Question: The accounting income of Grace Corporation and

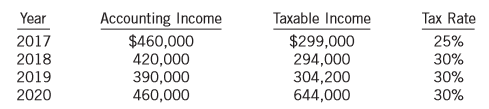

The accounting income of Grace Corporation and its taxable income for the years 2017 to 2020 are as follows:

The change in the tax rate from 25% to 30% was not enacted until early in 2018.

Accounting income for each year includes an expense of $40,000 that will never be deductible for tax purposes. The remainder of the difference between accounting income and taxable income in each period is due to one reversing difference for the depreciation of property, plant, and equipment. No deferred taxes existed at the beginning of 2017.

Instructions:

(a) Calculate the current and deferred tax expense or benefit for each of the four years. Also calculate the balance of the deferred tax balance sheet account at the end of each fiscal year from 2017 to 2020.

(b) Prepare journal entries to record income taxes in all four years.

(c) Prepare the bottom of the income statement for 2018, beginning with the line “Income before income tax.â€

Transcribed Image Text:

Accounting Income $460,000 420,000 390,000 460,000 Year Taxable Income Tax Rate 2017 $299,000 294,000 304,200 644,000 25% 30% 30% 2018 2019 2020 30%

> Instructions: Access the financial statements of Air Canada and WestJet Airlines Ltd. for their years ended December 31, 2014 through SEDAR (www.sedar.com) or the companies’ websites. Review the financial statements, including the notes, and then answer

> You have just been hired as the new controller of SWT Services Inc., and on the top of the stack of papers on your new desk is a bundle of draft contracts with a note attached. The note says, “Please help me to understand which of these leases would be b

> Lanier Dairy Ltd. leases its milk cooling equipment from Green Finance Corporation. Both companies use IFRS 16. The lease has the following terms. 1. The lease is dated May 30, 2017, with a lease term of eight years. It is non-cancellable and requires eq

> Jennings Inc., which uses IFRS 16, manufactures an X-ray machine with an estimated life of 12 years and leases it to SNC Medical Centre for a period of 10 years. The machine’s normal selling price is $343,734, and the lessee guarantees a residual value a

> Assume the same data as in P20-15 and that Provincial Airlines Corp. has an incremental borrowing rate of 8%. Instructions: Answer the following questions, rounding all numbers to the nearest dollar. (a) Discuss the nature of this lease in relation to t

> CHL Corporation manufactures specialty equipment with an estimated economic life of 12 years and leases it to Provincial Airlines Corp. for a period of 10 years. Both CHL and Provincial Airlines follow ASPE. The equipment’s normal selling price is $210,4

> Dubois Steel Corporation, as lessee, signed a lease agreement for equipment for five years, beginning January 31, 2017. Annual rental payments of $41,000 are to be made at the beginning of each lease year (January 31). The insurance and repairs and maint

> Lee Industries Inc. and Lor Inc. enter into an agreement that requires Lor Inc. to build three diesel-electric engines to Lee’s specifications. Both Lee and Lor follow ASPE and have calendar year ends. Upon completion of the engines, Lee has agreed to le

> At the end of the December 31, 2016 fiscal year, Yin Trucking Corporation, which follows IFRS 16, negotiated and closed a long-term lease contract for newly constructed truck terminals and freight storage facilities. The buildings were erected to the com

> Assume the same information as in P20-9. Instructions: Answer the following questions, rounding all numbers to the nearest dollar. (a) Assuming that Woodhouse Leasing Corporation’s accounting period ends on September 30, answer the fol

> Assume the same information as in P20-9. Follow the instructions assuming that McKee Electronics follows IFRS 16. Data from P20-9: The following facts pertain to a non-cancellable lease agreement between Woodhouse Leasing Corporation and McKee Electron

> DBRS is a large bond-rating agency in Canada that develops credit ratings for companies as a whole and also for its specific securities. Instructions: Access the agency’s website at www.dbrs. com and, under the “About Ratings” heading, locate and invest

> Interior Design Inc. (ID) is a privately owned business that produces interior decorating options for consumers. ID follows ASPE. The software that it purchased six years ago to present clients with designs that are unique to their offices is no longer s

> Dela Corporation initiated a defined benefit pension plan for its 50 employees on January 1, 2017. The insurance company that administers the pension plan provides the following information for the years 2017, 2018, and 2019: There were no balances as

> Bouter Corporation Limited (BCL) began operations in 1996 and in 2006 adopted a defined benefit pension plan for its employees. By January 1, 2017, the defined benefit obligation was $510,000. On January 2, 2017, for the first time, BCL agreed to a new u

> Manon Corporation applies ASPE and sponsors a defined benefit pension plan. The following pension plan information is available for 2017 and 2018: The pension fund paid out benefits in each year. There were no actuarial gains or losses incurred on the

> Brawn Corporation sponsors a defined benefit pension plan for its 100 employees. On January 1, 2017, the company’s actuary provided the following information: Pension plan assets (fair value)………………………………………$1,040,000 Defined benefit obligation…………………………

> You are the controller of a newly established technology firm that is offering a new pension plan to its employees. The plan was established on January 1, 2017, with an initial contribution by the employer equal to the actuarial estimate of the past serv

> The following information is available for HTM Corporation’s defined benefit pension plan: On January 1, 2017, HTM Corp. amended its pension plan, resulting in past service costs with a present value of $78,000. Instructions: (a) Cal

> D’Eon Corporation reports the following January 1, 2017 balances for its defined benefit pension plan, which it accounts for under IFRS: plan assets, $460,000; defined benefit obligation, $460,000. Other data relating to three years of

> Dungannon Enterprises Ltd. sells a specialty part that is used in widescreen televisions and provides the ultimate in screen clarity. To promote sales of its product, Dungannon launched a program with some of its smaller customers. In exchange for making

> Mullen Music Limited (MML) carries a wide variety of musical instruments, sound reproduction equipment, recorded music, and sheet music. MML uses two sales promotion techniques—warranties and premiums—to attract customers. Musical instruments and sound e

> Instructions: Access the financial statements for Loblaw Companies Limited for the year ended January 3, 2015 and Empire Company Limited for the year ended May 2, 2015, through SEDAR (www.sedar. com) and then answer the following questions. (a) Calculate

> The Hwang Candy Corporation (HCC) offers a mini piggy bank as a premium for every fi ve chocolate bar wrappers that customers send in along with $2.00. The chocolate bars are sold by HCC to distributors for $0.30 each. The purchase price of each piggy ba

> To increase the sales of its Sugar Kids breakfast cereal, KW Foods Limited (KW) places one coupon in each cereal box. Five coupons are redeemable for a premium consisting of a child’s hand puppet. In 2017, KW purchases 40,000 puppets at $1.50 each and se

> Renew Energy Ltd. (REL) manufactures and sells directly to customers a special long-lasting rechargeable battery for use in digital electronic equipment. Each battery sold comes with a guarantee that the company will replace free of charge any battery th

> Smythe Corporation sells televisions at an average price of $850 and they come with a standard one-year warranty. Smythe also offers each customer a separate three-year extended warranty contract for $90 that requires the company to perform periodic serv

> Brooks Inc. sells portable computer equipment with a two-year warranty contract that requires the corporation to replace defective parts and provide the necessary repair labour. During 2017, the corporation sells for cash 400 computers at a unit price of

> The following are selected transactions of Pendlebury Department Store Ltd. (PDSL) for the current year ending December 31. PDSL is a private company operating in the province of Manitoba. 1. On February 2, PDSL purchased goods having cash discount terms

> Lindall Limited (LL) has a 10-year loan issued by the bank that is due in five years. The VP Finance feels that the company is carrying too much debt on its statement of financial position and would like to repay the loan early. Unfortunately, the early

> Newfoundland University recently signed a contract with the bargaining unit that represents full-time professors. The contract agreement starts on April 1, 2016, the start of the university’s fiscal year. The following excerpt outlines the portion of the

> Mazza Corp. owes Tsang Corp. a $110,000, 10-year, 10% note issued at par plus $11,000 of accrued interest. The note is due today, December 31, 2017. Because Mazza Corp. is in financial trouble, Tsang Corp. agrees to forgive the accrued interest and $10,0

> At December 31, 2016, Shutdown Manufacturing Limited had outstanding a $300,000, 12% note payable to Thornton National Bank. Dated January 1, 2014, the note was issued at par and due on December 31, 2017, with interest payable each December 31. During 20

> Refer to the year-end financial statements and accompanying notes of Brookfield Asset Management Inc. in the Appendix at the end of Volume 2 of this text. Instructions: (a) Using ratio analysis, prepare an assessment of Brookfield Asset Management Inc.’

> Gaming Inc. issued a debenture bond to Karamoutz Bank to finance new technology it developed. The debenture was for $500,000, issued at face value, with a 10-year term and interest payable at 10%. Gaming Inc.’s new technology proved not to be technically

> Under the temporary difference approach, the tax rates used for deferred tax calculations are those enacted at the balance sheet date, and affect how the reversal will be treated for tax purposes. Instructions: For each of the following situations, disc

> Shikkiah Corp. (which is a private enterprise) tries to attract the most knowledgeable and creative employees it can find. To help accomplish this, the company offers a special group of technology employees the right to a fully paid sabbatical leave afte

> Refer to the example of HTSM Corp. in Appendix 19A and assume it is now 2018, three years after the defined benefit pension plan was initiated. In December 2018, HTSM’s actuary provided the company with an actuarial revaluation of the plan. The actuary’s

> Hass Foods Inc. sponsors a post-retirement medical and dental benefit plan for its employees. The company adopted the provisions of IAS 19 beginning January 1, 2017. The following balances relate to this plan on January 1, 2017: Plan assets…………………………………

> You are the auditor of Beaton and Gunter Inc., the Canadian subsidiary of a public multinational engineering company that offers a defined benefit pension plan to its eligible employees. Employees are permitted to join the plan after two years of employm

> Etienne Inc., a Canadian company traded on the Venture Exchange of the Toronto Stock Exchange, has sponsored a non-contributory defined benefit pension plan for its employees since 1992. Relevant information about the pension plan on January 1, 2017 is a

> Refer to the data in P19-9, except now assume Dela Corporation reports under IFRS. Depending on what your instructor assigns, do either parts (a), (b), (c), and (e) or parts (d) and (e). Data from P19-9: Dela Corporation initiated a defined benefit pen

> RWL Limited provides a long-term disability program for its employees through an insurance company. For an annual premium of $20,000, the insurance company is responsible for providing salary continuation to disabled employees on a long-term basis after

> The following are two independent situations related to future taxable and deductible amounts that resulted from temporary differences at December 31, 2017. In both situations, the future taxable amounts relate to property, plant, and equipment depreciat

> You, the ethical accountant, are the new controller at Pro Vision Corporation. It is January 2018 and you are currently preparing the December 31, 2017 financial statements. Pro Vision manufactures household appliances. It is a private company and has be

> Sarah Corp. reported the following differences between statement of financial position carrying amounts and tax bases at December 31, 2016: The differences between the carrying amounts and tax bases were expected to reverse as follows: Tax rates enac

> Andrew Weiman and Mei Lee are discussing accounting for income taxes. They are currently studying a schedule of taxable and deductible amounts that will arise in the future as a result of existing temporary differences. The schedule applies to a company

> The accounting records of Steven Corp., a real estate developer, indicated income before income tax of $850,000 for its year ended December 31, 2017, and of $525,000 for the year ended December 31, 2018. The following data are also available. 1. Steven C

> The following information applies to Edward Corporation, which reports under IFRS. 1. Prior to 2016, taxable income and accounting income were identical. 2. Accounting income was $1.7 million in 2016 and $1.4 million in 2017. 3. On January 1, 2016, equip

> Eloisa Corporation applies IFRS. Information about Eloisa Corporation’s income before income tax of $633,000 for its year ended December 31, 2017 includes the following: 1. CCA reported on the 2017 tax return exceeded depreciation reported on the income

> At December 31, 2016, Wright Corporation had a temporary difference (related to pensions) and reported a related deferred tax asset of $30,000 on its balance sheet. At December 31, 2017, Wright has five temporary differences. An analysis reveals the foll

> On December 31, 2016, Haley Inc. has taxable temporary differences of $2.2 million and a deferred tax liability of $616,000. These temporary differences are due to Haley having claimed CCA in excess of book depreciation in prior years. Haley’s year end i

> Aaron Engines Ltd. operates small engine repair outlets and is a tenant in several of Tran Holdings Inc.’s strip shopping malls. Aaron signed several lease renewals with Tran that each called for a three-month rent-free period. The leas

> Chen Corporation reported income before income tax for the year ended December 31, 2017 of $1,645,000. In preparing the 2017 financial statements, the accountant discovered an error that was made in 2016. The error was that a piece of land with a cost of

> The consolidated financial statements of Deutsche Lufthansa AG for the year ended December 31, 2014 are available in the company’s 2014 Annual Report on the www.lufthan sagroup.com website. Instructions: (a) What is included in the current liabilities f

> Access the annual report for Air Canada for its December 31, 2014 fiscal year end from SEDAR or the company’s website (www.aircanada.com). Also, access the annual report for the year ended December 31, 2014 for British Airways plc from the company’s pare

> Calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown in parentheses. a. Bank of Nova Scotia (BNS): 25%, Sun Energy (SU): 25%, Telus (T): 25%, George Weston (WN): 25% b. BNS: 10%, SU: 10%, T: 70%, WN

> Calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown in parentheses. a. Bank of Montreal (BMO): 25%, Magna International (MG): 25%, Power (POW): 25%, Rogers Communication (RCL.B): 25% b. BMO: 20%, M

> Calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown in parentheses. a. Canadian National Railway (CNR): 10%, Enbridge (ENB): 40%, Loblaw (L): 40%, Manulife Financial (MFC): 10% b. CNR: 50%, ENB: 30

> Calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown in parentheses. a. Agnico Eagle (AEM): 25%, Bell Canada Enterprises (BCE): 25%, Bank of Montreal (BMO: 25%, Dollarama (DOL): 25% b. AEM: 30%, BCE

> Refer to Exercise 7.85. Compute the correlation matrix of the returns of the four banks. Briefly describe what the correlations tell you. Data from Exercise 7.85: An analyst recommends that you invest in a portfolio made up of Bank of Montreal (BMO), Ban

> An analyst recommends that you invest in a portfolio made up of Bank of Montreal (BMO), Bank of Nova Scotia (BNS), Canadian Imperial Bank of Commerce (CM), and Royal Bank (RY). Why would it not useful in diversification?

> Refer to Exercise 6.83. Respondents in Greece, Hungary, and Poland were asked whether they approved or disapproved of the way the EU was dealing with the refugee issue. The number of respondents and the percentage opting for disapprove are listed here.

> In June 2016, Britons were heading to the polls to vote in a referendum to decide whether the United Kingdom would leave the European Union. Pew Research Center conducted surveys in European countries to determine opinions about the possible â€

> calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown. a. United Health (UNH): 25%, United Technologies (UTX): 25%, Verizon (VZ): 25%, Walmart (WMT): 25% b. UNH: 10%, UTX: 20%, VZ: 30%, WMT: 40% c. U

> calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown. a. Chevron (CVX): 25%, du Pont (DD): 25%, Procter & Gamble (PG): 25%, Travelers (TRV): 25% b. CVX: 50%, DD: 20%, PG: 15%, TRV: 15% c. CVX: 10%,

> calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown. a. Coca Cola (KO): 40%, Pfizer (PFE): 20%, Verizon Communications (VZ): 40% b. KO: 60% PFE: 20%, (VZ): 20% c. KO: 10%, PFE: 30%, VZ: 60% d. Whic

> calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown. a. General Electric (GE): 25%, Johnson & Johnson (JNJ): 25%, McDonald’s (MCD): 25%, Merck (MRK): 25% b. GE: 5%, JNJ: 30%, MCD: 40%, MRK: 25% c.

> calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown. a. Chevron (CVX): 25%, Coca Cola (KO): 25%, Disney (DIS): 25%, Exxon Mobil (XOM): 25% b. CVX: 10%, KO: 20%, DIS: 30%, XOM: 40% c. CVX: 55%, KO:

> calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown. a. 3M (MMM): 25%, Boeing (BA): 25%, Home Depot (HD): 25%, Travelers (TRV): 25% b. MMM: 10%, HD: 50%, IBM: 20%, TRV: 20% c. MMM: 30%, HD: 20%, IB

> calculate the mean and standard deviation of the portfolio. The proportions invested in each stock are shown. a. American Express (AXP): 20%, Goldman Sachs (GS): 30%, JP Morgan Chase (JPM): 50% b. AXP: 20%, GS: 60%, JPM: 20% c. AXP: 50%, GS: 30%, JPM: 20

> Researchers at the University of Pennsylvania School Of Medicine have determined that children under 2 years old who sleep with the lights on have a 36% chance of becoming myopic before they are 16 Children who sleep in darkness have a 21% of becoming my

> Refer to Exercise 7.73. Compute the expected value and standard deviation of the portfolio composed of 30% stock 1 and 70% stock 2. Data from Exercise 7.73: An investor is given the following information about the returns on two stocks: Stock 1 2 Mea

> Refer to Exercise 7.73. Compute the expected value and standard deviation of the portfolio composed of 60% stock 1 and 40% stock 2. The coefficient of correlation is .4. Data from Exercise 7.73: An investor is given the following information about the re

> An investor is given the following information about the returns on two stocks: a. If he is most interested in maximizing his returns, which stock should he choose? b. If he is most interested in minimizing his risk, which stock should he choose? St

> A portfolio is composed of two stocks. The proportion of each stock, their expected values, and standard deviations are listed next. For each of the following coefficients of correlation, calculate the expected value and standard deviation of the portfo

> Describe what happens to the expected value and standard deviation of the portfolio returns when the coefficient of correlation decreases.

> A professor of business statistics is about to begin work on a new research project. Because his time is quite limited, he has developed a PERT/CPM critical path, which consists of the following activities: 1. Conduct a search for relevant research artic

> In preparing to launch a new product, a marketing manager has determined the critical path for her department. The activities and the mean and variance of the completion time for each activity along the critical path are shown in the accompanying table.

> The operations manager of a large plant wishes to overhaul a machine. After conducting a PERT/CPM analysis he has developed the following critical path. 1. Disassemble machine 2. Determine parts that need replacing 3. Find needed parts in inventory 4. Re

> There are four activities along the critical path for a project. The expected values and variances of the completion times of the activities are listed here. Determine the expected value and variance of the completion time of the project. Expected Co

> Refer to Exercise 7.63. a. Determine the probability distribution of the total scores for both teams. b. Calculate the mean, variance, and standard deviation of the total scores for both teams. c. Calculate the covariance and coefficient of correlation o

> Refer to Exercise 7.63. a. Determine the probability distribution of the visiting team scores. b. Calculate the mean, variance, and standard deviation of the visiting team scores. Data from Exercise 7.63: After watching several seasons of soccer a statis

> Refer to Exercise 7.63. a. Determine the probability distribution of the home team scores. b. Calculate the mean, variance, and standard deviation of the home team scores. Data from Exercise 7.63: After watching several seasons of soccer a statistician p

> After watching several seasons of soccer a statistician produced the following bivariate distribution of scores. a. What is the probability that the home team wins? b. What is the probability of a tie? c. What is the probability that the visiting team w

> Refer to Exercise 7.59. a. Determine the probability distribution of smoke detectors. b. What is the mean, variance, and standard deviation of the number of smoke detectors? Data from Exercise 7.59: A fire inspector has conducted an extensive analysis of

> Refer to Exercise 7.59. a. Determine the probability distribution of carbon monoxide detectors. b. What is the mean, variance, and standard deviation of the number of carbon monoxide detectors? Data from Exercise 7.59: A fire inspector has conducted an e

> The mark on a statistics exam that consists of 100 multiple-choice questions is a random variable. a. What are the possible values of this random variable? b. Are the values countable? Explain. c. Is there a finite number of values? Explain. d. Is the ra

> The amount of money students earn on their summer jobs is a random variable. a. What are the possible values of this random variable? b. Are the values countable? Explain. c. Is there a finite number of values? Explain. d. Is the random variable discrete

> The distance a car travels on a tank of gasoline is a random variable. a. What are the possible values of this random variable? b. Are the values countable? Explain. c. Is there a finite number of values? Explain. d. Is the random variable discrete or co

> The number of accidents that occur on a busy stretch of highway is a random variable. a. What are the possible values of this random variable? b. Are the values countable? Explain. c. Is there a finite number of values? Explain. d. Is the random variable

> Refer to Exercise 7.59. a. What proportions of homes have one carbon monoxide detector and two smoke detectors? b. What proportion of homes with one carbon monoxide detector have two smoke detectors? c. What proportion of homes with two smoke detectors h

> Suppose that there are two people in a room. The probability that they share the same birthday (date, not necessarily year) is 1/365, and the probability that they have different birthdays is 364/365. To illustrate, suppose that you’re in a room with one

> In the last part of the 20th century, scientists developed the theory that the planet was warming and the primary cause was the increasing amounts of carbon dioxide (CO2), which is the product of burning oil, natural gas, and coal (fossil fuels). Althoug

> Did you conclude in Case 4.1 that the earth has warmed since 1880 and that there is some linear relationship between CO2 and temperature anomalies? If so, here is another look at the same data. C04-02a lists the temperature anomalies from 1880 to 1940, C

> Now that we have presented techniques that allow us to conduct more precise analyses, we’ll return to Case 3.1. Recall that there are two issues in this discussion. First, is there global warming and, second, if so, is carbon dioxide the cause? The only

> Since the 1960s, Québécois have been debating whether to separate from Canada and form an independent nation. A referendum was held on October 30, 1995, in which the people of Quebec voted not to separate. The vote was extremely close, with the “no” side

> The 2004–2005 hockey season was cancelled because of a player strike. The key issue in this labor dispute was a “salary cap.” The team owners wanted a salary cap to cut their costs. The owners of small-market teams wanted the cap to help their teams be c

> Adam Smith published The Wealth of Nations in 1776 in which he argued that when institutions protect the liberty of individuals, greater prosperity results for all. Since 1995, the Wall Street Journal and the Heritage Foundation, a think tank in Washingt

> Pregnant women are screened for a birth defect called Down syndrome. Down syndrome babies are mentally and physically challenged. Some mothers choose to abort the fetus when they are certain that their baby will be born with the syndrome. The most common