Question: The 2020 accounting records of Blocker Transport

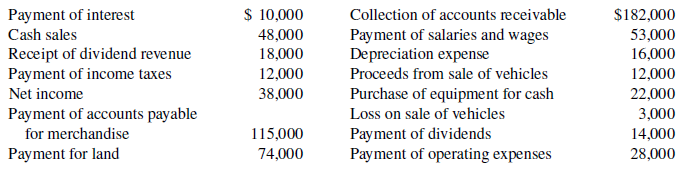

The 2020 accounting records of Blocker Transport reveal these transactions and events.

Instructions

Prepare the cash flows from operating activities section using the direct method. (Not all of the items will be used.)

Transcribed Image Text:

$ 10,000 $182,000 Payment of interest Cash sales Collection of accounts receivable Receipt of dividend revenue Payment of income taxes 48,000 18,000 Payment of salaries and wages Depreciation expense Proceeds from sale of vehicles 53,000 16,000 12,000 12,000 Net income 38,000 Purchase of equipment for cash 22,000 Loss on sale of vehicles Payment of accounts payable for merchandise 3,000 Payment of dividends Payment of operating expenses 115,000 14,000 28,000 Payment for land 74,000

> PepsiCo’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements

> The following data, presented in alphabetical order, are taken from the records of Nieto Corporation. Accounts payable …………………………………………………………………………………………….. $ 260,000 Accounts receivable …………………………………………………………………………………………….. 140,000 Accumulated deprecia

> The annual report of Apple Inc. is presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions a. Determine the percentage increase for (1) s

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following: a. What is the definition of long-term obligation? b. What guidance does the Codification provide for the disclosure of long-term obligations?

> Sam Masasi, president of Masasi Corporation, is considering the issuance of bonds to finance an expansion of his business. He has asked you to (1) discuss the advantages of bonds over common stock financing, (2) indicate the types of bonds he might issue

> On January 1, 2018, Glover Corporation issued $2,400,000 of 5-year, 8% bonds at 95. The bonds pay interest annually on January 1. By January 1, 2020, the market rate of interest for bonds of risk similar to those of Glover Corporation had risen. As a res

> Amazon.com, Inc.’s financial statements are presented in Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. The complete annual reports of Amazon and Wal-Mart, including the notes to the financial sta

> PepsiCo’s financial statements are presented in Appendix B. Financial statements of The Coca-Cola Company are presented in Appendix C. The complete annual reports of PepsiCo and Coca-Cola, including the notes to the financial statements

> The financial statements of Apple Inc. are presented in Appendix A. The complete annual report, including the notes to the financial statements, is available at the company’s website. Instructions a. What were Apple’s

> If your school has a subscription to the FASB Codification, log in and prepare responses to the following. a. What is the definition of a trading security? b. What is the definition of an available-for-sale security? c. What is definition of a holding ga

> Will Hardin, the owner-president of Computer Services Company, is unfamiliar with the statement of cash flows that you, as his accountant, prepared. He asks for further explanation. Instructions Write him a brief memo explaining the form and content of

> Fegan Corporation has purchased two securities for its portfolio. The first is a stock investment in Plummer Corporation, one of its suppliers. Fegan purchased 10% of Plummer with the intention of holding it for a number of years, but has no intention of

> The following securities are in Frederick Company’s portfolio of long-term securities at December 31, 2020. On December 31, 2020, the total cost of the portfolio equaled total fair value. Frederick had the following transactions relat

> At the beginning of the question-and-answer portion of the annual stockholders’ meeting of Neosho Corporation, stockholder John Linton asks, “Why did management sell the holdings in JMB Company at a loss when this company has been very profitable during

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Use the company’s

> The financial statements of Louis Vuitton are presented in Appendix F. The complete annual report, including the notes to its financial statements, is available at the company’s website. Instructions Use the company’s

> Ratzlaff Company issues (in euros) €2 million, 10-year, 8% bonds at 97, with interest payable annually on January 1. Instructions a. Prepare the journal entry to record the sale of these bonds on January 1, 2020. b. Assuming instead that the above bonds

> Ayala Corporation accumulates the following data relative to jobs started and finished during the month of June 2020. Overhead is applied on the basis of standard machine hours. Three hours of machine time are required for each direct labor hour. The j

> U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Depreciation is computed by the straight-line method with no salvage value. The company&

> The wages payable related to the factory workers for Larkin Company during the month of January are $76,000. The employer’s payroll taxes for the factory payroll are $8,000. The fringe benefits to be paid by the employer on this payroll are $6,000. Of th

> An incomplete cost of goods manufactured schedule is presented below. Instructions Complete the cost of goods manufactured schedule for Hobbit Company. Work in process (1/1) $210,000 Direct materials $ ? Raw materials inventory (1/1) Add: Raw mater

> National Express reports the following costs and expenses in June 2020 for its delivery service. Instructions Determine the total amount of (a) delivery service (product) costs and (b) period costs. $ 6,400 11,200 Advertising Indirect materials Dri

> Gala Company is a manufacturer of laptop computers. Various costs and expenses associated with its operations are as follows. 1. Property taxes on the factory building. 2. Production superintendents’ salaries. 3. Memory boards and chips used in assemblin

> Heidebrecht Design acquired 20% of the outstanding common stock of Quayle Company on January 1, 2020, by paying $800,000 for the 30,000 shares. Quayle declared and paid $0.30 per share cash dividends on March 15, June 15, September 15, and December 15, 2

> Keisha Tombert, the bookkeeper for Washington Consulting, a political consulting firm, has recently completed a managerial accounting course at her local college. One of the topics covered in the course was the cost of goods manufactured schedule. Keisha

> Incomplete manufacturing cost data for Horizon Company for 2020 are presented as follows for four different situations. Instructions a. Indicate the missing amount for each letter. b. Prepare a condensed cost of goods manufactured schedule for situatio

> Justin Bleeber has prepared the following list of statements about managerial accounting, financial accounting, and the functions of management. 1. Financial accounting focuses on providing information to internal users. 2. Staff positions are directly i

> Lendell Company has these comparative balance sheet data: Additional information for 2020: 1. Net income was $25,000. 2. Sales on account were $375,000. Sales returns and allowances amounted to $25,000. 3. Cost of goods sold was $198,000. 4. Net cash p

> Nordstrom, Inc. operates department stores in numerous states. Suppose selected financial statement data (in millions) for 2020 are presented below. For the year, net credit sales were $8,258 million, cost of goods sold was $5,328 million, and net cash

> Suppose the comparative balance sheets of Nike, Inc. are presented here. Instructions a. Prepare a horizontal analysis of the balance sheet data for Nike, using 2019 as a base. (Show the amount of increase or decrease as well.) b. Prepare a vertical an

> Here is financial information for Glitter Inc. Instructions Prepare a schedule showing a horizontal analysis for 2020, using 2019 as the base year. December 31, 2020 December 31, 2019 Current assets $106,000 $ 90,000 Plant assets (net) 400,000 350,

> Lorance Corporation issued $400,000, 7%, 20-year bonds on January 1, 2020, for $360,727. This price resulted in an effective-interest rate of 8% on the bonds. Interest is payable annually on January 1. Lorance uses the effective-interest method to amorti

> Gridley Company issued $800,000, 11%, 10-year bonds on December 31, 2019, for $730,000. Interest is payable annually on December 31. Gridley Company uses the straight-line method to amortize bond premium or discount. Instructions Prepare the journal ent

> Comparative balance sheets for International Company are presented as follows. Additional information: 1. Net income for 2020 was $135,000. 2. Cash dividends of $70,000 were declared and paid. 3. Bonds payable amounting to $50,000 were redeemed for ca

> On December 31, 2020, Turnball Associates owned the following securities, held as a long-term investment. The securities are not held for influence or control of the investee. On December 31, 2020, the total fair value of the securities was equal to it

> The following information is taken from the 2020 general ledger of Swisher Company. Instructions In each case, compute the amount that should be reported in the operating activities section of the statement of cash flows under the direct method. Re

> The condensed financial statements of Ness Company for the years 2019 and 2020 are presented below. Compute the following ratios for 2020 and 2019. a. Current ratio. b. Inventory turnover. (Inventory on December 31, 2018, was $340.) c. Profit margin.

> Panza Corporation experienced a fire on December 31, 2020, in which its financial records were partially destroyed. It has been able to salvage some of the records and has ascertained the following balances. Additional information: 1. The inventory tur

> Here is the income statement for Myers, Inc. Additional information: 1. Common stock outstanding January 1, 2020, was 32,000 shares, and 40,000 shares were outstanding at December 31, 2020. 2. The market price of Myers stock was $14 at December 31, 202

> For its fiscal year ending October 31, 2020, Haas Corporation reports the following partial data shown below. The loss on discontinued operations was comprised of a $50,000 loss from operations and a $70,000 loss from disposal. The income tax rate is 2

> Here are comparative balance sheets for Velo Company. indirect method Additional information: 1. Net income for 2020 was $93,000. 2. Cash dividends of $35,000 were declared and paid. 3. Bonds payable amounting to $50,000 were redeemed for cash $50,000.

> Rojas Corporation’s comparative balance sheets are presented below. Additional information: 1. Net income was $22,630. Dividends declared and paid were $19,500. 2. No noncash investing and financing activities occurred during 2020. 3.

> The following three accounts appear in the general ledger of Herrick Corp. during 2020. Instructions From the postings in the accounts, indicate how the information is reported on a statement of cash flows using the indirect method. The loss on disposa

> The following information is available for Stamos Corporation for the year ended December 31, 2020. Beginning cash balance …………………………………………………………. $ 45,000 Accounts payable decrease …………………………………………………………. 3,700 Depreciation expense ……………………………………………………

> The current sections of Scoggin Inc.’s balance sheets at December 31, 2019 and 2020, are presented here. Scoggin’s net income for 2020 was $153,000. Depreciation expense was $24,000. Instructions Prepare the net cash

> In January 2020, the management of Kinzie Company concludes that it has sufficient cash to permit some short-term investments in debt and equity securities. During the year, the following transactions occurred. Feb. 1 Purchased 600 shares of Muninger com

> Gutierrez Company reported net income of $225,000 for 2020. Gutierrez also reported depreciation expense of $45,000 and a loss of $5,000 on the disposal of plant assets. The comparative balance sheet shows a decrease in accounts receivable of $15,000 for

> Cushenberry Corporation had the following transactions. 1. Sold land (cost $12,000) for $15,000. 2. Issued common stock at par for $20,000. 3. Recorded depreciation on buildings for $17,000. 4. Paid salaries of $9,000. 5. Issued 1,000 shares of $1 par va

> An analysis of comparative balance sheets, the current year’s income statement, and the general ledger accounts of Wellman Corp. uncovered the following items. Assume all items involve cash unless there is information to the contrary. a. Payment of inter

> Suppose a recent income statement for McDonald’s Corporation shows cost of goods sold $4,852.7 million and operating expenses (including depreciation expense of $1,201 million) $10,671.5 million. The comparative balance sheet for the year shows that inve

> Macgregor Company completed its fi rst year of operations on December 31, 2020. Its initial income statement showed that Macgregor had revenues of $192,000 and operating expenses of $78,000. Accounts receivable and accounts payable at year-end were $60,0

> Rodriquez Corporation’s comparative balance sheets are presented below. Additional information: 1. Net income was $18,300. Dividends declared and paid were $16,400. 2. Equipment which cost $10,000 and had accumulated depreciation of $

> Tabares Corporation had these transactions during 2020. a. Issued $50,000 par value common stock for cash. b. Purchased a machine for $30,000, giving a long-term note in exchange. c. Issued $200,000 par value common stock upon conversion of bonds having

> Writing Agee Company purchased 70% of the outstanding common stock of Himes Corporation. Instructions a. Explain the relationship between Agee Company and Himes Corporation. b. How should Agee account for its investment in Himes? c. Why is the accountin

> The following are two independent situations. 1. Gambino Cosmetics acquired 10% of the 200,000 shares of common stock of Nevins Fashion at a total cost of $13 per share on March 18, 2020. On June 30, Nevins declared and paid a $60,000 dividend. On Decemb

> The following section is taken from Mareska’s balance sheet at December 31, 2020. Interest is payable annually on January 1. The bonds are callable on any annual interest date. Instructions a. Journalize the payment of the bond inter

> On January 1, Zabel Corporation purchased a 25% equity in Helbert Corporation for $180,000. At December 31, Helbert declared and paid a $60,000 cash dividend and reported net income of $200,000. Instructions a. Journalize the transactions. b. Determine

> On February 1, Rinehart Company purchased 500 shares (2% ownership) of Givens Company common stock for $32 per share. On March 20, Rinehart Company sold 100 shares of Givens stock for $2,900. Rinehart received a dividend of $1.00 per share on April 25. O

> Nosker Inc. had the following transactions pertaining to investments in common stock. Jan. 1 Purchased 2,500 shares of Escalante Corporation common stock (5%) for $152,000 cash. July 1 Received a cash dividend of $3 per share. Dec. 1 Sold 500 shares of E

> Financial Statement Hulse Company had the following transactions pertaining to stock investments. Feb. 1 Purchased 600 shares of Wade common stock (2%) for $7,200 cash. July 1 Received cash dividends of $1 per share on Wade common stock. Sept. 1 Sold 300

> Flynn Company purchased 70 Rinehart Company 6%, 10-year, $1,000 bonds on January 1, 2020, for $70,000. The bonds pay interest annually on January 1. On January 1, 2021, after receipt of interest, Flynn Company sold 40 of the bonds for $38,500. Instructi

> Jenek Corporation had the following transactions pertaining to debt investments. 1. Purchased 40 Leeds Co. 9% bonds (each with a face value of $1,000) for $40,000 cash. Interest is payable annually on January 1, 2020. 2. Accrued interest on Leeds Co. bon

> Adcock Company issued $600,000, 9%, 20-year bonds on January 1, 2020, at 103. Interest is payable annually on January 1. Adcock uses straight-line amortization for bond premium or discount. Instructions Prepare the journal entries to record the followin

> On January 1, 2020, Throm Inc. entered into an agreement to lease 20 computers from Drummond Electronics. The terms of the lease agreement require three annual rental payments of $20,000 (including 10% interest) beginning December 31, 2020. The present v

> Hatfield Corporation reports the following amounts in its 2020 financial statements: Instructions a. Compute the December 31, 2020, balance in stockholders’ equity. b. Compute the debt to assets ratio at December 31, 2020. c. Compute

> Uttinger Company has the following data at December 31, 2020. The available-for-sale securities are held as a long-term investment. Instructions a. Prepare the adjusting entries to report each class of securities at fair value. b. Indicate the stateme

> Kershaw Electric sold $6,000,000, 10%, 10-year bonds on January 1, 2020. The bonds were dated January 1, 2020, and paid interest on January 1. The bonds were sold at 98. Instructions a. Prepare the journal entry to record the issuance of the bonds on Ja

> Data for debt investments classified as trading securities are presented in E16.10. Assume instead that the investments are classified as available for- sale debt securities. They have the same cost and fair value as indicated in E16.10. The securities a

> Financial Statement At December 31, 2020, the trading debt securities for Storrer, Inc. are as follows. Instructions a. Prepare the adjusting entry at December 31, 2020, to report the securities at fair value. b. Show the balance sheet and income state

> Mr. Taliaferro is studying for an accounting test and has developed the following questions about investments. 1. What are three reasons why companies purchase investments in debt or stock securities? 2. Why would a corporation have excess cash that it d

> Jernigan Co. receives $300,000 when it issues a $300,000, 10%, mortgage note payable to finance the construction of a building at December 31, 2020. The terms provide for annual installment payments of $50,000 on December 31. Instructions Prepare the jo

> The following are two independent situations. 1. Longbine Corporation redeemed $130,000 face value, 12% bonds on June 30, 2020, at 102. The carrying value of the bonds at the redemption date was $117,500. The bonds pay annual interest, and the interest p

> The following section is taken from Ohlman Corp.’s balance sheet at December 31, 2019. Bond interest is payable annually on January 1. The bonds are callable on any interest date. Instructions a. Journalize the payment of the bond in

> Whitmore Company issued $500,000 of 5-year, 8% bonds at 97 on January 1, 2020. The bonds pay interest annually. Instructions a. 1. Prepare the journal entry to record the issuance of the bonds. 2. Compute the total cost of borrowing for these bonds. b.

> Swisher Company issued $2,000,000 of bonds on January 1, 2020. Instructions a. Prepare the journal entry to record the issuance of the bonds if they are issued at (1) 100, (2) 98, and (3) 103. b. Prepare the journal entry to record the redemption of

> Laudie Company issued $400,000 of 9%, 10-year bonds on January 1, 2020, at face value. Interest is payable annually on January 1, 2021. Instructions Prepare the journal entries to record the following events. a. The issuance of the bonds. b. The accrual

> On January 1, 2020, Forrester Company issued $400,000, 8%, 5-year bonds at face value. Interest is payable annually on January 1. Instructions Prepare journal entries to record the following. a. The issuance of the bonds. b. The accrual of interest on D

> On May 1, 2020, Herron Corp. issued $600,000, 9%, 5-year bonds at face value. The bonds were dated May 1, 2020, and pay interest annually on May 1. Financial statements are prepared annually on December 31. Instructions a. Prepare the journal entry to r

> On January 1, 2020, Klosterman Company issued $500,000, 10%, 10-year bonds at face value. Interest is payable annually on January 1. Instructions Prepare journal entries to record the following. a. The issuance of the bonds. b. The accrual of interest o

> Gilliland Airlines is considering two alternatives for the financing of a purchase of a fleet of airplanes. These two alternatives are: 1. Issue 90,000 shares of common stock at $30 per share. (Cash dividends have not been paid nor is the payment of any

> Lopez Company uses a standard cost accounting system. Some of the ledger accounts have been destroyed in a fi re. The controller asks your help in reconstructing some missing entries and balances. Instructions Answer the following questions. a. Material

> In May 2020, the budget committee of Grand Stores assembles the following data in preparation of budgeted merchandise purchases for the month of June. 1. Expected sales: June $500,000, July $600,000. 2. Cost of goods sold is expected to be 75% of sales.

> The Ferrell Transportation Company uses a responsibility reporting system to measure the performance of its three investment centers: Planes, Taxis, and Limos. Segment performance is measured using a system of responsibility reports and return on investm

> Indicate which of the four perspectives in the balanced scorecard is most likely associated with the objectives that follow. 1. Percentage of repeat customers. 2. Number of suggestions for improvement from employees. 3. Contribution margin. 4. Brand reco

> The South Division of Wiig Company reported the following data for the current year. Sales ………………………………….. $3,000,000 Variable costs …………………….…. 1,950,000 Controllable fixed costs ………….… 600,000 Average operating assets ………. 5,000,000 Top management is

> Fisk Company uses a standard cost accounting system. During January, the company reported the following manufacturing variances. In addition, 8,000 units of product were sold at $8 per unit. Each unit sold had a standard cost of $5. Selling and adminis

> Urban Corporation prepared the following variance report. Instructions Fill in the appropriate amounts or letters for the question marks in the report. Urban Corporation Variance Report–Purchasing Department For the Week Ended January 9, 2020 Туре

> The Mixing Department manager of Malone Company is able to control all overhead costs except rent, property taxes, and salaries. Budgeted monthly overhead costs for the Mixing Department, in alphabetical order, are: Actual costs incurred for January 20

> Vilander Carecenters Inc. provides financing and capital to the healthcare industry, with a particular focus on nursing homes for the elderly. The following selected transactions relate to bonds acquired as an investment by Vilander, whose fiscal year en

> The Current Designs staff has prepared the annual manufacturing budget for the rotomolded line based on an estimated annual production of 4,000 kayaks during 2020. Each kayak will require 54 pounds of polyethylene powder and a finishing kit (rope, seat,

> Ceelo Company purchased (at a cost of $10,200) and used 2,400 pounds of materials during May. Ceelo’s standard cost of materials per unit produced is based on 2 pounds per unit at a cost $5 per pound. Production in May was 1,050 units. Instructions a. C

> Kirkland Company combines its operating expenses for budget purposes in a selling and administrative expense budget. For the first 6 months of 2020, the following data are available. 1. Sales: 20,000 units quarter 1; 22,000 units quarter 2. 2. Variable c

> Drake Corporation is reviewing an investment proposal. The initial cost is $105,000. Estimates of the book value of the investment at the end of each year, the net cash flows for each year, and the net income for each year are presented in the schedule b

> During March 2020, Toby Tool & Die Company worked on four jobs. A review of direct labor costs reveals the following summary data. Analysis reveals that Job A257 was a repeat job. Job A258 was a rush order that required overtime work at premium rat

> Legend Service Center just purchased an automobile hoist for $32,400. The hoist has an 8-year life and an estimated salvage value of $3,000. Installation costs and freight charges were $3,300 and $700, respectively. Legend uses straight-line depreciation

> Fuqua Company’s sales budget projects unit sales of part 198Z of 10,000 units in January, 12,000 units in February, and 13,000 units in March. Each unit of part 198Z requires 4 pounds of materials, which cost $2 per pound. Fuqua Company desires its endin

> Iggy Company is considering three capital expenditure projects. Relevant data for the projects are as follows. Annual income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Iggy C

> The actual selling expenses incurred in March 2020 by Fallon Company are as follows. Instructions a. Prepare a flexible budget performance report for March using the budget data in E25.5, assuming that March sales were $170,000. b. Prepare a flexible b

> Bruno Corporation is involved in the business of injection molding of plastics. It is considering the purchase of a new computer-aided design and manufacturing machine for $430,000. The company believes that with this new machine it will improve producti

> Using the information in E25.3, assume that in July 2020, Myers Company incurs the following manufacturing overhead costs. Instructions a. Prepare a flexible budget performance report, assuming that the company worked 9,000 direct labor hours during th