Question: Assume the same facts as in E8-

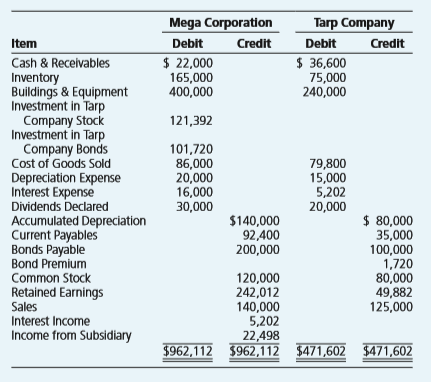

Assume the same facts as in E8-15 except for the changes in the trial balances, but prepare entries using straight-line amortization of bond discount or premium.

Required:

Record the journal entry or entries for 20X4 on Mega’s books related to its investment in Tarp Company stock.

Record the journal entry or entries for 20X4 on Mega’s books related to its investment in Tarp Company bonds.

Record the journal entry or entries for 20X4 on Tarp’s books related to its bonds payable.

Prepare the consolidation entries needed to complete a consolidated worksheet for 20X4.

Prepare a three-part consolidated worksheet for 20X4.

Data from E8-15:

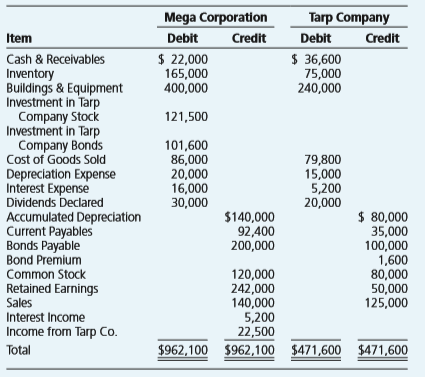

Mega Corporation purchased 90 percent of Tarp Company’s voting common shares on January 1, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of the book value of Tarp Company. Mega also purchased $100,000 of 6 percent, five-year bonds directly from Tarp on January 1, 20X2, for $104,000. The bonds pay interest annually on December 31. The trial balances of the companies as of December 31, 20X4, are as follows:

Required:

Record the journal entry or entries for 20X4 on Mega’s books related to its investment in Tarp Common stock.

Record the journal entry or entries for 20X4 on Mega’s books related to its investment in Tarp Company bonds.

Record the journal entry or entries for 20X4 on Tarp’s books related to its bonds payable.

Prepare the consolidation entries needed to complete a consolidated worksheet for 20X4.

Prepare a three-part consolidated worksheet for 20X4.

Transcribed Image Text:

> Apex Corporation acquired 75 percent of Beta Company’s common stock on May 15, 20X3, at underlying book value. Beta’s balance sheet on December 31, 20X6, contained these amounts: During 20X7, Apex earned operating i

> Presley Pools Inc. acquired 60 percent of the common stock of Jacobs Jacuzzi Company on December 31, 20X6, for $1,800,000. At that date, the fair value of the noncontrolling interest was $1,200,000. The full amount of the differential was assigned to goo

> Emerald Corporation acquired 10,500 shares of the common stock and 800 shares of the 8 percent preferred stock of Pert Company on December 31, 20X4, at the book value of the underlying stock interests. At that date, the fair value of the noncontrolling i

> Purple Corporation owns 80 percent of Corn Corporation’s common stock. It purchased the shares on January 1, 20X1, for $520,000. At the date of acquisition, the fair value of the noncontrolling interest was $130,000, and Corn reported common stock outsta

> The trial balance data presented in P8–24 can be converted to reflect use of the cost method by inserting the following amounts in place of those presented for Bennett Corporation: Stone reported retained earnings of $25,000 on the date

> Stacey Corporation owns 80 percent of the common shares and 70 percent of the preferred shares of Upland Company, all purchased at underlying book value on January 1, 20X2. At that date, the fair value of the noncontrolling interest in Uplandâ€

> Snerd Corporation’s controller is having difficulty explaining the impact of several of the company’s intercorporate bond transactions. Required: Snerd receives interest payments in excess of the amount of interest income it records on its investm

> Topp Manufacturing Company acquired 90 percent of Bussman Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Bussman reported common

> Topp Manufacturing Company acquired 90 percent of Bussman Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Bussman reported common

> Topp Manufacturing Company acquired 90 percent of Bussman Corporation’s outstanding common stock on December 31, 20X5, for $1,152,000. At that date, the fair value of the noncontrolling interest was $128,000, and Bussman reported common

> First Boston Corporation acquired 80 percent of Gulfside Corporation common stock on J anuary 1, 20X5. Gulfside holds 60 percent of the voting shares of Paddock Company, and Paddock owns 10 percent of the stock of First Boston. All acquisitions were made

> Panther Enterprises owns 80 percent of Grange Corporation’s voting stock. Panther acquired the shares on January 1, 20X4, for $234,500. On that date, the fair value of the noncontrolling interest was $58,625, and Grange reported common

> On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company’s stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Skate’s book value. Th

> On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company’s stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Skate’s book value. Th

> Lance Corporation purchased 75 percent of Avery Company’s common stock at underlying book value on January 1, 20X3. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Avery’s book va

> Lance Corporation purchased 75 percent of Avery Company’s common stock at underlying book value on January 1, 20X3. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Avery’s book va

> Promise Enterprises acquired 90 percent of Brown Corporation’s voting common stock on January 1, 20X3, for $315,000. At that date, the fair value of the noncontrolling interest of Brown Corporation was $35,000. Immediately after Promise

> Stellar Corporation purchased bonds of its subsidiary from a nonaffiliate during 20X6. Although Stellar purchased the bonds at par value, a loss on bond retirement is reported in the 20X6 consolidated income statement as a result of the purchase. Req

> Bennett Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the noncontrolling interest was equal to 40 percent of Stone’s book value. On December

> Bennett Corporation owns 60 percent of the stock of Stone Container Company, which it acquired at book value in 20X1. At that date, the fair value of the noncontrolling interest was equal to 40 percent of Stone’s book value. On December

> Grasper Corporation owns 70 percent of Latent Corporation’s common stock and 25 percent of Dally Corporation’s common stock. In addition, Latent owns 40 percent of Dally’s stock. In 20X6, Grasper, Latent, and Dally reported operating income of $90,000, $

> Tyler Manufacturing purchased 60 percent of the ownership of Brown Corporation stock on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Brown Corporation.

> Tyler Manufacturing purchased 60 percent of the ownership of Brown Corporation stock on J anuary 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of the book value of Brown Corporation

> On January 1, 20X2, Fischer Corporation purchased 90 percent of Culbertson Company common shares and 60 percent of its preferred shares at underlying book value. At that date, the fair value of the noncontrolling interest in Culbertson’

> Brown Company owns 90 percent of the common stock and 60 percent of the preferred stock of White Corporation, both acquired at underlying book value on January 1, 20X1. At that date, the fair value of the noncontrolling interest in White common stock was

> Offenberg Company issued $100,000 of 10 percent bonds on January 1, 20X1, at 120. The bonds mature in 10 years and pay 10 percent interest annually on December 31. Mainstream Corporation holds 80 percent of Offenberg’s voting shares, ac

> Mainstream Corporation holds 80 percent of Offenberg Company’s voting shares, acquired on January 1, 20X1, at underlying book value. On January 1, 20X4, Mainstream purchased Offenberg bonds with a par value of $40,000. The bonds pay 10

> Clayton Corporation purchased 75 percent of Topple Company common stock and 40 percent of its preferred stock on January 1, 20X6, for $270,000 and $80,000, respectively. At the time of purchase, the fair value of Topple’s common shares

> Farflung Corporation has in excess of 60 subsidiaries worldwide. It owns 65 percent of the voting common stock of Micro Company and 80 percent of the shares of Eagle Corporation. Micro sold $400,000 par value first mortgage bonds at par value on January

> Bliss Perfume Company issued $300,000 of 10 percent bonds on January 1, 20X2, at 110. The bonds mature 10 years from issue and have semiannual interest payments on January 1 and July 1. Parsons Corporation owns 80 percent of Bliss Perfume stock. On Janua

> Bliss Perfume Company issued $300,000 of 10 percent bonds on January 1, 20X2, at 110. The bonds mature 10 years from issue and have semiannual interest payments on January 1 and July 1. Parsons Corporation owns 80 percent of Bliss Perfume stock. On April

> Pride Corporation owns 80 percent of Simba Corporation’s outstanding common stock. Simba, in turn, owns 10 percent of Pride’s outstanding common stock. Required: What percent of the dividends paid by Simba is reported as dividends declared in

> Bath Corporation acquired 80 percent of Stang Brewing Company’s stock on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of Stang’s book va

> Bath Corporation acquired 80 percent of Stang Brewing Company’s stock on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 p ercent of Stang’s book v

> Stable Home Builders Inc. acquired 80 percent of Acme Concrete Works stock on January 1, 20X3, for $360,000. At that date, the fair value of the noncontrolling interest was $90,000. Acme Concrete’s balance sheet contained the following

> Pound Manufacturing Corporation prepared the following balance sheet as of January 1, 20X8: The company is considering a 2-for-1 stock split, a stock dividend of 4,000 shares, or a stock dividend of 1,500 shares on its $10 par value common stock.

> Ballard Corporation purchased 70 percent of Condor Company’s voting shares on January 1, 20X4, at underlying book value. On that date it also purchased $100,000 par value 12 percent Condor bonds, which had been issued on January 1, 20X1

> Lake Company reported the following summarized balance sheet data as of December 31, 20X2: Lake issues 4,000 additional shares of its $10 par value stock to its shareholders as a stock dividend on April 20, 20X3. The market price of Lake&acir

> Amazing Corporation purchased $100,000 par value bonds of its subsidiary, Broadway Company, on December 31, 20X5, from Lemon Corporation for $102,800. The 10-year bonds bear a 9 percent coupon rate, and Broadway originally sold them on January 1, 20X3, t

> Assume the same facts as in E8-3 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-3: Wood Corporation owns 70 percent of Carter Company’s voting shares. On January 1, 20X3, Carter sold bonds with a par valu

> Amazing Corporation purchased $100,000 par value bonds of its subsidiary, Broadway Company, on December 31, 20X5, from Lemon Corporation. The 10-year bonds bear a 9 percent coupon rate, and Broadway originally sold them on January 1, 20X3, to Lemon. Inte

> Talbott Company purchased 80 percent of Short Company’s stock on January 1, 20X8, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of Short’s book value. On

> Gross Corporation issued $500,000 par value, 10-year bonds at 104 on January 1, 20X1, which Independent Corporation purchased. On January 1, 20X5, Rupp Corporation purchased $200,000 of Gross bonds from Independent for $196,700. The bonds pay 9 percent i

> Gross Corporation issued $500,000 par value 10-year bonds at 104 on January 1, 20X1, which Independent Corporation purchased. On July 1, 20X5, Rupp Corporation purchased $200,000 of Gross bonds from Independent. The bonds pay 9 percent interest annually

> Blank Corporation prepared the following summarized balance sheet on January 1, 20X1: Shepard Company acquires 80 percent of Blank Corporation’s common stock on January 1, 20X1, for $80,000. At that date, the fair value of t

> On January 1, 20X1, Fern Corporation paid Morton Advertising $116,200 to acquire 70 percent of Vincent Company’s stock. Fern also paid $45,000 to acquire $50,000 par value 8 percent, 10-year bonds directly from Vincent on that date. Thi

> On January 1, 20X1, Fern Corporation paid Morton Advertising $116,200 to acquire 70 percent of Vincent Company’s stock. Fern also paid $45,000 to acquire $50,000 par value 8 percent, 10-year bonds directly from Vincent on that date. Int

> Browne Corporation purchased 11,000 shares of Schroeder Corporation on January 1, 20X3, at book value. At that date, the fair value of the noncontrolling interest was equal to 26.6 percent of Schroeder’s book value. On December 31, 20X8

> Mega Corporation purchased 90 percent of Tarp Company’s voting common shares on January 1, 20X2, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 10 percent of the book value of Tarp Com

> Wood Corporation owns 70 percent of Carter Company’s voting shares. On January 1, 20X3, Carter sold bonds with a par value of $600,000 at 98. Wood purchased $400,000 par value of the bonds; the remainder was sold to nonaffiliates. The bonds mature in fiv

> Blatant Advertising Corporation acquired 60 percent of Quinn Manufacturing Company’s shares on December 31, 20X1, at underlying book value of $180,000. At that date, the fair value of the noncontrolling interest was equal to 40 percent

> Porter Company purchased 60 percent ownership of Temple Corporation on January 1, 20X1, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 40 percent of Temple’s book value. On January 1,

> Assume the same facts as in E8-14 except for the changes in the trial balances and assuming the bonds were sold for $82,000, but prepare entries using straight-line amortization of bond discount or premium. Data from E8-14: Porter Company purchased 60

> Weal Corporation purchased 60 percent of Modern Products Company’s shares on December 31, 20X7, for $210,000. At that date, the fair value of the noncontrolling interest was $140,000. On January 1, 20X9, Weal purchased an additional 20

> Explain how a reciprocal ownership arrangement between two subsidiaries could lead the parent company to overstate its income if no adjustment is made for the reciprocal relationship.

> Assume the same facts as in E8-13 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-13: Stang Corporation issued to Bradley Company $400,000 par value, 10-year bonds with a coupon rate of 12 percent on Janua

> Stang Corporation issued to Bradley Company $400,000 par value, 10-year bonds with a coupon rate of 12 percent on January 1, 20X5, at 105. The bonds pay interest semiannually on July 1 and January 1. On January 1, 20X8, Purple Corporation purchased $100,

> Parent Company holds 80 percent ownership of Subsidiary Company, and Subsidiary Company owns 90 percent of the stock of Tiny Corporation. What effect will $100,000 of unrealized intercompany profits on Tiny’s books on December 31, 20X5, have on the amoun

> Assume the same facts as in E8-12 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-12: Bundle Company issued $500,000 par value, 10-year bonds at 104 on January 1, 20X3, which Mega Corporation purchased. Th

> Bundle Company issued $500,000 par value, 10-year bonds at 104 on January 1, 20X3, which Mega Corporation purchased. The coupon rate on the bonds is 11 percent. Interest payments are made semiannually on July 1 and January 1. On July 1, 20X6, Parent Comp

> Hydro Corporation needed to build a new production facility. Because it already had a relatively high debt ratio, the company decided to establish a joint venture with Rich Corner Bank. This arrangement permitted the joint venture to borrow $30 million f

> Strong Manufacturing Company holds 94 percent ownership of Thorson Farm Products and 68 percent ownership of Kenwood Distributors. Thorson has excess cash at the end of 20X4 and is considering buying shares of its own stock, shares of Strong, or shares o

> Online Enterprises owns 95 percent of Downlink Corporation. On January 1, 20X1, Downlink issued $200,000 of five-year bonds at 115. Annual interest of 12 percent is paid semiannually on January 1 and July 1. Online purchased $100,000 of the bonds on Augu

> Online Enterprises owns 95 percent of Downlink Corporation. On January 1, 20X1, Downlink issued $200,000 of five-year bonds at 115. Annual interest of 12 percent is paid semiannually on January 1 and July 1. Online purchased $100,000 of the bonds on July

> Hardcore Mining Company acquired 88 percent of the common stock of Mountain Trucking Company on January 1, 20X2, at a cost of $30 per share. On December 31, 20X7, when the book value of Mountain Trucking stock was $70 per share, Hardcore sold one-quarter

> Apple Corporation holds 60 percent of Shortway Publishing Company’s voting shares. Apple issued $500,000 of 10 percent bonds with a 10-year maturity on January 1, 20X2, at 90. On January 1, 20X8, Shortway purchased $100,000 of the Apple

> Apple Corporation holds 60 percent of Shortway Publishing Company’s voting shares. Apple issued $500,000 of 10 percent (paid semiannually) bonds with a 10-year maturity on January 1, 20X2, at 90. On January 1, 20X8, Shortway purchased $

> Book Corporation purchased 90,000 shares of Lance Company at underlying book value of $3 per share on June 30, 20X1. On January 1, 20X5, Lance reported its net book value as $400,000 and continued to have 100,000 shares of common stock outstanding. On th

> Assume the same facts as in E8-9 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-9: Farley Corporation owns 70 percent of Snowball Enterprises’ stock. On January 1, 20X1, Farley sold $1 million par value,

> Farley Corporation owns 70 percent of Snowball Enterprises’ stock. On January 1, 20X1, Farley sold $1 million par value, 7 percent (paid semiannually), 20-year, first mortgage bonds to Kling Corporation at 97. On January 1, 20X8, Snowball purchased $300,

> Companies sometimes employ accounting practices that are not necessarily in accordance with accounting theory or even current standards. In some cases, companies may be following industry practices rather than generally accepted practices. In other cases

> Nettle Corporation sold $100,000 par value, 10-year first mortgage bonds to Timberline Corporation on January 1, 20X5. The bonds, which bear a nominal interest rate of 12 percent, pay interest semiannually on January 1 and July 1. The entry to record int

> Assume the same facts as in E8-8 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-8: Able Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 years a

> Able Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 years and pay interest semiannually on January 1 and July 1. Prime Corporation purchased $400,000 of Able’s bonds from the original purchase

> Snow Corporation issued common stock with a par value of $100,000 and preferred stock with a par value of $80,000 on January 1, 20X5, when the company was created. Klammer Corporation acquired a controlling interest in Snow on January 1, 20X6.

> Assume the same facts as in E8-7 but prepare entries using straight-line amortization of bond discount or premium. Data from E8-7: Able Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 years a

> Able Company issued $600,000 of 9 percent first mortgage bonds on January 1, 20X1, at 103. The bonds mature in 20 years and pay interest semiannually on January 1 and July 1. Prime Corporation purchased $400,000 of Able’s bonds from the original purchase

> Bradley Corporation sold bonds to Flood Company in 20X2 at 90. At the end of 20X4, Century Corporation purchased the bonds from Flood at 105. Bradley then retired the full bond issue on December 31, 20X7, at 101. Century holds 80 percent of Bradley’s vot

> Assume the same facts as in E8-1 and prepare entries using straight-line amortization of bond discount or premium. Data from E8-1: Lamar Corporation owns 60 percent of Humbolt Corporation’s voting shares. On January 1, 20X2, Lamar Corporation sold $150

> Lamar Corporation owns 60 percent of Humbolt Corporation’s voting shares. On January 1, 20X2, Lamar Corporation sold $150,000 par value, 6 percent first mortgage bonds to Humbolt for $156,000. The bonds mature in 10 years and pay interest semiannually on

> How does the use of interperiod tax allocation procedures affect the amount of income assigned to noncontrolling shareholders in the period in which the subsidiary records unrealized intercompany profits?

> Are there any book-tax differences that arise in an acquisition that do not require the inclusion of a deferred tax asset or liability in the net identifiable assets acquired?

> Snapper Corporation holds 70 percent ownership of Bit Company, and Bit holds 60 percent ownership of Slide Company. Should Slide be consolidated with Snapper Corporation? Why?

> How will parent company shares held by a subsidiary be reflected in the consolidated balance sheet when the treasury stock method is used?

> Major companies often have very complex organizational structures, sometimes consisting of different types of entities. Some organizational structures include combinations of corporations, partnerships, and perhaps other types of entities. Complex organi

> What effect will a subsidiary’s 15 percent stock dividend have on the consolidated financial statements?

> How is the amount of income assigned to the noncontrolling interest affected when the parent purchases the bonds of its subsidiary from an unaffiliated company for less than book value?

> How is the amount of income assigned to the noncontrolling interest affected by the direct placement of a subsidiary’s bonds with the parent company?

> When a subsidiary purchases the bonds of its parent from a nonaffiliate for less than book value, what will be the effect on consolidated net income and income to the controlling interest?

> What portion of the sales of an acquired company is included in the consolidated income statement following a midyear acquisition?

> Are sales included in the consolidated cash flows worksheet in computing cash flows from operating activities under (a) the indirect method or (b) the direct method?

> A parent company sells common shares of one of its subsidiaries to a nonaffiliate for more than their carrying value on the parent’s books. How should the parent company report the sale? How should the sale be reported in the consolidated financial state

> Why are changes in inventory balances not shown in the statement of cash flows when the direct method is used in presenting the cash flows from operating activities?

> What portion of subsidiary preferred stock outstanding is reported as part of the noncontrolling interest in the consolidated balance sheet?

> How do the consolidation entries at the end of the year change when an acquisition occurs at midyear rather than at the beginning of the year?

> Assume the same facts as in E8-6 except that the company uses straight-line amortization. Required: Select the correct answer for each of the following questions. What amount of interest expense should be included in the 20X4 consolidated income s

> How are dividends declared by an acquired company prior to the date of a midyear acquisition treated in the consolidated financial statements?

> How is an increase in inventory included in the amounts reported as cash flows from operating activities under (a) the indirect method and (b) the direct method?

> Why are payments to suppliers not shown in the statement of cash flows when the indirect method is used in presenting cash flows from operating activities?

> Why are dividend payments to noncontrolling shareholders treated as an outflow of cash in the consolidated cash flow statement but not included as dividends paid in the consolidated retained earnings statement?