Question: The accountant for Roadrunner Food Services is

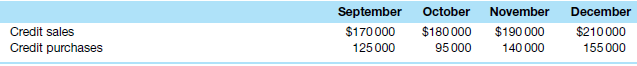

The accountant for Roadrunner Food Services is preparing its cash budget for November and December 2021. The accountant, Ross Leon, has collected the following information regarding expected credit sales and expected purchases of inventory on credit.

Ross has analysed the accounts receivable records for the past few years and has determined that customers normally pay 60 per cent in the month of sale, 30 per cent in the month following the sale and 8 per cent in the second month following the sale. The remaining 2 per cent is considered a bad debt and uncollectable.

Foods R Us, the only supplier to Roadrunner Food Services, offers a 4 per cent discount if its customers pay by the 15th day of the following month. Ross always takes advantage of this discount. Cash payment for operating expenses are expected to be $85 000 per month for November and December. The expected cash balance on 1 November is $10 000.

Required

(a) Explain to the owner of Roadrunner Food Services why a cash budget is important for the business.

(b) Prepare a cash budget for the months of November and December 2021.

(c) Ross would like to purchase a new vehicle in December. The cost of the vehicle is $40 000. Based on your cash budget, what recommendations would you make regarding this purchase?

Transcribed Image Text:

Credit sales Credit purchases September $170 000 125 000 October $180 000 95 000 November $190 000 140 000 December $210000 155 000

> Outline some cash-flow warning signals.

> Valley Company had a positive net cash flow for the year, but its statement of profit or loss reported a loss for the period. Explain.

> Outline the format of a statement of cash flows, identifying each of the activity classifications.

> Which of the following are not disclosed in a statement of cash flows? (a) Net cash flows from financing activities (b) The cash on hand at the end of the reporting period (c) The amount of depreciation for a reporting period (d) The proceeds from borrow

> What is the purpose of a statement of cash flows?

> Explain how you would determine if an income or expense item is material.

> The global financial crisis (GFC) was brought about by a bank induced liquidity squeeze in August 2007. Globally banks realised that their statement of financial positions contained highly toxic sub-prime mortgages and their derivatives and hedge fund ma

> Acquire a statement of cash flows for a company you are interested in evaluating. Normally, the financial statements are available on the company website. If you have trouble locating the financial statements of a company, ask at your library. Required

> Jenny Jones and Wendy Wilson are discussing the results of their Crystal Partnership. Presented below is the Crystal Partnership statement of cash flows for the year ended 31 December 2020. Jenny is impressed and pleased that the partnership has done so

> Refer to problems 7.43 and 7.44 and evaluate Food and Wine Ltd’s statement of cash flows. In problems 7.43 and 7.44 Financial statements of Food and Wine Ltd are presented below. Sales Cost of sales Opening inventory + Inventory pu

> Prepare a reconciliation of cash flows from operating activities and profit after tax for Food and Wine Ltd from problem 7.43. In problem 7.43 Financial statements of Food and Wine Ltd are presented below. Sales Cost of sales Opening inventory + Inv

> Financial statements of Food and Wine Ltd are presented below. Sales Cost of sales Opening inventory + Inventory purchases - Closing inventory Gross profit Expenses Wages and salaries Interest expense Depreciation expense Other expenses Interest rece

> Refer to problems 7.40 and 7.41 and complete an evaluation of the statement of cash flows of Flowers Ltd. In problem 7.40 and 7.41 Assets Cash Accounts receivable Inventory Prepaid expenses Property, plant and equipment Less: Accumulated depreciatio

> Prepare a reconciliation of cash flows from operating activities and profit after tax for Flowers Ltd from problem 7.40. In problem 7.40 Assets Cash Accounts receivable Inventory Prepaid expenses Property, plant and equipment Less: Accumulated depre

> A comparative statement of financial positions as at 31 December 2019 and 2020 for Flowers Ltd is shown below. Sales for 2020 were $180 000 and profit after tax was $16 350. Cost of sales was $136 456. Dividends of $6000 were declared and paid during th

> What is meant by the term ‘cash’?

> What is the main expense incurred by a retail business? Comment on how this differs to: 1) A service business; and 2) A manufacturing business.

> Dick Smith Holdings Ltd was a company operating in the consumer electronics goods area. Dick Smith commenced this business in 1968. It was acquired by Woolworths during the early 1980s and was sold to Anchorage Capital Partners Pty Ltd in November 2012.

> Information for Fred and Ginger’s Dance Pty Ltd has been extracted from its financial statements and is presented below. Information relating to the year ended 30 June 2020 is as follows. Total asset expenditure …&a

> The importance of cash flow to people both inside and outside an entity is apparent by a quick look through financial papers and internet sites. For instance, Foster’s Group Ltd eagerly announced in the press that it has curtailed its negative cash flow

> Presented below is information for the Hudson Partnership for the year ended 31 December 2019. Use the information to prepare a statement of cash flows. Cash balance, 31 December 2019 ……………………………….. $ 51 618 Cash paid to employees and suppliers ………………………

> Presented below is information for Sarah Waters, a sole trader, for the year ended 31 December 2020. Use the information to prepare a statement of cash flows. Cash balance, 31 December 2020 ……………………………………………….. $17 085 Cash paid to employees and supplier

> Refer to the data on Fruit Plantations Pty Ltd in exercise 7.33 and answer the following questions. In exercise 7.33 (a) Fruit Plantations Pty Ltd’s profit after income tax for the 4 months to 31 December 2019 was $105 000 and for the

> Outline how a creditor, an investor and an employee would each interpret this statement of cash flows of Fruit Plantations Pty Ltd. Cash flows from operating activities Receipts from customers FRUIT PLANTATIONS PTY LTD Statement of cash flows Receipt

> The financial information below has been extracted from the accounts of Misty Wines Pty Ltd. Peta Stevens, the sole shareholder, wants to evaluate the cash position of her company and understands she will need to calculate some cash-based ratios to do th

> Design Homes Ltd had a $58 000 net loss for 2020. A dividend of $22 000 was paid during the year and depreciation expense was $15 000. Inspection of the statement of financial position shows the following working capital accounts. Required Calculate whe

> Tom and Clancy Partners reported a profit of $76 000 for the year. The statement of profit or loss also showed depreciation expense of $8000 and a loss on the sale of a motor vehicle of $2000. The statement of financial position showed an increase in acc

> Explain the three methods of depreciation.

> The following list contains activities that may be added or subtracted from operating profit when reconciling to cash flows from operating activities. Indicate whether each activity is added, subtracted or irrelevant. (a) Decrease in accrued expenses. (b

> An entity is converting its accrual-based accounting records to a cash basis. The amount of $53 000 (including $7000 depreciation) was shown as ‘Other expenses’ in the statement of profit or loss. On inspection of the statement of financial position, you

> Fresh Food Catering Ltd’s capital expenditure for the current year on new equipment was $196 900. Current liabilities and non-current liabilities were $98 590 and $732 800 respectively. Sales for the current year were $331 650 and cash flows from operati

> Wattle Ltd has cash from operating activities of $57 246. It has incurred capital expenditure of $47 350, of which $33 900 was for additional equipment. Calculate the entity’s free cash flow. Comment on what the figure indicates.

> The sole trader of Rhode Store has approached you for a loan. You note that the closing cash balances for the last two years were $15 920 and $18 650 respectively. Rhode Store also took out a loan of $27 750 for the current year and sold plant worth $59

> On inspection of the financial statements, you note that sales are $67 500, and the beginning and closing accounts receivable balances are $49 500 and $63 000 respectively. What were the cash receipts from customers?

> ‘We made a profit of $124 000, so why is there only $15 000 in the bank?’ exclaimed Mr Charlton, the owner of the local fish and chip shop. Explain to Mr Charlton the relationship between profit and cash flow, to help him understand the reason why there

> Smith and Jones Partnership provides specialist financial planning services to its clients. The following information relates to the year just ended. Required Using the direct method, prepare the operating activities section of the statement of cash flo

> Molly Winter Pty Ltd has the following items in its accounts. • Bank interest received. • Depreciation of delivery van. • Cash purchase of office equipment. • Sale of goods for cash. • GST payable. • Receipts from share capital issue. • Cash from debentu

> The cash flows below were extracted from the accounts of Martin Jones, a music shop owner. Repayment of loan …………………………………………….. $420 000 Sale of property …………………………………………………… 390 000 Interest received ………………………………………………………. 1 560 Payments to employees …

> Discuss the difference between profit or loss and comprehensive income.

> Compute the cash from operations in each of the following cases (A and B). All sales and purchases have been made on credit. Sales revenue Depreciation expense Cost of sales Other expenses Dividends paid Increase/(decrease) in: Inventories Accounts r

> Consider the following transactions. • Credit purchases, $12 000. • Cash paid to suppliers, $16 000. • Credit sales, $21 000. • Cost of sales, $15 000. • Cash payme

> In what section of the statement of cash flows (operating, investing or financing) would each of the following items appear? (a) Cash paid to employees. (b) Cash received from debentures. (c) Payment of income tax. (d) Gain/loss from sale of motor vehicl

> Three sisters formed a partnership, FreshGlow, to sell skincare products made from organic ingredients. They have been operating for one year. The bank balance at the end of the year is $34 500. A summary of business transactions is as follows. Sales to

> The following ledger account shows the transactions in an entity’s cash account during the month. Required Prepare a statement of cash flows based on the cash account. Opening balance Receipts from customers Dividends received Sale

> Outline the difference between cash and accrual bases of accounting.

> List four ratios that could help evaluate an entity’s cash adequacy, liquidity, solvency and profitability.

> Outline the difference between the direct method and the indirect method of reporting cash flows. Why is it necessary to present the cash flows using both methods?

> Choose the correct response. The primary purpose of a statement of cash flows is to provide relevant information about: (a) An entity’s ability to meet future obligations. (b) The differences between profit and associated cash receipts and payments. (c)

> Fill in the blanks in the following statement by choosing the words from those in brackets that best complete the statement. Changes in non-current liabilities and equity would usually be classified as cash flows from (operating, financing or investing)

> The ASX convened the ASX Corporate Governance Council (ASXCGC) in August 2002. It was prompted by suggestions from ASIC and government that ASX take a leadership role in formulating a non-legislative response to the corporate governance issues arising fo

> Review the following quote from Colquhoun (2013). Investors assessing the recent reporting season of publicly listed companies will base their opinions of corporate performance largely on a handful of key numbers, all expressed in dollar terms and all de

> The 2017 statement of profit or loss (referred to as consolidated income statement) for Wesfarmers is provided below. Required Using the above information, answer the following questions. (a) Give an example of an expense that would be included in each

> In its 2018 annual report, Qantas Airways referred to ‘underlying profit’ and ‘statutory profit’. Identify the differences in these profit figures. Debate the merits of reporting non-statutory profit figures.

> Depreciation expense is an allocation of the cost of an asset over the asset’s useful life. Entities assess the useful lives of their various assets. The notes to the accounts for two airlines reveal the following variation in useful-li

> Groupon is a US company with a deal-of-the-day website that features discounted gift certificates usable at local or national companies. Since its formation, it has faced a number of questions relating to its accounting practices. Here are two examples o

> Jim St Cloud operates a wholesale clothing operation called St Cloud’s Designs. All the sales and purchases of the business are made on credit. The opening and closing balances for accounts receivable, inventory and accounts payable are

> The International Accounting Standards Board (IASB) and the US accounting standard–setting board worked on a joint project to develop a new standard on revenue recognition. Podcasts summarizing the project are available on various websites including that

> True Blue Ltd is reviewing its accounting policies and estimations. Detailed below are its current policies and estimations. Using these current policies, the company’s calculated profit figure is $840 000. What would True Blue Ltd&acir

> Samsung Group upholds a belief in shared responsibility — to its people, the planet and society. Samsung Electronics produces a sustainability report that includes the company’s profiles as well as its economic, environmental and social performance indic

> Commentary in Decore Ltd’s yearly summary FY18 notes: Our net profit remained the same as in FY17, the main reason being the contribution we made to our co-worker loyalty program, Give ($100 million), as well as the growing number of co

> Locate the most recent annual financial statements for Samsung Group from its website. Examine the information in the report and answer the following questions about Samsung Group’s statement of changes in equity. Required (a) Identify and state Samsung

> Note 1(d) of JB Hi-Fi Ltd’s 2018 (p. 60) notes to the financial statements states: Estimates and judgements used in the preparation of these financial statements are continually evaluated and are based on historical experience and other factors, includin

> Jacinta Williams had prepared the financial statements for her business, a sole proprietorship, to take to her accountant. Unfortunately, she has misplaced the statement of profit or loss. Her accountant assures her that the profit or loss for the period

> Generate the adjustments needed to the income, expense, asset and/or liability accounts for Board Games Pty Ltd to reflect the following transactions in the entity’s financial statements for the 12-month reporting period ended 31 December 2019 using the

> On 31 December 2018, Narvey Horman sold whitegood appliances to a customer for $8000. The customer paid cash for the whitegoods. Narvey Horman includes a three-year warranty service with the sale of all its whitegoods. Required (a) Explain Narvey Horman

> The following are the revenue recognition policies of Flight Centre Travel (FLT) Group as detailed in the company’s 2017 annual report (pp. 47, 103–104). Accounting policy The group recognises revenue when: • The amount of revenue can be reliably measure

> Beatrice has prepared a statement of profit or loss for the 12-month reporting period ended 30 June on a cash basis, showing a $64 800 profit. The cash-based statement shows the following. Sales ……………………………………………………………………. $416 100 Inventory purchased ……

> The statement of profit or loss for JB Hi-Fi Ltd for the financial year ended 30 June 2018 was provided in figure 6.2. It reports that JB Hi-Fi Ltd increased its gross profit from $1230.5 million in 2017 to $1470.2 million in 2018. Its profit for 2018 wa

> You are the assistant accountant at Sunshine Plantations Pty Ltd and have prepared the following statement of profit or loss for the year ended 31 December 2021. SUNSHINE PLANTATIONS PTY LTD Statement of profit or loss for the year ended 31 December 2021

> ‘The profit represents the increase in the value of an entity during the reporting period.’ Critically evaluate this statement.

> The consolidated statement of cash flows for CSR Ltd for the year ended 31 March 2018 is presented below. Required (a) What information does the statement of cash flows provide? (b) Outline the two different methods of preparing the statement of cash fl

> A list of account balances for Mr Tanner’s business Robotics at the end of the 30 June 2020 reporting period is shown below. Prepare the statement of profit or loss for the reporting period, and the equity balance at the end of the year. …………………………………………

> The following information was obtained from the financial records of Broadbeach Ltd for the year ended 30 June 2018. Prepare the statement of profit or loss for the year ended 30 June 2018. …………………………………………………………………………………………………………………. $’000 Retained earn

> Myer shares slumped when the department store posted a 23.1 per cent slide in profit for the first half of the 2014–15 year. Myer’s profit was mostly hit by a 24-basis-point fall in gross profit margin and a 6.2 per cent increase in the cash cost of doin

> The accountant at AppsGalore, a technology business, has determined that the following adjustments should be made in the entity’s accounts for the year ended 30 June using an accrual-based system. 1. Income earned but not invoiced totalling $21 000. 2. U

> (a) Compare the adjustments necessary on the accounts (income or expense only) of Peter Burrows to reflect: (1) A cash-based; and (2) An accrual-based accounting system (assume the accounting period is for 12 months ending on 31 December 2018). (i) Accru

> In its first year of operation, Harrington Pty Ltd earned $150 000 in services revenue, $30 000 of which was on account and still outstanding at the end of the reporting period. The remaining $120 000 was received in cash from customers. The company paid

> Categorise each of the following expenses into one of the expense types listed at the heads of the columns. Purchases Depreciation of office equipment Sales commission Interest expense Lease charges Sales staff salaries General staff salaries Adverti

> You have just completed the statement of profit or loss for the reporting period. The CEO (who has no accounting background) is reviewing the statement and asks you to explain why the profit is relatively low compared to the increase in the cash at bank

> Using the information relating to Coconut Plantations Pty Ltd in 6.20, recalculate the depreciation expense to be recorded in the statement of profit or loss for the year in which the machine was purchased and the subsequent year using the diminishing ba

> Coconut Plantations Pty Ltd purchased machinery for its manufacturing process on 1 March 2019. The machinery cost $900 000. Coconut Plantations Pty Ltd estimates that the machinery has a useful life of five years and will have a $75 000 residual value. U

> JB Hi-Fi Ltd’s 2018 annual report includes governance, environmental and social statements, and notes that the company recognises the importance of all these matters to its shareholders, suppliers and customers. Putting this into practice, JB Hi-Fi Ltd d

> Solve the missing items for each independent case. The cost of sales is 60 per cent of sales revenue for each case. Sales revenue 180 000 d. 204 500 875 000 m. Cost of sales a. 102 000 g. j. 66 000 Other expenses b. e. 115 000 k. 32 000 Profit 40 000

> (a) Classify the following as either accounting policy choices or accounting estimations. (i) Impairment of assets. (ii) Employee benefits (long service leave). (iii) First in, first out (FIFO) method of costing inventory. (iv) Depreciation method of mot

> Consider each of the following transactions and examine whether they satisfy the expense definition criteria under the accrual method of accounting. (a) Paid salaries owing from the previous reporting period. (b) Owner withdrew money to purchase a motor

> Consider each of the following transactions and examine whether they satisfy the income definition criteria using the accrual method of accounting. (a) Received cash for services to be provided in the next reporting period. (b) Borrowed money from a bank

> Explain whether the following statements are true or false for an entity using the accrual method of accounting. (a) Statements of profit or loss are used only by users external to the entity. (b) Revenue from sales is included in the statement of profit

> Describe the users who would be interested in the financial position and performance of an entity and explain their interest.

> Outline the importance of strategic planning.

> For the budgets you identified in 9.8 above, discuss the type of information provided in each budget and who in the entity would provide such information.

> State the different types of budgets that may be prepared to construct the master budget.

> Explain why the sales budget is often referred to as the ‘cornerstone’ of budgeting.

> Outline six ways to increase cash inflow during periods of cash shortages identified in a cash budget.

> Explain why it is important to link operational budgets to strategic plans.

> Explain the difference between profit or loss, gross profit and EBIT.

> Discuss the benefits to an entity in preparing a budget for the coming financial year.

> Explain the benefits of preparing a cash budget for an entity.

> Differentiate between authoritarian and participative styles of budgeting.

> What does a favourable variance indicate?

> Explain the main steps in the budgeting process.