Question: Sager Company manufactures variations of its

Sager Company manufactures variations of its product, a technopress, in response to custom orders from its customers. On May 1, the company had no inventories of goods in process or finished goods but held the following raw materials.

Material M . . . . . . . . 200 units @ $250 5 $50,000

Material R . . . . . . . . 95 units @ 180 5 17,100

Paint . . . . . . . . . . . . . 55 units @ 75 5 4,125

Total cost . . . . . . . . . $71,22

On May 4, the company began working on two technopresses: Job 102 for Worldwide Company and Job 103 for Reuben Company.

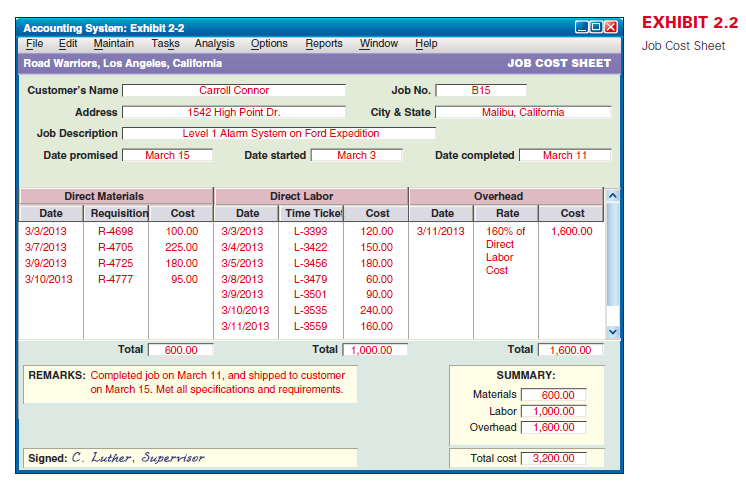

RequiredUsing Exhibit 2.2 as a guide,

Exhibit 2.2:

prepare job cost sheets for jobs 102 and 103.

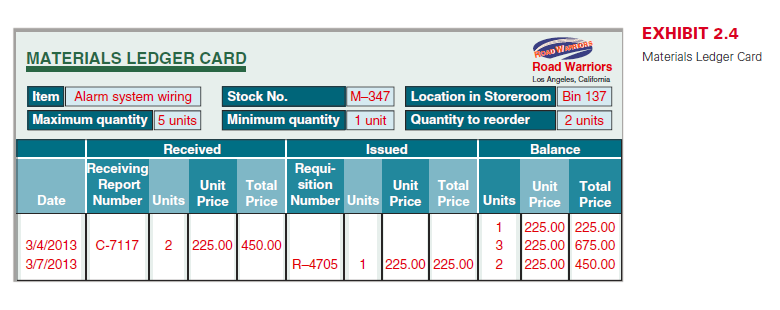

Using Exhibit 2.4 as a guide,

prepare materials ledger cards for Material M, Material R, and paint. Enter the beginning raw materials inventory dollar amounts for each of these materials on their respective ledger cards. Then, follow the instructions in this list of activities.

a. Purchased raw materials on credit and recorded the following information from receiving reports and invoices.

Receiving Report No. 426, Material M, 250 units at $250 each.

Receiving Report No. 427, Material R, 90 units at $180 each.

Instructions: Record these purchases with a single journal entry. Enter the receiving report information on the materials ledger cards.

b. Requisitioned the following raw materials for production.

Requisition No. 35, for Job 102, 135 units of Material M.

Requisition No. 36, for Job 102, 72 units of Material R.

Requisition No. 37, for Job 103, 70 units of Material M.

Requisition No. 38, for Job 103, 38 units of Material R.

Requisition No. 39, for 15 units of paint.

Instructions: Enter amounts for direct materials requisitions on the materials ledger cards and the job cost sheets. Enter the indirect material amount on the materials ledger card. Do not record a journal entry at this time.

c. Received the following employee time tickets for work in May.

Time tickets Nos. 1 to 10 for direct labor on Job 102, $90,000.

Time tickets Nos. 11 to 30 for direct labor on Job 103, $65,000.

Time tickets Nos. 31 to 36 for equipment repairs, $19,250.

Instructions: Record direct labor from the time tickets on the job cost sheets. Do not record a journal entry at this time.

d. Paid cash for the following items during the month: factory payroll, $174,250, and miscellaneous overhead items, $102,000.

Instructions: Record these payments with journal entries.

e. Finished Job 102 and transferred it to the warehouse. The company assigns overhead to each job with a predetermined overhead rate equal to 80% of direct labor cost.

Instructions: Enter the allocated overhead on the cost sheet for Job 102, fill in the cost summary section of the cost sheet, and then mark the cost sheet “Finished.†Prepare a journal entry to record the job’s completion and its transfer to Finished Goods.

f. Delivered Job 102 and accepted the customer’s promise to pay $400,000 within 30 days.Instructions: Prepare journal entries to record the sale of Job 102 and the cost of goods sold.

g. Applied overhead to Job 103 based on the job’s direct labor to date.

Instructions: Enter overhead on the job cost sheet but do not make a journal entry at this time.h. Recorded the total direct and indirect materials costs as reported on all the requisitions for the month.

Instructions: Prepare a journal entry to record these costs.

i. Recorded the total direct and indirect labor costs as reported on all time tickets for the month.

Instructions: Prepare a journal entry to record these costs.

j. Recorded the total overhead costs applied to jobs.

Instructions: Prepare a journal entry to record the allocation of these overhead costs.k. Compute the balance in the Factory Overhead account as of the end of May.

Transcribed Image Text:

EXHIBIT 2.2 Accounting System: Exhibit 2-2 File Edit Maintain Road Warriors, Los Angeles, California Tasks Analysis Options Reports Window Help Job Cost Sheet JOB COST SHEET Customer's Name Carroll Connor Job No. В15 1542 High Point Dr. Malibu, California Address City & State Job Description Level 1 Alam Systom on Ford Expedition Date promised | March 15 March 3 Date completed March 11 Date started Direct Materials Direct Labor Overhead Requisition Time Ticke Date Cost Date Cost Date Rate Cost 3/3/2013 R-4698 100.00 3/3/201: L-3393 120.00 3/11/2013 160% of 1,600.00 3/7/2013 R4705 225.00 3/4/2013 L-3422 150.00 Direct Labor 3/9/2013 R4725 180.00 3/5/2013 L-3456 180.00 Cost 3/10/2013 R-4777 95.00 3/8/2013 L-3479 60.00 3/9/2013 L-3501 90.00 3/10/2013 L-3535 240.00 3/11/2013 L-3559 160.00 Total 600.00 Total 1,000.00 Total 1,600.00 REMARKS: Completed job on March 11, and shipped to customer on March 15. Met all specifications and requirements. SUMMARY: Materials 600.00 Labor 1,000.00 Overhead 1,600.00 Signed: C. Luther, Supervisor Total cost 3,200.00 EXHIBIT 2.4 MATERIALS LEDGER CARD OAD WO Road Warriors Materials Ledger Card Los Angeles, California Item Alarm system wiring Maximum quantity 5 units Stock No. Minimum quantity 1 unit Quantity to reorder M-347 Location in Storeroom Bin 137 2 units Received Issued Balance Receiving Report Requi- Unit Total sition Unit Total Unit Total Number Units Price Price Number Units Price Price Units Price Price 225.00 225.00 225.00 675.00 225.00 450.00 Date 1 3/4/2013 C-7117 2 225.00 450.00 3 3/7/2013 R-4705 1 225.00 225.00 2

> 1. If management wants the most accurate product cost, which of the following costing methods should be used? a. Volume-based costing using departmental overhead rates b. Volume-based costing using a plantwide overhead rate c. Normal costing using a plan

> Manufacturers and merchandisers can apply just-in-time (JIT) to their inventory management. Both Polaris and Arctic Cat want to know the impact of a JIT inventory system for their operating cash flows. Review each company’s statement of cash flows in App

> Refer to the information in QS 4-7. Compute the activity rate for each activity, assuming the company uses activity-based costing. Information from 4-7: Xie Company identified the following activities, costs, and activity drivers. The company manufactur

> Ciolino Co.’s March 31 inventory of raw materials is $80,000. Raw materials purchases in April are $500,000, and factory payroll cost in April is $363,000. Overhead costs incurred in April are: indirect materials, $50,000; indirect labo

> Refer to the information in QS 4-5. What are the company’s departmental overhead rates if the assembly department assigns overhead based on direct labor hours and the finishing department assigns overhead based on machine hours? Inform

> Can services be delivered by means of process operations? Support your answer with an example.

> What are the two main inventory methods used in process costing? What are the differences between these methods?

> Many contractors work on custom jobs that require a job order costing system. Required Access the Website AMSI.com and click on Construction Management Software, and then on star builder. Prepare a one-page memorandum for the CEO of a construction compa

> Refer to the information in Exercise 3-15. Prepare a process cost summary using the FIFO method. (Round cost per equivalent unit calculations to two decimal places.) Information from Exercise 3-15: The following partially completed process cost summary

> The following partially completed process cost summary describes the July production activities of AshadCompany. Its production output is sent to its warehouse for shipping. All direct materials are added to products when processing begins. Beginning goo

> Consider the following data for two products of Gitano Manufacturing. Required1. Using direct labor hours as the basis for assigning overhead costs, determine the total production cost per unit for each product line.2. If the market price for Product A

> The following flowchart shows the August production activity of the Spalding Company. Use the amounts shown on the flowchart to compute the missing four numbers identified by blanks. Production Beginning goods in process $17,250 Factory overhead $51,

> Refer to the information in Exercise 3-12 and complete it for each of the three separate assumptions using the FIFO method for process costing. Information from Exercise 3-12: The production department in a process manufacturing system completed 80,000

> Why is it possible for direct labor in process operations to include the labor of employees who do not work directly on products or services?

> The production department in a process manufacturing system completed 80,000 units of product and transferred them to finished goods during a recent period. Of these units, 24,000 were in process at the beginning of the period. The other 56,000 units wer

> Describe how use of absorption costing in determining income can lead to over-production and a buildup of inventory. Explain how variable costing can avoid this same problem.

> Refer to the information in Exercise 3-9 and complete its parts (1) and (2) using the FIFO method. (Round cost per equivalent unit to two decimal places.) Information from Exercise 3-9: The production department described in Exercise 3-8 had $850,000 of

> Refer to the information in Exercise 3-8 to compute the number of equivalent units with respect to both materials used and labor used in the production department for April using the FIFO method. Information from Exercise 3-8: During April, the productio

> Kenzi Kayaking, a manufacturer of kayaks, began operations this year. During this first year, the company produced 1,050 kayaks and sold 800 at a price of $1,050 each. At the current year-end, the company reported the following income statement informati

> Blazer Chemical produces and sells an ice-melting granular used on roadways and sidewalks in winter. It annually produces and sells about 100 tons of its granular. In its nine-year history, the company has never reported a net loss. However, because of t

> Mortech had net income of $250,000 based on variable costing. Beginning and ending inventories were 50,000 units and 48,000 units, respectively. Assume the fixed overhead per unit was $0.75 for both the beginning and ending inventory. What is net income

> Describe the usefulness of variable costing for controlling company costs.

> Vijay Company reports the following information regarding its production costs. Compute its production cost per unit under absorption costing. Direct materials . . . . . . . . . . . . . . . . . . . $10 per unit Direct labor. . . . . . . . . . . . . . .

> Assume that you are preparing for a second interview with a manufacturing company. The company is impressed with your credentials but has indicated that it has several qualified applicants. You anticipate that in this second interview, you must show what

> Under absorption costing a company had the following per unit costs when 10,000 units were produced. Direct labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2 Direct material . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Var

> The production department described in Exercise 3-8 had $850,000 of direct materials and $650,000 of direct labor cost charged to it during April. Also, its beginning inventory included $118,840 of direct materials cost and $47,890 of direct labor. Info

> Piaggio, Polaris, and Arctic Cat are competitors in the global marketplace. Selected data forPiaggio follow. Required1. Review the discussion of the importance of the cost of goods sold divided by total expenses ratio in BTN 3-2. Compute the cost of go

> During April, the production department of a process manufacturing system completed a number of units of a product and transferred them to finished goods. Of these transferred units, 60,000 were in process in the production department at the beginning of

> Tavella Co.’s August 31 inventory of raw materials is $150,000. Raw materials purchases in September are $400,000, and factory payroll cost in September is $232,000. Overhead costs incurred in September are: indirect materials, $30,000;

> When output volume increases, do variable costs per unit increase, decrease, or stay the same within the relevant range of activity? Explain.

> What is a variable cost? Identify two variable costs.

> The following journal entries are recorded in Kiesha Co.’s process cost accounting system. Kieshaproduces apparel and accessories. Overhead is applied to production based on direct labor cost for the period. Prepare a brief explanation

> Refer to Exercise 5-10. (1) Prepare a contribution margin income statement for Blanchard Company showing sales, variable costs, and fixed costs at the break-even point. (2) If the company’s fixed costs increase by $135,000, what amount of sales (in dolla

> Rey Company’s single product sells at a price of $216 per unit. Cost data for its single product follows. Compute this company’s break-even volume in units. Direct materials . . . . . . . . . . . . . . . . . . . . . . . . $20 per unit Direct labor . . .

> Polarix is a retailer of ATVs (all-terrain vehicles) and accessories. An income statement for its Consumer ATV Department for the current year follows. ATVs sell, on average, for $3,800. Variable selling expenses are $270 each. The remaining selling expe

> MidCoast Airlines provides charter airplane services. In October this year, the company was operating at 60% of its capacity when it received a bid from the local community college. The college was organizing a Washington, D.C., trip for its internationa

> Way Cool produces two different models of air conditioners. The company produces the mechanical systems in their components department. The mechanical systems are combined with the housing assembly in its finishing department. The activities, costs, and

> Oak Mart, a producer of solid oak tables, reports the following data from its current year operations, which is its second year of business. Sales price per unit . . . . . . . . . . . . . . . . . . . . . . $320 per unit Units produced this year . . . .

> Hayek Furnaces prepares the income statement under variable costing for its managerial reports, and it prepares the income statement under absorption costing for external reporting. For its first month of operations, 375 furnaces were produced and 225 we

> Explain in simple terms the notion of equivalent units of production (EUP). Why is it necessary to use EUP in process costing?

> Swisher Company’s computer system generated the following trial balance on December 31, 2013. The company’s manager knows that the trial balance is wrong because it does not show any balance for Goods in Process Invent

> Tee-Pro has three types of costs: t-shirt cost, factory rent cost, and utilities cost. This company sells its shirts for $16.50 each. Management has prepared the following estimated cost information for next month under two different sales levels. Requ

> Jacquie Inc. reports the following annual cost data for its single product. Normal production and sales level . . . . . . . . . 60,000 units Sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . $56.00 per unit Direct materials . . . . . .

> When units produced exceed units sold for a reporting period, would income under variable costing be greater than, equal to, or less than income under absorption costing? Explain.

> Li Company produces a product that sells for $84 per unit. A customer contacts Li and offers to purchase 2,000 units of its product at a price of $68 per unit. Variable production costs with this order would be $30 per unit, and variable selling expenses

> Cool Sky Company reports the following costing data on its product for its first year of operations. During this first year, the company produced 44,000 units and sold 36,000 units at a price of $140 per unit. Production costs Direct materials per unit

> Ming Company had net income of $772,200 based on variable costing. Beginning and ending inventories were 7,800 units and 5,200 units, respectively. Assume the fixed overhead per unit was $3.00 for both the beginning and ending inventory. What is net inco

> Refer to the information for D’Souza Company in QS 6-2. Compute the contribution margin.

> Blanchard Company manufactures a single product that sells for $180 per unit and whose total variable costs are $135 per unit. The company’s annual fixed costs are $562,500. (1) Use this information to compute the company’s (a) contribution margin, (b) c

> Refer to the information about Ramort Company in QS 6-8. Would the answer to the question in QS 6-8 change if the company uses variable costing? Explain. Information from QS 6-8: Ramort Company reports the following cost data for its single product. The

> Polaris’s financial statements and notes in Appendix A provide evidence of growth potential in its sales. Required 1. Identify at least two types of costs that will predictably increase as a percent of sales with growth in sales. 2. Explain why you beli

> A jeans maker is designing a new line of jeans called the Slims. The jeans will sell for $205 per pair and cost $164 per pair in variable costs to make. (1) Compute the contribution margin per pair. (2) Compute the contribution margin ratio. (3) Describe

> Sims Company, a manufacturer of in-home decorative fountains, began operations on September 1 of the current year. Its cost and sales information for this year follows. Production costs Direct materials . . . . . . . . . . . . . . . . . . . . . . . $40

> Felix & Co. reports the following information about its sales and cost of sales. Draw an estimated line of cost behavior using a scatter diagram, and compute fixed costs and variable costs per unit sold. Then use the high-low method to estimate the f

> Company A is a manufacturer with current sales of $6,000,000 and a 60% contribution margin. Its fixed costs equal $2,600,000. Company B is a consulting firm with current service revenues of $4,500,000 and a 25% contribution margin. Its fixed costs equal

> Should Polaris use single product or multiproduct break-even analysis? Explain.

> _______ of _______ reflects expected sales in excess of the level of break-even sales.

> KTM has both fixed and variable costs. Why are fixed costs depicted as a horizontal line on a CVP chart?

> Why are multiple departmental overhead rates more accurate for product costing than a single plantwide overhead rate?

> Assume that a straight line on a CVP chart intersects the vertical axis at the level of fixed costs and has a positive slope that rises with each additional unit of volume by the amount of the variable costs per unit. What does this line represent?

> Ramort Company reports the following cost data for its single product. The company regularly sells 20,000 units of its product at a price of $60 per unit. If Ramort doubles its production to 40,000 units while sales remain at the current 20,000 unit leve

> In cost-volume-profit analysis, what is the estimated profit at the break-even point?

> How is a scatter diagram used to identify and measure the behavior of a company’s costs?

> List three methods to measure cost behavior.

> Trio Company reports the following information for the current year, which is its first year of operations. Direct materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $15 per unit Direct labor . . . . . . . . . . . . . . . . . . . . . .

> In December 2012, Yerbury Company’s manager estimated next year’s total direct labor cost assuming 50 persons working an average of 2,000 hours each at an average wage rate of $25 per hour. The manager also estimated the following manufacturing overhead

> In performing CVP analysis for a manufacturing company, what simplifying assumption is usually made about the volume of production and the volume of sales?

> Define and describe contribution margin per unit.

> Define and explain the contribution margin ratio.

> How is cost-volume-profit analysis useful?

> When output volume increases, do fixed costs per unit increase, decrease, or stay the same within the relevant range of activity? Explain.

> Refer to information in QS 6-6. Prepare an income statement under absorption costing. Information from 6-6: Aces Inc., a manufacturer of tennis rackets, began operations this year. The company produced 6,000 rackets and sold 4,900. Each racket was sold

> Empire Plaza Hotel is a luxury hotel with 400 rooms. Its regular room rate is $300 per night per room. The hotel’s cost is $165 per night per room and consists of the following. Variable direct labor and materials cost . . . . . . . . . . . . . . . . .

> Rafner Manufacturing identified the following data in its two production departments. Required1. What is the company’s single plantwide overhead rate based on direct labor hours? 2. What is the company’s single plant

> What are three common methods of assigning overhead costs to a product?

> Explain how contribution margin analysis is useful for managerial decisions and performance evaluations.

> Identify each of the following activities as unit level (U), batch level (B), product level (P), or facility level (F) to indicate the way each is incurred with respect to production. 1. Paying real estate taxes on the factory building. 2. Attaching labe

> List the three main advantages of the plantwide and departmental overhead rate methods.

> In the blank next to each of the following terms, place the letter A through D that corresponds to the description of that term. Some letters are used more than once. 1. Activity-based costing 2. Plantwide overhead rate metho 3. Departmental overhead rat

> In the blank next to the following terms, place the letter A through D corresponding to the best description of that term. 1. Activity 2. Activity driver 3. Cost object 4. Cost pool A. Measurement associated with an activity. B. A group of costs that hav

> The following is taken from Ronda Co.’s internal records of its factory with two operating departments. The cost driver for indirect labor and supplies is direct labor costs, and the cost driver for the remaining overhead items is numbe

> Refer to the data in QS 4-7. Assume that the following information is available for the company’s two products. RequiredAssign overhead costs to each product model using activity-based costing (ABC). What is the overhead cost per unit

> Xie Company identified the following activities, costs, and activity drivers. The company manufactures two types of go-karts: Deluxe and Basic. Production volume is 10,000 units of the Deluxe model and 30,000 units of the Basic model. Required1. Comput

> A company has two products: standard and deluxe. The company expects to produce 36,375 standard units and 62,240 deluxe units. It uses activity-based costing and has prepared the following analysis showing budgeted cost and cost driver activity for each

> In December 2012, Pavelka Company’s manager estimated next year’s total direct labor cost assuming 50 persons working an average of 2,000 hours each at an average wage rate of $15 per hour. The manager also estimated the following manufacturing overhead

> Tent Pro produces two lines of tents sold to outdoor enthusiasts. The tents are cut to specifications in department A. In department B the tents are sewn and folded. The activities, costs, and drivers associated with these two manufacturing processes and

> What are the major limitations of variable costing?

> Why are overhead costs allocated to products and not traced to products as direct materials and direct labor are?

> Mathwerks produces two electronic, handheld educational games: Fun with Fractions and Count Calculus. Data on these products follow. Additional data from its two production departments follow. Required1. Using ABC, determine the cost of each product l

> Ryan Foods produces gourmet gift baskets that it distributes online as well as from its small retail store. The following details about overhead costs are taken from its records. Additional information on the drivers for its production activities follo

> Midwest Paper produces cardboard boxes. The boxes require designing, cutting, and printing. (The boxes are shipped flat and customers fold them as necessary.) Midwest has a reputation for providing highquality products and excellent service to customers,

> Wade Company makes two distinct products with the following information available for each. The company’s direct labor rate is $20 per direct labor hour (DLH). Additional information follows. Required 1. Compute the manufacturing co

> The following data are for the two products produced by Tadros Company. The company’s direct labor rate is $20 per direct labor hour (DLH). Additional information follows. Required1. Compute the manufacturing cost per unit using the

> Sara’s Salsa Company produces its condiments in two types: Extra Fine for restaurant customers and Family Style for home use. Salsa is prepared in department 1 and packaged in department 2. The activities, overhead costs, and drivers as

> Bright Day Company produces two beverages, Hi-Voltage and EasySlim. Data about these products follow. Additional data from its two production departments follow. Required1. Determine the cost of each product line using ABC.2. What is the cost per bottl

> Craft Pro Machining produces machine tools for the construction industry. The following details about overhead costs were taken from its company records. Additional information on the drivers for its production activities follows. Grinding . . . . . .

> Xylon Company manufactures custom-made furniture for its local market and produces a line of home furnishings sold in retail stores across the country. The company uses traditional volume-based methods of assigning direct materials and direct labor to it

> Smythe Crystal makes fine tableware in its Ireland factory. The following data are taken from its production plans for the year. Direct labor costs . . . . . . . . . €5,870,000 Setup costs. . . . . . . . . . . . . . . 630,000 Required

> Prescott Company’s predetermined overhead rate is 200% of direct labor. Information on the company’s production activities during September 2013 follows. a. Purchased raw materials on credit, $125,000. b. Paid $84,000 cash for factory wages. c. Paid $11,

> Polaris must assign overhead costs to its products. Activity-based costing is generally considered more accurate than other methods of assigning overhead. If this is so, why do all manufacturing companies not use it?