Question: The following are the transactions relating to

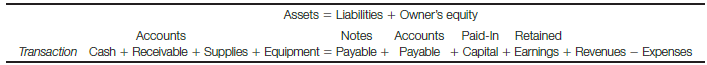

The following are the transactions relating to the formation of Cardinal Mowing Services, Inc., and its first month of operations. Prepare an answer sheet with the columns shown. Record each transaction in the appropriate columns of your answer sheet. Show the amounts involved and indicate how each account is affected (+ or -). After all transactions have been recorded, calculate the total assets, liabilities, and owners’ equity at the end of the month and calculate the amount of net income for the month.

a. The firm was organized and the owners invested cash of $600.

b. The company borrowed $900 from a relative of the owners; a short-term note was signed.

c. Two lawn mowers costing $480 each and a trimmer costing $130 were purchased for cash. The original list price of each mower was $610, but a discount was received because the seller was having a sale.

d. Gasoline, oil, and several packages of trash bags were purchased for cash of $90.

e. Advertising flyers announcing the formation of the business and a newspaper ad were purchased. The cost of these items, $170, will be paid in 30 days.

f. During the first two weeks of operations, 47 lawns were mowed. The total revenue for this work was $705; $465 was collected in cash and the balance will be received within 30 days.

g. Employees were paid $420 for their work during the first two weeks.

h. Additional gasoline, oil, and trash bags costing $110 were purchased for cash.

i. In the last two weeks of the first month, revenues totaled $920, of which $375 was collected.

j. Employee wages for the last two weeks totaled $510; these will be paid during the first week of the next month.

k. It was determined that at the end of the month the cost of the gasoline, oil, and trash bags still on hand was $30.

l. Customers paid a total of $150 due from mowing services provided during the first two weeks. The revenue for these services was recognized in transaction f.

After you have completed parts a through l in Exercise 4.2, prepare an income statement for Cardinal Mowing Services, Inc., for the month presented and a balance sheet at the end of the month using the captions shown on the answer sheet.

Transcribed Image Text:

Assets = Liabilities + Owner's equity Accounts Notes Accounts Paid-In Retained Transaction Cash + Receivable + Supplies + Equipment = Payable + Payable + Capital + Earnings + Revenues Еxpenses

> Please refer to Case 4.26 on pages 144–145 for the financial statement data needed for the analysis of this case. You should also review the solution to Case 4.26, provided by your instructor, before attempting to complete this case.) Y

> Answer the following questions using data from the Intel Corporation annual report in the appendix: Required: a. Find the discussion of depreciation methods used by Intel on page 695. Explain why the particular method is used for the purpose described.

> At the beginning of the current fiscal year, the balance sheet for Davis Co. showed liabilities of $320,000. During the year liabilities decreased by $18,000, assets increased by $65,000, and paid in capital increased from $30,000 to $192,000. Dividends

> The inventory records of Kuffel Co. reflected the following information for the year ended December 31, 2010: Required: a. Assume that Kuffel Co. uses a periodic inventory system. Calculate cost of goods sold and ending inventory under FIFO and LIFO. b

> The following data are available for Sellco for the fiscal year ended on January 31, 2011: Sales….. . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . ……… . 1,600 units Beginning inventory . . . . . . . . . .. . . . . . . . . . . 500 units

> Mower- Blower Sales Co. started business on January 20, 2010. Products sold were snow blowers and lawn mowers. Each product sold for $350. Purchases during 2010 were as follows: The December 31, 2010, inventory included 10 blowers and 25 mowers. Assume

> A portion of the current assets section of the December 31, 2010, balance sheet for Gibbs Co. is presented here: The company’s accounting records revealed the following information for the year ended December 31, 2011: Sales (all on

> Med Tech, Inc. manufactures and sells diagnostic equipment used in the medical profession. Its job costing system was designed using an activity-based costing approach. Direct materials and direct labor costs are accumulated separately, along with inform

> A portion of the current assets section of the December 31, 2011, balance sheet for Carr Co. is presented here: The company’s accounting records revealed the following information for the year ended December 31, 2011: Sales (all on a

> The following is a portion of the current asset section of the balance sheets of HiROE Co., at December 31, 2011 and 2010: Required: a. Describe how the allowance amount at December 31, 2011, was most likely determined. b. If bad debts expense for 2011

> The following is a portion of the current assets section of the balance sheets of Avanti’s, Inc., at December 31, 2011 and 2010: Required: a. If $11,800 of accounts receivable were written off during 2011, what was the amount of bad d

> Branson Co. received its bank statement for the month ending May 31, 2010, and reconciled the statement balance to the May 31, 2010, balance in the Cash account. The reconciled balance was determined to be $18,600. The reconciliation recognized the follo

> Beckett Co. received its bank statement for the month ending June 30, 2010, and reconciled the statement balance to the June 30, 2010, balance in the Cash account. The reconciled balance was determined to be $4,800. The reconciliation recognized the foll

> a. If the beginning balance of the Inventory account and the cost of items purchased or made during the period are correct, but an error resulted in overstating the firm’s ending inventory balance by $5,000, how would the firm’s cost of goods sold be aff

> At the beginning of its current fiscal year, Willie Corp.’s balance sheet showed assets of $12,400 and liabilities of $7,000. During the year, liabilities decreased by $1,200. Net income for the year was $3,000, and net assets at the en

> a. Use the horizontal model or write the journal entry to record the payment of a one-year insurance premium of $3,000 on March 1. b. Use the horizontal model or write the adjusting entry that will be made at the end of every month to show the amount of

> Natco, Inc., uses the FIFO inventory costflow assumption. In a year of rising costs and prices, the firm reported net income of $480,000 and average assets of $3,000,000. If Natco had used the LIFO cost-flow assumption in the same year, its cost of goods

> Proponents of the LIFO inventory cost-flow assumption argue that this costing method is superior to the alternatives because it results in better matching of revenue and expense. Required: a. Explain why “better matching” occurs with LIFO. b. What is th

> Evans, Inc., had current liabilities at November 30 of $137,400. The firm’s current ratio at that date was 1.8. Required: a. Calculate the firm’s current assets and working capital at November 30. b. Assume that management paid $30,600 of accounts payab

> Moiton Co.’s assets include notes receivable from customers. During fiscal 2010, the amount of notes receivable averaged $46,250, and the interest rate of the notes averaged 6.4%. Required: a. Calculate the amount of interest income earned by Moiton Co.

> Agrico, Inc., accepted a 10-month, 13.8% (annual rate), $4,500 note from one of its customers on June 15; interest is payable with the principal at maturity. Required: a. Use the horizontal model or write the entry to record the interest earned by Agric

> a. Calculate the approximate annual rate of return on investment of the following cash discount terms: 1. 1/15, n30. 2. 2/10, n60. 3. 1/10, n90. b. Which of these terms, if any, is not likely to be a significant incentive to the customer to pay promptly?

> Annual credit sales of Nadak Co. total $340 million. The firm gives a 2% cash discount for payment within 10 days of the invoice date; 90% of Nadak’s accounts receivable are paid within the discount period. Required: a. What is the total amount of cash

> On January 1, 2010, the balance in Kubera Co.’s Allowance for Bad Debts account was $9,720. During the year, a total of $23,900 of delinquent accounts receivable was written off as bad debts. The balance in the Allowance for Bad Debts account at December

> On January 1, 2010, the balance in Tabor Co.’s Allowance for Bad Debts account was $13,400. During the first 11 months of the year, bad debts expense of $21,462 was recognized. The balance in the Allowance for Bad Debts account at November 30, 2010, was

> a. Show the reconciling items in a horizontal model or write the adjusting journal entry (or entries) that should be prepared to reflect the reconciling items of Exercise 5.2. b. What is the amount of cash to be included in the August 31 balance sheet fo

> Charlie and Mari belle Brown have owned and operated a retail furniture store for more than 30 years. They have employed an independent CPA during this time to prepare various sales tax, payroll tax, and income tax returns, as well as financial statement

> a. Show the reconciling items in a horizontal model or write the adjusting journal entry (or entries) that should be prepared to reflect the reconciling items of Exercise 5.1. b. What is the amount of cash to be included in the October 31 balance sheet f

> On November 1, 2010, Wenger Co. paid its landlord $25,200 in cash as an advance rent payment on its store location. The six-month lease period ends on April 30, 2011, at which time the contract may be renewed. Required: a. Use the horizontal model or wr

> The following table summarizes the beginning and ending inventories of Decatur Manufacturing, Inc., for the month of March: Feb. 28 Mar. 31 Raw materials . . . . . . . . . . . . . . . . . . . . . . . $ 53,600 $ 44,160 Work in process . . . . . . . . . .

> Set up a horizontal model in the following format: Required: a. Enter the beginning (December 29, 2007) and ending (December 27, 2008) account balances for Accounts Receivable, Inventories, and Accounts Payable. Find these amounts on the balance sheet

> Calco, Inc., rents its store location. Rent is $1,500 per month, payable quarterly in advance. On July 1, a check for $4,500 was issued to the landlord for the July–September quarter. Required: Use the horizontal model to show the effects on the financi

> On January 10, 2010, the first day of the spring semester, the cafeteria of The Defiance College purchased for cash enough paper napkins to last the entire 16-week semester. The total cost was $4,800. Required: Use the horizontal model to show the effe

> Selected information taken from the financial statements of Ford star Co. for the year ended December 31, 2010, follows: Net cash provided by operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 98,000 Cost of g

> Selected information taken from the financial statements of Verb eke Co. for the year ended December 31, 2010, follows: Gross profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . $412,00

> a. Based on your answers to Problem 4.17, prepare an income statement (ignoring income taxes) for Kissick Co.’s first year of operations and a balance sheet as of the end of the year. (Hint: You may find it helpful to prepare T-accounts for each account

> Use the horizontal model, or write the journal entry, for each of the following transactions that occurred during the first year of operations at Kissick Co. a. Issued 200,000 shares of $5-par-value common stock for $1,000,000 in cash. b. Borrowed $50

> Answer these questions that are related to the following Interest Payable T-account: a. What is the amount of the February 28 adjustment? b. What account would most likely have been credited for the amount of the February transactions? c. What account w

> Jennifer Rankine is an accountant for a local manufacturing company. Jennifer’s good friend, Mike Bortolotto, has been operating a retail sporting goods store for about a year. The store has been moderately successful, and Mike needs a bank loan to help

> Assume that Cater Co.’s accountant neglected to record the payroll expense accrual adjustment at the end of October. Required: a. Explain the effect of this omission on net income reported for October. b. Explain the effect of this omission on net incom

> Precision Numbers, Inc., manufactures pocket calculators. Costs incurred in making 25,000 calculators in April included $85,000 of fixed manufacturing overhead. The total absorption cost per calculator was $12.50. Required: a. Calculate the variable cos

> Proco had an account payable of $16,800 due to Shirmoo, Inc., one of its suppliers. The amount was due to be paid on January 31. Proco did not have enough cash on hand then to pay the amount due, so Proco’s treasurer called Shirmoo’s treasurer and agreed

> On April 1, 2010, Tabor Co. received a $6,000 note from a customer in settlement of a $6,000 account receivable from that customer. The note bore interest at the rate of 15% per annum, and the note plus interest was payable March 31, 2011. Required: Use

> During the month of April, Simpson Co. had cash receipts from customers of $170,000. Expenses totaled $156,000, and accrual basis net income was $42,000. There were no gains or losses during the month. Required: a. Calculate the revenues for Simpson Co.

> Enter the following column headings across the top of a sheet of paper: Enter the transaction / situation letter in the first column and show the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or o

> Prepare an answer sheet with the column headings shown after the following list of transactions. Record the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on the income statement by entering the a

> Prepare an answer sheet with the column headings shown after the following list of transactions. Record the effect, if any, of the transaction entry or adjusting entry on the appropriate balance sheet category or on the income statement by entering the a

> Write the journal entry (ies) for each of the transactions of Exercise 4.2. Exercise 4.2: The following are the transactions relating to the formation of Cardinal Mowing Services, Inc., and its first month of operations. Prepare an answer sheet with th

> Write the journal entry (ies) for each of the transactions of Exercise 4.1. Exercise 4.1: The transactions relating to the formation of Blue Co. Stores, Inc., and its first month of operations follow. Prepare an answer sheet with the columns shown. Rec

> Write a statement identifying the expectations you have for this course.

> Brent, Inc., manufactures wool sweaters. Costs incurred in making 55,000 sweaters in August included $330,000 of fixed manufacturing overhead. The total absorption cost per sweater was $38.60. Required: a. Calculate the variable cost per sweater. b. The

> The transactions relating to the formation of Blue Co. Stores, Inc., and its first month of operations follow. Prepare an answer sheet with the columns shown. Record each transaction in the appropriate columns of your answer sheet. Show the amounts invol

> This exercise provides practice in understanding the operation of T-accounts and transaction analysis. For each situation, you must solve for a missing amount. Use a T-account for the balance sheet account, show in a horizontal model, or prepare journal

> Gerrard Construction Co. is an excavation contractor. The following summarized data (in thousands) are taken from the December 31, 2010, financial statements: For the Year Ended December 31, 2010: Net revenues . . . . . . . . . . . . . . . . . . . . . .

> DeBauge Realtors, Inc., is a realty firm owned by Jeff and Kristi DeBauge. The DeBauge family owns 100% of the corporation’s stock. The following summarized data (in thousands) are taken from the December 31, 2010, financial statements: For the Year End

> Manyops, Inc., is a manufacturing firm that has experienced strong competition in its traditional business. Management is considering joining the trend to the “service economy” by eliminating its manufacturing operations and concentrating on providing sp

> Following are the current asset and current liability sections of the balance sheets for Cal ketch, Inc., at August 31, 2011 and 2010 (in millions): Required: a. Calculate the working capital and current ratio at each balance sheet date. Round your cur

> Annual reports provide significant information about an organization’s capital budget and capital budgeting process. Intel Corporation provides financial reports for several years at www.intel.com (About Intel → Investor Relations → Financials and Filing

> Prepare an answer sheet with the column headings shown here. For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on the appropriate balance sheet category and on net income by entering for each acco

> Prepare an answer sheet with the column headings shown here. For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on the appropriate balance sheet category and on net income by entering for each acco

> Prepare an answer sheet with the column headings shown here. For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on the appropriate balance sheet category and on net income by entering for each acco

> Staley Toy Co. makes toy flutes. Two manufacturing overhead application bases are used; some overhead is applied on the basis of machine hours at a rate of $7.50 per machine hour, and the balance of the overhead is applied at the rate of 200% of direct l

> For each of the following costs, check the columns that most likely apply (both variable and fixed might apply for some costs). Product Costs Direct Indirect Period Variable Fixed Raw materials Staples used to secure packed boxes of product Plant ja

> Following are a statement of cash flows (indirect method) for Harris, Inc., for the year ended December 31, 2011, and the firm’s balance sheet at December 31, 2010: HARRIS, INC. Statement of Cash Flows For the Year Ended December 31, 2011of Cash

> Refer to the consolidated statements of income on page 687 of the Intel Corporation annual report in the appendix. Required: a. Does Intel use the single-step format or the multiple-step format? Which format do you prefer? Explain your answer. b. Refer

> For each of the following items, calculate the amount of revenue or expense that should be recognized on the income statement for Pelkey Co. for the year ended December 31, 2010: a. Cash collected from customers during the year amounted to $365,000, and

> For each of the following items, calculate the cash sources or cash uses that should be recognized on the statement of cash flows for Baldin Co. for the year ended December 31, 2010: a. Sales on account (all are collectible) amounted to $760,000, and ac

> Thrifty Co. reported net income of $465,000 for its fiscal year ended January 31, 2011. At the beginning of that fiscal year, 200,000 shares of common stock were outstanding. On October 31, 2010, an additional 60,000 shares were issued. No other changes

> Ringemup, Inc., had net income of $473,400 for its fiscal year ended October 31, 2010. During the year the company had outstanding 38,000 shares of $4.50, $50 par value preferred stock, and 105,000 shares of common stock. Required: Calculate the basic e

> A partially completed balance sheet for Blue Co., Inc., as of January 31, 2011, follows. Where amounts are shown for various items, the amounts are correct. Required: Using the following data, complete the balance sheet. a. Blue Co.’s

> Refer to the selected financial data (five-year financial summary) on page 685 of the Intel Corporation annual report in the appendix. selected financial data: Required: Compare the trend of the operating income data with the trend of net income data

> If you were interested in evaluating the profitability of a company and could have only limited historical data, would you prefer to know operating income or net income for the past five years? Explain your answer.

> MBI, Inc., had sales of $141.6 million for fiscal 2010. The company’s gross profit ratio for that year was 31.6%. Required: a. Calculate the gross profit and cost of goods sold for MBI, Inc., for fiscal 2010. b. Assume that a new product is developed an

> Refer to the consolidated statements of income on page 687 of the Intel Corporation annual report in the appendix. consolidated statements: Required: a. Calculate the gross profit ratio for each of the past three years. b. Assume that Intelâ

> Assume that the ending inventory of a merchandising firm is overstated by $40,000. Required: a. By how much and in what direction (overstated or understated) will the firm’s cost of goods sold be misstated? b. If this error is not corrected, what effect

> If the ending inventory of a firm is overstated by $50,000, by how much and in what direction (overstated or understated) will the firm’s operating income be misstated? (Use the cost of goods sold model, enter hypothetically “correct” data, and then refl

> Kirkland Theater sells season tickets for six events at a price of $180. In pricing the tickets, the planners assigned the leadoff event a value of $45 because the program was an expensive symphony orchestra. The last five events were priced equally; 1,2

> Big Blue University has a fiscal year that ends on June 30. The 2010 summer session of the university runs from June 9 through July 28. Total tuition paid by students for the summer session amounted to $112,000. Required: a. How much revenue should be

> Refer to the consolidated statements of cash flows on page 689 of the Intel Corporation annual report in the appendix. consolidated statements: Required: a. Identify the two most significant sources of cash from operating activities during 2008. How m

> Following are comparative statements of cash flows, as reported by The Coca-Cola Company in its 2008 annual report: Required: a. Briefly review the consolidated statements of cash flows, and then provide an overall evaluation of the “

> Kenisha Morgan owns and operates Morgan’s Furniture Emporium, Inc. The balance sheet totals for assets, liabilities, and owner’s equity at August 1, 2010, are as indicated. Described here are several transactions enter

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or m

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or m

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or m

> Enter the following column headings across the top of a sheet of paper: Enter the transaction letter in the first column and show the effect (if any) of each of the following transactions on each financial statement category by entering a plus (+) or m

> On January 1, 2010, Metco, Inc., had issued an outstanding 574,600 shares of $2 par value common stock. On March 15, 2010, Metco, Inc., purchased for its treasury 4,400 shares of its common stock at a price of $75 per share. On August 10, 2010, 1,400 of

> On May 4, 2010, Docker, Inc., purchased 800 shares of its own common stock in the market at a price of $18.25 per share. On September 19, 2010, 600 of these shares were sold in the open market at a price of $19.50 per share. There were 36,200 shares of D

> Permabilt Corp. was incorporated on January 1, 2010, and issued the following stock for cash: 3,600,000 shares of no-par common stock were authorized; 1,050,000 shares were issued on January 1, 2010, at $46 per share. 1,200,000 shares of $100 par value

> Homestead Oil Corp. was incorporated on January 1, 2010, and issued the following stock for cash: 800,000 shares of no-par common stock were authorized; 150,000 shares were issued on January 1, 2010, at $19 per share. 200,000 shares of $100 par value, 9

> Allyn, Inc., has the following owners’ equity section in its November 30, 2010, balance sheet: Paid-in capital: 12% preferred stock, $60 par value, 1,500 shares authorized, issued, and outstanding . . .. .. . . .. . . . . . .. . . .. . . . $ ? Common st

> Assume that you own 3,000 shares of Blueco, Inc.’s, common stock and that you currently receive cash dividends of $.42 per share per year. Required: a. If Blueco, Inc., declared a 5% stock dividend, how many shares of common stock would you receive as a

> Indicate the effect of each of the following transactions on total assets, total liabilities, and total owners’ equity. Use ï€«ï€ for increase, − for decrease, and (NE) for no effect. The

> Under what circumstances would you (as an investor) prefer to receive cash dividends rather than stock dividends? Under what circumstances would you prefer stock dividends to cash dividends?

> Blanker, Inc., has paid a regular quarterly cash dividend of $0.50 per share for several years. The common stock is publicly traded. On February 21 of the current year, Blanker’s board of directors declared the regular first-quarter dividend of $0.50 per

> Qamar, Inc., did not pay dividends in 2009 or 2010, even though 50,000 shares of its 6.5%, $50 par value cumulative preferred stock were outstanding during those years. The company has 800,000 shares of $2.50 par value common stock outstanding. Required

> Calculate the cash dividends required to be paid for each of the following preferred stock issues: Required: a. The semiannual dividend on 6% cumulative preferred, $50 par value, 30,000 shares authorized, issued, and outstanding. b. The annual dividend

> Calculate the annual cash dividends required to be paid for each of the following preferred stock issues: Required: a. $3.75 cumulative preferred, no par value; 200,000 shares authorized, 161,522 shares issued. (The treasury stock caption of the stockho

> The balance sheet caption for common stock is the following: Common stock without par value, 2,000,000 shares authorized, 400,000 shares issued, and 360,000 shares outstanding . . . . . . . . . . . . . . . . . . . . . . . $2,600,000 Required: a. Calcul

> From the following data, calculate the Retained Earnings balance as of December 31, 2010: Retained earnings, December 31, 2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $490,400 Net decrease in total assets during 2011

> At the beginning of the current fiscal year, the balance sheet of Cummings Co. showed liabilities of $219,000. During the year, liabilities decreased by $36,000; assets increased by $77,000; and paid-in capital also increased by $10,000 to $190,000. Divi