Question: Summer Company sells all its output at

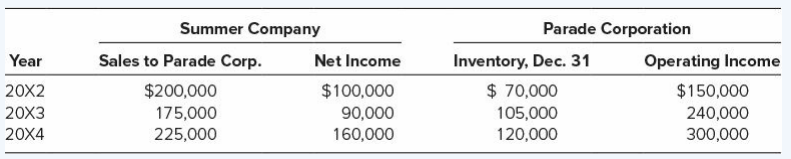

Summer Company sells all its output at 25 percent above cost. Parade Corporation purchases all its inventory from Summer. Selected information on the operations of the companies over the past three years is as follows:

Parade acquired 60 percent of the ownership of Summer on January 1, 20X1, at underlying book value.

Required:

Compute consolidated net income and income assigned to the controlling interest for 20X2, 20X3, and 20X4.

Transcribed Image Text:

Summer Company Parade Corporation Year Sales to Parade Corp. Net Income Inventory, Dec. 31 Operating Income $200,000 175,000 225,000 $100,000 90,000 $ 70,000 105,000 $150,000 240,000 20X2 20X3 20X4 160,000 120,000 300,000

> Paragraph Corporation acquired controlling ownership of Sentence Corporation on December 31, 20X3, and a consolidated balance sheet was prepared immediately. Partial balance sheet data for the two companies and the consolidated entity at that date follow

> On January 2, 20X8, Photo Corporation acquired 75 percent of Shutter Company’s outstanding common stock. In exchange for Shutter’s stock, Photo issued bonds payable with a par value of $500,000 and fair value of $510,0

> Phone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $102,200. At that date, the fair value of the non controlling interest was $43,800. Data from the balance sheets of the two companies in

> Pesto Company paid $164,000 to acquire 40 percent ownership of Sauce Company on January 1, 20X2. Net book value of Sauce’s assets on that date was $300,000. Book values and fair values of net assets held by Sauce were the same except fo

> Plug Corporation acquired 35 percent of Spark Corporation’s stock on January 1, 20X8, by issuing 25,000 shares of its $2 par value common stock. Spark Corporation’s balance sheet immediately before the acquisition cont

> On January 1, 20X0, Pepper Corporation issued 6,000 of its $10 par value shares to acquire 45 percent of the shares of Salt Manufacturing. Salt Manufacturing’s balance sheet immediately before the acquisition contained the following ite

> Peace Company issued common shares with a par value of $50,000 and a market value of $165,000 in exchange for 30 percent ownership of Symbol Corporation on January 1, 20X2. Symbol reported the following balances on that date: The estimated economic lif

> Par Corporation holds 60 percent of Short Publishing Company’s voting shares. Par issued $500,000 of 10 percent bonds with a 10-year maturity on January 1, 20X2, at 90. On January 1, 20X8, Short purchased $100,000 of the Par bonds for $

> This problem is a continuation of P5-37. Pirate Corporation acquired 60 percent ownership of Ship Company on January 1, 20X8, at underlying book value. At that date, the fair value of the non controlling interest was equal to 40 percent of the book value

> Pencil Company purchased 40 percent ownership of Stylus Corporation on January 1, 20X1, for $150,000. Stylus’s balance sheet at the time of acquisition was as follows: During 20X1 Stylus Corporation reported net income of $30,000 and

> On December 31, 20X6, Print Corporation and Size Company entered into a business combination in which Print acquired all of Size’s common stock for $935,000. At the date of combination, Size had common stock outstanding with a par value

> Prince Corporation acquired 100 percent of Sword Company on January 1, 20X7, for $203,000. The trial balances for the two companies on December 31, 20X7, included the following amounts: Additional Information: 1. On January 1, 20X7, Sword reported net

> Prime Corporation acquired 100 percent ownership of Steak Products Company on January 1, 20X1, for $200,000. On that date, Steak reported retained earnings of $50,000 and had $100,000 of common stock outstanding. Prime has used the equity method in accou

> Price Corporation acquired 100 percent ownership of Saver Company on January 1, 20X8, for $128,000. At that date, the fair value of Saver’s buildings and equipment was $20,000 more than the book value. Buildings and equipment are deprec

> Price Corporation acquired 100 percent ownership of Saver Company on January 1, 20X8, for $128,000. At that date, the fair value of Saver’s buildings and equipment was $20,000 more than the book value. Buildings and equipment are deprec

> On January 2, 20X8, Primary Corporation acquired 100 percent of Secondary Company’s outstanding common stock. In exchange for Secondary’s stock, Primary issued bonds payable with a par and fair value of $650,000 direct

> Pretzel Corporation acquired 100 percent of Stick Company’s outstanding shares on January 1, 20X7. Balance sheet data for the two companies immediately after the purchase follow: As indicated in the parent company balance sheet, Pretz

> Power Corporation acquired 100 percent ownership of Scrub Company on February 12, 20X9. At the date of acquisition, Scrub Company reported assets and liabilities with book values of $420,000 and $165,000, respectively, common stock outstanding of $80,000

> Powder Company spent $240,000 to acquire all of Sawmill Corporation’s stock on January 1, 20X2. On December 31, 20X4, the trial balances of the two companies were as follows: Sawmill Corporation reported retained earnings of $100,000

> Select the correct answer for each of the following questions. 1. Peel Company received a cash dividend from a common stock investment. Should Peel report an increase in the investment account if it carries the investment at fair value or if it uses the

> Powder Company spent $240,000 to acquire all of Sawmill Corporation’s stock on January 1, 20X2. The balance sheets of the two companies on December 31, 20X3, showed the following amounts: Sawmill reported retained earnings of $100,000

> Pot Inc. acquired all Seed Inc.’s outstanding $25 par common stock on December 31, 20X3, in exchange for 40,000 shares of its $25 par common stock. Pot’s common stock closed at $56.50 per share on a national stock exch

> Post Records Inc. acquired all of Script Studios’ voting shares on January 1, 20X2, for $280,000. Post’s balance sheet immediately after the combination contained the following balances: Script Studiosâ€&#

> Pork Corporation acquired all the voting shares of Swine Enterprises on January 1, 20X4. Balance sheet amounts for the companies on the date of acquisition were as follows: Swine Enterprises’ buildings and equipment were estimated to

> Sheet Company reported the following net income and dividends for the years indicated: Pillow Corporation acquired 75 percent of Sheet’s common stock on January 1, 20X5. On that date, the fair value of Sheet’s net as

> Pintime Industries Inc. entered into a business combination agreement with Sydrolized Chemical Corporation (SCC) to ensure an uninterrupted supply of key raw materials and to realize certain economies from combining the operating processes and the market

> On January 1, 20X1, Palpha Corporation acquired all of Stravo Company’s assets and liabilities by issuing shares of its $3 par value stock to the owners of Stravo Company in a business combination. Palpha also made a cash payment for st

> On January 1, 20X2, Plend Corporation acquired all of Stork Corporation’s assets and liabilities by issuing shares of its common stock. Partial balance sheet data for the companies prior to the business combination and immediately follo

> Pumpworks Inc. and Seaworthy Rope Company agreed to merge on January 1, 20X3. On the date of the merger agreement, the companies reported the following data: Pumpworks has 10,000 shares of its $20 par value shares outstanding on January 1, 20X3, and Se

> Following are the balance sheets of Power Boogie Musical Corporation and Shoot-Toot Tuba Company as of December 31, 20X5. In preparation for a possible business combination, a team of experts from Power Boogie Musical made a thorough examination and a

> Assume the same facts as in E8-9 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-9: Packed Corporation owns 70 percent of Snowball Enterprises’ stock. On January 1, 20X1, Packed sold $1 million par value,

> Pamrod Manufacturing acquired all the assets and liabilities of Stafford Industries on January 1, 20X2, in exchange for 4,000 shares of Pamrod’s $20 par value common stock. Balance sheet data for both companies just before the merger ar

> On January 1, 20X3, Pure Products Corporation issued 12,000 shares of its $10 par value stock to acquire the net assets of Steel Company. Underlying book value and fair value information for the balance sheet items of Steel at the time of acquisition fol

> The fair values of assets and liabilities held by three reporting units and other information related to the reporting units owned by Prover Company are as follows: Required: a. Determine the amount, if any, that Prover should report as a goodwill impa

> Saspro Division is considered to be an individual reporting unit of Pabor Company. Pabor acquired the division by issuing 100,000 shares of its common stock with a market price of $7.60 each. Pabor’s management was able to identify assets with fair value

> Power Company purchased Sark Corporation’s net assets on January 3, 20X2, for $625,000 cash. In addition, Power incurred $5,000 of direct costs in consummating the combination. At the time of acquisition, Sark reported the following his

> Pancor Corporation paid cash of $178,000 to acquire Sink Company’s net assets on February 1, 20X3. The balance sheet data for the two companies and fair value information for Sink immediately before the business combination were Requi

> Plint Corporation exchanged shares of its $2 par common stock for all of Sark Company’s assets and liabilities in a planned merger. Immediately prior to the combination, Sark’s assets and liabilities were as follows: Assets Cash & Equivalents …………………………

> On January 1, 20X2, Prost Company acquired all of SKK Corporation’s assets and liabilities by issuing 24,000 shares of its $4 par value common stock. At that date, Prost shares were selling at $22 per share. Historical cost and fair val

> Peal Corporation issued 4,000 shares of its $10 par value stock with a market value of $85,000 to acquire 85 percent of the common stock of Seed Company on August 31, 20X3. Seed’s fair value was determined to be $100,000 on that date. Peal had earlier pu

> Plumb Company created Stew Company as a wholly owned subsidiary by transferring assets and accounts payable to Stew in exchange for its common stock. Stew recorded the following entry when it received the assets and accounts payable: Required: a. What

> Pun Corporation concluded the fair value of Slender Company was $60,000 and paid that amount to acquire its net assets. Slender reported assets with a book value of $55,000 and fair value of $71,000 and liabilities with a book value and fair value of $20

> Pagle Corporation established a subsidiary to enter into a new line of business considered to be substantially more risky than Pagle’s current business. Pagle transferred the following assets and accounts payable to Sand Corporation in

> Pab Corporation decided to establish Sollon Company as a wholly owned subsidiary by transferring some of its existing assets and liabilities to the new entity. In exchange, Sollon issued Pab 30,000 shares of $6 par value common stock. The following infor

> Pie Corporation acquired 80 percent of Slice Company’s common stock on December 31, 20X5, at underlying book value. The book values and fair values of Slice’s assets and liabilities were equal, and the fair value of th

> Pawn Corporation purchased 30 percent of Shop Company’s common stock on January 1, 20X5, by issuing preferred stock with a par value of $50,000 and a market price of $120,000. The following amounts relate to Shop’s bal

> Select the correct answer for each of the following questions. 1. On July 1, 20X3, Barker Company purchased 20 percent of Acme Company’s outstanding common stock for $400,000 when the fair value of Acme’s net assets wa

> Potter Corporation and its subsidiary reported consolidated net income of $164,300 for 20X2. Potter owns 60 percent of the common shares of its subsidiary, acquired at book value. Non controlling interest was assigned income of $15,200 in the consolidate

> Select the correct answer for each of the following questions. 1. What is the theoretically preferred method of presenting a non controlling interest in a consolidated balance sheet? a. As a separate item within the liability section. b. As a deduction f

> Paint Corporation owns 60 percent of Stain Company’s shares. Partial 20X2 financial data for the companies and consolidated entity were as follows: On January 1, 20X2, Paint’s inventory contained items purchased from

> On January 1, 20X1, Prize Corporation paid Morton Advertising $116,200 to acquire 70 percent of Statue Company’s stock. Prize also paid $45,000 to acquire $50,000 par value 8 percent, 10-year bonds directly from Statue on that date. Thi

> Assume the same facts as in E8-8 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-8: Suspect Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 year

> Punk Corporation purchased 90 percent of Soul Company’s voting common shares on January 1, 20X2, at underlying book value. At that date, the fair value of the non controlling interest was equal to 10 percent of the book value of Soul Co

> Packed Corporation owns 70 percent of Snowball Enterprises’ stock. On January 1, 20X1, Packed sold $1 million par value, 7 percent (paid semiannually), 20-year, first mortgage bonds to Kling Corporation at 97. On January 1, 20X8, Snowball purchased $300,

> Suspect Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 years and pay interest semiannually on January 1 and July 1. Prime Corporation purchased $400,000 of Suspect’s bonds from the original pu

> Suspect Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 years and pay interest semiannually on January 1 and July 1. Prime Corporation purchased $400,000 of Suspect’s bonds from the original pu

> Select the correct answer for each of the following questions. 1. [AICPA Adapted] Wagner, a holder of a $1,000,000 Palmer Inc. bond, collected the interest due on March 31, 20X8, and then sold the bond to Seal Inc. for $975,000. On that date, Palmer, a 7

> Proctor Corporation purchased bonds of its subsidiary from a non affiliate during 20X6. Although Proctor purchased the bonds at par value, a loss on bond retirement is reported in the 20X6 consolidated income statement as a result of the purchase. Requi

> Purse Corporation owns 70 percent of Scarf Company’s voting shares. On January 1, 20X3, Scarf sold bonds with a par value of $600,000 at 98. Purse purchased $400,000 par value of the bonds; the remainder was sold to non affiliates. The bonds mature in fi

> Stallion Corporation sold $100,000 par value, 10-year first mortgage bonds to Pony Corporation on January 1, 20X5. The bonds, which bear a nominal interest rate of 12 percent, pay interest semiannually on January 1 and July 1. The current market interest

> Sibling Company issued $500,000 par value, 10-year bonds at 104 on January 1, 20X3, which Mega Corporation purchased. The coupon rate on the bonds is 11 percent. Interest payments are made semiannually on July 1 and January 1. On July 1, 20X6, Parent Com

> Pepper Enterprises owns 95 percent of Salt Corporation. On January 1, 20X1, Salt issued $200,000 of five-year bonds at 115. Annual interest of 12 percent is paid semiannually on January 1 and July 1. Pepper purchased $100,000 of the bonds on July 1, 20X3

> Phoster Corporation established Skine Company as a wholly owned subsidiary. Phoster reported the following balance sheet amounts immediately before and after it transferred assets and accounts payable to Skine Company in exchange for 4,000 shares of $12

> Par Corporation holds 60 percent of Short Publishing Company’s voting shares. Par issued $500,000 of 10 percent (paid semiannually) bonds with a 10-year maturity on January 1, 20X2, at 90. On January 1, 20X8, Short purchased $100,000 of

> Pretzel Corporation owns 60 percent of Stick Corporation’s voting shares. On January 1, 20X2, Pretzel Corporation sold $150,000 par value, 6 percent first mortgage bonds to Stick for $156,000. The bonds mature in 10 years and pay interest semiannually on

> Pitcher Corporation purchased 60 percent of Softball Corporation’s voting common stock on January 1, 20X1. On January 1, 20X5, Pitcher received $245,000 from Softball for a truck Pitcher had purchased on January 1, 20X2, for $300,000. The truck is expect

> Pitcher Corporation purchased 60 percent of Softball Corporation’s voting common stock on January 1, 20X1. On December 31, 20X5, Pitcher received $210,000 from Softball for a truck Pitcher had purchased on January 1, 20X2, for $300,000. The truck is expe

> Paste Corporation owns 70 percent of Stick Corporation’s voting common stock. On March 12, 20X2, Stick sold land it had purchased for $140,000 to Paste for $185,000. Paste plans to build a new warehouse on the property in 20X3. Required: a. Give the wor

> Pam Corporation holds 70 percent ownership of Spray Enterprises. On December 31, 20X6, Spray paid Pam $40,000 for a truck that Pam had purchased for $45,000 on January 1, 20X2. The truck was considered to have a 15-year life from January 1, 20X2, and no

> On January 1, 20X5, Potter Corporation started using a wholly owned subsidiary to deliver all its sales overnight to its customers. During 20X5, Potter recorded delivery service expense of $76,000 and made payments of $58,000 to the subsidiary. Required

> Paragraph Corporation purchased land on January 1, 20X1, for $20,000. On June 10, 20X4, it sold the land to its subsidiary, Sentence Corporation, for $30,000. Paragraph owns 60 percent of Sentence’s voting shares. Required: a. Give the worksheet consoli

> Passenger Products purchased 65 percent of Seat Sales Company’s stock at underlying book value on January 1, 20X3. At that date, the fair value of the non controlling interest was equal to 35 percent of the book value of Seat Sales. Seat Sales reported s

> Plastic Corporation purchased management consulting services from its 75 percent-owned subsidiary, Spoon Inc. During 20X3, Plastic paid Spoon $123,200 for its services. For the year 20X4, Spoon billed Plastic $138,700 for such services and collected all

> Assume the same facts as in E8-7 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-7: Suspect Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 year

> Passport Manufacturing purchased an ultrasound drilling machine with a remaining 10-year economic life from a 70 percent-owned subsidiary for $360,000 on January 1, 20X6. Both companies use straight-line depreciation. The subsidiary recorded the followin

> Select the correct answer for each of the following questions. 1. Upper Company holds 60 percent of Lower Company’s voting shares. During the preparation of consolidated financial statements for 20X5, the following consolidation entry w

> Plumber Corporation owns 60 percent of Socket Corporation’s voting common stock. On December 31, 20X4, Plumber paid Socket $276,000 for dump trucks Socket had purchased on January 1, 20X2. Both companies use straight-line depreciation.

> Pocket Corporation holds 70 percent of Strap Company’s voting common stock. On January 1, 20X2, Strap paid $300,000 to acquire a building with a 15-year expected economic life. Strap uses straight-line depreciation for all depreciable assets. On December

> Parent Company holds 90 percent of Surrogate Company’s voting common shares. On December 31, 20X8, Parent recorded a loss of $16,000 on the sale of equipment to Surrogate. At the time of the sale, the equipment’s estimated remaining economic life was eig

> Pea Company purchased 70 percent of Split Company’s stock approximately 20 years ago. On December 31, 20X8, Pea purchased a building from Split for $300,000. Split had purchased the building on January 1, 20X1, at a cost of $400,000 and used straight-lin

> Post Delivery Service acquired at book value 80 percent of the voting shares of Script Real Estate Company. On that date, the fair value of the non controlling interest was equal to 20 percent of Script’s book value. Script Real Estate reported common st

> Progeny Corporation owns 75 percent of Spawn Corporation’s voting common stock. Progeny reported income from its separate operations of $90,000 and $110,000 in 20X4 and 20X5, respectively. Spawn reported net income of $60,000 and $40,000 in 20X4 and 20X5

> Playoff Corporation holds 90 percent ownership of Series Company. On July 1, 20X3, Playoff sold equipment that it had purchased for $30,000 on January 1, 20X1, to Series for $28,000. The equipment’s original six-year estimated total economic life remains

> Photo Industries has owned 80 percent of Shutter Corporation for many years. On January 1, 20X6, Photo paid Shutter $270,000 to acquire equipment that Shutter had purchased on January 1, 20X3, for $300,000. The equipment is expected to have no scrap valu

> Pester Company transferred the following assets to a newly created subsidiary, Shumby Corporation, in exchange for 40,000 shares of its $3 par value stock Required: a. Give the journal entry in which Pester recorded the transfer of assets to Shumby Cor

> On January 1, 20X7, Pillow Corporation sold to Sheet Corporation equipment it had purchased for $150,000 and used for eight years. Pillow recorded a gain of $14,000 on the sale. The equipment has a total useful life of 15 years and is depreciated on a st

> For each question, select the single best answer. 1. Water Company owns 80 percent of Fire Company’s outstanding common stock. On December 31, 20X9, Fire sold equipment to Water at a price in excess of Fire’s carrying

> Pie Bakery owns 60 percent of Slice Products Company’s stock. During 20X8, Slice produced 100,000 bags of flour, which it sold to Pie Bakery for $900,000. On December 31, 20X8, Pie had 20,000 bags of flour purchased from Slice Products on hand. Slice pri

> Planner Corporation owns 60 percent of Schedule Company’s voting shares. During 20X3, Planner produced 25,000 computer desks at a cost of $82 each and sold 10,000 of them to Schedule for $94 each. Schedule sold 7,000 of the desks to unaffiliated companie

> Planet Corporation acquired 90 percent of Saturn Company’s voting shares of stock in 20X1. During 20X4, Planet purchased 40,000 Play day doghouses for $24 each and sold 25,000 of them to Saturn for $30 each. Saturn sold 18,000 of the doghouses to retail

> Planet Corporation acquired 90 percent of Saturn Company’s voting shares of stock in 20X1. During 20X4, Planet purchased 40,000 Play day doghouses for $24 each and sold 25,000 of them to Saturn for $30 each. Saturn sold all of the doghouses to retail est

> Select the correct answer for each of the following questions. Amber Corporation holds 80 percent of the stock of Movie Productions Inc. During 20X4, Amber purchased an inventory of snack bar items for $40,000 and resold $30,000 to Movie Productions for

> Select the correct answer for each of the following questions. Lorn Corporation purchased inventory from Dresser Corporation for $120,000 on September 20, 20X1, and resold 80 percent of the inventory to unaffiliated companies prior to December 31, 20X1,

> Select the correct answer for each of the following questions. Blue Company purchased 60 percent ownership of Kelly Corporation in 20X1. On May 10, 20X2, Kelly purchased inventory from Blue for $60,000. Kelly sold all of the inventory to an unaffiliated

> Select the correct answer for each of the following questions. 1. During 20X3, Park Corporation recorded sales of inventory for $500,000 to Small Company, its wholly owned subsidiary, on the same terms as sales made to third parties. At December 31, 20X3

> Assume the same facts as in E8-6 except that the company uses straight-line amortization. Required Select the correct answer for each of the following questions. 1. What amount of interest expense should be included in the 20X4 consolidated income statem

> Power Products Corporation, which sells a broad line of home detergent products, owns 75 percent of the stock of Scrub Soap Company. During 20X8, Scrub sold soap products to Power Products for $180,000, which it had produced for $120,000. Power Products

> Plump Corporation holds 60 percent ownership of Slim Company. Each year, Slim purchases large quantities of a gnarl root used in producing health drinks. Slim purchased $150,000 of roots in 20X7 and sold $40,000 of these purchases to Plump for $60,000. B

> The December 31, 20X8, balance sheets for Pint Corporation and its 70 percent-owned subsidiary Saloon Company contained the following summarized amounts: Pint acquired the shares of Saloon Company on January 1, 20X7. On December 31, 20X8, assume Pint s

> Pistol Corporation acquired 70 percent of Scope Corporation’s voting stock on May 18, 20X1. The companies reported the following data with respect to intercompany sales in 20X4 and 20X5: Pistol reported operating income (excluding inc