected return of 11.4 percent and a beta of 1.25, and Stock Y has an expected r

> A proposed cost-saving device has an installed cost of $735,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes. The required initial net working capital investment is $55,000, the tax rate

> You want to create a portfolio equally as risky as the market, and you have $1,000,000 to invest. Given this information, fill in the rest of the following table:,,,

> Consider the following information about three stocks:b. If the expected T-bill rate is 3.80 percent, what is the expected risk premium on the portfolio?c. If the expected inflation rate is 3.30 percent, what are the approximate and exact expected real r

> In Problem 20, McGilla Golf would like to know the sensitivity of NPV to changes in the price of the new clubs and the quantity of new clubs sold. What is the sensitivity of the NPV to each of these variables?Data from Problem 20:McGilla Golf has decided

> Assume that the historical return on large-company stocks is a predictor of the future returns. What return would you estimate for large-company stocks over the next year? The next 10 years? 20 years? 40 years?

> A stock has a beta of 1.12 and an expected return of 10.8 percent. A risk-free asset currently earns 2.7 percent.

> You own a portfolio that has $3,480 invested in Stock A and $7,430 invested in Stock B. If the expected returns on these stocks are 8 percent and 11 percent, respectively, what is the expected return on the portfolio?

> In the previous problem, what would the risk-free rate have to be for the two stocks to be correctly priced?Previous problem:Stock Y has a beta of 1.2 and an expected return of 11.1 percent. Stock Z has a beta of .80 and an expected return of 7.85 percen

> Stock Y has a beta of 1.2 and an expected return of 11.1 percent. Stock Z has a beta of .80 and an expected return of 7.85 percent. If the risk-free rate is 2.4 percent and the market risk premium is 7.2 percent, are these stocks correctly priced?

> Fuente, Inc., has identified an investment project with the following cash flows. If the discount rate is 8 percent, what is the future value of these cash flows in Year 4? What is the future value at a discount rate of 11 percent? At 24 percent?Year ………

> Asset W has an expected return of 11.8 percent and a beta of 1.10. If the risk-free rate is 3.3 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the relationship between portfolio expected return and portf

> A stock has an expected return of 11.85 percent, its beta is 1.24, and the expected return on the market is 10.2 percent. What must the risk-free rate be?

> Aria Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation implant as follows:Year ………………………………………………………………………………………….. Unit Sales1 …………………………………………………………………………………………………….. 73,0002 …………………………………………………………………………………………………….. 86,0

> A stock has an expected return of 10.45 percent, its beta is .93, and the risk-free rate is 3.6 percent. What must the expected return on the market be?

> A stock has an expected return of 10.2 percent, the risk-free rate is 3.9 percent, and the market risk premium is 7.2 percent. What must the beta of this stock be?

> A stock has a beta of 1.15, the expected return on the market is 10.3 percent, and the risk-free rate is 3.1 percent. What must the expected return on this stock be?

> You own a portfolio equally invested in a risk-free asset and two stocks. If one of the stocks has a beta of 1.17 and the total portfolio is equally as risky as the market, what must the beta be for the other stock in your portfolio?

> You own a stock portfolio invested 20 percent in Stock Q, 30 percent in Stock R, 35 percent in Stock S, and 15 percent in Stock T. The betas for these four stocks are .79, 1.23, 1.13, and 1.36, respectively.What is the portfolio beta?

> Consider the following information:b. What is the variance of this portfolio? The standard deviation?

> What are the portfolio weights for a portfolio that has 115 shares of Stock A that sell for $43 per share and 180 shares of Stock B that sell for $19 per share?

> First Simple Bank pays 6.4 percent simple interest on its investment accounts. If First Complex Bank pays interest on its accounts compounded annually, what rate should the bank set if it wants to match First Simple Bank over an investment horizon of 10

> You’ve observed the following returns on Crash-n-Burn Computer’s stock over the past five years: 8 percent, −15 percent, 19 percent, 31 percent, and 21 percent.a. What was the arithmetic average return on the company’s stock over this five-year period?b.

> Using the following returns, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y.

> In the previous problem, suppose the fixed asset actually qualifies for 100 percent bonus depreciation in the first year. What is the new NPV?Previous problem:You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers

> In the previous problem, suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures.Previous problem:We are evaluating a project that costs

> What was the average annual return on large-company stocks from 1926 through 2016: a. In nominal terms?b. In real terms?

> Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today.a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year?b. What was your total nominal ra

> Rework Problems 1 and 2 assuming the ending share price is $58.Data from Problem 2:In Problem 1, what was the dividend yield? The capital gains yield?Data from Problem 1:Suppose a stock had an initial price of $65 per share, paid a dividend of $1.45 per

> In Problem 27, suppose you’re confident about your own projections, but you’re a little unsure about Detroit’s actual machine screw requirement. What is the sensitivity of the project OCF to changes in the quantity supplied? What about the sensitivity of

> If the appropriate discount rate for the following cash flows is 7.17 percent per year, what is the present value of the cash flows?Year …………………………………………………………………………… Cash Flow1 …………………………………………………………………………………….. $2,4802 ………………………………………………………………………………………

> This problem concerns the effect of taxes on the various break-even measures. a. Show that, when we consider taxes, the general relationship between operating cash flow, OCF, and sales volume, Q, can be written as:b. Use the expression in part (a) to fin

> Suppose the returns on long-term corporate bonds and T-bills are normally distributed. Based on the historical record, use the NORMDIST function in Excel® to answer the following questions:a. What is the probability that in any given year, the return on

> Hybrid cars are touted as a “green” alternative; however, the financial aspects of hybrid ownership are not as clear. Consider the 2016 Toyota Camry Hybrid LE, which had a list price of $5,500 (including tax consequences) more than the comparable Volkswa

> You have been hired as a consultant for Pristine Urban-Tech Zither, Inc. (PUTZ), manufacturers of fine zithers. The market for zithers is growing quickly. The company bought some land three years ago for $1.9 million in anticipation of using it as a toxi

> Over a 40-year period, an asset had an arithmetic return of 11.2 percent and a geometric return of 9.4 percent. Using Blume’s formula, what is your best estimate of the future annual returns over 5 years? 10 years? 20 years?

> In Problem 1, what was the dividend yield? The capital gains yield?Data from Problem 1:Suppose a stock had an initial price of $65 per share, paid a dividend of $1.45 per share during the year, and had an ending share price of $71. Compute the percentage

> You are considering a new product launch. The project will cost $1,950,000, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 210 units per year; price per unit will be $17,500, variable cost

> In the previous problem, what is the degree of operating leverage at the given level of output? What is the degree of operating leverage at the accounting break-even level of output?Data from Problem 17:Consider a four-year project with the following inf

> Suppose the returns on long-term corporate bonds are normally distributed. Based on the historical record, what is the approximate probability that your return on these bonds will be less than −2.1 percent in a given year? What range of returns would you

> Beginning three months from now, you want to be able to withdraw $2,500 each quarter from your bank account to cover college expenses over the next four years. If the account pays .57 percent interest per quarter, how much do you need to have in your ban

> A stock has had the following year-end prices and dividends:What are the arithmetic and geometric average returns for the stock?

> A stock has had returns of 8 percent, 26 percent, 14 percent, −17 percent, 31 percent, and −1 percent over the last six years. What are the arithmetic and geometric average returns for the stock?

> You find a certain stock that had returns of 9 percent, −16 percent, 18 percent, and 14 percent for four of the last five years. If the average return of the stock over this period was 10.3 percent, what was the stock’s return for the missing year? What

> You bought one of Great White Shark Repellant Co.’s 5.8 percent coupon bonds one year ago for $1,030. These bonds make annual payments and mature 14 years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 5.1

> Look at Table 12.1 and Figure 12.7 in the text. When were T-bill rates at their highest over the period from 1926 through 2016? Why do you think they were so high during this period? What relationship underlies your answer?Data from Figure 12.7:,,,

> Most corporations pay quarterly dividends on their common stock rather than annual dividends. Barring any unusual circumstances during the year, the board raises, lowers, or maintains the current dividend once a year and then pays this dividend out in eq

> Given the information in Problem 10, what was the average real risk-free rate over this time period? What was the average real risk premium?Data from Problem 10:For Problem 9, suppose the average inflation rate over this period was 3.1 percent and the av

> For Problem 9, suppose the average inflation rate over this period was 3.1 percent and the average T-bill rate over the period was 3.9 percent.Data from Problem 9:You’ve observed the following returns on Crash-n-Burn Computer’s stock over the past five y

> Suppose a stock had an initial price of $65 per share, paid a dividend of $1.45 per share during the year, and had an ending share price of $71. Compute the percentage total return.

> A project has the following estimated data: Price = $62 per unit; variable costs = $28 per unit; fixed costs = $27,300; required return = 12 percent; initial investment = $34,800; life = four years. Ignoring the effect of taxes, what is the accounting br

> In the previous problem, suppose you make $5,700 annual deposits into the same retirement account. How large will your account balance be in 30 years?Previous problem:You are planning to make monthly deposits of $475 into a retirement account that pays 1

> Consider the following income statement for the Heir Jordan Corporation:A 20 percent growth rate in sales is projected. Prepare a pro forma income statement assuming costs vary with sales and the dividend payout ratio is constant. What is the projected a

> In each of the following cases, find the unknown variable:,,,

> In each of the following cases, calculate the accounting break-even and the cash breakeven points. Ignore any tax effects in calculating the cash break-even.,,,

> We are evaluating a project that costs $786,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 65,000 units per year. Price per unit is $48, variab

> For the company in the previous problem, suppose management is most concerned about the impact of its price estimate on the project’s profitability. How could you address this concern? Describe how you would calculate your answer. What values would you u

> Sloan Transmissions, Inc., has the following estimates for its new gear assembly project: Price = $1,440 per unit; variable costs = $460 per unit; fixed costs = $3.9 million; quantity = 85,000 units. Suppose the company believes all of its estimates are

> Suppose in the previous problem that the company always needs a conveyor belt system; when one wears out, it must be replaced. Which project should the firm choose now?Previous problem:Letang Industrial Systems Company (LISC) is trying to decide between

> Consider four different stocks, all of which have a required return of 13 percent and a most recent dividend of $3.75 per share. Stocks W, X, and Y are expected to maintain constant growth rates in dividends for the foreseeable future of 10 percent, 0 pe

> In the previous problem, you feel that the values are accurate to within only ±10 percent. What are the best-case and worst-case NPVs? Hint: The price and variable costs for the two existing sets of clubs are known with certainty; only the sales gained o

> McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $845 per set and have a variable cost of $405 per set. The company has spent $150,000 for a marketing study that determined the company will sell 60,000 sets per year for

> K-Too Everwear Corporation can manufacture mountain climbing shoes for $33.18 per pair in variable raw material costs and $24.36 per pair in variable labor expense. The shoes sell for $170 per pair. Last year, production was 145,000 pairs. Fixed costs we

> You are planning to make monthly deposits of $475 into a retirement account that pays 10 percent interest compounded monthly. If your first deposit will be made one month from now, how large will your retirement account be in 30 years?

> Consider a four-year project with the following information: Initial fixed asset investment = $575,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $29; variable costs = $19; fixed costs = $235,000; quantity so

> Your firm is contemplating the purchase of a new $485,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $35,000 at the end of that time. You will save $140,000 before tax

> In the previous problem, what will be the new degree of operating leverage in each case?Data from Problem 14:At an output level of 17,500 units, you have calculated that the degree of operating leverage is 3.26. The operating cash flow is $78,000 in this

> At an output level of 17,500 units, you have calculated that the degree of operating leverage is 3.26. The operating cash flow is $78,000 in this case. Ignoring the effect of taxes, what are fixed costs? What will the operating cash flow be if output ris

> Input area:Fixed costs89000Units sold10400OCF127400New units sold11100Output area:Original DOL1.69858712715856%DQ0.0673076923076923%DOCF0.114327979712595New OCF141965.3846New DOL1.62691338625342

> In the previous problem, suppose fixed costs are $175,000. What is the operating cash flow at 43,000 units? The degree of operating leverage?Data from Problem 11:At an output level of 45,000 units, you calculate that the degree of operating leverage is 2

> At an output level of 45,000 units, you calculate that the degree of operating leverage is 2.79. If output rises to 48,000 units, what will the percentage change in operating cash flow be? Will the new level of operating leverage be higher or lower? Expl

> Perine, Inc., has balance sheet equity of $6.8 million. At the same time, the income statement shows net income of $815,000. The company paid dividends of $285,000 and has 245,000 shares of stock outstanding. If the benchmark PE ratio is 16, what is the

> Consider a project with the following data: Accounting break-even quantity = 13,700 units; cash break-even quantity = 9,600 units; life = five years; fixed costs = $185,000; variable costs = $23 per unit; required return = 12 percent. Ignoring the effect

> Night Shades, Inc. (NSI), manufactures biotech sunglasses. The variable materials cost is $11.13 per unit, and the variable labor cost is $7.29 per unit.a. What is the variable cost per unit?b. Suppose the company incurs fixed costs of $875,000 during a