Question: The Addington Book Company has the following

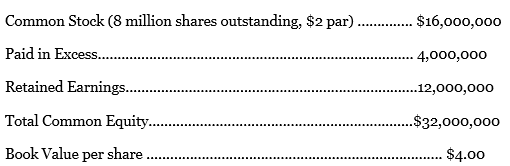

The Addington Book Company has the following equity position. The stock is currently selling for $3 per share.

a. What was the average price at which the company originally sold its stock?

b. Reconstruct the equity statement above to reflect a four-for-o

c. Reconstruct the statement to reflect a 12.5% stock dividend.

Transcribed Image Text:

Common Stock (8 million shares outstanding, $2 par) . $16,000,000 Paid in Excess. 4,000,000 Retained Earnings.. ..12,000,000 Total Common Equity.. $32,000,000 Book Value per Share $4.00

> You're a supervisor in the treasury department of Big Corp. Recently there's been increasing concern about the firm's rising interest costs. Fred Eyeshade is an analyst in your group who transferred from the accounting department a short time ago. He

> In evaluating the situation presented in the last problem, you've found a pure play company in the proposed industry whose beta is 2.5. The rate of return on short-term treasury bills is currently 8% and a typical stock investment returns 14%. Explain h

> Charlie Henderson, a senior manager in the Bartok Company, is known for taking risks. He recently proposed that the company expand its operations into a new and untried field. He put together a set of cash flow projections and calculated an IRR of 25%

> Might Ed’s case in the preceding problem be helped by a real option? If so What kind? How would it help?

> Ed Draycutt is the engineering manager of Airway Technologies, a firm that makes computer systems for air traffic control installations at airports. He has proposed a new device the success of which depends on two separate events. First the Federal Avi

> Webley Motors, a manufacturer of small gas engines, has been working on a new design for several years. It's now considering going into the market with the new product, and has projected future sales and cash flows. The marketing and finance departments

> How are planning assumptions reflected in projected financial statements? Is there a standard computational procedure for incorporating assumptions into planned numbers? What's the difference between simple, estimated plans and more complex precise pla

> Creighton Inc. is preparing a bid to sell a large telephone communications system to a major business customer. It is characteristic of the telephone business that the vendor selling a system gets substantial follow-on business in later years by making

> Most top executives are graded primarily on their results in terms of net income rather than net cash flow. Why then, is capital budgeting done with incremental cash flows rather than with incremental net income?

> You are a new financial analyst at Belvedere Corp, a large manufacturing firm that is currently looking into diversification opportunities. The vice president of marketing is particularly interested in a venture that is only marginally connected with wh

> You've just begun work at the brokerage firm of Dewey, Cheatam, and Howe as a stock analyst. This morning you read an article in the paper that said a large-scale reduction in defense spending is eminent. Fred Fastbuck, a broker at the firm, has severa

> The Wycombe Company is doing well and is interested in diversifying, so it's been looking around for an acquisition target. The Albe Company has been found with the help of an investment banker. Albe is quite profitable, and about half the size of Wyco

> Blazingame Mill Works recently sold a tract of land it owned for 30 years. All expenses and taxes have been paid, and the company has $10 million sitting in the bank as a result of the sale. As there aren't any pressing investment opportunities availab

> Your friend James is an exchange student from an underdeveloped country. He comes from a privileged family that’s influential in the government, but the bulk of the nation’s population is very poor despite the fact that the people are frugal and hardwor

> You're the CFO of the Kraknee Roller Skate Company, which sells roller skates worldwide and also builds and operates roller rinks. Some time ago Archie Speedo, the head of international marketing proposed selling skates in Russia. Everyone thought he w

> You're the CFO of the Overseas Sprocket Company, which imports a great deal of product from Europe and the Far East and is continually faced with exchange rate exposure on unfilled contracts. Harry Byrite, the head of purchasing, has a plan to avoid exc

> You're the Treasurer of Warm Wear Inc., which imports wool sweaters from around the world. Kreploc, a company in the country of Slobodia, has a product your marketing department would like to carry, and doesn't require payment until 90 days after delive

> Briefly explain the idea of representing an interest rate as a collection of components. What is represented by the base rate? What is the risk premium for? Explain the idea of risk in lending.

> Your pal, Fred Flinderbinder, came into class this morning grinning from ear to ear. It seems a stock in which he advised his parents to invest is doing fabulously well. Fred said the firm usually pays a dividend of $2.00 a share, which is about 4% of

> You're a bank officer considering making a loan to small family-owned company. The firm's principal owner is a hard-working, conservative woman who has built up the company over a number of years. However, two of her grown children are now active in the

> The Tanglefern Corporation has traditionally paid out 60% of its earnings in dividends. Recently some marvelous growth opportunities have arisen that involve only a little risk but require a lot of cash. Most of the executive team thinks the firm shoul

> You're the treasurer of SuperTech Inc., a high technology firm in the fast-growing computer business. The management team has recently been trying to decide on a long-term dividend policy. Earnings are good, but the firm has far more investment opportun

> You've just been hired as CFO of the Gatsby Corp., a new company in the hi-tech computer business. Shortly after your arrival you were amazed to find that the firm does virtually no planning. An extensive business plan was put together when it was starte

> You're the CFO of the Ramkin Company, which makes and sells electronic equipment. The firm was originally an independent business, but was acquired by the larger Big Tech Inc. ten years ago, and is now operated as a division. Big Tech has an elaborate

> Ed Perez has always wanted to run his own restaurant. He worked part-time in the food service business during high school and college and has worked for a large restaurant chain since graduating from college four years ago. He's now ready to open a fra

> Webley Corp. has a capital budget limited to $20M. Five relatively high IRR projects are available that have initial investments totaling $15M. They are all roughly the same size. A sixth project has an IRR only slightly lower than those of the first

> The Budwell & Son Oil Company is looking at two drilling proposals. One project lasts for three years, costs $20M to start, pays back quickly, and has an NPV of $15M. The other project also costs about $20M to start, but has an expected life of seven y

> Charlie Brown is thinking about starting Wing-It Airlines to fly a commuter route in and out of a major city. Four planes are on the market that will do the job, but each has different flight, load, and operating characteristics. Charlie is unsure of th

> Discuss the similarities and differences between supply and demand for a good (product or service) and supply and demand in a money (debt) market.

> Risk in capital projects is the probability that a project will earn less than expected. Make up and describe one hypothetical project in each of the replacement, expansion and new venture categories, and list a few ways that each might go wrong and cau

> You are a financial analyst for the Ajax Company, which uses about $1M of inventory per month. The purchasing manager has come to you for help with a buying decision. He can get a big discount on $15M of inventory by buying it all at once. However, the

> Sourdough Mills has considered acquiring Mrs. Baird’s Bakery as an expansion strategy. Mrs. Baird’s Bakery generated positive cash flows of $5.3 million last year, and cash flows are expected to increase by 4% per year for the foreseeable future. Mrs.

> Randal Flapjack is a retired short-order cook living on a fixed income in the state of Utopia where all financial markets are perfectly efficient. Randal has 20,000 shares of the Sugarcooky Corp., which pays an annualized dividend of $1.00 per share. Su

> Integrity Group, an association of venture capitalists, is considering using a leveraged buyout to purchase Schrag Co., a well-established hi-tech firm. Schrag has long-term debt with a book value of $15 million and a debt to equity ratio of 1:10. The f

> Lattig Corp. had a $2.0 million cash flow last year, and projects that figure to increase by $200,000 per year for the next five years (to $3.0 million). After that, Lattig expects an annual growth rate of 6% forever. If the discount rate is 12%, a. W

> Bridgeport Inc has a $30 million revolving credit agreement with its bank at prime plus 3.2% based on a calendar year. Prior to the month of April, it had taken down $15 million that was outstanding for the entire month. On April 10, it took down anoth

> You own 1,000 shares of Jennings Corp. stock, which is currently selling for $88.00. Calculate the number of shares you would own and the stock’s market price after each of the following stock splits. a. A two-for-one stock split b. A three-for-one s

> The Conejo Corp. borrows from its bank under an $8 million revolving credit arrangement. It pays a base rate of 9% on its outstanding loan plus a ¼% commitment fee on the unused balance. The firm had borrowed $2 million going into April and borrowed an

> Thompson Inc. has a $10M revolving credit agreement with its bank. It pays interest on borrowing at 2% over prime and a ¼% commitment fee on available but unused funds. Last month Thompson had borrowings of $5M for the first half of the month and $10M fo

> The Philipps Lighting Company manufactures decorative light fixtures. Its revenues are about $100 million a year. It purchases inputs from approximately 20 suppliers most of which are much larger companies located in various parts of the country. Sam

> Rocky Inc. can buy its inventory from any of four suppliers all of which offer essentially the same pricing and quality. Their credit terms, however, vary considerably as follows: a. Calculate the implied interest rate associated with each policy. b

> The Holderall Rope and Yarn Co. has 2 million common shares outstanding. Its capital structure is two-thirds equity. The firm expects earnings of $10 million next year, and anticipates capital spending of $12 million on projects. How much will the per-

> Southern Fabrics Inc factors all of its receivables. The firm does $150 million in business each year, and would have an ACP of 36.5 days if it collected its own receivables. The firm's gross margin is 35%. The factor operates without recourse and pays

> Parnell Bolts Inc. has 20 million common shares outstanding, and net income of $30 million. The stock sells at a P/E of 15. The company has $5 million available to pay the next quarterly dividend, but is considering a repurchase instead. a. If Parnell

> DeSquam Inc. pledges receivables of $250M per year to the Sharkskin Finance Company which advances cash equal to 80% of the face value of the accounts pledged. DeSquam’s receivables are usually collected in about 36 days, so 10% of the annual amount adv

> BWP projects sales of 100,000 units next year at an average price of $50 per unit. Variable costs are estimated at 40% of revenue, and fixed costs will be $2.4 million. BWP has $1 million in bonds outstanding on which it pays 8%, and its marginal tax r

> Wysoski Enterprises is considering a stock dividend. The firm’s capital includes 3 million shares of $1 par value stock issued at an average price of $8. Retained earnings total $20 million. State the equity accounts now and after each of the followin

> Seinway Corp. just declared a 10% stock dividend. Before the dividend the stock sold for $34 per share and the equity section of the firm’s balance sheet was as follows: Restate the equity accounts and estimate the stockâ€

> The Argo Pamphlet Company’s dividend payout ratio is 35%. It is currently paying an annual dividend of $1.30. a. What is Argo’s EPS? b. What is the market price of Argo’s stock if its P/E ratio is 14? c. How much current income per share will stockholde

> Does the EOQ model properly applied prevent stockouts? Does it address stockouts at all? Do you think the EOQ model solves very many of management's inventory problems?

> Harrison Hardware anticipates $2 million in net income next year and a 20% participation in the firm’s dividend reinvestment plan. Management expects to spend $2.375 million on new capital projects, and maintain the current capital structure which is 64

> The Canterbury Coach Corporation has EBIT of $3.62 million, and total capital of $20 million, which is 15% debt. There are 425,000 shares of stock outstanding which sell at book value. The firm pays 12% interest on its debt and is subject to a combined

> The Tanenbaum Tea Company wants to show the stock market an EPS of $3 per share, but doesn't expect to be able to improve profitability over what is reflected in the financial plan for next year. The plan is partially reproduced as follows. Tanenbaum'

> Biltmore Industries has grown at an average of 6% per year over its long history. Its stock price is currently $40 and its most recent dividend was $2.50. Biltmore just announced that it plans to discontinue dividends for several years to take advantag

> Find the MIRR and the IRR for the following capital budgeting project and comment on the difference between the two. The cost of capital is 12%. Year: 1 2 3 ($8bo) $550 ($150) $700

> Newrock Manufacturing Inc. has the following target capital structure Investment bankers have advised the CFO that the company could raise up to $5 million in new debt financing by issuing bonds at a 6.0% coupon rate, beyond that amount new debt would

> Taunton Construction Inc.'s capital situation is described as follows: Debt: The firm issued 10,000 25-year bonds10 years ago at their par value of $1,000. The bonds carry a coupon rate of 14% and are now selling to yield 10%. Preferred Stock: 30,000

> The Maritime Engineering Corp sold 1,500 convertible bonds two years ago at their $1,000 par value. The 20-year bonds carried a coupon rate of 8% and were convertible into stock at $20 per share. At the time, the firm’s stock was selling for $15, and s

> Whitley Motors Inc. has the following capital. Debt: The firm issued 900, 25-year bonds five years ago which were sold at a par value of $1,000. The bonds carry a coupon rate of 7%, but are currently selling to yield new buyers 10%. Preferred Stock:3

> Consider two mutually exclusive projects, A and B. Project A requires an initial cash outlay of $100,000 followed by five years of $30,000 cash inflows. Project B requires an initial cash outlay of $240,000 with cash inflows of $40,000 in the first two

> Compare the implications of the MM model with taxes and bankruptcy costs to the things we discovered by studying the Arizona Hot Air Balloon Corporation.

> Hammell Industries has been using 10% as its cost of retained earnings for a number of years. Management has decided to revisit this decision based on recent changes in financial markets. An average stock is currently earning 8%, treasury bills yield 3

> Griffin Ross Construction Inc. (GRC) builds upscale homes in several New England cities. The firm is subject to the ups and downs of the construction industry and has a historical beta of 2.1. GRC has traditionally operated with a capital structure of

> Assume Schoen Industries of the last problem is subject to income tax at a rate of 40%. a. Recalculate the value of the firm assuming there is no tax shield associated with debt and compare it to the value calculated in the last problem. That is, assu

> Illinois Fabrics Inc. makes upholstery that’s used in high-quality furniture, largely chairs and sofas. Illinois has traditionally sold their fabric to manufacturers who use it to cover furniture frames they produce. These manufacturers then wholesale

> The Singleton Metal Stamping Company is planning to buy a new computer controlled stamping machine for $10 million. The purchase will be financed entirely with borrowed money that will change Singleton's capital structure substantially. It will also ch

> The stock market is generally depressed, and the price of Westin Metals Inc.’s common shares has been below its historic average value for some time. The shares are trading at $35 which represents a P/E of 19 on earnings of $7,000,000. Before the curren

> Tydek Inc. just lost a major lawsuit and its stock price dropped by 40% to $6. There are 3.5 million shares outstanding with a book value per share of $10. The company has $5 million in cash readily available. The CFO feels the decline in price is temp

> The Featherstone Corp. has $8M in cash for its next dividend but is considering a repurchase instead. Featherstone has 10M shares outstanding, currently selling at $40 per share. The P/E is 20 on EPS of $2. a. If the dividend is paid how large will it

> You're a financial analyst at Pinkerton Interactive Graphic Systems (PIGS), a successful entrant in a new and rapidly growing field. As in most new fields, however, rapid growth is anything but assured, and PIGS's future performance is uncertain. The fi

> Algebraically derive EPS = ROE [Book value per share]. (Hint: Write the definitions of ROE, EPS, and book value, and then start substituting.)

> In another short paragraph, describe the effect of adding bankruptcy costs to the MM model with taxes.

> Balfour Corp has the following operating results and capital structure ($000). The firm is contemplating a capital restructuring to 60% debt. Its stock is currently selling for book value at $25 per share. The interest rate is 9%, and combined state a

> Referring to Willerton Industries of the previous problem, the company’s long-term debt is comprised of 20-year $1,000 face value bonds issued seven years ago at an 8% coupon rate. The bonds are now selling to yield 6%. Willerton’s preferred is from a

> Assume Connecticut Computer Company of the last two problems is earning an EBIT of $15,000. Once again, calculate the chart showing the implication of adding more leverage. Verbally rationalize the result.

> Reconsider the Connecticut Computer Company of the previous problem assuming the firm has experienced some difficulties, and its EBIT has fallen to $8,000. a. Reconstruct the three-column chart developed in problem 1 assuming Connecticut’s EBIT remains a

> The Spitfire Model Airplane Company has the following modified income statement ($000) at 100,000 units of production. a. What are Spitfire's contribution margin and dollar breakeven point? b. Calculate Spitfire's current DFL, DOL, and DTL. c. Calculat

> Use the information from the previous two problems. Calculate BWP’s breakeven point in units and dollars, with and without the purchase of the new machine. Problem 13: BWP intends to purchase a machine that will result in a major improvement in produc

> If Spitfire elects to do the project, what is an abandonment option at the end of year 1 worth if Spitfire can recover $8M of the initial investment into other uses at that time? If the recovery is $13M?

> BWP intends to purchase a machine that will result in a major improvement in product quality along with a small increase in manufacturing efficiency. The machine will cost $1 million, which will be borrowed at 9%. The quality improvement is expected to

> Referring to the Cranberry Company of the previous problem: a. Calculate the DOL when sales are 20%, 30% and 40% above breakeven. b. Suppose automated equipment is added which increases fixed costs by $20,000 per month. How much will total variable co

> Cranberry Wood Products Inc. spends an average of $9.50 in labor and $12.40 in materials on every unit it sells. Sales commissions and shipping amount to another $3.10. All other costs are fixed and add up to $140,000 per month. The average unit sells

> In a short paragraph, describe the result of adding taxes to the MM model.

> The Connecticut Computer Company has the following selected financial results. The company is considering a capital restructuring to increase leverage from its present level of 10% of capital. a. Calculate Connecticut’s ROE and EPS

> The market price of Albertson Ltd.’s common stock is $5.50, and 100,000 shares are outstanding. The firm's books show common equity accounts totaling $400,000. There are 5,000 preferred shares outstanding that originally sold for their par value of $50

> The Wall Company has 142,500 shares of common stock outstanding that are currently selling at $28.63. It has 4,530 bonds outstanding that won’t mature for 20 years. They were issued at a par value of $1,000 paying a coupon rate of 6%. Comparable bonds

> Five years ago Hemingway Inc. issued 6,000 thirty-year bonds with par values of $1,000 at a coupon rate of 8%. The bonds are now selling to yield 5%. The company also has 15,000 shares of preferred stock outstanding that pay a dividend of $6.50 per sha

> A relatively young firm has capital components valued at book and market and market component costs as follows. No new securities have been issued since the firm was originally capitalized. a. Calculate the firm's capital structures and WACCs based on

> Again, referring to Willerton of the two previous problems, assume the firm’s cost of retained earnings is 11% and its marginal tax rate is 40%, calculate its WACC using its book value-based capital structure ignoring floatation costs.

> Calculate the NPV for the following projects. a. An outflow of $7,000 followed by inflows of $3,000, $2,500 and $3,500 at one-year intervals at a cost of capital of 7%. b. An initial outlay of $35,400 followed by inflows of $6,500 for three years and the

> The Ebitts Field Corp. manufactures baseball gloves. Charlie Botz, the company's top salesman, has recommended expanding into the baseball bat business. He has put together a project proposal including the following information in support of his idea. &

> If Glendale’s management in the last problem attaches a probability of .7 to the better outcome, what is the project’s most likely (expected) NPV? Comment on the result of your calculations.

> The Brown Owl Corporation manufactures high quality outdoor equipment for adventurous people who enjoy hiking, hunting, climbing, and trekking under extreme conditions. The firm has been very successful with things like cold weather clothing, boots, mou

> Every company should take full advantage of the sophisticated cash management services offered by today's banking industry. Right or wrong? Explain.

> After World War II, the United States was the world's dominant economic power. We're still the largest economy, but the rest of the world has caught up significantly. In some areas we've lost the lead. The production of consumer electronic equipment,

> Crest Concrete Inc. has been building basements and slab foundations for new homes in La Crosse, Wisconsin for more than 20 years. However, new home sales have slowed recently and residential construction work is hard to get. As a result, management is c

> New buyers of Simmonds Inc. stock expect a return of about 22%. The firm pays flotation costs of 9% when it issues new securities. What is Simmonds’ cost of equity (Hint: This problem is very simple since we don’t have to estimate the investors’ return

> The New England Brewing Company produces a super-premium beer using a recipe that’s been in the owner’s family since colonial times. Surprisingly, the firm doesn’t own its own brewing facilities, but rents time on the equipment of large brewers who have

> Spitfire Aviation Inc. manufactures small, private aircraft. Management is evaluating a proposal to introduce a new high-performance plane. High performance aviation is an expensive sport undertaken largely by people who are both young and wealthy. Spit

> Vaughn Clothing of the previous problem has a real option possibility. Carlson Flooring has expressed an interest in trading buildings with Vaughn after Vaughn’s is refurbished. Carlson has offered to reimburse Vaughn for 70% of its refurbishment costs