Question: The City of Scottsdale, Arizona, provides the

The City of Scottsdale, Arizona, provides the following report on the following page about its reserve policies on page 12 of its October 2007 financial trends booklet.

Required

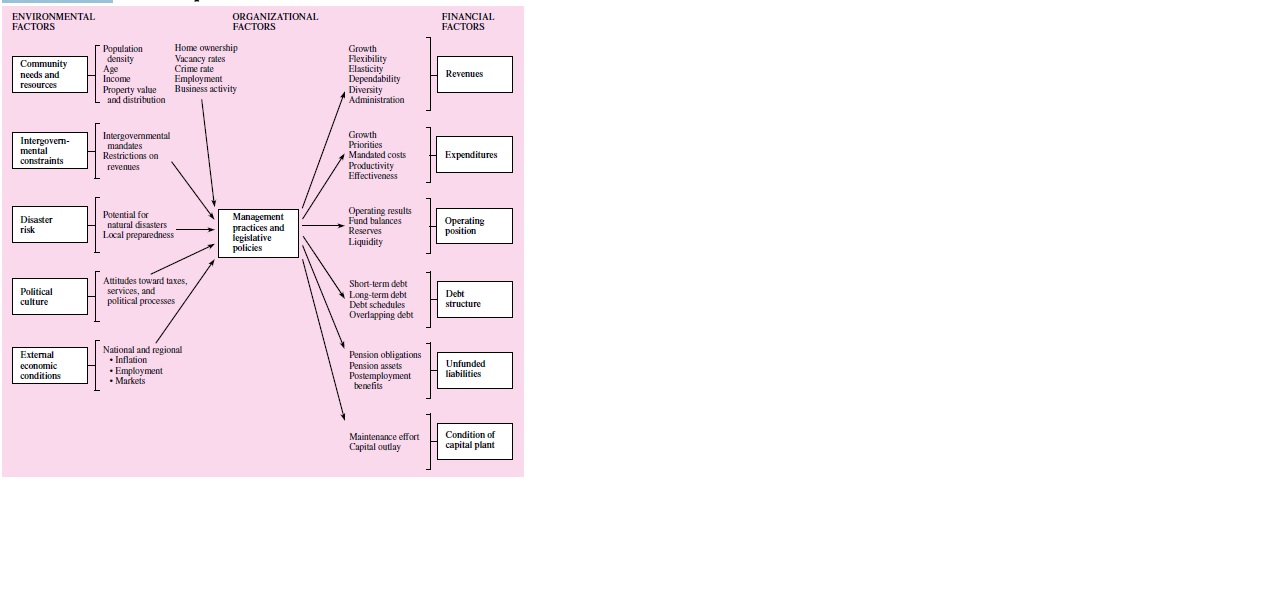

a. Refer to Illustration 10–1. To which categories of factors affecting financial condition do you believe this statement belongs?

Illustration 10–1

b. Assess the adequacy of this note. Do you need more information to understand how the reserve financial policy affects the city’s financial condition? Explain.

Reserve Policies (excerpt from 2007 Financial Trends for the City of Scottsdale, Arizona)

37. All fund designations and reserves will be evaluated annually for long-term adequacy and use requirements in conjunction with development of the City’s balanced five year financial plan.

38. General Fund Stabilization Reserve of 10 percent of annual general governmental (General and Transportation funds) operating expenditures will be maintained for unforeseen emergencies or catastrophic impacts to the City. Funds in excess of 10 percent, but not to exceed $5 million, may be used for economic investment in the community when justified by the financial return to the City.

39. Debt Service Reserve will be funded with secondary property taxes, levied by City Council, sufficient to pay the bonded indebtedness for General Obligation bond principal and interest. A debt service sinking fund will be maintained to account for these restricted revenues and debt payments, as well as any additional debt amounts deemed to be advisable and necessary for any public or municipal purposes. An excise tax debt reserve will be funded at no less than the annual debt service for all currently outstanding (1%) excise tax–supported debt.

40. Water and Sewer Fund Reserves will be maintained to meet three objectives:

1) to ensure adequate funding for operations; 2) to ensure infrastructure repair and replacement; and 3) to provide working capital to provide level rate change for customers.

a. An Operating Reserve will be funded not to exceed 90 days of budgeted system operating expenditures to provide sufficient expenditure flexibility during times of unusual weather resulting in variations in average consumption and associated operating expenses.

b. A Replacement and Extension Reserve will be maintained, per bond indenture requirements, to meet the minimum requirement of 2% of all tangible assets of the system to ensure replacement of water and sewer infrastructure.

c. In addition, working capital will be funded based upon a multiyear financial plan to provide adequate cash for water and sewer capital improvements and to level the impact of rate increases upon our customers.

41. Solid Waste Management Fund Reserve will be funded not to exceed 90 days of budgeted system operating expenditures to provide contingency funding for costs associated with solid waste disposal. Costs may include site purchase, technology applications, or intergovernmental investment to maximize the value of waste disposal activities.

42. Aviation Fund Reserve will be funded not to exceed 90 days of budgeted system operating expenditures to provide contingency funding for costs associated with airport operations. Costs may include site purchase, technology applications, or intergovernmental investment to maximize the value of airport activities.

43. Self-Insurance Reserves will be maintained at a level, which, together with purchased insurance policies, will adequately indemnify the City’s property, liability, and health benefit risk. A qualified actuarial firm shall be retained on an annual basis in order to recommend appropriate funding levels, which will be approved by Council.

44. Fleet Management Reserve will be maintained based upon lifecycle replacement plans to ensure adequate fund balance required for systematic replacement of fleet vehicles and operational contingencies. Operating departments will be charged for fleet operating costs per vehicle class and replacement costs spread over the useful life of the vehicles.

45. Contingency Reserves to be determined annually will be maintained to offset unanticipated revenue shortfalls and/or unexpected expenditure increases. Contingency reserves may also be used for unanticipated and/or inadequately budgeted events threatening the public health or safety. Use of contingency funds should be utilized only after all budget sources have been examined for available funds, and subject to City Council approval.

Transcribed Image Text:

ENVIRONMENTAL FACTORS ORGANIZATIONAL FACTORS FINANCIAL FACTORS Population density Age Home ownership Vacancy rates Crime rate Employment Business activity Growth Flexibility Elasticity Dependability Diversity Administration Community needs and Revenues Income resources Property value and distribution Intergovem- mental constraints Intergovemmental mandates Restrictions on Growth Priorities Mandated costs H Expenditures Productivity Effectiveness revenues Potential for patural disasters Management practices and legislative policies Operating results Fund balances Reserves Disaster risk Operating position Local preparedness Liquidity Attitudes toward taxes, services, and political processes Short-term debt Political culture Long-term debt Debt schedules Debt structure Ovrlapping debt Extemal economic сonditions National and regional • Inflation • Employment • Markets Pension obligations Pension assets Unfunded liabilities Postemployment benefits Maintenance effort Condition of Capital outlay capital plant

> Write T if the corresponding statement is true. If the statement is false, write F and state what changes should be made to make it a true statement. 1. Activities of a general purpose government that provide the basis for GASB’s financial accounting and

> Locate a comprehensive annual financial report (CAFR) for a local government from some source on the Internet, perhaps the Web site of the governmental entity or the Governmental Accounting Standards Board’s Web site. Print a copy of the balance sheet an

> For more than 100 years, the financial statements of the Town of Brookfield have consisted of a statement of cash receipts and a statement of cash disbursements prepared by the town treasurer for each of its three funds: the General Fund, the Road Tax Fu

> Explain the criteria for determining if a governmental or enterprise fund must be reported as a major fund. What other funds should or may be reported as major funds?

> Amber City borrowed $1,000,000 secured by a 5-year mortgage note. The cash from the note was used to purchase a building for vehicle and equipment maintenance. Show how these two transactions should be recorded in the General Fund and governmental activi

> Which fund category uses the modified accrual basis of accounting? What are the recognition rules for revenues and expenditures under the modified accrual basis of accounting?

> What are the three categories of funds prescribed by GASB standards and which fund types are included in each? Do the three fund categories correspond precisely with the three activity categories described in Chapter 2? If not, how do they differ?

> “Governmental and not-for-profit organizations do not differ significantly from for-profit organizations and therefore should follow for-profit accounting and reporting standards.” Do you agree or disagree with this statement? Why or why not?

> The government-wide financial statements for the City of Arborland for a three-year period are presented on the following pages. Additional information follows: Population: Year 2011: 30,420, Year 2010: 28,291, Year 2009: 26,374. Debt limit remained

> “If a discrete presentation is used for the financial data of a component unit in the statement of net assets of a governmental financial reporting entity, there is no need for the component unit to issue a separate financial report.” Is this statement t

> Condensed government-wide financial information from the comprehensive annual financial report for the Commonwealth of Pennsylvania for the fiscal year ended June 30, 2007, is provided below. Required a. Identify significant trends that appear in the co

> The transmittal letter from the chief financial officer to the mayor and city council of Detroit that accompanies the City of Detroit’s Comprehensive Annual Financial Report for the Year Ended June 30, 2004, includes the following: Econ

> Examine the following tables from the 2009 Financial Trend Monitoring Report for the Town of Oakdale that reports on fiscal year 2008. The performance indicators selected are total revenue and revenue per capita. The town provides three reference groups

> Write the letters a through o on a sheet of paper. Beside each letter, put a plus (+) if a high or increasing value of the item is generally associated with stronger financial condition, a minus (─) if a high or increasing value of the item is generally

> Choose the best answer. 1. Which of the following groups or parties generally has taken the most initiative to evaluate the financial condition of a city? a. Citizens. b. Managers. c. Credit market analysts. d. Legislative and oversight bodies. 2. Which

> The City of Edmond, Oklahoma, uses the Crawford Performeter® as a financial analysis tool and presents the results of this analysis in its Managements’s Discussion and Analysis in the annual audited financial statements. For

> You are a new city council person for the City of Scottsdale, Arizona. You are aware that several cities have been in the news recently for financial crises for which the council or board is being held accountable. The governing bodies have been criticiz

> For the fiscal year 2007, the City and County of Denver, Colorado, had approximately $4.9 billion in bonded debt. You are a senior accountant in the controller’s office of the City and County of Denver and have been asked to make a presentation at the ne

> You are an accountant with the national office of the National Association of State Retirement Administrators (NASRA) and have just been appointed by the membership as its representative to the Governmental Accounting Standards Advisory Council (GASAC) f

> What organizations does the governmental reporting entity include? Define primary government. How does a component unit differ from the primary government?

> “Credit or bond analysts are interested only in the financial condition of the government when determining bond ratings.” Do you agree or disagree with this statement? Explain.

> Identify some financial indicators or ratios that are designed to measure the short-term financial position of a governmental entity. Why are these measures not as useful in assessing long-term financial or economic condition?

> Should citizens be concerned if the pension plan funding measure decreases over time? Why?

> Explain how organizational factors, such as management practices and legislative policies, affect a government’s financial condition.

> Explain what assessment can be made from the ratio unrestricted net assets as a percentage of total revenue that cannot be made from the ratio unreserved fund balances as a percentage of total revenues.

> Describe how a taxpayer might assess the financial solvency and viability of a government using government-wide financial statements prepared according to generally accepted accounting principles.

> Describe how citizens can use the financial trend monitoring system (FTMS) of the ICMA to assess the financial condition of their local government.

> The International City/County Management Association (ICMA) describes four types of solvency within the concept of financial condition. Identify each type and explain why each is important to the long-term financial health of a government.

> Which of the following terms best represents a broad concept of financial health encompassing the government’s ability and willingness to meet its financial obligations and commitments to provide services: financial position, financial condition, or econ

> Describe some typical causes of municipal financial crises. How could an effective monitoring system reduce the risk of a financial crisis?

> Describe the fiduciary activities of a state or local government and explain how accounting and financial reporting for fiduciary activities differ from those for governmental and business-type activities.

> The Village of Rodale keeps its governmental fund accounting records on a modified accrual basis. At the end of the fiscal year, the village accountant must convert the modified accrual information to accrual information to allow for preparation of the g

> Following is the governmental activities pre-closing trial balance for the Town of Freaz. Freaz is a relatively small town and, as a result, it has only governmental funds (i. e., it uses no proprietary funds). There are no component units. To complete t

> You have recently started working as the controller for a small county. The county is preparing its financial statements for the comprehensive annual financial report and you have been given the following statement for review. You know that in addition t

> You have been provided with the following information concerning operating activity for Leesburg County. For the year ended June 30, 2011, the net change in total governmental fund balances was $131,700, and the change in net assets of governmental activ

> The City of Allenton has engaged you to examine its June 20, 2011, financial statements. You are the first CPA ever engaged by the city and you find that the city’s accounting staff is unfamiliar with GAAP accounting and reporting requi

> The City of Lynnwood was recently incorporated and had the following transactions for the fiscal year ended December 31, 2011. 1. The city council adopted a General Fund budget for the fiscal year. Revenues were estimated at $2,000,000 and appropriations

> Choose the best answer. 1. Some governments have begun to provide highly condensed financial information, budget summaries, and narrative descriptions, in addition to their traditional CAFR. This type of report is generally referred to as a (an): a. Popu

> Choose the best answer. 1. Which of the following fund type(s) uses the accrual basis of accounting? a. Special revenue. b. Internal service. c. Pension trust. d. Both b and c. 2. Which of the following items would generally be reported as a program reve

> You have just been hired as an accountant for a large metropolitan city in the eastern part of the country. Your first assignment is to assist the finance director in the preparation of a “popular report.” The city has long been concerned w

> The MD&A for the 2007 City and County of Denver CAFR is included as Appendix B in this chapter. On the following pages are selected tables from the statistical section of the 2007 CAFR. Use the MD&A and the provided statistical tables to complete

> Describe the business-type activities of a state or local government and explain how and why accounting and financial reporting for business-type activities differ from those for governmental activities.

> Following are descriptions of several relationships between primary governments and other organizations.* Required Using just the information provided, indicate whether you believe the primary government should include the organization as a component un

> What is OCBOA and why would a government choose to use OCBOA rather than GAAP?

> Assuming that a government has governmental, proprietary, and fiduciary funds, identify the nine financial statements that must be prepared for the CAFR.

> Explain the difference between a CAFR and general purpose external financial reports.

> The controller is considering whether a component unit should be presented in the financial statements as a discrete or a blended component unit. What should be considered in making the decision?

> Explain the difference between a primary government and a component unit.

> What is a financial reporting entity and what organizations generally make up a financial reporting entity?

> A city manager was overheard saying, “Since we don’t release them to the public, I don’t see any value in taking the time to prepare interim reports.” Explain why you agree or disagree with this statement.

> What is the difference between a note to the financial statements and required supplementary information?

> What is a special district and why might a government create one or more special districts?

> Describe the governmental activities of a state or local government and identify the measurement focus and basis of accounting used in accounting and financial reporting for these activities.

> Ray County administers a tax agency fund, an investment trust fund, and a private-purpose trust fund. The tax agency fund acts as an agent for the county, a city within the county, and the school district within the county. Participants in the investment

> The State of Nodak operates a Public Employees Retirement System (PERS) for all employees of the state. The preclosing trial balance of the PERS as of June 30, 2011, follows (in thousands of dollars): Required a. Prepare a statement of changes in plan

> The Village of Dover administers a defined benefit pension plan for its police and fire personnel. Employees are not required to contribute to the plan. The village received from the actuary and other sources the following information about the Public Sa

> The Albertville City Council decided to pool the investments of its General Fund with Albertville Schools and Richwood Township in an investment pool to be managed by the city. Each of the pool participants had reported its investments at fair value as o

> St. George County has entered into a contract for the demolition and construction of a six-lane bridge. It is expected that the project will take three years to complete. The terms of the contract indicate that the county will retain 5 percent (retained

> Fawn community, located in the City of Deerville, voted to form a local improvement district to fund the construction of a new community center. The city agreed to construct the community center and administer the bond debt; however, Fawn community was s

> The county collector of Lincoln County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax agency fund, t

> GASB standards require that governments report other postemployment benefits offered to employees. A typical example of such benefits is health care provided to retirees. It is estimated that the unrecorded and unfunded liability related to OPEB is huge.

> Following is a list of fund names and descriptions of funds from comprehensive annual financial reports (CAFRs). Required For each fund, indicate which type of fund should be used to account for the activities and explain why that fund is most appropria

> While the examples in this chapter have focused on a single-employer plan, many states operate statewide plans, referred to as Public Employee Retirement Systems (PERS), to which multiple employers contribute. One of the largest PERS plans in the nation

> Place the abbreviations corresponding to the appropriate reporting attribute(s) in the spaces provided for each financial statement. Include all that apply. Basis of Accounting Activities or Funds Governmental activities GA Business-type activities

> What are the two types of risk that are of concern to investment managers? Define each type of risk.

> If you were trying to assess the financial health of a government administered pension plan, which financial statements or schedules would you review and why?

> Explain the difference between a private-purpose trust and a public-purpose trust. How does the reporting for the two types of trusts differ?

> GASB standards require that investments be reported at fair value. Explain the GASB reporting requirements related to fair value. How do these requirements differ from reporting requirements for corporate entities?

> How does the accounting for an internal investment pool differ from the accounting for an external investment pool?

> What is a “pass-through” agency fund and under what conditions is it appropriate to use such a fund?

> Why do agency funds have no fund equity?

> Must an agency fund be used to account for withholding taxes, retirement contributions, and (if applicable) social security taxes of General Fund employees? Explain.

> Identify the different types of trust funds and explain the purpose of each type.

> Explain the distinction(s) between agency funds and trust funds.

> In partnership with Jefferson County and the Mound City Visitor’s Bureau, Mound City recently established a Native American Heritage Center and Museum, organized as a tax-exempt not-for-profit organization. Although the facility does not charge admission

> From the right-hand column, choose the letter that corresponds to the section of the statement of cash flows where the activity listed in the left-hand column would be reported. Activities Cash Flow Section A. Operating Activities B. Noncapital Fina

> Von County has prepared the following statement of revenues, expenses, and changes in fund net assets for its proprietary funds. The county has three enterprise funds and two internal service funds. Required The statement as presented is not in accorda

> Following is the June 30, 2010, statement of net assets for the City of Bay Lake Water Utility Fund. Required a. For fiscal year 2011, prepare general journal entries for the Water Utility Fund using the following information. (1) The amount in the Acc

> The Town of Elizabeth operates the old train station as an enterprise fund. The train station is on the national register of historic buildings. Since the town has held the building for such a long time, the Central Station Fund has no long-term debt. Th

> The City of Dalton accounts for its parking facilities as an enterprise fund. For the year ended December 31, 2011, the pre-closing trial balance for the Parking Facilities Fund is provided. Additional information concerning the Parking Facilities Fund

> During the past year, Oak City had a number of transactions that impacted net asset classifications of its produce market, which is operated as an enterprise fund. All nominal accounts for the period have been closed to unrestricted net assets. For repor

> The City of Ashville operates an internal service fund to provide garage space and repairs for all city-owned-and-operated vehicles. The Central Garage Fund was established by a contribution of $300,000 from the General Fund on July 1, 2008, at which tim

> As of September 30, 2010, the Central Duplicating Fund of the Town of Fredericksburg had the following post-closing trial balance: During the fiscal year ended September 30, 2011, the following transactions (summarized) occurred: 1. Employees were paid

> The City of Dixon operates a mass transit system (DTS) consisting of a network of bus and trolley routes. The following information is provided about the operations and financing of the mass transit system.* 1. Operating revenues for the most recent fisc

> Jaffry County operates a Risk Management Pool as an internal service fund. The Risk Management Pool provides the insurance function for the county departments through the purchase of insurance policies and the investing of resources to cover uninsured lo

> Examine the Federal Accounting Standards Advisory Board’s Web site at www.fasab.gov and prepare a brief report about its mission and structure and compile a list of organizations represented on its Accounting and Auditing Policy Committee. Can you obtain

> The balance sheet and statement of revenues, expenditures, and changes in fund balance for the Building Maintenance Fund, an internal service fund of Coastal City, are reproduced here. No further information about the nature or purposes of this fund is g

> What is meant by “segment information for enterprise funds”? When is the disclosure of segment information required?

> Explain the difference between operating revenues/expenses and non-operating revenues/expenses. Why does the GASB require that operating revenues/expenses be reported separately on proprietary statements of revenues, expenses, and changes in fund net ass

> What are regulatory accounting principles and how do they relate to enterprise fund accounting?

> How does the statement of cash flows under GASB standards differ from the statement of cash flows under FASB standards?

> Explain how capitalization of interest costs differs for enterprise funds as opposed to governmental funds.

> What is the purpose of the Restricted Assets section of an enterprise fund statement of fund net assets? Provide examples of items that might be reported in the Restricted Assets section.

> How does GASB reporting of uncollectible accounts for governmental funds and proprietary funds differ from the reporting of uncollectible accounts under FASB standards?

> A member of the city commission insists that the city’s internal service fund prepare and submit a budget for commission approval. The commissioner argues that it is only through the budget that the commissioners will be able to ensure control over the i

> When would a city establish an internal service fund? An enterprise fund?

> Examine the Governmental Accounting Standards Board’s Web site (www.gasb.org) and prepare a brief report about its mission and structure and the representative organizations on its advisory council. Can you get a copy of the full text of a GASB statement

> Explain the reporting requirements for internal service funds and enterprise funds.

> Transaction data related to the City of Chambers’s issuance of serial bonds to finance street and park improvements follow. Utilizing worksheets formatted as shown at the end of the problem, prepare all necessary journal entries for the

> Following are transaction data for a term bonds issue for the City of Nevin. Prepare all necessary entries for these transactions in the city’s funds, and governmental activities journal at the government-wide level. a. On July 1, 2010, the first day of