Question: Refer to the data in Exercise 15-

Refer to the data in Exercise 15-24. Assume the transfer price is unchanged from the current transfer price.

Required

a. Does Hamlet Industries want to accept this order?

b. Will the Distribution Division manager be willing to accept this order?

c. Will the Fabrication Division manager be willing to accept this order?

Exercise 15-24:

> On July 1, 2013, Scott London, a former KPMG audit partner, pleaded guilty to securities fraud. He had been passing information to his friend, Bryan Shaw, over a two-year period ending in 2012. He told his friend about earnings announcements by Herbalife

> Google is the world’s largest search engine. In 2009, it had approximately 400 million Web users, of which 200 million are located in the United States. Its global revenue from advertising amounted to $23.6 billion. China is the world’s third-largest eco

> The Sarbanes-Oxley Act of 2002 created the Public Company Accounting Oversight Board (PCAOB). The PCAOB reports to the U.S. Securities and Exchange Commission (SEC). One of the PCAOB’s responsibilities is to audit the accounting firms through practice in

> At the firm, we’ve got a new way of looking at tax issues. It’s called ‘risk management,’ and, in your case, John, it means that we can be more aggressive than in the past. In the past, when there was an issue open to interpretation, we advised you to ad

> Sophia and Maya were having a quiet afterwork drink at the Purple Pheasant around the corner from their office. Both are professional accountants in their late twenties and were talking about their futures in public accounting. “I want to concentrate on

> Before 2002, accounting firms would provide multiple services to the same firm. Hired by the shareholders, they would audit the financial statements that were prepared by management while also pro- viding consulting services to those same managers. Some

> As Bill Adams packed his briefcase on Friday, March 15, he could never remember being so glad to see a weekend. As a senior tax manager with a major accounting firm, Hay & Hay, on the fast track for partnership, he was worried that the events of the week

> The Italian federal corporate tax system has an official, legal tax structure and tax rates just as the U.S. system does. However, all similarity between the two systems ends there. The Italian tax authorities assume that no Italian corporation would eve

> The leak of the Panama Papers in 2016 revealed the existence of hundreds of thou- sands of offshore shell companies used by the world’s wealthy to avoid paying taxes, raised the public’s awareness of advantaged treatment of the wealthy, and led to renewe

> Multinationals are headquartered in one country but have operations worldwide. Generally, each multinational pays income taxes in the jurisdiction in which it generates its profits. For example, a German company with operations in the United States and S

> Multidisciplinary practices are probably an inevitable development. Clients want “one- stop shopping,” at a professional firm where they can go for all their needs, and where the partner responsible for their work can keep them briefed on new services th

> Stan Jones was an investor who had recently lost money on his investment in Fine Line Hotels, Inc., and he was anxious to discuss the problem with Janet Todd, a qualified accountant who was his friend and occasional advisor. “How can they justify this, J

> In June 2002, Martha Stewart began to wrestle with allegations that she had improperly used inside information to sell a stock investment to an unsuspecting investing public. That was when her personal friend Sam Waksal was defending himself against SEC

> It’s legal, but is it ethical? For years, a nationally known doughnut chain only sold sugary drinks at its retail outlets on a prominent university campus. Sugar consumption is known to contribute to diseases such as heart disease, tooth decay, diabetes,

> At one time, a well-known communications firm measured all managers at all levels on return on net assets (RONA). Write a report to the firm’s CFO indicating why you believe that the use of a single performance measure for managers at all levels will not

> Consider the following jobs. Identify a nonfinancial performance measure that you would recommend. a. Flight attendant b. Hotel parking valet c. Sports venue ticket-taker d. Bank teller e. Restaurant wait-staff

> Kipling’s Taco Shop was the only establishment serving tacos and other quick bites in a small college town for more than 20 years. Service was limited to the walk-up window, with no delivery and no inside seating. The owner of Kipling’s focused on well-m

> Refer to the information in Exercise 17-43. Required Write a memo to the managers at Crescent Call Centers recommending which variances they should investigate this period along with your reasons. Exercise 17-43: The standard direct labor cost per call

> Refer to the information in Exercise 17-41. Required Write a memo to the senior manager of Oakman Accounting Partners recommending which variances from the past year the firm should investigate along with your reasons. Exercise 17-41:

> Gerisch Consolidated sold 21,150 units of its only product last period. It had budgeted sales of 24,300 units based on an expected market share of 25 percent. The sales activity variance for the period is $340,200 U. The industry volume variance was $194

> Refer to the information in Exercise 17-22. Assume that Fischer Fabrication had no beginning finished goods inventory and only produced one product. A count of inventory showed that 4,400 units remained in the warehouse. Required a. Assume Fischer writes

> The River Plant of Carlisle, Inc. produces a particular metal fixture used in aerospace and maritime industries. The following information is available for the last operating month: ∙ The plant produced and sold 27,600 fixtures for $72

> The (partial) cost sheet for the single product manufactured at Briarcliff Corporation follows: The master budget level of production is 45,000 direct labor-hours, which is also the production volume used to compute the fixed overhead application rate. O

> Refer to the information in Exercises 16-38 and 16-39. Required What are the fixed overhead price and production volume variances for Golden Food Products? Exercise 16-38: Exercise 16-39:

> When would you advise a firm to use direct intervention to set transfer prices? What are the disadvantages of such a practice?

> Annland Components applies fixed overhead at the rate of $5.10 per unit. For October, budgeted fixed overhead was $513,825. The production volume variance amounted to $3,825 favorable, and the price variance was $12,750 unfavorable. Required a. What was

> Coe Parts applies fixed overhead at the rate of $6.80 per unit. Budgeted fixed overhead was $197,200. This month 28,120 units were produced, and actual fixed overhead was $192,100. Required a. What are the fixed overhead price and production volume varia

> Rankin Fabrication reports the following information with respect to its direct materials: Rankin Fabrication holds no materials inventories. Required a. Prepare a short report for Rankin’s management showing direct materials price and

> Refer to the information in Exercises 16-38 and 16-39. During the year, the company purchased 320,000 pounds of material and employed 32,500 hours of direct labor. Required a. Compute the direct materials price and efficiency variances. b. Compute the di

> Golden Food Products produces special-formula pet food. The company carries no inventories. The master budget calls for the company to manufacture and sell 120,000 cases at a budgeted price of $60 per case this year. The standard direct cost sheet for on

> Engleside Components produces testing equipment for medical devices. Recently, one of the company’s usual suppliers was unable to fill an order, so the purchasing manager chose a supplier who had been approved. The price was significantly higher than the

> Selected data for March for Irvington, Inc. follow. The variable material sales activity variance is $21,600 U. Required a. How many units were budgeted for March in the master budget? b. Recreate the master budget for March.

> The following data are available for the most recent year of operations for Prest Products. The revenue portion of the sales activity variance is $225,000 U. Required a. How many units were actually sold in the most recent period? b. Prepare a sales acti

> The Main Street plant controller at Nowak Enterprises sends you the following graph to explain the plant’s costs. Required Given the data shown in the graph, determine the following: a. Budgeted fixed cost per period. b. Budgeted variab

> Burdeno Appliances has two divisions, Sales and Financing. Sales is responsible for selling Burdeno’s inventory and maintaining inventory for future sale. Financing Division takes loan applications, packages loans into pools, and sells them in the financ

> What are the limitations of market-based transfer prices? What are the limitations of cost based transfer prices?

> Refer to the information in Exercise 15-36. Suppose Manufacturing is located in Country X with a tax rate of 35 percent and Marketing in Country Y with a tax rate of 15 percent. All other facts remain the same. Required a. Current output in Manufacturing

> Refer to the information in Exercise 15-24. Assume there is no special order pending. Required a. What transfer price would you recommend for Hamlet Industries? b. Using your recommended transfer price, what will be the income of the two divisions, assum

> Anstell Corporation operates a Manufacturing Division and a Marketing Division. Both divisions are evaluated as profit centers. Marketing buys products from Manufacturing and packages them for sale. Manufacturing sells many components to third parties in

> Refer to the information in Exercise 15-34. Suppose Production is located in Country A with a tax rate of 30 percent and Distribution in Country B with a tax rate of 10 percent. All other facts remain the same. Required a. Current output in Production is

> Carol Components operates a Production Division and a Packaging Division. Both divisions are evaluated as profit centers. Packaging buys components from Production and assembles them for sale. Production sells many components to third parties in addition

> Cascade Containers is organized into two divisions—Manufacturing and Distribution. Manufacturing produces a product that can be sold immediately or transferred to Distribution for further processing and then sold. Distribution only buys from Manufacturin

> Refer to the data in Exercise 15–26. Suppose that Civic Division will charge the client interested in implementing a costing system by the hour based on cost plus a fixed fee, where the cost is primarily the consultant’s hourly pay. Assume also that Civi

> Whitehill Chemicals has two operating divisions. Its Formulation Division in the United States mixes, processes, and tests basic chemicals, and then ships them to Ireland, where the company’s Commercial Division uses the chemicals to produce and sell var

> Hardyke Group operates a local after-school recreation and activities program. The Education Department is a state governmental agency. Hardyke has an agreement with the Department to provide services to students in need for a nominal $1 per day, to be p

> Pilgrim Logistics operates a network of delivery vans. Pilgrim allows its decentralized units (divisions) to “rent” vans to another Pilgrim division. Commercial Division has leased some of its idle vans to Retail Division for $450 per month. Recently, Co

> How can ratios, such as ROI, be used for control as well as performance evaluation?

> Lola Metals has two decentralized divisions, Stamping and Finishing. Finishing always has purchased certain units from Stamping at $36 per unit. Stamping plans to raise the price to $48 per unit, the price it receives from outside customers. As a result,

> Lamothe Solutions is a management consulting firm. Its Business Division advises firms on the adoption and use of financial systems. Civic Division consults with state and local governments. Civic Division has a client that is interested in implementing

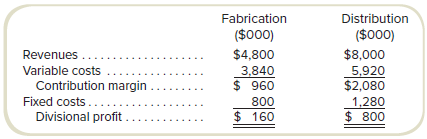

> Hamlet Industries is organized into two divisions, Fabrication and Finishing. Both divisions are considered to be profit centers, and the two division managers are evaluated in large part on divisional income. The company makes a single product. It is ma

> Refer to the data in Exercise 14-45. Assume that the division uses beginning-of-year asset values in the denominator for computing ROI. Required a. Compute ROI, using net book value. b. Compute ROI, using gross book value. c. If you worked Exercise 14-39

> Refer to the information in Exercises 14-40 and 14-41. Required a. What is the division’s residual income before considering the project? b. What is the division’s residual income if the asset is purchased? c. What is the division’s residual income if th

> Refer to the data in Exercise 14-37. Required Evaluate the performance of the two divisions assuming Houghton Chemicals uses economic value added (EVA). Exercise 14-37:

> Refer to the data in Exercises 14-24, 14-28, and 14-32. The individual regions are responsible for research and development (R&D) decisions and for current liabilities. Information on R&D expenditures (which are included in SG&A) for the year

> Refer to the data in Exercise 14-33. Required Evaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA). Exercise 14-33:

> The following data are available for two divisions of Ryan Enterprises: The cost of capital for the company is 7 percent. Ignore taxes. Required a. If Ryan measures performance using ROI, which division had the better performance? b. If Ryan measures per

> What is the coordinating role of budgeting?

> Refer to the information in Exercise 14-24. Information on the division assets in the three regions of Lauderdale Corporation follows: Required Compute the division ROI for each of the three regions. How have these regions performed? Exercise 14-24:

> The following partial financial information (in thousands of dollars) is available for Thole, Inc.: Corporate overhead costs at Thole are allocated to divisions based on relative sales. Required a. Complete the income statements for both divisions and th

> Refer to Exercise 14-25. The results for year 2 have just been posted: Required Compute divisional operating income for the two divisions. How have these divisions performed? Exercise 14-25:

> Owen Audio shows the following information for its two divisions for year 1. Required Compute divisional operating income for the two divisions. Ignore taxes. How have these divisions performed?

> Refer to the data in Exercise 13-54 and in Exhibits 13.20 and 13.21. Required To what level or levels would funding for Product Development Group have to drop such that one, but only one, of the PDG Areas received no funding? Explain. Exercise 13-54:

> Lauderdale Corporation is organized in three geographical divisions (regions) with managers responsible for revenues, costs, and assets in their respective regions. The firm is highly decentralized and managers are evaluated solely on divisional performa

> Chatsworth Theatre Group (CTG) is a not-for-profit organization that stages plays and other performances in a medium-sized city. Ticket revenues cover a portion of the operating costs, but CTG also relies on donations from local donors. In preparing the

> Gladstone Mini-Golf operates in a tourist area. The population grows significantly in the summer but is relatively small the rest of the year. For that reason, the business operates only during the roughly four-month (125-day) period from mid-May to mid-

> A friend tells you that the Business Application “The Risks of Focusing on Efficiency” demonstrates “that trying to achieve efficient operations is not a good idea.” Do you agree? Explain.

> If customers are satisfied, they will buy your products and profits will increase. Therefore, you only need to measure profit. Comment.

> What problems might arise if a firm relies solely on management estimates in preparing the master budget?

> Consider a class you are taking (perhaps cost accounting) or have taken in the past. Was your evaluation based on a single measure of performance (a final exam, for example) or did the instructor use multiple measures of performance (perhaps a quiz, midt

> Consider the Business Application “A New Strategy for an Old Business.” Prior to the internet, the The New York Times (and other papers) offered news, a crossword puzzle, recipes, and so on. They are also offered in the newer digital model of the paper.

> Consider a locally owned coffee shop, a Starbucks store, and a retail gas station that offers fresh coffee in its convenience stores. Characterize these stores according to the Porter strategy framework.

> Consider the Business Application “Changes in Bank Distribution Channels—a Mix Variance Interpretation.” In what ways would the mix variance described there be similar to the sales mix and production mix variances described in the chapter? In what ways w

> Consider a firm in the “sharing economy,” such as Uber, Lyft, or Airbnb. Do you think they would benefit by computing and evaluating (1) market share and industry volume variances; (2) sales mix and sales quantity variances; and (3) production mix and yi

> What are the three elements of a management control system?

> What does dysfunctional decision making refer to?

> A business school dean asks you for help in understanding the school’s inability to meet its budget. What are some of the variances you think might be important to consider? Why?

> What are the advantages of decentralization? What are some major disadvantages of decentralization?

> Why is performance measurement an important component of a management control system in a decentralized organization?

> What does decentralization mean in the context of a management control system?

> What is the difference among a firm’s value proposition, its mission, and its mission statement?

> How is benchmarking used?

> What is benchmarking?

> Why do effective performance evaluation systems measure different things at different levels in the organization?

> A balanced scorecard is a set of two or more performance measures. Do you agree? Why or why not?

> How do companies evaluate their own performance in getting workers involved and committed?

> Why measure delivery performance?

> There is no reason to investigate favorable variances; only unfavorable variances indicate problems.” Do you agree?

> Why is manufacturing cycle efficiency important to most organizations?

> What performance factors do measures related to customer satisfaction attempt to evaluate?

> What is the difference between an organization’s mission and its strategy?

> What is “management by exception”?

> What are several examples of companies that probably use materials mix and yield variances?

> For what decisions would a manager want to know market share variance?

> Why is there no efficiency variance for revenues?

> What does a manager learn by computing an industry volume variance?

> Variance analysis can be useful in a manufacturing environment where you know the standards, but it wouldn’t be useful in a service environment.” True or false?

> Standards and budgets are the same thing. True or false?

> How could a hospital firm use the mix variances to analyze salary costs regarding emergency room services?

> What is the basic difference between a master budget and a flexible budget? a. A flexible budget considers only variable costs; a master budget considers all costs. b. A master budget is based on a predicted level of activity; a flexible budget is based

> What is the standard cost sheet?