Question: The Carson Distribution Corporation, a firm in

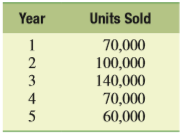

The Carson Distribution Corporation, a firm in the 34 percent marginal tax bracket with a 15 percent required rate of return or discount rate, is considering a new project that involves the introduction of a new product. This project is expected to last five years, and then, because this is somewhat of a fad product, it will be terminated. Given the following information, determine the net cash flows associated with the project and the project’s NPV, profitability index, and internal rate of return. Apply the appropriate decision criteria.

Cost of new plant and equipment:…………………………$9,900,000

Shipping and installation costs:……………………………….$ 100,000

Unit sales:

Sales price per unit: $280/unit in Years 1–4, $180/unit in Year 5

Variable cost per unit: $140/unit

Annual fixed costs: $300,000

Working-capital requirements: There will be an initial working-capital requirement of $100,000 just to get production started. For each year, the total investment in net working capital will equal 10 percent of the dollar value of sales for that year. Thus, the investment in working capital will increase during Years 1 through 3 and then decrease in Year 4. Finally, all working capital will be liquidated at the termination of the project at the end of Year 5.

The depreciation method: Use the simplified straight-line method over five years. It is assumed that the plant and equipment will have no salvage value after five years.

Transcribed Image Text:

Year Units Sold 1 70,000 100,000 140,000 70,000 60,000 3 4

> The Mitchell Electric Company had net income of $750,000, cash flow from financing activities of $150,000, a depreciation expense of $50,000, and cash flow from operating activities of $575,000. a. Calculate the firm’s quality of earnin

> The cash flow statements for retailing giant BigBox, Inc., spanning the period 2013–2016 are as follows: Answer the following questions using the information found in these statements: a. Does BigBox generate positive cash flow from

> Google, Inc. (GOOG), is one of the most successful internet firms, and it experienced very rapid growth in revenues from 2011 through 2014. The cash flow statements for Google, Inc., spanning the period are as follows: Answer the following questions u

> Prepare a balance sheet and income statement for TNT, Inc., from the following scrambled list of items: a. Prepare an income statement for TNT. b. Prepare a balance sheet for TNT. c. What can you say about the firm’s financial conditi

> On July 25, 2011, the average price of a gallon of gasoline was $3.70. Just five years later the price of that same gallon of gas was $2.14. What was the rate of inflation (deflation) in the price of a gallon of gas over the period?

> Following is a scrambled list of accounts from the income statement and balance sheet of Belmond, Inc.: a. What is the firm’s net working capital? b. Complete an income statement and a balance sheet for Belmond. c. If you were asked t

> If you deposit $10,000 today into an account earning an 11 percent annual rate of return, in the third year how much interest will you earn? How much of the total is simple interest, and how much results from compounding of interest?

> If you deposit $3,500 today into an account earning an 11 percent annual rate of return, what will your account be worth in 35 years (assuming no further deposits)? In 40 years?

> You have just introduced “must-have” headphones for the iPod. Sales of the new product are expected to be 10,000 units this year and to increase by 15 percent per year in the future. What are expected sales during each of the next three years? Graph this

> A new finance book sold 15,000 copies following the first year of its release, and its sales were expected to increase by 20 percent per year. What sales are expected during Years 2, 3, and 4? Graph this sales trend and explain.

> Your grandmother just gave you $6,000. You’d like to see how much it might grow if you invest it. a. Calculate the future value of $6,000, given that it will be invested for five years at an annual interest rate of 6 percent. b. Recalculate part a using

> You just received a $5,000 bonus. a. Calculate the future value of $5,000, given that it will be held in the bank for five years and earn an annual interest rate of 6 percent. b. Recalculate part a using a compounding period that is (1) semiannual and (2

> Calculate the amount of money that will be in each of the following accounts at the end of the given deposit period: Annual Compounding Periods per Year (m) Amount Compounding Periods (years) Account Holder Deposited Interest Rate Theodore Logan III

> Hollywood sound company Merry Sountracks, Inc., is a successful sound and editing firm. Last year the firm earned $4 million in taxable income (earnings before taxes). Use the corporate tax rates found in the chapter to calculate the firm’s tax liability

> You are hoping to buy a house in the future and recently received an inheritance of $20,000. You intend to use your inheritance as a down payment on your house. a. If you put your inheritance in an account that earns a 7 percent interest rate compounded

> If the price of a gallon of regular gasoline is $2.49 and the anticipated rate of inflation in energy prices is such that this cost of gasoline is expected to rise by 5 percent per year, what is the expected price per gallon in 10 years?

> Microwave Oven Programming, Inc., is considering the construction of a new plant. The plant will have an initial cash outlay of $7 million (CF0 = -$7 million) and will produce cash flows of $3 million at the end of Year 1, $4 million at the end of Year 2

> Leslie Mosallam, who recently sold her Porsche, placed $10,000 in a savings account paying annual compound interest of 6 percent. a. Calculate the amount of money that will accumulate if Leslie leaves the money in the bank for 1, 5, and 15 years. b. Supp

> GMT Transport Company ended the year with record sales of $18 million. The firm’s cost of goods sold totaled $10.8 million while its operating expenses (including depreciation) totaled $4 million. GMT paid $1.5 million in interest expense and had an inco

> Who really owns a corporation, and how does that impact the goal of the firm?

> List the three main forms of business organization, and describe their advantages and disadvantages. If you were to consider starting up a lawn-care business for the summer, what type of business organization might you use?

> In very basic terms, describe how profits and cash flow are different.

> According to Principle 2, how should investors decide where to invest their money?

> Explain the three types of business decisions that a financial manager faces.

> In Regardless of Your Major: Defined Benefit vs. Defined Contribution Retirement Plans on page 20, two types of pension plans are discussed. Describe each. Which type is now the dominant type in use?

> What are the limitations of the use of forward contracts to construct a hedge against price risk? How does a futures exchange control for these limitations?

> Describe how forward contracts can be used to hedge the risk of fluctuating commodity prices for firms that must purchase these commodities in the future.

> Mark McNibble is CFO for McNabb Fabrications, Inc. Mark is considering a new project that involves the introduction of a new product. McNabb is in the 34 percent marginal tax bracket has a 15 percent required rate of return or discount rate for new inves

> What is a forward contract, and how does it typically differ from an exchange traded futures contract?

> Finance for Life: Do You Need Life Insurance? on page 638 discussed factors involved in the decision to purchase life insurance. What are some commonsense guidelines that can be used to answer the question of whether you need life insurance?

> Firms regularly use insurance as a means of managing their risk exposure. What are some of the types of risks that are typically transferred to insurance companies through the use of insurance contracts?

> What was the risk management policy followed by the Chesapeake Energy Corporation (CHK) with respect to the price of the oil and gas it needed for its future production prior to 2011?

> A firm’s cash flows are risky for a number of reasons. Identify and discuss five sources of risk or volatility in firm cash flows.

> Define the term risk management.

> Chemical plants rely on crude oil as the base material for the manufacture of a whole host of products. How might such a firm hedge the risk of a price increase in the cost of crude oil spanning the next 12 months of its operations?

> What is a swap contract? How are swap contracts used to hedge interest rate risk?

> Define a call option, and contrast it with a put option.

> In Regardless of Your Major: Welcome to a Risky World on page 634, the need to engage in risk management was linked to the day-to-day activities of firm employees from multiple functional areas, including operations, marketing, and accounting. What are t

> The Shome Corporation is considering a new project that involves the introduction of a new product. The firm in in the 34 percent marginal tax bracket and has a 15 percent required rate of return or discount rate for new investments. This project is expe

> The forward rate for the Indian currency, the rupee, is not quoted in the New York exchange market. If you were exposed to exchange risk in rupees, how could you cover your position?

> What steps can a firm take to reduce foreign exchange rate risk? Indicate at least two different techniques.

> Define exchange rate risk and political risk.

> What are the markets and mechanics involved in engaging in simple arbitrage?

> Referring back to Finance for Life: International Investing on page 620, why is the diversification that international investing provides to individual investors of value?

> Referring back to Regardless of Your Major: Working in a Flat World on page 608, why do businesses operate internationally, and what different types of businesses tend to operate in the international environment? Why are the techniques and strategies ava

> A corporation desires to enter a particular foreign market. The direct foreign investment analysis indicates that a direct investment in the plant in the foreign country is not profitable. What other course of action can the company take to enter the for

> How is the direct foreign investment decision made? What are the inputs to this decision process? Are the inputs more complicated than those for the domestic investment decision? Why or why not?

> What additional factors are encountered in international as compared with domestic financial management? Discuss each briefly.

> Finance for Life: Credit Scoring on page 595 described the credit scoring system used to determine whether credit will be extended. What is a good credit score?

> What is the principle of self-liquidating debt, and how can it be used to manage a firm’s working capital?

> How does a firm’s use of short-term debt, as opposed to long-term debt, subject the firm to a greater risk of illiquidity?

> What is the risk-return tradeoff that arises when a firm manages its working capital?

> What is a firm’s net working capital, and how is it related to the current ratio and the firm’s overall liquidity?

> Why is the current ratio used to measure a firm’s liquidity?

> In Regardless of Your Major: Conflicting Objectives Lead to Problems in Managing a Firm’s Working Capital on page 578, we learned that the objectives of a firm’s sales force and the goal of maximizing shareholder wealth are not always in sync when it com

> In Finance for Life: Credit Scoring on page 595, we learned about the determinants of your credit score. Describe the five components of a credit score and the relative weight or importance of each.

> What factors determine the size of the investment a firm makes in accounts receivable? Which of these factors are under the control of the financial manager?

> Describe the meaning of the following trade credit terms: “2/10, net 30”; “4/20, net 60”; and “3/15, net 45.”

> How can the basic interest expense formula—Interest = Principle × Rate × Time— be used to estimate the annualized cost of short-term credit?

> Traid Winds Corporation, a firm in the 34 percent marginal tax bracket with a 15 percent required rate of return or discount rate, is considering a new project that involves the introduction of a new product. This project is expected to last five years,

> In the chapter introduction, we noted that computer company Dell is an industry leader in its working-capital management practices. Describe how the firm came to have this reputation.

> What would be the probable effect of each of the following on a firm’s cash position? a. A new advertising campaign that results in more rapidly rising sales. b. A delay in the payment of the firm’s accounts payable. c. A decision to offer a more liberal

> Compare and contrast discretionary and spontaneous sources of short-term financing.

> Distinguish among the three components of a firm’s overall planning process: the short-term operating financial plan, the long-term operating financial plan, and the strategic plan.

> Describe the percent-of-sales method of financial forecasting.

> Forecasting a firm’s future sales is the key element in developing a financial plan, yet forecasting can be extremely difficult in some industries. If forecast accuracy is very poor, does this mean that the financial planning process is not worthwhile? E

> What is the primary objective of the financial planning process?

> In Regardless of Your Major: Financial Planning Engages Everyone on page 554, we learned that financial planning engages everyone throughout the organization. How do marketing and accounting specialists contribute to the financial planning process?

> Cousin Harold runs a pharmacy but likes to dabble in common stock investing as a hobby. One day last week he called you to find out what had happened to his portfolio because one of the stocks he owns had announced the decision to repurchase 10 percent o

> In Finance for Life: The Importance of Dividends on page 541, we learned about the importance of dividend reinvestment to creating personal wealth through investing in stocks. Many companies now offer dividend reinvestment plans. What are these plans, a

> Garcia’s Truckin’, Inc., is considering the purchase of a new production machine for $200,000. The purchase of this machine would result in an increase in earnings before interest and taxes of $50,000 per year. To operate this machine properly, workers w

> Describe the dividend distribution process, including the importance of the declaration date, date of record, and ex-dividend date.

> Your Aunt Mary recently called to ask you about a letter she had just received from her stockbroker. She said that the letter notified her that one of the stocks she owns will be paying a 10 percent stock dividend, so her 100 shares will now be 110 share

> What is a stock dividend, and how is it similar to a stock split?

> A firm’s dividend policy is generally characterized in terms of two attributes. Explain each.

> Explain what a firm’s dividend policy is as if you were talking to your grandmother, who has had no formal education in business.

> In Regardless of Your Major: Firms Almost Never Decrease Their Dividend on page 528, we learned that firms try to sustain their dividend payout even during economic downturns. Use the internet to determine what Royal Dutch Shell did with respect to its

> What is the current U.S. tax policy with regard to the taxation of dividend income and capital gains income resulting from a share repurchase? If the individual stockholder could choose whether to receive a cash dividend or to have the firm engage in a s

> Your Uncle Bob has no formal education in business or finance but has been investing in the stock market for many years. At a recent family reunion, Uncle Bob told you that he liked to invest in stocks with a very long history of paying cash dividends. D

> Under what conditions is the firm’s dividend policy not important to its investors?

> Why is a stable dividend payout policy popular from the viewpoint of the corporation? Is it also popular with investors? Why?

> Raymobile Motors is considering the purchase of a new production machine for $500,000. The purchase of this machine would result in an increase in earnings before interest and taxes of $150,000 per year. To operate this machine properly, workers would ha

> In the introduction, we pointed out that Emerson Electric Co. (EMR) had paid cash dividends for 53 consecutive years. Look up the company’s cash dividend for the most recent year. What is the dividend for that year?

> Describe why capital structure is relevant to the value of the firm. Discuss the potential violations of both of the basic assumptions that support the M&M capital structure theory.

> Under the conditions of the M&M capital structure theory, the firm’s financing decisions do not have an impact on firm value. When this theory holds (i.e., is true), how do the firm’s financing decisions affect the firm’s weighted average cost of capital

> What does Figure 15.2 have to say about the impact of a firm’s financing decisions on firm cash flows? Figure 15.2: Debt or bonds 20% or $100,000 Debt or bonds 40% or Equity or Total cash flows are $200,000 common stock the same,

> What are the two fundamental assumptions that are used to support the M&M capital structure theory? Describe each in commonsense terms.

> What is the significance of the notion that a firm’s financing decisions are irrelevant? What does this mean to the financial manager?

> What is financial leverage? What is meant by the use of the terms favorable and unfavorable with regard to financial leverage?

> What are non-interest-bearing liabilities? Give some examples. Why are non- interest-bearing liabilities not included in the firm’s capital structure?

> The tax implications of leasing versus buying a piece of equipment can sometimes favor leasing and at other times favor buying. Explain.

> Use Figure 15-9 to describe potential differences between leasing a piece of equipment with a capital lease and purchasing the equipment using a bank loan. Figure 15-9: Вuying Leasing Capital Markets (c.g., commercial banks and insurance companies)

> Landcruisers Plus (LP) has operated an online retail store selling off-road truck parts. As the name implies, the firm specializes in parts for the venerable Toyota FJ40, which is known throughout the world for its durability and off-road prowess. The fa

> In Finance in a Flat World: Capital Structures Around the World on page 510, we learned that capital structures differ dramatically in different countries around the world. What are some possible causes for the observed differences?

> A firm is considering replacing its current production facility with a new robotics production facility. As a result of this move, the firm’s fixed costs will increase dramatically. To finance this new project, the firm is considering either issuing comm

> What is financial flexibility, and why is it an important consideration when evaluating a financing decision?

> How does a firm’s financial structure differ from its capital structure?

> Do you think firms with stable income streams should use higher or lower levels of debt in their capital structures? Why?

> Explain how industry norms might be used by the financial manager in the design of the company’s financing mix

> The Ballard Corporation is considering adding more debt to its capital structure and has asked you to provide it with some guidance. After looking at future levels of Ballard’s EBIT, you feel very confident that in the future it will consistently be abov