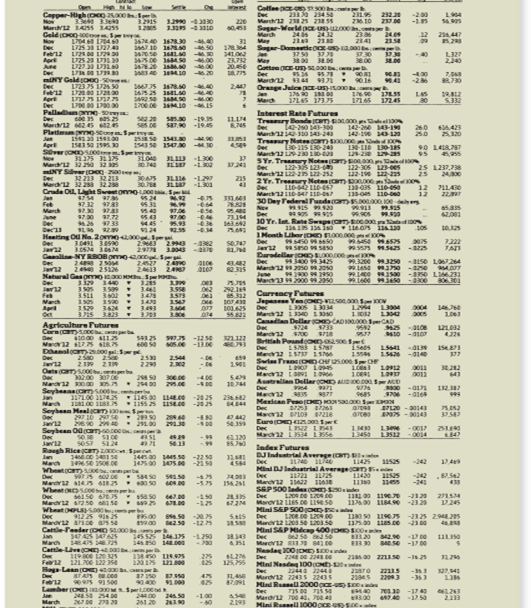

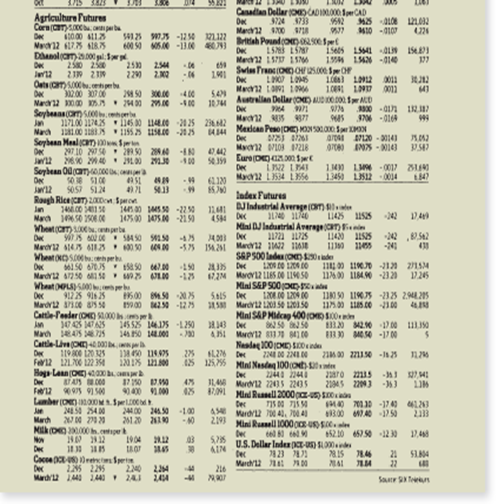

Question: Refer to Table 25.2 given below

Refer to Table 25.2 given below to answer this question. Suppose today is November 22, 2011, and your firm produces breakfast cereal and needs 140,000 bushels of corn in March 2012 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might go up between now and March.

a. How could you use corn futures contracts to hedge your risk exposure? What price would you effectively be locking in based on the closing price of the day?

b. Suppose corn prices are $6.13 per bushel in March. What is the profit or loss on your futures position? Explain how your futures position has eliminated your exposure to price risk in the corn market.

Table 25.2

Continue to next page……………..

Transcribed Image Text:

Open Sere Cotfee po R 233a 234 50 Capper-Higho s00 2319 Z10 Dec 232 -2.00 32915 329043010 220 Merch12 2 25 2 March12 SASS 1455 Geld (C cco Now Dec Feb12 Agr Sugar-WorldpU 00.c 24 2432 21 Sogar-DometieO 2.000 37 50 37 Merch Mey 23 2341 20.447 24. .12 3674.40 147.30 10 1S0 50 -6.00 31 17834 341.0 Z3.72 2045 09 L725 3 2740 37.30 8.00 -40 1725 21 17L L327 2,240 5.00 1se 00 D782 1. 0 00 20 38.00 Cottee -U 0 L DO 17 Dec mINY Gald OO- Dec Der 430 -26 Merd12 344 9n 016 Orange Julcp-u o 176 0 17145 17375 1723 75 1725 S0 244 Jan 17245 LAS 30 Apr Dec Palladan me-sy: Dec March12 425 625 Platimum Os eya March 5332 Interest Rate Futures Treaury Bonda C .00 Del Dec March12 1to 143-24 Treaury Note m 0 0 Dec March12 L2-230 LD- SYr. Treamury Nete(T)s0n Dec March12 L22-2is 122-252 2Yr. Treaury Notes m 00e Dec March12110-47 ID- 30 Dey Tederl Fundscom.000 00 es Nee Der 10 Yr. let. Rate Swepe(cm-o0.000 Dec 1Month Libor CHD FO0.000 00 Dec Ja2 DaradellarOD0000e Dec March12 5o 200 June Marc3 9200 99 2050 sea 20 ss0 ses De -19.5 -19.45 S87.90 142-20 13-1 260 250 64423 25120 142-190 143-120 25 se 154L 0 1543 5 154 0 Jan Apr Sver O 00 New March12 225a 12 5 INY Sver (C-0 Dec Mard2 322 228 Crade OL, Lght Sweet omo 130-LIO 130-S 90 1418787 95 31375 31S 3L3 -L300 32 122-35 123- 25 127.78 25 240 122-305 123-0es 122-19 12-225 30A75 30.7 L87 L30 32 213 32 213 3L116 -1297 215 12 12 71L430 22 13-os 110-000 Jan Fet 531 -4 97.32 9783 .30 170 7.72 .26 March June Dec De13 Heating O Na. 2omo000 Sp Dec Ja12 73.14 99.90s 99.0 42.001 445 36 92.55 4 97.33 124 99.5450 575 7222 JATI 3.0491 390 seso saso Caasline NY RBOB omoo S AR 2 5O 99300 3425 993200 32se -aIsO LO67264 Der Ja2 24 e 25126 Natural Gasomo MM Sp Dec Ja12 Feb 240 43.2 82 315 2413 1400 s0 -0 LIM231 99160 9350 -300 806.301 3.5 3.44 3.511 3 A 3.55 062 292 Currency Putures Jepanee Yen(O so.000 SoON Dec March12 10 130 Canadlan Dellar CADI0.000 SerCAD Dec Marc12 00 Brttah Pound co soeSpet Dec March 1529 3424 - 13 3.715 130S L3034 1304 0004 14 Apr Oct 3.823 379 014 Agriculture Futures Corn Cs.0 c 3724 3733 Dec Mard12 75 sI Danalc .00l Sa S125 600 s0 05.00 -13.00 S975 -1250 121122 i sees 1.5 2580 25 De 2530 2299 2544 Dec Marc12 LO891 109 Australlan Dellar OME AUD D L.907 L0945 0011 0011 Oats 00 ceb De Mard12 0.00 05. 1.0 30200 30700 2 50 • 24 00 30.00 5.4 Dec 9971 132. Seybeans msc0cprb Jan Narh Mac2 3835 3706 -0164 999 1171.00 114.2 l1e5 0 L14E.0 181.00 1185 1155 25 LiSE.c0 -20 5 -2025 2362 444 Mexican Pese(CHE) NSac.co0 S ON Dec aros PL20 - 30141 Seybean MealcT 297 10 2 e 26.90 294e Mac2 1OB 7218 De 2 4442 EureDa00n Ser Dec 2100 2130 -100 -0017 0014 Soybean Odamso.cocc ea De Jan12 Raugh Rice gc) z Spec Marc12 L3534 L55 13459 13512 s0 $10e sOS S124 61120 Index Futures DJIndustrial Averge ( e Dec Mini DJIndutrial AverageC) d Dec 14.co sese 1650 2506.0e Jan March Wheat cT)00.cperbe Dec 147500 1S e -2150 111 454 11525 242 172a L2s 11430 S450 s.50 050 D0 -242 -24 -5.75 154.21 Wheat O .co cpr Dec SSPS00 ledeOM de 1IL 00 119 -21 11600 1184.90 -23 29 150 S a 50 -150 -125 Dec Maro12 LIES De LI S0 Mini SEP S0 Dec Marc2 L205e 12050 Mini SAP Mdcag 00OD0 Dec 17245 Wheat PLs e Dec Mard2 arsDe as se 912 25 916 25 95.00 50205 900 e2sa -12 75 110 50 L1975 -23 25 2.94.20s Cattle-Feeder OHD S00 347425 147625 14S 4s 145 S 14175 14550 14.es Jan -1.290 17 00 Bese -100 Marh Cattle LveOHE) De De Fe12 Nasdag 200HED Snd 138 0 L14.975 120175 1800 275 425 Dec 224 De 224 De 2as00 221use 121200 122 35t 125,755 Mini Nesdag 100CON te Hags Lean (CHE) .o De 244 2244 Dec Mard12 22435 22435 Mini Reeu 2000g-us) S Dec Mard2 e 4, 04 Mini Ruasell 1000 ocE-U5)5.00lee 2aro TAS .cee 1750 a 9000 .000 47% 2045 22093 -353 Far2 425 87091 Lamber (C noMSpro Ja 7030 -1743 7.40 -1750 1.23 2113 24400 24.50 -1.00 -40 454 3.00 March 2J DO 27 20 261 20 2193 3.50 Agriculture Futures Corn(m parba Canadlan Dellar ADIO00 SCAD De Mard12 00 78 125 95 -1250 121122 600 50 5.00 -130 Britiah Pund(00 et De Med2 157 1S 1. 154 -01e 250 2500 219 219 Oats o ne 0200 307 06 Nard2 0 A 40 2.e -400 Seybean(m el De 2530 2290 244 Swl TrancONDOH US.000 O De 101 LO LOS Ma2 1O 10 1.00 10 0011 41 5.49 Australlan Dellar OME) AUDO D0 NCD De Jan 11100 11S 6 0 110 -2025 22 Mal2M5 77 A Mexdcan PnoDE ON S SpN De aro A0 - 3014 A Seybean MealCT) f 207 10 27 54 230 2 IN 140 LM 0017 B 13450 L3512 0014 De Seybean Odama000 De Ma2 LI534 LI56 5057 S124 471 ladex Futures Rough Rice (cT) 2Don Spron Narch 150 500.00 Whet(om , t De 144 00 1MS -220 145 00 1475.0 -2150 111 JIndustrial Average (m a 45 Dec Miai DJ Indurtrial AveregeCT)i 121 I125 -24 Wheat NOSO h SEP 500 laden O de 2M Maror2 LIES 00 LIM 50 Mini SAP S00O a Sais Dec S Mardv2 L200 50 120050 Mini SAP Midcap 400 SC0n 1100 L18490 -2320 D245 Wheat 0 0 Dec Mard2 10e BS 50 Cattle-leeler (CHE) 000 912 25 916 25 500 8.50 075 19900 259 -1275 11NI 90 LI5 -235 294.25 11500 L185.00 2300 4 145 525 1415 -250 14 50 14.000 0 R143 De Marh RAS S Catle Live (O) 4 D0 De Fe2 121.0 12 35 Hags Lann (O) 400 D B 30 M0 -17 00 Neslag 100CME) SDende L2 De 425 125% Mini Nasdag 100O te De LA Merdv12 22435 22435 091 Mini Ruasell 2000 p) S n Der 45 Vard2 40, 700 40 219 Mini Runel 1000 oU) Sle 13A 0 114975 275 47% 21045 2209) 6) F12 975 91500 Lamber (OoDM.Sp M 4450 254.00 20 00 2 20 90400 V1000 425 24400 244 0 -100 20120 210 1300 70 -17 50 March Der 52 10 457 50 12 0 Now De U.S. Dellar Inden C-S) SO AIN Der 30 7823 747 21 S14 22 Cace Dr p Dec Mard2 14 1440 24 244 2 2295 Merc2 1 A D0 240 216 Saur n

> For the following scenarios, describe a hedging strategy using futures contracts that might be considered. a. A public utility is concerned about rising costs. b. A candy manufacturer is concerned about rising costs. c. A corn farmer fears that this year

> The capital structure of Ricketti Enterprises, Inc., consists of 20 million shares of common stock and 1.5 million warrants. Each warrant gives its owner the right to purchase one share of common stock for an exercise price of $19. The current stock pric

> An insurance policy is considered analogous to an option. From the policyholder’s point of view, what type of option is an insurance policy? Why?

> An asset costs $550,000 and will be depreciated in a straight-line manner over its three-year life. It will have no salvage value. The corporate tax rate is 34 percent, and the appropriate interest rate is 10 percent. a. What set of lease payments will m

> MVP, Inc., has produced rodeo supplies for over 20 years. The company currently has a debt–equity ratio of 50 percent and is in the 40 percent tax bracket. The required return on the firm’s levered equity is 16 percent. MVP is planning to expand its prod

> Here are the most recent balance sheets for Country Kettles, Inc. Excluding accumulated depreciation, determine whether each item is a source or a use of cash, and the amount: COUNTRY KETTLES, INC. Balance Sheet 2011 2012 Assets Cash $ 48,180 $ 45,81

> Ted and Alice Hansel have a son who will begin college 10 years from today. School expenses of $30,000 will need to be paid at the beginning of each of the four years that their son plans to attend college. What is the duration of this liability to the c

> What is the difference between transactions and economic exposure? Which can be hedged more easily? Why?

> A stock is currently priced at $73. The stock will either increase or decrease by 15 percent over the next year. There is a call option on the stock with a strike price of $70 and one year until expiration. If the risk-free rate is 8 percent, what is the

> Rob Stevens is the chief executive officer of Isner Construction, Inc., and owns 950,000 shares of stock. The company currently has 6 million shares of stock and convertible bonds with a face value of $40 million outstanding. The convertible bonds have a

> What is the impact of lengthening the time to expiration on an option’s value? Explain.

> Many lessors require a security deposit in the form of a cash payment or other pledged collateral. Suppose Lambert requires Wildcat to pay a $500,000 security deposit at the inception of the lease. If the lease payment is still $1,650,000, is it advantag

> There is a European put option on a stock that expires in two months. The stock price is $73, and the standard deviation of the stock returns is 70 percent. The option has a strike price of $80, and the risk-free interest rate is a 5 percent annual perce

> Why would ALC be willing to buy planes from Boeing and Airbus and then lease the planes to China Eastern Airlines? How is this different from just lending money to China Eastern Airlines to buy the planes?

> Triad Corporation has established a joint venture with Tobacco Road Construction, Inc., to build a toll road in North Carolina. The initial investment in paving equipment is $80 million. The equipment will be fully depreciated using the straight-line met

> Here are some important figures from the budget of Cornell, Inc., for the second quarter of 2013: The company predicts that 5 percent of its credit sales will never be collected, 35 percent of its sales will be collected in the month of the sale, and th

> ABC Company and XYZ Company need to raise funds to pay for capital improvements at their manufacturing plants. ABC Company is a well-established firm with an excellent credit rating in the debt market; it can borrow funds either at 11 percent fixed rate

> Bernanke Corp. has just issued a 30-year callable, convertible bond with a coupon rate of 6 percent annual coupon payments. The bond has a conversion price of $93. The company’s stock is selling for $28 per share. The owner of the bond will be forced to

> A warrant with six months until expiration entitles its owner to buy 10 shares of the issuing firm ’ s common stock for an exercise price of $31 per share. If the current market price of the stock is $15 per share, will the warrant be worthless?

> You are in discussions to purchase an option on an office building with a strike price of $63 million. The building is currently valued at $60 million. The option will allow you to purchase the building either six months from today or one year from today

> You are given the following information concerning options on a particular stock: Stock price = $83 Exercise price = $80 Risk-free rate = 6% per year, compounded continuously Maturity = 6 months Standard deviation = 53% per year a. What is the

> How would the analysis of real options change if a company has competitors?

> When you take out an ordinary student loan, it is usually the case that whoever holds that loan is given a guarantee by the U.S. government, meaning that the government will make up any payments you skip. This is just one example of the many loan guarant

> Quartz Corporation is a relatively new firm. Quartz has experienced enough losses during its early years to provide it with at least eight years of tax loss carry forwards. Thus, Quartz’s effective tax rate is zero. Quartz plans to lease equipment from N

> Suppose it is estimated that the equipment will have an after tax residual value of $700,000 at the end of the lease. What is the maximum lease payment acceptable to Wildcat now? Required information The Wildcat Oil Company is trying to decide whether to

> Why wouldn’t China Eastern Airlines purchase the planes if they were obviously needed for the company’s operations?

> Shattered Glass, Inc., is an all-equity firm. The cost of the company’s equity is currently 11 percent, and the risk-free rate is 3.5 percent. The company is currently considering a project that will cost $11.4 million and last six years. The project wil

> Bolero, Inc., has compiled the following information on its financing costs: The company is in the 35 percent tax bracket and has a target debt–equity ratio of 60 percent. The target short-term debt/long-term debt ratio is 20 percent.

> Lewellen Products has projected the following sales for the coming year: Sales in the year following this one are projected to be 15 percent greater in each quarter. a. Calculate payments to suppliers assuming that Lewellen places orders during each qua

> In an ideal economy, net working capital is always zero. Why might net working capital be positive in a real economy?

> What is the duration of a bond with four years to maturity and a coupon of 8 percent paid annually if the bond sells at par?

> Explain why a put option on a bond is conceptually the same as a call option on interest rates.

> Sportime Fitness Center, Inc., issued convertible bonds with a conversion price of $51. The bonds are available for immediate conversion. The current price of the company’s common stock is $44 per share. The current market price of the convertible bonds

> Why do firms issue convertible bonds and bonds with warrants?

> Wet for the Summer, Inc., manufactures filters for swimming pools. The company is deciding whether to implement a new technology in its pool filters. One year from now the company will know whether the new technology is accepted in the market. If the dem

> You are discussing real options with a colleague. During the discussion, the colleague states, “Real option analysis makes no sense because it says that a real option on a risky venture is worth more than a real option on a safe venture.’’ How should you

> Super Sonics Entertainment is considering buying a machine that costs $540,000. The machine will be depreciated over five years by the straight-line method and will be worthless at that time. The company can lease the machine with year-end payments of $1

> What are the deltas of a call option and a put option with the following characteristics? What does the delta of the option tell you? Stock price = $67 Exercise price = $70 Risk-free rate = 5% per year, compounded continuously Maturity = 9 month

> The following is the sales budget for Shleifer, Inc., for the first quarter of 2013: Credit sales are collected as follows: 65 percent in the month of the sale. 20 percent in the month after the sale. 15 percent in the second month after the sale. The a

> What is meant by the term off–balance sheet financing? When do leases provide such financing, and what are the accounting and economic consequences of such activity?

> Daniel Kaffe, CFO of Kendrick Enterprises, is evaluating a 10-year, 8 percent loan with gross proceeds of $5,850,000. The interest payments on the loan will be made annually. Flotation costs are estimated to be 2.5 percent of gross proceeds and will be a

> Consider the following financial statement information for the Bulldog Icers Corporation: Calculate the operating and cash cycles. How do you interpret your answer? Item Beginning Ending Inventory $17,385 $19,108 Accounts receivable 13,182 13,973 Ac

> What are the costs of shortages? Describe them.

> What is the duration of a bond with three years to maturity and a coupon of 7 percent paid annually if the bond sells at par?

> If a textile manufacturer wanted to hedge against adverse movements in cotton prices, it could buy cotton futures contracts or buy call options on cotton futures contracts. What would be the pros and cons of the two approaches?

> An analyst has recently informed you that at the issuance of a company’s convertible bonds, one of the two following sets of relationships existed: Assume the bonds are available for immediate conversion. Which of the two scenarios do

> An analyst has recently informed you that at the issuance of a company’s convertible bonds, one of the two following sets of relationships existed: Assume the bonds are available for immediate conversion. Which of the two scenarios do y

> Star Mining buys a gold mine, but the cost of extraction is currently too high to make the mine profitable. In option terminology, what type of option(s) does the company have on this mine?

> Rework Problem 1 assuming that the scanner will be depreciated as three-year property under MACRS Problem 1 Assume that the tax rate is 35 percent. You can borrow at 8 percent before taxes. Should you lease or buy? Required data: You work for a nuclear

> What are the prices of a call option and a put option with the following characteristics? Stock price = $93 Exercise price = $90 Risk-free rate = 4% per year, compounded continuously Maturity = 5 months Standard deviation = 62% per year

> Discuss the IRS criteria for determining whether a lease is tax deductible. In each case give a rationale for the criterion.

> What are the two types of risk that are measured by a levered beta?

> The Litzenberger Company has projected the following quarterly sales amounts for the coming year: a. Accounts receivable at the beginning of the year are $310. Litzenberger has a 45-day collection period. Calculate cash collections in each of the four q

> Is it possible for a firm’s cash cycle to be longer than its operating cycle? Explain why or why not.

> You are short 25 gasoline futures contracts, established at an initial settle price of $2.46 per gallon, where each contract represents 42,000 gallons. Over the subsequent four trading days, gasoline settles at $2.42, $2.47, $2.50, and $2.56, respectivel

> A company produces an energy-intensive product and uses natural gas as the energy source. The competition primarily uses oil. Explain why this company is exposed to fluctuations in both oil and natural gas prices.

> A warrant gives its owner the right to purchase three shares of common stock at an exercise price of $53 per share. The current market price of the stock is $58. What is the minimum value of the warrant?

> What is dilution, and why does it occur when warrants are exercised?

> Jet Black is an international conglomerate with a petroleum division and is currently competing in an auction to win the right to drill for crude oil on a large piece of land in one year. The current market price of crude oil is $93 per barrel, and the l

> Explain why a swap is effectively a series of forward contracts. Suppose a firm enters a swap agreement with a swap dealer. Describe the nature of the default risk faced by both parties.

> In the previous question, over what range of lease payments will the lease be profitable for both parties? Required information You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice wi

> What are the prices of a call option and a put option with the following characteristics? Stock price = $57 Exercise price = $60 Risk-free rate = 6% per year, compounded continuously Maturity = 3 months Standard devi ation = 54% per year

> Discuss the accounting criteria for determining whether a lease must be reported on the balance sheet. In each case give a rationale for the criterion.

> North Pole Fishing Equipment Corporation and South Pole Fishing Equipment Corporation would have identical equity betas of 1.10 if both were all equity financed. The market value information for each company is shown here: The expected return on the ma

> If Wild Widgets, Inc., were an all-equity company, it would have a beta of .85. The company has a target debt–equity ratio of .40. The expected return on the market portfolio is 11 percent, and Treasury bills currently yield 4 percent. The company has on

> Indicate the impact of the following on the cash and operating cycles, respectively. Use the letter I to indicate an increase, the letter D for a decrease, and the letter N for no change. a. The terms of cash discounts offered to customers are made less

> You are long 10 gold futures contracts, established at an initial settle price of $1,580 per ounce, where each contract represents 100 ounces. Over the subsequent four trading days, gold settles at $1,587, $1,582, $1,573, and $1,584, respectively. Comput

> Bubbling Crude Corporation, a large Texas oil producer, would like to hedge against adverse movements in the price of oil because this is the firm’s primary source of revenue. What should the firm do? Provide at least two reasons why it probably will not

> Hannon Home Products, Inc., recently issued $2 million worth of 8 percent convertible debentures. Each convertible bond has a face value of $1,000. Each convertible bond can be converted into 21.50 shares of common stock any time before maturity. The sto

> What happens to the price of a convertible bond if interest rates increase?

> General Modems has five-year warrants that currently trade in the open market. Each warrant gives its owner the right to purchase one share of common stock for an exercise price of $55. a. Suppose the stock is currently trading for $51 per share. What is

> The Webber Company is an international conglomerate with a real estate division that owns the right to erect an office building on a parcel of land in downtown Sacramento over the next year. This building would cost $25 million to construct. Due to low d

> Utility companies often face a decision to build new plants that burn coal, oil, or both. If the prices of both coal and gas are highly volatile, how valuable is the decision to build a plant that can burn either coal or oil? What happens to the value of

> The price of Tara, Inc., stock will be either $50 or $70 at the end of the year. Call options are available with one year to expiration. T-bills currently yield 5 percent. a. Suppose the current price of Tara stock is $62. What is the value of the call o

> Assume that your company does not contemplate paying taxes for the next several years. What are the cash flows from leasing in this case? You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common p

> Comment on the following remarks: a. Leasing reduces risk and can reduce a firm’s cost of capital. b. Leasing provides 100 percent financing. c. If the tax advantages of leasing were eliminated, leasing would disappear.

> Milano Pizza Club owns three identical restaurants popular for their specialty pizzas. Each restaurant has a debt–equity ratio of 40 percent and makes interest payments of $41,000 at the end of each year. The cost of the firm’s levered equity is 19 perce

> Indicate the effect that the following will have on the operating cycle. Use the letter I to indicate an increase, the letter D for a decrease, and the letter N for no change. a. Receivables average goes up. b. Credit repayment times for customers are in

> For the year just ended, you have gathered the following information about the Holly Corporation: a. A $200 dividend was paid. b. Accounts payable increased by $500. c. Fixed asset purchases were $900. d. Inventories increased by $625. e. Long-term debt

> Suppose a financial manager buys call options on 50,000 barrels of oil with an exercise price of $95 per barrel. She simultaneously sells a put option on 50,000 barrels of oil with the same exercise price of $95 per barrel. Consider her gains and losses

> What is the difference between a forward contract and a futures contract? Why do you think that futures contracts are much more common? Are there any circumstances under which you might prefer to use forwards instead of futures? Explain.

> When should a firm force conversion of convertibles? Why?

> Eckely, Inc., recently issued bonds with a conversion ratio of 17.5. If the stock price at the time of the bond issue was $48.53, what was the conversion premium?

> Gasworks, Inc., has been approached to sell up to 5 million gallons of gasoline in three months at a price of $3.65 per gallon. Gasoline is currently selling on the wholesale market at $3.30 per gallon and has a standard deviation of 58 percent. If the r

> What is the difference between an American option and a European option?

> The price of Ervin Corp. stock will be either $74 or $96 at the end of the year. Call options are available with one year to expiration. T-bills currently yield 5 percent. a. Suppose the current price of Ervin stock is $80. What is the value of the call

> What would the lease payment have to be for both the lessor and the lessee to be indifferent about the lease? You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high

> What are some of the potential problems with looking at IRRs when evaluating a leasing decision?

> Gemini, Inc., an all-equity firm, is considering a $1.7 million investment that will be depreciated according to the straight-line method over its four-year life. The project is expected to generate earnings before taxes and depreciation of $595,000 per

> McConnell Corp. has a book value of equity of $13,205. Long-term debt is $8,200. Net working capital, other than cash, is $2,205. Fixed assets are $18,380. How much cash does the company have? If current liabilities are $1,630, what are current assets?

> Refer to Table 25.2 in the text to answer this question. Suppose you sell five March 2012 silver futures contracts on November 22, 2011, at the last price of the day. What will your profit or loss be if silver prices turn out to be $31.39 per ounce at ex

> If a firm is buying call options on pork belly futures as a hedging strategy, what must be true about the firm’s exposure to pork belly prices?

> In the previous problem, suppose you wanted the option to sell the land to the buyer in one year. Assuming all the facts are the same, describe the transaction that would occur today. What is the price of the transaction today? Data from previous problem

> Explain the following limits on the prices of warrants: a. If the stock price is below the exercise price of the warrant, the lower bound on the price of a warrant is zero. b. If the stock price is above the exercise price of the warrant, the lower bound

> Jared Lazarus has just been named the new chief executive officer of BluBell Fitness Centers, Inc. In addition to an annual salary of $410,000, his three-year contract states that his compensation will include 15,000 at-the-money European call options on

> Complete the following sentence for each of these investors: a. A buyer of call options. b. A buyer of put options. c. A seller (writer) of call options. d. A seller (writer) of put options. “The (buyer/seller) of a (put/call) option (pays/receives) mone

> Zoso is a rental car company that is trying to determine whether to add 25 cars to its fleet. The company fully depreciates all its rental cars over five years using the straight-line method. The new cars are expected to generate $175,000 per year in ear

> Use the option quote information shown here to answer the questions that follow. The stock is currently selling for $114. a. Suppose you buy 10 contracts of the February 110 call option. How much will you pay, ignoring commissions? b. In part (a), supp

> Indicate the impact of the following corporate actions on cash, using the letter I for an increase, D for a decrease, or N when no change occurs. a. A dividend is paid with funds received from a sale of debt. b. Real estate is purchased and paid for with

> Refer to Table 25.2 in the text to answer this question. Suppose you purchase a March 2012 cocoa futures contract on November 22, 2011, at the last price of the day. What will your profit or loss be if cocoa prices turn out to be $2,431 per metric ton at