Question: Refer to the data in Exercise 10-

Refer to the data in Exercise 10-32.

Required

a. How can Northwestern Bank use the information from the activity-based costing analysis to manage its costs?

b. What does Northwestern Bank need to consider before implementing your suggestions from requirement (a)?

Exercise 10-32:

> WSM Corporation is considering offering an air shuttle service between Sao Paulo and Rio de Janeiro. It plans to offer four flights every day (excluding certain holidays) for a total of 1,400 flights per year (= 350 days × 4 flights per day)

> Ag-Coop is a large farm cooperative with a number of agriculture-related manufacturing and service divisions. As a cooperative, it pays no federal income taxes. The company owns a fertilizer plant that processes and mixes petrochemical compounds into thr

> Vermont Company uses continuous processing to produce stuffed bears and FIFO process costing to account for its production costs. It uses FIFO because costs are quite unstable due to the volatile price of fine materials it uses in production. The bears a

> Refer to the data in Exercise 8-24. Required a. Compute the equivalent units for materials using FIFO. b. Compute the equivalent units for conversion costs using FIFO. Exercise 8-24: Kronk, Inc. provides the following information concerning the work in

> Consider the following actions of a retail store trying to manage the costs of its returns service. Required Match each of the process improvements listed with how they deliver cost reductions.

> Refer to the data in Exercise 8-22. Assume that beginning inventory is 20 percent complete with respect to materials and 40 percent complete with respect to conversion costs. Required a. Compute the equivalent units for materials using FIFO. b. Compute t

> By mistake, the production supervisor at East Manufacturing transposed the digits on the production report and reported a higher percentage of completion for each inventory component. Assume that there was no beginning inventory. Required What is the eff

> Kronk, Inc. provides the following information concerning the work in process at its plant: ∙ Beginning inventory was partially complete (materials are 100 percent complete; conversion costs are 10 percent complete). ∙ Started this month, 65,000 units. ∙

> Hoyt, Inc. has a process costing system at its Forest Street Plant. All materials are introduced when conversion costs reach 40 percent. The following information is available for physical units during August: Required a. Compute the equivalent units for

> Refer to the data in Exercise 8-28 for Charlevoix Chemicals. Required Charlevoix Chemicals uses FIFO process costing at the Bay Plant for product costing. The following equivalent units (materials; conversion) used to compute production costs for May wou

> When using the FIFO method of process costing, total equivalent units produced for a given period equal a. The number of units started and completed during the period plus the number of units in beginning work in process plus the number of units in endin

> Sturgis Manufacturing produces one model of precision tool and accounts for costs using a job cost system. Information from the most recent fiscal year indicates the following. ∙ Total manufacturing cost during the year was $2,578,125 based on actual dir

> The partially completed T-accounts and selected additional information for Hancock Parts for the month of February follow: Additional information for February follows: ∙ Sales revenue in February was $179,200. ∙ The op

> Partially completed T-accounts and additional information for Dumfries Designs for the month of August follow: Additional information for August follows: ∙ The labor wage rate was $28 per hour. ∙ During the month, sale

> Selected information from the Iowa Instruments accounting records for April follows: Additional information for April follows: ∙ The labor wage rate was $30 per hour. ∙ During the month, sales revenue was $320,000, and

> The following partially complete T-accounts for the month of June along with additional information are from Renfrew & Co.: Additional information for June follows: ∙ Manufacturing overhead is applied at 90 percent of direct labor c

> Radford Products adds materials at the beginning of the process in Department A. The following information on physical units for Department A for the month of January is available. Required a. Compute the equivalent units for materials costs and for conv

> Lawn Products produces two products (X and Y) and a by-product (Z) from a joint process using a raw material (Alpha). The company chooses to allocate the costs on the basis of the physical quantities method. Last month, it processed 22,000 pounds of Alph

> Elmira Tool and Die makes machine tools to order. The following transactions occurred in October: 1. Issued $2,800 of supplies from the materials inventory. 2. Purchased $42,000 of materials. 3. Issued $37,600 in direct materials to the production depart

> Refer to the facts in Exercise 11-50. The sale of FP-40 has been banned by a recent law. If FP-40 is produced, disposal in an approved manner costs $120,000 for every 55,000 units produced. Required a. Assume that Forest Products continues to use the phy

> Refer to the facts in Exercises 11-47 and 11-48. Required Which, if any, of the four products would you recommend Barrett Chemicals sell at split-off (and not process further)? Explain. Does your answer depend on the method used to allocate the joint cos

> Denver Fabricators manufactures products DF1 and DF2 from a joint process, which also yields a by-product, BP. The company accounts for the revenues from its by-product sales as other income. Additional information follows: Required Assuming that joint p

> Milo Manufacturing produces products Kappa and Lambda from a joint process. Total joint costs are $150,000. The sales value at split-off was $162,000 for 1,200 units of Kappa and $63,000 for 1,800 units of Lambda. Required a. What joint costs are allocat

> Gunston Processing produces two products, ALT-1 and ALT-2, from a batch using a single raw material, ALT-0. Both products require further processing before they be can be sold. A batch of ALT-1 can be sold for $150,000 after processing costs of $30,000.

> Refer to the data in Exercise 11-39. Suppose that Sanford Agricultural Chemicals uses the physical quantities method to allocate joint costs and the revenues from by-products are credited to joint costs. Required Under these assumptions, the following pr

> Sanford Agricultural Chemicals (SAC) produces two main products, M-4 and M-5, and one byproduct, BYP, from a single input, Gen-10. Products M-4 and M-5 can either be sold at split off or processed further and sold. A given batch begins with 2,500 pounds

> Refer to the facts in Exercise 11-27. Woodstock Binding estimates that the variable costs in the IT Department total $110,000, and in the HR Department variable costs total $140,000. Avoidable fixed costs in the IT Department are $18,000. Required If Woo

> Refer to the facts in Exercise 11-25. Mack Precision Tool and Die estimates that the variable costs in the Repair Department total $15,225, and in Quality Control variable costs total $39,200. Avoidable fixed costs in the Repair Department are $12,400. R

> Refer to Exercises 11-27, 11-29, and 11-32 (Woodstock Binding). Required a. Which method do you think is best? Why? b. How much would it be worth to the company to use the best method compared to the worst of the three methods? (Numbers are not required

> Ervin Equipment, a manufacturer of exercise and workout equipment for sale to institutions, uses job costing. The following transactions occurred in January: 1. Purchased $76,000 of materials. 2. Paid $81,000 cash for utilities, power, equipment maintena

> Refer to the data for Memorial Services, Inc. in Exercise 11-33. Required Use the reciprocal method to allocate the service department costs to the production departments. (Matrix algebra is not required.) Exercise 11-33:

> Refer to the data for Memorial Services, Inc. in Exercise 11-33. Required Use the step method to allocate the service department costs to the two production departments. Allocate HR costs first, followed by IT, and then Accounting. Exercise 11-33:

> Refer to the data for Woodstock Binding in Exercise 11-27. Required Allocate the service department costs using the reciprocal method. (Matrix algebra is not required because there are only two service departments.) Exercise 11-27:

> Activity and selected costs for three production departments (Training, Independent, and Commercial) and two service departments (Accounting and Facilities) at DuBay Films for the past month follow: Required Allocate service department costs to Training,

> Refer to the data for Mack Precision Tool and Die in Exercise 11-25. Required Use the reciprocal method to allocate the service costs. (Matrix algebra is not required.) Exercise 11-25:

> Refer to the data for Woodstock Binding in Exercise 11-27. Required Use the step method to allocate the service costs, using the following: a. The order of allocation starts with IT. b. The order of allocation starts with HR. Exercise 11-27:

> You are the division president of Wood Division of Underwood Enterprises. The only other division at Underwood Enterprises is Plastics Division. Each division has 12,000 employees. Last year, Wood Division had a turnover of 2,500 employees (2,500 employe

> Consider adapting the cost of quality framework to financial reporting issues. Assign costs to one of four categories: prevention (P), appraisal (A), internal failure (IF), and external failure (EF), where the categories refer to financial reporting acti

> Many companies have adapted the cost of quality framework to environmental issues. They assign costs to one of four categories: prevention (P), appraisal (A), internal failure (IF), and external failure (EF), where the categories refer to environmental a

> Cairney, Inc. manufactures a specialized part used in internal combustion engines. The annual demand for the part is 225,000 units. The facility has a practical capacity of 240,000 units annually. The company leased the current facility because facilitie

> Barker Products is a job shop. The following events occurred in September: 1. Purchased $13,000 of materials. 2. Issued $14,500 in direct materials to the production department. 3. Purchased $11,000 of materials. 4. Issued $900 of supplies from the mater

> Which method, weighted-average or FIFO, better reflects the current cost of production when using process costing?

> Basil’s Framing manufactures picture frames in one workshop, which has a practical capacity of 40,000 frames. The variable cost of a frame is $24 per unit, and the fixed costs of the workshop are $392,000 annually. Current annual demand is 28,000 frames.

> Middle Industries produces a sensor for use in manufacturing. It produces the sensor in a plant with an annual practical capacity of 75,000 units. The variable cost of the sensor is $185.00 per unit, and the fixed costs of the plant are $12,375,000 annua

> Hosmer Industries provides the following information about resources and usage: Required a. Compute the cost driver rate for each resource. b. Describe what the term unused resource capacity means.

> Wykes Metal Working uses a special lathe to shape components. Data on the lathe and its usage follow: Required Compute the cost of unused resource capacity in energy and repairs for Wykes Metal Working.

> Ellery Products manufactures various components for the fashion industry. Ellery buys fabric from two vendors: Ewers Textiles and Bramford Materials. Ellery chooses the vendor based on price. Once the fabric is received, it is inspected to ensure that it

> Central State College (CSC) is a state-supported college with a large business school. The business school offers an undergraduate degree and training programs for a local manufacturer. The state does not support the training programs, which are paid for

> Lygon Food Distributors (LFD), introduced in the chapter, hired a consultant to update its system for reporting the cost of customers. The consultant showed Anjana Malik, the owner of LFD, an analysis that indicates that customer support costs are signif

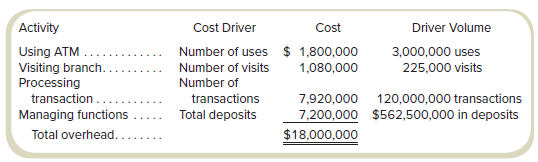

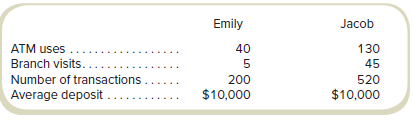

> Northwestern Bank (NB) offers only checking accounts. Customers can write checks and use a network of automated teller machines. NB earns revenue by investing the money deposited; currently, it averages 4.1 percent annually on its investments of those de

> Rupert’s Appliance Warehouse (RAW) delivers appliances to retailers throughout the city. The firm adds 6 percent to the cost of the appliances to cover the delivery cost. The delivery fee is meant to cover the cost of delivery. The fina

> Under what conditions are the results from using the direct method of allocation the same as those from using the other two methods? Why?

> Alter’s Home Center (AHC) sells renovation and remodeling products to both contractors and individual home owners. One of the services AHC offers is delivery of the purchased products to the customer’s work site. Becau

> The following are various activities for EMS Law School. Required Suggest a feasible cost driver base for each of the following, and explain why each selected cost driver base is feasible. a. Course registration. b. Admissions: Attending recruiting fairs

> The following are various activities for Humphrey Insurance Agency. Required Suggest a feasible cost driver base for each of the following, and explain why each selected cost driver base is feasible. a. Consumer contract customer service. b. Consumer con

> Brentwood Disaster Relief (BDR) is a local not-for-profit organization working to help victims of disasters. Required The following are various resources and activities of the organization. Indicate whether each is likely to apply at the (1) unit level o

> Consider the following actions of a manufacturing firm trying to manage the costs of materials handling from the direct materials inventory to the production line. Required Match each of the process improvements listed with how it delivers cost reduction

> Consider the following actions of a college placement center trying to manage the costs of its placement services. Required Match each of the process improvements listed with how it delivers cost reductions.

> The manager of the Personnel Department at Binder City has been reading about time-driven ABC and wants to apply it to that department. The manager has identified four basic activities Personnel Department employees spend most of their time on: Interview

> Meadow Logistics, Inc. (MLI) distributes food purchased in bulk to small retailers. The firm is divided into two divisions: Purchasing and Distribution. Purchasing is responsible for ordering goods from the manufacturer, receiving them, and then moving t

> Exeter Group is a large retail company that has brick-and-mortar outlets throughout the Southeast. It has been in business for many years, but two years ago started an online sales channel to offset slowing in-store sales. The human resources (HR) depart

> Cathedral City Services (CCS) is a not-for-profit organization offering two services in a midsized city. The services are “Elder Meals” and “Jobs4U.” Elder Meals is a meals-on-wheels

> What argument(s) could be given in support of the reciprocal method as the preferred method for distributing the costs of service departments?

> Spencer’s Sports manufactures outdoor equipment at three regional plants. The Freeway Plant produces two models of fishing reels, the Stream and the Surf. The Surf model is heavier and more durable. Overhead costs are currently allocate

> Shady Fabrication Group (SFG) manufactures components for manufacturing equipment at several facilities. The company produces two, related, parts at its Park River Plant, the models SF-08 and SF-48. The differences in the models are the quality of the ma

> Asbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have a smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model.

> Richard’s Events provides catering services, among other services. The company has adopted activity-based costing (ABC) for the catering services. The ABC system classifies activities into two groups based on the cost driver used: diner

> Refer to the data in Exercise 9-38. Required a. Compute the unit (per visitor) costs for the two tour types (public and donor) assuming PCHS uses the current cost system. b. Compute the unit (per visitor) costs for the two tour types (public and donor) a

> The Philip County Historical Society (PCHS) collects and displays historical artifacts from the local area. One of its services is dedicated tours. PCHS offers dedicated tours to two groups: the general public (generally tourists and local residents) and

> Refer to the information in Exercise 9-34. Required a. Compute the unit costs for the two products, Standard and Premium, using the current costing system at Benton (using direct labor costs as the allocation basis for overhead). b. Compute the unit cost

> Benton Corporation manufactures computer microphones, which come in two models: Standard and Premium. Data for a representative quarter for the two models follow: Manufacturing overhead in the plant has three main functions: supervision, setup labor, and

> After reviewing the new activity-based costing system that Nancy Chen has implemented at IVC’s CenterPoint manufacturing facility, Tom Spencer, the production supervisor, believes that he can reduce production costs by reducing the time spent on machine

> Refer to the information in Exercise 9-31. The manager of the Los Angeles office is now unhappy with the results of the controller’s study. The manager asks the controller to develop separate rates for fixed and variable costs in the Pe

> As the representative of the local accounting club, you have been asked by the dean to help them understand the costs of the different degrees offered at the school. You decide to use an activity-based costing system. Write a report outlining the first t

> Trombly Travel Products (TTP) manufactures and sells travel bags and accessories. TTP produces backpacks at its West Street plant. The different backpack models are identified by the primary material used: canvas, nylon, or leather. The company uses a pl

> West State Furniture (WSF) manufactures desks and desk chairs using two departments within a single facility. The West Department produces the desks, and the State Department produces the chairs. WSF uses plantwide allocation to allocate its overhead to

> Edlie Accessories (EA) makes travel bags, both for sale under their own label (“Branded”) and for other resellers to put their label on the bags (“Private-Label”). The bags sold thro

> Wakefield Instruments manufactures three digital piano models, which differ only in the components included: Solo, Recital, and Concert. Production takes place in two departments, Assembly and Finishing. The Solo and Recital models are complete after the

> McClellan Recreation manufactures and sells two models of paddle boards: Starter and Pro. The Starter model is a basic board used for instruction and purchased by novices. The Pro model is made with premium materials and comes with several accessories. T

> Refer to the information in Exercise 8-51. Required a. Prepare a production cost report using the FIFO method. b. Is the ending inventory higher using FIFO or the weighted-average method? Why? c. Would you recommend that Beverly Plastics use the FIFO met

> Lincolnshire Lumber sells boards for many uses including wood floors. For floors, the boards are sold to local installers or do-it-yourself homeowners. The boards go through up to four processes, although only the first two are completed for all sales. L

> Refer to the information in Exercise 8-49. Required a. Prepare a production cost report for August using the weighted-average method. b. Is the ending inventory higher using FIFO or the weighted-average method? Why? c. Would you recommend that Terminal I

> Armada Shipping is a global logistics company. The company is organized into two divisions: Contracts and Retail. The Contracts Division, which is by far the larger division, handles customers who have regular shipping requirements and have signed contra

> Fulton Construction is a general contractor for large construction projects. The budget costs and the time to reach a particular percentage of completion (in months) follow. Also shown are the actual results (cost and months) up to the latest report, whi

> Customers don’t cost money; they bring in revenue.” Do you agree? Why?

> Clarita Contracting builds roads, tunnels, bridges, and other transportation infrastructure. The following are the budgeted costs and time (months) to a given stage of completion for a project to upgrade a bridge to current standards. The project was ori

> Queenston Professional Support (QPS) provides professional services (IT, payroll and billing, and so on) to firms requiring temporary help in those areas. QPS bills clients for its various services based on the hours its professionals spend. In January,

> Farnsworth Executive Coaching (FEC) offers services to firms in advising executives on improving productivity and leadership. For August, FEC worked 660 hours for Grace Corporation and 390 hours for Temple Construction. In addition, FEC had small engagem

> In October, Temptations Event Planners (TEP) planned events for two clients. TEP worked 140 hours for Ward Corporation and 240 hours for Girardin Industries. TEP bills clients at the rate of $350 per hour; labor cost for its planning staff is $140 per ho

> Heidt Cleaning Services (HCS) is a local custodial service company serving both the residential and commercial markets. The owner is considering dropping the commercial clients because that business seems only marginally profitable. Twenty-five employees

> Refer to the information in Exercise 7-41. The controller at Wanda Instrumentation chose direct materials cost as the allocation base in Year 2, based on what the financial staff thought reflected the relation between overhead and direct labor cost. Year

> Wanda Instrumentation produces navigational equipment for ships, aircraft (both staffed and drones), and land vehicles. The parts are produced to specification by their customers. Depending on the customer and the type of job, the customer pays according

> Audubon, Inc. uses a predetermined factory overhead rate based on machine-hours. For October, Audubon recorded $4,500 in overapplied overhead, based on 34,100 actual machine-hours worked and actual manufacturing overhead incurred of $583,725. Audubon est

> Jason’s Custom Tooling (JCT) uses a job order cost system and applies overhead using a predetermined overhead rate based on direct labor costs. The following debits (credits) appeared in Workin- Process Inventory for November: Job 13-11

> Brunswick Home Remodelers (BHM) uses a job order cost system. The following debits (credits) appeared in Work-in-Process Inventory for April: BHM applies overhead to production at a predetermined rate of 65 percent based on direct materials cost. Job BH-

> You are working at a hotel in a resort location. The manager says that the hotel must raise the rates in the winter when it has fewer tourists because the cost per room is much higher. How would you respond?

> Regular Company produces audio equipment, specifically headphones and speakers. A new CEO has just been hired and announces a new policy that if a product cannot earn a markup of at least 25 percent, it will be dropped. The markup is computed as product

> Heidelberg Fabrication manufactures two products, G-09 and G-35: Production at the plant is automated and any labor cost is included in overhead. Data on manufacturing overhead at the plant follow: Required a. Heidelberg currently applies overhead on the

> In what ways is joint cost allocation similar to the allocation of fixed costs? In what ways is it different?

> How is joint cost allocation like service department cost allocation?