Question: Sheet Company reported the following net income

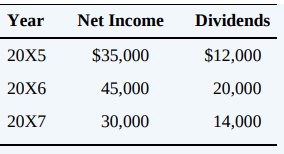

Sheet Company reported the following net income and dividends for the years indicated:

Pillow Corporation acquired 75 percent of Sheet’s common stock on January 1, 20X5. On that date, the fair value of Sheet’s net assets was equal to the book value. Pillow uses the equity method in accounting for its ownership in Sheet and reported a balance of $259,800 in its investment account on December 31, 20X7.

Required:

a. What amount did Pillow pay when it purchased Sheet’s shares?

b. What was the fair value of Sheet’s net assets on January 1, 20X5?

c. What amount was assigned to the NCI shareholders on January 1, 20X5?

d. What amount will be assigned to the NCI shareholders in the consolidated balance sheet prepared at December 31, 20X7?

Transcribed Image Text:

Year Net Income Dividends 20X5 $35,000 $12,000 20X6 45,000 20,000 20X7 30,000 14,000

> Palm Corporation and Staple Company have announced terms of an exchange agreement under which Palm will issue 8,000 shares of its $10 par value common stock to acquire all of Staple Company’s assets. Palm shares currently are trading at

> The trial balance data presented in Problem P6-34 can be converted to reflect use of the cost method by inserting the following amounts in place of those presented for Prime Corporation: Investment in Steak Company ……………………………..$280,000 Retained Earning

> On December 31, 20X7, Prime Corporation recorded the following entry on its books to adjust from the fully adjusted equity method to the modified equity method for its investment in Steak Company stock: Investment in Steak Company Stock ……………11,000 Reta

> Prime Corporation acquired 80 percent of Steak Company’s voting shares on January 1, 20X4, for $280,000 in cash and marketable securities. At that date, the noncontrolling interest had a fair value of $70,000 and Steak reported net asse

> The December 31, 20X6, condensed balance sheets of Pine Corporation and its 90 percent-owned subsidiary, Slim Corporation, are presented in the accompanying worksheet. Additional Information: 1. Pine’s investment in Slim was acquired f

> Song Corporation was created on January 1, 20X0, to develop computer software. On January 1, 20X5, Polka Company purchased 90 percent of Song’s common stock at underlying book value. At that date, the fair value of the non controlling i

> Point Corporation acquired 60 percent of Stick Company’s stock on January 1, 20X3, for $24,000 in excess of book value. On that date, the book values and fair values of Stick’s assets and liabilities were equal and the

> Pop Corporation acquired 70 percent of Soda Company’s voting common shares on January 1, 20X2, for $108,500. At that date, the non controlling interest had a fair value of $46,500 and Soda reported $70,000 of common stock outstanding an

> Phone Corporation owns 80 percent of Smart Company’s stock. At the end of 20X8, Phone and Smart reported the following partial operating results and inventory balances: Phone regularly prices its products at cost plus a 40 percent mar

> Plaza Corporation purchased 70 percent of Square Company’s voting common stock on January 1, 20X5, for $291,200. On that date, the non controlling interest had a fair value of $124,800 and the book value of Square’s ne

> Pepper Enterprises owns 95 percent of Salt Corporation. On January 1, 20X1, Salt issued $200,000 of five-year bonds at 115. Annual interest of 12 percent is paid semiannually on January 1 and July 1. Pepper purchased $100,000 of the bonds on August 31, 2

> Pirate Company purchased 60 percent ownership of Ship Corporation on January 1, 20X1, for $82,800. On that date, the non controlling interest had a fair value of $55,200 and Ship reported common stock outstanding of $100,000 and retained earnings of $20,

> On January 1, 20X1, Pesto Corporation purchased 90 percent of Sauce Corporation’s common stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of Sauce Corporation’s book value. Pesto uses the

> Plug Products owns 80 percent of the stock of Spark Filter Company, which it acquired at underlying book value on August 30, 20X6. At that date, the fair value of the non controlling interest was equal to 20 percent of the book value of Spark Filter. Sum

> Peace Corporation acquired 75 percent of the ownership of Symbol Company on January 1, 20X1. The fair value of the non controlling interest at acquisition was equal to its proportionate share of the fair value of the net assets of Symbol. The full amount

> In preparing the consolidation worksheet for Pencil Corporation and its 60 percent-owned subsidiary, Stylus Company, the following consolidation entries were proposed by Pencil’s bookkeeper: To eliminate the unpaid balance for interco

> Pawn Corporation acquired 70 percent of Shop Corporation’s voting stock on January 1, 20X2, for $416,500. The fair value of the non controlling interest was $178,500 at the date of acquisition. Shop reported common stock outstanding of $200,000 and retai

> Pizza Corporation acquired 80 percent ownership of Slice Products Company on January 1, 20X1, for $160,000. On that date, the fair value of the non controlling interest was $40,000, and Slice reported retained earnings of $50,000 and had $100,000 of comm

> Pirate Corporation acquired 60 percent ownership of Ship Company on January 1, 20X8, at underlying book value. At that date, the fair value of the non controlling interest was equal to 40 percent of the book value of Ship Company. Accumulated depreciatio

> This problem is a continuation of P5-35. Pillow Corporation acquired 80 percent ownership of Sheet Company on January 1, 20X7, for $173,000. At that date, the fair value of the non controlling interest was $43,250. The trial balances for the two companie

> Pillow Corporation acquired 80 percent ownership of Sheet Company on January 1, 20X7, for $173,000. At that date, the fair value of the non controlling interest was $43,250. The trial balances for the two companies on December 31, 20X7, included the foll

> Permott Corporation has been in the midst of a major expansion program. Much of its growth had been internal, but in 20X1 Permott decided to continue its expansion through the acquisition of other companies. The first company acquired was Sippy Inc., a s

> This problem is a continuation of P5-33. Pie Corporation acquired 75 percent of Slice Company’s ownership on January 1, 20X8, for $96,000. At that date, the fair value of the noncontrolling interest was $32,000. The book value of Slice&

> Pie Corporation acquired 75 percent of Slice Company’s ownership on January 1, 20X8, for $96,000. At that date, the fair value of the non controlling interest was $32,000. The book value of Slice’s net assets at acquis

> Paste Corporation acquired 70 percent of Stick Company’s stock on January 1, 20X9, for $105,000. At that date, the fair value of the non controlling interest was equal to 30 percent of the book value of Stick Company. The companies repo

> Paragraph Corporation acquired controlling ownership of Sentence Corporation on December 31, 20X3, and a consolidated balance sheet was prepared immediately. Partial balance sheet data for the two companies and the consolidated entity at that date follow

> On January 2, 20X8, Photo Corporation acquired 75 percent of Shutter Company’s outstanding common stock. In exchange for Shutter’s stock, Photo issued bonds payable with a par value of $500,000 and fair value of $510,0

> Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $102,200. At that date, the fair value of the non controlling interest was $43,800. Data from the balance sheets of the two companies in

> Pesto Company paid $164,000 to acquire 40 percent ownership of Sauce Company on January 1, 20X2. Net book value of Sauce’s assets on that date was $300,000. Book values and fair values of net assets held by Sauce were the same except fo

> Plug Corporation acquired 35 percent of Spark Corporation’s stock on January 1, 20X8, by issuing 25,000 shares of its $2 par value common stock. Spark Corporation’s balance sheet immediately before the acquisition cont

> On January 1, 20X0, Pepper Corporation issued 6,000 of its $10 par value shares to acquire 45 percent of the shares of Salt Manufacturing. Salt Manufacturing’s balance sheet immediately before the acquisition contained the following ite

> Peace Company issued common shares with a par value of $50,000 and a market value of $165,000 in exchange for 30 percent ownership of Symbol Corporation on January 1, 20X2. Symbol reported the following balances on that date: The estimated economic lif

> Par Corporation holds 60 percent of Short Publishing Company’s voting shares. Par issued $500,000 of 10 percent bonds with a 10-year maturity on January 1, 20X2, at 90. On January 1, 20X8, Short purchased $100,000 of the Par bonds for $

> This problem is a continuation of P5-37. Pirate Corporation acquired 60 percent ownership of Ship Company on January 1, 20X8, at underlying book value. At that date, the fair value of the non controlling interest was equal to 40 percent of the book value

> Pencil Company purchased 40 percent ownership of Stylus Corporation on January 1, 20X1, for $150,000. Stylus’s balance sheet at the time of acquisition was as follows: During 20X1 Stylus Corporation reported net income of $30,000 and

> On December 31, 20X6, Print Corporation and Size Company entered into a business combination in which Print acquired all of Size’s common stock for $935,000. At the date of combination, Size had common stock outstanding with a par value

> Prince Corporation acquired 100 percent of Sword Company on January 1, 20X7, for $203,000. The trial balances for the two companies on December 31, 20X7, included the following amounts: Additional Information: 1. On January 1, 20X7, Sword reported net

> Prime Corporation acquired 100 percent ownership of Steak Products Company on January 1, 20X1, for $200,000. On that date, Steak reported retained earnings of $50,000 and had $100,000 of common stock outstanding. Prime has used the equity method in accou

> Price Corporation acquired 100 percent ownership of Saver Company on January 1, 20X8, for $128,000. At that date, the fair value of Saver’s buildings and equipment was $20,000 more than the book value. Buildings and equipment are deprec

> Price Corporation acquired 100 percent ownership of Saver Company on January 1, 20X8, for $128,000. At that date, the fair value of Saver’s buildings and equipment was $20,000 more than the book value. Buildings and equipment are deprec

> On January 2, 20X8, Primary Corporation acquired 100 percent of Secondary Company’s outstanding common stock. In exchange for Secondary’s stock, Primary issued bonds payable with a par and fair value of $650,000 direct

> Pretzel Corporation acquired 100 percent of Stick Company’s outstanding shares on January 1, 20X7. Balance sheet data for the two companies immediately after the purchase follow: As indicated in the parent company balance sheet, Pretz

> Power Corporation acquired 100 percent ownership of Scrub Company on February 12, 20X9. At the date of acquisition, Scrub Company reported assets and liabilities with book values of $420,000 and $165,000, respectively, common stock outstanding of $80,000

> Powder Company spent $240,000 to acquire all of Sawmill Corporation’s stock on January 1, 20X2. On December 31, 20X4, the trial balances of the two companies were as follows: Sawmill Corporation reported retained earnings of $100,000

> Select the correct answer for each of the following questions. 1. Peel Company received a cash dividend from a common stock investment. Should Peel report an increase in the investment account if it carries the investment at fair value or if it uses the

> Powder Company spent $240,000 to acquire all of Sawmill Corporation’s stock on January 1, 20X2. The balance sheets of the two companies on December 31, 20X3, showed the following amounts: Sawmill reported retained earnings of $100,000

> Pot Inc. acquired all Seed Inc.’s outstanding $25 par common stock on December 31, 20X3, in exchange for 40,000 shares of its $25 par common stock. Pot’s common stock closed at $56.50 per share on a national stock exch

> Post Records Inc. acquired all of Script Studios’ voting shares on January 1, 20X2, for $280,000. Post’s balance sheet immediately after the combination contained the following balances: Script Studiosâ€&#

> Pork Corporation acquired all the voting shares of Swine Enterprises on January 1, 20X4. Balance sheet amounts for the companies on the date of acquisition were as follows: Swine Enterprises’ buildings and equipment were estimated to

> Pintime Industries Inc. entered into a business combination agreement with Sydrolized Chemical Corporation (SCC) to ensure an uninterrupted supply of key raw materials and to realize certain economies from combining the operating processes and the market

> On January 1, 20X1, Palpha Corporation acquired all of Stravo Company’s assets and liabilities by issuing shares of its $3 par value stock to the owners of Stravo Company in a business combination. Palpha also made a cash payment for st

> On January 1, 20X2, Plend Corporation acquired all of Stork Corporation’s assets and liabilities by issuing shares of its common stock. Partial balance sheet data for the companies prior to the business combination and immediately follo

> Pumpworks Inc. and Seaworthy Rope Company agreed to merge on January 1, 20X3. On the date of the merger agreement, the companies reported the following data: Pumpworks has 10,000 shares of its $20 par value shares outstanding on January 1, 20X3, and Se

> Following are the balance sheets of Power Boogie Musical Corporation and Shoot-Toot Tuba Company as of December 31, 20X5. In preparation for a possible business combination, a team of experts from Power Boogie Musical made a thorough examination and a

> Assume the same facts as in E8-9 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-9: Packed Corporation owns 70 percent of Snowball Enterprises’ stock. On January 1, 20X1, Packed sold $1 million par value,

> Pamrod Manufacturing acquired all the assets and liabilities of Stafford Industries on January 1, 20X2, in exchange for 4,000 shares of Pamrod’s $20 par value common stock. Balance sheet data for both companies just before the merger ar

> On January 1, 20X3, Pure Products Corporation issued 12,000 shares of its $10 par value stock to acquire the net assets of Steel Company. Underlying book value and fair value information for the balance sheet items of Steel at the time of acquisition fol

> The fair values of assets and liabilities held by three reporting units and other information related to the reporting units owned by Prover Company are as follows: Required: a. Determine the amount, if any, that Prover should report as a goodwill impa

> Saspro Division is considered to be an individual reporting unit of Pabor Company. Pabor acquired the division by issuing 100,000 shares of its common stock with a market price of $7.60 each. Pabor’s management was able to identify assets with fair value

> Power Company purchased Sark Corporation’s net assets on January 3, 20X2, for $625,000 cash. In addition, Power incurred $5,000 of direct costs in consummating the combination. At the time of acquisition, Sark reported the following his

> Pancor Corporation paid cash of $178,000 to acquire Sink Company’s net assets on February 1, 20X3. The balance sheet data for the two companies and fair value information for Sink immediately before the business combination were Requi

> Plint Corporation exchanged shares of its $2 par common stock for all of Sark Company’s assets and liabilities in a planned merger. Immediately prior to the combination, Sark’s assets and liabilities were as follows: Assets Cash & Equivalents …………………………

> On January 1, 20X2, Prost Company acquired all of SKK Corporation’s assets and liabilities by issuing 24,000 shares of its $4 par value common stock. At that date, Prost shares were selling at $22 per share. Historical cost and fair val

> Peal Corporation issued 4,000 shares of its $10 par value stock with a market value of $85,000 to acquire 85 percent of the common stock of Seed Company on August 31, 20X3. Seed’s fair value was determined to be $100,000 on that date. Peal had earlier pu

> Plumb Company created Stew Company as a wholly owned subsidiary by transferring assets and accounts payable to Stew in exchange for its common stock. Stew recorded the following entry when it received the assets and accounts payable: Required: a. What

> Pun Corporation concluded the fair value of Slender Company was $60,000 and paid that amount to acquire its net assets. Slender reported assets with a book value of $55,000 and fair value of $71,000 and liabilities with a book value and fair value of $20

> Pagle Corporation established a subsidiary to enter into a new line of business considered to be substantially more risky than Pagle’s current business. Pagle transferred the following assets and accounts payable to Sand Corporation in

> Pab Corporation decided to establish Sollon Company as a wholly owned subsidiary by transferring some of its existing assets and liabilities to the new entity. In exchange, Sollon issued Pab 30,000 shares of $6 par value common stock. The following infor

> Pie Corporation acquired 80 percent of Slice Company’s common stock on December 31, 20X5, at underlying book value. The book values and fair values of Slice’s assets and liabilities were equal, and the fair value of th

> Pawn Corporation purchased 30 percent of Shop Company’s common stock on January 1, 20X5, by issuing preferred stock with a par value of $50,000 and a market price of $120,000. The following amounts relate to Shop’s bal

> Select the correct answer for each of the following questions. 1. On July 1, 20X3, Barker Company purchased 20 percent of Acme Company’s outstanding common stock for $400,000 when the fair value of Acme’s net assets wa

> Potter Corporation and its subsidiary reported consolidated net income of $164,300 for 20X2. Potter owns 60 percent of the common shares of its subsidiary, acquired at book value. Non controlling interest was assigned income of $15,200 in the consolidate

> Select the correct answer for each of the following questions. 1. What is the theoretically preferred method of presenting a non controlling interest in a consolidated balance sheet? a. As a separate item within the liability section. b. As a deduction f

> Summer Company sells all its output at 25 percent above cost. Parade Corporation purchases all its inventory from Summer. Selected information on the operations of the companies over the past three years is as follows: Parade acquired 60 percent of the

> Paint Corporation owns 60 percent of Stain Company’s shares. Partial 20X2 financial data for the companies and consolidated entity were as follows: On January 1, 20X2, Paint’s inventory contained items purchased from

> On January 1, 20X1, Prize Corporation paid Morton Advertising $116,200 to acquire 70 percent of Statue Company’s stock. Prize also paid $45,000 to acquire $50,000 par value 8 percent, 10-year bonds directly from Statue on that date. Thi

> Assume the same facts as in E8-8 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-8: Suspect Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 year

> Punk Corporation purchased 90 percent of Soul Company’s voting common shares on January 1, 20X2, at underlying book value. At that date, the fair value of the non controlling interest was equal to 10 percent of the book value of Soul Co

> Packed Corporation owns 70 percent of Snowball Enterprises’ stock. On January 1, 20X1, Packed sold $1 million par value, 7 percent (paid semiannually), 20-year, first mortgage bonds to Kling Corporation at 97. On January 1, 20X8, Snowball purchased $300,

> Suspect Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 years and pay interest semiannually on January 1 and July 1. Prime Corporation purchased $400,000 of Suspect’s bonds from the original pu

> Suspect Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 years and pay interest semiannually on January 1 and July 1. Prime Corporation purchased $400,000 of Suspect’s bonds from the original pu

> Select the correct answer for each of the following questions. 1. [AICPA Adapted] Wagner, a holder of a $1,000,000 Palmer Inc. bond, collected the interest due on March 31, 20X8, and then sold the bond to Seal Inc. for $975,000. On that date, Palmer, a 7

> Proctor Corporation purchased bonds of its subsidiary from a non affiliate during 20X6. Although Proctor purchased the bonds at par value, a loss on bond retirement is reported in the 20X6 consolidated income statement as a result of the purchase. Requi

> Purse Corporation owns 70 percent of Scarf Company’s voting shares. On January 1, 20X3, Scarf sold bonds with a par value of $600,000 at 98. Purse purchased $400,000 par value of the bonds; the remainder was sold to non affiliates. The bonds mature in fi

> Stallion Corporation sold $100,000 par value, 10-year first mortgage bonds to Pony Corporation on January 1, 20X5. The bonds, which bear a nominal interest rate of 12 percent, pay interest semiannually on January 1 and July 1. The current market interest

> Sibling Company issued $500,000 par value, 10-year bonds at 104 on January 1, 20X3, which Mega Corporation purchased. The coupon rate on the bonds is 11 percent. Interest payments are made semiannually on July 1 and January 1. On July 1, 20X6, Parent Com

> Pepper Enterprises owns 95 percent of Salt Corporation. On January 1, 20X1, Salt issued $200,000 of five-year bonds at 115. Annual interest of 12 percent is paid semiannually on January 1 and July 1. Pepper purchased $100,000 of the bonds on July 1, 20X3

> Phoster Corporation established Skine Company as a wholly owned subsidiary. Phoster reported the following balance sheet amounts immediately before and after it transferred assets and accounts payable to Skine Company in exchange for 4,000 shares of $12

> Par Corporation holds 60 percent of Short Publishing Company’s voting shares. Par issued $500,000 of 10 percent (paid semiannually) bonds with a 10-year maturity on January 1, 20X2, at 90. On January 1, 20X8, Short purchased $100,000 of

> Pretzel Corporation owns 60 percent of Stick Corporation’s voting shares. On January 1, 20X2, Pretzel Corporation sold $150,000 par value, 6 percent first mortgage bonds to Stick for $156,000. The bonds mature in 10 years and pay interest semiannually on

> Pitcher Corporation purchased 60 percent of Softball Corporation’s voting common stock on January 1, 20X1. On January 1, 20X5, Pitcher received $245,000 from Softball for a truck Pitcher had purchased on January 1, 20X2, for $300,000. The truck is expect

> Pitcher Corporation purchased 60 percent of Softball Corporation’s voting common stock on January 1, 20X1. On December 31, 20X5, Pitcher received $210,000 from Softball for a truck Pitcher had purchased on January 1, 20X2, for $300,000. The truck is expe

> Paste Corporation owns 70 percent of Stick Corporation’s voting common stock. On March 12, 20X2, Stick sold land it had purchased for $140,000 to Paste for $185,000. Paste plans to build a new warehouse on the property in 20X3. Required: a. Give the wor

> Pam Corporation holds 70 percent ownership of Spray Enterprises. On December 31, 20X6, Spray paid Pam $40,000 for a truck that Pam had purchased for $45,000 on January 1, 20X2. The truck was considered to have a 15-year life from January 1, 20X2, and no

> On January 1, 20X5, Potter Corporation started using a wholly owned subsidiary to deliver all its sales overnight to its customers. During 20X5, Potter recorded delivery service expense of $76,000 and made payments of $58,000 to the subsidiary. Required

> Paragraph Corporation purchased land on January 1, 20X1, for $20,000. On June 10, 20X4, it sold the land to its subsidiary, Sentence Corporation, for $30,000. Paragraph owns 60 percent of Sentence’s voting shares. Required: a. Give the worksheet consoli

> Passenger Products purchased 65 percent of Seat Sales Company’s stock at underlying book value on January 1, 20X3. At that date, the fair value of the non controlling interest was equal to 35 percent of the book value of Seat Sales. Seat Sales reported s

> Plastic Corporation purchased management consulting services from its 75 percent-owned subsidiary, Spoon Inc. During 20X3, Plastic paid Spoon $123,200 for its services. For the year 20X4, Spoon billed Plastic $138,700 for such services and collected all

> Assume the same facts as in E8-7 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-7: Suspect Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 year

> Passport Manufacturing purchased an ultrasound drilling machine with a remaining 10-year economic life from a 70 percent-owned subsidiary for $360,000 on January 1, 20X6. Both companies use straight-line depreciation. The subsidiary recorded the followin