Question: On January 1, 20X5, Pond Corporation purchased

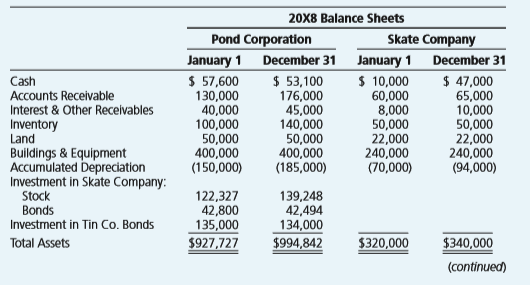

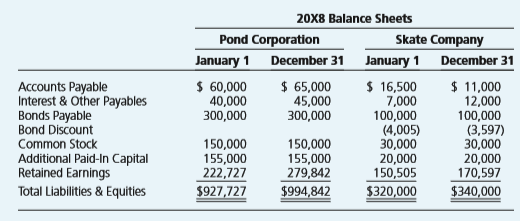

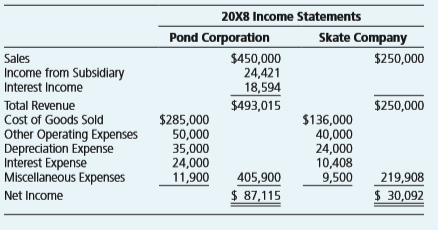

On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company’s stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Skate’s book value. The balance sheets for Pond and Skate at January 1, 20X8, and December 31, 20X8, and income statements for 20X8 were reported as follows:

Additional Information:

Pond sold a building to Skate for $65,000 on December 31, 20X7. Pond had purchased the building for $125,000 and was depreciating it on a straight-line basis over 25 years. At the time of sale, Pond reported accumulated depreciation of $75,000 and a remaining life of 10 years.

On July 1, 20X6, Skate sold land that it had purchased for $22,000 to Pond for $35,000. Pond is planning to build a new warehouse on the property prior to the end of 20X9.

Skate issued $100,000 par value, 10-year bonds with a coupon rate of 10 percent on January 1, 20X5, at $95,000. On December 31, 20X7, Pond purchased $40,000 par value of Skate’s bonds for $42,800. Interest payments are made on July 1 and January 1.

Pond and Skate paid dividends of $30,000 and $10,000, respectively, in 20X8.

Required:

Prepare all consolidation entries needed at December 31, 20X8, to complete a three-part consolidation worksheet.

Prepare a three-part worksheet for 20X8 in good form.

Transcribed Image Text:

20X8 Balance Sheets Pond Corporation Skate Company January 1 December 31 $ 57,600 130,000 40,000 100,000 January 1 December 31 $ 53,100 176,000 45,000 140,000 50,000 400,000 (185,000) $ 10,000 60,000 8,000 50,000 22,000 240,000 (70,000) $ 47,000 65,000 10,000 50,000 22,000 240,000 (94,000) Cash Accounts Receivable Interest & Other Receivables Inventory Land Buildings & Equipment Accumulated Depreciation Investment in Skate Company: 50,000 400,000 (150,000) Stock Bonds 122,327 42,800 135,000 $927,727 139,248 42,494 134,000 $994,842 Investment in Tin Co. Bonds Total Assets $320,000 $340,000 (continued) 20X8 Balance Sheets Pond Corporation Skate Company January 1 December 31 January 1 December 31 $ 60,000 40,000 300,000 $ 65,000 45,000 300,000 $ 16,500 7,000 100,000 (4,005) 30,000 20,000 150,505 $320,000 $ 11,000 12,000 100,000 (3,597) 30,000 20,000 170,597 Accounts Payable Interest & Other Payables Bonds Payable Bond Discount Common Stock Additional Paid-In Capital Retained Earnings Total Liabilities & Equities 150,000 155,000 222,727 $927,727 150,000 155,000 279,842 $994,842 $340,000 20X8 Income Statements Pond Corporation Skate Company $450,000 24,421 18,594 $493,015 Sales $250,000 Income from Subsidiary Interest Income Total Revenue Cost of Goods Sold $250,000 Other Operating Expenses Depreciation Expense Interest Expense Miscellaneous Expenses $285,000 50,000 35,000 24,000 11,900 $136,000 40,000 24,000 10,408 9,500 405,900 $ 87,115 219,908 $ 30,092 Net Income

> PepsiCo, Inc., is a dominant player in the beverage, snack food, and restaurant businesses. A recent PepsiCo annual report included the following note: At year-end, $3.5 billion of short-term borrowings were reclassified as long-term, reflecting PepsiCo’

> Columbia Sportswear is an outdoor and active lifestyle apparel and footwear company. Last year, Columbia reported cost of goods sold of $941 million. This year, cost of goods sold was $1,146 million. Accounts payable was $174 million at the end of last y

> Dell Computers is a leader in the computer industry with over $59 billion in sales each year. A recent annual report for Dell contained the following note: Warranty We record warranty liabilities at the time of sale for the estimated costs that may be in

> During its first year of operations, Walnut Company completed the following two transactions. The annual accounting period ends December 31. a. Paid and recorded wages of $130,000 during Year 1; however, at the end of Year 1, three days’ wages are unpaid

> Using data from the previous problem, complete the following: Required: For each transaction (including adjusting entries) listed in the previous problem, indicate the effects (e.g., cash + or −) using the format below. You do not need to include amount

> Refer to the financial statements of American Eagle Outfitters in Appendix B and Urban Outfitters in Appendix C. Financial statements of American Eagle: Financial statements of Urban Outfitters: Required: 1. How do American Eagle’s an

> Rogers Company completed the following transactions during Year 1. Rogers’s fiscal year ends on December 31. Required: 1. Prepare journal entries for each of these transactions. 2. Prepare all adjusting entries required on December 31.

> On January 1, Boston Company completed the following transactions (use a 7% annual interest rate for all transactions): a. Borrowed $115,000 for seven years. Will pay $6,000 interest at the end of each year and repay the $115,000 at the end of the 7th ye

> a. A friend of yours, Grace, wants to purchase a house in five years. To save for the house, Grace decides to deposit $112,000 in a savings account on January 1 of this year. The savings account will earn 6% annually. Any interest earned will be added to

> Mansfield Corporation purchased a new warehouse at the beginning of Year 1 for $1,000,000. The expected life of the asset is 20 years with no residual value. The company uses straight-line depreciation for financial reporting purposes and accelerated dep

> Vigeland Company completed the following transactions during Year 1. Vigeland’s fiscal year ends on December 31. Required: 1. Prepare journal entries for each of these transactions. 2. Prepare all adjusting entries required on December

> Rungano Corporation is a global publisher of magazines, books, and music and video collections and is a leading direct mail marketer. Many direct mail marketers use high-speed Didde press equipment to print their advertisements. These presses can cost mo

> Starn Tool Company has five different intangible assets to be accounted for and reported on the financial statements. The management is concerned about the amortization of the cost of each of these intangibles. Facts about each intangible follow: a. Pate

> The notes to a recent annual report from Weebok Corporation indicated that the company acquired another company, Sport Shoes, Inc. Assume that Weebok acquired Sport Shoes on January 5 of the current year. Weebok acquired the name of the company and all o

> During the current year ending on December 31, BSP Company completed the following transactions: a. On January 1, purchased a patent for $28,000 cash (estimated useful life, seven years). b. On January 1, purchased the assets (not detailed) of another bu

> Singapore Airlines reported the following information in the notes to a recent annual report (in Singapore dollars): Singapore Airlines also reported the following cash flow details: Required: 1. Reconstruct the information in Note 21 using T-accounts f

> Refer to the financial statements of Urban Outfitters in Appendix C at the end of this book Financial statements of Urban Outfitters: Required: 1. Urban Outfitters does not report paying any cash for interest during the year. If it had, where would you

> On January 1 of this year, Thomas Insurance Corporation issued bonds with a face value of $4,000,000 and a coupon rate of 9 percent. The bonds mature in five years and pay interest annually every December 31. When the bonds were sold, the annual market r

> Nettle Corporation sold $100,000 par value, 10-year first mortgage bonds to Timberline Corporation on January 1, 20X5. The bonds, which bear a nominal interest rate of 12 percent, pay interest semiannually on January 1 and July 1. The current market inte

> Grower Supply Corporation holds 85 percent of Schultz Company’s voting common stock. At the end of 20X4, Schultz purchased 30 percent of Grower Supply’s stock. Schultz records dividends received from Grower Supply as nonoperating income. In 20X5, Grower

> Clayton Corporation purchased 75 percent of Topple Corporation common stock and 40 percent of its preferred stock on January 1, 20X6, for $270,000 and $80,000, respectively. At the time of purchase, the fair value of the common shares of Topple held by t

> The summarized balance sheet of Separate Company on January 1, 20X3, contained the following amounts: On January 1, 20X3, Joint Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Separate Company at

> When an affiliate’s bonds are purchased from a nonaffiliate during the period, what balances will be stated incorrectly in the consolidated financial statements if the intercompany bond ownership is not eliminated in preparing the consolidation worksheet

> When a bond issue has been placed directly with an affiliate, what account balances will be stated incorrectly in the consolidated statements if the intercompany bond ownership is not eliminated in preparing the consolidation worksheet?

> What is meant by a constructive bond retirement in a multicorporate setting? How does a constructive bond retirement differ from an actual bond retirement?

> When is a gain or loss on bond retirement included in the consolidated income statement?

> Lane Manufacturing Company acquired 75 percent of Tin Corporation stock at underlying book value. At the date of acquisition, the fair value of the noncontrolling interest was equal to 25 percent of Tin’s book value. The balance sheets

> The trial balance data presented in P7-33 can be converted to reflect use of the cost method by inserting the following amounts in place of those presented for Prime Company: Required: Prepare the journal entries that would have been recorded on

> Using the data in P7-33, on December 31, 20X7, Prime Company recorded the following entry on its books to adjust its investment in Lane Company from the fully adjusted equity method to the modified equity method: Required: Adjust the data reported by

> Mist Company acquired 65 percent of Blank Corporation’s voting common stock on June 20, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 35 percent of the book value of Blank Corpo

> Great Company acquired 80 percent of Meager Corporation’s common stock on January 1, 20X4, for $280,000. The fair value of the noncontrolling interest was $70,000 at the date of acquisition. Great’s corporate controller has lost the consolidation files f

> Rossman Corporation holds 75 percent of the common stock of Schmid Distributors Inc., purchased on December 31, 20X1, for $2,340,000. At the date of acquisition, Schmid reported common stock with a par value of $1,000,000, additional paid-in capital of $

> Select the correct answer for each of the following questions. Wagner, a holder of a $1,000,000 Palmer Inc. bond, collected the interest due on March 31, 20X8, and then sold the bond to Seal Inc. for $975,000. On that date, Palmer, a 75 percent owner of

> Block Corporation was created on January 1, 20X0, to develop computer software. On January 1, 20X5, Foster Company acquired 90 percent of Block’s common stock at its underlying book value. At that date, the fair value of the noncontroll

> Partial trial balance data for Mound Corporation, Shadow Company, and the consolidated entity at December 31, 20X7, are as follows: Additional Information: Mound Corporation acquired 60 percent ownership of Shadow Company on January 1, 20X4, for $106,

> Craft Corporation held 80 percent of Delta Corporation’s outstanding common shares on December 31, 20X2, which it had acquired at underlying book value. When the shares were acquired, the fair value of the noncontrolling interest was eq

> Penn Corporation purchased 80 percent ownership of ENC Company on January 1, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of ENC. On January 1, 20X4, Penn sold 2,000

> Apex Corporation acquired 75 percent of Beta Company’s common stock on May 15, 20X3, at underlying book value. Beta’s balance sheet on December 31, 20X6, contained these amounts: During 20X7, Apex earned operating i

> Presley Pools Inc. acquired 60 percent of the common stock of Jacobs Jacuzzi Company on December 31, 20X6, for $1,800,000. At that date, the fair value of the noncontrolling interest was $1,200,000. The full amount of the differential was assigned to goo

> Emerald Corporation acquired 10,500 shares of the common stock and 800 shares of the 8 percent preferred stock of Pert Company on December 31, 20X4, at the book value of the underlying stock interests. At that date, the fair value of the noncontrolling i

> Purple Corporation owns 80 percent of Corn Corporation’s common stock. It purchased the shares on January 1, 20X1, for $520,000. At the date of acquisition, the fair value of the noncontrolling interest was $130,000, and Corn reported common stock outsta

> The trial balance data presented in P8–24 can be converted to reflect use of the cost method by inserting the following amounts in place of those presented for Bennett Corporation: Stone reported retained earnings of $25,000 on the date

> Stacey Corporation owns 80 percent of the common shares and 70 percent of the preferred shares of Upland Company, all purchased at underlying book value on January 1, 20X2. At that date, the fair value of the noncontrolling interest in Uplandâ€

> Snerd Corporation’s controller is having difficulty explaining the impact of several of the company’s intercorporate bond transactions. Required: Snerd receives interest payments in excess of the amount of interest income it records on its investm

> Topp Manufacturing Company acquired 90 percent of Bussman Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Bussman reported common

> Topp Manufacturing Company acquired 90 percent of Bussman Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Bussman reported common

> Topp Manufacturing Company acquired 90 percent of Bussman Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Bussman reported common

> First Boston Corporation acquired 80 percent of Gulfside Corporation common stock on J anuary 1, 20X5. Gulfside holds 60 percent of the voting shares of Paddock Company, and Paddock owns 10 percent of the stock of First Boston. All acquisitions were made

> Panther Enterprises owns 80 percent of Grange Corporation’s voting stock. Panther acquired the shares on January 1, 20X4, for $234,500. On that date, the fair value of the noncontrolling interest was $58,625, and Grange reported common

> On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company’s stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Skate’s book value. Th

> Lance Corporation purchased 75 percent of Avery Company’s common stock at underlying book value on January 1, 20X3. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Avery’s book va

> Lance Corporation purchased 75 percent of Avery Company’s common stock at underlying book value on January 1, 20X3. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Avery’s book va

> Promise Enterprises acquired 90 percent of Brown Corporation’s voting common stock on January 1, 20X3, for $315,000. At that date, the fair value of the noncontrolling interest of Brown Corporation was $35,000. Immediately after Promise

> Stellar Corporation purchased bonds of its subsidiary from a nonaffiliate during 20X6. Although Stellar purchased the bonds at par value, a loss on bond retirement is reported in the 20X6 consolidated income statement as a result of the purchase. Req

> Bennett Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the noncontrolling interest was equal to 40 percent of Stone’s book value. On December

> Bennett Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the noncontrolling interest was equal to 40 percent of Stone’s book value. On December

> Grasper Corporation owns 70 percent of Latent Corporation’s common stock and 25 percent of Dally Corporation’s common stock. In addition, Latent owns 40 percent of Dally’s stock. In 20X6, Grasper, Latent, and Dally reported operating income of $90,000, $

> Tyler Manufacturing purchased 60 percent of the ownership of Brown Corporation stock on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Brown Corporation.

> Tyler Manufacturing purchased 60 percent of the ownership of Brown Corporation stock on J anuary 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Brown Corporation

> On January 1, 20X2, Fischer Corporation purchased 90 percent of Culbertson Company common shares and 60 percent of its preferred shares at underlying book value. At that date, the fair value of the noncontrolling interest in Culbertson’

> Brown Company owns 90 percent of the common stock and 60 percent of the preferred stock of White Corporation, both acquired at underlying book value on January 1, 20X1. At that date, the fair value of the noncontrolling interest in White common stock was

> Offenberg Company issued $100,000 of 10 percent bonds on January 1, 20X1, at 120. The bonds mature in 10 years and pay 10 percent interest annually on December 31. Mainstream Corporation holds 80 percent of Offenberg’s voting shares, ac

> Mainstream Corporation holds 80 percent of Offenberg Company’s voting shares, acquired on January 1, 20X1, at underlying book value. On January 1, 20X4, Mainstream purchased Offenberg bonds with a par value of $40,000. The bonds pay 10

> Clayton Corporation purchased 75 percent of Topple Company common stock and 40 percent of its preferred stock on January 1, 20X6, for $270,000 and $80,000, respectively. At the time of purchase, the fair value of Topple’s common shares

> Farflung Corporation has in excess of 60 subsidiaries worldwide. It owns 65 percent of the voting common stock of Micro Company and 80 percent of the shares of Eagle Corporation. Micro sold $400,000 par value first mortgage bonds at par value on January

> Bliss Perfume Company issued $300,000 of 10 percent bonds on January 1, 20X2, at 110. The bonds mature 10 years from issue and have semiannual interest payments on January 1 and July 1. Parsons Corporation owns 80 percent of Bliss Perfume stock. On Janua

> Bliss Perfume Company issued $300,000 of 10 percent bonds on January 1, 20X2, at 110. The bonds mature 10 years from issue and have semiannual interest payments on January 1 and July 1. Parsons Corporation owns 80 percent of Bliss Perfume stock. On April

> Pride Corporation owns 80 percent of Simba Corporation’s outstanding common stock. Simba, in turn, owns 10 percent of Pride’s outstanding common stock. Required: What percent of the dividends paid by Simba is reported as dividends declared in

> Bath Corporation acquired 80 percent of Stang Brewing Company’s stock on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of Stang’s book va

> Bath Corporation acquired 80 percent of Stang Brewing Company’s stock on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 p ercent of Stang’s book v

> Stable Home Builders Inc. acquired 80 percent of Acme Concrete Works stock on January 1, 20X3, for $360,000. At that date, the fair value of the noncontrolling interest was $90,000. Acme Concrete’s balance sheet contained the following

> Pound Manufacturing Corporation prepared the following balance sheet as of January 1, 20X8: The company is considering a 2-for-1 stock split, a stock dividend of 4,000 shares, or a stock dividend of 1,500 shares on its $10 par value common stock.

> Ballard Corporation purchased 70 percent of Condor Company’s voting shares on January 1, 20X4, at underlying book value. On that date it also purchased $100,000 par value 12 percent Condor bonds, which had been issued on January 1, 20X1

> Lake Company reported the following summarized balance sheet data as of December 31, 20X2: Lake issues 4,000 additional shares of its $10 par value stock to its shareholders as a stock dividend on April 20, 20X3. The market price of Lake&acir

> Amazing Corporation purchased $100,000 par value bonds of its subsidiary, Broadway Company, on December 31, 20X5, from Lemon Corporation for $102,800. The 10-year bonds bear a 9 percent coupon rate, and Broadway originally sold them on January 1, 20X3, t

> Assume the same facts as in E8-3 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-3: Wood Corporation owns 70 percent of Carter Company’s voting shares. On January 1, 20X3, Carter sold bonds with a par valu

> Amazing Corporation purchased $100,000 par value bonds of its subsidiary, Broadway Company, on December 31, 20X5, from Lemon Corporation. The 10-year bonds bear a 9 percent coupon rate, and Broadway originally sold them on January 1, 20X3, to Lemon. Inte

> Talbott Company purchased 80 percent of Short Company’s stock on January 1, 20X8, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of Short’s book value. On

> Gross Corporation issued $500,000 par value, 10-year bonds at 104 on January 1, 20X1, which Independent Corporation purchased. On January 1, 20X5, Rupp Corporation purchased $200,000 of Gross bonds from Independent for $196,700. The bonds pay 9 percent i

> Gross Corporation issued $500,000 par value 10-year bonds at 104 on January 1, 20X1, which Independent Corporation purchased. On July 1, 20X5, Rupp Corporation purchased $200,000 of Gross bonds from Independent. The bonds pay 9 percent interest annually

> Blank Corporation prepared the following summarized balance sheet on January 1, 20X1: Shepard Company acquires 80 percent of Blank Corporation’s common stock on January 1, 20X1, for $80,000. At that date, the fair value of t

> On January 1, 20X1, Fern Corporation paid Morton Advertising $116,200 to acquire 70 percent of Vincent Company’s stock. Fern also paid $45,000 to acquire $50,000 par value 8 percent, 10-year bonds directly from Vincent on that date. Thi

> On January 1, 20X1, Fern Corporation paid Morton Advertising $116,200 to acquire 70 percent of Vincent Company’s stock. Fern also paid $45,000 to acquire $50,000 par value 8 percent, 10-year bonds directly from Vincent on that date. Int

> Browne Corporation purchased 11,000 shares of Schroeder Corporation on January 1, 20X3, at book value. At that date, the fair value of the noncontrolling interest was equal to 26.6 percent of Schroeder’s book value. On December 31, 20X8

> Mega Corporation purchased 90 percent of Tarp Company’s voting common shares on January 1, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of the book value of Tarp Com

> Assume the same facts as in E8-15 except for the changes in the trial balances, but prepare entries using straight-line amortization of bond discount or premium. Required: Record the journal entry or entries for 20X4 on Mega’s b

> Wood Corporation owns 70 percent of Carter Company’s voting shares. On January 1, 20X3, Carter sold bonds with a par value of $600,000 at 98. Wood purchased $400,000 par value of the bonds; the remainder was sold to nonaffiliates. The bonds mature in fiv

> Blatant Advertising Corporation acquired 60 percent of Quinn Manufacturing Company’s shares on December 31, 20X1, at underlying book value of $180,000. At that date, the fair value of the noncontrolling interest was equal to 40 percent

> Porter Company purchased 60 percent ownership of Temple Corporation on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of Temple’s book value. On January 1,

> Assume the same facts as in E8-14 except for the changes in the trial balances and assuming the bonds were sold for $82,000, but prepare entries using straight-line amortization of bond discount or premium. Data from E8-14: Porter Company purchased 60

> Weal Corporation purchased 60 percent of Modern Products Company’s shares on December 31, 20X7, for $210,000. At that date, the fair value of the noncontrolling interest was $140,000. On January 1, 20X9, Weal purchased an additional 20

> Explain how a reciprocal ownership arrangement between two subsidiaries could lead the parent company to overstate its income if no adjustment is made for the reciprocal relationship.

> Assume the same facts as in E8-13 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-13: Stang Corporation issued to Bradley Company $400,000 par value, 10-year bonds with a coupon rate of 12 percent on Janua

> Stang Corporation issued to Bradley Company $400,000 par value, 10-year bonds with a coupon rate of 12 percent on January 1, 20X5, at 105. The bonds pay interest semiannually on July 1 and January 1. On January 1, 20X8, Purple Corporation purchased $100,

> Parent Company holds 80 percent ownership of Subsidiary Company, and Subsidiary Company owns 90 percent of the stock of Tiny Corporation. What effect will $100,000 of unrealized intercompany profits on Tiny’s books on December 31, 20X5, have on the amoun

> Assume the same facts as in E8-12 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-12: Bundle Company issued $500,000 par value, 10-year bonds at 104 on January 1, 20X3, which Mega Corporation purchased. Th

> Bundle Company issued $500,000 par value, 10-year bonds at 104 on January 1, 20X3, which Mega Corporation purchased. The coupon rate on the bonds is 11 percent. Interest payments are made semiannually on July 1 and January 1. On July 1, 20X6, Parent Comp

> Hydro Corporation needed to build a new production facility. Because it already had a relatively high debt ratio, the company decided to establish a joint venture with Rich Corner Bank. This arrangement permitted the joint venture to borrow $30 million f

> Strong Manufacturing Company holds 94 percent ownership of Thorson Farm Products and 68 percent ownership of Kenwood Distributors. Thorson has excess cash at the end of 20X4 and is considering buying shares of its own stock, shares of Strong, or shares o

> Online Enterprises owns 95 percent of Downlink Corporation. On January 1, 20X1, Downlink issued $200,000 of five-year bonds at 115. Annual interest of 12 percent is paid semiannually on January 1 and July 1. Online purchased $100,000 of the bonds on Augu