Question: Sier Specialty Corp., a division of FH

Sier Specialty Corp., a division of FH Inc., manufactures three models of bicycle gearshift components that are sold to bicycle manufacturers, retailers, and catalogue outlets. Since beginning operations in 1969, Sier has used normal absorption costing and has assumed a fi rst-in, first-out cost flow in its perpetual inventory system. Except for overhead, manufacturing costs are accumulated using actual costs. Overhead is applied to production using predetermined overhead rates. The balances of the inventory accounts at the end of Sier’s fiscal year, September 30, 2017, follow. The inventories are stated at cost before any year-end adjustments.

Finished goods………………………….$757,000

Work in process……………………………192,500

Raw materials…………………………….300,000

Factory supplies ……………………………69,000

The following information relates to Sier’s inventory and operations:

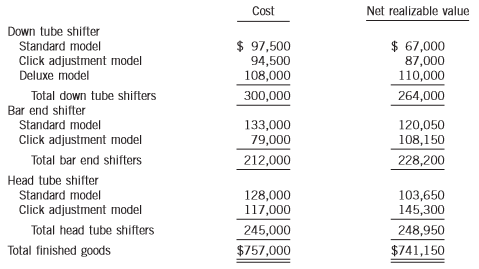

1. The finished goods inventory consists of these items:

2. Half of the finished goods inventory of head tube shifters is at catalogue outlets on consignment.

3. Three-quarters of the finished goods inventory of bar end shifters has been pledged as collateral for a bank loan.

4. Half of the raw materials balance is for derailleurs acquired at a contracted price that is 20% above the current market price. The net realizable value of the rest of the raw materials is $135,500.

5. The total net realizable value of the work-in-process inventory is $105,500.

6. Included in the cost of factory supplies are obsolete items with a historical cost of $4,200. The net realizable value of the remaining factory supplies is $65,900.

7. Sier applies the lower of cost and net realizable value method to each of the three types of shifters in finished goods inventory. For each of the other three inventory accounts, Sier applies the lower of cost and net realizable value method to the total of each inventory account.

8. Consider all of the amounts presented above as being material amounts in relation to Sier’s financial statements as a whole.

Instructions:

(a) Assuming that ASPE is followed, prepare the inventory section of Sier’s statement of financial position as at September 30, 2017, including any required note(s).

(b) Regardless of your answer to (a), assume that the net realizable value of Sier’s inventories is less than cost. Explain how this decline would be presented in Sier’s income statement for the fiscal year ended September 30, 2017, under ASPE.

(c) Assume that Sier has a firm purchase commitment for the same type of derailleur that is included in the raw materials inventory as at September 30, 2017, and that the purchase commitment is at a contracted price that is 15% higher than the current market price. These derailleurs are to be delivered to Sier after September 30, 2017. Discuss the impact, if any, that this purchase commitment would have on Sier’s financial statements prepared for the fiscal year ended September 30, 2017, under ASPE.

(d) How would your response to (c) change under IFRS?

(e) Explain and compare the disclosure requirements under ASPE and IFRS.

Transcribed Image Text:

Cost Net realizable value Down tube shifter $ 97,500 94,500 $ 67,000 87,000 110,000 Standard model Click adjustment model Deluxe model 108,000 Total down tube shifters 300,000 264,000 Bar end shifter Standard model 133,000 79,000 120,050 Click adjustment model 108,150 Total bar end shifters 212,000 228,200 Head tube shifter Standard model Click adjustment model 128,000 117,000 103,650 145,300 Total head tube shifters 245,000 248,950 Total finished goods $757,000 $741,150

> A business using the retail method of inventory costing determines that inventory at retail is $775,000. If the ratio of cost to retail price is 66%, what is the amount of inventory to be reported on the financial statements?

> Based on the data in Exercise 6-15 and assuming that cost was determined by the FIFO method, show how the inventory would appear on the balance sheet. Data from Exercise 6-15: On the basis of the following data, determine the value of the inventory at

> From the list that follows, identify the accounts that should be closed to Income Summary at the end of the fiscal year: A. Accounts Payable B. Accumulated Depreciation—Equipment C. Depreciation Expense—Equipment D. Equipment E. Common Stock F. Dividends

> K. Mello Company has three employees—a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: For the current pay period, the computer programmer worked 44 hours and

> MGM Resorts International owns and operates hotels and casinos including the MGM Grand and the Bellagio in Las Vegas, Nevada. As of a recent year, MGM reported accounts receivable of $562,947,000 and allowance for doubtful accounts of $89,602,000. Johnso

> Fed Ex Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: A. Prepare an income statement. B. Compare your income statement with the income statement that is available at FedExâ€&

> At the end of the current year, the accounts receivable account has a debit balance of $2,950,000 and sales for the year total $27,400,000. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the following assumptio

> A business issued a 60-day note for $75,000 to a creditor on account. The note was discounted at 7%. Journalize the entries to record (A) the issuance of the note and (B) the payment of the note at maturity.

> Indicate whether each of the following types of transactions will either (A) increase stockholders’ equity or (B) decrease stockholders’ equity: 1. Expenses 2. issuing common stock in exchange for cash 3. dividends 4. revenues

> Sun Airlines is a commercial airline that targets business and non-business travelers. In recent months, the airline has been unprofitable. The company has break-even sales volume of 75% of capacity, which is significantly higher than the industry average

> Identify each of the following as (A) a current asset or (B) property, plant, and equipment: 1. Accounts Receivable 2. Building 3. Cash 4. Equipment 5. Prepaid Insurance 6. Supplies

> Bon Nebo Co. sold 25,000 annual subscriptions of Bjorn for $85 during December 20Y5. These new subscribers will receive monthly issues, beginning in January 20Y6. In addition, the business had taxable income of $840,000 during the first calendar quarter o

> Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 2018, are as follows: Prepare a retained earnings statement for the year. Retained Earnings 31,200 May 1 (2017) 475,500 Dividends Apr. 30 Sept. 30 1,250 Apг.

> Climate Control Systems Co. offers its services to residents in the Spokane area. Selected accounts from the ledger of Climate Control Systems for the fiscal year ended December 31, 2018, are as follows: Prepare a retained earnings statemen

> The debits and credits from four related transactions, A through D, are presented in the following T accounts. Describe each transaction. Cash Accounts Payable B 300 3,920 A 20,580 D 16,660 D 16,660 Inventory A 20,580 3,920 300

> A retailer is considering the purchase of 250 units of a specific item from either of two suppliers. Their offers are as follows: Supplier One: $400 a unit, total of $100,000, 1/10, n/30, no charge for freight. Supplier Two: $399 a unit, total of $99,750

> A business using the retail method of inventory costing determines that inventory at retail is $1,235,000. If the ratio of cost to retail price is 54%, what is the amount of inventory to be reported on the financial statements?

> An accountant prepared the following post-closing trial balance: Prepare a corrected post-closing trial balance. Assume that all accounts have normal balances and that the amounts shown are correct. Security Services Co. Post-Closing Trial Balance

> The following preliminary unadjusted trial balance of Ranger Co., a sports ticket agency, does not balance: When the ledger and other records are reviewed, you discover the following: (1) the debits and credits in the cash account total $77,600 and $62

> The actual cash received from cash sales was $295,455, and the amount indicated by the cash register total was $295,340. Journalize the entry to record the cash receipts and cash sales.

> Break-even analysis is an important tool for managing any business, including colleges and universities. In a group, identify three areas where break-even analysis might be used at your college or university. For each area, identify the revenues, variabl

> The Boeing Company is one of the world’s major aerospace firms with operations involving commercial aircraft, military aircraft, missiles, satellite systems, and information and battle management systems. As of a recent year, Boeing had $4,281 million of

> Warwick’s Co., a women’s clothing store, purchased $75,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30. Warwick’s returned $9,000 of the merchandise, receiving a credit memo. Journalize Warwick’s entries to record (A) the

> A business using the retail method of inventory costing determines that inventory at retail is $396,400. If the ratio of cost to retail price is 61%, what is the amount of inventory to be reported on the financial statements?

> For a recent year, Best Buy reported sales of $42,410 million. Its gross profit was $9,690 million. What was the amount of Best Buy’s cost of goods sold?

> During the current year, merchandise is sold for $11,750,000. The cost of the goods sold is $7,050,000. A. What is the amount of the gross profit? B. Compute the gross profit percentage (gross profit divided by sales). C. Will the income statement always

> The inventory was destroyed by fire on December 31. The following data were obtained from the accounting records: A. Estimate the cost of the inventory destroyed. B. Briefly describe the situations in which the gross profit method is useful. Jan. 1

> List the errors you find in the following balance sheet. Prepare a corrected balance sheet. Labyrinth Services Co. Balance Sheet For the Year Ended August 31, 2018 Assets Current assets: $ 18,500 31,300 Cash....... Accounts payable.. Supplies . Prep

> The units of an item available for sale during the year were as follows: There are 1,100 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost by the (A) first-in, first-out meth

> Summary operating data for Custom Wire & Tubing Company during the year ended April 30, 2018, are as follows: cost of goods sold, $6,100,000; administrative expenses, $740,000; interest expense, $25,000; rent revenue, $60,000; sales, $9,332,500; and sell

> The following income statement for Curbstone Company was prepared for the year ended August 31, 2018: A. Identify the errors in the income statement. B. Prepare a corrected income statement. Curbstone Company Income Statement For the Year Ended Aug

> The controller of Tri Con Global Systems Inc. has developed a new costing system that traces the cost of activities to products. The new system is able to measure post-manufacturing activities, such as selling, promotional, and distribution activities, a

> In August, Lannister Company introduced a new performance measurement system in manufacturing operations. One of the new performance measures is lead time, which is determined by tagging a random sample of items with a log sheet throughout the month. The

> Fellows Inc., a publicly traded manufacturing company in the technology industry, has a November 30 fiscal year end. The company grew rapidly in its first 10 years and made three public offerings over this period. During its rapid growth period, Fellows

> Harper Corporation had the following portfolio of investments at December 31, 2017, that qualified and were accounted for using the FV-OCI method: Early in 2018, Harper sold all the Frank Inc. shares for $17 per share, less a 1% commission on the sale.

> Brooks Corp. is a medium-sized corporation that specializes in quarrying stone for building construction. The company has long dominated the market, and at one time had 70% market penetration. During prosperous years, the company’s profits and conservati

> P9-10 Octavio Corp. prepares financial statements annually on December 31, its fiscal year end. At December 31, 2017, the company has the account Investments in its general ledger, containing the following debits for investment purchases, and no credits:

> MacAskill Corp. has the following portfolio of securities acquired for trading purposes and accounted for using the FV-NI model at September 30, 2017, the end of the company’s third quarter: On October 8, 2017, the Yuen shares were so

> Milford Company determined its ending inventory at cost and at lower of cost and net realizable value at December 31, 2015, 2016, and 2017, as follows: Instructions: (a) Prepare the journal entries that are required at December 31, 2016 and 2017, assum

> Lupulin Limited stocks a variety of sports equipment for sale to institutions. The following stock record card for basketballs was taken from the records at the December 31, 2017 year end: A physical inventory on December 31, 2017, reveals that 100 bas

> Some of the transactions of Collins Corp. during August follow. Collins uses the periodic inventory method. Aug. 10…………………………..Purchased merchandise on account, $12,000, terms 2/10, n/30. 13……………Returned $1,200 of the purchase of August 10 and received

> Halm Skidoos Limited, a private company that began operations in 2014, always values its inventories at their current net realizable value. The company uses ASPE. Its annual inventory figure is arrived at by taking a physical count and then pricing each

> Ianthe Limited, a manufacturer of small tools, provided the following information from its accounting records for the year ended December 31, 2017: Inventory at December 31, 2017 (based on physical count of goods in Ianthe’s plant, at

> In its 2014 financial statements (Note 3), Air Canada has disclosed its critical estimates and judgements used in preparing the financial statements. Instructions: Access the 2014 audited annual financial statements for Air Canada for the year ended Dec

> On February 1, 2017, Akeson Ltd. began selling electric scooters that it purchased exclusively from Ionone Motors Inc. Ionone Motors offers vendor rebates based on the volume of annual sales to its customers, and calculates and pays the rebates at its fi

> The cash account of Villa Corp. shows a ledger balance of $3,969.85 on June 30, 2017. The bank statement as at that date indicates a balance of $4,150. When the statement was compared with the cash records, the following facts were determined: 1. There w

> The records for the Clothing Department of Ji-Woon’s Department Store are summarized as follows for the month of January: 1. Inventory, January 1: at retail, $28,000; at cost, $18,000 2. Purchases in January: at retail, $147,000; at cost, $110,000 3. Fre

> The records for the Clothing Department of Danny’s Discount Store are summarized below for the month of January. Inventory, January 1: at retail $25,000; at cost $17,000 Purchases in January: at retail $137,000; at cost $82,500 Freight-in: $7,000 Purchas

> The Eserine Wood Corporation manufactures desks. Most of the company’s desks are standard models that are sold at catalogue prices. At December 31, 2017, the following finished desks appear in the company’s inventory:

> Logo Limited follows ASPE. It manufactures sweatshirts for sale to athletic-wear retailers. The following summary information was available for Logo for the year ended December 31, 2016: Cash……………………………………………….$20,000 Accounts receivable…………………………..40,0

> The following independent situations relate to inventory accounting: 1. Kessel Co. purchased goods with a list price of $175,000 and a trade discount of 20% based on the quantity purchased, with terms 2/10, net 30. 2. Sanderson Company’

> Desrosiers Ltd. had the following long-term receivable account balances at December 31, 2016: Notes receivable……………………………………….$1,800,000 Notes receivable—Employees………………………..400,000 Transactions during 2017 and other information relating to Desrosiers’

> On December 31, 2017, Zhang Ltd. rendered services to Beggy Corp. at an agreed price of $91,844.10. In payment, Zhang accepted $36,000 cash and agreed to receive the balance in four equal installments of $18,000 that are due each December 31. An interest

> Lian Tang, HK Corporation’s controller, is concerned that net income may be lower this year. He is afraid that upper-level management might recommend cost reductions by laying off accounting staff, himself included. Tang knows that depreciation is a majo

> On October 1, 2017, Healy Farm Equipment Corp. sold a harvesting machine to Homestead Industries. Instead of a cash payment, Homestead Industries gave Healy Farm Equipment a $150,000, two-year, 10% note; 10% is a realistic rate for a note of this type. T

> The statement of financial position of Alice Inc. at December 31, 2016, includes the following: Transactions in 2017 include the following: 1. Accounts receivable of $146,000 were collected. This amount includes gross accounts of $50,000 on which 2% sa

> The following information relates to Shea Inc.’s accounts receivable for the 2017 fiscal year: 1. An aging schedule of the accounts receivable as at December 31, 2017, is as follows: 2. The Accounts Receivable control account has a de

> From its first day of operations to December 31, 2017, Campbell Corporation provided for uncollectible accounts receivable under the allowance method: entries for bad debt expense were made monthly based on 2.5% of credit sales, bad debts that were writt

> Fortini Corporation had record sales in 2017. It began 2017 with an Accounts Receivable balance of $475,000 and an Allowance for Doubtful Accounts of $33,000. Fortini recognized credit sales during the year of $6,675,000 and made monthly adjusting entrie

> A series of unrelated situations follow: 1. Atlantic Inc.’s unadjusted trial balance at December 31, 2017, included the following accounts (accounted for using ASPE): 2. An analysis and aging of Central Corp.’s accou

> Joseph Kiuvik is reviewing the cash accounting for Connolly Corporation, a local mailing service. Kiuvik’s review will focus on the petty cash account and the bank reconciliation for the month ended May 31, 2017. He has collected the fo

> The Patchwork Corporation manufactures sweaters for sale to athletic-wear retailers. The following information was available on Patchwork for the years ended December 31, 2016 and 2017: During 2017, Patchwork had the following transactions: 1. On June

> The Cormier Corporation sells office equipment and supplies to many organizations in the city and surrounding area on contract terms of 2/10, n/30. In the past, over 75% of the credit customers have taken advantage of the discount by paying within 10 day

> In 2017, Ibran Corp. required additional cash for its business. Management decided to use accounts receivable to raise the additional cash and has asked you to determine the income statement effects of the following transactions: 1. On July 1, 2017, Ibra

> When Canadian public companies were required to apply IFRS beginning in 2011, one of the major issues faced by some entities, particularly those whose revenues were regulated by an independent body, concerned the accounting for regulatory assets. This is

> Dev Equipment Corp. usually closes its books on December 31, but at the end of 2017 it held its cash book open so that a more favourable statement of financial position could be prepared for credit purposes. Cash receipts and disbursements for the first

> Shanahan Construction Company has entered into a non-cancellable contract beginning January 1, 2017, to build a parking complex. It has been estimated that the complex will cost $600,000 and will take three years to construct. The complex will be billed

> Air France-KLM Group and Air Canada are both global airline companies. Both companies report under IFRS. Access the financial statements of Air France-KLM for its year ended December 31, 2014, and Air Canada for the same period, from each company’s websi

> Howeven Inc. is a private company that expects to “go public” and become publicly traded soon. Accordingly, it expects to be adopting IFRS by 2017. It is a manufacturing company with extensive investments in property,

> Realtor Inc. is a company that owns five large office buildings that are leased out to tenants. Most of the leases are for 10 years or more with renewal clauses for an additional 5 years. Currently, Realtor Inc. is a private company that follows ASPE. Re

> Hale Hardware takes pride in being the “shop around the corner” that can compete with the big-box home improvement stores by providing good service from knowledgeable sales associates (many of whom are retired local handymen). Hale has developed the foll

> Tablet Tailors sells tablet PCs combined with Internet service (Tablet Bundle A) that permits the tablet to connect to the Internet anywhere (that is, set up a Wi-Fi hot spot). The price for the tablet and a four-year Internet connection service contract

> Martz Inc. has a customer loyalty program that rewards a customer with one customer loyalty point for every $100 of purchases. Each point is redeemable for a $3 discount on any future purchases. On July 2, 2017, customers purchase products for $300,000 (

> Lydia Trottier has prepared baked goods for sale since 1998. She started a baking business in her home and has been operating in a rented building with a storefront since 2003. Trottier incorporated the business as MLT Inc. on January 1, 2017, with an in

> Presented below are three independent revenue arrangements for Colbert Company. The company follows IFRS. Instructions: Respond to the requirements related to each revenue arrangement. (a) Colbert sells 3-D printer systems. Recently, Colbert provided a

> Nickel Strike Mines is a nickel mining company with mines in northern Ontario, Colombia, and Australia. It is a publicly traded company and follows IFRS, and has historically followed industry practice and used unit of production as its depreciation poli

> Van Hatten Consolidated has three operating divisions: DeMent Publishing Division, Ankiel Security Division, and Depp Advisory Division. Each division maintains its own accounting system but follows IFRS. DeMent Publishing Division The DeMent Publishing

> Economy Appliance Co. manufactures low-price, no-frills appliances that are in great demand for rental units. Pricing and cost information on Economy’s main products are as follows. Item………………………………..Stand-Alone Selling Price (Cost) Refrigerator……………………

> On January 1, 2017, Caroline Lampron and Jenni Meno formed a computer sales and service enterprise in Montreal by investing $90,000 cash. The new company, Razorback Sales and Service, has the following transactions in January: 1. Paid $6,000 in advance f

> The following is from a recent income statement for Graben Inc. (a public company): Sales revenue…………………………………………$21,924,000,000 Costs and expenses…………………………………..20,773,000,000 Income from operations……………………………….1,151,000,000 Other income………………………………………

> The equity accounts of Good Karma Corp. as at January 1, 2017, were as follows: Retained earnings, January 1, 2017 ……………………………………………$257,600 Common shares …………………………………………………………………………600,000 Preferred shares………………………………………………………………………….250,000 Contribut

> Amos Corporation was incorporated and began business on January 1, 2017. It has been successful and now requires a bank loan for additional working capital to finance an expansion. The bank has requested an audited income statement for the year 2017 usin

> Faldo Corp. is a public company and has 100,000 common shares outstanding. In 2017, the company reported income from continuing operations before income tax of $2,710,000. Additional transactions not considered in the $2,710,000 are as follows: 1. In 201

> Joe Schreiner, controller for On Time Clock Company Inc., recently prepared the company’s income statement and statement of changes in equity for 2017. Schreiner believes that the statements are a fair presentation of the companyâ

> A comparative statement of financial position for Spencer Corporation follows: Additional information: 1. Net income for the fiscal year ending December 31, 2017, was $19,000. 2. In March 2017, a plot of land was purchased for future construction of a

> The statement of financial position of Manion Corporation follows (in thousands)L: Instructions: Evaluate the statement of financial position. Briefly describe the proper treatment of any item that you find incorrect. Assume the company follows IFRS.

> Two well-known company names in the transportation industry in Canada are Canadian National Railway Company and Canadian Pacifi c Railway Limited. Go to either SEDAR (www.sedar.com) or each company’s website to gain access to the financial statements of

> P6-1 BBQ Master Company sells total outdoor barbecue solutions, providing gas and charcoal barbecues, accessories, and installation services for custom patio barbecue stations. Instructions: Respond to the requirements related to the following independe

> The statement of financial position of Sargent Corporation follows for the current year, 2017: The following additional information is available: 1. The Current Assets section includes the following: cash $150,000; accounts receivable $170,000, less $1

> Jia Inc. applies ASPE and had the following statement of financial position at the end of operations for 2016: During 2017, the following occurred: 1. Jia Inc. sold some of its trademarks. The trademarks had an unlimited useful life and a cost of $10,0

> Aero Inc. had the following statement of financial position at the end of operations for 2016: During 2017, the following occurred: 1. Aero liquidated its FV-NI investments portfolio at a loss of $5,000. 2. A parcel of land was purchased for $38,000. 3

> In an examination of Garganta Limited as at December 31, 2017, you have learned about the following situations. No entries have been made in the accounting records for these items. 1. The corporation erected its present factory building in 2001. Deprecia

> The statement of financial position of Delacosta Corporation as at December 31, 2017, is as follows: Note 1: Goodwill in the amount of $70,000 was recognized because the company believed that the carrying amount of assets was not an accurate representa

> The trial balance of Eastwood Inc. and other related information for the year 2017 follows: Additional information: 1. The inventory has a net realizable value of $212,000. The FIFO method of inventory valuation is used. 2. The fair valueâ€&

> Statement of financial position items for Montoya Inc. follow for the current year, 2017: Instructions: (a) Prepare a classified statement of financial position in good form. The numbers of authorized shares are as follows: unlimited common and 20,000

> A list of accounts follows: Instructions: Prepare a classified statement of financial position in good form, without specific amounts. Accounts Receivable Pension Obligation, non-current Bonds Payable due in four years Prepaid Rent Buildings Purcha

> A combined single-step income and statement of retained earnings for California Tanning Salon Corp. follows for 2017 (amounts in thousands): Additional facts are as follows: 1. Selling, general, and administrative expenses for 2017 included a usual but

> Canadian Tire Corporation, Limited is one of Canada’s best-known retailers. Obtain a copy of Canadian Tire’s financial statements for the year ended January 3, 2015, through SEDAR (www.sedar.com) or on the company’s website. To answer the following quest

> The following account balances were included in the trial balance of Reid Corporation at June 30, 2017: During 2017, Reid incurred production salary and wage costs of $710,000, consumed raw materials and other production supplies of $474,670, and had a

> The following financial statement was prepared by employees of Intellisys Corporation: Note 1: New styles and rapidly changing consumer preferences resulted in a $37,000 loss on the disposal of discontinued styles and related accessories. Note 2: The c