Question: Wonder Amusements Ltd. (WAL) was incorporated over

Wonder Amusements Ltd. (WAL) was incorporated over 40 years ago as an amusement park and golf course. Over time, a nearby city has grown to the point where it borders on WAL’s properties. In recent years WAL’s owners, who are all members of one family, have seen WAL’s land values increase significantly. Majority shareholder Howard Smith owns 55% of the outstanding shares and is no longer active in WAL’s day-to-day activities.

Last year Howard hired a new chief executive officer, Leo Titan. Leo has a reputation as an aggressive risk taker. Howard is committed to supporting Leo’s plans and has the personal financial resources required to do so.

Eight months ago, WAL became the successful bidder for a new sports franchise, in conjunction with a minority partner. Under the terms of the franchise agreement, WAL is required to build a sports arena, which is currently being constructed. The arena is being built on a section of the amusement park. Another section of the amusement park is being relocated to ensure that the entrances to the arena are close to public transportation and parking. Consequently, some of the rides will be relocated. WAL is the sole owner of the arena at present.

The sports franchise is separately incorporated as Northern Sports Ltd. (NSL); WAL holds 75% of the shares in the company. Another bid is being prepared by NSL to obtain a second sports franchise so that the arena can be used more often. NSL will be required to lease space from WAL when the arena is completed, in about 22 months.

For the first two sports seasons, NSL will have to lease arena space from Aggressive Ltd. (AL). During this time, NSL does not expect to be profitable because:

- It may take time to build a competitive team;

- AL is charging a high rent and is not giving NSL a share of concession (e.g., hot dogs, drinks) revenue;

- AL cannot make the better dates (e.g., Saturday night) available to NSL to attract sports fans;

- As a newcomer to the league, NSL is restricted with regard to the players available to it and the days of the week it can play in its home city.

Consequently, NSL has arranged to borrow funds from WAL and from others to finance costs and losses.

Your employer, Fabio & Fox, Chartered Accountants, has conducted the audit of WAL for several years. WAL has tended to be marginally profitable one year and then have losses the next. The company has continued to operate because the directors knew that the real estate holdings were becoming increasingly valuable. For purposes of financial statements WAL uses Canadian ASPE.

Leo is expected to oversee the expanded accounting and finance functions in the company. He has met with you and the partner in charge of the WAL audit and has discussed various issues related to the year ending 30 September 20X7. His comments are provided in Exhibit 1.

Exhibit 1 Notes from Discussion with Leo Titan

Table Summary: Summary

1. To build a road to the arena’s parking lot, two holes of the 18-hole golf course will be relocated next spring. Costs of $140,000 are expected to be incurred this year in design, tree planting, ground preparation, and grass seeding to ready the area for next spring. These costs are to be capitalized as part of the golf course lands, along with related property taxes of $13,000 and interest of $15,000.

2. Approximately $600,000 will be required to relocate the rides currently on land needed for the arena. This amount is to be capitalized, net of scrap recovery on dismantled and redundant equipment of $60,000. Virtually all the rides were fully depreciated years ago.

3. In May 20X7, WAL acquired, for $4.25 million, all of the shares of an amusement park in a different city, when its land lease expired. The amusement park company was wound up and the equipment, rides, concessions, and other assets are being transported to WAL at a cost of $350,000. According to Leo, the estimated fair market value of WAL’s net assets is $4.85 million, including liabilities of $1.20 million.

WAL expects to spend approximately $400,000 in getting the assets in operating order and $500,000 on foundations and site preparations for the rides. Leo wants to “capitalize as much as possible.â€

4. To assist in financing the new ventures, WAL sold excess land to developers who intend to construct a shopping centre, office buildings, and expensive homes that will be adjacent to the golf course and away from the amusement park. The developers and WAL agreed to these terms:

Paid to WAL on 1 May 20X7 $ 6,000,000

To be paid to WAL on 1 March 20X8 10,000,000

To be paid to WAL on 1 March 20X9 8,000,000

$24,000,000

The land is to be turned over to the developers on or about 1 February 20X8, but the sale is to be reported in fiscal 20X7. The land was carried on WAL’s books at $1.35 million; a pro-rata portion of the total land carrying value (at cost) will be allocated to the portion sold to the developers.

5. An additional “contingent profit†will accrue to WAL if the developers earn a return on investment of more than 25% when they resell the newly constructed buildings. Leo wants a note to the 20X7 financial statements that describes the probability of a contingent gain.

6. The golf course has been unprofitable in recent years. However, green fees are to be raised and specific tee-off times will be allotted to a private club, currently being organized. Members of the private club will pay a nonrefundable entrance fee of $2,000 per member plus $100 per month for five years. The $2,000 is to be recorded as revenue on receipt. Approximately $350,000 is to be spent to upgrade the club facilities.

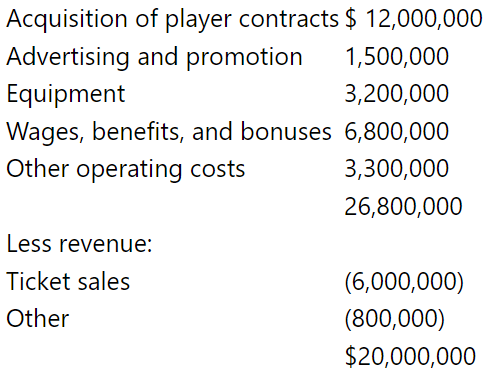

7. Leo wants to capitalize all costs of NSL on NSL’s books until it has completed its first year of operations. In addition to the franchise fee, $20 million will have to be spent on the following:

The value of players can change quickly, depending upon their performance, injuries, and other factors.

8. The new sports arena will have private boxes in which a company can entertain groups of clients. The boxes are leased on a five-year contract basis, and they must be occupied for a fixed number of nights at a minimum price per night. To date, 12 boxes have been leased for $15,000 per box for a five-year period, exclusive of nightly charges. A down payment of $3,000 was required; the payments have been recorded as revenue.

9. Three senior officers of WAL, including Leo, receive bonuses based on income before income taxes. The three have agreed to have their fiscal 20X7 bonuses accrued in fiscal 20X8 along with their fiscal 20X8 bonuses. Actual payments to them are scheduled for January 20X9.

You have been asked by the partner to prepare a report for him, which will be used for the next meeting with Leo. He would like you to discuss the accounting implications related to your discussion with Leo. The partner wants a thorough analysis of all important issues as well as support for your position.

In your review of documents, and as a result of various conversations, you have learned the following:

1. The arena will be mortgaged, but only for about 50% of its expected cost. Lenders are concerned about the special-use nature of the arena and whether it will be successfully rented for other events, such as concerts.

2. The mortgage lenders to WAL and the minority shareholders in NSL are both expected to want to see appraisals and financial statements before deciding whether to invest. Covenants will be required by the lenders to ensure that excessive expenditures are not undertaken and that cash is preserved.

3. Leo does not intend to consolidate NSL until it is profitable. The investment in NSL will be reported on WAL’s financial statements at cost. The WAL financial statements will be used for income tax purposes.

4. WAL’s minority shareholders are not active in the business and want quarterly financial statements to monitor progress and assess Leo’s performance. The minority shareholders have all expressed concern over Leo’s growth strategy over the past year. Most are approaching their retirement years and are relying on WAL to supplement their retirement income.

Required:

Prepare the report.

> The accounts of Quickly Company provided the following 20X4 information at 31 December: Accounts receivable balance $600,000 (dr.) Allowance for sales discounts 5,500 (cr.) Allowance for doubtful accounts 40,000 (cr.) In fact, the allowance for sales dis

> 1. Loans and receivables are classified according to their business model. 2. All notes receivables are measured at amortized cost. 3. Overdrafts can be netted against a positive balance in a bank account with any bank. 4. Gains and losses from translati

> Arrow Co. entered into a contract with a customer for $410,000. The contract is for the delivery of equipment and a three-year service maintenance contract for the equipment. Arrow sells separately the equipment for a selling price of $400,000, and the m

> SorCo. Inc. has just entered into a sale agreement with a customer. The contract is for $1,100,000. However, the payments will be made as follows: 1 August 20X1 on date of delivery $500,000; 1 August 20X2 $300,000 and 1 August 20X3 $300,000. SorCo has es

> Rock Gasoline decided to implement a customer loyalty point program. For each litre of fuel sold, the customer earns one point. The points can be accumulated and redeemed later for gas, products in the store, or a car wash. In May, Rock had sales of $60,

> CCS is a construction company that builds roads in the Northwest Territories (NWT). CCS uses the percentage-of-completion method and measures completion on the basis of kilometres completed. In November 20X9, CCS signed an agreement with the NWT governme

> Spreadsheets Made Easy (SME) is a public company that designs and sells spreadsheet software. Corporate customers purchase licences for the number of users in their company who can access the software from their network at any time. The perpetual licence

> Indicate whether each statement is required in IFRS or in ASPE, or in both.

> ELC Inc. sells all types of electronics with a one-year warranty for product assurance on all products sold. On 26 February, a customer came into the store and purchased a television for $1,250. The company estimates, from past experience, that warranty

> Under contract, Sojourn Co. delivers 1,000 units to Customer A for $50 each on 1 April. Sojourn’s documented policy is to allow a customer to return any unused product within 90 days and receive a full refund. The cost of each product is $35. On the basi

> Dress for Success is an upscale dress shop. On 15 August, Sally, a regular customer, came in and put a deposit down on two items: $50 on a dress and $100 on a suit. The deposit was in the amount of $150, which represented 20% of the total retail value of

> Floral Design Co. is a chain of florists located in the Greater Halifax area. Floral Design sells made-to-order bouquets, in-store floral arrangements, and provides design services for events such as weddings and corporate events. They also provide arran

> - The entity assesses the risk, timing, or amount of the entity’s future cash flows expected to change as a result of the contract. - A separate performance obligation is identified for each distinct good or service. - The entity allocates the transact

> Green Equipment Inc. (Green) sells heavy-duty tractors. The 250GT tractor has a stand-alone price of $220,000. Green offers to sell the 250GT inclusive of a five-year service contract intended to cover all repairs and maintenance on the tractor for $235,

> Abateer company provides interior design services for residential and commercial customers. Assume Abateer entered into the following contracts during the year: 1. A contract with a family renovating their home. The contract specifies that Abateer will p

> Paper Supply Ltd. has contracted with a local copy and print centre to provide packages of plain printer paper, as needed, each month. Each package costs $15 and contains 500 sheets of paper. If the copy and print centre purchases over 1,500 packages in

> James Ehnes has recently completed his second year of accounting studies. He has just been hired as a summer intern at the auditing firm of Hetu & Fauré. He feels fortunate to have landed an internship in such a prestigious firm. His supervisor, Venus Ya

> You have been asked to participate in a panel discussion at an accounting conference along with respected academics from around the world. The panel centres on discussion of the IASB’s Conceptual Framework for Financial Reporting. You have been provided

> Sander Persaud is an audit manager for a national public accounting firm. Every summer, the firm recruits several university students as interns. One such intern is Taylor Jay, a high-performing student who has just finished their third year of universit

> Andriana Bessemer, a sole practitioner in a rural area, is working on a client file when one of her most important clients, Richard Wright, walks in. Richard operates one of the largest dairy farms in the region. “Sorry to barge in like this, but I’ve ju

> Dabika Mulla and Elicia Yang have owned and operated a small gardening centre and landscaping business for the past 10 years. Their business is incorporated as a private corporation. Since there is no market price for their shares, their shareholder agre

> Northern Energy Ltd. (NEL) is a large Canadian private company organized in three operating segments: propane operations, trucking, and mineral explorations. Financial statements have not been audited, and NEL has simply used the cost method for its inve

> Nitrale Corporation (NC) is a Canadian company owned by 3 independent investors: Blakey Straun, Humza Ali, and Xavier Kingston. In October 20X4, NC was formed. The company manufactures the chips that go into radio frequency identification (RFID) tags, wh

> In May 20X1, a group of outdoor enthusiasts formed Wild Ones Ltd. (Wild Ones). Wild Ones operates in central Newfoundland and is involved in a variety of outdoor adventure activities. Start-up capital was provided from an inheritance that one of the owne

> Quinter Corp. (QC) was formed in April 20X5 and funded by five shareholders that are public companies. As such, the shareholders are requiring that QC adopt IFRS even though it is a private company. QC was formed to hold a variety of investments. Quinter

> In February, Huron Ltd. incurred costs to obtain a contract with a customer. The contract is for two years. The following costs were incurred: Travel costs to meet with the customer $10,000 Legal costs to write up the agreement $5,000 Cost of meals $7,00

> You have just been hired as an accounting advisor by Road Safety Inc. (RSI), a company that manufactures road safety equipment (e.g., crash barriers, traffic lights, and electronic information signs). RSI was founded in 20X4 and has grown rapidly over th

> You were recently approached by one of your clients, Wendy Wonders, the chief financial officer of Rock Group Ltd. (RGL), a Canadian public company with a 31 December year-end. RGL manufactures and sells power precision hand tools and accessories, such a

> Bright Lights Ltd. (Bright) is a private company incorporated five years ago by a group of friends who had recently graduated with business or engineering degrees. The group is interested in innovative designs to meet a variety of lighting needs and has

> Juno Corporation (JC) is a Canadian online streaming service that provides access to a wide variety of movies and TV shows. The company has been in operation for the past five years and currently has a subscriber base of five million customers. JC curren

> Winery Inc. (WI) is a private corporation formed in 20X8. Prior to 20X8, WI had been operating as a partnership by the Verity family. Due to their success and desire to expand, they have made the decision to incorporate so that they will have additional

> Glowworm Inc. “I cannot believe you have advised against an employee bonus this year,” exclaimed Jessica Simpson, senior accountant of Glowworm Inc. (GI), as she stormed into the office of the GI chief financial officer on Monday morning. GI is a large,

> Titles Inc. (TI) is a major publisher of books for postsecondary education. TI is a Canadian public corporation. One of TI’s major shareholders is Global Holdings PLC (GHC), a London-based media company. In early 20X4, TI’s executives were preparing a bi

> CBD Inc. (CBD) grows and manufacturers Cannabis sativa plant species and then curates their product into CBD oil. The company was incorporated in 20X6, and operates out of Prince Edward Country, Ontario. CBD Inc. primarily sells its products via online c

> Love Your Pet, Inc. (LPI) is a pet food company located in rural Quebec. LPI has been operating for years as a distributor of pet food but in the last year has begun to manufacture raw dog food. In the current year, LPI has been certified by the Canadian

> Mitrium Corp. is a large privately held company that manufactures frozen ice cream products, which are sold to large and small retailers across North America. The shares of this company are held by 12 individuals, some of them related and some of them no

> Crane Inc. is an agent for Phillips Co. and negotiates sales contracts between Phillips and the final customer for heating and air conditioning units. By agreement, Crane is to receive a commission of 15% on each sale. During the last quarter, Crane nego

> Match the user with the most likely objective. User 1. Bank 2.Small private company 3. Not-for-profit organization 4. Management 5. Shareholders with agreement objective 1. Stewardship 2. Income tax deferral 3. Cash flow prediction 4. Contract Compliance

> The Melville Credit Union has operated in small-town, rural Nova Scotia for the last 27 years. In the summer of 20X4, after decades of operation as a prosperous paper mill, the Lancaster Mersey Mill was abruptly shut down. Lancaster had been a major empl

> Reliable Construction Inc. (RCI) is a public company that sells construction equipment to builders of primarily homes, office buildings, and highways. RCI has been in operation for over 30 years. Up until this year, the company has had profits with the r

> Thomas Technologies Corp. (TTC) is an engineering services company based in Calgary. The company’s Class B common shares are listed on the Toronto Stock Exchange. The Class A common shares are all owned by Theodore Thomas, the company founder, and his im

> Lake Country Ltd. (LCL) is a Canadian manufacturer of outdoor furniture products. LCL manufactures high-quality, durable, and attractive furniture such as outdoor seating, tables, and accessories. LCL sells its products directly to retailers, who in turn

> Pocket Entertainment Group Ltd. (PEG) is an interactive entertainment company that develops mobile apps. Sharleen Williams and her family members own the majority of the 4,000 shares, and have financed all growth through shareholder loans, equity investm

> Solar Power Inc. (SPI) is a public company manufacturing and distributing solar panels. It has been in existence for the past ten years, of which the last three have been as a public company. To date SPI has experienced good growth rates, slightly higher

> Rosy Ltd. (Rosy) is a consumer products company that designs, manufactures, markets, and distributes a diverse portfolio of products, primarily in the recreational and leisure segments. The products enjoy strong positive brand recognition and include suc

> “Frankly, if we continue to grow, we will be out of business soon.” This was the glum assessment of Kathy Lin, President and CEO of Purple Ltd. (Purple), a company that designs, manufactures, and retails womenâ&#

> The owner of Bettany Inc., Mario Sloan, has come to you, a public accountant, for advice. “I am very worried about my business right now. The bank loan is at its maximum level, we have no cash, and my salary is backing up, unpaid. I don

> The management of WPB Ltd. has spent the past year reorganizing the company’s business activities. WPB is a service provider to hospitals. Originally the company operated only in Canada, where hospital care is provided at government expense through publi

> Information related to various financial statement items is provided for two cases: Case A Operating expenses were $500,000. Inventory increased by $72,000, accounts payable increased by $50,000, and prepaid rent decreased by $16,000. Case B Sales revenu

> Colour My World Inc. (CMWI) has been operating as a private company for the past 25 years. It manufactures and sells paint. At first, the owners ran only a few retail stores in Northern Ontario, but the company has since expanded with stores across Canad

> T&E Investor Corporation (TEIC) is a holding company with wholly owned interests in the travel and entertainment industry. It is listed on the Toronto Stock Exchange and is subject to the reporting requirements of that exchange and of the Ontario Securit

> Singh Solutions Inc. (SSI) is an Ontario-based manufacturing business that specializes in the production of fire and soundproofing insulation. The company holds public-listed debt, and the family of its founder, Jasmeet Singh, retains control through spe

> International Corp. (IC) is a large Canadian company that has operations around the world that are very diverse. In the past few years they have acquired a number of different companies in a variety of businesses. They have decided this year that it is t

> Dubois Ltd. is a Vancouver-based private company established 30 years ago. Until very recently, all 16 of the shareholders have been relatives of the founder, Blanche Dubois. The company has been profitable in most years. In recent years, however, it has

> On 1 May 20X7, Bertrum Ltd. purchased $1,000,000 of Fox Corp. 6.2% bonds. The bonds pay semi-annual interest each 1 May and 1 November. The market interest rate was 6% on the date of purchase. The bonds mature on 1 November 20X11. Required: 1. Calculate

> On 1 January 20X5, Franco Ltd. purchased $400,000 of Gentron Company 5% bonds. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 6% on the date of purchase. The bonds mature on 31 December 20X10. The company ha

> On 1 July 20X2, New Company purchased $600,000 of Old Corp. 5.5% bonds, classified as an AC investment. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 5% on the date of purchase. The bonds mature on 30 June

> On 1 June 20X8, Ghana Company purchased $7,000,000 of Monaco Corp. 5.8% bonds, classified as a FVOCI-Bond investment. The bonds pay semi-annual interest each 30 May and 30 November. The market interest rate was 6% on the date of purchase. The bonds matur

> Selected accounts from the SFP of Norry Ltd. at 31 December 20X4 and 20X5 are presented below. Norry reported earnings of $280,000 in 20X5. There was a new $140,000 of note payable this year that was direct financing (a note issued by the vendor) for a p

> On 1 July 20X8, Sun Company purchased $4,000,000 of Moon Corp. 6.2% bonds, classified as an AC investment. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 6% on the date of purchase. The bonds mature on 30 Ju

> Poffer Investments (Poffer) is an investment company. The owners are avid investors that have pooled their money to earn income through their investments. They have a small, but wealthy client base that they manage funds for. All investments are purchase

> Timmins Ltd. owns a number of investments in bonds. Timmins has a 31 December year-end. Case A $3,000,000 bonds in Lakehead Corp. a publicly traded company. The bonds are currently classified as AC with an amortized cost of $3,250,000 as at December 31 a

> Yohan Inc. owns 14,000 shares in Placelid Corporation (represents 10%). Both companies are private entities. The shares were purchased in 20X1 for $20 per share, plus transaction fees of $6,250. In 20X6, Placelid experienced significant challenges with i

> Operators 1 and 2 are both copper mining companies. Operator 1 focuses on drilling and extraction; Operator 2 focuses on the grinding and concentration process (to extract the ore). The companies work together to drill, extract, and partially process the

> On 3 January 20X4, TA Company purchased 2,000 shares of the 10,000 outstanding shares of common stock of UK Corp. for $14,600 cash. TA has significant influence as a result of this acquisition. At that date, the statement of financial position of UK Corp

> On 2 January 20X5, Junction Ltd., a private company, purchased 90,000 of the 100,000 outstanding common shares of Wicket Corporation for $12 per share. The remaining 10,000 shares are owned by an investor. Transactions costs totalled $12,500. During 20X5

> On 1 January 20X8, Khalil Ltd. purchased $2,000,000 of six-year, Harvest Ltd. 5.4% bonds. The bonds pay semi-annual interest each 30 June and 31 December. The market interest rate was 6% on the date of purchase. Khalil is a private company that complies

> Return to the facts of A11-7. Assume now that New Company is a private company that complies with ASPE. Straight-line amortization will be used rather than the effective-interest method. Required: 1. Calculate the price paid by New Company. 2. Construct

> Return to the facts of A11-2. Assume now that the investor is a private company that complies with ASPE. Required: How should the investor classify each of the investments? What accounting method should be used for each? Data from A11-2: For each situat

> Selected accounts from the SFP of Penton Ltd. at 31 December 20X5 and 20X4 are presented below. Penton declared $100,000 of cash dividends during the year, and purchased $200,000 of machinery in direct exchange for common shares. Required: List the items

> Return to the facts of A11-1. Assume now that the investor is a private company that complies with ASPE. Required: How should the investor classify each of the investments? What accounting method should be used for each? Data from A11-1:; The following

> The following comparative data are available from the 20X4 statement of financial position of Trevor Holdings Ltd: In 20X4, the following transactions took place and are properly reflected in the accounts, above. 1. There were no purchases or sales of FV

> For each of the following transactions, identify the item(s) that would appear on the statement of cash flows. Assume that the indirect method of presentation is used in the operating activities section, and cash flow from investing revenue is classified

> Consider the following investment categories: 1. AC investment 2. FVOCI-Bond investment 3 FVTPL investment 4. FVOCI-Equity investment 5. Associate 6. Subsidiary 7. Joint venture An investor company that is a public company has the following items: 1. SRY

> On 31 December 20X6, TKB Company’s investments in equity securities were as follows: Required: 1. Explain what the carrying value for each investment represents. 2. What was the original cost of the FVOCI investment? 3. TKB reclassified

> In 20X1, Pepper Company bought 75% of S Company’s common shares, establishing control over the board of directors. Pepper Company used the cost method to account for its investment in S Co. during the year, but prepared consolidated fin

> Royals Imports is a public company. It reported the following at the end of 20X5: FVOCI investment, Huebner Co. 20,000 shares ($542,000 cost) $ 742,000 FVTPL investments Adams Co., 28,000 shares $1,816,000 - Sawicki Co., $150,000 par value, 8% bond, due

> Consider each of the following scenarios, and discuss how each arrangement should be classified. Scenario 1 A group of three investors, Companies A, B, and C, have entered into an agreement to purchase and manage a large outdoor retail mall. A new compa

> On 3 January 20X8 Raylink Inc., a publicly traded company, purchased 60,000 common shares of Tall Forest Ltd. for $27 per share. There are a total of 300,000 common shares issued and outstanding. Tall Forest has the following assets on the date the share

> On 1 January 20X6, Loffer Ltd. purchased 37% of Ming’s common shares for a price of $875,000. The remainder of the shares in Ming are closely held by family members of the founder of the company. Loffer considers this a strategic investment, acquired to

> Selected accounts from the SFP of Katten Ltd. at 31 December 20X8 and 20X7 are presented below. Katten reported earnings of $100,000 in 20X8. There was a stock dividend recorded, valued at $50,000 that reduced retained earnings and increased common share

> On 1 January 20X5, Zan Company purchased 5,000 of the 20,000 outstanding common shares of Woo Computer Corp. (WC) for $120,000 cash. Zan had significant influence as a result of the investment and will use the equity method to account for the investment.

> Premium Investments Ltd. bought the following bond investment: $4,000,000 bonds of Trans-BC Operations Ltd. The bonds were purchased 1 Feb 20X5. Interest at 6% is payable semi-annually on January 31 and July 31. The bonds mature in four years on 31 Janua

> Lauren Corp. purchased a $728,000 investment in the common shares of Reesh Corp. on 15 May 20X5. The investment is a FVTPL investment. Reesh is a private company and few shares are bought and sold. Lauren was speculating that the value of the Reesh commo

> Adar purchased on 1 October 20X3 a $70,000, 5%, ten-year bond that pays interest each 31 March and 30 September. The bond was purchased for $65,014, and is expected to yield 6%. It is trading at 94 at December 20X3 and Adar has determined that the credit

> For each situation below, indicate how the investment would be classified, and how it would be accounted for. The investor is a public company. 1. Common shares are bought in a public company whose shares are broadly held and widely traded. The company i

> Danigal purchased a $150,000, 6% coupon bond from Intregal Corp. on 1 January 20X2. Interest is paid semi-annually on 30 June and 31 December. The market interest rate was 4.5% at the time of purchase. The bond expires on 31 December 20X7. The bond is re

> 16 July 20X7: Sachet Inc. purchased the following 15,000 shares in Zynic Inc., a European corporation, for €32 per share. Management designated the shares as FVOCI. Total commissions and fees to purchase the shares: €1,300. - 31 December 20X7: Zynic shar

> On 22 May 20X5, Friedland Ltd. purchased 52,000 shares of Gerstan Ltd. for US$13.40 per share, plus US$2,000 in commissions and fees. The shares were purchased from a broker on account, with later cash payment. On 22 May 20X5, the exchange rate was US$1

> Cudmore Ltd. had two FVTPL investments at the end of 20X4, disclosed on the SFP as follows: Kelowna Ltd. 2,000 shares $ 88,700 Burnaby Corp. 7,200 shares 66,240 $154,940 By the end of 20X4, unrealized losses of $3,700 related to the Kelowna Ltd. shares a

> During 20X2, Morran Company purchased shares in two corporations and bond securities of a third. The share investments are classified as FVOCI-Equity and the bond investment is FVTPL. Transactions in 20X2 include: 1. Purchased 3,000 of the 100,000 common

> Selected accounts from the SFP of MNN Ltd. at 31 December 20X4 and 20X5 are presented below. Depreciation was $40,000 for equipment, $60,000 for buildings, and $75,000 for machinery. A new machine was purchased in 20X5, with 25% of the price paid in cash

> On 30 April 20X2, Marc Company purchased 4,000 shares of Spencer Ltd. for $17 per share plus $400 in commission. In 20X2, the company received a $0.65 per share dividend, and the shares had a fair value of $16 per share at the end of the year. In 20X3, t

> London Ltd. reported the following transactions and information regarding the shares of Dolma Corp: - 15 October 20X2, purchased 3,000 shares at $42 per share plus $1,200 commission. - 1 December 20X2, received $0.50 per share cash dividend. - 31 Decembe

> On 1 November 20X8, Porter Company acquired the following FVTPL investments: - Minto Corp.—2,000 common shares at $15 cash per share - Pugwash Corp.—700 preferred shares at $25 cash per share The annual reporting period ends 31 December. Quoted fair valu

> At the end of 20X9, Canfrax Corp. Ltd. reported an unrealized loss on Comet Company shares of $24,600 in earnings. Investments were reported on the statement of financial position as follows: Long-term assets: investments: Star Co. common shares $1,370,1

> Shyloft Corporation purchased $85,000, 7% bonds of Coyyle Ltd. on 2 July 20X3. Interest is paid 1 July and 1 January. The bonds expire on 30 June 20X13. The market interest rate at the time of purchase was 6.5%. The fair value of the bond is as follows:

> The following investments are held by investors that are public companies: 1. A $5,000,000 5% publicly traded 10-year bond of Tree Ltd. The bonds are held for short-term capital appreciation, as the investor is expecting interest rates to change. 2. A $4

> Quality Producers acquired factory equipment on 1 January 20X5, costing $156,000. Component parts are not significant and need not be recognized and depreciated separately. In view of pending technological developments, it is estimated that the machine w

> Mace Company acquired equipment that cost $36,000, which will be depreciated on the assumption that the equipment will last six years and have a $2,400 residual value. Component parts are not significant and need not be recognized and depreciated separat