Question: The Elder Clinic, a not-for-profit

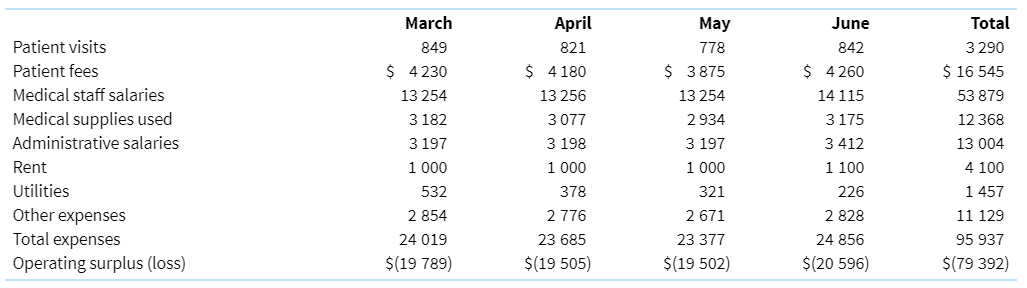

The Elder Clinic, a not-for-profit entity, provides limited medical services to low-income elderly patients. The manager’s summary report for the past four months of operations is reproduced here.

The clinic receives an operating subsidy from the state government, but unfortunately, the operating loss incurred through June ($79Â 392) is larger than anticipated. Part of the problem is the salary increase that went into effect in June, which had been overlooked when the budget was submitted to the state government last year. To compound the problem, the cold winter months traditionally bring with them an increase in cold weather related health problems. Thus, the clinic is likely to experience an increase in patient visits during July.

The accountant made the following assumptions in developing the cost function:

Salaries are fixed, and June values are used.

Medical supplies vary with patient visits.

Rent and utilities are fixed, and last period’s costs are used.

Other expenses are mixed and using regression, fixed cost is $702 and variable cost is $2.53 per patient visit.

Clinic management is considering an increase in patient fees to reduce losses.

Required

(a) Develop a cost function for this data (refer to chapter 2). Use the cost function you developed to solve for the average patient fee necessary to break even, assuming there are 940 patient visits. Compare this new fee with the average patient fee charged during March through June.

(b) Suppose the clinic raises its patient fees to break even. What problems do you see from the elderly patients’ perspective if the fee is raised?

(c) In this setting, would an increase in fees be likely to affect patient volume? What problems do you see from the clinic’s perspective if the fee is raised?

(d) Other than raising the fee, what ideas might the clinic consider to balance the budget?

Transcribed Image Text:

Patient visits Patient fees Medical staff salaries Medical supplies used Administrative salaries Rent Utilities Other expenses Total expenses Operating surplus (loss) March 849 Ś 4230 13 254 3 182 3 197 1 000 532 2 854 24 019 $(19 789) April 821 $ 4180 13 256 3077 3 198 1 000 378 2 776 23 685 $(19 505) May 778 $ 3875 13 254 2934 3 197 1 000 321 2 671 23 377 $(19 502) June 842 $ 4260 14 115 3175 3 412 1 100 226 2 828 24 856 $(20 596) Total 3 290 $ 16 545 53 879 12 368 13 004 4 100 1 457 11 129 95 937 $(79 392)

> You are about to start a coffee shop business. What do you understand by ‘cost behaviour’? Explain how your accountants could help you in building an understanding of cost behaviour. Identify the likely key costs and classify each as fixed or variable.

> At two levels of activity within the relevant range, average costs are $192 and $188 respectively. Assuming the cost function is linear, what can be said about the existence of fixed and variable costs?

> You have been asked to provide the managing director with an approximate cost function for the entity’s activities, and it must be done by this afternoon. Some members of the board of directors want to understand why performance varies so much across sto

> A motor vehicle assembly plant closes every August to retool for the next year’s model. How should August’s cost data be used in estimating the overhead cost function?

> ‘As volume increases, total cost increases and per-unit cost decreases.’ What type of linear cost function does this describe? Draw a simple graph of this type of cost function.

> The trend line developed using regression analysis provides a more accurate representation of a mixed cost function than the two-point or high-low methods. Explain why.

> Bridges and Roads is an entity engaged in road construction. Some selected items from its chart of accounts are listed below. Required For each account, indicate whether the account represents a fixed, variable or mixed cost for the operation of road co

> Community Children’s Hospital can invest in one of two different projects. The first project is to purchase and operate a hotel that is located two blocks from the hospital. The CEO of the hospital has no experience in operating a hotel, but the hospital

> Suppose you are responsible for ordering a replacement for your office photocopy machine. Part of your job is to decide whether to buy or lease the machine. Required (a) Describe something that could be considered relevant information in this decision a

> (a) With reference to Merino Designs in self-study problem 2, demonstrate the meaning of the structural cost drivers’ scope, technology and experience. (b) Classify Merino Designs’ likely strategy as low cost or produc

> With reference to Merino Designs in self-study problem 2, differentiate between an industry value chain and an organisational value chain.

> Initially the Techtra entities bid for any type of electronic assembly work that became available (mostly subcontract work from other firms experiencing temporary capacity problems). But over the years the firm narrowed its focus. It now produces essenti

> Tiffany Campbell is the cost accountant in a small manufacturing company, Calculator Components (CC). CC produces components for one of the large calculator manufacturers. Its strategy is to provide highly reliable components at the lowest possible price

> Rausher Industries began a new product line this year. Management wants a cost report for the current year and a budget for next year. The product requires processing in two departments. Materials are added at the beginning of the process in department 1

> The accountant at Cellular Advantage needs to close the books at the end of January using the following information. Direct materials are added at the start of production. Conversion costs are incurred evenly throughout production. Inspection occurs when

> Toddler Toys produces toy construction vehicles for young children. Plastic pieces are moulded in the plastics department. These pieces are transferred to the assembly department, where direct materials are added after some assembly has been done. For ex

> The Rally Company operates under a process cost system using the weighted average method. All direct materials are added at the beginning of production in the department, and conversion costs are incurred evenly throughout production. Inspection occurs w

> The new cost analyst in your accounting department just received a computer-generated report that contains the results of a simple regression analysis. The analyst was estimating the costs of the marketing department using units sold as the cost driver.

> Empire Forging produces small plumbing valves. January data for its valve-making process follow. Beginning WIP was 60 000 units. Good units completed and transferred out during the current period totalled 420 000. Ending WIP was 68 000 units. Inspection

> Red Dog Products manufactures toys for dogs and cats. The most popular toy is a small ball that dispenses tiny treats and is placed within a larger ball. To get the treats, dogs must roll the balls around until the treats fall out. These balls are mass p

> Use the information for Kim Mills from Problem 8.25. Now, assume that inspection occurs when units are 40 per cent complete. Required (a) Calculate total spoilage for conversion cost calculations. (b) If normal spoilage is 1800 units instead of 3600, wh

> Kim Mills produces material for knitwear. The knit cloth is sold by the bolt. November data for its milling process follow. Beginning WIP was 20 000 units. Good units completed and transferred out during current period totalled 90 000. Ending WIP was 17

> Refer to the information provided in Problem 8.23 Required (a) Prepare a process cost report using the FIFO method. (b) Explain how a standard cost report would differ from the FIFO report you just produced. (c) Under what circumstances would a standard

> Victoria’s Closet mass-produces luxurious sleepwear for women. Consider the following data for the flannel nightgown department for the month of January. All direct materials are added at the beginning of production in the department, a

> Benton Industries began the year with 15 000 units in department 3 beginning WIP. These units were one-third complete, with $40 470 transferred-in cost for prior departments’ work and $14 322 for department 3 conversion costs. During the year, 93 000 add

> Fran Markus is in the cost accounting group at Boats Galore, a large manufacturing company that produces customised boats and yachts. The company sometimes experiences quality problems with its fibreglass raw material, causing flawed areas in boat hulls.

> 'Our costs are out of control, our accounting system is screwed up, or both!' screamed the sales manager. 'We are simply non-competitive on a great many of the jobs we bid on. Just last week we lost a customer when a competitor underbid us by 25 per cent

> Flexible Manufacturers produces small batches of customised products. The accounting system is set up to allocate plant overhead to each job using the following production cost pools and overhead allocation rates Actual resources used for job 75: The

> Spencer and Church is a CPA entity engaged in local practice. Some selected items from its chart of accounts are listed below. Required For each account, indicate whether the account represents a fixed, variable or mixed cost for the operations of the l

> The Eastern Seaboard Company uses an estimated rate for allocating factory overhead to job orders based on machine hours for the machining department and on a direct labour cost basis for the finishing department. The company budgeted the following for l

> You are helping a friend, Jonah, set up a new accounting system for a small start-up construction company. He specialises in custom, energy efficient homes that are built on a cost-plus basis. Cost-plus means that his customers pay a fixed percentage abo

> Dapper Dan Draperies manufactures and installs custom-ordered draperies. Required (a) For all drapes, occasionally the sewing equipment malfunctions and the drape must be reworked. Explain how to account for the cost of rework when it is needed. (b) Exp

> A family member asked you to review the accounting system used for Hanna’s, a custom stained glass manufacturing business. The owner currently uses a software package to keep track of her bank account, but she does not produce financial statements. The o

> Required (a) (i) Explain how the budgeting process helps top managers articulate decisions about the use of resources. (ii) Explain how a budget identifies the resources available to individual departments within an organisation. (b) (i) Explain why th

> You are the accountant for Wok and Egg Roll Express. Following are assumptions about sales for the coming month. Wok offers three basic meals: noodle bowls, egg rolls, and rice bowls. Each meal can be prepared with several different meats or with vegetab

> The accountant at Fighting Kites has always prepared a budget that is calculated using only one estimated volume of sales. He has asked you to help him set up a spreadsheet that can be used for sensitivity analysis in the budgeting process. This year it

> Central Coast Public Clinic is a free outpatient clinic for public assistance patients. Among other services, the clinic provides visiting nurses for elderly patients in their homes. A homemaker who cleans and performs other household tasks accompanies e

> Patricia sighed and briefly closed her eyes. She was frustrated with the reconciliation she was working on. She was sure that she was missing something, but she could not determine what it was. And she felt the clock ticking. Patricia knew that the time

> The Red Bean Company processes and distributes beans. The beans are packed in 500 gram-plastic bags and sold to grocery chains for $0.50 each in boxes of 100 bags. During March the entity anticipates selling 16Â 000 boxes (sales in February we

> Yummy Yoghurt sells yoghurt cones in a variety of natural flavours. Data for a recent month follow: (a) Categorise each cost as fixed or variable. (b) Create a cost function. Revenue Cost of ingredients Rent Store attendant salary Profit $4500 1000

> Point Piper prepares monthly cash budgets. Provided below is a set of relevant data extracted from existing reports, and the sub-budgets for the two months of September and October. All sales are on credit. Collections from debtors normally have the fo

> The Fairyland Children’s Centre is a community-based, not-for-profit childcare service. A committee of management oversees its operations, with the elected members being parents of children attending the centre. The centre is licensed t

> Refer to the Paige’s Fashion House case in self-study problem 1. Paige ensures that members of her staff regularly attend international fashion shows (for design ideas) as well as become involved in Australian fashion shows. While these

> The Dancing Goat is a small coffee operation with ten cafés located around Melbourne. Each has a manager and up to five full-time employees to cover the 7.30 am to 4.30 pm, Monday to Saturday opening hours. Logan, the owner, employs a total

> Green Building Group specialises in a range of construction services including design services, shop and office fiitouts, and recently developed environmental consulting services for architects and local government. Summarised statement of profit or loss

> ‘I’m really not sure our information systems are as well placed as they could be to help us drive our performance. The industry data and my own observations suggest we need to do better in this regard. I really want to be ready when the market and the ec

> Cowmilka is a dairy products producer. Its logistics cost centre has 65 employees and a fleet of 25 milk tankers. It is a cross-functional cost centre with administrative staff (customer service and order processors), mechanics and tanker drivers. Tanker

> Toddler Toy Company sells baby dolls, teddy bears, and toy cars. The managers established a preliminary budget using the following assumptions. They would now like to evaluate the sensitivity of budgeted results to different sets of assumptions. Requir

> Trang Nguyen owns Trang’s Stained Glass in Sydney. The business produces and sells three different types of stained glass windows: small, medium, and large. Trang has two full-time employees who work regular schedules to cut glass and assemble the window

> The following is the description of a cost: total fixed costs are $50 000 per month and the variable cost per unit is $10 when production is under 1000 units. The variable cost drops to $9 per unit after the first 1000 units are produced. Required (a) W

> Jasmine Krishnan has been taking entrepreneurship courses as part of her business degree. She developed a plan to start a travel agency specialising in semester break trips for students. She learned how to develop CVP analysis in her cost accounting clas

> Joe Davies is thinking about starting a company to produce carved wooden clocks. He loves making the clocks. He sees it as an opportunity to be his own boss, making a living doing what he likes best. Joe paid $300 for the plans for the first clock, and h

> Ersatz manufactures a single product. The following income statement shows two different levels of activity, which are assumed to be within Ersatz’s relevant range. You may want to use a spreadsheet to perform calculations. Required (

> A neighbour asked for your help preparing a grant for a not-for-profit after-school art program that would benefit primary school children in the neighbourhood. He wants to charge low fees for most children, but also offer some scholarships for low-incom

> Dreamtime produces two products: regular boomerangs and premium boomerangs. Last month 1200 units of regular and 2400 units of premium were produced and sold. Average prices and costs per unit for the month are displayed here. Product line fixed costs

> Francesca would like to lease a coffee cart in Melbourne. The lease is $800 per month and a city license to sell food and beverages costs $20 per month. The lessor of the stand has shown Francesca records indicating that gross revenues average $32 per ho

> Oysters Away picks, shucks and packs oysters and then sells them wholesale to fine restaurants across the state. The income statement for last year follows: Pickers, shuckers and packers are employed on an hourly basis and can be laid off whenever nece

> The following information for Pet Palace, a large retail store that sells pet-related merchandise, was recorded for the first quarter. The store tracks merchandise according to product type. The category ‘Other’ includ

> In recent years, slow response times and frequent repairs have plagued Jetson Engineering’s computer system. The cause was a substantial increase in computer-aided design work that pushed the system beyond its intended capacity. Bob Wilson, the productio

> The Gleason Company, a division of a large international company, has prepared estimated costs for next year that can be traced to each department as follows. Management would like to know the estimated total allocated product cost per unit. These cost

> Suppose that the following are activities conducted by Microsoft Corporation. A. Comparing the timeliness of development steps of a new release of Windows with the timeline that was laid out to guide development. B. Developing a timeline for the release

> Danish Hospital recently installed a RAP Scanner, which is a diagnostic tool used both in suspected cancer cases and for detecting certain birth defects while the foetus is still in the womb. The scanner is leased for $5000 per month, and a full-time ope

> In comprehensive example 6 (Middletown Children’s Clinic), we did not perform direct or step-down methods for the dual-rate costs. Following are the allocation bases for these costs. The support cost data are in comprehensive example 6.

> Space Products manufactures commercial and military satellites. Under its government contracts, the company is permitted to allocate administrative and other costs to its military division. These costs are then reimbursed by the government department. Go

> You are an accountant for the Department of Defence. The government is considering a change of rules for the allocation of research and development costs. The government is asking contractors to submit a list of potential cost pools and allocation bases

> Your brother is a physician and has decided to start a home health care agency. The government will reimburse treatment costs for about half of the patients under a new government-sponsored health insurance program for low-income residents. Your brother

> Categorisation of support costs Suppose a charitable organisation called Food on Wheels provides meals for low-income individuals who are unable to leave their homes. To support its services, it solicits contributions from individuals and businesses. Fo

> Prime Personal Trainers is a personal training service in Bankstown for people who want to work out at home. Prime offers two different types of services: Setup and Continuous Improvement. Setup services consist of several home visits by a personal train

> Refer to question 3.41 above. Required (a) Draw a diagram of the costing system currently used by Hawk and Eagle Co. (b) Draw a diagram to show the proposed changes to the costing system under each of the three methods outlined. (c) Briefly comment on

> Hawk and Eagle Co., a law firm, had the following costs last year: The following costs were included in overhead: The firm recently improved its ability to document and trace costs to individual cases. Revised bookkeeping procedures now allow the fir

> Vines Company is a manufacturer of women’s and men’s swimsuits. The company uses a dual-rate system to allocate support costs. Last year’s support departments’ fixed and variable cos

> Differentiate between the management accounting function and the management accountant.

> Software Solutions is a family-owned business that has been in operation for more than 15 years. The board of directors is comprised of mainly family members, plus a few professionals such as an accountant and lawyer. Regina is a staff accountant who has

> Refer to the data and requirements of problem 2.23. Required (a) Perform multiple regression using all three cost drivers. Compare the adjusted R-squares and cost functions for the multiple regression with the results of simple regressions for each pote

> Laura Mills is the controller of Peer Jets International, a manufacturer of small corporate jets. She has undertaken a project to study the behaviour of overhead cost. She has assembled factory overhead data for the last 30 months from the company’s manu

> Polar Bear Ski Wear is a shop that sells skiwear at a ski resort. Its cost accountant developed the following scatter plot for the cost of electricity for lights, heating and cooling against retail sales revenue. Required (a) In a business such as reta

> The Leyland Hospital Café has been reporting losses in past months. In July, for example, the loss was $5000. The café purchases prepared food directly from Hospital Food Services. This charge varies proportionately with the n

> Susan looked at her long-distance telephone bill with dismay. After leaving her job last year to become a self-employed consultant, her long-distance charges had grown considerably. She had not changed long-distance plans for years, partly because she ha

> The following scatter plot and simple regression results used revenue as a potential cost driver for research and development costs. Required (a) Discuss whether the scatter plot suggests that revenue is a cost driver for research and development cost

> Following are sales and administrative cost data for Big Jack Burgers for four months: Administrative cost is a mixed cost, and sales is a potential cost driver. Required (a) Using the high-low method, create a cost function for administrative costs.

> Mernda Health Care Centre recently began to offer day surgery procedures. The Centre was not experienced in the costing of such services and, as a temporary measure, the subsidised patientday charge was set at $100. This charge was similar to other provi

> Wentworth Ltd sold 100 000 1 litre bottles of mineral water last year at $4 per unit and made a profit of $50 000. This year the costs for Wentworth Ltd remained the same, it sold 120 000 units at the same price, and made a profit of $80 000. Required (

> Classify the following reports as internal or external. (a) Operating budget (b) Credit reports (c) Financial statements (d) Capital budget (e) Tax returns (f) Analysis of product mix

> Smeyer Industries is a large entity with more than 40 departments, each employing 35 to 100 people. Recent experience suggests that the cost function used to estimate overhead in department IP-14 is no longer appropriate. The current function was develop

> Suppose you have the responsibility of creating a cost function for the costs of an internet service provider’s help line. Required (a) What is the cost object? Identify where you might obtain information about past costs for the cost object. (b) Identi

> The Elder Clinic, a not-for-profit entity, provides limited medical services to low-income elderly patients. The manager’s summary report for the past four months of operations is reproduced here. The clinic receives an operating sub

> Suppose we need to predict the cost of maintenance for Brush Valley High School for the upcoming school year. From the school district records we gather weekly data about costs and volumes for two potential cost drivers: labour hours used in the maintena

> The Woolworths Group has a goal of having customers put the company first across all their brands. To achieve this the Group has identified five priorities. 1. Building a customer and store-led culture and team. 2. Generating sustainable sales momentum i

> Traditionally, government organisations have tended to operate in silos, focusing on their own objectives and managing and protecting their own budgets. Recently, however, faced with seemingly intractable economic, social and environmental problems, many

> Using figure 1.5 as an example, develop an internal value chain for an airline such as Virgin Australia. Figure 1.5: FIGURE 1.5 Sample organisational value chain for a winery Primary activities Research and development • wine varieties • production

> Australian fashion designer Sean Ashby commenced his men’s swimwear and clothing business aussieBum in 2001. A keen swimmer and surfer, he was unable to find a good pair of men’s cossies and used his life savings of $20 000 to make a series of prototypes

> Frank owns a caravan and loves to visit national parks with his family. However, the family only takes two one-week trips in the caravan each year. Frank’s wife would rather stay in motels than the caravan. She presented him with the fo

> Janet Baker is deciding where to live during her second year at university. During her first year, she lived in the university residence college. Recently, her friend Rachel asked her to share an off-campus flat for the upcoming school year. Janet likes

> Some activities add value to an organisation, while others do not. Required Determine whether each of the following activities is likely to be value-added or non-value-added, and explain your choice. (a) Inspection activities (b) Moving materials to wor

> Explain the value chain and list ways that value chain analysis benefits organisations.

> The Steelcase Workplace Index studied the types of work-related activities that Americans did while on vacation in the summer. Among other things, 40% read work-related material. Thirty-four percent checked in with the boss. Respondents to the study were

> A telephone survey conducted by the Maritz Marketing Research company found that 43% of Americans expect to save more money next year than they saved last year. Forty-five percent of those surveyed plan to reduce debt next year. Of those who expect to sa

> A few years ago, a survey commissioned by The World Almanac and Maturity News service reported that 51% of the respondents did not believe the Social Security system will be secure in 20 years. Of the respondents who were age 45 or older, 70% believed th

> In a certain city, 30% of the families have a MasterCard, 20% have an American Express card, and 25% have a Visa card. Eight percent of the families have both a MasterCard and an American Express card. Twelve percent have both a Visa card and a MasterCar

> An Adweek Media/Harris Poll revealed that 44% of U.S. adults in the 18–34 years’ category think that “Made in America” ads boost sales. A different Harris Interactive poll showed that 78% of U.S. adults in the 18–34 years’ category use social media onlin