Question: Refer to the information and analysis of

Refer to the information and analysis of Problem 16-78.

Required

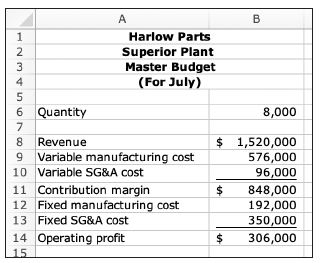

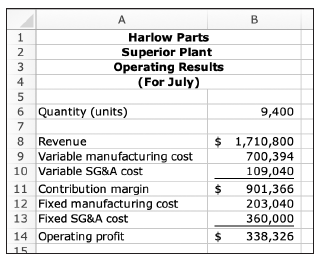

Help the managers at Harlow understand the implications from the profit variance analysis by writing a short summary of your analysis. Include visualizations to highlight your conclusions.

Problem 16-78:

> What is goal congruence? How is it different from behavioral congruence?

> What are the five basic kinds of decentralized units in a responsibility accounting system?

> What are the advantages of financial measures of performance? What are the advantages of nonfinancial measures of performance?

> Why is worker involvement important to an organization’s success?

> Why is it important for management accountants to understand business strategy?

> If the sales activity or materials efficiency variance is zero, there is no reason to compute a mix and quantity or yield variance. True or false?

> How would you recommend accounting for variances at the end of the year? Why?

> What complication arises in variance analysis when the number of units produced is not the same as the number of units sold?

> Fixed cost variances are computed differently from the variances for variable costs. Why?

> The Treadway Commission commented that a factor giving rise to fraud is the existence of pressures on division managers to achieve unrealistic profit objectives. Why might top management set unrealistic profit targets?

> Actual direct materials costs differ from the master budget amount. What are the three primary reasons for the difference?

> Why is transfer pricing important in tax accounting?

> How does the separation of duties help prevent financial fraud?

> What role do “packages” play in zero-based budgeting? How do these roles address critiques of traditional budgeting?

> How are actual direct labor costs used in a standard cost system? Does this differ from their use in a normal costing system? If so, how? If not, why not?

> Montgomery Fashions produces and sells clothing through various retailers. Montgomery is highly decentralized and allows its managers discretion in managing with little direct oversight. This latitude in decision making is checked by using a performance

> Mack’s Juices produces and bottles a line of fruit juices. The manufacturing process entails mixing and adding juices and other ingredients at the bottling plant, which is a part of Blending Division. The finished product is packaged in

> Refer to the data in Problem 15-41. Division managers are evaluated using residual income using a 9 percent cost of capital. Required a. What is the residual income for Western without the transfer to Eastern? b. What is Western’s residual income if it t

> Washburn Associates has two divisions. Western Division, which has an investment base of $50,000,000, produces and sells 1,400,000 units of a product at a market price of $60 per unit. Its variable costs total $25 per unit. The division also charges each

> Norfolk Advisors operates a network of offices that provide business and financial advice to small businesses. Each office is managed by an office director. The office director is given relatively wide latitude in running the office, although any product

> The Treadway Commission commented that the forces leading to financial fraud were present in all companies to some extent, but fraudulent financial reporting resulted from the right combustible mixture of forces and opportunities to commit fraud. Based o

> Tarnow Manufacturing produces metal components and is organized in four geographic divisions (North, South, East, and West). The company adopted a balanced scorecard approach to performance measurement several years ago. Although there were some initial

> Many firms in the service industry have empowered their customer-facing employees to handle service complaints on the spot rather than having the customer contact a corporate customer service center. For example, some airline and hotel companies authoriz

> The interaction between customers and line employees is often more direct in service industries than in manufacturing firms. At the same time, we often observe that employees in many service firms (for example, in hotels and airlines) are given authority

> A common method of measuring performance in many college and university courses is to combine objective measures (test scores, for example) with subjective measures (class participation measures, for example). These scores are weighted and combined to de

> Venice Textiles produces cloth. The inputs are fabric, labor, and overhead. Fragmentary productivity records from plant files for the last period show the following: Required Determine the partial fabric (materials) productivity.

> Refer to the data in Exercise 18-42 (McNichols Lubricants). From the accounting records, you also gather the following information for the two years. Required a. Compute the total factor productivity measures for quarter 1 and quarter 2 based on the thre

> Boleyn Cycles produces several models of high-end bicycles and related products. The company collects various operational performance measurements monthly and reviews them as part of its continuous improvement program. The company has recently been evalu

> Henderson Parts manufactures parts for turbines. The company is in the process of adopting lean manufacturing techniques to remain competitive. Part of the effort is to eliminate as much of the nonvalue-added time in production as possible. The plant con

> Prevost Chemicals manufactures an industrial solvent at its only processing plant. A liquid chemical and labor are the two primary inputs. All other resources are included in manufacturing overhead. The plant never has any work-in-process or finished goo

> Terrell Industries produces a single product at its Roosevelt facility. The product has two main inputs, metal and labor, with additional costs being included in manufacturing overhead. The plant carries neither work-in-process nor finished goods invento

> Each April, it is common to find news articles contrasting executive pay with firm performance. For example, on April 9, 2009, The Wall Street Journal reported that the top three executives at Kilroy Realty (a California property developer and manager) w

> Mission statements can be difficult to write, especially for not-for-profit organizations engaged in charitable work. Consider the following two statements from relief organizations: • American Red Cross: “The American Red Cross prevents and alleviates h

> Write a report to the CEO of Acer Incorporated (a manufacturer of laptops) recommending specific benchmark measures. Include specific competitors against which to measure.

> Stansbury Stores is a general grocery and convenience items retailer. The business is quite competitive and margins are thin. The company recently reviewed its performance measurement system and decided to adopt a balanced scorecard. As a part of that re

> Brace Parts manufactures components for the audiovideo equipment industry. At a recent corporate retreat, the management of Brace reviewed the company strategy and decided that Brace had a strategic advantage in being able to differentiate several of its

> A company is considering using sales revenue (selling price multiplied by sales quantity) as a performance measure for its marketing manager. The newly hired compensation analyst suggests that it might be better to just use the sales quantity (a nonfinan

> Goodwin Advisors offers financial advice on an hourly basis. The following information for the second quarter is the flexible budget based on the actual volume of 3,500 hours: The master budget for the second quarter was based on selling 4,000 advising h

> McKinley City Tours offers small group guided walks. The following information for July provides the original budget: McKinley actually sold 1,440 tours in July. The price variance was $2,880 unfavorable, the variable cost variance was $5,760 unfavorable

> La Salle Outfitters organizes wilderness tours. For the most recent touring season, the industry volume variance showed La Salle sold 336 more tours than expected, but the market share variance resulted in 96 fewer tours than expected. The standard contr

> You are a county supervisor for Firwood County and are preparing for the monthly supervisor meeting where the operations of various units are reviewed. One of the units that the county government operates is a motor pool with 50 vehicles. The motor pool

> The Berry Bowl sells fresh fruit cups from a cart. The owner want to compare this quarter’s results with those for last quarter. The owner believes that the last quarter’s operations were “what we exp

> Consider the Business Application “Recent Experiences with Zero-Based Budgeting. According to the Application, the company Kraft Heinz intends to keep using zero-based budgeting while other firms in the same industry are dropping it. What might lead one

> Refer to the information in Problem 17-58. Required Write a memo to the managers at Pease Contractors recommending which variances they should investigate this period, along with your reasons. Problem 17-58:

> Earle Soup Company makes three varieties of soups: Bean, Tomato, and Vegetable. Sales volume for the annual budget is determined by estimating the total market volume for soups and then applying the company’s prior-year market share, ad

> Refer to the information in Problem 17-52. Required Write a memo to the managers at Graves Bank & Trust recommending which variances they should investigate this period, along with your reasons. Problem 17-52: Graves Bank & Trust (GB&T) estimates that i

> Larned Company makes a storage box using metal. The company uses a standard costing system. Variable overhead is allocated on the basis of direct materials usage (pounds). Overhead is allocated to units based on expected production of 13,500 units. Larne

> Gateshead Indistries manufactures a single product and started the year with no inventories. Selected information about results for the period just ended include the following: Thirty percent of this period’s production has not been sol

> Refer to the information and analysis of Problem 16-79. Required Help the managers at Harlow understand the implications from the production cost variance analysis by writing a short summary of your analysis. Include visualizations to highlight your conc

> The following information concerning actual results is available from Hamburg, Inc.: The company planned to sell 64,800 units at a price of $11 each. Variable marketing and administrative costs are budgeted at 15 percent of revenue. You have discovered t

> Refer to the information in Problem 16-75. Assume that the company carries no beginning or ending inventories. Sales in March totaled $3,800,000 for both products combined. Required Prepare the journal entries to record the activity for the last month us

> Anthon Corporation has provided the following information regarding last month’s activities. Variable overhead is applied on the basis of direct labor-hours. Required Prepare a report that shows all variable production cost price and ef

> A company has a bonus plan that states that managers with division income ranked below the average of all managers receive no bonus for the year. What biases might arise in this system?

> Copland Components manufactures an electronic device for vehicle manufacturing. The current standard cost sheet for a device follows: Assume that the following data appeared in Copland’s records at the end of the past month: There are n

> Refer to the information in Problem 16-71. Assume there are no beginning inventories or ending inventories. All production was sold on account for $2,500,000. Selling and administrative costs were incurred as budgeted. Selling and administrative costs we

> The Valley Plant of Patton Supply manufactures a single product. The standard cost sheet for the product follows: Standards have been computed based on a master budget activity level of 20,000 direct labor hours per month. Actual activity for the past mo

> Hart Business Solutions operates call centers for multiple clients. Hart has suffered declining profits and is looking at ways to improve its performance. Because of competition in the industry, Hart managers do not believe they can raise prices without

> The following is a typical monthly report used to evaluate managers at the six manufacturing plants of Missouri Foundries: Required Identify and explain at least three changes to the report that would make the cost information more meaningful and less th

> Parkdale Courier Service employs several delivery specialists. The following reports the information for these specialists for April: Required Based on these data, what was the number of actual hours worked and what was the labor price variance?

> McCoy Industries has prepared the following, partially complete profit variance analysis: Required Find the values of the missing items (a) through (x). Assume that actual sales volume equals actual production volume. (There are no inventory level change

> The following, partially complete profit variance analysis is from October for La Salle Manufacturing: Required Find the values of the missing items (a) through (q). Assume that the actual sales volume equals actual production volume. (There are no inven

> The following are the actual results for Bentler Associates for the most recent period: The company planned to produce and sell 72,000 units for $12.50 each. At that volume, the contribution margin would have been $648,000. Variable marketing and adminis

> Rogge Corporation makes a specialized sensor that is used in testing equipment. The company is organized in two divisions: Assembly and Shipping. Managers in both divisions are evaluated as profit centers using divisional income. Orders are received in S

> In the previous chapters, we considered different allocation methods and considered which one might be “better.” Why might a manager have a different opinion about the “best” allocation system after moving to another business unit? Is this ethical?

> In Chapter 12, we discussed corporate cost allocation and the incentive problems associated with these allocations. How is the problem of corporate cost allocations similar to the transfer pricing problems studied in this chapter? Is the approach suggest

> Whipple Parts is organized in two divisions: Stamping and Assembly. Managers in both divisions are evaluated as profit centers using divisional income. All orders at Whipple come to Assembly Division. The company makes a single product, which is a specia

> Milner Technologies is a large, multidivision firm. One division, Testing, is well known inside Milner for its efficient information technology (IT). A smaller division, Energy, has approached Testing with a proposal that Testing provide IT support in th

> Radom Manufacturing produces various products. The company operates a landfill, which it uses to dispose of nonhazardous trash. The trash is hauled from the two nearby manufacturing facilities in trucks that can carry up to five tons of trash in a load.

> Grand Amusements, Inc. (GAI) has two operating divisions, Parks and Foods. The two divisions have a marketing agreement to provide incentives to customers. Parks Division offers vouchers good for meals at the restaurants of Foods Division, and Foods Divi

> Wager Enterprises has four operating divisions: Tours, Hotels, Concerts, and Ticket Services. Each division is a separate segment for financial reporting purposes. Revenues and costs related to outside transactions were as follows for the past year (doll

> Northfield Manufacturing has two operating divisions in a semiautonomous organizational structure. Americas Division, based in the United States, produces a specialized memory chip that is an input to Asia Division, based in Japan. Americas Division uses

> Norfolk, Inc. consists of three divisions—Tidal, Hill, and Wood—that operate as if they were independent companies. Each division has its own sales force and production facilities. Each division manager is responsible

> Fenton Supplies manufactures and sells food products for restaurants and other institutional food providers. Produce Division does both manufacturing (blending, canning, bottling) and storing of products until shipping. Produce Division workers then load

> LGA’s Energy Division is operating at capacity. It has been asked by Products Division to supply it a thermal switch, which Energy sells to its regular customers for $72 each. Products, which is operating at 75 percent capacity, is will

> Dakota Security Systems (DSS) is a decentralized organization that evaluates divisional management based on measures of divisional contribution margin. Residential Division and Commercial Division both sell security and monitoring equipment. Residential

> The manager of an operating department just received a cost report and has made the following comment with respect to the costs allocated from one of the service departments: “This charge to my division doesn’t seem right. The service center installed eq

> Pallister Medical, Inc. (PMI) produces and sells a single drug. The company is organized into three divisions: Production, Packaging, and Distribution. Production, located in country A, manufactures the drug producing a single-dose capsule. The variable

> Refer to the information in Exercise 14-48. Assume that the company uses a 12 percent cost of capital. As in Exercise 14-48, performance measures are based on beginning-of-year gross book values for the investment base. Required a. What is the residual i

> Refer to the information in Problems 14-63 and 14-64. Looking at the EVA results for year 3, the president of Marine Division complains that the division is evaluated unfairly because a common cost of capital is used. The president believes that the R&am

> Refer to the information in Problems 14-63 and 14-64. The executives at Bentler’s corporate headquarters are intrigued and interested by the EVA findings. They are concerned, however, about the estimated cost of capital that is used (12

> Refer to the information in Problem 14-63. Looking at the ROI results for year 3, the president of Aeronautics Division complains that the division is evaluated unfairly because of the accounting rules that R&D expenditures be expensed in the year in

> Bentler Industries provides high-technology navigation and communication equipment for the aerospace and shipbuilding industries. It is organized into two divisions, Aeronautics and Marine. The division presidents are given wide decision-making authority

> Vermont Automotive is a regional chain of auto parts stores. The managers of the individual stores are evaluated using ROI. Vermont requires managers to earn an ROI of at least 10 percent of assets. The manager of the Erie store estimates revenues in the

> Technology firms, pharmaceutical firms, oil and gas companies, and other ventures inevitably incur costs on unsuccessful investments in new projects (e.g., new technologies or new drugs). For oil and gas firms, a debate continues over whether those costs

> Division managers at Lesure, Inc. are granted a wide range of decision authority. With the exception of managing cash, which is done at corporate headquarters, divisions are responsible for sales, pricing, production, costs of operations, and management

> Refer to the facts in Problem 14-52 through 14-54. Assume that the Leidich Corporation performance measurement and bonus plans are based on residual income instead of ROI. The company uses a cost of capital of 10 percent in computing residual income. Req

> Surveying the accounts payable records, a clerk in the controller’s office noted that expenses appeared to rise significantly within one month of the close of the budget period. The organization did not have a seasonal product or service to explain this

> Refer to the facts in Problem 14-52. Assume that the performance measurement and bonus plans at Leidich Corporation are based on residual income instead of ROI. The company uses a cost of capital of 10 percent in computing residual income. Required a. Wh

> Refer to the information in Problem 14-52. The manager is still assessing the problem of whether to acquire SSM’s assembly machine. SSM tells the manager that the new machine could be acquired next year, but it will cost 20 percent more

> Refer to the data in Problems 14-49 and 14-50. The manager of the Canal Division complains that the calculation of EVA is unfair because a much longer life is assumed for the Lake Division in calculating EVA. The manager of Lake Division responds that EV

> Refer to the data in Problem 14-49. R&D is assumed to have a three-year life in Canal Division and an eight-year life in Lake Division. All R&D expenditures are spent at the beginning of the year. Assume there are no current liabilities and (unre

> Navarre Energy Research specializes in developing and commercializing new products. It is organized into two divisions, which are based on the products they produce. Canal Division is smaller, and the lives of the products it produces tend to be shorter

> Refer to the data in Exercise 13-51. Recent economic events in the local area have led the owner of Lamphere Lawncare to revise some estimates in budgeting the operating income for the following year. First, unexpected competition has depressed prices. T

> Norcross Carpet Cleaning (NCC) is a commercial service specializing in maintaining floor coverings in high-traffic areas such as malls and office buildings. The business is highly seasonal, with high demand in the winter and low demand in the summer. In

> Refer to the data in Problem 13-68. Required a. Prepare a cash budget for the year. b. The owners want to ensure that they have cash on hand at the end of the year equal to the current accounts payable balance on December 31. Will the store meet that req

> Owen Surf Sports is an idea of two budding entrepreneurs. Their plan is to sell kiteboards from a store in the local town. Between them, they invest $30,000 in capital and are in the process of applying for a bank loan, also for $30,000. The loan would b

> Refer to the information in Exercise 14-45. Assume that the company uses an 8 percent cost of capital. Required a. Compute residual income, using net book value for each year. b. Compute residual income, using gross book value for each year. Exercise 14

> Accounting is objective and precise. Therefore, performance measures based on accounting numbers must be objective and precise. Do you agree? Explain.

> Lane Products manufactures a popular kitchen utensil. The company recently expanded, and the controller believes that it will need to borrow cash to continue operations. It opened negotiations with the local bank for a one-month loan of $40,000 starting

> Refer to the data in Problem 13-64. The managers of Vernon Cabins are considering different pricing strategies for year 2. Under the first strategy (High Price), they will work to maintain an average price of $260 per night. They realize that this will r