Question: The following are all changes in the

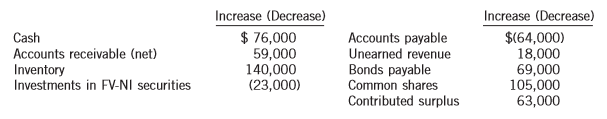

The following are all changes in the account balances of Chili Lime Ltd. during the current year, except for Retained Earnings:

Instructions:

Calculate the net income for the current year, assuming that there were no entries in the Retained Earnings account except for net income and a dividend declaration of $16,000, which was paid in the current year.

Transcribed Image Text:

Increase (Decrease) Increase (Decrease) $ 76,000 59,000 140,000 (23,000) Cash Accounts receivable (net) Accounts payable Unearned revenue Bonds payable Common shares Contributed surplus $(64,000) 18,000 69,000 105,000 63,000 Inventory Investments in FV-NI securities

> At the end of 2017, Perez Corporation has accounts receivable of $2.5 million and an allowance for doubtful accounts of $120,000. On January 16, 2018, Perez determined that its $20,000 receivable from Morganfield Ltd. will not be collected, and managemen

> Information on Janut Corp., which reports under ASPE, follows: July 1 Janut Corp. sold to Harding Ltd. merchandise having a sales price of $9,000, terms 3/10, n/60. Janut records its sales and receivables net. 3 Harding Ltd. returned defective merchandis

> Access the financial statements of Magna International Inc. for the company’s year ended December 31, 2014. These are available at www. sedar.com or the company’s website. Review the information that is provided and answer the following questions about t

> Assume that Lee Inc. has the following accounts at the end of the current year: 1. Common Shares 2. Raw Materials Inventory 3. FV-OCI Investments 4. Unearned Rent Revenue 5. Work-in-Process Inventory 6. Intangible Assets—Copyrights 7. Buildings 8.

> The bookkeeper for Garfield Corp. has prepared the following statement of financial position as at July 31, 2017: The following additional information is provided: 1. Cash includes $1,200 in a petty cash fund and $12,000 in a bond sinking fund. 2. The

> Bruno Corp. has decided to expand its operations. The bookkeeper recently completed the following statement of financial position in order to obtain additional funds for expansion: Instructions: (a) Prepare a revised statement of financial position usi

> LeBlanc Inc. shows a balance of $519,289 in the Accounts Receivable account on December 31, 2017. The balance consists of the following: Installment accounts due in 2018……………………………………………..$ 91,000 Installment accounts due after 2018……………………………………………80,0

> Selected accounts follow for Kings Inc., as reported in the work sheet at the end of May 2017: Instructions: Extend the amounts reported in the adjusted trial balance to the appropriate columns in the work sheet. Do not total individual columns. Ad

> Eli Corp. has just received its August 31, 2017 bank statement, which is summarized as follows: The general ledger Cash account contained the following entries for the month of August: Deposits in transit at August 31 are $3,800, and cheques outstand

> The following independent situations require professional judgement for determining when to recognize revenue from the transactions. 1. Air Yukon sells you an advance purchase airline ticket in September for your flight home at Christmas. 2. Better Buy L

> Kali Corp. established a petty cash fund early in 2017 to increase the efficiency of accounting for small cash transactions and to improve control over many of the small expenditures it makes. The company decided to set up the imprest fund at $500 and a

> Use the information in E5-17 for Dropafix Inc. Instructions: (a) Calculate the current and acid test ratios for 2016 and 2017. (b) Calculate Dropafix’s current cash debt coverage ratio for 2017. (c) Calculate Dropafix’

> Lute Retail Ltd. follows ASPE. It transfers $355,000 of its accounts receivable to an independent trust in a securitization transaction on July 11, 2017, receiving 96% of the receivables balance as proceeds. Lute will continue to manage the customer acco

> Financial statements can be a valuable tool for many parties interested in a company’s performance. Consider a public company in Alberta that drills oil and sells it to refineries in the United States. The company prepares its financial statements using

> The classifications on Chesapeake Limited’s statement of financial position are as follows: 1. Current assets 2. Long-term investments 3. Property, plant, and equipment 4. Intangible assets 5. Other assets 6. Current liabilities 7. Non-current liab

> Chessman Corporation factors $600,000 of accounts receivable with Liquidity Financing, Inc. on a with recourse basis. Liquidity Financing will collect the receivables. The receivable records are transferred to Liquidity Financing on August 15, 2017. Liqu

> The trial balance before adjustment for Bassel Company shows the following balances. The following cases are independent: 1. To obtain cash, Bassel factors without recourse $20,000 of receivables with Anila Finance. The finance charge is 10% of the amo

> On April 1, 2017, Ibrahim Corporation assigns $400,000 of its accounts receivable to First National Bank as collateral for a $200,000 loan that is due July 1, 2017. The assignment agreement calls for Ibrahim to continue to collect the receivables. First

> By December 31, 2017, Clearing Corp. had performed a significant amount of environmental consulting services for Rank Ltd. Rank was short of cash, and Clearing agreed to accept a $200,000, non–interest-bearing note due December 31, 2019, as payment in fu

> On September 1, 2017, Myo Inc. sold goods to Khin Corporation, a new customer. Before shipping the goods, Myo’s credit and collections department conducted a procedural credit check and determined that Khin is a high-credit-risk customer. As a result, My

> Little Corp. was experiencing cash flow problems and was unable to pay its $105,000 account payable to Big Corp. when it fell due on September 30, 2017. Big agreed to substitute a one-year note for the open account. The following two options were present

> The current assets and current liabilities sections of the statement of financial position of Agincourt Corp. are as follows: The following errors have been discovered in the corporation’s accounting: 1. January 2018 cash disbursement

> Uddin Corp.’s statement of financial position at the end of 2016 included the following items: The following information is available for the 2017 fiscal year: 1. Net income was $391,000. 2. Equipment (cost of $20,000 and accumulated

> Selected accounts follow of Aramis Limited at December 31, 2017: The following additional information is available: 1. Inventory is valued at the lower of cost and net realizable value using FIFO. 2. Equipment is recorded at cost. Accumulated depreciat

> Hans Hoogervorst, Chair of the IASB, delivered a speech at the Korean Accounting Review International Symposium in Seoul, Korea, on March 31, 2015, entitled “Mind the Gap (Between non-GAAP and GAAP).” In this presentation, he spoke of issues related to t

> The controller for Fashion Co. is trying to determine the amount of cash to report on the December 31, 2017 statement of financial position. The following information is provided: 1. A commercial savings account with $600,000 and a commercial chequing ac

> Lujie Xie is the controller of Lincoln Corporation and is responsible for the preparation of the year-end financial statements on December 31, 2017. Lincoln prepares financial statements in accordance with ASPE. The following transactions occurred during

> The trial balance of Zhang Ltd. at December 31, 2017, follows: Instructions: (a) Prepare a classified statement of financial position as at December 31, 2017. Ignore income taxes. (b) Is there any situation where it would make more sense to have a stat

> Samson Corporation is preparing its December 31, 2017 statement of financial position. The following items may be reported as either current or long-term liabilities: 1. On December 15, 2017, Samson declared a cash dividend of $1.50 per common share to s

> Assume that Elrond Inc. decided to sell Demand TV Ltd., a subsidiary, on September 30, 2017. There is a formal plan to dispose of the business component, and the sale qualifies for discontinued operations treatment. Pertinent data on the operations of th

> Keith Nobrega is trying to determine the amount to set aside so that he will have enough money on hand in two years to overhaul the engine on his vintage used car. While there is some uncertainty about the cost of engine overhauls in two years, by conduc

> Corporation during the current year. 1. Ordinary operating maintenance on equipment was recorded as follows: Equipment……………………………………………..2,500 Accounts Payable…………………………………….2,500 2. Trimm received an advance on a custom order for merchandise that will

> Selected accounts for Winslow Inc. as at December 31, 2017, are as follows: Instructions: Prepare closing entries for Winslow Inc. on December 31, 2017. Inventory FV-NI Investments FV-OCI Investments Retained Earnings Dividends Accumulated Other $

> Use the information in E5-14 for Carmichael Industries. Instructions: (a) Calculate the current and acid test ratios for 2016 and 2017. (b) Calculate Carmichael’s current cash debt coverage ratio for 2017. (c) Based on the analyses in

> Use the information in E5-18 for Sensify Corporation. Instructions: (a) Calculate the current ratio and debt to total assets ratio as at December 31, 2016 and 2017. Calculate the free cash flow for December 31, 2017. (b) Based on the analysis in (a), co

> Rudolph Corp. is a subsidiary of Huntley Corp. and follows IFRS. The ethical accountant, working as Rudolph’s controller, believes that the yearly charge for doubtful accounts for Rudolph should be 2% of net credit sales. The president, nervous that the

> Echo Corp., a retail propane gas distributor, has increased its annual sales volume to a level that is three times greater than the annual sales of a dealer that it purchased in 2016 in order to begin operations. The board of directors of Echo Corp. rece

> The comparative statement of financial position of Sensify Corporation as at December 31, 2017, follows: Net income of $37,000 was reported and dividends of $13,000 were declared and paid in 2017. New equipment was purchased, and equipment with a carry

> The comparative statement of financial position of Dropafix Inc. as at June 30, 2017, and a statement of comprehensive income for the 2017 fiscal year follow: DROPAFIX INC. Statement of Comprehensive Income For the Year Ended June 30, 2017 Net sales&ac

> The statement of income of Kneale Transport Inc. for the year ended December 31, 2017, reported the following condensed information: Kneale’s statement of financial position included the following comparative data at December 31: Ad

> Eddie Zambrano Corporation, a private company, began operations on January 1, 2014. During its first three years of operations, Zambrano reported net income and declared dividends as follows: The following information is for 2017: Income before income

> A comparative statement of financial position for Carmichael Industries Inc. follows: Additional information: 1. Net income for the fiscal year ending December 31, 2017, was $129,000. 2. Cash dividends of $60,000 were declared and paid. Dividends paid

> It is February 2018 and Janix Corporation is preparing to issue fi nancial statements for the year ended December 31, 2017. To prepare fi nancial statements and related disclosures that are faithfully representative, Janix is reviewing the following even

> Several statement of financial position accounts of Green spoon Inc. follow: 1. FV-OCI Investments 2. Common Shares 3. Dividends Payable 4. Accumulated Depreciation—Equipment 5. Construction in Process (Warehouse) 6. Petty Cash 7. Interest Payable

> The following information was taken from the records of Biscay Inc. for the year 2017: The following additional information was also available: income tax applicable to income from continuing operations, $465,000; income tax recovery applicable to loss

> Income statement information for Flett Tire Repair Corporation for the year 2017 follows: The effective tax rate on all income is 25%, and Flett applies ASPE. Instructions: (a) Prepare a multiple-step income statement for 2017, showing expenses by fun

> The trial balance for Hanna Resort Limited on August 31 is as follows: Additional information: 1. The balance in Prepaid Insurance includes the cost of an insurance policy that will expire on September 30, 2017. 2. An inventory count on August 31 shows

> Write a short essay (one or two pages) describing the incurred loss model and the expected loss model of impairment. Summarize each model and compare the two models, indicating the potential benefits and drawbacks of each. Which model do you think provid

> Videohound Video Company, a sole proprietorship, had the following information for 2017: Instructions: Calculate the net income for 2017. $ 23,000 19,000 $101,000 20,000 Cash balance, January 1 Accounts receivable, January 1 Collections from custom

> On October 5, 2017, Diamond in the Rough Recruiting Group Inc.’s board of directors decided to dispose of the Blue Division. A formal plan was approved. Diamond derives approximately 75% of its income from its human resources management practice. The Blu

> A review of the accounts of Tucker and Wu Pan Accountants reflected the following transactions, which may or may not require adjustment for the year ended December 31, 2017. 1. The Prepaid Rent account shows a debit of $7,200 paid October 1, 2017, for a

> Bill Rosenberg recently opened his legal practice as a sole proprietorship. During the first month of operations, the following events and transactions occurred: Apr. 2 Invested $15,000 cash along with equipment valued at $10,000 in the business. 2 Hired

> Pike Corporation, a clothing retailer, had income from operations (before tax) of $375,000, and recorded the following before-tax gains/(losses) for the year ended December 31, 2017: Gain on sale of equipment……………………………………………..27,000 Unrealized (loss)/g

> Canviar Corp. maintains its financial records using the cash basis of accounting. As it would like to secure a long-term loan from its bank, the company asks you, as an independent CPA, to convert its cash basis income statement information to the accrua

> At December 31, 2017, Tres Hombres Corporation had the following shares outstanding: 10% cumulative preferred shares,……………………………107,500 shares outstanding ………………………………………….$10,750,000 Common shares, …………………………………………………4,000,000 shares outstanding ………………

> The shareholders’ equity section of Cadmium Corporation as at December 31, 2017, follows: Net income of $24 million for 2017 reflects a total effective tax rate of 25%. Included in the net income figure is a loss of $15 million (befor

> Rainy Day Umbrella Corporation had the following balances at December 31, 2016 (all amounts in thousands): preferred shares, $3,375; common shares, $8,903; contributed surplus, $3,744; retained earnings, $23,040; and accumulated other comprehensive incom

> Instructions: Gain access to the 2014 financial statements of Potash Corporation of Saskatchewan from the company’s website (www.potashcorp.com) or www.sedar.com. The company, also known as PotashCorp, indicates prior to Note 1 to the financial statement

> The following are selected ledger accounts of Holland Rose Corporation at December 31, 2017: Holland’s effective tax rate on all items is 25%. A physical inventory indicates that the ending inventory is $686,000. The number of common

> The following balances were taken from the books of Quality Fabrication Limited on December 31, 2017: Assume the total effective tax rate on all items is 25%. Instructions: Prepare a multiple-step income statement showing expenses by function. Assume

> Two accountants, Yuan Tsui and Sergio Aragon, are arguing about the merits of presenting an income statement in the multiple-step versus the single-step format. The discussion involves the following 2017 information for P. Bride Company (in thousands):

> The financial records of Geneva Inc. were destroyed by fi re at the end of 2017. Fortunately, the controller had kept the following statistical data related to the income statement: 1. The beginning merchandise inventory was $84,000 and it decreased by 2

> The following is information for Gottlieb Corp. for the year ended December 31, 2017: The effective tax rate is 25% on all items. Gottlieb prepares financial statements in accordance with IFRS. The FV-OCI investments trade on the stock exchange. Gains/

> Reach Out Card Company Limited reported the following for 2017: net sales revenue, $1.2 million; cost of goods sold, $750,000; selling and administrative expenses, $320,000; gain on disposal of building, $250,000; and unrealized gain-OCI (related to FV-O

> (a) Identify three common forms of business organizations. Briefly outline the pros and cons of setting up a company using each form of organization. (b) Identify why accounting professionals use LLPs and PCs.

> The conceptual framework identifies the fundamental and enhancing qualitative characteristics that make accounting information useful. Instructions Answer the following questions related to these qualitative characteristics. (a) Which quality of financia

> The conceptual framework has been created to make accounting information useful. Instructions: Indicate whether the following statements about the conceptual framework are true or false. If false, provide a brief explanation supporting your position. (a

> Alex Roddick is the new owner of Ace Computer Services. At the end of August 2017, his first month of ownership, Roddick is trying to prepare monthly financial statements. Below is some information related to unrecorded expenses that the business incurre

> Structured entities or variable interest entities (VIEs) have long been on the agendas of the financial accounting standard setting communities. Recently, however, standards have been updated to deal with the issues presented by such entities. Instructi

> Barnett Inc. purchased computer equipment on March 1, 2017, for $31,000. The computer equipment has a useful life of fi ve years and a residual value of $1,000. Barnett uses a double declining-balance method of depreciation for this type of capital asset

> During 2017, Laiken Limited sold its only Class 3 asset. At the time of sale, the balance of the un depreciated capital cost for this class was $37,450. The asset originally cost $129,500. Instructions: (a) Calculate recaptured CCA, capital gains, and t

> On August 1, 2017, Iroko Corporation purchased a new machine for its assembly process. The cost of this machine was $136,400. The company estimated that the machine would have a trade-in value of $14,200 at the end of its useful life. Its useful life was

> The 2017 annual report of Trocchi Inc. contains the following information (in thousands): Instructions: (a) Calculate the following ratios for Trocchi Inc. for 2017: 1. Asset turnover ratio 2. Rate of return on assets 3. Profit margin on sales (b) How

> On April 1, 2017, Lombardi Corp. was awarded $460,000 cash as compensation for the forced sale of its land and building, which were directly in the path of a new highway. The land and building cost $60,000 and $280,000, respectively, when they were acqui

> On December 31, 2016, Grey Inc. owns a machine with a carrying amount of $940,000. The original cost and accumulated depreciation for the machine on this date are as follows: Machine…………………………………………………………$1,300,000 Accumulated depreciation………………………………….

> Consider the following independent situations for Kwok Corporation. Kwok applies ASPE. Situation 1: Kwok purchased equipment in 2010 for $120,000 and estimated a $12,000 residual value at the end of the equipment’s 10-year useful life. At December 31, 20

> As the president of Niagara Wineries Corp., you are considering purchasing Grimsby Wine Accessories Limited, whose statement of financial position is summarized as follows: The current assets’ fair value is $80,000 higher than their c

> Onkar Corporation bought a machine on June 1, 2013, for $31,800, f.o.b. the place of manufacture. Freight costs were $300, and $500 was spent to install it. The machine’s useful life was estimated at 10 years, with a residual value of $1,900, while the m

> Net income figures for Belgian Ltd. are as follows: 2013—$75,000……………………………..2016—$87,000 2014—$53,000……………………………..2017—$69,000 2015—$84,000 Future income is expected to continue at the average amount of the past five years. The company’s identifiable

> Refer to the 2014 financial statements and accompanying notes of Royal Bank of Canada (RBC) that are found on the company’s website (www.royalbank.ca) or at www.sedar.com. Instructions: (a) What percentage of RBC’s total assets is held in investments (a

> Rotterdam Corporation’s pre-tax accounting income of $725,000 for the year 2017 included the following items: Amortization of identifiable intangibles…………………$147,000 Depreciation of building………………………………………….115,000 Loss from discontinued operations……………

> The following is net asset information for the Dhillon Division of Klaus, Inc.: The purpose of the Dhillon Division (also identified as a reporting unit or cash-generating unit) is to develop a nuclear-powered aircraft. If successful, travelling delays

> On July 1, 2017, Zoe Corporation purchased the net assets of Soorya Company by paying $415,000 cash and issuing a $50,000 note payable to Soorya Company. At July 1, 2017, the statement of financial position of Soorya Company was as follows: The recorde

> Fred Moss, owner of Medici Interiors Inc., is negotiating for the purchase of Athenian Galleries Ltd. The condensed statement of financial position of Athenian follows in an abbreviated form: Medici and Athenian agree that the land is undervalued by $4

> Refer to the information provided in E12-17, but now assume that Lighting Designs Corp. is a publicly accountable company. At December 31, 2017, the copyright’s value in use is $1,850,000 and its selling costs are $100,000. Instructions: (a) Prepare the

> The following information is for a copyright owned by Lighting Designs Corp., a private entity, at December 31, 2017. Lighting Designs Corp. applies ASPE. Cost……………………………………………………………………………..$4,300,000 Carrying amount……………………………………………………………..2,150,000 Ex

> Instructions: Repeat E12-13, but now assume that the licence was granted in perpetuity and has an indefinite life, and that Dayton prepares financial statements in accordance with ASPE. Data from E12-13: At the end of 2017, Dayton Corporation owns a li

> Instructions: Repeat E12-13, but now assume that the licence was granted in perpetuity and has an indefinite life. Data from E12-13: At the end of 2017, Dayton Corporation owns a licence with a remaining life of 10 years and a carrying amount of $530,0

> Instructions: Repeat E12-13, but now assume that Dayton prepares financial statements in accordance with ASPE, and that the recoverable amount under ASPE (undiscounted future cash flows) is calculated to be $500,000 at the end of 2018. Data from E12-13:

> At the end of 2017, Dayton Corporation owns a licence with a remaining life of 10 years and a carrying amount of $530,000. Dayton expects undiscounted future cash flows from this licence to total $535,000. The licence’s fair value is $425,000 and disposa

> Refer to the annual financial statements of Brookfield Asset Management Inc. for its fiscal year ended December 31, 2014, found at the end of the book. Instructions: (a) Review Brookfield Asset Management Inc.’s balance sheet. Identify all financial inv

> Blue and White Town Taxi Incorporated applied for several taxi licences for its taxicab operations in the Town of Somerville and, on August 31, 2017, incurred costs of $12,500 in the application process. The outcome of applying for taxi licences in the t

> During 2017, Saskatchewan Enterprises Ltd., a private entity, incurred $4.7 million in costs to develop a new software product called Dover. Of this amount, $1.8 million was spent before establishing that the product was technologically and financially f

> Towers Inc. (TI) is a leader in delivering communications technology that powers global commerce and secures the world’s most critical information. Its shares trade on the Canadian and U.S. national stock exchanges. The company had been experiencing unpr

> Iskra Vremec and Colin McFee are experienced scuba divers who have spent many years in the salvage business. About a year ago, they decided to start their own company to recover damaged and sunken vessels and their cargoes off the east coast of Canada. T

> Shannonrock Racing Inc. (SR) is a promoter and sponsor of motor-sport activities. It is privately owned. The owner is looking to expand and has approached the local bank who has agreed to accept financial statements prepared in accordance with ASPE. The

> EMI Inc. is a public company that operates numerous movie theatres in Canada. Historically, it operated as a trust and its business model consisted of distributing all of its earnings to shareholders through dividends. As a result of tax changes two year

> Grappa Grapes Inc. (GGI) grows grapes and produces sparkling wines. The company is located in a very old area of town with easy access to fertile farmland that is excellent for growing grapes. It is owned by the Grappa family. The company has been in ope

> Fritz’s Furniture (FF) is a mid-sized owner-operated business that was started 25 years ago by Fred Fritz. The retail furniture business is cyclical, with business dropping off in times of economic downturn, as is the case currently. In order to encourag

> Standford Pharmaceuticals Inc. (SP) researches, develops, and produces over-the-counter drugs. During the year, it acquired 100% of the net assets of Jenstar Drugs Limited (JDL) for $200 million. The fair value of the identifiable assets at the time of t