Question: Skinny Dippers Inc. produces non-fat frozen

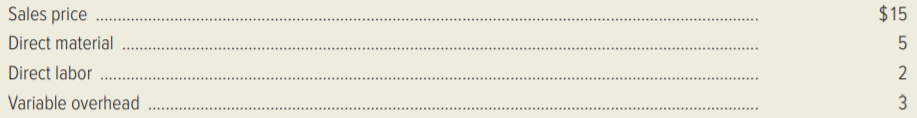

Skinny Dippers Inc. produces non-fat frozen yogurt. The product is sold in five-gallon containers, which have the following price and variable costs.

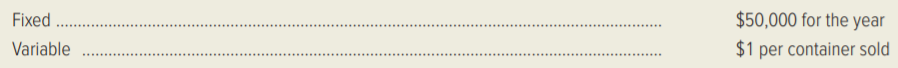

Budgeted fixed overhead in 20x1, the company’s first year of operations, was $300,000. Actual production was 150,000 five-gallon containers, of which 125,000 were sold. Skinny Dippers Inc. incurred the following selling and administrative expenses.

Required:

1. Compute the product cost per container of frozen yogurt under (a) variable costing and (b) absorption costing.

2. Prepare operating income statements for 20x1 using (a) absorption costing and (b) variable costing.

3. Reconcile the operating income reported under the two methods by listing the two key places where the income statements differ.

4. Reconcile the operating income reported under the two methods using the shortcut method.

5. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following information changes: the selling price and direct-material cost per unit are $16.00 and $4.50, respectively.

> MedLine Equipment Corporation specializes in the manufacture of medical equipment, a field that has become increasingly competitive. Approximately two years ago, Ben Harrington, president of MedLine, became concerned that the company’s

> MedTech, Inc., manufactures diagnostic testing equipment used in hospitals. The company practices JIT production management and has a state-of-the-art manufacturing system, including an FMS and an AMHS. The following nonfinancial data were collected biwe

> Pittsburgh Plastics Corporation manufactures a range of molded plastic products, such as kitchen utensils and desk accessories. The production process in the North Hills plant is a JIT system, which operates in four flexible manufacturing cells. An autom

> You are preparing for an internship interview with a startup company. It’s very important to be knowledgeable about the company, so: • Visit the company’s website. Spend some time exploring the website to learn about the company’s product or service, and

> Warriner Equipment Company, which is located in Ontario, Canada, manufactures heavy construction equipment. The company’s primary product, an especially powerful bulldozer, is among the best produced in North America. The company operat

> As a group, discuss the activities of your college or university (e.g., admission, registration, etc.). List as many activities as you can. Required: Make a presentation to your class that includes the following: 1. Your list of activities. 2. The hiera

> Building Services Co. (BSC) was started a number of years ago by Jim and Joan Forge to provide cleaning services to both large and small businesses in their home city. Over the years, as local businesses reduced underutilized building maintenance staffs,

> Buckeye Department Stores, Inc., operates a chain of department stores in Ohio. The company’s organization chart appears below. Operating data for 20x1 follow. The following fixed expenses are controllable at the divisional level: depre

> Show-Off, Inc., sells merchandise through three retail outlets—in Las Vegas, Reno, and Sacramento—and operates a general corporate headquarters in Reno. A review of the company’s income statement indi

> Rocky Mountain General Hospital serves three counties in Colorado. The hospital is a non-profit organization that is supported by patient billings, county and state funds, and private donations. The hospital’s organization is shown in t

> Cleveland Computer Accessory Company (CCAC) distributes keyboard trays to computer stores. The keyboard trays can be attached to the underside of a desk, effectively turning it into a computer table. The keyboard trays are purchased from a manufacturer t

> White Mountain Sled Company manufactures children’s snow sleds. The company’s performance report for November is as follows. The company uses sales variance analysis to explain the difference between budgeted and actua

> College Memories, Inc., publishes college yearbooks. A monthly flexible overhead budget for the firm follows. The planned monthly production is 6,400 yearbooks. The standard direct-labor allowance is .25 hours per book and overhead is budgeted and applie

> Montreal Scholastic Supply Company uses a standard-costing system. The firm estimates that it will operate its manufacturing facilities at 800,000 machine hours for the year. The estimate for total budgeted overhead is $2,000,000. The standard variable-o

> Rutherford Wheel and Axle, Inc., has an automated production process, and production activity is quantified in terms of machine hours. A standard-costing system is used. The annual static budget for 20x1 called for 6,000 units to be produced, requiring 3

> WoodCrafts, Inc., is a manufacturer of furniture for specialty shops throughout the Northeast and has an annual sales volume of $12 million. The company has four major product lines: bookcases, magazine racks, end tables, and bar stools. Each line is man

> Top Quality Fruit Company, based on Oahu, grows, processes, cans, and sells three main pineapple products: sliced, crushed, and juice. The outside skin is cut off in the Cutting Department and processed as animal feed. The feed is treated as a by-product

> Eastern Auto Parts Company manufactures replacement parts for automobile repair. The company recently installed a flexible manufacturing system, which has significantly changed the production process. The installation of the new FMS was not anticipated w

> Flaming Foliage Sky Tours is a small sightseeing tour company in New Hampshire. The firm specializes in aerial tours of the New England countryside during September and October, when the fall color is at its peak. Until recently, the company had not had

> For each of the following independent Cases A and B, fill in the missing information. The company budgets and applies production overhead costs on the basis of direct-labor hours. (U denotes unfavourable variance; F denotes favorable variance.)

> Mark Fletcher, president of SoftGro, Inc., was looking forward to seeing the performance reports for November because he knew the company’s sales for the month had exceeded budget by a considerable margin. SoftGro, a distributor of educ

> Maxwell Company uses a standard cost accounting system and applies production overhead to products on the basis of machine hours. The following information is available for the year just ended: Standard variable-overhead rate per hour: $2.50 Standard fix

> Fall City Hospital has an outpatient clinic. Jeffrey Harper, the hospital’s chief administrator, is very concerned about cost control and has asked that performance reports be prepared that compare budgeted and actual amounts for medical assistants, clin

> Johnson Electrical produces industrial ventilation fans. The company plans to manufacture 72,000 fans evenly over the next quarter at the following costs: direct material, $1,440,000; direct labor, $360,000; variable production overhead, $450,000; and fi

> Newark Plastics Corporation developed its overhead application rate from the annual budget. The budget is based on an expected total output of 720,000 units requiring 3,600,000 machine hours. The company is able to schedule production uniformly throughou

> Countrytime Studios is a recording studio in Nashville. The studio budgets and applies overhead costs on the basis of production time. Countrytime’s controller anticipates 10,000 hours of production time to be available during the year.

> Gibralter Insurance Company uses a flexible overhead budget for its application-processing department. The firm offers five types of policies, with the following standard hours allowed for clerical processing. The following numbers of insurance applicati

> Disk City, Inc., is a retailer for digital video disks. The projected net income for the current year is $200,000 based on a sales volume of 200,000 video disks. Disk City has been selling the disks for $16 each. The variable costs consist of the $10-uni

> Calgary Paper Company produces paper for photocopiers. The company has developed standard overhead rates based on a monthly capacity of 180,000 direct-labor hours as follows: During April, 90,000 units were scheduled for production; however, only 80,000

> Refer to your solution for the problem 10-47 regarding Springsteen Company. Required: 1. Prepare journal entries to record all of the events listed for Springsteen Company during July. Specifically, these journal entries should reflect the following eve

> Springsteen Company manufactures guitars. The company uses a standard, job-order cost-accounting system in two production departments. In the Construction Department, the wooden guitars are built by highly skilled craftsmen and coated with several layers

> Rocky Mountain Camping Equipment, Inc., has established the following direct-material standards for its two products. During March, the company purchased 2,100 yards of tent fabric for its standard model at a cost of $13,440. The actual March production

> Aquafloat Corporation manufactures rafts for use in swimming pools. The standard cost for material and labor is $89.20 per raft. This includes 8 kilograms of direct material at a standard cost of $5.00 per kilogram, and 6 hours of direct labor at $8.20 p

> Schiffer Corporation manufactures agricultural machinery. At a recent staff meeting, the following direct-labor variance report for the year just ended was presented by the controller. Schiffer’s controller uses the following rule of th

> Quincy Farms produces items made from local farm products that are distributed to supermarkets. For many years, Quincy’s products have had strong regional sales on the basis of brand recognition: however, other companies have begun marketing similar prod

> Ogwood Company’s Johnstown Division is a small manufacturer of wooden household items. Al Rivkin, division controller, plans to implement a standard-costing system. Rivkin has collected information from several co-workers that will assist him in developi

> The director of cost management for Portland Instrument Corporation compares each month’s actual results with a monthly plan. The standard direct-labor rates for the year just ended and the standard hours allowed, given the actual outpu

> Associated Media Graphics (AMG) is a rapidly expanding company involved in the mass reproduction of instructional materials. Ralph Boston, owner and manager of AMG, has made a concentrated effort to provide a quality product at a fair price, with deliver

> Progressive Applications Corporation, a developer and distributor of business applications software, has been in business for five years. The company’s main products include programs used for list management, billing, and accounting for the mail order sh

> Orion Corporation has established the following standards for the prime costs of one unit of its chief product, dartboards. During June, Orion purchased 160,000 pounds of direct material at a total cost of $304,000. The total wages for June were $42,000,

> Santa Rosa Industries uses a standard-costing system to assist in the evaluation of operations. The company has had considerable trouble in recent months with suppliers and employees, so much so that management hired a new production supervisor, Frank Sc

> Sal Amato operates a residential landscaping business in an affluent suburb of St. Louis. In an effort to provide quality service, he has concentrated solely on the design and installation of upscale landscaping plans (e.g., trees, shrubs, fountains, and

> During May, Joliet Fabrics Corporation manufactured 500 units of a special multilayer fabric with the trade name Stylex. The following information from the Stylex production department also pertains to May. The standard prime costs for one unit of Stylex

> South Atlantic Chemical Company manufactures industrial chemicals in Rio de Janeiro, Brazil. The company plans to introduce a new chemical solution and needs to develop a standard product cost. The new chemical solution is made by combining a chemical co

> New Jersey Valve Company manufactured 7,800 units during January of a control valve used by milk processors in its Camden plant. Records indicated the following: The control valve has the following standard prime costs: Required: 1. Prepare a schedule o

> “We really need to get this new material-handling equipment in operation just after the new year begins. I hope we can finance it largely with cash and marketable securities, but if necessary we can get a short-term loan down at Metro B

> Healthful Foods Inc., a manufacturer of breakfast cereals and snack bars, has experienced several years of steady growth in sales, profits, and dividends while maintaining a relatively low level of debt. The board of directors has adopted a long-run stra

> Fresh Pak Corporation manufactures two types of cardboard boxes used in shipping canned food, fruit, and vegetables. The canned food box (type C) and the perishable food box (type P) have the following material and labour requirements. The following prod

> Toronto Business Associates, a division of Maple Leaf Services Corporation, offers management and computer consulting services to clients throughout Canada and the north western United States. The division specializes in website development and other Int

> United Security Systems, Inc. (USSI), manufactures and sells security systems. The company started by installing photoelectric security systems in offices and has expanded into the private-home market. USSI has a basic security system that has been devel

> Vista Electronics, Inc., manufactures two different types of coils used in electric motors. In the fall of the current year, Erica Becker, the controller, compiled the following data. Sales forecast for 20x0 (all units to be shipped in 20x0): Raw-materia

> Empire Chemical Company produces three products using three different continuous processes. The products are Yarex, Darol, and Norex. Projected sales in gallons for the three products for the years 20x2 and 20x3 are as follows: Inventories are planned fo

> Tulsa Chemical Company (TCC) produces and distributes industrial chemicals. TCC’s earnings increased sharply in 20x1, and bonuses were paid to the management staff for the first time in several years. Bonuses are based in part on the amount by which repo

> Alpha-Tech, a rapidly growing distributor of electronic components, is formulating its plans for 20x5. Carol Jones, the firm’s marketing director, has completed the following sales forecast. Phillip Smith, an accountant in the Planning

> Badlands Inc. manufactures a household fan that sells for $40 per unit. All sales are on account, with 40 percent of sales collected in the month of sale and 60 percent collected in the following month. The data that follow were extracted from the compan

> Mary and Kay, Inc., a distributor of cosmetics throughout Florida, is in the process of assembling a cash budget for the first quarter of 20x1. The following information has been extracted from the company’s accounting records: All sale

> Western State University (WSU) is preparing its master budget for the upcoming academic year. Currently, 8,000 students are enrolled on campus; however, the admissions office is forecasting a 5 percent growth in the student body despite a tuition hike to

> Spiffy Shades Corporation manufactures artistic frames for sunglasses. Talia Demarest, controller, is responsible for preparing the company’s master budget. In compiling the budget data for 20x1, Demarest has learned that new automated

> As a group, take a walking tour of your campus and the surrounding community. Make a list of all of the environmental costs of which you see evidence. Required: Make a presentation to the class about your findings. List and categorize the environmental

> Metropolitan Dental Associates is a large dental practice in Chicago. The firm’s controller is preparing the budget for the next year. The controller projects a total of 48,000 office visits, to be evenly distributed throughout the year

> Laser News Technology, Inc., manufactures computerized laser printing equipment used by newspaper publishers throughout North America. In recent years, the company’s market share has been eroded by stiff competition from Asian and Europ

> Advanced Technologies (AT) produces two compression machines that are popular with manufacturers of plastics: no. 165 and no. 172. Machine no. 165 has an average selling price of $60,000, whereas no. 172 typically sells for approximately $55,000. The com

> Chataqua Can Company manufactures metal cans used in the food-processing industry. A case of cans sells for $50. The variable costs of production for one case of cans are as follows: Variable selling and administrative costs amount to $1 per case. Budget

> Dayton Lighting Company had operating income for the first 10 months of the current year of $200,000. One hundred thousand units were manufactured during this period (the same as the planned production), and 100,000 units were sold. Fixed manufacturing o

> Great Out doze Company manufactures sleeping bags, which sell for $65 each. The variable costs of production are as follows: Budgeted fixed overhead in 20x1 was $200,000 and budgeted production was 25,000 sleeping bags. The year’s actua

> Colorado Telecom, Inc., manufactures telecommunications equipment. The company has always been production oriented and sells its products through agents. Agents are paid a commission of 15 percent of the selling price. Colorado Telecom’

> Alpine Thrills Ski Company recently expanded its manufacturing capacity. The firm will now be able to produce up to 15,000 pairs of cross-country skis of either the mountaineering model or the touring model. The sales department assures management that i

> Ohio Limestone Company produces thin limestone sheets used for cosmetic facing on buildings. The following income statement represents the operating results for the year just ended. The company had sales of 1,800 tons during the year. The manufacturing c

> Cincinnati Tool Company (CTC) manufactures a line of electric garden tools that are sold in general hardware stores. The company’s controller, Will Fulton, has just received the sales forecast for the coming year for CTCâ€

> Refer to the original data given for Jupiter Game Company in the problem 7-46. An activity-based costing study has revealed that Jupiter’s $150,000 of fixed costs include the following components: Management is considering the installat

> Rio Bus Tours has incurred the following bus maintenance costs during the recent tourist season. (The real is Brazil’s national monetary unit. On the day this exercise was written, the real was equivalent in value to .2545 U.S. dollar.)

> For each of the following independent cases, use the equation method to compute the economic order quantity.

> Jupiter Game Company manufactures pocket electronic games. Last year Jupiter sold 25,000 games at $25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. In an attempt to improve its product, the company is considering replac

> Silver Screen Inc. owns and operates a nationwide chain of movie theatres. The 500 properties in the Silver Screen chain vary from low-volume, small-town, single-screen theatres to high-volume, urban, multiscreen theatres. The firm’s ma

> Celestial Products, Inc., has decided to introduce a new product, which can be manufactured by either a computer-assisted manufacturing system or a labour-intensive production system. The manufacturing method will not affect the quality of the product. T

> Terry Smith and two of his colleagues are considering opening a law office in a large metropolitan area that would make inexpensive legal services available to those who could not otherwise afford services. The intent is to provide easy access for their

> The European Division of Worldwide Reference Corporation produces a pocket dictionary containing popular phrases in six European languages. Annual budget data for the coming year follow. Projected sales are 100,000 books. Required: 1. Calculate the brea

> Athletico Inc. manufactures warm-up suits. The company’s projected income for the coming year, based on sales of 160,000 units, is as follows: Required: In completing the following requirements, ignore income taxes. 1. Prepare a CVP gr

> Serendipity Sound, Inc., manufactures and sells compact discs. Price and cost data are as follows: In the following requirements, ignore income taxes. Required: 1. What is Serendipity Sound’s break-even point in units? 2. What is the c

> Consolidated Industries is studying the addition of a new valve to its product line. The valve would be used by manufacturers of irrigation equipment. The company anticipates starting with a relatively low sales volume and then boosting demand over the n

> Lawrence Corporation sells two ceiling fans, Deluxe and Basic. Current sales total 60,000 units, consisting of 39,000 Deluxe units and 21,000 Basic units. Selling price and variable cost information follow. Salespeople currently receive flat salaries tha

> Houston-based Advanced Electronics manufactures audio speakers for desktop computers. The following data relate to the period just ended when the company produced and sold 42,000 speaker sets: Management is considering relocating its manufacturing facili

> Alexandria Aluminum Company, a manufacturer of recyclable soda cans, had the following inventory balances at the beginning and end of 20x1. During 20x1, the company purchased $250,000 of raw material and spent $400,000 on direct labor. Manufacturing over

> Corrigan Enterprises is studying the acquisition of two electrical component insertion systems for producing its sole product, the universal gismo. Data relevant to the systems follow. Model no. 6754: Variable costs, $16.00 per unit Annual fixed costs, $

> College Pak Company produced and sold 60,000 backpacks during the year just ended at an average price of $20 per unit. Variable manufacturing costs were $8 per unit, and variable marketing costs were $4 per unit sold. Fixed costs amounted to $180,000 for

> Review Exhibit 6-12, which is a Tableau portrayal of the regression results for Donut Desire’s five donut shop locations, based on the entire ten-year data set (i.e., the past ten years). Required: The regression equation for the North

> Refer to Exhibit 6–11 and the Tableau displays presented in Exhibits 6–12, 6–13, 6–14, and 6–15. Suppose you are a managerial accountant or cost analyst for Donut D

> Review Exhibit 6–12, which is a Tableau portrayal of the regression results for Donut Desire’s five donut shop locations, based on the entire ten-year data set (i.e., the past ten years). In addition, review Exhibit 6&

> Dana Rand owns a catering company that prepares banquets and parties for both individual and business functions throughout the year. Rand’s business is seasonal, with a heavy schedule during the summer months and the year-end holidays a

> The controller of Chittenango Chain Company believes that the identification of the variable and fixed components of the firm’s costs will enable the firm to make better planning and control decisions. Among the costs the controller is

> Refer to the original data in the problem 6-41 for Martha’s Vineyard Marine Supply. Required: 1. Build a spreadsheet: Construct an Excel spreadsheet and use the Excel commands to perform a least-squares regression. Estimate the variabl

> Martha’s Vineyard Marine Supply is a wholesaler for a large variety of boating and fishing equipment. The company’s controller, Mathew Knight, has recently completed a cost study of the firm’s materia

> Rolling Hills Golf Association is a non-profit, private organization that operates three 18-hole golf courses north of Philadelphia. The organization’s financial director has just analyzed the course maintenance costs incurred by the go

> Vancouver Shakespearean Theater’s board of directors is considering the replacement of the theater’s lighting system. The old system requires two people to operate it, but the new system would require only a single ope

> The Allegheny School of Music has hired you as a consultant to help in analyzing the behaviour of the school’s costs. Use the account-classification method of cost estimation to classify each of the following costs as variable, fixed, or semi variable. B

> Antioch Extraction, which mines ore in Montana, uses a calendar year for both financial-reporting and tax purposes. The following selected costs were incurred in December, the low point of activity, when 1,500 tons of ore were extracted: Peak activity of

> Northwest Aircraft Industries (NAI) was founded 45 years ago by Jay Preston as a small machine shop producing machined parts for the aircraft industry, which is prominent in the Seattle/Tacoma area of Washington. By the end of its first decade, NAIâ

> Knickknack, Inc., manufactures two products: Odds and Ends. The firm uses a single, plant wide overhead rate based on direct-labor hours. Production and product-costing data are as follows: Knickknack, Inc., prices its products at 120 percent of cost, wh

> Manchester Technology, Inc., manufactures several different types of printed circuit boards; however, two of the boards account for the majority of the company’s sales. The first of these boards, a television circuit board, has been a s

> Montreal Electronics Company manufactures two large-screen television models: The Nova, which has been produced for 10 years and sells for $900, and the Royal, a new model introduced in early 20x0, which sells for $1,140. Based on the following income st