Question: Singapore Airlines reported the following

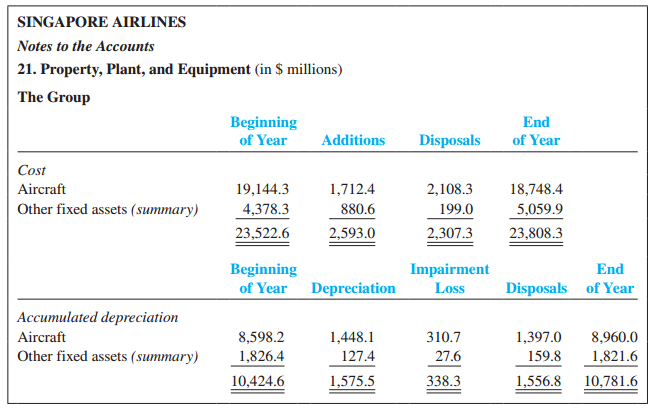

Singapore Airlines reported the following information in the notes to a recent annual report (in Singapore dollars):

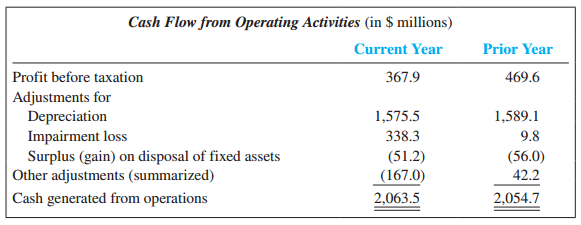

Singapore Airlines also reported the following cash flow details:

Required:

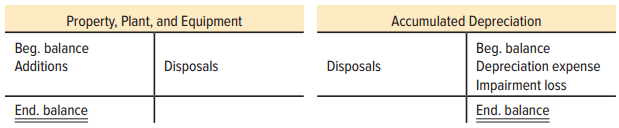

1. Reconstruct the information in Note 21 using T-accounts for Property, Plant, and Equipment and Accumulated Depreciation:

2. Compute the amount of cash the company received for disposals and transfers for the current year. Show computations.

3. Compute the percentage of depreciation expense to cash flows from operations for the current year. What do you interpret from the result?

Transcribed Image Text:

SINGAPORE AIRLINES Notes to the Accounts 21. Property, Plant, and Equipment (in $ millions) The Group Beginning of Year End Additions Disposals of Year Cost Aircraft 19,144.3 1,712.4 880.6 2,108.3 18,748.4 Other fixed assets (summary) 4,378.3 199.0 5,059.9 23,522.6 2,593.0 2,307.3 23,808.3 Beginning Impairment End of Year Depreciation Loss Disposals of Year Accumulated depreciation Aircraft 8,598.2 1,448.1 310.7 1,397.0 8,960.0 Other fixed assets (summary) 1,826.4 127.4 27.6 159.8 1,821.6 10,424.6 1,575.5 338.3 1,556.8 10,781.6 Cash Flow from Operating Activities (in $ millions) Current Year Prior Year Profit before taxation Adjustments for Depreciation Impairment loss Surplus (gain) on disposal of fixed assets |Other adjustments (summarized) | Cash generated from operations 367.9 469.6 1,575.5 1,589.1 338.3 9.8 (51.2) (56.0) (167.0) 2,063.5 42.2 2,054.7 Property, Plant, and Equipment Accumulated depreciation Beg. balance Beg. balance Depreciation expense Impairment loss Additions Disposals Disposals End. balance End. balance

> Define note payable. When must a company reclassify a long-term note payable as a current liability?

> Why is depreciation expense added to net income (indirect method) on the statement of cash flows?

> Define goodwill. When is it appropriate to record goodwill as an intangible asset?

> Define intangible asset. What period should be used to amortize an intangible asset with a definite life?

> When equipment is sold for more than net book value, how is the transaction recorded? For less than net book value? What is net book value?

> Define accrued liability. What is an example of an accrued liability?

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange. The majority of Pool’s customers are small, family-owned businesses. Poo

> Over what period should an addition to an existing long-lived asset be depreciated? Explain.

> What type of depreciation expense pattern is used under each of the following methods and when is its use appropriate? a. The straight-line method. b. The units-of-production method. c. The double-declining-balance method.

> The estimated useful life and residual value of a long-lived asset relate to the current owner or user rather than all potential users. Explain this statement.

> In computing depreciation, three values must be known or estimated; identify and explain the nature of each.

> Distinguish among depreciation, depletion, and amortization.

> Distinguish between ordinary repairs and improvements. How is each accounted for?

> Describe the relationship between the expense recognition principle and accounting for long-lived assets.

> Under the cost measurement concept, what amounts should be included in the acquisition cost of a long-lived asset?

> What are the classifications of long-lived assets? Explain each.

> How is the fixed asset turnover ratio computed? Explain its meaning.

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. Assume Pool Corporation purchased for cash new loading equipment for the warehouse on January 1 of Year 1, at an invoice price of $72,000. It al

> Define long-lived assets. Why are they considered to be a “bundle of future services”?

> Cron Corporation is planning to issue bonds with a face value of $700,000 and a coupon rate of 13 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year. C

> Claire Corporation is planning to issue bonds with a face value of $100,000 and a coupon rate of 8 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on Jan

> Claire Corporation is planning to issue bonds with a face value of $100,000 and a coupon rate of 8 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on Jan

> PowerTap Utilities is planning to issue bonds with a face value of $1,000,000 and a coupon rate of 10 percent. The bonds mature in 10 years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1 of this year.

> On January 1 of this year, Cunningham Corporation issued bonds with a face value of $200,000 and a coupon rate of 6 percent. The bonds mature in 10 years and pay interest annually every December 31. When the bonds were sold, the annual market rate of int

> Rosh Corporation is planning to issue bonds with a face value of $800,000 and a coupon rate of 8 percent. The bonds mature in four years and pay interest semiannually every June 30 and December 31. All of the bonds will be sold on January 1 of this year.

> On January 1 of this year, Barnett Corporation sold bonds with a face value of $500,000 and a coupon rate of 7 percent. The bonds mature in 10 years and pay interest annually on December 31. Barnett uses the effective-interest amortization method. Ignore

> On January 1 of this year, Nowell Company issued bonds with a face value of $100,000 and a coupon rate of 8 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. When the bonds were sold, the annual market r

> Electrolux Corporation manufactures electrical test equipment. The company’s board of directors authorized a bond issue on January 1 of this year with the following terms: Face (par) value: $800,000 Coupon rate: 8 percent payable each December 31 Maturit

> French energy giant GDF Suez recently issued a zero coupon bond. This bond issuance garnered attention because it was the first time in 14 years that a zero coupon bond had been issued in euros. The zero coupon bond has a face value of €500 million and m

> Serotta Corporation is planning to issue bonds with a face value of $300,000 and a coupon rate of 12 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on J

> Serotta Corporation is planning to issue bonds with a face value of $300,000 and a coupon rate of 12 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on J

> On January 1 of this year, Olive Corporation issued bonds. Interest is payable once a year on December 31. The bonds mature at the end of four years. Olive uses the effective-interest amortization method. The partially completed amortization schedule bel

> Last year, Arbor Corporation reported the following: BALANCE SHEET Total Assets…………………………………………………. $800,000 Total Liabilities ……………………………………………….500,000 Total Shareholders’ Equity …………………………….$300,000 This year, Arbor is considering whether to issue mo

> For each of the following situations, determine whether the company should (a) report a liability on the balance sheet, (b) disclose a contingent liability in the footnotes, or (c) not report the situation. Justify your conclusions. 1. An automobile comp

> PepsiCo, Inc., is a dominant player in the beverage, snack food, and restaurant businesses. A recent PepsiCo annual report included the following note: At year-end, $3.5 billion of short-term borrowings were reclassified as long-term, reflecting PepsiCo’

> Columbia Sportswear is an outdoor and active lifestyle apparel and footwear company. Last year, Columbia reported cost of goods sold of $941 million. This year, cost of goods sold was $1,146 million. Accounts payable was $174 million at the end of last y

> Dell Computers is a leader in the computer industry with over $59 billion in sales each year. A recent annual report for Dell contained the following note: Warranty We record warranty liabilities at the time of sale for the estimated costs that may be in

> During its first year of operations, Walnut Company completed the following two transactions. The annual accounting period ends December 31. a. Paid and recorded wages of $130,000 during Year 1; however, at the end of Year 1, three days’ wages are unpaid

> Using data from the previous problem, complete the following: Required: For each transaction (including adjusting entries) listed in the previous problem, indicate the effects (e.g., cash + or −) using the format below. You do not need to include amount

> Refer to the financial statements of American Eagle Outfitters in Appendix B and Urban Outfitters in Appendix C. Financial statements of American Eagle: Financial statements of Urban Outfitters: Required: 1. How do American Eagle’s an

> Rogers Company completed the following transactions during Year 1. Rogers’s fiscal year ends on December 31. Required: 1. Prepare journal entries for each of these transactions. 2. Prepare all adjusting entries required on December 31.

> On January 1, Boston Company completed the following transactions (use a 7% annual interest rate for all transactions): a. Borrowed $115,000 for seven years. Will pay $6,000 interest at the end of each year and repay the $115,000 at the end of the 7th ye

> a. A friend of yours, Grace, wants to purchase a house in five years. To save for the house, Grace decides to deposit $112,000 in a savings account on January 1 of this year. The savings account will earn 6% annually. Any interest earned will be added to

> Mansfield Corporation purchased a new warehouse at the beginning of Year 1 for $1,000,000. The expected life of the asset is 20 years with no residual value. The company uses straight-line depreciation for financial reporting purposes and accelerated dep

> Vigeland Company completed the following transactions during Year 1. Vigeland’s fiscal year ends on December 31. Required: 1. Prepare journal entries for each of these transactions. 2. Prepare all adjusting entries required on December

> Rungano Corporation is a global publisher of magazines, books, and music and video collections and is a leading direct mail marketer. Many direct mail marketers use high-speed Didde press equipment to print their advertisements. These presses can cost mo

> Starn Tool Company has five different intangible assets to be accounted for and reported on the financial statements. The management is concerned about the amortization of the cost of each of these intangibles. Facts about each intangible follow: a. Pate

> The notes to a recent annual report from Weebok Corporation indicated that the company acquired another company, Sport Shoes, Inc. Assume that Weebok acquired Sport Shoes on January 5 of the current year. Weebok acquired the name of the company and all o

> During the current year ending on December 31, BSP Company completed the following transactions: a. On January 1, purchased a patent for $28,000 cash (estimated useful life, seven years). b. On January 1, purchased the assets (not detailed) of another bu

> Refer to the financial statements of Urban Outfitters in Appendix C at the end of this book Financial statements of Urban Outfitters: Required: 1. Urban Outfitters does not report paying any cash for interest during the year. If it had, where would you

> On January 1 of this year, Thomas Insurance Corporation issued bonds with a face value of $4,000,000 and a coupon rate of 9 percent. The bonds mature in five years and pay interest annually every December 31. When the bonds were sold, the annual market r

> Nettle Corporation sold $100,000 par value, 10-year first mortgage bonds to Timberline Corporation on January 1, 20X5. The bonds, which bear a nominal interest rate of 12 percent, pay interest semiannually on January 1 and July 1. The current market inte

> Grower Supply Corporation holds 85 percent of Schultz Company’s voting common stock. At the end of 20X4, Schultz purchased 30 percent of Grower Supply’s stock. Schultz records dividends received from Grower Supply as nonoperating income. In 20X5, Grower

> Clayton Corporation purchased 75 percent of Topple Corporation common stock and 40 percent of its preferred stock on January 1, 20X6, for $270,000 and $80,000, respectively. At the time of purchase, the fair value of the common shares of Topple held by t

> The summarized balance sheet of Separate Company on January 1, 20X3, contained the following amounts: On January 1, 20X3, Joint Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Separate Company at

> When an affiliate’s bonds are purchased from a nonaffiliate during the period, what balances will be stated incorrectly in the consolidated financial statements if the intercompany bond ownership is not eliminated in preparing the consolidation worksheet

> When a bond issue has been placed directly with an affiliate, what account balances will be stated incorrectly in the consolidated statements if the intercompany bond ownership is not eliminated in preparing the consolidation worksheet?

> What is meant by a constructive bond retirement in a multicorporate setting? How does a constructive bond retirement differ from an actual bond retirement?

> When is a gain or loss on bond retirement included in the consolidated income statement?

> Lane Manufacturing Company acquired 75 percent of Tin Corporation stock at underlying book value. At the date of acquisition, the fair value of the noncontrolling interest was equal to 25 percent of Tin’s book value. The balance sheets

> The trial balance data presented in P7-33 can be converted to reflect use of the cost method by inserting the following amounts in place of those presented for Prime Company: Required: Prepare the journal entries that would have been recorded on

> Using the data in P7-33, on December 31, 20X7, Prime Company recorded the following entry on its books to adjust its investment in Lane Company from the fully adjusted equity method to the modified equity method: Required: Adjust the data reported by

> Mist Company acquired 65 percent of Blank Corporation’s voting common stock on June 20, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 35 percent of the book value of Blank Corpo

> Great Company acquired 80 percent of Meager Corporation’s common stock on January 1, 20X4, for $280,000. The fair value of the noncontrolling interest was $70,000 at the date of acquisition. Great’s corporate controller has lost the consolidation files f

> Rossman Corporation holds 75 percent of the common stock of Schmid Distributors Inc., purchased on December 31, 20X1, for $2,340,000. At the date of acquisition, Schmid reported common stock with a par value of $1,000,000, additional paid-in capital of $

> Select the correct answer for each of the following questions. Wagner, a holder of a $1,000,000 Palmer Inc. bond, collected the interest due on March 31, 20X8, and then sold the bond to Seal Inc. for $975,000. On that date, Palmer, a 75 percent owner of

> Block Corporation was created on January 1, 20X0, to develop computer software. On January 1, 20X5, Foster Company acquired 90 percent of Block’s common stock at its underlying book value. At that date, the fair value of the noncontroll

> Partial trial balance data for Mound Corporation, Shadow Company, and the consolidated entity at December 31, 20X7, are as follows: Additional Information: Mound Corporation acquired 60 percent ownership of Shadow Company on January 1, 20X4, for $106,

> Craft Corporation held 80 percent of Delta Corporation’s outstanding common shares on December 31, 20X2, which it had acquired at underlying book value. When the shares were acquired, the fair value of the noncontrolling interest was eq

> Penn Corporation purchased 80 percent ownership of ENC Company on January 1, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of ENC. On January 1, 20X4, Penn sold 2,000

> Apex Corporation acquired 75 percent of Beta Company’s common stock on May 15, 20X3, at underlying book value. Beta’s balance sheet on December 31, 20X6, contained these amounts: During 20X7, Apex earned operating i

> Presley Pools Inc. acquired 60 percent of the common stock of Jacobs Jacuzzi Company on December 31, 20X6, for $1,800,000. At that date, the fair value of the noncontrolling interest was $1,200,000. The full amount of the differential was assigned to goo

> Emerald Corporation acquired 10,500 shares of the common stock and 800 shares of the 8 percent preferred stock of Pert Company on December 31, 20X4, at the book value of the underlying stock interests. At that date, the fair value of the noncontrolling i

> Purple Corporation owns 80 percent of Corn Corporation’s common stock. It purchased the shares on January 1, 20X1, for $520,000. At the date of acquisition, the fair value of the noncontrolling interest was $130,000, and Corn reported common stock outsta

> The trial balance data presented in P8–24 can be converted to reflect use of the cost method by inserting the following amounts in place of those presented for Bennett Corporation: Stone reported retained earnings of $25,000 on the date

> Stacey Corporation owns 80 percent of the common shares and 70 percent of the preferred shares of Upland Company, all purchased at underlying book value on January 1, 20X2. At that date, the fair value of the noncontrolling interest in Uplandâ€

> Snerd Corporation’s controller is having difficulty explaining the impact of several of the company’s intercorporate bond transactions. Required: Snerd receives interest payments in excess of the amount of interest income it records on its investm

> Topp Manufacturing Company acquired 90 percent of Bussman Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Bussman reported common

> Topp Manufacturing Company acquired 90 percent of Bussman Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Bussman reported common

> Topp Manufacturing Company acquired 90 percent of Bussman Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Bussman reported common

> First Boston Corporation acquired 80 percent of Gulfside Corporation common stock on J anuary 1, 20X5. Gulfside holds 60 percent of the voting shares of Paddock Company, and Paddock owns 10 percent of the stock of First Boston. All acquisitions were made

> Panther Enterprises owns 80 percent of Grange Corporation’s voting stock. Panther acquired the shares on January 1, 20X4, for $234,500. On that date, the fair value of the noncontrolling interest was $58,625, and Grange reported common

> On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company’s stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Skate’s book value. Th

> On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company’s stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Skate’s book value. Th

> Lance Corporation purchased 75 percent of Avery Company’s common stock at underlying book value on January 1, 20X3. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Avery’s book va

> Lance Corporation purchased 75 percent of Avery Company’s common stock at underlying book value on January 1, 20X3. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Avery’s book va

> Promise Enterprises acquired 90 percent of Brown Corporation’s voting common stock on January 1, 20X3, for $315,000. At that date, the fair value of the noncontrolling interest of Brown Corporation was $35,000. Immediately after Promise

> Stellar Corporation purchased bonds of its subsidiary from a nonaffiliate during 20X6. Although Stellar purchased the bonds at par value, a loss on bond retirement is reported in the 20X6 consolidated income statement as a result of the purchase. Req

> Bennett Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the noncontrolling interest was equal to 40 percent of Stone’s book value. On December

> Bennett Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the noncontrolling interest was equal to 40 percent of Stone’s book value. On December

> Grasper Corporation owns 70 percent of Latent Corporation’s common stock and 25 percent of Dally Corporation’s common stock. In addition, Latent owns 40 percent of Dally’s stock. In 20X6, Grasper, Latent, and Dally reported operating income of $90,000, $

> Tyler Manufacturing purchased 60 percent of the ownership of Brown Corporation stock on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Brown Corporation.

> Tyler Manufacturing purchased 60 percent of the ownership of Brown Corporation stock on J anuary 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Brown Corporation

> On January 1, 20X2, Fischer Corporation purchased 90 percent of Culbertson Company common shares and 60 percent of its preferred shares at underlying book value. At that date, the fair value of the noncontrolling interest in Culbertson’

> Brown Company owns 90 percent of the common stock and 60 percent of the preferred stock of White Corporation, both acquired at underlying book value on January 1, 20X1. At that date, the fair value of the noncontrolling interest in White common stock was

> Offenberg Company issued $100,000 of 10 percent bonds on January 1, 20X1, at 120. The bonds mature in 10 years and pay 10 percent interest annually on December 31. Mainstream Corporation holds 80 percent of Offenberg’s voting shares, ac

> Mainstream Corporation holds 80 percent of Offenberg Company’s voting shares, acquired on January 1, 20X1, at underlying book value. On January 1, 20X4, Mainstream purchased Offenberg bonds with a par value of $40,000. The bonds pay 10

> Clayton Corporation purchased 75 percent of Topple Company common stock and 40 percent of its preferred stock on January 1, 20X6, for $270,000 and $80,000, respectively. At the time of purchase, the fair value of Topple’s common shares

> Farflung Corporation has in excess of 60 subsidiaries worldwide. It owns 65 percent of the voting common stock of Micro Company and 80 percent of the shares of Eagle Corporation. Micro sold $400,000 par value first mortgage bonds at par value on January

> Bliss Perfume Company issued $300,000 of 10 percent bonds on January 1, 20X2, at 110. The bonds mature 10 years from issue and have semiannual interest payments on January 1 and July 1. Parsons Corporation owns 80 percent of Bliss Perfume stock. On Janua