Question: Refer to the information in Exercise 3-

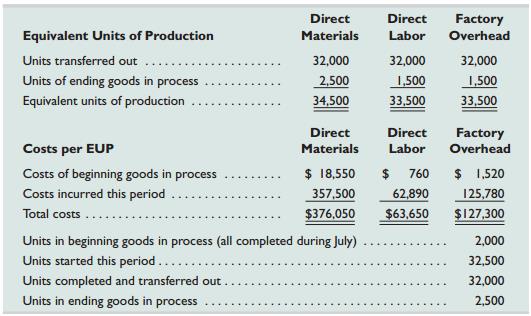

Refer to the information in Exercise 3-15. Prepare a process cost summary using the FIFO method. (Round cost per equivalent unit calculations to two decimal places.)

Information from Exercise 3-15:

The following partially completed process cost summary describes the July production activities of AshadCompany. Its production output is sent to its warehouse for shipping. All direct materials are added to products when processing begins. Beginning goods in process inventory is 20% complete with respect to direct labor and overhead.

Transcribed Image Text:

Direct Direct Factory Overhead Equivalent Units of Production Materials Labor Units transferred out 32,000 32,000 32,000 Units of ending goods in process 2,500 1,500 1,500 Equivalent units of production 34,500 33,500 33,500 Direct Direct Factory Overhead Costs per EUP Materials Labor $ 760 $ 18,550 357,500 $376,050 Costs of beginning goods in process $ 1,520 Costs incurred this period 62,890 125,780 Total costs .. $63,650 $127,300 Units in beginning goods in process (all completed during July) 2,000 Units started this period .... 32,500 Units completed and transferred out 32,000 Units in ending goods in process 2,500

> Describe the contribution margin ratio in layperson’s terms.

> After all labor costs for a period are allocated, what balance should remain in the Factory Payroll account?

> Are there situations where Polariscan use process costing? Identify at least one and explain it.

> Explain a hybrid costing system. Identify a product or service operation that might well fit a hybrid costing system.

> Grand Garden is a luxury hotel with 150 suites. Its regular suite rate is $250 per night per suite. The hotel’s cost per night is $140 per suite and consists of the following. Variable direct labor and materials cost . . . . . . . . . . . . . . . . . .

> How do step-wise costs and curvilinear costs differ?

> Refer to Vijay Company’s data in QS 6-4. Compute its production cost per unit under variable costing.

> Refer to the information in Exercise 4-6 to answer the following requirements. Information from 4-6: Way Cool produces two different models of air conditioners. The company produces the mechanical systems in their components department. The mechanical sy

> Piaggiois thinking of expanding sales of its most popular scooter model by 65%. Should we expect its variable and fixed costs for this model to stay within the relevant range? Explain.

> Trez Company began operations this year. During this first year, the company produced 100,000 units and sold 80,000 units. The absorption costing income statement for its first year of operations follows. Sales (80,000 units 3 $50 per unit) . . . . . .

> What is a cost object?

> Polaris offers extended service contracts that provide repair and maintenance coverage over its products. As you complete the following requirements, assume that the Polaris services department uses many of Polaris’s existing resources such as its facili

> D’Souza Company sold 10,000 units of its product at a price of $80 per unit. Total variable cost is $50 per unit, consisting of $40 in variable production cost and $10 in variable selling and administrative cost. Compute the manufacturing (production) ma

> Access and review Piaggio’s Website (www.piaggio.com) to answer the following questions. Required 1. Do you believe that Piaggio’s managers use single product CVP analysis or multiproduct break-even analysis? Explain. 2. How does the addition of a new p

> A recent annual report for McDonald’s reports the following operating income for its United States and APMEA (Asia-Pacific, Middle East, and Africa) geographic segments: Required1. Is operating income growing faster in the United Stat

> Chem-Melt produces and sells an ice-melting granular used on roadways and sidewalks in winter. The company annually produces and sells about 300,000 lbs of its granular. In its ten-year history, the company has never reported a net loss. Because of this

> Multiproduct break-even analysis is often viewed differently when actually applied in practice. You are to visit a local fast-food restaurant and count the number of items on the menu. To apply multiproduct break-even analysis to the restaurant, similar

> Is it possible to have under- or overapplied overhead costs in a process cost accounting system? Explain.

> Following are activities in providing medical services at Healthsmart Clinic. A. Registering patients B. Cleaning beds C. Stocking examination rooms D. Washing linens E. Ordering medical equipment F. Heating the clinic G. Providing security services H.

> E’Lonte Company began operations this year. During this first year, the company produced 300,000 units and sold 250,000 units. Its income statement under absorption costing for its first year of operations follows. Additional Informat

> Diaz Company reports the following variable costing income statement for its single product. Thiscompany’s sales totaled 50,000 units, but its production was 80,000 units. It had no beginning finished goods inventory for the current per

> Labor costs of an auto repair mechanic are seldom based on actual hours worked. Instead, the amount paid a mechanic is based on an industry average of time estimated to complete a repair job. The repair shop bills the customer for the industry average am

> Assume that a company produces a single product by processing it first through a single production department. Directlabor costs flow through what accounts in this company’s process cost system?

> Laval produces lamps and home lighting fixtures. Its most popular product is a brushed aluminum desk lamp. This lamp is made from components shaped in the fabricating department and assembled in its assembly department. Information related to the 35,000

> Both Polaris and Arctic Cat sell motorized vehicles, and each of these companies has a different product mix. Required1. Assume the following data are available for both companies. Compute each company’s break-even point in unit sales.

> The usefulness of a single plantwide overhead rate is based on two assumptions. What are those assumptions?

> Refer to the information in Exercise 4-9. Information from Exercise 4-9: Textra Plastics produces parts for a variety of small machine manufacturers. Most products go through two operations, molding and trimming, before they are ready for packaging. Exp

> Aces Inc., a manufacturer of tennis rackets, began operations this year. The company produced 6,000 rackets and sold 4,900. Each racket was sold at a price of $90. Fixed overhead costs are $78,000 and fixed selling and administrative costs are $65,200. T

> After reading an article about activity-based costing in a trade journal for the furniture industry,Adria Lopez wondered if it was time to critically analyze overhead costs at Success Systems. In a recent month, Adria found that setup costs, inspection c

> KTM’s managers rely on reports of variable costs. How variable costing reports can prepared using the contribution margin format help managers in computing break-even volume in units?

> Toyota embraces lean techniques, including lean accounting. What are the two key components of lean accounting?

> A list of activities that generate quality costs is provided below. For each activity, indicate whether it relates to a prevention activity (P), appraisal activity (A), internal failure activity (I), or external failure activity (E). a. Inspecting raw ma

> Piaggiois a manufacturer. “Activity-based costing is only useful for manufacturing companies.” Is this a true statement? Explain.

> This chapter’s opener featured Neal Gottlieb and his company Three Twins Ice Cream. Required 1. Neal recently built a large manufacturing facility. Explain how his company’s process cost summary report would differ after his new manufacturing facility i

> How can absorption costing lead to incorrect short-run pricing decisions?

> What is the main factor for a company in choosing between the job order costing and process costing accounting systems? Give two likely applications of each system.

> A company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and cost driver activity for each of the company’s three activity cost pools follow. Compute the activity rates for eac

> Identify the control document for materials flow when a materials requisition slip is not used.

> Explain why equivalent units of production for both direct labor and overhead can be the same as, and why they can be different from, equivalent units for direct materials.

> Refer to information about Azule Company in Problem 6-1B. In the company’s planning documents,Roberta Azule, the company president, reports that the company’s break-even volume in unit sales is 55,715 units. This break-even point is computed as follows.

> Aziz Company sells two types of products, Basic and Deluxe. The company provides technical support for users of its products, at an expected cost of $250,000 per year. The company expects to process 10,000 customer service calls per year. Required 1. De

> 1. If management wants the most accurate product cost, which of the following costing methods should be used? a. Volume-based costing using departmental overhead rates b. Volume-based costing using a plantwide overhead rate c. Normal costing using a plan

> Manufacturers and merchandisers can apply just-in-time (JIT) to their inventory management. Both Polaris and Arctic Cat want to know the impact of a JIT inventory system for their operating cash flows. Review each company’s statement of cash flows in App

> Refer to the information in QS 4-7. Compute the activity rate for each activity, assuming the company uses activity-based costing. Information from 4-7: Xie Company identified the following activities, costs, and activity drivers. The company manufactur

> Ciolino Co.’s March 31 inventory of raw materials is $80,000. Raw materials purchases in April are $500,000, and factory payroll cost in April is $363,000. Overhead costs incurred in April are: indirect materials, $50,000; indirect labo

> Refer to the information in QS 4-5. What are the company’s departmental overhead rates if the assembly department assigns overhead based on direct labor hours and the finishing department assigns overhead based on machine hours? Inform

> Can services be delivered by means of process operations? Support your answer with an example.

> What are the two main inventory methods used in process costing? What are the differences between these methods?

> Many contractors work on custom jobs that require a job order costing system. Required Access the Website AMSI.com and click on Construction Management Software, and then on star builder. Prepare a one-page memorandum for the CEO of a construction compa

> The following partially completed process cost summary describes the July production activities of AshadCompany. Its production output is sent to its warehouse for shipping. All direct materials are added to products when processing begins. Beginning goo

> Consider the following data for two products of Gitano Manufacturing. Required1. Using direct labor hours as the basis for assigning overhead costs, determine the total production cost per unit for each product line.2. If the market price for Product A

> The following flowchart shows the August production activity of the Spalding Company. Use the amounts shown on the flowchart to compute the missing four numbers identified by blanks. Production Beginning goods in process $17,250 Factory overhead $51,

> Refer to the information in Exercise 3-12 and complete it for each of the three separate assumptions using the FIFO method for process costing. Information from Exercise 3-12: The production department in a process manufacturing system completed 80,000

> Why is it possible for direct labor in process operations to include the labor of employees who do not work directly on products or services?

> The production department in a process manufacturing system completed 80,000 units of product and transferred them to finished goods during a recent period. Of these units, 24,000 were in process at the beginning of the period. The other 56,000 units wer

> Describe how use of absorption costing in determining income can lead to over-production and a buildup of inventory. Explain how variable costing can avoid this same problem.

> Refer to the information in Exercise 3-9 and complete its parts (1) and (2) using the FIFO method. (Round cost per equivalent unit to two decimal places.) Information from Exercise 3-9: The production department described in Exercise 3-8 had $850,000 of

> Refer to the information in Exercise 3-8 to compute the number of equivalent units with respect to both materials used and labor used in the production department for April using the FIFO method. Information from Exercise 3-8: During April, the productio

> Kenzi Kayaking, a manufacturer of kayaks, began operations this year. During this first year, the company produced 1,050 kayaks and sold 800 at a price of $1,050 each. At the current year-end, the company reported the following income statement informati

> Blazer Chemical produces and sells an ice-melting granular used on roadways and sidewalks in winter. It annually produces and sells about 100 tons of its granular. In its nine-year history, the company has never reported a net loss. However, because of t

> Mortech had net income of $250,000 based on variable costing. Beginning and ending inventories were 50,000 units and 48,000 units, respectively. Assume the fixed overhead per unit was $0.75 for both the beginning and ending inventory. What is net income

> Describe the usefulness of variable costing for controlling company costs.

> Vijay Company reports the following information regarding its production costs. Compute its production cost per unit under absorption costing. Direct materials . . . . . . . . . . . . . . . . . . . $10 per unit Direct labor. . . . . . . . . . . . . . .

> Assume that you are preparing for a second interview with a manufacturing company. The company is impressed with your credentials but has indicated that it has several qualified applicants. You anticipate that in this second interview, you must show what

> Under absorption costing a company had the following per unit costs when 10,000 units were produced. Direct labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2 Direct material . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Var

> The production department described in Exercise 3-8 had $850,000 of direct materials and $650,000 of direct labor cost charged to it during April. Also, its beginning inventory included $118,840 of direct materials cost and $47,890 of direct labor. Info

> Piaggio, Polaris, and Arctic Cat are competitors in the global marketplace. Selected data forPiaggio follow. Required1. Review the discussion of the importance of the cost of goods sold divided by total expenses ratio in BTN 3-2. Compute the cost of go

> During April, the production department of a process manufacturing system completed a number of units of a product and transferred them to finished goods. Of these transferred units, 60,000 were in process in the production department at the beginning of

> Tavella Co.’s August 31 inventory of raw materials is $150,000. Raw materials purchases in September are $400,000, and factory payroll cost in September is $232,000. Overhead costs incurred in September are: indirect materials, $30,000;

> When output volume increases, do variable costs per unit increase, decrease, or stay the same within the relevant range of activity? Explain.

> What is a variable cost? Identify two variable costs.

> The following journal entries are recorded in Kiesha Co.’s process cost accounting system. Kieshaproduces apparel and accessories. Overhead is applied to production based on direct labor cost for the period. Prepare a brief explanation

> Refer to Exercise 5-10. (1) Prepare a contribution margin income statement for Blanchard Company showing sales, variable costs, and fixed costs at the break-even point. (2) If the company’s fixed costs increase by $135,000, what amount of sales (in dolla

> Rey Company’s single product sells at a price of $216 per unit. Cost data for its single product follows. Compute this company’s break-even volume in units. Direct materials . . . . . . . . . . . . . . . . . . . . . . . . $20 per unit Direct labor . . .

> Polarix is a retailer of ATVs (all-terrain vehicles) and accessories. An income statement for its Consumer ATV Department for the current year follows. ATVs sell, on average, for $3,800. Variable selling expenses are $270 each. The remaining selling expe

> MidCoast Airlines provides charter airplane services. In October this year, the company was operating at 60% of its capacity when it received a bid from the local community college. The college was organizing a Washington, D.C., trip for its internationa

> Way Cool produces two different models of air conditioners. The company produces the mechanical systems in their components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and

> Oak Mart, a producer of solid oak tables, reports the following data from its current year operations, which is its second year of business. Sales price per unit . . . . . . . . . . . . . . . . . . . . . . $320 per unit Units produced this year . . . .

> Hayek Furnaces prepares the income statement under variable costing for its managerial reports, and it prepares the income statement under absorption costing for external reporting. For its first month of operations, 375 furnaces were produced and 225 we

> Explain in simple terms the notion of equivalent units of production (EUP). Why is it necessary to use EUP in process costing?

> Swisher Company’s computer system generated the following trial balance on December 31, 2013. The company’s manager knows that the trial balance is wrong because it does not show any balance for Goods in Process Invent

> Tee-Pro has three types of costs: t-shirt cost, factory rent cost, and utilities cost. This company sells its shirts for $16.50 each. Management has prepared the following estimated cost information for next month under two different sales levels. Requ

> Jacquie Inc. reports the following annual cost data for its single product. Normal production and sales level . . . . . . . . . 60,000 units Sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . $56.00 per unit Direct materials . . . . . .

> When units produced exceed units sold for a reporting period, would income under variable costing be greater than, equal to, or less than income under absorption costing? Explain.

> Li Company produces a product that sells for $84 per unit. A customer contacts Li and offers to purchase 2,000 units of its product at a price of $68 per unit. Variable production costs with this order would be $30 per unit, and variable selling expenses

> Cool Sky Company reports the following costing data on its product for its first year of operations. During this first year, the company produced 44,000 units and sold 36,000 units at a price of $140 per unit. Production costs Direct materials per unit

> Ming Company had net income of $772,200 based on variable costing. Beginning and ending inventories were 7,800 units and 5,200 units, respectively. Assume the fixed overhead per unit was $3.00 for both the beginning and ending inventory. What is net inco

> Refer to the information for D’Souza Company in QS 6-2. Compute the contribution margin.

> Blanchard Company manufactures a single product that sells for $180 per unit and whose total variable costs are $135 per unit. The company’s annual fixed costs are $562,500. (1) Use this information to compute the company’s (a) contribution margin, (b) c

> Sager Company manufactures variations of its product, a technopress, in response to custom orders from its customers. On May 1, the company had no inventories of goods in process or finished goods but held the following raw materials. Material M . . . .

> Refer to the information about Ramort Company in QS 6-8. Would the answer to the question in QS 6-8 change if the company uses variable costing? Explain. Information from QS 6-8: Ramort Company reports the following cost data for its single product. The

> Polaris’s financial statements and notes in Appendix A provide evidence of growth potential in its sales. Required 1. Identify at least two types of costs that will predictably increase as a percent of sales with growth in sales. 2. Explain why you beli

> A jeans maker is designing a new line of jeans called the Slims. The jeans will sell for $205 per pair and cost $164 per pair in variable costs to make. (1) Compute the contribution margin per pair. (2) Compute the contribution margin ratio. (3) Describe

> Sims Company, a manufacturer of in-home decorative fountains, began operations on September 1 of the current year. Its cost and sales information for this year follows. Production costs Direct materials . . . . . . . . . . . . . . . . . . . . . . . $40

> Felix & Co. reports the following information about its sales and cost of sales. Draw an estimated line of cost behavior using a scatter diagram, and compute fixed costs and variable costs per unit sold. Then use the high-low method to estimate the f

> Company A is a manufacturer with current sales of $6,000,000 and a 60% contribution margin. Its fixed costs equal $2,600,000. Company B is a consulting firm with current service revenues of $4,500,000 and a 25% contribution margin. Its fixed costs equal

> Should Polaris use single product or multiproduct break-even analysis? Explain.

> _______ of _______ reflects expected sales in excess of the level of break-even sales.

> KTM has both fixed and variable costs. Why are fixed costs depicted as a horizontal line on a CVP chart?

> Why are multiple departmental overhead rates more accurate for product costing than a single plantwide overhead rate?