Question: Scion Corp. manufactures earth-moving equipment.

Scion Corp. manufactures earth-moving equipment. Department A303 produces a number of small metal parts for the equipment, including specialized screw products, rods, frame fittings, and some engine parts. Scion uses flexible budgeting. The budget for each line item is based on an estimate of the

TABLE 1 Part Number UAV 672

budgeting Standards per 100 Parts per Batch

Raw materials…………………………………….. $26.72

Direct labor, salaried ………………………..2.5 hours

Direct labor, hourly ………………………….3.2 hours

Machine hours …………………………………6.3 hours

fixed costs and variable costs per unit of volume for that item. The volume measure chosen for each line item is the one with the greatest cause-and-effect relation to the item. For example, the volume measure for utilities is machine hours, whereas the volume measure for supervision is direct labor hours of hourly employees.

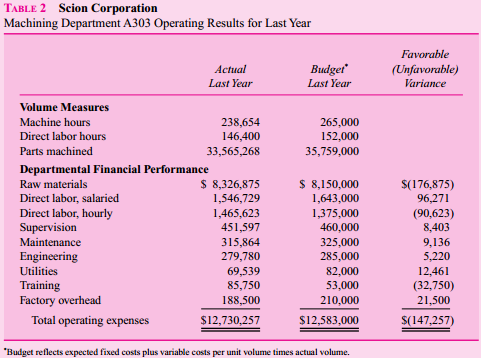

At the beginning of the year, the plant is given an annual production quota consisting of the number of each piece of earth-moving equipment to produce. These equipment quotas are exploded into the total number of parts each department must produce, using data about what parts are required for each unit of equipment. Each department has a detailed set of standards, developed over a number of years that translate each part produced into the number of machine hours, direct labor hours, raw materials, and so on. Table 1 summarizes the operating results of department A303—specifically, the budgeted cost per batch of 100 parts for part number UAV 672.

Given the production quotas and the detailed set of quantities of each input required to produce a particular part, Department A303’s financial budget for the year can be developed. At the end of the year, the actual number of each type of part produced times the budgeting standards for each part can be used to calculate the flexible budget for that line item in the budget. That is, given the actual list of parts produced in Department A303, the flexible budget in Table 2 reports how much should have been spent on each line item. Price fluctuations in raw materials are not charged to the production managers. If low-quality materials are purchased and cause the production departments to incur higher costs, these variances are not charged to the production departments.

The manager of Department A303 does not have any say over which parts to produce. The manager’s major responsibilities include delivering the required number of good parts at the specified time while meeting or bettering the cost targets. The two most important components of the manager’s compensation and bonus depend on meeting delivery schedules and the favorable cost variances from the flexible budget.

Senior management of the plant is debating the process used each year to update the various budgeting standards. Productivity increases for labor would cause the amount of direct labor per part to fall over time. One updating scheme would be to take the budgeting standards from last year (e.g., Table 1) and reduce each part’s direct labor standard by an average productivity improvement factor estimated by senior plant management to apply across all departments in the plant. The productivity improvement factor is a single plant wide number. For example, if the average productivity factor is forecast to be 5 percent, then for part UAV 672 the budgeting standard for “Direct labor, salaried†becomes 2.375 hours (95 percent of 2.5 hours). This is termed “adjusting the budget.â€

An alternative scheme, called “adjusting the actual,†takes the actual number of direct labor hours used for each part and applies the productivity improvement factor. For example, suppose part UAV 672 used an average of 2.6 hours of salaried direct labor last year for all batches of the part manufactured. The budgeting standard for “Direct labor, salaried†for next year then becomes 2.47 hours (95 percent of 2.6 hours).

Under both schemes, last year’s actual numbers and last year’s budgeted numbers are known before this year’s budget is set.

Required:

Discuss the advantages and disadvantages of the two alternative schemes (adjusting the budget versus adjusting the actual).

Transcribed Image Text:

TABLE 2 Scion Corporation Machining Department A303 Operating Results for Last Year Favorable Actual Last Year Budget (Unfavorable) Variance Last Year Volume Measures 265,000 152,000 Machine hours 238,654 146,400 Direct labor hours Parts machined 33,565,268 35,759,000 Departmental Financial Performance $ 8,150,000 $ 8,326,875 1,546,729 Raw materials Direct labor, salaried Direct labor, hourly Supervision $(176,875) 96,271 (90,623) 8,403 1,643,000 1,375,000 460,000 325,000 285,000 82,000 53,000 210,000 1,465,623 451,597 Maintenance 315,864 9,136 5,220 Engineering 279,780 69,539 85,750 188,500 Utilities Training Factory overhead 12,461 (32,750) 21,500 Total operating expenses $12,730,257 $12,583,000 $(147,257) "Budget reflects expected fixed costs plus variable costs per unit volume times actual volume.

> Data for the Bidwell Company are as follows: Required: a. Based on the preceding data, calculate break-even sales in units. b. If Bidwell Company is subject to an effective income tax rate of 40 percent, calculate the number of units Bidwell would have t

> Kollel is a private hospital that operates in a large metropolitan area. The hospital admits “regular” patients and “private” patients. Regular patients are admitted and treated by s

> J.P. Max is a department store carrying a large and varied stock of merchandise. Management is considering leasing part of its floor space for $72 per square foot per year to an outside jewelry company that would sell merchandise. Two areas currently in

> Potter-Bowen (PB) manufactures and sells postage meters throughout the world. Postage meters print the necessary postage on envelopes, eliminating the need to affix stamps. The meter keeps track of the postage, the user takes the meter’s counter to a pos

> Portable Phones, Inc., manufactures and sells wireless telephones for residential and commercial use. Portable Phones’ plant is organized by product line, with five phone assembly departments in total. Each of these five phone assembly departments is res

> “It was in Deyang in 1969 that I came to know how China’s peasants really lived. Each day started with the production team leader allocating jobs. All the peasants had to work, and they each earned a fixed number of ‘work points’ (gong-fen) for their day

> US Copiers manufactures a full line of copiers including desktop models. The Small Copier Division (SCD) manufactures desktop copiers and sells them in the United States. A typical model has a retail price of less than $500. An integral part in the copie

> Some economists (e.g., Hayek) argue that decentralization of economic decisions in the economy leads to efficient resource allocation. What differences exist within the firm that make the link between decentralization and efficiency less clear?

> Federal Mixing (FM) is a division of Federal Chemicals, a large diversified chemical company. FM provides mixing services for both outside customers and other Federal divisions. FM buys or receives liquid chemicals and combines and packages them accordin

> Mr. Jones intends to retire in 20 years at the age of 65. As yet he has not provided for retirement income, and he wants to set up a periodic savings plan to do this. If he makes equal annual payments into a savings account that pays 4 percent interest p

> Taylor Chemicals produces a particular chemical at a fixed cost of $1,000 per day. The following table displays how marginal cost varies with output (in cases): Required: a. Given the preceding data, construct a table that reports total cost and average

> Telephone Computer Corporation (TCC) manufactures and sells two computerized directory assistance computers to telephone companies. The firm has its own sales force that sells directly to the phone companies. TCC currently sells two computer systems: the

> You are working for an investment banking firm. One of your clients is examining the possibility of purchasing Stirling Manufacturing, a parts supplier (specifically, tail-light assemblies) to the automobile industry. Stirling has sales of $130 million a

> Kinsley & Sons is a large, successful direct-mail catalog company in the highly competitive market for upscale men’s conservative business and business-casual dress wear. On sales of $185 million they had earnings of $13 million. Most of the sales are fr

> WWWeb Marketing is a decentralized firm specializing in designing and operating Internet marketing Web sites. The firm is four years old and has been growing rapidly, but it only shows a small profit. WWWeb has three profit centers: Design Division, Serv

> Western Sugar processes sugar beets into granulated sugar that is sold to food companies. It uses a standard cost system to aid in cost control and performance evaluation. To compute the standards for next year, the actual expense incurred by expense cat

> Avant Designs designs and manufactures polished-nickel fashion bracelets. It offers two bracelets: Aztec and Mayan. The following data summarize budgeted operations for the current year: Budgeted fixed manufacturing overhead for the year was $258,000. Re

> The PQR Coal Company has several conventional and strip mining operations. Recently, new legislation has made strip mining, which produces coal of high sulfur content, unprofitable, so those operations will be discontinued. Unfortunately, PQR purchased $

> The Doe Company sells three products: sliced pineapples, crushed pineapples, and pineapple juice. The pineapple juice is a by-product of sliced pineapple, while crushed pineapples and sliced pineapples are produced simultaneously from the same pineapple.

> Neweway Plastics manufactures an acrylic compound used in automobile bumpers in a continuous flow process. Raw material is added at the beginning of the process and conversion costs are incurred uniformly over the process. The accompanying table summariz

> Healing Touch manufactures massage chairs with the following standard cost structure: During the month 500 chairs are manufactured and the following costs incurred: Required: a. Calculate all materials and labor variances (including price, quantity, wage

> Friendly Grocer has three departments in its store: beverages, dairy and meats, and canned and packaged foods. Each department is headed by a departmental manager. Operating results for the last month (in thousands) are given in the table. The direct cos

> One large company that has been successful in applying Total Quality Management (TQM) principles in manufacturing reports that it has had less success in applying the same techniques in improving administrative functions such as order taking, distributio

> Aspen View produces a full line of sunglasses. This year it began producing a new model of sunglasses, the Peak 32. It produced 5,300 pairs and sold 4,900 pairs. The following table summarizes the fixed and variable costs of producing Peak 32 sunglasses.

> DeJure Scents manufactures an aftershave and uses process costing. All materials are added at the beginning of the process and conversion costs are incurred uniformly over time. In May, DeJure started 15,000 gallons. There was no beginning inventory. May

> Just One, Inc., has two mutually exclusive investment projects, P and Q, shown below. Suppose the market interest rate is 10 percent. The ranking of projects differs, depending on the use of IRR or NPV measures. Which project should be selected? Why is t

> Wyatt Oil owns a major oil refinery in Channelview, Texas. The refinery processes crude oil into valuable outputs in a two-stage process. First, it distills a barrel of crude oil at a variable cost of $2 per barrel into two types of outputs: light distil

> Why are drivers for long-haul (cross-country) moving companies (e.g., Allied Van Lines) often franchised, while moving companies that move households within the same city hire drivers as employees? Franchised drivers own their own trucks. They are not pa

> Murray Hill was preparing the monthly report that allocates the three service department’s (A, B, and C) costs to the three operating divisions (D1, D2, and D3) when he choked to death on a stale double cream-filled donut. You must step

> Royal Resort and Casino (RRC), a publicly traded company, caters to affluent customers seeking plush surroundings, high-quality food and entertainment, and all the “glitz” associated with the best resorts and casinos.

> Department 100 is the first step in the firm’s manufacturing process. Data for the current quarter’s operations are as follows: Number of Units

> Dakota Mining is considering operating a strip mine, the cost of which is $4.4 million. Cash returns will be $27.7 million, all received at the end of the first year. The land must be returned to its natural state at a cost of $25 million, payable after

> The Winterton Group is an investment advisory firm specializing in high-income investors in upstate New York. Winterton has offices in Rochester, Syracuse, and Buffalo. Operating as a profit center, each office receives central services, including inform

> Robin Jensen, manager of market planning for Viral Products of the IDP Pharmaceutical Co., is responsible for advertising a class of products. She has designed a three-year marketing plan to increase the market share of her product class. Her plan involv

> Microelectronics is a large electronics firm with multiple divisions. The circuit board division manufactures circuit boards, which it sells externally and internally. The phone division assembles cellular phones and sells them to external customers. Bot

> Scanners Plus manufactures and sells two types of scanners for personal computers, the Home Scanner and the Pro Scanner. The Home model is a low resolution model for small office applications. The Pro model is a high resolution model for professional use

> Old Turkey Mash is a whiskey manufactured by distilling grains and corn and then aging the mixture for five years in 50-gallon oak barrels. Distilling requires about a week and aging takes place in carefully controlled warehouses. Before it ages, the wh

> A company recently raised the pay of employees by 20 percent. The productivity of the employees, however, remained the same. The CEO of the company was quoted as saying, “It just goes to show that money does not motivate people.” Provide a critical evalu

> Suppose the market rate of interest is 10 percent and you have just won a $1 million lottery that entitles you to $100,000 at the end of each of the next 10 years. Required: a. What is the minimum lump-sum cash payment you would be willing to take now in

> In its radio fund-raising campaign, National Public Radio (NPR) stated, “On-air radio membership campaigns are the most cost-effective means we have for raising the funds necessary to bring you the type of programming you expect.” NPR is commercial-free,

> The purchasing department of Ball Brothers purchases raw materials and supplies for the various divisions in the firm. Most of the purchasing department’s costs are labor costs. The costs of the purchasing department depend on the number of items purchas

> Carlos Sanguine, Inc., makes premium wines and table wines. Grapes are crushed and the free flowing juice and the first-processing juice are made into premium wines (bottles with corks). The second- and third-processing juices are made into table wines (

> The Medford Mug Company is an old-line maker of ceramic coffee mugs. It imprints company logos and other sayings on mugs for both commercial and wholesale markets. The firm has the capacity to produce 50 million mugs per year, but the recession has cut p

> Sunnybrook Farms is a local grocery store that is currently open only Monday through Saturday. Sunnybrook is considering opening on Sundays. The annual incremental costs of Sunday openings are estimated at $24,960. Sunnybrook Farms’ gross margin on sales

> Oneida Metal manufactures stainless steel boxes to house sophisticated communications integrated circuit boards for the defense industry. Oneida cuts the metal, bends it to form the chassis and top, punches holes, and drills and taps holes for screws. On

> Software Development Inc. (SDI) produces and markets software for personal computers, including spreadsheet, word processing, desktop publishing, and database management programs. SDI has annual sales of $800 million. Producing software is a time-consumi

> I’ve given a good deal of thought to this issue of how companies . . . go about negotiating objectives with their different business units. The typical process in such cases is that once the parent negotiates a budget with a unit, the budget then becomes

> Galt Electric Motors (GEM) produces two types of motors, small and large. Standard machine time to make one small motor is 20 minutes; standard machine time to make one large motor is 30 minutes. GEM plans to make 30,000 small motors and 20,000 large mot

> A Swiss firm, Smythe and Yves (S&Y), manufactures toiletries such as hand soaps, shampoo, conditioners, and a mouthwash that hotels purchase and place in the rooms for their guests. S&Y uses a standard cost system. One of the fragrances the compa

> True Cost Manufacturing, Inc., manufactures and sells large business equipment for the office and business markets. The primary function of Manufacturing is to provide components and subassemblies for the profit centers within the company. To maintain co

> Webb & Drye (WD) is a New York City law firm with over 200 attorneys. WD has a sophisticated set of information technologies—including intranets and extranets, e-mail servers, the firm’s accounting, payroll, and cl

> Silky Smooth lotions come in three sizes: 4, 8, and 12 ounces. The following table summarizes the selling prices and variable costs per case of each lotion size Fixed costs are $771,000. Current production and sales are 2,000 cases of 4-ounce bottles; 4,

> Alliance Tooling produces a single product in its plant. At the beginning of the year, there were no units in inventory. During the year, Alliance produced 120,000 units and sold 100,000 units at $26.75 per unit. Variable manufacturing costs are $13.50 p

> In the 1800s Australia was a colony of England and most of its trade was with England. Australia primarily exported agricultural products such as wheat and imported manufactured goods such as steel, machinery, and textiles. The volume of trade measured i

> Spa Ariana promotes itself as an upscale spa offering a variety of treatments, including massages, facials, and manicures, performed in a luxurious setting by qualified therapists. The owners of Spa Ariana invested close to $450,000 of their own money th

> Access.Com produces and sells software to libraries and schools to block access to Web sites deemed inappropriate by the customer. In addition, the software also tracks and reports on Web sites visited and advises the customer of other Web sites the cust

> Declining Market, Inc., is considering the problem of when to stop production of a particular product in its product line. Sales of the product in question have been declining and all estimates are that they will continue to decline. Capital equipment us

> You work on a team that reports to the chief financial officer of Fiedler International, a consumer products company that manages a variety of consumer beauty brands (shampoos, facial soaps, deodorants). Your team evaluates possible acquisitions. You are

> Compute the unknowns: There is no opening or closing finished goods or work-in-process inventory. Sales S100,000 29,000 Direct materials used Direct labor 10,000 Variable selling and administration expenses Fixed manufacturing overhead Fixed selling

> Ware Paper Box manufactures corrugated paper boxes. It uses a job order costing system. Operating data for February and March are as follows: The factory was closed due to a labor strike prior to January 28, when job #613 was started. There were no other

> Donovan Steel has two profit centers: Ingots and Stainless Steel. These profit centers rely on services supplied by two service departments: electricity and water. The profit centers’ consumption of the service departmentsâ€&

> Jim Shoe, chief executive officer of Jolsen International, a multinational textile conglomerate, has recently been evaluating the profitability of one of the company’s subsidiaries, Pride Fashions, Inc., located in Rochester, New York. The Rochester faci

> The Flower City Grocery is faced with the following capital budgeting decision. Its display freezer system must be repaired. The cost of this repair will be $1,000 and the system will be usable for another five years. Alternatively, the firm could purcha

> APC is a contract manufacturer of printed circuit board assemblies that specializes in manufacturing and test engineering support of complex printed circuit boards for companies in the defense and medical instruments industries. The assembly process begi

> At the Hilton Applefest and Trade Expo, James Jones, owner of Jones Orchard, saw a sign displayed in front of a vendor’s booth: I CAN GET YOU PESTICIDES AT $10.00 A GALLON—GUARANTEED IN WRITING! Over a one-year period,

> Consider the following two separate firms. One firm manufactures flexible packaging films for the snack, bakery, confectionery, and tobacco industries. Its manufacturing process has been quite stable for many years, with few technological innovations. Mo

> Wasley has three operating divisions. Each manager of a division is evaluated on that division’s total operating income. Managers are paid 10 percent of operating income as a bonus. The AB division makes products A and B. The C division

> At its Lyle Avenue plant, Milan Pasta produces two types of pasta: spaghetti and fettuccine. The two pastas are produced on the same machines, with different settings and slightly different raw materials. The fettuccine, being a wider noodle and more sus

> Familia Insurance Company (FMC) specializes in offering insurance products to the Hispanic community. It has its own direct sales organization of agents that sells three lines of insurance: life insurance, auto insurance, and home insurance. FMC is organ

> The Easton plant produces sheet metal chassis for television sets. Its customer is General Electric Appliances. The chassis are manufactured on a computerized, numerically controlled (NC) machine that cuts, drills, and bends the metal to form the chassis

> DigiEar has invented and patented a new digital behind-the-ear hearing aid with adaptive noise reduction and automatic feedback cancellation. DigiEar produces four different models of its DigiEar device. The following table summarizes the planned product

> A bank has three service centers: EDP (electronic data processing), copying, and accounting. These service centers provide services to one another as well as to three operating divisions: A, B, and C. The distribution of each service centerâ€&

> World Imports buys products from around the world for import into the United States. The firm is organized into a number of separate regional sales districts that sell the imported goods to retail stores. The eastern sales district is responsible for sel

> Veriplex manufactures process control equipment. This 100-year-old German company has recently acquired another firm that has a design for a new proprietary process control system. A key component of the new system to be manufactured by Veriplex is calle

> Joan Chris is the Denver district manager of Stale-Mart, an old established chain of more than 100 department stores. Her district contains eight stores in the Denver metropolitan area. One of her stores, the Broadway store, is over 30 years old. Chris b

> The demand for DVD players is expanding rapidly, but the industry is highly competitive. A plant to make DVD players costs $40 million, has an annual capacity of 100,000 units, and has an indefinite physical life. The variable production cost per unit is

> For each of the following questions draw a graph that depicts how costs vary with volume. Completely label each graph and axis. a. Plant XXX works a 40-hour week. Management can vary the number of employees. Currently, 200 employees are being paid $10 pe

> Using the data from Table 10–6, recast the analysis with one change of assumption: Instead of assuming that an additional $17,000 of overhead was incurred in both years, assume that overhead was lower each year by $10,000. How do incent

> Media Designs is a marketing firm that designs and prints customized marketing brochures. The design department designs the brochure and the printing department prints and binds it. Each department has separate overhead rates. The following estimates for

> Alexander Products manufactures dental equipment and uses a standard cost system. A new product (HV65) that is being introduced requires a particular type of stainless steel. Alexander purchased a quantity of this stainless steel (in meters). The followi

> The empirical evidence reveals that very few firms change their standard prices and standard quantities during the fiscal year. Most firms have the following policy, “We set our standards before the fiscal year begins and we NEVER, NEVER change them duri

> Premier Brands buys and manages consumer personal products brands such as cosmetics, hair care, and personal hygiene. Premier management purchases underperforming brands and redesigns their marketing strategy and brand equity positioning, and then promot

> Innovative Sports sells a patented golf trainer called the Puttmaster. This device, which sells for $69.95, consists of a metal strip on the floor that is attached to the golfer’s putter with elastic bands. By taking practice strokes with the putter atta

> One of the main tenets of economic analysis is that people act in their narrow self-interest. Why then do people leave tips in restaurants? If a study were to compare the size of tips earned by servers in restaurants on interstate highways with those in

> Suppose that a mining operation has spent $8 million developing an ore deposit in South America. Current expectations are that the deposit will require two years of development and will result in a realizable cash flow of $10 million at that time. The co

> With gasoline prices at $3.00 per gallon, consumers are flocking to purchase hybrid vehicles (combination of gasoline and electric motors) that get 50 miles per gallon of gasoline. The monthly payment on a three-year lease of a hybrid is $499 compared to

> Artco manufactures fiberglass home and office planters in a variety of decorator colors. These planters, in three sizes, are used to hold indoor plants. Overhead is allocated based on the standard pounds of fiberglass per planter. Here are standards for

> Software Associates (SA) is a computer software consulting firm that specializes in designing and implementing integrated marketing database warehousing programs. Humphrey Catalog is a client. In preparing its bid for Humphrey, SA estimates its total lab

> A plant manufactures two products, Hi-V and Lo-V. Hi-V is the high-volume product that represents most of the plant’s revenue. It is produced 10 times per year, inventoried, and shipped to customers twice a month. Lo-V is a specialty pr

> To generate needed foreign exchange, the Cuban government entered into a joint venture with Domingo Cigars of Spain. The joint venture manufactures Domingo Cigars in Cuba using Cuban tobacco and employees. Domingo and the Cuban government split all profi

> Pebble Beach Sandals has designed and patented a luxury golf sandal for both men and women. The unique handmade designs include spikes and cleats to prevent the golfer from slipping during the swing. The sandal is made from sheepskin creating comfortable

> Ab Landlord owns a dilapidated 30-year-old apartment building in Los Angeles. The net cash flow from renting the apartments last year was $200,000. She expects that inflation will cause the net cash flows from renting the apartments to increase at a rate

> IVAX manufactures commercial brushes in two operating divisions (O1 and O2) and has two service departments (Human Resources and Janitorial/Maintenance). The two service departments’ costs are allocated to the two operating departments.

> You are evaluating ways to expand an optometry practice and its earnings capacity. Optometrists perform eye exams, prescribe corrective lenses (eyeglasses and contact lenses), and sell corrective lenses. One way to expand the practice is to hire an addit

> The following data summarize the operating performance of your company’s wholly owned Canadian subsidiary for 2009 to 2011. The cost of capital for this subsidiary is 10 percent. Required: Critically evaluate the performance of this sub

> Lys Wheels manufactures high-performance mountain bikes. Lys uses a predetermined overhead rate based on direct labor hours to absorb overhead to mountain bikes. For the last fiscal year, the firm had the following operating data: Actual direct labor hou

> Magic Floor produces and sells a complete line of floor care products: wax strippers, floor soaps, and floor waxes. All of these products are packaged on a new high-speed bottling fill line. Empty bottles (pints, quarts, half gallons, or gallons) are aut

> Sue Young sells fax machines for Fast Fax. There are two fax machines: model 700 and model 800. At the beginning of the month, Sue’s sales budget is as follows: At the end of the month, the number of units sold and the actual contributi

> Janitorial services is one of five service departments in a firm that allocates service department costs using the step-down allocation method. Janitorial services is currently the third service department (S3) in the step-down process. The following tab

> The sales department of a cellular phone company pays its salespeople $1,500 per month plus 25 percent of each new subscriber’s first month’s billings. A new subscriber’s first-month bill averages $80. Salespeople work 160 hours a month (four weeks at 40