Question: The current assets and current liabilities sections

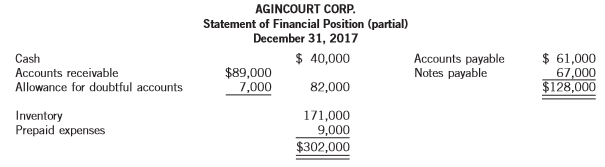

The current assets and current liabilities sections of the statement of financial position of Agincourt Corp. are as follows:

The following errors have been discovered in the corporation’s accounting:

1. January 2018 cash disbursements that were entered as at December 2017 included payments of accounts payable in the amount of $35,000, on which a cash discount of 2% was taken.

2. The inventory balance is based on an inventory count that included $27,000 of merchandise that was received at December 31 but with no purchase invoices received or entered. Of this amount, $10,000 was received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30.

3. Sales for the first four days in January 2018 in the amount of $30,000 were entered in the sales book as at December 31, 2017. Of these, $21,500 were sales on account and the remainder were cash sales.

4. Cash, not including cash sales, collected in January 2018 and entered as at December 31, 2017, totalled $35,324. Of this amount, $23,324 was received on account after cash discounts of 2% had been deducted; the remainder was proceeds on a bank loan (the amount owed to the bank for January 2018 was included as part of Notes Payable account).

Instructions:

(a) Adjust (correct) the statement of financial position’s current assets and current liabilities sections. (Assume that both accounts receivable and accounts payable are recorded gross.)

(b) Calculate the current ratio before and after the corrections prepared in part (a). Did the changes improve or worsen this ratio?

(c) Calculate the net effect of your adjustments on Agincourt Corp.’s retained earnings balance. (d) Assume that in February 2018, Agincourt approaches its bank for another bank loan, based on its corrected statement of financial position as at December 31, 2017. Also assume that the terms of the new bank loan would require that Agincourt maintain a current ratio of 1.5. As Agincourt’s bank manager, discuss the importance of recording the adjustments above and correcting the statement of financial position as at December 31, 2017.

(e) If the adjustments had not been reflected in the statement of financial position provided to the bank manager, do you think the bank manager would have suspected that the financial statements were incorrect? If so, how would the manager have suspected this misstatement to be the case?

Transcribed Image Text:

AGINCOURT CORP. Statement of Financial Position (partial) December 31, 2017 $ 40,000 Accounts payable Notes payable $ 61,000 67,000 $128,000 Cash $89,000 7,000 Accounts receivable Allowance for doubtful accounts 82,000 Inventory Prepaid expenses 171,000 9,000 $302,000

> Eureka Limited has a calendar-year accounting period. The following errors were discovered in 2017. 1. The December 31, 2015 merchandise inventory had been understated by $51,000. 2. Merchandise purchased on account in 2016 was recorded on the books for

> Salamander Limited makes the following errors during the current year. Each error is an independent case. 1. Ending inventory is overstated by $1,020, but purchases are recorded correctly. 2. Both ending inventory and a purchase on account are understate

> At December 31, 2017, Igor Ltd. has outstanding non-cancellable purchase commitments for 32,500 litres of raw material at $2.00 per litre. The material will be used in Igor’s manufacturing process, and the company prices its raw materials inventory at co

> During 2017, Build it Furniture Limited purchased a railway car load of wicker chairs. The manufacturer of the chairs sold them to Build it for a lump sum of $59,850, because it was discontinuing manufacturing operations and wanted to dispose of its enti

> In an annual audit of Solaro Company Limited, you find that a physical inventory count on December 31, 2017, showed merchandise of $441,000. You also discover that the following items were excluded from the $441,000: 1. Merchandise of $61,000 is held by

> The following is a list of items that may or may not be reported as inventory in J Soukas Corp.’s December 31 balance sheet: 1. Goods out on consignment at another company’s store 2. Goods sold on an installment basis 3. Goods purchased f.o.b. shipping p

> Jaeco Corporation asks you to review its December 31, 2017 inventory values and prepare the necessary adjustments to the books. The following information is given to you: 1. Jaeco uses the periodic method of recording inventory. A physical count reveals

> Khalfan Industries would like to determine the fair value of its manufacturing facility in London, Ontario. The facility consists of land, building, and manufacturing equipment. Instructions: (a) Identify some of the considerations that are involved in

> Companies in the same line of business usually have similar investments and capital structures, and an opportunity for similar rates of return. One of the key performance indicators that is used to assess the profitability of companies is the return on a

> The financial statements of Trifolium Corporation for fiscal 2015 to fiscal 2017 are as follows (in thousands): Instructions: (a) Calculate Trifolium’s (1) inventory turnover and (2) average days to sell inventory for each of the two

> Milan Company Limited uses the gross profit method to estimate inventory for monthly reports. Information follows for the month of May: Instructions: (a) Calculate the estimated inventory at May 31, assuming that the gross profit is 25% of sales. (b) C

> Nicholas’s Christmas Tree Farm Ltd. grows pine, fi r, and spruce trees. The farm cuts and sells trees during the Christmas season and exports most of the trees to the United States. The remaining trees are sold to local tree-lot operators. It normally ta

> The Becker Milk Company Limited, a real estate and investment management company, reports the following information in its financial statements for the years ended April 30, 2014, 2013, and 2102: Instructions: (a) Calculate the accounts receivable turn

> The inventory of 3T Company on December 31, 2017, consists of the following items. Instructions: (a) Determine the inventory as at December 31, 2017, by the lower of cost and net realizable value method, applying this method directly to each item. (b)

> As a result of its annual inventory count, Tarweed Corp. determined its ending inventory at cost and at lower of cost and net realizable value at December 31, 2016, and December 31, 2017. This information is as follows: Instructions: (a) Prepare the jo

> The Ogale Equipment Corporation maintains a general ledger account for each class of inventory, debiting the individual accounts for increases during the period and crediting them for decreases. The transactions that follow are for the Raw Materials inve

> Information is presented in E8-18 on the inventory of mini-kettles at Funnell Company Limited for the month of May. Instructions: (a) Assuming that the perpetual inventory method is used, calculate the inventory cost at May 31 under each of the followin

> The following information is for the inventory of mini-kettles at Funnell Company Limited for the month of May: Instructions: (a) Assuming that the periodic inventory method is used, calculate the inventory cost at May 31 under each of the following co

> Schonfeld Corporation began operations on December 1, 2016. The only inventory transaction in 2016 was the purchase of inventory on December 10, 2016, at a cost of $20 per unit. None of this inventory was sold in 2016. Relevant information for fi scal 20

> Access the annual financial statements of Stora Enso Oyj for the company’s year ended December 31, 2014. These are available at the company’s website, www.storaenso.com. Review the information that is provided and answer the following questions about the

> Aquino Corporation is a multi-product fi rm. The following information concerns one of its products, the Trinton: Instructions: Calculate cost of goods sold, assuming Aquino uses: (a) A periodic inventory system and FIFO cost formula (b) A periodic inv

> On July 1, 2017, Agincourt Inc. made two sales: 1. It sold excess land in exchange for a four-year, non–interest-bearing promissory note in the face amount of $1,101,460. The land’s carrying value is $590,000. 2. It rendered services in exchange for an e

> Two or more items are omitted in each of the following tabulations of income statement data. Fill in the amounts that are missing. 2015 2016 2017 Sales $290,000 6,000 $410,000 Sales returns 13,000 347,000 32,000 Net sales Beginning inventory Ending

> In fiscal 2017, Ivanjoh Realty Corporation purchased unimproved land for $55,000. The land was improved and subdivided into building lots at an additional cost of $34,460. These building lots were all the same size but, because of differences in location

> Linsang Corporation’s retail store and warehouse closed for an entire weekend while the year-end inventory was counted. When the count was finished, the controller gathered all the count books and information from the clerical staff, co

> Iqbal Corporation uses the lower of FIFO cost and net realizable value method on an individual item basis, applying the direct method. The inventory at December 31, 2016, included product AG. Relevant per-unit data for product AG follow: Estimated selli

> The net income per books of Russell Industries Limited was determined without any knowledge of the following errors. The 2012 year was Russell’s first year in business. No dividends have been declared or paid. Instructions: (a) Prepar

> At January 1, 2017, the credit balance of Andy Corp.’s Allowance for Doubtful Accounts was $400,000. During 2017, the bad debt expense entry was based on a percentage of net credit sales. Net sales for 2017 were $80 million, of which 90% were on account.

> At the end of 2017, Perez Corporation has accounts receivable of $2.5 million and an allowance for doubtful accounts of $120,000. On January 16, 2018, Perez determined that its $20,000 receivable from Morganfield Ltd. will not be collected, and managemen

> Information on Janut Corp., which reports under ASPE, follows: July 1 Janut Corp. sold to Harding Ltd. merchandise having a sales price of $9,000, terms 3/10, n/60. Janut records its sales and receivables net. 3 Harding Ltd. returned defective merchandis

> Access the financial statements of Magna International Inc. for the company’s year ended December 31, 2014. These are available at www. sedar.com or the company’s website. Review the information that is provided and answer the following questions about t

> Assume that Lee Inc. has the following accounts at the end of the current year: 1. Common Shares 2. Raw Materials Inventory 3. FV-OCI Investments 4. Unearned Rent Revenue 5. Work-in-Process Inventory 6. Intangible Assets—Copyrights 7. Buildings 8.

> The bookkeeper for Garfield Corp. has prepared the following statement of financial position as at July 31, 2017: The following additional information is provided: 1. Cash includes $1,200 in a petty cash fund and $12,000 in a bond sinking fund. 2. The

> Bruno Corp. has decided to expand its operations. The bookkeeper recently completed the following statement of financial position in order to obtain additional funds for expansion: Instructions: (a) Prepare a revised statement of financial position usi

> LeBlanc Inc. shows a balance of $519,289 in the Accounts Receivable account on December 31, 2017. The balance consists of the following: Installment accounts due in 2018……………………………………………..$ 91,000 Installment accounts due after 2018……………………………………………80,0

> Selected accounts follow for Kings Inc., as reported in the work sheet at the end of May 2017: Instructions: Extend the amounts reported in the adjusted trial balance to the appropriate columns in the work sheet. Do not total individual columns. Ad

> Eli Corp. has just received its August 31, 2017 bank statement, which is summarized as follows: The general ledger Cash account contained the following entries for the month of August: Deposits in transit at August 31 are $3,800, and cheques outstand

> The following independent situations require professional judgement for determining when to recognize revenue from the transactions. 1. Air Yukon sells you an advance purchase airline ticket in September for your flight home at Christmas. 2. Better Buy L

> Kali Corp. established a petty cash fund early in 2017 to increase the efficiency of accounting for small cash transactions and to improve control over many of the small expenditures it makes. The company decided to set up the imprest fund at $500 and a

> Use the information in E5-17 for Dropafix Inc. Instructions: (a) Calculate the current and acid test ratios for 2016 and 2017. (b) Calculate Dropafix’s current cash debt coverage ratio for 2017. (c) Calculate Dropafix’

> Lute Retail Ltd. follows ASPE. It transfers $355,000 of its accounts receivable to an independent trust in a securitization transaction on July 11, 2017, receiving 96% of the receivables balance as proceeds. Lute will continue to manage the customer acco

> Financial statements can be a valuable tool for many parties interested in a company’s performance. Consider a public company in Alberta that drills oil and sells it to refineries in the United States. The company prepares its financial statements using

> The classifications on Chesapeake Limited’s statement of financial position are as follows: 1. Current assets 2. Long-term investments 3. Property, plant, and equipment 4. Intangible assets 5. Other assets 6. Current liabilities 7. Non-current liab

> Chessman Corporation factors $600,000 of accounts receivable with Liquidity Financing, Inc. on a with recourse basis. Liquidity Financing will collect the receivables. The receivable records are transferred to Liquidity Financing on August 15, 2017. Liqu

> The trial balance before adjustment for Bassel Company shows the following balances. The following cases are independent: 1. To obtain cash, Bassel factors without recourse $20,000 of receivables with Anila Finance. The finance charge is 10% of the amo

> On April 1, 2017, Ibrahim Corporation assigns $400,000 of its accounts receivable to First National Bank as collateral for a $200,000 loan that is due July 1, 2017. The assignment agreement calls for Ibrahim to continue to collect the receivables. First

> By December 31, 2017, Clearing Corp. had performed a significant amount of environmental consulting services for Rank Ltd. Rank was short of cash, and Clearing agreed to accept a $200,000, non–interest-bearing note due December 31, 2019, as payment in fu

> On September 1, 2017, Myo Inc. sold goods to Khin Corporation, a new customer. Before shipping the goods, Myo’s credit and collections department conducted a procedural credit check and determined that Khin is a high-credit-risk customer. As a result, My

> Little Corp. was experiencing cash flow problems and was unable to pay its $105,000 account payable to Big Corp. when it fell due on September 30, 2017. Big agreed to substitute a one-year note for the open account. The following two options were present

> Uddin Corp.’s statement of financial position at the end of 2016 included the following items: The following information is available for the 2017 fiscal year: 1. Net income was $391,000. 2. Equipment (cost of $20,000 and accumulated

> Selected accounts follow of Aramis Limited at December 31, 2017: The following additional information is available: 1. Inventory is valued at the lower of cost and net realizable value using FIFO. 2. Equipment is recorded at cost. Accumulated depreciat

> Hans Hoogervorst, Chair of the IASB, delivered a speech at the Korean Accounting Review International Symposium in Seoul, Korea, on March 31, 2015, entitled “Mind the Gap (Between non-GAAP and GAAP).” In this presentation, he spoke of issues related to t

> The controller for Fashion Co. is trying to determine the amount of cash to report on the December 31, 2017 statement of financial position. The following information is provided: 1. A commercial savings account with $600,000 and a commercial chequing ac

> Lujie Xie is the controller of Lincoln Corporation and is responsible for the preparation of the year-end financial statements on December 31, 2017. Lincoln prepares financial statements in accordance with ASPE. The following transactions occurred during

> The trial balance of Zhang Ltd. at December 31, 2017, follows: Instructions: (a) Prepare a classified statement of financial position as at December 31, 2017. Ignore income taxes. (b) Is there any situation where it would make more sense to have a stat

> Samson Corporation is preparing its December 31, 2017 statement of financial position. The following items may be reported as either current or long-term liabilities: 1. On December 15, 2017, Samson declared a cash dividend of $1.50 per common share to s

> Assume that Elrond Inc. decided to sell Demand TV Ltd., a subsidiary, on September 30, 2017. There is a formal plan to dispose of the business component, and the sale qualifies for discontinued operations treatment. Pertinent data on the operations of th

> Keith Nobrega is trying to determine the amount to set aside so that he will have enough money on hand in two years to overhaul the engine on his vintage used car. While there is some uncertainty about the cost of engine overhauls in two years, by conduc

> Corporation during the current year. 1. Ordinary operating maintenance on equipment was recorded as follows: Equipment……………………………………………..2,500 Accounts Payable…………………………………….2,500 2. Trimm received an advance on a custom order for merchandise that will

> Selected accounts for Winslow Inc. as at December 31, 2017, are as follows: Instructions: Prepare closing entries for Winslow Inc. on December 31, 2017. Inventory FV-NI Investments FV-OCI Investments Retained Earnings Dividends Accumulated Other $

> Use the information in E5-14 for Carmichael Industries. Instructions: (a) Calculate the current and acid test ratios for 2016 and 2017. (b) Calculate Carmichael’s current cash debt coverage ratio for 2017. (c) Based on the analyses in

> Use the information in E5-18 for Sensify Corporation. Instructions: (a) Calculate the current ratio and debt to total assets ratio as at December 31, 2016 and 2017. Calculate the free cash flow for December 31, 2017. (b) Based on the analysis in (a), co

> Rudolph Corp. is a subsidiary of Huntley Corp. and follows IFRS. The ethical accountant, working as Rudolph’s controller, believes that the yearly charge for doubtful accounts for Rudolph should be 2% of net credit sales. The president, nervous that the

> Echo Corp., a retail propane gas distributor, has increased its annual sales volume to a level that is three times greater than the annual sales of a dealer that it purchased in 2016 in order to begin operations. The board of directors of Echo Corp. rece

> The comparative statement of financial position of Sensify Corporation as at December 31, 2017, follows: Net income of $37,000 was reported and dividends of $13,000 were declared and paid in 2017. New equipment was purchased, and equipment with a carry

> The comparative statement of financial position of Dropafix Inc. as at June 30, 2017, and a statement of comprehensive income for the 2017 fiscal year follow: DROPAFIX INC. Statement of Comprehensive Income For the Year Ended June 30, 2017 Net sales&ac

> The statement of income of Kneale Transport Inc. for the year ended December 31, 2017, reported the following condensed information: Kneale’s statement of financial position included the following comparative data at December 31: Ad

> Eddie Zambrano Corporation, a private company, began operations on January 1, 2014. During its first three years of operations, Zambrano reported net income and declared dividends as follows: The following information is for 2017: Income before income

> A comparative statement of financial position for Carmichael Industries Inc. follows: Additional information: 1. Net income for the fiscal year ending December 31, 2017, was $129,000. 2. Cash dividends of $60,000 were declared and paid. Dividends paid

> It is February 2018 and Janix Corporation is preparing to issue fi nancial statements for the year ended December 31, 2017. To prepare fi nancial statements and related disclosures that are faithfully representative, Janix is reviewing the following even

> Several statement of financial position accounts of Green spoon Inc. follow: 1. FV-OCI Investments 2. Common Shares 3. Dividends Payable 4. Accumulated Depreciation—Equipment 5. Construction in Process (Warehouse) 6. Petty Cash 7. Interest Payable

> The following information was taken from the records of Biscay Inc. for the year 2017: The following additional information was also available: income tax applicable to income from continuing operations, $465,000; income tax recovery applicable to loss

> Income statement information for Flett Tire Repair Corporation for the year 2017 follows: The effective tax rate on all income is 25%, and Flett applies ASPE. Instructions: (a) Prepare a multiple-step income statement for 2017, showing expenses by fun

> The trial balance for Hanna Resort Limited on August 31 is as follows: Additional information: 1. The balance in Prepaid Insurance includes the cost of an insurance policy that will expire on September 30, 2017. 2. An inventory count on August 31 shows

> Write a short essay (one or two pages) describing the incurred loss model and the expected loss model of impairment. Summarize each model and compare the two models, indicating the potential benefits and drawbacks of each. Which model do you think provid

> Videohound Video Company, a sole proprietorship, had the following information for 2017: Instructions: Calculate the net income for 2017. $ 23,000 19,000 $101,000 20,000 Cash balance, January 1 Accounts receivable, January 1 Collections from custom

> The following are all changes in the account balances of Chili Lime Ltd. during the current year, except for Retained Earnings: Instructions: Calculate the net income for the current year, assuming that there were no entries in the Retained Earnings ac

> On October 5, 2017, Diamond in the Rough Recruiting Group Inc.’s board of directors decided to dispose of the Blue Division. A formal plan was approved. Diamond derives approximately 75% of its income from its human resources management practice. The Blu

> A review of the accounts of Tucker and Wu Pan Accountants reflected the following transactions, which may or may not require adjustment for the year ended December 31, 2017. 1. The Prepaid Rent account shows a debit of $7,200 paid October 1, 2017, for a

> Bill Rosenberg recently opened his legal practice as a sole proprietorship. During the first month of operations, the following events and transactions occurred: Apr. 2 Invested $15,000 cash along with equipment valued at $10,000 in the business. 2 Hired

> Pike Corporation, a clothing retailer, had income from operations (before tax) of $375,000, and recorded the following before-tax gains/(losses) for the year ended December 31, 2017: Gain on sale of equipment……………………………………………..27,000 Unrealized (loss)/g

> Canviar Corp. maintains its financial records using the cash basis of accounting. As it would like to secure a long-term loan from its bank, the company asks you, as an independent CPA, to convert its cash basis income statement information to the accrua

> At December 31, 2017, Tres Hombres Corporation had the following shares outstanding: 10% cumulative preferred shares,……………………………107,500 shares outstanding ………………………………………….$10,750,000 Common shares, …………………………………………………4,000,000 shares outstanding ………………

> The shareholders’ equity section of Cadmium Corporation as at December 31, 2017, follows: Net income of $24 million for 2017 reflects a total effective tax rate of 25%. Included in the net income figure is a loss of $15 million (befor

> Rainy Day Umbrella Corporation had the following balances at December 31, 2016 (all amounts in thousands): preferred shares, $3,375; common shares, $8,903; contributed surplus, $3,744; retained earnings, $23,040; and accumulated other comprehensive incom

> Instructions: Gain access to the 2014 financial statements of Potash Corporation of Saskatchewan from the company’s website (www.potashcorp.com) or www.sedar.com. The company, also known as PotashCorp, indicates prior to Note 1 to the financial statement

> The following are selected ledger accounts of Holland Rose Corporation at December 31, 2017: Holland’s effective tax rate on all items is 25%. A physical inventory indicates that the ending inventory is $686,000. The number of common

> The following balances were taken from the books of Quality Fabrication Limited on December 31, 2017: Assume the total effective tax rate on all items is 25%. Instructions: Prepare a multiple-step income statement showing expenses by function. Assume

> Two accountants, Yuan Tsui and Sergio Aragon, are arguing about the merits of presenting an income statement in the multiple-step versus the single-step format. The discussion involves the following 2017 information for P. Bride Company (in thousands):

> The financial records of Geneva Inc. were destroyed by fi re at the end of 2017. Fortunately, the controller had kept the following statistical data related to the income statement: 1. The beginning merchandise inventory was $84,000 and it decreased by 2

> The following is information for Gottlieb Corp. for the year ended December 31, 2017: The effective tax rate is 25% on all items. Gottlieb prepares financial statements in accordance with IFRS. The FV-OCI investments trade on the stock exchange. Gains/

> Reach Out Card Company Limited reported the following for 2017: net sales revenue, $1.2 million; cost of goods sold, $750,000; selling and administrative expenses, $320,000; gain on disposal of building, $250,000; and unrealized gain-OCI (related to FV-O

> (a) Identify three common forms of business organizations. Briefly outline the pros and cons of setting up a company using each form of organization. (b) Identify why accounting professionals use LLPs and PCs.

> The conceptual framework identifies the fundamental and enhancing qualitative characteristics that make accounting information useful. Instructions Answer the following questions related to these qualitative characteristics. (a) Which quality of financia

> The conceptual framework has been created to make accounting information useful. Instructions: Indicate whether the following statements about the conceptual framework are true or false. If false, provide a brief explanation supporting your position. (a

> Alex Roddick is the new owner of Ace Computer Services. At the end of August 2017, his first month of ownership, Roddick is trying to prepare monthly financial statements. Below is some information related to unrecorded expenses that the business incurre

> Structured entities or variable interest entities (VIEs) have long been on the agendas of the financial accounting standard setting communities. Recently, however, standards have been updated to deal with the issues presented by such entities. Instructi

> Barnett Inc. purchased computer equipment on March 1, 2017, for $31,000. The computer equipment has a useful life of fi ve years and a residual value of $1,000. Barnett uses a double declining-balance method of depreciation for this type of capital asset

> During 2017, Laiken Limited sold its only Class 3 asset. At the time of sale, the balance of the un depreciated capital cost for this class was $37,450. The asset originally cost $129,500. Instructions: (a) Calculate recaptured CCA, capital gains, and t

> On August 1, 2017, Iroko Corporation purchased a new machine for its assembly process. The cost of this machine was $136,400. The company estimated that the machine would have a trade-in value of $14,200 at the end of its useful life. Its useful life was