Question: Reliable Construction Inc. (RCI) is a public

Reliable Construction Inc. (RCI) is a public company that sells construction equipment to builders of primarily homes, office buildings, and highways. RCI has been in operation for over 30 years. Up until this year, the company has had profits with the real estate boom and large amounts of government funding for highway construction.

During the COVID-19 pandemic, things changed drastically and RCI has had to request increased financing from its bank. As a result, the bank has imposed a minimum current ratio and a minimum balance that must be maintained in one of its accounts.

It is now 5 March 20X1 and RCI is planning its first-quarter-end report of 20X1. Recently you were hired as an accounting policy analyst to assist RCI with its accounting policies. You have just finished a virtual meeting with Natalie, the majority shareholder and CEO, and Mario, the CFO. The following are comments and questions from the meeting.

Mario spoke first:

“The effects of COVID-19 have hit us hard. We have had profits for a number of years and never worried about having enough cash on hand. Cash is critical in our business where the manufacturing of this specialized equipment can take a long period of time. In addition, our customers are really struggling to be able to invest in new machinery and pay their bills.

“I am excited that you are able to join us and help out with a number of new situations that have arisen during the COVID-19 pandemic and possible solutions I have to solve our current cash crisis. Our bank has been very supportive but they are a little nervous about the repercussions of the economic downturn. I am not sure what, if anything, I need to do in the financial statements and notes about their recent covenant and restrictions. In addition, we have a number of bank accounts with our bank. Our line of credit has been in an overdraft position for over a year now. But we also have positive balances in our other accounts. All of these accounts are currently in cash and cash equivalents on our balance sheet. Is that okay?

“Some of our purchases for our manufacturing purchases are from the U.S. and we are required to pay in U.S. dollars. This has never been an issue for us before since the Canadian and U.S. dollar have been at par. The Canadian dollar has been dropping in value and is currently at an all-time low and may continue to drop. What is the appropriate accounting for this drop in value and what impact will this have on our financial statements?

“Some long-time customers who have been buying from us are having difficulty paying and are currently overdue. I know they are also struggling because of the COVID-19 pandemic. I believe they will pay eventually and I want to help them out. What Mario has done to make their life a little easier is to change their accounts receivable to a note. This note allows them a two-year period to pay with an interest rate of 4% even though the current market rate is 8%. Mario has just taken the $500,000 of accounts receivable and reclassified them as a note receivable since we are sure they will pay. Is this okay?

“To get some extra cash we were considering selling some of my high-quality receivables to a financial institution. RCI has $5,000,000 in these receivables. The financial institution will provide RCI with $4,800,000 in cash if we agree to make any payments that default. What would be the impact of this on RCI’s financial statements?

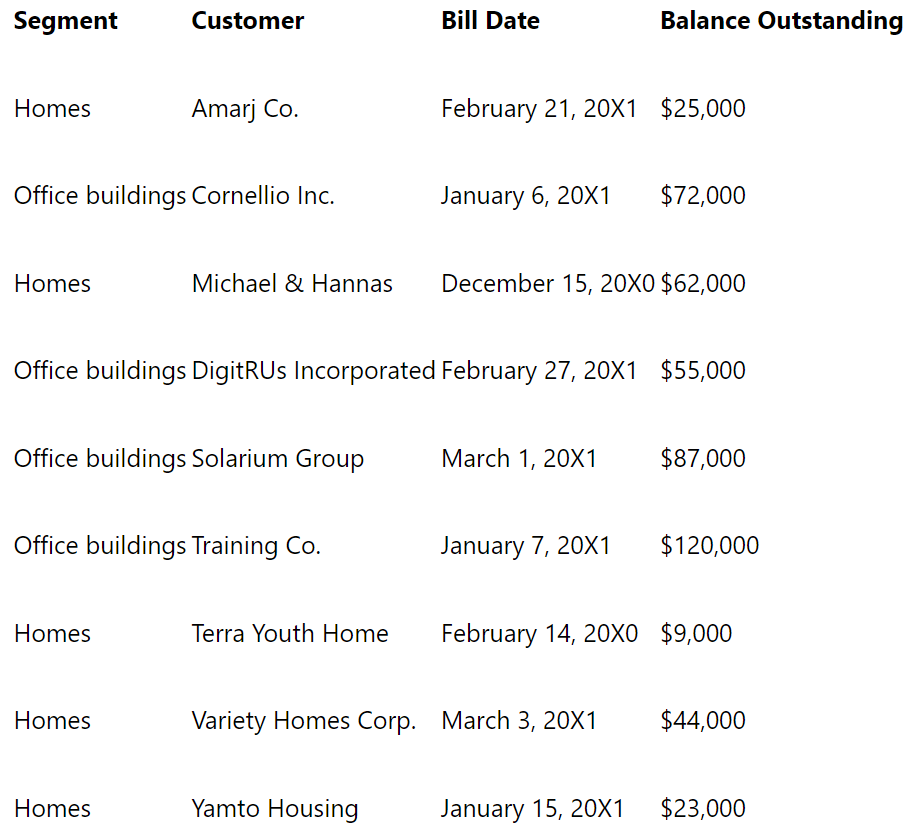

“RCI requires payment within 60 days of the invoice date. Terms are generous. Here are the details of the accounts receivable balance at March 5, 20X1 unrelated to the items we already told you about.â€

The following information was then presented on the virtual meeting shared screen:

Natalie continued:

“RCI normally allows for outstanding receivables greater than 60 days and less than 90 days at 5%, over 90 days and less than 100 days at 10%, greater than 100 and less than 130 days at 25% and over 130 days at 50%. The allowance for doubtful accounts currently has a balance of $8,900 and the items below have not been adjusted for. Can you consider each of these and figure out what we should do?

“Item A. Michael & Hannas has been complaining about the equipment received since the third quarter of fiscal 20X0. The owner has threatened us on multiple occasions about going to the media to report the terrible quality of equipment that RCI sells. We are afraid to follow up on outstanding payment given the situation. We have put this customer “on hold†and will not make any further sales to them right now.

“Item B. Training Co. faced a massive flood in late January 20X1 and due to an insurance policy lapse is now facing extreme financial difficulty. We have a close relationship with the CEO of Training Co. I believe there is a 50% chance that only half the outstanding balance can be collected by RCI. Mario thinks that a quarter of the outstanding balance will be collected at most.

“Item C. Yamto Housing contacted RCI in late February to report that its government funding for 20X1 has not yet come in and therefore it cannot pay its bill. Due to a glitch in the government funding portal, Yamto Housing may not be allocated any funds for 20X1.â€

Natalie then said:

“Mario, I think we should also talk about those cryptocurrencies. Remember how we recorded them as intangible assets when we acquired them a few years ago? Why don’t we reclassify them as cash? That will help boost our cash balance and the current ratio.

“We are running out of time and I just have one last thing on my agenda so let’s get to it. Mario was telling me that we can make great use of data analytics to manage our receivables. Given all the drama that has unfolded with the pandemic, do you see any merit in this? Just thought I would ask your opinion; I know it doesn’t quite fall under policy analysis.

“OK. I have to get to another meeting now. Wow. I have such screen fatigue from all these virtual meetings. Can you draft a report addressing my concerns? I’ll review the full written report but we can talk about it at a meeting. I’ll send you a calendar invitation for another meeting next week.â€

Required:

Prepare the requested report for Natalie

> Consider the following two independent errors that were discovered in 20X1 after the 20X0 financial statements were issued. Scenario A Inventory of $123,000 was missed in an inventory count. Scenario B Inventory of $250,000 was counted twice. Required: 1

> Redux Ltd. estimates its quarterly inventory by the retail inventory method. The following data are available for the quarter ended 30 September 20X6: Required: Prepare a schedule to compute the estimated inventory at 30 September 20X6.

> Pepper Ltd. delivers 500 units of product to Salt Corp. The sales price was $125 per unit, and Pepper’s cost was $75 per unit. Pepper has agreed that Salt may return any unused product within 60 days and receive a full refund. Based on historical experie

> 1. When initially recognized, accounts receivables are required to have a valuation allowance based on expected credit losses for their lifetime. 2. For a new company with no history of uncollectible accounts, receivables can be written off when they are

> Using the information from TR7-7 now assume the company is a private company and it has elected to use straight-line amortization. Required: 1. Calculate the present value of the note receivable. 2. Prepare entries for the sale, interest revenue, and cas

> Dharma, a public company, sold a piece of equipment at the beginning of year 1, receiving a $10,000, two-year 2% note. Interest is paid at the end of each year. Market interest rates are assumed to be 10%. Required: 1. Calculate the present value of the

> Indicate whether each of the following statements is true or false: 1. The continuity assumption states that a business entity will last long enough for its assets to be used up and its liabilities settled. 2. The entity basis of reporting is the same as

> Use information from TR7-5. Required: Record all journal entries for the sequence of events assuming the transfer is recorded as a borrowing. Data from TR7-5: Hum Corp. has accounts receivable of $460,000. The company transfers these accounts receivable

> Hum Corp. has accounts receivable of $460,000. The company transfers these accounts receivable to a financial institution. There are no bad debts associated with these accounts receivable. Proceeds of $444,500 are received from the transfer. The transfer

> The unadjusted net accounts receivable on the books of Elantra Ltd. as of 31 December 20X4 are as follows: Accounts receivable $100,000 Less: Allowance for doubtful accounts 10,000 $ 90,000 40% of the accounts are current and 5% might not be collected,

> The accounts of Quickly Company provided the following 20X4 information at 31 December: Accounts receivable balance $600,000 (dr.) Allowance for sales discounts 5,500 (cr.) Allowance for doubtful accounts 40,000 (cr.) In fact, the allowance for sales dis

> 1. Loans and receivables are classified according to their business model. 2. All notes receivables are measured at amortized cost. 3. Overdrafts can be netted against a positive balance in a bank account with any bank. 4. Gains and losses from translati

> Arrow Co. entered into a contract with a customer for $410,000. The contract is for the delivery of equipment and a three-year service maintenance contract for the equipment. Arrow sells separately the equipment for a selling price of $400,000, and the m

> SorCo. Inc. has just entered into a sale agreement with a customer. The contract is for $1,100,000. However, the payments will be made as follows: 1 August 20X1 on date of delivery $500,000; 1 August 20X2 $300,000 and 1 August 20X3 $300,000. SorCo has es

> Rock Gasoline decided to implement a customer loyalty point program. For each litre of fuel sold, the customer earns one point. The points can be accumulated and redeemed later for gas, products in the store, or a car wash. In May, Rock had sales of $60,

> CCS is a construction company that builds roads in the Northwest Territories (NWT). CCS uses the percentage-of-completion method and measures completion on the basis of kilometres completed. In November 20X9, CCS signed an agreement with the NWT governme

> Spreadsheets Made Easy (SME) is a public company that designs and sells spreadsheet software. Corporate customers purchase licences for the number of users in their company who can access the software from their network at any time. The perpetual licence

> Indicate whether each statement is required in IFRS or in ASPE, or in both.

> ELC Inc. sells all types of electronics with a one-year warranty for product assurance on all products sold. On 26 February, a customer came into the store and purchased a television for $1,250. The company estimates, from past experience, that warranty

> Under contract, Sojourn Co. delivers 1,000 units to Customer A for $50 each on 1 April. Sojourn’s documented policy is to allow a customer to return any unused product within 90 days and receive a full refund. The cost of each product is $35. On the basi

> Dress for Success is an upscale dress shop. On 15 August, Sally, a regular customer, came in and put a deposit down on two items: $50 on a dress and $100 on a suit. The deposit was in the amount of $150, which represented 20% of the total retail value of

> Floral Design Co. is a chain of florists located in the Greater Halifax area. Floral Design sells made-to-order bouquets, in-store floral arrangements, and provides design services for events such as weddings and corporate events. They also provide arran

> - The entity assesses the risk, timing, or amount of the entity’s future cash flows expected to change as a result of the contract. - A separate performance obligation is identified for each distinct good or service. - The entity allocates the transact

> Green Equipment Inc. (Green) sells heavy-duty tractors. The 250GT tractor has a stand-alone price of $220,000. Green offers to sell the 250GT inclusive of a five-year service contract intended to cover all repairs and maintenance on the tractor for $235,

> Abateer company provides interior design services for residential and commercial customers. Assume Abateer entered into the following contracts during the year: 1. A contract with a family renovating their home. The contract specifies that Abateer will p

> Paper Supply Ltd. has contracted with a local copy and print centre to provide packages of plain printer paper, as needed, each month. Each package costs $15 and contains 500 sheets of paper. If the copy and print centre purchases over 1,500 packages in

> James Ehnes has recently completed his second year of accounting studies. He has just been hired as a summer intern at the auditing firm of Hetu & Fauré. He feels fortunate to have landed an internship in such a prestigious firm. His supervisor, Venus Ya

> You have been asked to participate in a panel discussion at an accounting conference along with respected academics from around the world. The panel centres on discussion of the IASB’s Conceptual Framework for Financial Reporting. You have been provided

> Sander Persaud is an audit manager for a national public accounting firm. Every summer, the firm recruits several university students as interns. One such intern is Taylor Jay, a high-performing student who has just finished their third year of universit

> Andriana Bessemer, a sole practitioner in a rural area, is working on a client file when one of her most important clients, Richard Wright, walks in. Richard operates one of the largest dairy farms in the region. “Sorry to barge in like this, but I’ve ju

> Dabika Mulla and Elicia Yang have owned and operated a small gardening centre and landscaping business for the past 10 years. Their business is incorporated as a private corporation. Since there is no market price for their shares, their shareholder agre

> Northern Energy Ltd. (NEL) is a large Canadian private company organized in three operating segments: propane operations, trucking, and mineral explorations. Financial statements have not been audited, and NEL has simply used the cost method for its inve

> Nitrale Corporation (NC) is a Canadian company owned by 3 independent investors: Blakey Straun, Humza Ali, and Xavier Kingston. In October 20X4, NC was formed. The company manufactures the chips that go into radio frequency identification (RFID) tags, wh

> In May 20X1, a group of outdoor enthusiasts formed Wild Ones Ltd. (Wild Ones). Wild Ones operates in central Newfoundland and is involved in a variety of outdoor adventure activities. Start-up capital was provided from an inheritance that one of the owne

> Quinter Corp. (QC) was formed in April 20X5 and funded by five shareholders that are public companies. As such, the shareholders are requiring that QC adopt IFRS even though it is a private company. QC was formed to hold a variety of investments. Quinter

> In February, Huron Ltd. incurred costs to obtain a contract with a customer. The contract is for two years. The following costs were incurred: Travel costs to meet with the customer $10,000 Legal costs to write up the agreement $5,000 Cost of meals $7,00

> You have just been hired as an accounting advisor by Road Safety Inc. (RSI), a company that manufactures road safety equipment (e.g., crash barriers, traffic lights, and electronic information signs). RSI was founded in 20X4 and has grown rapidly over th

> You were recently approached by one of your clients, Wendy Wonders, the chief financial officer of Rock Group Ltd. (RGL), a Canadian public company with a 31 December year-end. RGL manufactures and sells power precision hand tools and accessories, such a

> Bright Lights Ltd. (Bright) is a private company incorporated five years ago by a group of friends who had recently graduated with business or engineering degrees. The group is interested in innovative designs to meet a variety of lighting needs and has

> Juno Corporation (JC) is a Canadian online streaming service that provides access to a wide variety of movies and TV shows. The company has been in operation for the past five years and currently has a subscriber base of five million customers. JC curren

> Winery Inc. (WI) is a private corporation formed in 20X8. Prior to 20X8, WI had been operating as a partnership by the Verity family. Due to their success and desire to expand, they have made the decision to incorporate so that they will have additional

> Glowworm Inc. “I cannot believe you have advised against an employee bonus this year,” exclaimed Jessica Simpson, senior accountant of Glowworm Inc. (GI), as she stormed into the office of the GI chief financial officer on Monday morning. GI is a large,

> Titles Inc. (TI) is a major publisher of books for postsecondary education. TI is a Canadian public corporation. One of TI’s major shareholders is Global Holdings PLC (GHC), a London-based media company. In early 20X4, TI’s executives were preparing a bi

> CBD Inc. (CBD) grows and manufacturers Cannabis sativa plant species and then curates their product into CBD oil. The company was incorporated in 20X6, and operates out of Prince Edward Country, Ontario. CBD Inc. primarily sells its products via online c

> Love Your Pet, Inc. (LPI) is a pet food company located in rural Quebec. LPI has been operating for years as a distributor of pet food but in the last year has begun to manufacture raw dog food. In the current year, LPI has been certified by the Canadian

> Mitrium Corp. is a large privately held company that manufactures frozen ice cream products, which are sold to large and small retailers across North America. The shares of this company are held by 12 individuals, some of them related and some of them no

> Crane Inc. is an agent for Phillips Co. and negotiates sales contracts between Phillips and the final customer for heating and air conditioning units. By agreement, Crane is to receive a commission of 15% on each sale. During the last quarter, Crane nego

> Match the user with the most likely objective. User 1. Bank 2.Small private company 3. Not-for-profit organization 4. Management 5. Shareholders with agreement objective 1. Stewardship 2. Income tax deferral 3. Cash flow prediction 4. Contract Compliance

> The Melville Credit Union has operated in small-town, rural Nova Scotia for the last 27 years. In the summer of 20X4, after decades of operation as a prosperous paper mill, the Lancaster Mersey Mill was abruptly shut down. Lancaster had been a major empl

> Thomas Technologies Corp. (TTC) is an engineering services company based in Calgary. The company’s Class B common shares are listed on the Toronto Stock Exchange. The Class A common shares are all owned by Theodore Thomas, the company founder, and his im

> Lake Country Ltd. (LCL) is a Canadian manufacturer of outdoor furniture products. LCL manufactures high-quality, durable, and attractive furniture such as outdoor seating, tables, and accessories. LCL sells its products directly to retailers, who in turn

> Pocket Entertainment Group Ltd. (PEG) is an interactive entertainment company that develops mobile apps. Sharleen Williams and her family members own the majority of the 4,000 shares, and have financed all growth through shareholder loans, equity investm

> Solar Power Inc. (SPI) is a public company manufacturing and distributing solar panels. It has been in existence for the past ten years, of which the last three have been as a public company. To date SPI has experienced good growth rates, slightly higher

> Rosy Ltd. (Rosy) is a consumer products company that designs, manufactures, markets, and distributes a diverse portfolio of products, primarily in the recreational and leisure segments. The products enjoy strong positive brand recognition and include suc

> “Frankly, if we continue to grow, we will be out of business soon.” This was the glum assessment of Kathy Lin, President and CEO of Purple Ltd. (Purple), a company that designs, manufactures, and retails womenâ&#

> The owner of Bettany Inc., Mario Sloan, has come to you, a public accountant, for advice. “I am very worried about my business right now. The bank loan is at its maximum level, we have no cash, and my salary is backing up, unpaid. I don

> The management of WPB Ltd. has spent the past year reorganizing the company’s business activities. WPB is a service provider to hospitals. Originally the company operated only in Canada, where hospital care is provided at government expense through publi

> Information related to various financial statement items is provided for two cases: Case A Operating expenses were $500,000. Inventory increased by $72,000, accounts payable increased by $50,000, and prepaid rent decreased by $16,000. Case B Sales revenu

> Wonder Amusements Ltd. (WAL) was incorporated over 40 years ago as an amusement park and golf course. Over time, a nearby city has grown to the point where it borders on WAL’s properties. In recent years WAL’s owners,

> Colour My World Inc. (CMWI) has been operating as a private company for the past 25 years. It manufactures and sells paint. At first, the owners ran only a few retail stores in Northern Ontario, but the company has since expanded with stores across Canad

> T&E Investor Corporation (TEIC) is a holding company with wholly owned interests in the travel and entertainment industry. It is listed on the Toronto Stock Exchange and is subject to the reporting requirements of that exchange and of the Ontario Securit

> Singh Solutions Inc. (SSI) is an Ontario-based manufacturing business that specializes in the production of fire and soundproofing insulation. The company holds public-listed debt, and the family of its founder, Jasmeet Singh, retains control through spe

> International Corp. (IC) is a large Canadian company that has operations around the world that are very diverse. In the past few years they have acquired a number of different companies in a variety of businesses. They have decided this year that it is t

> Dubois Ltd. is a Vancouver-based private company established 30 years ago. Until very recently, all 16 of the shareholders have been relatives of the founder, Blanche Dubois. The company has been profitable in most years. In recent years, however, it has

> On 1 May 20X7, Bertrum Ltd. purchased $1,000,000 of Fox Corp. 6.2% bonds. The bonds pay semi-annual interest each 1 May and 1 November. The market interest rate was 6% on the date of purchase. The bonds mature on 1 November 20X11. Required: 1. Calculate

> On 1 January 20X5, Franco Ltd. purchased $400,000 of Gentron Company 5% bonds. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 6% on the date of purchase. The bonds mature on 31 December 20X10. The company ha

> On 1 July 20X2, New Company purchased $600,000 of Old Corp. 5.5% bonds, classified as an AC investment. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 5% on the date of purchase. The bonds mature on 30 June

> On 1 June 20X8, Ghana Company purchased $7,000,000 of Monaco Corp. 5.8% bonds, classified as a FVOCI-Bond investment. The bonds pay semi-annual interest each 30 May and 30 November. The market interest rate was 6% on the date of purchase. The bonds matur

> Selected accounts from the SFP of Norry Ltd. at 31 December 20X4 and 20X5 are presented below. Norry reported earnings of $280,000 in 20X5. There was a new $140,000 of note payable this year that was direct financing (a note issued by the vendor) for a p

> On 1 July 20X8, Sun Company purchased $4,000,000 of Moon Corp. 6.2% bonds, classified as an AC investment. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 6% on the date of purchase. The bonds mature on 30 Ju

> Poffer Investments (Poffer) is an investment company. The owners are avid investors that have pooled their money to earn income through their investments. They have a small, but wealthy client base that they manage funds for. All investments are purchase

> Timmins Ltd. owns a number of investments in bonds. Timmins has a 31 December year-end. Case A $3,000,000 bonds in Lakehead Corp. a publicly traded company. The bonds are currently classified as AC with an amortized cost of $3,250,000 as at December 31 a

> Yohan Inc. owns 14,000 shares in Placelid Corporation (represents 10%). Both companies are private entities. The shares were purchased in 20X1 for $20 per share, plus transaction fees of $6,250. In 20X6, Placelid experienced significant challenges with i

> Operators 1 and 2 are both copper mining companies. Operator 1 focuses on drilling and extraction; Operator 2 focuses on the grinding and concentration process (to extract the ore). The companies work together to drill, extract, and partially process the

> On 3 January 20X4, TA Company purchased 2,000 shares of the 10,000 outstanding shares of common stock of UK Corp. for $14,600 cash. TA has significant influence as a result of this acquisition. At that date, the statement of financial position of UK Corp

> On 2 January 20X5, Junction Ltd., a private company, purchased 90,000 of the 100,000 outstanding common shares of Wicket Corporation for $12 per share. The remaining 10,000 shares are owned by an investor. Transactions costs totalled $12,500. During 20X5

> On 1 January 20X8, Khalil Ltd. purchased $2,000,000 of six-year, Harvest Ltd. 5.4% bonds. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 6% on the date of purchase. Khalil is a private company that complies

> Return to the facts of A11-7. Assume now that New Company is a private company that complies with ASPE. Straight-line amortization will be used rather than the effective-interest method. Required: 1. Calculate the price paid by New Company. 2. Construct

> Return to the facts of A11-2. Assume now that the investor is a private company that complies with ASPE. Required: How should the investor classify each of the investments? What accounting method should be used for each? Data from A11-2: For each situat

> Selected accounts from the SFP of Penton Ltd. at 31 December 20X5 and 20X4 are presented below. Penton declared $100,000 of cash dividends during the year, and purchased $200,000 of machinery in direct exchange for common shares. Required: List the items

> Return to the facts of A11-1. Assume now that the investor is a private company that complies with ASPE. Required: How should the investor classify each of the investments? What accounting method should be used for each? Data from A11-1:; The following

> The following comparative data are available from the 20X4 statement of financial position of Trevor Holdings Ltd: In 20X4, the following transactions took place and are properly reflected in the accounts, above. 1. There were no purchases or sales of FV

> For each of the following transactions, identify the item(s) that would appear on the statement of cash flows. Assume that the indirect method of presentation is used in the operating activities section, and cash flow from investing revenue is classified

> Consider the following investment categories: 1. AC investment 2. FVOCI-Bond investment 3 FVTPL investment 4. FVOCI-Equity investment 5. Associate 6. Subsidiary 7. Joint venture An investor company that is a public company has the following items: 1. SRY

> On 31 December 20X6, TKB Company’s investments in equity securities were as follows: Required: 1. Explain what the carrying value for each investment represents. 2. What was the original cost of the FVOCI investment? 3. TKB reclassified

> In 20X1, Pepper Company bought 75% of S Company’s common shares, establishing control over the board of directors. Pepper Company used the cost method to account for its investment in S Co. during the year, but prepared consolidated fin

> Royals Imports is a public company. It reported the following at the end of 20X5: FVOCI investment, Huebner Co. 20,000 shares ($542,000 cost) $ 742,000 FVTPL investments Adams Co., 28,000 shares $1,816,000 - Sawicki Co., $150,000 par value, 8% bond, due

> Consider each of the following scenarios, and discuss how each arrangement should be classified. Scenario 1 A group of three investors, Companies A, B, and C, have entered into an agreement to purchase and manage a large outdoor retail mall. A new compa

> On 3 January 20X8 Raylink Inc., a publicly traded company, purchased 60,000 common shares of Tall Forest Ltd. for $27 per share. There are a total of 300,000 common shares issued and outstanding. Tall Forest has the following assets on the date the share

> On 1 January 20X6, Loffer Ltd. purchased 37% of Ming’s common shares for a price of $875,000. The remainder of the shares in Ming are closely held by family members of the founder of the company. Loffer considers this a strategic investment, acquired to

> Selected accounts from the SFP of Katten Ltd. at 31 December 20X8 and 20X7 are presented below. Katten reported earnings of $100,000 in 20X8. There was a stock dividend recorded, valued at $50,000 that reduced retained earnings and increased common share

> On 1 January 20X5, Zan Company purchased 5,000 of the 20,000 outstanding common shares of Woo Computer Corp. (WC) for $120,000 cash. Zan had significant influence as a result of the investment and will use the equity method to account for the investment.

> Premium Investments Ltd. bought the following bond investment: $4,000,000 bonds of Trans-BC Operations Ltd. The bonds were purchased 1 Feb 20X5. Interest at 6% is payable semi-annually on January 31 and July 31. The bonds mature in four years on 31 Janua

> Lauren Corp. purchased a $728,000 investment in the common shares of Reesh Corp. on 15 May 20X5. The investment is a FVTPL investment. Reesh is a private company and few shares are bought and sold. Lauren was speculating that the value of the Reesh commo

> Adar purchased on 1 October 20X3 a $70,000, 5%, ten-year bond that pays interest each 31 March and 30 September. The bond was purchased for $65,014, and is expected to yield 6%. It is trading at 94 at December 20X3 and Adar has determined that the credit

> For each situation below, indicate how the investment would be classified, and how it would be accounted for. The investor is a public company. 1. Common shares are bought in a public company whose shares are broadly held and widely traded. The company i

> Danigal purchased a $150,000, 6% coupon bond from Intregal Corp. on 1 January 20X2. Interest is paid semi-annually on 30 June and 31 December. The market interest rate was 4.5% at the time of purchase. The bond expires on 31 December 20X7. The bond is re

> 16 July 20X7: Sachet Inc. purchased the following 15,000 shares in Zynic Inc., a European corporation, for €32 per share. Management designated the shares as FVOCI. Total commissions and fees to purchase the shares: €1,300. - 31 December 20X7: Zynic shar

> On 22 May 20X5, Friedland Ltd. purchased 52,000 shares of Gerstan Ltd. for US$13.40 per share, plus US$2,000 in commissions and fees. The shares were purchased from a broker on account, with later cash payment. On 22 May 20X5, the exchange rate was US$1

> Cudmore Ltd. had two FVTPL investments at the end of 20X4, disclosed on the SFP as follows: Kelowna Ltd. 2,000 shares $ 88,700 Burnaby Corp. 7,200 shares 66,240 $154,940 By the end of 20X4, unrealized losses of $3,700 related to the Kelowna Ltd. shares a